CBL & Associates Properties, Inc. (NYSE:CBL):

- FFO per diluted share increased 4.3% to

$0.49 for the first quarter 2012, compared with the prior-year

period.

- Same-store sales per square foot

increased 5.9% for mall tenants 10,000 square feet or less for

stabilized malls for the first quarter 2012.

- Portfolio occupancy at March 31, 2012,

increased 150 basis points to 91.8%, from the prior-year

period.

- Same-center NOI, excluding lease

termination fees, increased 1.5% in the first quarter 2012, over

the prior-year period.

- Average gross rent for leases signed in

the first quarter 2012 increased 7.2% over the prior gross rent per

square foot.

CBL & Associates Properties, Inc. (NYSE:CBL) announced

results for the first quarter ended March 31, 2012. A description

of each non-GAAP financial measure and the related reconciliation

to the comparable GAAP measure is located at the end of this news

release.

Three Months Ended

March 31,

2012 2011

Funds from Operations (“FFO”) per diluted

share, as adjusted (1)

$ 0.49 $ 0.47

(1) Excludes the gain on extinguishment of

debt of $0.17 per share recorded in the first quarter 2011

Stephen D. Lebovitz, president and chief executive officer of

CBL, commented, “We are encouraged that 2012 has started with such

strong results. During the first quarter, our portfolio of

market-dominant malls showed further improvement with strong

occupancy and sales performance, positive leasing spreads and

same-center NOI growth. Retailers have announced a large number of

new-store growth plans, and we are translating this increased

demand into further leasing gains. The strength of our portfolio

and our commitment to renovations and redevelopments makes CBL

malls the preferred destination for retailers and consumers

alike.

“In addition to the improving results in our operating

portfolio, we are also pleased with the attractive investments that

we have made this year that will contribute to our future growth.

Our recent acquisitions of interests in two operating outlet

centers in Texas and Pennsylvania for $109 million, and the

soon-to-be-developed The Outlet Shoppes at Atlanta complement the

success we are already experiencing with The Outlet Shoppes at

Oklahoma City. Our outlet center program greatly enhances

opportunities in our regional mall portfolio and provides other

benefits including leasing and operating synergies.”

FFO allocable to common shareholders for the first quarter of

2012 was $72,178,000, or $0.49 per diluted share, compared with FFO

allocable to common shareholders, as adjusted, of $70,601,000, or

$0.47 per diluted share, for the first quarter of 2011. FFO of the

operating partnership for the first quarter of 2012 was

$92,476,000, compared with $90,688,000, as adjusted, for the first

quarter 2011. FFO, as adjusted, in the first quarter 2011 excludes

the gain on extinguishment of debt of $32,015,000, or $0.17 per

diluted share.

Net income attributable to common shareholders for the first

quarter of 2012 was $15,455,000, or $0.10 per diluted share,

compared with net income of $36,725,000, or $0.25 per diluted share

for the first quarter of 2011. Net income for the first quarter

2011 includes gain on extinguishment of debt, net of noncontrolling

interest, of $24,923,000, or $0.17 per diluted share, of which

$24,470,000 is included in discontinued operations.

HIGHLIGHTS

- Portfolio same-center net operating

income (“NOI”), excluding lease termination fees, for the quarter

ended March 31, 2012, increased 1.5% compared with an increase of

0.5% for the prior-year period.

- Average gross rent on leases signed

during the first quarter of 2012 for tenants 10,000 square feet or

less increased 7.2% over the prior gross rent per square foot.

- Same-store sales per square foot for

mall tenants 10,000 square feet or less for stabilized malls for

the rolling twelve months ended March 31, 2012, increased 3.7% to

$339 per square foot compared with $327 per square foot for

the prior-year period.

- Consolidated and unconsolidated

variable rate debt of $1,192,300,000, as of March 31, 2012,

represented 12.7% of the total market capitalization for the

Company, compared with 15.9% in the prior-year period, and 22.8% of

the Company's share of total consolidated and unconsolidated debt,

compared with 26.6% in the prior-year period.

PORTFOLIO OCCUPANCY

March 31, 2012 2011 Portfolio

occupancy 91.8 % 90.3 % Mall portfolio

91.9

% 90.3 % Stabilized malls 91.8 % 90.4 % Non-stabilized malls 95.5 %

84.2 % Associated centers 92.9 % 91.1 % Community centers 91.0 %

90.5 %

ACQUISITIONS

Subsequent to the quarter end, CBL announced that it had

acquired interests in The Outlet Shoppes at El Paso in El Paso, TX

and The Outlet Shoppes at Gettysburg in Gettysburg, PA. The

operating outlet centers are owned and managed by Horizon Group

Properties and its affiliates.

CBL acquired a 75% interest in The Outlet Shoppes at El Paso and

a 50% interest in The Outlet Shoppes at Gettysburg, for a total

investment of $108.7 million. The total investment includes a cash

consideration of $38.2 million, as well as the assumption of $70.5

million of debt, which represents CBL’s share.

DISPOSITIONS

During the first quarter 2012, CBL disposed of the second phase

of Settlers Ridge, a community center in Robinson Township

(Pittsburgh), PA, and completed the previously announced sale of

Oak Hollow Square, a community center in High Point, NC. The

aggregate sales price for the two properties was $33.4 million.

FINANCING ACTIVITY

Year-to-date, CBL has closed two separate non-recourse loans

totaling $195.0 million at a weighted average interest rate of

5.09%. The ten-year non-recourse loans are secured by Northwoods

Mall in Charleston, SC, and Arbor Place Mall in Atlanta

(Douglasville), GA. After consideration of the mortgage loan

balances retired, the new loans generated excess proceeds of $79.4

million. CBL paid off the existing mortgage loans earlier in the

year using its lines of credit. Total proceeds were used to reduce

outstanding balances on the Company’s lines of credit.

OUTLOOK AND GUIDANCE

Based on first quarter results and today's outlook, the Company

is maintaining 2012 FFO guidance of $1.95 - $2.03 per share. The

full year guidance assumes $3.0 million to $5.0 million of

outparcel sales and same-center NOI growth in the range of 0.0% to

1.0%, excluding applicable lease termination fees. The guidance

excludes the impact of any future unannounced acquisitions or

dispositions. The Company expects to update its annual guidance

after each quarter's results.

Low High Expected diluted earnings per

common share $ 0.45 $ 0.53 Adjust to fully converted shares from

common shares (0.10 ) (0.12 ) Expected earnings per

diluted, fully converted common share 0.35 0.41 Add: depreciation

and amortization 1.50 1.50 Add: noncontrolling interest in earnings

of Operating Partnership 0.10 0.12

Expected FFO per diluted, fully converted common share $ 1.95

$ 2.03

INVESTOR CONFERENCE CALL AND SIMULCAST

CBL & Associates Properties, Inc. will conduct a conference

call at 11:00 a.m. ET on Tuesday, May 1, 2012, to discuss its first

quarter results. The number to call for this interactive

teleconference is (212) 231-2900. A seven-day replay of the

conference call will be available by dialing (402) 977-9140

and entering the passcode 21544167. A transcript of the Company's

prepared remarks will be furnished on a Form 8-K following the

conference call.

To receive the CBL & Associates Properties, Inc., first

quarter earnings release and supplemental information please visit

our website at cblproperties.com or contact Investor Relations at

423-490-8312.

The Company will also provide an online web simulcast and

rebroadcast of its 2012 first quarter earnings release conference

call. The live broadcast of the quarterly conference call will be

available online at cblproperties.com on Tuesday, May 1, 2012,

beginning at 11:00 a.m. ET. The online replay will follow shortly

after the call and continue through May 8, 2012.

CBL is one of the largest and most active owners and developers

of malls and shopping centers in the United States. CBL owns, holds

interests in or manages 160 properties, including 89 regional

malls/open-air centers. The properties are located in 26 states and

total 86.8 million square feet including 3.6 million square feet of

non-owned shopping centers managed for third parties. Headquartered

in Chattanooga, TN, CBL has regional offices in Boston (Waltham),

MA, Dallas (Irving), Texas, and St. Louis, MO. Additional

information can be found at cblproperties.com.

NON-GAAP FINANCIAL MEASURES

Funds From Operations

FFO is a widely used measure of the operating performance of

real estate companies that supplements net income (loss) determined

in accordance with GAAP. The National Association of Real Estate

Investment Trusts (“NAREIT”) defines FFO as net income (loss)

(computed in accordance with GAAP) excluding gains or losses on

sales of operating properties, plus depreciation and amortization,

and after adjustments for unconsolidated partnerships and joint

ventures and noncontrolling interests. Adjustments for

unconsolidated partnerships and joint ventures and noncontrolling

interests are calculated on the same basis. In October 2011, NAREIT

clarified that FFO should exclude the impact of losses on

impairment of depreciable properties. The Company has calculated

FFO for all periods presented in accordance with this

clarification. The Company defines FFO allocable to its common

shareholders as defined above by NAREIT less dividends on preferred

stock. The Company’s method of calculating FFO allocable to its

common shareholders may be different from methods used by other

REITs and, accordingly, may not be comparable to such other

REITs.

The Company believes that FFO provides an additional indicator

of the operating performance of its properties without giving

effect to real estate depreciation and amortization, which assumes

the value of real estate assets declines predictably over time.

Since values of well-maintained real estate assets have

historically risen with market conditions, the Company believes

that FFO enhances investors’ understanding of its operating

performance. The use of FFO as an indicator of financial

performance is influenced not only by the operations of the

Company’s properties and interest rates, but also by its capital

structure. The Company presents both FFO of its operating

partnership and FFO allocable to its common shareholders, as it

believes that both are useful performance measures. The Company

believes FFO of its operating partnership is a useful performance

measure since it conducts substantially all of its business through

its operating partnership and, therefore, it reflects the

performance of the properties in absolute terms regardless of the

ratio of ownership interests of the Company’s common shareholders

and the noncontrolling interest in the operating partnership. The

Company believes FFO allocable to its common shareholders is a

useful performance measure because it is the performance measure

that is most directly comparable to net income (loss) attributable

to its common shareholders.

In the reconciliation of net income attributable to the

Company's common shareholders to FFO allocable to its common

shareholders, located in this earnings release, the Company makes

an adjustment to add back noncontrolling interest in income (loss)

of its operating partnership in order to arrive at FFO of its

operating partnership. The Company then applies a percentage to FFO

of its operating partnership to arrive at FFO allocable to its

common shareholders. The percentage is computed by taking the

weighted average number of common shares outstanding for the period

and dividing it by the sum of the weighted average number of common

shares and the weighted average number of operating partnership

units outstanding during the period.

FFO does not represent cash flows from operations as defined by

accounting principles generally accepted in the United States, is

not necessarily indicative of cash available to fund all cash flow

needs and should not be considered as an alternative to net income

(loss) for purposes of evaluating the Company’s operating

performance or to cash flow as a measure of liquidity.

During 2011, the Company recorded a gain on extinguishment of

debt from discontinued operations. Considering the significance and

nature of this item, the Company believes that it is important to

identify the impact of the change on its FFO measures for a reader

to have a complete understanding of the Company’s results of

operations. Therefore, the Company has also presented its FFO

measures excluding this item.

Same-Center Net Operating Income

NOI is a supplemental measure of the operating performance of

the Company's shopping centers. The Company defines NOI as

operating revenues (rental revenues, tenant reimbursements and

other income) less property operating expenses (property operating,

real estate taxes and maintenance and repairs).

Similar to FFO, the Company computes NOI based on its pro rata

share of both consolidated and unconsolidated properties. The

Company's definition of NOI may be different than that used by

other companies and, accordingly, the Company's NOI may not be

comparable to that of other companies. A reconciliation of

same-center NOI to net income is located at the end of this

earnings release.

Since NOI includes only those revenues and expenses related to

the operations of its shopping center properties, the Company

believes that same-center NOI provides a measure that reflects

trends in occupancy rates, rental rates and operating costs and the

impact of those trends on the Company's results of operations.

Additionally, there are instances when tenants terminate their

leases prior to the scheduled expiration date and pay the Company

one-time, lump-sum termination fees. These one-time lease

termination fees may distort same-center NOI trends and may result

in same-center NOI that is not indicative of the ongoing operations

of the Company's shopping center properties. Therefore, the Company

believes that presenting same-center NOI, excluding lease

termination fees, is useful to investors.

Pro Rata Share of Debt

The Company presents debt based on its pro rata ownership share

(including the Company's pro rata share of unconsolidated

affiliates and excluding noncontrolling interests' share of

consolidated properties) because it believes this provides

investors a clearer understanding of the Company's total debt

obligations which affect the Company's liquidity. A reconciliation

of the Company's pro rata share of debt to the amount of debt on

the Company's consolidated balance sheet is located at the end of

this earnings release.

Information included herein contains "forward-looking

statements" within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company's various filings with the Securities and Exchange

Commission, including without limitation the Company's Annual

Report on Form 10-K, and the "Management's Discussion and Analysis

of Financial Condition and Results of Operations" included therein,

for a discussion of such risks and uncertainties.

CBL & Associates

Properties, Inc. Consolidated Statements of Operations

(Unaudited; in thousands, except per share amounts)

Three Months Ended

March 31,

2012 2011 REVENUES: Minimum rents

$

160,788 $ 170,914 Percentage rents

3,466 3,740 Other

rents

5,313 5,008 Tenant reimbursements

70,487 76,810

Management, development and leasing fees

2,469 1,337 Other

8,149 9,360 Total revenues

250,672 267,169

OPERATING EXPENSES: Property operating

38,361 40,159

Depreciation and amortization

63,157 67,699 Real estate

taxes

22,846 24,326 Maintenance and repairs

13,156

16,008 General and administrative

13,800 11,800 Other

6,758 8,303 Total operating expenses

158,078 168,295

Income from

operations 92,594 98,874 Interest and other income

1,075 545 Interest expense

(60,060 ) (68,213 )

Gain on extinguishment of debt

- 581 Gain on sales of real

estate assets

587 809 Equity in earnings of unconsolidated

affiliates

1,266 1,778 Income tax benefit

228

1,770

Income from continuing operations

35,690 36,144 Operating income (loss) of discontinued

operations

(50 ) 27,750 Gain on discontinued

operations

911 14

Net

income 36,551 63,908 Net income attributable to

noncontrolling interests in: Operating partnership

(4,362

) (10,451 ) Other consolidated subsidiaries

(6,140 ) (6,138 )

Net income attributable

to the Company 26,049 47,319 Preferred dividends

(10,594 ) (10,594 )

Net income attributable

to common shareholders $ 15,455 $ 36,725

Basic per share data attributable to common

shareholders: Income from continuing operations, net of

preferred dividends

$ 0.10 $ 0.10 Discontinued

operations

- 0.15 Net income

attributable to common shareholders

$ 0.10 $

0.25 Weighted average common shares outstanding

148,495 148,069

Diluted earnings per share data

attributable to common shareholders: Income from continuing

operations, net of preferred dividends

$ 0.10 $ 0.10

Discontinued operations

- 0.15

Net income attributable to common shareholders

$ 0.10

$ 0.25

Weighted average common and potential

dilutive common shares outstanding

148,538 148,123

Amounts attributable to common

shareholders: Income from continuing operations, net of

preferred dividends

$ 14,783 $ 15,112 Discontinued

operations

672 21,613 Net income

attributable to common shareholders

$ 15,455 $

36,725 The

Company's calculation of FFO allocable to its shareholders is as

follows: (in thousands, except per share data)

Three

Months Ended

March 31,

2012 2011 Net income attributable to

common shareholders

$ 15,455 $ 36,725 Noncontrolling

interest in income of operating partnership

4,362 10,451

Depreciation and amortization expense of: Consolidated properties

63,157 67,699 Unconsolidated affiliates

11,111 5,515

Discontinued operations

116 368 Non-real estate assets

(417 ) (638 ) Noncontrolling interests' share of

depreciation and amortization

(446 ) (149 ) Loss on

impairment of real estate, net of tax benefit

196 2,746 Gain

on depreciable property

(493 ) - Gain on discontinued

operations, net of tax provision

(565 )

(14 )

Funds from operations of the operating partnership

92,476 122,703 Gain on extinguishment of debt

- (32,015 )

Funds from operations of the

operating partnership, as adjusted $ 92,476

$ 90,688

Funds from operations per diluted

share $ 0.49 $ 0.64 Gain on extinguishment of

debt(1)

- (0.17 )

Funds from

operations, as adjusted, per diluted share $ 0.49

$ 0.47

Weighted average common and potential

dilutive common shares outstanding with operating partnership units

fully converted

190,302 190,259

Reconciliation of FFO of the operating

partnership to FFO allocable to Company shareholders:

Funds from operations of the operating partnership $

92,476 $ 122,703

Percentage allocable to common

shareholders(2)

78.05 % 77.85 %

Funds from

operations allocable to Company shareholders $

72,178 $ 95,524

Funds from

operations of the operating partnership, as adjusted $

92,476 $ 90,688

Percentage allocable to common

shareholders(2)

78.05 % 77.85 %

Funds from

operations allocable to Company shareholders, as adjusted

$ 72,178 $ 70,601 (1) Diluted

per share amounts presented for reconciliation purposes may differ

from actual diluted per share amounts due to rounding.

(2) Represents the weighted average number

of common shares outstanding for the period divided by the sum of

the weighted average number of common shares and the weighted

average number of operating partnership units outstanding during

the period. See the reconciliation of shares and operating

partnership units outstanding on page 9.

SUPPLEMENTAL FFO INFORMATION: Lease

termination fees

$ 750 $ 1,629 Lease termination fees

per share

$ - $ 0.01 Straight-line rental

income

$ 410 $ 1,128 Straight-line rental income per

share

$ - $ 0.01 Gains on outparcel sales

$ 99 $ 809 Gains on outparcel sales per share

$ - $ - Net amortization of acquired above-

and below-market leases

$ 142 $ 514 Net amortization

of acquired above- and below-market leases per share

$

- $ - Net amortization of debt premiums (discounts)

$ 452 $ 753 Net amortization of debt premiums

(discounts) per share

$ - $ - Income tax

benefit

$ 228 $ 1,770 Income tax benefit per share

$ - $ 0.01 Loss on impairment of real estate

from discontinued operations

$ (293 ) $ (2,746

) Loss on impairment of real estate from discontinued operations

per share

$ - $ (0.01 ) Gain on extinguishment

of debt

$ - $ 581 Gain on extinguishment of debt per

share

$ - $ - Gain on extinguishment of debt

from discontinued operations

$ - $ 31,434 Gain on

extinguishment of debt from discontinued operations per share

$ - $ 0.17

Same-Center Net Operating Income (Dollars in

thousands)

Three Months Ended

March 31,

2012 2011 Net income attributable to

the Company

$ 26,049 $ 47,319 Adjustments:

Depreciation and amortization

63,157 67,699 Depreciation and

amortization from unconsolidated affiliates

11,111 5,515

Depreciation and amortization from discontinued operations

116 368

Noncontrolling interests' share of

depreciation and amortization in other consolidated

subsidiaries

(446 ) (149 ) Interest expense

60,060 68,213

Interest expense from unconsolidated affiliates

11,203 5,802

Interest expense from discontinued operations

1 178

Noncontrolling interests' share of

interest expense in other consolidated subsidiaries

(460 ) (244 ) Abandoned projects expense

(124

) - Gain on sales of real estate assets

(587 )

(809 ) Gain on sales of real estate assets of unconsolidated

affiliates

5 - Gain on extinguishment of debt

- (581

) Gain on extinguishment of debt from discontinued operations

- (31,434 ) Writedown of mortgage notes receivable

-

1,500 Loss on impairment of real estate from discontinued

operations

293 2,746 Income tax benefit

(228 )

(1,770 )

Net income attributable to noncontrolling

interest in earnings of operating partnership

4,362 10,451 Gain on discontinued operations

(911 ) (14 ) Operating partnership's share of

total NOI

173,601 174,790 General and administrative

expenses

13,800 11,800 Management fees and non-property

level revenues

(6,498 ) (2,396 )

Operating partnership's share of property NOI

180,903

184,194 Non-comparable NOI

(5,361 )

(10,459 ) Total same-center NOI

$ 175,542 $

173,735 Total same-center NOI percentage change

1.0 % Total same-center NOI

$

175,542 $ 173,735 Less lease termination fees

(757 ) (1,518 ) Total same-center NOI,

excluding lease termination fees

$ 174,785 $

172,217 Malls

$ 156,041 $ 153,498

Associated centers

8,092 7,846 Community centers

5,132 5,160 Offices and other

5,520

5,713 Total same-center NOI, excluding lease

termination fees

$ 174,785 $ 172,217

Percentage Change: Malls

1.7 %

Associated centers

3.1 % Community centers

-0.5 % Offices and other

-3.4 %

Total same-center NOI, excluding lease termination fees

1.5 %

Company's Share of Consolidated and Unconsolidated

Debt (Dollars in thousands)

As of March 31, 2012

Fixed Rate Variable Rate Total

Consolidated debt

$ 3,393,241 $

1,066,007 $ 4,459,248 Noncontrolling

interests' share of consolidated debt

(29,256 )

(726 ) (29,982 ) Company's share of

unconsolidated affiliates' debt

675,356

127,019 802,375 Company's share

of consolidated and unconsolidated debt

$ 4,039,341

$ 1,192,300 $ 5,231,641

Weighted average interest rate

5.48

% 2.67 %

4.84

% As of March 31, 2011 Fixed

Rate Variable Rate Total Consolidated debt $

3,945,047 $ 1,239,051 $ 5,184,098 Noncontrolling interests' share

of consolidated debt (15,621 ) (928 ) (16,549 ) Company's share of

unconsolidated affiliates' debt 396,687

169,526 566,213 Company's share of

consolidated and unconsolidated debt $ 4,326,113 $ 1,407,649

$ 5,733,762 Weighted average interest rate

5.69 % 2.85 % 4.99 %

Debt-To-Total-Market Capitalization Ratio as of March 31,

2012 (In thousands, except stock price)

Shares

Outstanding

Stock Price(1)

Value Common stock and operating partnership units 190,275 $

18.92 $ 3,600,003 7.75% Series C Cumulative Redeemable Preferred

Stock 460 250.00 115,000 7.375% Series D Cumulative Redeemable

Preferred Stock 1,815 250.00 453,750 Total market

equity 4,168,753 Company's share of total debt 5,231,641

Total market capitalization $ 9,400,394

Debt-to-total-market capitalization ratio 55.7 %

(1) Stock price for common stock and

operating partnership units equals the closing price of the common

stock on March 30, 2012. The stock prices for the preferred stocks

represent the liquidation preference of each respective series.

Reconciliation of Shares and Operating

Partnership Units Outstanding (In thousands)

Three

Months Ended March 31, 2012: Basic

Diluted Weighted average shares - EPS

148,495

148,538 Weighted average operating partnership units

41,764 41,764 Weighted average

shares- FFO

190,259 190,302

2011: Weighted average shares - EPS 148,069

148,123 Weighted average operating partnership units 42,136

42,136 Weighted average shares- FFO

190,205 190,259

Dividend

Payout Ratio Three Months Ended March 31,

2012 2011 Weighted average cash dividend per share

$ 0.21913 $ 0.23034 FFO per diluted, fully converted

share, as adjusted

$ 0.49 $ 0.47

Dividend payout ratio

44.7 % 49.0 %

Consolidated

Balance Sheets (Unaudited; in thousands, except share data)

As of March

31,

2012

December 31,

2011

ASSETS Real estate assets: Land

$ 851,157 $

851,303 Buildings and improvements

6,779,274 6,777,776

7,630,431 7,629,079 Accumulated depreciation

(1,814,121 )

(1,762,149 ) 5,816,310 5,866,930

Held for sale

- 14,033 Developments in progress

127,407 124,707

Net investment in real estate assets

5,943,717

6,005,670 Cash and cash equivalents

61,669 56,092

Receivables:

Tenant, net of allowance for doubtful

accounts of $1,900 and $1,760 in 2012 and 2011, respectively

69,317 74,160

Other, net of allowance for doubtful

accounts of $1,269 and $1,400 in 2012 and 2011, respectively

9,535 11,592 Mortgage and other notes receivable

33,688 34,239 Investments in unconsolidated affiliates

304,573 304,710 Intangible lease assets and other assets

209,609

232,965 $

6,632,108 $

6,719,428 LIABILITIES, REDEEMABLE

NONCONTROLLING INTERESTS AND EQUITY Mortgage and other

indebtedness

$ 4,459,248 $ 4,489,355 Accounts payable

and accrued liabilities

270,782

303,577 Total liabilities

4,730,030 4,792,932

Commitments and contingencies Redeemable noncontrolling

interests: Redeemable noncontrolling partnership interests

36,596 32,271 Redeemable noncontrolling preferred joint

venture interest

423,777

423,834 Total redeemable noncontrolling

interests

460,373

456,105 Shareholders' equity: Preferred stock,

$.01 par value, 15,000,000 shares authorized:

7.75% Series C Cumulative Redeemable

Preferred Stock, 460,000 shares outstanding

5 5

7.375% Series D Cumulative Redeemable

Preferred Stock, 1,815,000 shares outstanding

18 18

Common stock, $.01 par value, 350,000,000

shares authorized, 148,689,623 and 148,364,037 issued and

outstanding in 2012 and 2011, respectively

1,487 1,484 Additional paid-in capital

1,658,893

1,657,927 Accumulated other comprehensive income

4,832 3,425

Dividends in excess of cumulative earnings

(416,826 )

(399,581 ) Total shareholders' equity

1,248,409 1,263,278 Noncontrolling interests

193,296 207,113

Total equity

1,441,705

1,470,391 $

6,632,108 $

6,719,428

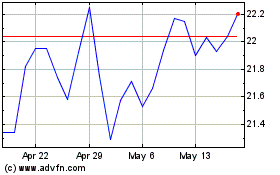

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jun 2024 to Jul 2024

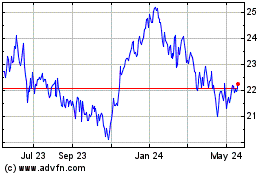

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jul 2023 to Jul 2024