CBL Closes Long-Term Fixed-Rate Loan Secured by Fremaux Town Center

11 June 2016 - 12:50AM

Business Wire

CBL & Associates Properties, Inc. (NYSE: CBL) today

announced that it closed on a non-recourse $73.0 million loan

secured by Fremaux Town Center in Slidell, LA. The 10-year loan

bears a fixed interest rate of 3.70%. Wells Fargo served as the

lender. Proceeds from the loan were used to retire two existing

construction loans with an aggregate balance of $73.0 million.

“This financing demonstrates our continued strong access to

capital,” said Farzana K. Mitchell, Chief Financial Officer.

“Replacing the floating rate construction loans with this

attractively priced long-term fixed-rate loan further enhances the

strength of our balance sheet. We are pleased to have completed two

major financing transactions with institutional lenders totaling

$185 million within the past week.”

CBL owns the 633,000-square-foot open-air center in a 65/35

joint venture with Stirling Properties, LLC based in Covington, LA.

All amounts above are reflected at 100%.

About CBL & Associates Properties, Inc.

Headquartered in Chattanooga, TN, CBL is one of the largest and

most active owners and developers of malls and shopping centers in

the United States. CBL owns, holds interests in or manages 147

properties, including 91 regional malls/open-air centers. The

properties are located in 31 states and total 84.3 million square

feet including 8.6 million square feet of non-owned shopping

centers managed for third parties. Additional information can be

found at cblproperties.com.

Forward-Looking Statements

Information included herein contains "forward-looking

statements" within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company's various filings with the Securities and Exchange

Commission, including without limitation the Company's Annual

Report on Form 10-K and the "Management's Discussion and Analysis

of Financial Condition and Results of Operations" included therein,

for a discussion of such risks and uncertainties.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160610005566/en/

CBL & Associates Properties, Inc.Investor Contact:Katie

Reinsmidt, 423-490-8301Senior Vice President - Investor Relations

and Corporate Investmentskatie.reinsmidt@cblproperties.com

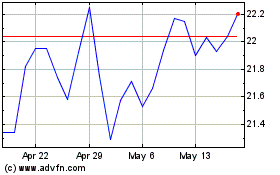

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jun 2024 to Jul 2024

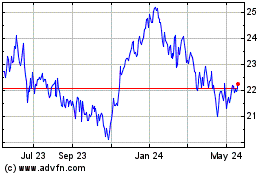

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Jul 2023 to Jul 2024