Regulatory News:

CGGVeritas (ISIN: FR0000120164 – NYSE: CGV) launched on

13 November 2012 an issuance of bonds convertible into

and/or exchangeable for new or existing shares (“OCEANEs”)

due 1st January 2019 (the “Bonds”).

The Joint Lead Managers and Joint Bookrunners of the issuance of

the Bonds have informed CGGVeritas that they are exercising in full

the over-allotment option granted to them.

As a result, the aggregate principal amount will be increased to

approximately €360 million.

Furthermore, one of the Joint Lead Managers and Joint

Bookrunners, as stabilising manager, has informed CGGVeritas that

no stabilisation has been carried out during the stabilisation

period, which began on 13 November 2012 and ended

today.

The expected date of issue and settlement and delivery of the

Bonds is 20 November 2012.

About CGGVeritas

CGGVeritas (www.cggveritas.com) is a leading international

pure-play geophysical company delivering a wide range of

technologies, services and equipment through Sercel, to its broad

base of customers mainly throughout the global oil and gas

industry.

CGGVeritas is listed on the regulated market of NYSE Euronext in

Paris (ISIN: 0000120164) and the New York Stock Exchange (in the

form of American Depositary Shares, NYSE: CGV).

***

IMPORTANT NOTICE

This press release and the information contained herein do not

constitute an offer to subscribe a purchase bonds convertible into

new shares and/or exchangeable for existing shares (the “Bonds”),

or any other securities, issued by CGGVeritas.

A prospectus (the “Prospectus”), consisting of the

Company's reference document filed with the Autorité des Marchés

Financiers (“AMF”) on 20 April 2012 under number D.12-0379

(the "Document de Référence"), the reference document

updates filed with the AMF on 25 September 2012 under number

D.12-0379-A01 and on 12 November 2012 under number D.12-0379-A02, a

securities note and a Prospectus summary (included in the

securities note), was approved by the AMF under visa n°12-542 on 13

November 2012. Copies of the Prospectus are available at the

registered office of the Company, on the website of the Company

(www.cggveritas.com) and on the website of the AMF

(www.amf-france.org).CGGVeritas draws investors’ attention to the

risk factors describing the Company, its industry and the

Acquisition, included in chapter 3 of the Document de Référence and

its updates, and section 2 of the securities note.

This press release is not an offer to the public, an offer to

subscribe or designed to solicit interest for purposes of an offer

to the public in any jurisdiction, including France.

The Bonds have only been offered by way of a private placement

in France and outside France (but not in the United States of

America, Canada, Australia or Japan) to persons referred to in

Article L. 411-2-II of the French monetary and financial code (Code

monétaire et financier), without a public offering in any country

(including France). The AMF granted visa n° 12-542 dated 13

November 2012 on the prospectus to list the Bonds on Euronext

Paris.

European Economic Area

With respect to the Member States of the European Economic Area

which have implemented the Prospectus Directive (the “Relevant

Member States”), no action has been undertaken or will be

undertaken to make an offer to the public of the Bonds requiring a

publication of a prospectus in any Relevant Member State. As a

result, the Bonds may only be offered in Relevant Member

States:

(a) to any legal entity which is a qualified investor as defined

in the Prospectus Directive;

(b) to fewer than 100 or, if the Relevant Member State has

implemented the relevant provision of the 2010 PD Amending

Directive, 150, natural or legal persons (other than qualified

investors as defined in the Prospectus Directive); or

(c) in any other circumstances falling within Article 3(2) of

the Prospectus Directive.

For the purposes of this paragraph, (i) the expression “offer

to the public of Bonds” in relation to any Bond in any Relevant

Member States, means any communication, to individuals or legal

entities, in any form and by any means, of sufficient information

on the terms and conditions of the offering and on the Bonds to be

offered, thereby enabling an investor to decide to purchase or

subscribe for the Bonds, as the same may be varied in that Member

State, (ii) the expression “Prospectus Directive” means

Directive 2003/71/EC (and amendments thereto, including the 2010 PD

Amending Directive, to the extent implemented in the Relevant

Member State), and includes any relevant implementing measure in

the Relevant Member State and (iii) the expression “2010 PD

Amending Directive” means Directive 2010/73/EU.

These selling restrictions with respect to Member States apply

in addition to any other selling restrictions which may be

applicable in the Member States who have implemented the Prospectus

Directive.

France

The Bonds have not been and will not be offered or sold or cause

to be offered or sold, directly or indirectly, to the public in

France. Any offers or sales of the Bonds and distributions of any

offering material relating to the Bonds have been and will be made

in France only to (a) persons providing investment services

relating to portfolio management for the account of third parties

(personnes fournissant le service d’investissement de gestion de

portefeuille pour compte de tiers), and/or (b) qualified investors

(investisseurs qualifiés) acting for their own account, as defined

in, and in accordance with, Articles L.411-1, L. 411-2 and D.411-1

of the French Code monétaire et financier.

United Kingdom

This press release is addressed only (i) to persons located

outside the United Kingdom, (ii) to investment professionals as

defined in Article 19(5) of the Financial Services and Markets Act

2000 (Financial Promotion) Order 2005 (the “Order”), (iii)

to people designated by Article 49(2) (a) to (d) of the Order or

(iv) to any other person to whom this press release could be

addressed pursuant to applicable law (the persons mentioned in

paragraphs (i), (ii), (iii) and (iv) all deemed relevant persons

(“Relevant Persons”). The Bonds and, if applicable, the

shares of CGGVeritas to be delivered upon exercise of the

conversion rights (the “Financial Instruments”) are intended

only for Relevant Persons and any invitation, offer of contract

related to the subscription, tender, or acquisition of the

Financial Instruments may be addressed and/or concluded only with

Relevant Persons. All persons other than Relevant Persons must

abstain from using or relying on this document and all information

contained therein.

This press release is not a prospectus which has been approved

by the Financial Services Authority or any other United Kingdom

regulatory authority for the purposes of Section 85 of the

Order.

Each institution in charge of the placement has represented and

agreed that:

(i) it has only communicated or caused to be communicated and

will only communicate or cause to be communicated invitations or

inducements to engage in investment activity (within the meaning of

Section 21 of the Financial Services and Markets Act 2000),

received by it in connection with the Bonds, in circumstances in

which Section 21(1) of the Financial Services and Markets Act 2000

does not apply to the issuer; and

(ii) it has complied and will comply with all applicable

provisions of the Financial Services and Market Act 2000 with

respect to anything that it has done or will do in relation to the

Bonds in the United Kingdom, from the United Kingdom or otherwise

involving the United Kingdom.

United States of America

This announcement does not constitute or form part of any offer

to sell, or a solicitation of offers to purchase or subscribe for,

securities in the United States of America. The securities referred

to herein have not been, and will not be, registered under the

Securities Act of 1933, as amended, and may not be offered or sold

in the United States of America to U.S. persons, or for the account

or benefit of U.S. persons absent registration or an applicable

exemption from registration requirements. The issuer does not

intend to register any portion of the proposed offering in the

United States of America and no public offering will be made in the

United States of America. This notice is issued pursuant to Rule

135(c) of the Securities Act of 1933, as amended.

Canada, Australia and Japan

The Bonds have not been and will not be offered, sold or

purchased in Canada, Australia or Japan.

The information contained in this press release does not

constitute an offer of securities for sale in Canada, Australia or

Japan.

This press release has been issued by and is the sole

responsibility of CGGVeritas. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by the

Joint Lead Managers and Joint Bookrunners or by any of their

respective affiliates or agents as to, or in relation to, the

accuracy or completeness of this press release or any other written

or oral information made available to or publicly available to any

interested party or its advisers, and any responsibility or

liability therefor whether arising in tort, contract or otherwise

is expressly disclaimed.

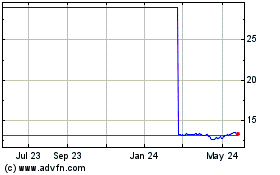

Conductor Global Equity ... (NYSE:CGV)

Historical Stock Chart

From Nov 2024 to Dec 2024

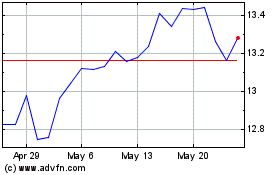

Conductor Global Equity ... (NYSE:CGV)

Historical Stock Chart

From Dec 2023 to Dec 2024