United States

Securities and

exchange commission

washington, d.c. 20549

FORM 6-K

report of foreign

private issuer

pursuant to rule 13a-16 or 15d-16 of

the securities exchange act of 1934

For the month of October 2024

Commission File Number 1-15224

Energy Company of Minas Gerais

(Translation of Registrant’s Name into English)

Avenida Barbacena, 1200

30190-131 Belo Horizonte, Minas Gerais, Brazil

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F a

Form 40-F ___

Index

Item Description

of Items

Forward-Looking Statements

This report contains statements about expected future events and financial

results that are forward-looking and subject to risks and uncertainties. Actual results could differ materially from those predicted in

such forward-looking statements. Factors which may cause actual results to differ materially from those discussed herein include those

risk factors set forth in our most recent Annual Report on Form 20-F filed with the Securities and Exchange Commission. CEMIG undertakes

no obligation to revise these forward-looking statements to reflect events or circumstances after the date hereof, and claims the protection

of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COMPANHIA ENERGÉTICA DE MINAS GERAIS – CEMIG

By: /s/ Leonardo George de Magalhães .

Name: Leonardo George de Magalhães

Title: Chief Finance and Investor Relations

Officer

Date: October 10, 2024

| 1. | Earnings Release – 2Q2024 |

CONTENTS

2Q24

HIGHLIGHTS |

2 |

CONSOLIDATED

RESULTS FOR THE QUARTER |

5 |

iNCOME

STATEMENTs |

6 |

RESULTS

BY BUSINESS SEGMENT |

7 |

CONSOLIDATED

ELECTRICITY MARKET |

8 |

PERFORMANCE

BY COMPANY |

9 |

Cemig

D |

9 |

Billed

electricity market |

9 |

Sources

and uses of electricity – MWh |

10 |

Client

base |

10 |

Performance

by sector |

10 |

The

Annual Tariff Adjustment |

11 |

Five-year

Tariff Reviews compared |

12 |

Supply

quality indicators – DEC and FEC |

13 |

Energy

losses |

14 |

Cemig

GT and Cemig Holding Company |

15 |

Electricity

market |

15 |

Sources

and uses of electricity – planning |

16 |

Gasmig |

17 |

Consolidated

results |

18 |

Net

profit |

18 |

Operational

revenue |

18 |

Operational

costs and expenses |

21 |

Finance

income and expenses |

24 |

Equity

income (gain/loss in non-consolidated investees) |

25 |

CONSOLIDATED

EBITDA (IFRS, and Adjusted) |

26 |

Ebitda

of Cemig D |

27 |

Cemig

GT – Ebitda |

28 |

Investments |

29 |

Debt |

30 |

Covenants

– Eurobonds |

32 |

Cemig’s

long-term ratings |

33 |

Cemig

in ESG |

34 |

Performance

of Cemig’s shares |

36 |

Cemig

generation plants |

37 |

Solar

generation – expansion |

37 |

RAP

in the 2024–2025 cycle |

38 |

Regulatory

Transmission Revenue |

39 |

Complementary

information |

39 |

Cemig

D |

39 |

Cemig

GT |

41 |

Cemig,

Consolidated |

42 |

Disclaimer |

48 |

| |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 4 |  |

CONSOLIDATED RESULTS FOR THE QUARTER

Consolidated

results – 2Q24

Consolidated

results – 2Q24

| |

2Q24 |

2Q23 |

Change % |

| Ebitda by company, IFRS |

|

|

|

| (R$ ’000) |

|

| Cemig D (IFRS) |

1,329,254 |

688,323 |

93.1% |

| Cemig GT (IFRS) |

641,413 |

629,067 |

2.0% |

| Gasmig (IFRS) |

236,749 |

254,754 |

–7.1% |

| Consolidated (IFRS) |

2,370,583 |

1,878,934 |

26.2% |

| |

2Q24 |

2Q23 |

Change % |

| Adjusted Ebitda, by company |

|

|

|

| (R$ ’000) |

|

|

|

| Cemig D |

872,391 |

688,323 |

26.7% |

| Cemig GT |

638,505 |

629,067 |

1.5% |

| Consolidated |

1,916,435 |

1,878,235 |

2.0% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 5 |  |

iNCOME

STATEMENTs

| |

2Q24 |

2Q23 |

Change, % |

| PROFIT AND LOSS ACCOUNT (R$ ’000) |

|

|

|

| NET REVENUE |

9,435,991 |

8,819,517 |

7.0% |

| |

|

|

|

| COSTS |

6,246,124 |

5,709,925 |

9.4% |

| Cost of electricity |

3,693,227 |

3,468,393 |

6.5% |

| Gas purchased for resale |

508,828 |

572,442 |

–11.1% |

| Charges for use of national grid |

817,136 |

704,850 |

15.9% |

| Infrastructure construction costs |

1,226,933 |

964,240 |

27.2% |

| |

|

|

|

| OPERATING EXPENSES |

1,195,774 |

1,603,202 |

–25.4% |

| People |

416,784 |

321,233 |

29.7% |

| Employees’ and managers’ profit shares |

43,187 |

36,645 |

17.9% |

| Post-employment liabilities |

98,391 |

157,841 |

–37.7% |

| Materials |

33,591 |

30,826 |

9.0% |

| Outsourced services |

507,706 |

456,909 |

11.1% |

| Depreciation and amortization |

337,779 |

303,263 |

11.4% |

| Provisions |

–429,592 |

132,503 |

–424.2% |

| Impairment |

4,438 |

–335 |

–1,424.8% |

| Provisions for client default |

77,300 |

21,266 |

263.5% |

| Other operating costs and expenses, net |

106,190 |

143,051 |

–25.8% |

| |

|

|

|

| Share of profit (loss) in non-consolidated investees |

38,711 |

69,281 |

–44.1% |

| |

|

|

|

| Net finance income (expenses) |

118,119 |

39,810 |

196.7% |

| Profit before income and Social Contribution taxes |

2,150,923 |

1,615,481 |

33.1% |

| Income tax and Social Contribution tax |

–462,337 |

–370,099 |

24.9% |

| |

|

|

|

| NET PROFIT FOR THE PERIOD |

1,688,586 |

1,245,382 |

35.6% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 6 |  |

RESULTS

BY BUSINESS SEGMENT

| INFORMATION BY SEGMENT, 2Q24 |

|

|

| Item |

Electricity |

Gas |

Equity interests |

Elimin-ations |

TOTAL |

|

|

| Generation |

Transmis-sion |

Trading |

Distribution |

|

|

| |

|

| NET REVENUE |

721,189 |

313,235 |

1,658,117 |

6,326,844 |

861,273 |

9,460 |

–454,127 |

9,435,991 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

COST OF

ELECTRICITY AND GAS |

–90,355 |

–81 |

–1,469,585 |

–3,394,674 |

–508,828 |

–1,318 |

445,650 |

–5,019,191 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| OPERATIONAL COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

| People |

–44,536 |

–44,665 |

–21,059 |

–283,162 |

–18,454 |

–4,908 |

– |

–416,784 |

|

|

| Employees’ and managers’ profit shares |

–4,683 |

–4,963 |

–3,215 |

–29,143 |

– |

–1,183 |

– |

–43,187 |

|

|

| Post-employment liabilities |

–10,372 |

–6,409 |

–1,469 |

–64,219 |

– |

–15,922 |

– |

–98,391 |

|

|

| Materials, Outsourced services and Other expenses |

–53,324 |

–22,994 |

–10,064 |

–526,616 |

–21,303 |

1,517 |

8,477 |

–624,307 |

|

|

| Depreciation and amortization |

–83,670 |

60 |

–4 |

-224,113 |

–24,085 |

–5,967 |

– |

–337,779 |

|

|

| Provisions |

14,074 |

16,760 |

–59,210 |

378,912 |

–414 |

–25,448 |

– |

324,674 |

|

|

| Infrastructure construction costs |

– |

–72,720 |

– |

–1,078,688 |

–75,525 |

– |

– |

–1,226,933 |

|

|

| Total cost of operation |

–182,511 |

–134,931 |

–95,021 |

–1,827,029 |

–139,781 |

–51,911 |

8,477 |

–2,422,707 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| OPERATIONAL COSTS AND EXPENSES |

–272,866 |

–135,012 |

–1,564,606 |

–5,221,703 |

–648,609 |

–53,229 |

454,127 |

–7,441,898 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Share of profit (loss) in non-consolidated investees |

1,012 |

– |

– |

– |

– |

37,699 |

– |

38,711 |

|

|

| Net finance income (expenses) |

–75,996 |

–41,764 |

6,921 |

305,459 |

–11,937 |

–64,564 |

– |

118,119 |

|

|

| PROFIT (LOSS) BEFORE TAXES ON PROFIT |

373,339 |

136,459 |

100,432 |

1,410,600 |

200,727 |

–70,634 |

– |

2,150,923 |

|

|

| Income tax and Social Contribution tax |

–58,300 |

–27,512 |

576 |

–350,163 |

–62,904 |

35,966 |

– |

–462,337 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| NET PROFIT FOR THE PERIOD |

315,039 |

108,947 |

101,008 |

1,060,437 |

137,823 |

–34,668 |

– |

1,688,586 |

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 7 |  |

CONSOLIDATED

ELECTRICITY MARKET

Cemig’s consolidated

electricity market

In June 2024 the Cemig Group

invoiced 9.31 million clients – an increase of approximately 179,000 clients, or 1.96%, in its consumer base since the end of June

2023. Of this total number of consumers, 9,312,882 comprise final consumers (and/or Cemig’s own consumption); and 538 are other

agents in the Brazilian power sector.

The chart below itemizes

the Cemig Group’s sales to final consumers:

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 8 |  |

PERFORMANCE

BY COMPANY

Cemig

D

Billed electricity market

| |

2Q24 |

2Q23 |

Change % |

| Captive clients + Transmission service (MWh) |

|

|

|

| Residential |

3,150,675 |

2,944,206 |

7.0% |

| Industrial |

5,771,074 |

5,613,226 |

2.8% |

| Captive market |

278,451 |

340,970 |

–18.3% |

| Transport |

5,492,623 |

5,272,256 |

4.2% |

| Commercial, services and Others |

1,622,287 |

1,565,792 |

3.6% |

| Captive market |

1,037,239 |

1,101,140 |

–5.8% |

| Transport |

585,048 |

464,652 |

25.9% |

| Rural |

767,562 |

805,322 |

–4.7% |

| Captive market |

752,773 |

796,071 |

–5.4% |

| Transport |

14,789 |

9,251 |

59.9% |

| Public services |

831,774 |

866,177 |

–4.0% |

| Captive market |

697,111 |

759,544 |

–8.2% |

| Transport |

134,663 |

106,633 |

26.3% |

| Concession holders |

74,376 |

78,183 |

–4.9% |

| Transport |

74,376 |

78,183 |

–4.9% |

| Own consumption |

7,710 |

7,370 |

4.6% |

| Total |

12,225,458 |

11,880,276 |

2.9% |

| Total, captive market |

5,923,959 |

5,949,301 |

–0.4% |

| Total, energy transported for Free Clients |

6,301,499 |

5,930,975 |

6.2% |

In

2Q24, energy supplied to captive clients plus energy transported for Free Clients and distributors totaled 12,230 GWh, or 2.9%

more than in 2Q23, mainly reflecting increases in consumption by residential consumers (an increase of 206.5 GWh or 7.0%), industrial

clients (an increase of 157.8 GWh or 2.8%), and commercial clients (an increase of 56.5 GWh or 3.6%) – reflecting: (i) high

ambient temperatures; (ii) higher industrial production, and (iii) increased activity in commerce and services.

The

2.9% increase in total energy distributed comprises: (a) an increase of 6.2% (+370.5 GWh) in use of the network by Free Clients,

and (b) a decrease of 0.4% (-25.3 GWh) in consumption by the captive market.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 9 |  |

Sources and uses of electricity –

MWh

| |

2Q24 |

2Q23 |

Change % |

| Metered market – MWh |

|

|

|

| Transported for distributors |

65,408 |

78,704 |

–16.9% |

| Transported for Free Clients |

6,263,100 |

5,846,035 |

7.1% |

| Own load + Distributed generation |

8,891,020 |

8,179,347 |

8.7% |

| Consumption by captive market |

5,814,060 |

5,793,844 |

0.3% |

| Distributed Generation market |

1,487,050 |

1,101,458 |

35.0% |

| Losses in distribution network |

1,589,910 |

1,284,045 |

23.8% |

| Total volume carried |

15,219,528 |

14,104,086 |

7.9% |

Client base

Of Cemig’s total of

9.31 million consumers (2.0% more than in June 2023), 3,422 were Free Clients using the distribution network of Cemig D.

| |

Jun. 24 |

Jun. 2023 |

Change % |

| NUMBER OF CAPTIVE CLIENTS |

|

|

|

| Residential |

7,872,637 |

7,619,544 |

3.3% |

| Industrial |

27,406 |

28,784 |

–4.8% |

| Commercial, services and Others |

908,389 |

944,880 |

–3.9% |

| Rural |

405,987 |

444,232 |

–8.6% |

| Public authorities |

71,375 |

70,442 |

1.3% |

| Public lighting |

6,896 |

7,344 |

–6.1% |

| Public services |

13,706 |

13,632 |

0.5% |

| Own consumption |

763 |

762 |

0.1% |

| Total, captive clients |

9,307,159 |

9,129,620 |

1.9% |

| NUMBER OF FREE CLIENTS |

|

|

|

| Industrial |

1,390 |

1,139 |

22.0% |

| Commercial |

1,950 |

1,566 |

24.5% |

| Rural |

34 |

14 |

142.9% |

| Concession holders ++/s??++ |

7 |

8 |

–12.5% |

| Others |

41 |

23 |

78.3% |

| Total, Free Clients |

3,422 |

2,750 |

24.4% |

| Total, Captive market + Free Clients |

9,310,581 |

9,132,370 |

2.0% |

Performance by sector

Industrial:

Energy distributed to Industrial clients was 2.8% higher in 2Q24 than 2Q23, on higher physical production by industry, and was 47.2% of

Cemig D’s total distribution. The greater part was energy transported for industrial Free Clients (44.9%), which was 4.2% higher

by volume than in 2Q23. Energy billed to captive industrial clients was 2.3% of the total distributed, and 18.3% less in total than in

2Q23 – mainly due to migration of industrial clients to the Free Market.

Highlights by industrial

sector were: (i) higher electricity consumption by Metals manufacturing (up +12.0%), Ferro-alloys (up 5.6%), Food and beverages (up

5.3%), and Cement (up 4.9%); and (ii) lower consumption in Non-ferrous metals (down 28.5%), Chemicals (down 5.8%), and Steel (down

2.7%).

Residential:

Residential consumption was 25.8% of total energy distributed by Cemig D, and 7.0% higher than

in 2Q23. Average monthly consumption per consumer in the quarter, at 133.4 kWh/month) was 3.6% higher than in 2Q23, reflecting temperatures

higher than historic averages, and higher family consumption. Also contributing to higher consumption was the growth in the number of

clients in this category – an increase of +3.3% (+253,100 clients).

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 10 |  |

Commercial

and services: Energy distributed to these consumers

was 13.3% of the total distributed by Cemig D in 2Q24, and by volume 3.6% more than in 2Q23. This increase is the result of a 5.8% reduction

in energy billed to captive clients, and an increase of 25.9% in the volume of energy transported for Free Clients. The increase in consumption

is related to expansion of the services sector, growth of retail sales, and the effect of temperatures above historical averages in the

period. It is worth noting that the increase in this user category happened in spite of the migration of consumers to Distributed Generation,

which, along with migration to the Free Market, was reducing captive consumption.

Rural:

Consumption by rural clients was 6.3% of the total energy distributed, and 4.7% lower by volume

than in 2Q23, mainly due to a reduction of 8.6% in the number of consumer units in this category.

Public services

consumed 6.8% of the energy distributed in 2Q24, in total 4.0% lower by volume than in 2Q23.

The Annual Tariff Adjustment

The tariffs of Cemig

D are adjusted in May of each year; and every five years are subjected to a Periodic Tariff Review, also in May. The aim of the Tariff

Adjustment is to pass on changes in non-manageable costs in full to the client and provide inflation adjustment for the manageable costs

as specified in the Tariff Review. Manageable costs are adjusted by the IPCA inflation index, less a factor known as the ‘X Factor’,

to capture productivity, under a system using the price-cap regulatory model.

On May 14, 2024 Aneel ratified

Cemig D’s Tariff Adjustment to be effective from May 28, 2024 to May 27, 2025, the result of which was an average increase for consumers

of 7.32%. The average effect for low-voltage clients was an increase of 6.72%, and for residential consumers an increase of 6.70%. The

percentage component corresponding to manageable costs (referred to as ‘Portion B’) was 1.27%. The increase relating to non-manageable

costs (‘Portion A’ – comprising purchase of energy, transmission, sector charges and non-recoverable revenues) was 0.81%;

and the increase in the financial components of the tariff contributed 5.23%. The financial components effect in 2024 comes mainly from

removal of the component included in the 2023 adjustment process relating to the repayment to consumers of PIS, Pasep and Cofins taxes

totaling R$ 1.27 billion.

| Average effects of the May 2024 Tariff Adjustment |

| High voltage – average |

8.63% |

| Low voltage – average |

6.72% |

| Average effect |

7.32% |

See more details at this link:

https://www2.aneel.gov.br/aplicacoes/tarifa/arquivo/Nota%20T%C3%A9cnica%20RTA%202024_CEMIG.pdf

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 11 |  |

Five-year Tariff Reviews compared

Comparison of the Tariff Reviews made in 2023

and the previous cycle (2018):

| Five-year Tariff Reviews |

2018 |

2023 |

| Gross Remuneration Base: R$ mn |

20,490 |

25,587 |

| Net Remuneration Base: R$ mn |

8,906 |

15,200 |

| Average depreciation rate: |

3.84% |

3.95% |

| WACC (after taxes): |

8.09% |

7.43% |

| Remuneration of ‘Special Obligations’ R$ mn |

149 |

272 |

| CAIMI* (Annual support for facilities) R$ mn |

333 |

484 |

| QRR** (Depreciation quota) R$ mn |

787 |

1,007 |

* CAIMI: (Cobertura Anual de Instalações

Móveis e Imóveis) – Annual support for facilities.

** QRR: ‘Regulatory Reintegration Quota’:

Gross base x annual depreciation rate.

See more details at this link:

https://www2.aneel.gov.br/aplicacoes/tarifa/arquivo/NT%2012%202023%20RTP%20Cemig.pdf

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 12 |  |

Supply quality indicators – DEC and

FEC

In 2023 the State of Minas

Gerais experienced an increase in extreme atmospheric events, which caused a slight increase in electricity outages. Cemig has taken initiatives

to reduce the number and duration of outages, making major investments in the distribution business to provide a quality service to clients.

These actions are already

generating positive results. The DEC indicator (average outage Duration per Consumer) was again within the regulatory limit: in

the 12-month window to the end of June 2024 Cemig’s DEC was 9.19 hours, compared to the regulatory target of 9.64 hours.

Combating default

The Company has kept its

collection activity at a high level, keeping its Receivables Recovery Index high: in June 2024 it was 98.21%.

New payment channels, and

online negotiation, have helped to increase the proportion of collection via digital channels (PIX instant payments, automatic debits,

payments by card, app, etc.). This percentage reached 67.71% of the total collected in 2Q24, compared to 59.62% in 2Q23. A highlight

is the PIX system, which was used for 26.2% of all collections. This system has saved R$ 25 million since it was implemented. The

change in the collection mix has reduced costs by 21% compared to June 2023.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 13 |  |

Energy losses

In the 12 months to the

end of June 2024 energy losses, at 10.91%, were above the regulatory target (10.66%).

Highlights

in our combat of energy losses in the period to June 2024 include: 185,000 inspections; replacement of more than 336,000 obsolete meters;

replacement of 57,000 conventional meters by smart meters (bringing the total of smart meters installed since the project began in September

2021 to 400,000); and regularization of 6,900 clandestine connections made by families living in ‘invaded’ and low-income

areas, through our Energia Legal program, which uses ‘bulletproofed’ networks, bringing the total of connections regularized

by the program since it began in February 2023 to 17,093. Planned for full-year 2024 are: 350,000 inspections; installation of a further

200,000 smart meters; and regularization for 30,000 families in low-income communities.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 14 |  |

Cemig

GT and Cemig Holding Company

Electricity market

The total volume of electricity

sold by Cemig GT and the holding company (‘Cemig H’), excluding sales on the wholesale power exchange (CCEE)

was 2.5% less than in 2Q23. Cemig GT billed 4,845 GWh (including quota sales) in 2Q24, 24.3% less than in 2Q23.

The lower figure is the

result of transfer of sales contracts to Cemig H, which reported sales of 4,714 GWh in 2Q24, 38.5% more than in 2Q23. The migration

of purchase contracts from Cemig GT to the holding company began in 3Q21, and has been gradually increasing since then. Approximately

60% of these contracts have now been transferred.

| |

2Q24 |

2Q23 |

Change % |

| Cemig GT – MWh |

| Free Clients |

2,930,478 |

3,736,779 |

–21.6% |

| Industrial |

1,966,550 |

2,723,027 |

-27.8% |

| Commercial |

888,478 |

1,009,531 |

–12.0% |

| Rural |

4,278 |

4,221 |

1.3% |

| Public authorities |

826 |

– |

– |

| ‘Energy retailer’ Free Clients |

70,345 |

– |

– |

| Free Market – Traders and cooperatives |

774,876 |

1,524,251 |

–49.2% |

| Quota supply |

560,621 |

557,934 |

0.5% |

| Regulated Market |

545,964 |

546,854 |

–0.2% |

| Regulated Market – Cemig D |

32,617 |

32,174 |

1.4% |

| Total, Cemig GT |

4,844,556 |

6,397,993 |

–24.3% |

| Cemig H – MWh |

|

|

|

| Free Clients |

2,597,781 |

1,849,940 |

40.4% |

| Industrial |

2,090,040 |

1,531,475 |

36.5% |

| Commercial |

492,665 |

313,433 |

57.2% |

| Rural |

15,076 |

5,032 |

199.6% |

| Free Market – Traders and cooperatives |

2,116,554 |

1,553,365 |

36.3% |

| Total Cemig H |

4,714,335 |

3,403,306 |

38.5% |

| Cemig GT + H |

9,558,890 |

9,801,298 |

–2.5% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 15 |  |

Sources and uses of electricity –

planning

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 16 |  |

Gasmig

Gasmig is the exclusive

distributor of piped natural gas for the whole of the State of Minas Gerais. It supplies industrial, commercial and residential

users, compressed natural gas, vehicle natural gas, and gas as fuel for thermoelectric generation plants. Its concession expires in January

2053. Cemig owns 99.57% of Gasmig.

Gasmig’s Tariff

Review was completed in April 2022. Highlights:

| § | The WACC used

(real, after taxes) was reduced from 10.02% p.a. to 8.71% p.a. |

| § | The Net Remuneration

Base was increased significantly, to R$ 3.48 billion. |

| § | The regulator

recognized the cost of PMSO (Personnel, Materials, Services outsourced and Other expenses) in full. |

| Market: Volume in ’000 m3 |

2022 |

2023 |

1H23 |

1H24 |

1H23–1H24 |

| Automotive |

40,950 |

31,907 |

16,759 |

11,518 |

–31.3% |

| Compressed vehicle natural gas |

364 |

541 |

308 |

263 |

–14.6% |

| Industrial |

870,667 |

830,943 |

422,675 |

390,394 |

–7.6% |

| Industrial compressed natural gas |

13,616 |

12,473 |

6,117 |

4,915 |

–19.7% |

| Residential |

11,392 |

11,912 |

6,025 |

5,749 |

–4.6% |

| Co-generation |

13,137 |

12,075 |

5,812 |

6,983 |

20.1% |

| Commercial |

23,114 |

21,964 |

10,585 |

11,085 |

4.7% |

| Subtotal – conventional sales |

973,240 |

921,815 |

468,281 |

430,907 |

–8.0% |

| Thermoelectric generation |

37,991 |

– |

– |

– |

– |

| Subtotal |

1,011,231 |

921,815 |

468,281 |

430,907 |

–8.0% |

| Industrial – Free Market |

87,133 |

92,362 |

42,111 |

45,903 |

9.0% |

| Industrial compressed natural gas – Free Market |

– |

– |

– |

5,491 |

– |

| Thermoelectric – Free Market |

7,119 |

19,050 |

316 |

11,304 |

3477% |

| Total (sales + Free Clients) |

1,105,483 |

1,033,227 |

510,708 |

493,605 |

–3.3% |

| Ebitda (R$ ’000) |

2Q24 |

2Q23 |

| Profit (loss) for the period |

137,823 |

162,581 |

| Income tax and Social Contribution tax |

64,608 |

78,231 |

| Net finance income (expenses) |

11,937 |

–7,883 |

| Depreciation and amortization |

22,381 |

21,825 |

| Ebitda per CVM Resolution 156 |

236,749 |

254,754 |

Volume of gas sold

in 1H24 was 8.0% lower than in 1H23, and volume distributed to industrial Free Clients was 9.0% higher.

Gasmig’s Ebitda

was 7.1% lower in 2Q24 than 2Q23, reflecting the lower volume of gas sold, and also the lower compensatory component included in the tariff

(for differences between actual costs and cost included in the tariff award calculation). In 2Q23 there was a positive effect on profit

from receipt of R$ 24 million in these compensatory payments.

Gasmig’s number

of clients increased by 13.1% from 1H23, to a total of 100,482 consumers in June 2024. This growth reflects expansion of both

the commercial and the residential client bases (addition of 11,700 clients).

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 17 |  |

Consolidated

results

Net profit

For 2Q24, Cemig once again reports

net profit of more than R$ 1 billion: R$ 1,689 million in 2Q24, compared to R$ 1,245 million in 2Q23. Adjusted 2Q24

net profit is R$ 1,134 million, which compares with R$ 1,214 million in 2Q23. Main factors in this result were:

| § | Cemig D

distributed 2.9% more energy in 2Q24 than in 2Q23. |

| § | Post-retirement

expenses were R$ 59.5 million lower. |

| § | Losses from default

(expected client credits) were R$ 56 million higher. |

| § | Equity income

(gain/loss in non-consolidated investees) in 2Q24 was R$ 30.6 million lower than in 2Q23. |

| § | The profit of

Gasmig was R$ 24.8 million lower than in 2Q23. |

Main non-recurring effects:

| § | Reversal of tax

provisions – Court judgment on social security contributions on profit sharing: R$ 584.4 million. |

| § | Reversal of amounts

repayable to consumers, with recognition of R$ 410.6 million in Finance income: |

| § | Expense on the

2024 Voluntary Retirement Program, recognized in Personnel expenses: R$ 78.1 million. |

| § | Provision

for a legal action, related

to an energy sale contract: R$ 52.6 million. |

| § | Success in the

legal action on the PAT fund: Finance income of R$ 50.2 million, and credit of R$ 31 million in income tax results. |

| § | Variation in

the US dollar exchange rate, net of our hedge transactions: Financial expense of R$ 144.4 million. |

More details of these variations

are given below.

Operational revenue

| |

2Q24 |

2Q23 |

Change % |

| R$ ’000 |

|

|

|

| Revenue from supply of electricity |

8,144,077 |

7,528,639 |

8.2% |

| Revenue from use of distribution systems (TUSD charge) |

1,251,554 |

1,118,367 |

11.9% |

| CVA and Other financial components in tariff adjustments |

-56,556 |

-164,649 |

–65.7% |

|

Reimbursement (to consumers)

of credits of

PIS, Pasep and Cofins taxes

– Amounts realized |

190,186 |

561,518 |

–66.1% |

| Transmission – Operation and maintenance revenue |

79,716 |

95,764 |

–16.8% |

| Transmission – Construction revenue |

104,891 |

69,802 |

50.3% |

| Financial remuneration of transmission contractual assets |

134,430 |

107,485 |

25.1% |

| Generation reimbursement |

20,596 |

23,469 |

–12.2% |

| Distribution construction revenue |

1,154,213 |

915,822 |

26.0% |

|

Adjustment to expected

cash flow from indemnifiable

financial assets of the distribution

concession |

22,258 |

46,731 |

–52.4% |

| Gain on financial updating of Concession Grant Fee |

107,011 |

94,837 |

12.8% |

| Settlements on CCEE |

14,380 |

14,002 |

2.7% |

| Retail supply of gas |

972,424 |

1,073,563 |

–9.4% |

| Fine for continuity indicator shortfall |

–37,084 |

–32,910 |

12.7% |

| Other operational revenues |

761,856 |

599,075 |

27.2% |

| Taxes and charges reported as deductions from revenue |

–3,427,961 |

–3,231,998 |

6.1% |

| Net operational revenue |

9,435,991 |

8,819,517 |

7.0% |

| |

|

|

|

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 18 |  |

Revenue from supply of electricity

| |

2Q24 |

2Q23 |

Change, % |

| |

MWh |

R$ ’000 |

Average price billed – R$/MWh (1) |

MWh |

R$ ’000 |

Average price billed – R$/MWh (1) |

MWh |

R$ ’000 |

| Residential |

3,150,675 |

3,066,719 |

973.35 |

2,944,206 |

2,531,656 |

859.88 |

7.0% |

21.1% |

| Industrial |

4,368,250 |

1,326,674 |

303.71 |

4,595,472 |

1,475,346 |

321.04 |

–4.9% |

–10.1% |

| Commercial, services and others |

2,447,423 |

1,609,719 |

657.72 |

2,424,104 |

1,597,321 |

658.93 |

1.0% |

0.8% |

| Rural |

779,848 |

599,558 |

768.81 |

805,325 |

538,750 |

668.98 |

–3.2% |

11.3% |

| Public authorities |

261,327 |

232,496 |

889.67 |

239,549 |

186,873 |

780.1 |

9.1% |

24.4% |

| Public lighting |

243,995 |

131,933 |

540.72 |

267,837 |

126,351 |

471.75 |

–8.9% |

4.4% |

| Public services |

192,990 |

174,633 |

904.88 |

252,158 |

167,976 |

666.15 |

–23.5% |

4.0% |

| Subtotal |

11,444,508 |

7,141,732 |

624.03 |

11,528,651 |

6,624,273 |

574.59 |

–0.7% |

7.8% |

| Own consumption |

7,710 |

– |

– |

7,370 |

– |

– |

4.6% |

– |

| Retail supply not yet invoiced, net |

– |

68,410 |

– |

– |

–47,525 |

– |

– |

– |

| |

11,452,218 |

7,210,142 |

624.03 |

11,536,021 |

6,576,748 |

574.59 |

–0.7% |

9.6% |

|

Wholesale supply to

other concession holders (2) |

3,952,637 |

966,330 |

244.48 |

4,136,944 |

969,884 |

234.44 |

–4.5% |

–0.4% |

| Wholesale supply not yet invoiced, net |

– |

-32,395 |

– |

– |

–17,993 |

– |

– |

80.0% |

| Total |

15,404,855 |

8,144,077 |

526.6 |

15,672,965 |

7,528,639 |

484.77 |

–1.7% |

8.2% |

| (1) | The calculation of average price

does not include revenue from supply not yet billed. |

| (2) | Includes Regulated Market Electricity

Sale Contracts (CCEARs) and ‘bilateral contracts’ with other agents. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 19 |  |

Energy sold to final consumers

Gross revenue from

sales to final consumers in 2Q24 was R$ 7,210.1 million, which compares with R$ 6,576.77 million in 2Q23, a year-on-year

increase of 9.6%, in spite of the total volume of energy sold to final consumers being 0.7% lower. The difference mainly reflects a lower

total of credits of PIS, Pasep and Cofins taxes being reimbursed to consumers in 2Q24: R$ 190 million, compared to R$ 562

million in 2Q23.

Wholesale supply

Revenue from wholesale supply

in 2Q24 was R$ 933.9 million, compared to R$ 951.9 million in 2Q23 – reflecting volume sold 4.5% lower year-on-year.

Transmission

| |

2Q24 |

2Q23 |

Change % |

| TRANSMISSION REVENUE (R$ ’000) |

|

|

|

| Operation and maintenance |

79,716 |

95,764 |

–16.8% |

| Infrastructure construction, strengthening and enhancement |

104,891 |

69,802 |

50.3% |

| Financial remuneration of transmission contractual assets |

134,430 |

107,485 |

25.1% |

| Total |

319,037 |

273,051 |

16.8% |

Revenue from financial

remuneration of transmission contractual assets was 25.1% higher, at R$ 26.9 million, in 2Q24, mainly due to the IPCA inflation

index, the basis for remuneration of the contract, being higher: +1.05% in 2Q24, compared to +0.76% in 2Q23. Construction revenue

was 50.3% higher, at R$ 35.1 million, mainly due to the stage of the construction projects to enhance strengthen the Company’s

networks: this phase involves significant supply of primary equipment, with high financial value. In counterpart, operation and maintenance

revenue was 16.8% lower.

Gas

Gross revenue from supply

of gas in 2Q24 was R$ 972.4 million, compared to R$ 1,073.6 million in 2Q23. This reflects lower volume sold to the industrial

and automotive segments in 2Q24, and also a lower ‘compensation component’ being awarded in the tariff in 2024. In 2Q23 there

was a contribution to revenue of R$ 24 million in these compensatory components.

Revenue from Use of Distribution Systems –

The TUSD charge

| |

2Q24 |

2Q23 |

Change % |

| TUSD (R$ ’000) |

| Use of the Electricity Distribution System |

1,251,554 |

1,118,367 |

11.9% |

2Q24 revenue from the TUSD

– charged to Free Consumers on the distribution of energy to them – being R$ 133.2 million higher than in 2Q23

was mainly due to the volume of energy transported for Free Clients being 6.2% higher (the main contributors being the industrial and

commercial client categories).

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 20 |  |

| |

2Q24 |

2Q23 |

Change % |

| POWER TRANSPORTED – MWh |

| Industrial |

5,492,623 |

5,272,256 |

4.2% |

| Commercial |

585,048 |

464,652 |

25.9% |

| Rural |

14,789 |

9,251 |

59.9% |

| Public services |

134,663 |

106,633 |

26.3% |

| Concession holders |

74,376 |

78,183 |

–4.9% |

| Total energy transported |

6,301,499 |

5,930,975 |

6.2% |

Operational costs and expenses

| |

2Q24 |

2Q23 |

Change % |

| CONSOLIDATED (R$ ’000) |

|

|

|

| Electricity bought for resale |

3,693,227 |

3,468,393 |

6.5% |

| Charges for use of national grid |

817,136 |

704,850 |

15.9% |

| Gas purchased for resale |

508,828 |

572,442 |

–11.1% |

| Construction cost |

1,226,933 |

964,240 |

27.2% |

| People |

416,784 |

321,233 |

29.7% |

| Employees’ and managers’ profit shares |

43,187 |

36,645 |

17.9% |

| Post-employment liabilities |

98,391 |

157,841 |

–37.7% |

| Materials |

33,591 |

30,826 |

9.0% |

| Outsourced services |

507,706 |

456,909 |

11.1% |

| Depreciation and amortization |

337,779 |

303,263 |

11.4% |

| Provisions |

-429,592 |

132,503 |

–424.2% |

| Impairments (reversal) |

4,438 |

-335 |

–1424.8% |

| Provisions for client default |

77,300 |

21,266 |

263.5% |

| Other operating costs and expenses, net |

106,190 |

143,051 |

–25.8% |

| Total |

7,441,898 |

7,313,127 |

1.8% |

Operational costs and expenses

in 2Q24 totaled R$ 7.44 billion, compared to R$ 7.31 billion in 2Q23. The main variations are: total cost

of electricity purchased for resale R$ 224.8 million higher; construction cost R$ 262.7 million higher; expenditure on charges

for use of the national grid R$ 112.3 million higher; the provision for client default R$ 56.0 million higher; and cost of personnel

R$ 95.6 million higher – partially offset by R$ 562.1 million in reversal of provisions. See more details on costs and

expenses in the pages below.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 21 |  |

Electricity purchased for resale

| |

2Q24 |

2Q23 |

Change % |

| CONSOLIDATED (R$ ’000) |

|

|

|

| Electricity acquired in Free Market |

1,269,988 |

1,265,440 |

0.4% |

| Electricity acquired in Regulated Market auctions |

1,035,152 |

980,749 |

5.5% |

| Distributed generation |

697,974 |

491,669 |

42.0% |

| Supply from Itaipu Binacional |

304,286 |

310,711 |

–2.1% |

| Physical guarantee quota contracts |

214,415 |

228,692 |

–6.2% |

| Individual (‘bilateral’) contracts |

122,958 |

127,295 |

–3.4% |

| Proinfa |

116,081 |

127,895 |

–9.2% |

| Spot market |

132,881 |

141,020 |

–5.8% |

| Quotas for Angra I and II nuclear plants |

94,393 |

89,918 |

5.0% |

| Credits of PIS, Pasep and Cofins taxes |

–294,901 |

–294,996 |

0.0% |

| |

3,693,227 |

3,468,393 |

6.5% |

The consolidated expense

on electricity bought for resale in 2Q24 was R$ 3.69 billion, an increase of R$ 224.8 million (6.5%) from 2Q23. Main factors are:

| § | Expenses on energy

acquired in the Regulated Market were R$ 54.4 million higher (+5.5%) than in 2Q23, reflecting (i) the annual adjustments to

contracts, by the IPCA inflation index, and (ii) entry of new contracts. |

| § | The expense on

distributed generation was R$ 206.3 million higher (+42.0%), reflecting the increase in the number of generation units (to 273,000

in June 2024, from 231,000 in June 2023), and a 32.9% YoY increase in the volume of energy injected, to 1,487 GWh in 2Q24. |

| § | The costs of

energy acquired in the Free Market (the Company’s highest cost of purchased energy) totaled R$ 1,270 million, an increase of

R$ 4.5 million (+0.4%) in relation to 2Q23. |

| § | Costs of physical

quota guarantee contracts in 2Q24 totaled R$ 214.4 million, compared to R$ 228.7 million in 2Q23. This reduction mainly reflects

(i) seasonal effects in allocation of energy by Aneel, and (ii) reduction of quota contracts due to the process of privatization

of Eletrobras. |

Note that for Cemig D, purchased

energy is a non-manageable cost: the difference between the amounts used as a reference for calculation of tariffs and the costs actually

incurred is compensated for in the next tariff adjustment.

| |

2Q24 |

2Q23 |

Change % |

| Cemig D (R$ ’000) |

|

|

|

| Supply acquired in auctions on the Regulated Market |

1,045,713 |

995,113 |

5.1% |

| Distributed generation |

697,973 |

491,670 |

42.0% |

| Supply from Itaipu Binacional |

304,286 |

310,711 |

–2.1% |

| Physical guarantee quota contracts |

218,530 |

238,435 |

–8.3% |

| Individual (‘bilateral’) contracts |

122,958 |

127,295 |

–3.4% |

| Proinfa |

116,081 |

127,895 |

–9.2% |

| Quotas for Angra I and II nuclear plants |

94,393 |

89,918 |

5.0% |

| Spot market – CCEE |

121,879 |

99,298 |

22.7% |

| Credits of PIS, Pasep and Cofins taxes |

-177,062 |

-174,303 |

1.6% |

| |

2,544,751 |

2,306,032 |

10.4% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 22 |  |

Charges for use

of the transmission network, and other system charges

Charges for use of the transmission

network in 2Q24 totaled R$ 817.14 million, 15.9% higher than in 2Q23. The difference primarily reflects (i) entry into operation

of Reserve Energy contracts under the Simplified Competitive Procedure (PCS) of 2021, with a consequent increase in the reserve energy

charges in the period; (ii) dispatching of thermal plants, due to supply factors; and (iii) a lower volume of wind generation.

This is a non-manageable

cost in the distribution business: the difference between the amounts used as a reference for calculation of tariffs and the costs actually

incurred is compensated for in the next tariff adjustment.

Gas purchased for

resale

The expense on acquisition

of gas in 2Q24 was R$ 508.83 million, or 11.1% less than in 2Q23. This reflects both (i) a lower price of gas acquired for resale,

and also (ii) lower quantity: total volume sold was 8.0% lower year-on-year.

Outsourced services

Expenditure on outsourced

services was 11.1% (R$ 50.8 million) higher than in 2Q23, the main factors being: (i) the expense on maintenance of electrical facilities

and equipment was higher by R$ 22.7 million (+13.7%); (ii) the expense on cleaning of power line pathways was R$ 10.4 million higher

(+37.5%); and (iii) the expense on tree pruning was R$ 8.0 million higher (+63.3%).

Provisions for client

default

The expense on provisions

for losses due to client default in 2Q24 was R$ 77.3 million, compared to R$ 21.3 million in 2Q23. The low figure in 2023 mainly

reflects the revision, in 3Q22, of the criteria for accounting for overdue client receivables, which had a positive effect over 12 months:

in that revision, the threshold for posting 100% loss was increased from 12 to 24 months, so as to more faithfully reflect the behavior

of Cemig’s clients in practice.

Provisions

The provisions in 2Q24 was

a reversal of R$ 429.6 million – which compares to posting of new provisions totaling R$ 132.5 million in 2Q23. This mainly

reflects the judgment won in the courts by the Company, in the first instance, canceling the charge of social security contributions on

Profit Sharing. As a result, provisions previously made for that action, totaling R$ 584.4 million, were reversed.

Also in the quarter, a provision

of R$ 52.6 million was made for a civil action against Cemig GT, due to reassessment of the probability of loss from possible to probable,

which called for annulment of a purchase clause in a Free Market trading contract and repayment of the amounts the plaintiff had paid.

In addition, the judgment to reduce the amount of the termination fine and to remove the incidence of spread in the calculation of the

debt was partially granted.

Post-employment

liabilities

The impact of the Company’s

post-retirement obligations on operational profit in 2Q24 was an expense of R$ 98.4 million, compared to an expense of R$ 157.8

million in 2Q23. The difference is mainly due to reduction in the number of participants in the Integrated Health Plan (Plano de Saúde

Integrado – PSI) due to active employees voluntarily subscribing to the new health plan, called the Premium Plan, offered by

the Company.

People

Personnel expenses were

R$ 416.8 million in 2Q24, compared to R$ 321.2 million in 2Q23. In May 2024 Cemig approved the 2024 Voluntary Retirement Program,

which was joined by 357 employees. The expense on the program totaled R$ 78.1 million, recognized in Personnel costs.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 23 |  |

Finance income and expenses

| |

2Q24 |

2Q23 |

Change % |

| (R$ ’000) |

|

|

|

| Finance income |

725,474 |

512,131 |

41.7% |

| Finance expenses |

–607,355 |

–472,321 |

28.6% |

| Net finance income (expenses) |

118,119 |

39,810 |

196.7% |

For 2Q24 the Company posed

consolidated net financial revenue, of R$ 118.1 million, compared to net financial revenue of R$ 39.8 million in 2Q23.

Components:

| § | The main factor

is a write-down, in May 2024, recognized in Finance income, of R$ 410.6 million in the liability posted as “Amounts to be repaid

to consumers” – due to the estimated amount of financial updating that had been posted by Cemig D for this liability being

higher than under the criterion finally used by Aneel. |

| § | The Company won

a legal action requesting the right to deduct from income tax the costs and expenses incurred on the Workers’ Food Program (PAT),

up to a limit of 4% of tax payable, without being subject to limitations set by certain regulations in force at the time. The Company

also requested recognition of the right to be reimbursed amounts paid in excess in the years 2004-2008, with monetary updating by the

Selic rate. As a result of the judgment, a recoverable total of R$ 81.2 million was recognized in June 2024: R$ 50.2 million

in Finance revenue, and credit of R$31 million in the income tax result. |

| § | Income from cash

investments, at R$ 117 million in 2Q24, R$ 11 million higher than in 2Q23 – mainly reflecting a higher volume of cash

available for investment in 2024. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 24 |  |

| § | Monetary updating

on the balances of CVA and Other financial components in tariff increases: an expense of R$ 2.7 million in 2Q24, compared

to a gain (revenue) of R$ 65.5 million in 2Q23. This basically reflects the monetary updating of the Financial component “Bandeira

Escassez Hídrica” approved by Aneel in the 2023 tariff process, with financial revenue recorded in 2Q23. |

| § | In 2Q24 the US

dollar appreciated by 11.26% against the Real, compared to a depreciation of 5.14% in 2Q23, generating an expense of R$ 214.5

million in 2Q24, compared to a gain of R$ 197.5 million in 2Q23. |

| § | The fair value

of the financial instrument contracted to hedge the risks connected with the Eurobonds gained R$ 70 million in value in 2Q24; and

lost value of R$ 150 million in 2Q23. |

Eurobonds: Effects in the quarter (R$ ’000)

| |

2Q24 |

2Q23 |

| Effect of FX variation on the debt |

–214,451 |

197,496 |

| Effect on the hedge |

70,018 |

–150,010 |

| Net effect in Financial income (expenses) |

–144,433 |

47,486 |

Equity income (gain/loss in non-consolidated

investees)

| |

2Q24 |

2Q23 |

Change R$ ’000 |

| Gain/loss on equity in non-consolidated investees (R$ ’000) |

|

|

|

| Taesa |

51,707 |

41,221 |

10,486 |

| Aliança Geração |

– |

29,191 |

–29,191 |

| Paracambi |

4,398 |

6,486 |

–2,088 |

| Hidrelétrica Pipoca |

6,316 |

2,813 |

3,503 |

| Hidrelétrica Cachoeirão |

832 |

3,261 |

–2,429 |

| Guanhães Energia |

3,823 |

2,183 |

1,640 |

| Cemig Sim (Equity holdings) |

3,534 |

3,151 |

383 |

| Baguari Energia |

– |

1,707 |

–1,707 |

| Retiro Baixo |

– |

949 |

–949 |

| Belo Monte (Aliança Norte and Amazônia Energia) |

–27,178 |

–21,681 |

–5,497 |

| Itaocara |

–4,721 |

– |

–4,721 |

| Total |

38,711 |

69,281 |

–30,570 |

The gain in equity value

of non-consolidated investees in 2Q24 was R$ 30.6 million lower than in 2Q23. Note that the investment in Aliança

Geração, following its classification, as from April 2024, as a non-current asset held for sale, is no longer included

in Equity income. The gain in value of Cemig’s stake in Aliança Geração in 2Q23 was R$ 29.2 million.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 25 |  |

CONSOLIDATED

EBITDA (IFRS, and Adjusted)

Ebitda is a non-accounting

metric, prepared by the Company, reconciled with its consolidated financial statements in accordance with the specifications in CVM Circular

SNC/SEP 01/2007 and CVM Resolution 156 of June 23, 2022. It comprises: Net profit adjusted for the effects of: (i) Net financial

revenue (expenses), (ii) Depreciation and amortization, and (iii) Income tax and the Social Contribution tax. Ebitda is not

a metric recognized by Brazilian GAAP nor by IFRS; it does not have a standard meaning; and it may be non-comparable with metrics with

similar titles provided by other companies. Cemig publishes Ebitda because it uses it to measure its own performance. Ebitda should not

be considered in isolation or as a substitute for net profit or operational profit, nor as an indicator of operational performance or

cash flow, nor to measure liquidity nor the capacity for payment of debt. In accordance with CVM Instruction 156/2022, the Company adjusts

Ebitda to exclude extraordinary items which, by their nature, do not contribute to information on the potential for gross cash flow generation.

| Consolidated 2Q24 Ebitda |

| R$ ’000 |

Generation |

Transmission |

Trading |

Distribution |

Gas |

Holding co. and equity interests |

Total |

| Profit (loss) for the period |

315,039 |

108,947 |

101,008 |

1,060,437 |

137,823 |

–34,668 |

1,688,586 |

| Income tax and Social Contribution tax |

58,300 |

27,512 |

–576 |

350,163 |

62,904 |

–35,966 |

462,337 |

| Net finance income (expenses) |

75,996 |

41,764 |

–6,921 |

–305,459 |

11,937 |

64,564 |

–118,119 |

| Depreciation and amortization |

83,670 |

–60 |

4 |

224,113 |

24,085 |

5,967 |

337,779 |

| Ebitda per CVM Resolution 156 |

533,005 |

178,163 |

93,515 |

1,329,254 |

236,749 |

–103 |

2,370,583 |

| Net profit attributed to non-controlling stockholders |

– |

– |

– |

– |

–593 |

– |

–593 |

| Reversal of tax provision – Social security contributions on profit sharing |

–30,503 |

–32,967 |

–5,049 |

–513,331 |

– |

–2,500 |

–584,350 |

| Provision for civil action on an energy sale |

– |

– |

52,647 |

– |

– |

– |

52,647 |

| Voluntary retirement program |

9,312 |

10,064 |

1,541 |

56,468 |

– |

763 |

78,148 |

| Adjusted Ebitda |

511,814 |

155,260 |

142,654 |

872,391 |

236,156 |

–1,840 |

1,916,435 |

| Consolidated 2Q23 Ebitda |

| R$ ’000 |

Generation |

Transmission |

Trading |

Distribution |

Gas |

Holding co. and equity interests |

Total |

| Profit (loss) for the period |

362,695 |

99,390 |

213,386 |

365,437 |

162,582 |

41,892 |

1,245,382 |

| Income tax and Social Contribution tax |

79,933 |

35,403 |

121,145 |

137,575 |

76,527 |

–80,484 |

370,099 |

| Net finance income (expenses) |

–10,055 |

1,359 |

–28,664 |

–11,565 |

–7,884 |

16,999 |

–39,810 |

| Depreciation and amortization |

80,078 |

–121 |

3 |

196,873 |

23,528 |

2,902 |

303,263 |

| Ebitda per CVM Resolution 156 |

512,651 |

136,031 |

305,870 |

688,320 |

254,753 |

–18,691 |

1,878,934 |

| Non-recurring and non-cash effects |

|

|

|

|

|

|

|

| Net profit attributed to non-controlling stockholders |

– |

– |

– |

– |

–699 |

– |

–699 |

| Adjusted Ebitda |

512,651 |

136,031 |

305,870 |

688,320 |

254,054 |

–18,691 |

1,878,235 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 26 |  |

Ebitda of Cemig D

| |

2Q24 |

2Q23 |

Change % |

| Cemig D Ebitda – R$ ’000 |

|

|

|

| Net profit for the period |

1,060,436 |

365,439 |

190.2% |

| Income tax and Social Contribution tax |

350,163 |

137,575 |

154.5% |

| Net finance revenue (expenses) |

–305,458 |

–11,565 |

2,541.2% |

| Amortization |

224,113 |

196,874 |

13.8% |

| Ebitda |

1,329,254 |

688,323 |

93.1% |

| Reversal of tax provision – Social security contributions on profit sharing |

–513,331 |

– |

– |

| Voluntary retirement program |

56,468 |

– |

– |

| Adjusted Ebitda |

872,391 |

688,323 |

26.7% |

The main factors in Cemig

D’s 2Q24 Adjusted Ebitda, at R$ 872.4 million, being 26.7% more than in 2Q23, were:

| § | 2.9% more

energy distributed than in 2Q23 (0.4% less in the captive market and 6.2% more in the Free Market), reflecting (i) high temperatures,

(ii) higher industrial production, and (iii) stronger activity in commerce and services in the period. Residential consumption

was up 7.0%, industrial consumption was up 2.8%, and consumption by commerce was up 3.6%. |

| § | New Replacement

Value (VNR) posted in 2Q24 was R$ 22.3 million, vs. R$ 46.7 million in 2Q23. |

| § | Higher volume

of client default provisions: R$ 72.5 million in 2Q24,vs. R$ 21.3 million in 2Q23 – mainly reflecting the revision, in

3Q22, of the rules for measurement of provisions for default, which had a positive effect in the subsequent 12 months. |

| § | Post-employment

expenses R$ 41.8 million lower in 2Q24, as a result of the new health plan being accepted by some of the active employees. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 27 |  |

Cemig GT – Ebitda

| Cemig GT 2Q24 Ebitda |

|

|

|

|

|

| R$ ’000 |

Generation |

Transmission |

Trading |

Equity interests |

Total |

| Profit (loss) for the period |

313,025 |

107,131 |

–22,360 |

–69,873 |

327,923 |

| Income tax and Social Contribution tax |

58,299 |

26,616 |

–13,745 |

–31,713 |

39,457 |

| Net finance income (expenses) |

75,996 |

41,890 |

–6,921 |

79,395 |

190,360 |

| Depreciation and amortization |

83,669 |

– |

4 |

– |

83,673 |

| Ebitda per CVM Resolution 156 |

530,989 |

175,637 |

–43,022 |

–22,191 |

641,413 |

| Reversal of tax provision – Social security contributions on profit sharing |

–30,503 |

–32,967 |

–5,049 |

–2,500 |

–71,019 |

| Voluntary retirement program |

6,643 |

7,178 |

1,099 |

544 |

15,464 |

| Provision for civil action on an energy sale |

22,612 |

24,439 |

3,743 |

1,853 |

52,647 |

| Adjusted Ebitda |

529,741 |

174,287 |

–43,229 |

–22,294 |

638,505 |

| Cemig GT 2Q23 Ebitda |

|

|

|

|

|

| R$ ’000 |

Generation |

Transmission |

Trading |

Equity interests |

Total |

| Profit (loss) for the period |

363,181 |

97,811 |

9,384 |

–10,890 |

459,486 |

| Income tax and Social Contribution tax |

79,932 |

34,400 |

16,052 |

–26,115 |

104,269 |

| Net finance income (expenses) |

–10,055 |

1,632 |

–28,664 |

22,318 |

–14,769 |

| Depreciation and amortization |

80,078 |

– |

3 |

– |

80,081 |

| Ebitda per CVM Resolution 156 |

513,136 |

133,843 |

–3,225 |

–14,687 |

629,067 |

Cemig GT adjusted

EBITDA was R$638.5 million in 2Q24, being 1.5% higher than in 2Q23. The effects on EBITDA are as follows:

| § | A GSF better

in 2Q24 – approximately 5% higher than in 2Q23. |

| § | Volume of energy

sold, excluding settlements on the CCEE, 24.3% lower, due to transfer of contracts to the holding company. |

| § | Lower equity

income (share of gain/loss in non-consolidated investees): R$ 8.3 million negative in 2Q24, vs. R$ 95 million positive in 2Q23.

A significant component was equity income of R$ 27.2 million negative from Belo Monte in 2Q24. |

| § | Post-employment

expenses were R$ 12.5 million lower in 2Q24, as a result of the new health plan being accepted by part of the active employees. |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 28 |  |

Investments

In

1H24 Cemig invested a total of R$ 2.45 billion, 43.1% more than in 1H23. Cemig Distribution invested the most –

R$ 1.96 billion – in the half year.

Energizing

of the photovoltaic solar plants began in June 2024. At Eduardo Soares (Boa Esperança), 172 of the 285 generation

units solar plant are now in commercial operation; and at the Jusante solar plant, 102 of the 238 units are at the operational

testing phase. These two plants are expected to be in 100% commercial operation in August-September 2024 – making a further forceful

contribution to our growth in renewable generation sources.

Gasmig

has begun works on the Centro-Oeste Project, with allocated capex of R$ 780 million, for construction of 300 kilometers of

pipeline network.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 29 |  |

Debt

| CONSOLIDATED (R$ ’000) |

Jun. 2024 |

Dec. 2023 |

Change, % |

| Gross debt |

11,643,438 |

9,831,139 |

18.4% |

| Cash and equivalents + Securities |

2,995,257 |

2,311,464 |

29.6% |

| Net debt |

8,648,181 |

7,519,675 |

15.0% |

| Debt in foreign currency |

2,133,148 |

1,854,093 |

15.1% |

| CEMIG GT (R$ ’000) |

Jun. 2024 |

Dec. 2023 |

Change, % |

| Gross debt |

3,156,086 |

2,868,093 |

10.0% |

| Cash and equivalents + Securities |

1,158,602 |

937,518 |

23.6% |

| Net debt |

1,997,484 |

1,930,575 |

3.5% |

| Debt in foreign currency |

2,133,148 |

1,854,093 |

15.1% |

| CEMIG D (R$ ’000) |

Jun. 2024 |

Dec. 2023 |

Change, % |

| Gross debt |

7,381,071 |

5,887,622 |

25.4% |

| Cash and equivalents + Securities |

719,308 |

450,748 |

59.6% |

| Net debt |

6,661,763 |

5,436,874 |

22.5% |

| Debt in foreign currency |

– |

– |

– |

In 2Q24 Cemig D amortized

debt of R$ 135 million.

In March Cemig D concluded

a R$ 2 billion issue of “ESG” debentures (proceeds to be used for sustainable purposes) – for which demand was

2.73 times the offering – in two series: (1) for R$ 400 million, paying the CDI rate plus 0.80% p.a., maturing

in 5 years with partial amortization in the 4th year; and (2) for R$ 1.6 billion, paying IPCA inflation plus 6.1469%,

p.a., with 10-year maturity and amortizations in years 8 and 9.

After this issue the average

tenor of Cemig’s debt increased by approximately one year, to 3.4 years in June 2024. Leverage (Net debt/adjusted

Ebitda) remains low, at 1.02x.

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 30 |  |

| |

2Q24 |

| DEBT AMORTIZED – R$ ’000 |

|

| Cemig GT |

– |

| Cemig D |

135,000 |

| Others |

– |

| Total |

135,000 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 31 |  |

Covenants

– Eurobonds

| Last 12 months |

Jun. 2024 |

|

Dec. 2023 |

| R$ mn |

GT |

H |

|

GT |

H |

| Net profit (loss) |

2,155 |

5,965 |

|

2,403 |

5,767 |

| Net financial revenue (expenses) |

376 |

376 |

|

96 |

379 |

| Income tax and Social Contribution tax |

540 |

1,170 |

|

584 |

1,084 |

| Depreciation and amortization |

335 |

1,334 |

|

329 |

1,274 |

| Profit (loss) in minority holdings |

-38 |

-371 |

|

–141 |

–432 |

|

Provisions for change

in obligation under

put option |

0 |

- |

|

58 |

58 |

| Non-operational profit (loss) – includes any gains on sales of assets, and any writeoffs of value in, or impairment of, assets |

-320 |

-320 |

|

–289 |

–289 |

| Non-recurring non-monetary expenses and/or charges. |

-3 |

-454 |

|

–21 |

–57 |

| Any non-recurring non-monetary credits or gains that increase net profit |

- |

-3 |

|

– |

23 |

| Non-monetary gains related to transmission and/or generation reimbursements |

-562 |

-567 |

|

–515 |

–524 |

|

Dividends received in

cash from

minority investments

(as measured in Cash flow

statement) |

306 |

175 |

|

363 |

592 |

| Inflation correction on concession charges |

-418 |

-418 |

|

–412 |

–412 |

| Cash inflows related to concession charges |

336 |

336 |

|

331 |

331 |

| Cash inflows related to transmission revenue for coverage of cost of capital |

845 |

854 |

|

738 |

747 |

| Adjusted Ebitda |

3,552 |

8,077 |

|

3,524 |

8,541 |

| 12 months |

Jun. 2024 |

|

Dec. 2023 |

| R$ mn |

GT |

H |

|

GT |

H |

| Consolidated debt |

3,156 |

11,643 |

|

2,868 |

9,831 |

| Derivative hedge instrument |

–487 |

–487 |

|

–368 |

–368 |

| Debt contracts with Forluz |

114 |

504 |

|

138 |

611 |

| Consolidated cash and cash equivalents and consolidated securities posted as current assets |

–1,159 |

–2,995 |

|

–938 |

–2,311 |

| Adjusted net debt |

1,624 |

8,665 |

|

1,700 |

7,763 |

| |

Jun. 2024 |

|

Dec. 2023 |

| Net debt covenant / Ebitda covenant |

0.46 |

1.07 |

|

0.48 |

0.91 |

|

Limit for: (Net debt

covenant) /

(Ebitda covenant) |

2.50 |

3.00 |

|

2.50 |

3.00 |

| Consolidated debt with asset guarantees |

– |

– |

|

– |

– |

|

(Consolidated debt with

guarantees) /

(Ebitda covenant) |

– |

– |

|

– |

– |

| Limit for: (Consolidated debt with guarantees) / (Ebitda covenant) |

– |

1.75 |

|

– |

1.75 |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 32 |  |

Cemig’s

long-term ratings

Cemig’s ratings have

improved significantly in recent years, and are currently at their highest-ever level. In 2021 the three principal rating agencies upgraded

their ratings for Cemig. In April 2022, Moody’s again upgraded its rating for Cemig, this time by one notch. In 2023, S&P, Fitch

Ratings and Moody’s maintained their ratings for Cemig. In May 2024 Moody’s increased its ratings on the Brazilian scale

for Cemig, Cemig D and Cemig GT from “AA.br“ to “AA+.br reflecting our success in implementing measures

that increased the Company’s credit quality.

More details in this

table:

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 33 |  |

Cemig

in ESG

Highlights

| § | Cemig customers

with distributed generation systems will now have their energy account issued and delivered directly by the Cemig meter reader. Previously

customers not opting to receive their bills by email automatically had them sent by mail. This will save Cemig more than R$ 12 million

per year on bill delivery. |

| § | Cemig has installed

more than 3,000 reclosers at location in the distribution network throughout the state, to improve continuity of power supply, reduce

costs, and avoid unnecessary outages. In 2024 Cemig will invest a total of R$ 120 million in automation of its electricity network. |

| § | Cemig has launched

Cemig Agro project to meet needs of the rural regions of the state of Minas Gerais. Its goal is to expand electricity supply, improve

supply quality, and provide new channels for client service – aiming to reduce both outages and client response time. |

| § | Cemig is in the

FTSEforGood index, with a score of 3.8, an improvement of more than 9% on the previous year, and above the average for the electricity

sector (2.8) in all aspects assessed – with emphasis on governance, in which Cemig’s score was 4.5 out of a total of 5. Cemig

also scored maximum points in three other key aspects: anti-corruption, climate change, and biodiversity. |

Environment

| § | Cemig has joined

the UN’s Net Zero Movement, and monitors reduction of its activities’ CO2 emissions. The Company

reduced emissions by 48.97% from 2021 to 2023. The Brazilian GHG Protocol program, the main instrument used in the country to quantify

an organization’s GHG emissions, awarded Cemig its Gold Seal – its maximum level of recognition for companies that

present complete, third-party-verified emissions data. |

Social

| § | Mental health:

Cemig has launched its Energia Mental program, promoting initiatives that help create a healthier, more welcoming work environment

in terms of mental health, as a component of workplace health. |

| § | Low-income

communities: Cemig’s Energia Legal program regularizes connections for communities in the Greater Belo Horizonte region.

Since its launch it has served 8,047 families – conducting 6,000 energy efficiency visits; donating lamps; providing safety and

consumption guidelines; installing 4,500 connection installations for low-income families free of charge; and registering 2,250 families

for the social (low-income) electricity tariff (TSEE). |

Governance

| § | Cemig has Sarbanes-Oxley

Law (SOX) certification for its financial statements, with no material weakness reported. This is acknowledgment that Cemig’s internal

controls are solid, as a result of assertive measures taken in recent years. |

Cemig

in the key sustainability indices

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 34 |  |

Indicators

| |

1Q24 |

2Q24 |

| |

Climate change and renewable energy |

|

|

|

% of generation from renewable sources |

100% |

100% |

| Consumption of electricity per employee (MWh) |

2.26 |

2.11 |

| Consumption of renewable fuels (GJ) |

35,620 |

153,415 |

| Consumption of non-renewable fuels (GJ) |

851,121 |

768,881 |

| Index of energy losses in the national grid (Cemig GT)(%) |

2.51 |

2.44 |

| I–REC (renewable-source) certificates sold |

1,627,823 |

333,159 |

| Cemig renewable source RECs sold |

1,667,149 |

322,211 |

| Number of smart meters installed |

30,179 |

25,574 |

| |

|

|

|

|

Impact and environmental protection |

|

|

| |

|

|

| Number of transformers refurbished |

233 |

0 |

| Percentage of waste sent for reuse |

98.00% |

98.99 |

| |

|

|

|

|

Water resources |

|

|

| Water consumption (m³) |

49,039.62 |

50,669.95 |

| Surface Water Monitoring Management Indicator (%) |

100 |

100 |

| |

|

|

|

|

Sustainable social development |

|

|

| |

|

|

| Allocation to the Children’s and Adolescents’ Fund (FIA) (R$) |

814,970 |

874,932 |

| Allocated to the Fund for the Aged (R$) |

814,970 |

874,932 |

| Allocated via the Sports Incentive Law (R$) |

1,629,939.79 |

1,749,865 |

| Allocated to culture (R$) |

19,997,993 |

24,040,837 |

| Number of homes connected via the Energia Legal program |

3,714 |

4,138 |

| |

|

|

|

|

Health and safety |

|

|

| Accident frequency rate (employees + outsourced) |

3.46 |

3.78 |

| Number of fatal or non-fatal accidents with the population |

20 |

42 |

| |

|

|

|

|

Transparency |

|

|

| % of shares held by members of Boards |

0.01 |

0 |

| Number of independent members of the Board of Directors |

10 |

8 |

| |

|

|

|

|

Ethics and Integrity |

|

|

| Total accusations received |

136 |

182 |

| Total completed cases ruled valid or partially valid |

47 |

19 |

| |

|

|

|

|

Diversity and equity |

|

|

| Number of registered employees |

4,893 |

5,013 |

| White employees, % |

57.1% |

56.1% |

| African-Brazilian employees, % |

38.3% |

39.4% |

| Mixed-race employees, % |

0.5% |

0.4% |

| Indigenous-origin employees, % |

0.1% |

0.1% |

| Employees not declaring race, % |

4.1% |

3.9% |

| Women in Cemig workforce, % |

14.1% |

14.2% |

| Women in leadership positions: % |

19.7% |

19.5% |

| African-Brazilians in leadership positions, % |

17.2% |

18.0% |

| Employees below age 30, % |

5.7% |

7.5% |

| Employees aged 30 to 50, % |

60.6% |

60.7% |

| Employees aged over 50, % |

33.6% |

31.7% |

COMPANHIA ENERGÉTICA DE MINAS GERAIS S.A. | 35 |  |

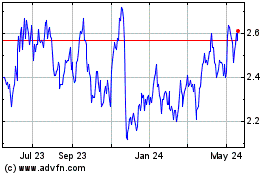

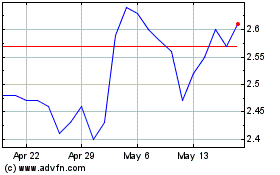

Performance

of Cemig’s shares

| |

Jun. 30, 2024 |

Dec. 31, 2023 |

Change, % |

| Prices (2) |

| CMIG4 (PN) at the close (R$/share) |

9.89 |

8.42 |

17.48% |

| CMIG3 (ON) at the close (R$/share) |

12.22 |

11.18 |

9.33% |

| CIG (ADR for PN shares), at close (US$/share) |

1.73 |

1.69 |

2.45% |

| CIG.C (ADR for ON shares) at close (US$/share) |

2.38 |

3.12 |

–23.72% |

| XCMIG (Cemig PN shares on Latibex), close (€/share) |

2.36 |

1.88 |

25.53% |

| Average daily volume |

| CMIG4 (PN) (R$ mn) |

141.46 |

131.35 |

7.70% |

| CMIG3 (ON) (R$ mn) |

4.85 |

7.82 |

–37.98% |

| CIG (ADR for PN shares) (US$ mn) |

5.03 |

8.98 |

–43.99% |

| CIG.C (ADR for ON shares) (US$ mn) |

0.56 |

0.17 |

229.41% |

| Indices |

| IEE |

88,289 |

94,957 |

–7.02% |

| IBOV |

123,907 |

134,185 |

–7.66% |

| DJIA |

39,119 |

37,689 |

3.79% |

| Indicators |

| Market valuation at end of period, R$ mn |

30,521 |

27,948 |

9.21% |

| Enterprise value (EV)(1) R$ mn |

37,675 |

35,892 |

4.97% |

| Dividend yield of CMIG4 (PN) (3) % |

10.92 |

11.24 |

–0.32 pp |

| Dividend yield of CMIG3 (ON) (3) % |

8.84 |

8.53 |

0.31 pp |

| (1) EV = Market valuation [= R$/share x number of shares] + consolidated Net debt. |

| (2) Share prices adjusted for corporate action payments, including dividends. |

|