Chimera Increases Second Quarter 2024 Common Stock Dividends to $0.35

14 June 2024 - 6:15AM

Business Wire

- BOARD DECLARES SECOND QUARTER 2024 DIVIDEND OF $0.35 PER SHARE

OF COMMON STOCK

The Board of Directors of Chimera Investment Corporation

announced the declaration of its second quarter cash dividend of

$0.35 per common share, an increase from its first quarter cash

dividend of $0.33 on a reverse-stock-split adjusted basis. The

dividend is payable July 31, 2024 to common stockholders of record

on June 28, 2024. The ex-dividend date is June 28, 2024.

Disclaimer

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995. Actual results

may differ from expectations, estimates and projections and,

consequently, readers should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,”

“target,” “assume,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believe,” “predicts,” “potential,” “continue,” and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements involve significant

risks and uncertainties that could cause actual results to differ

materially from expected results, including, among other things,

those described in our most recent Annual Report on Form 10-K, and

any subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, under the caption “Risk Factors.” Factors that could

cause actual results to differ include, but are not limited to: our

business and investment strategy; our ability to accurately

forecast the payment of future dividends on our common and

preferred stock, and the amount of such dividends; our ability to

determine accurately the fair market value of our assets;

availability of investment opportunities in real estate-related and

other securities, including our valuation of potential

opportunities that may arise as a result of current and future

market dislocations; our expected investments; changes in the value

of our investments, including negative changes resulting in margin

calls related to the financing of our assets; changes in inflation,

interest rates and mortgage prepayment rates; prepayments of the

mortgage and other loans underlying our mortgage-backed securities,

or MBS, or other asset-backed securities, or ABS; rates of default,

forbearance, deferred payments, delinquencies or decreased recovery

rates on our investments; general volatility of the securities

markets in which we invest; our ability to maintain existing

financing arrangements and our ability to obtain future financing

arrangements; our ability to effect our strategy to securitize

residential mortgage loans; interest rate mismatches between our

investments and our borrowings used to finance such purchases;

effects of interest rate caps on our adjustable-rate investments;

the degree to which our hedging strategies may or may not protect

us from interest rate volatility; the impact of and changes to

various government programs; impact of and changes in governmental

regulations, tax law and rates, accounting guidance, and similar

matters; market trends in our industry, interest rates, the debt

securities markets or the general economy; estimates relating to

our ability to make distributions to our stockholders in the

future; our understanding of our competition; our ability to find

and retain qualified personnel; our ability to maintain our

classification as a real estate investment trust, or, REIT, for

U.S. federal income tax purposes; our ability to maintain our

exemption from registration under the Investment Company Act of

1940, as amended, or 1940 Act; our expectations regarding

materiality or significance; and the effectiveness of our

disclosure controls and procedures.

Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Chimera does not undertake or accept any obligation to release

publicly any updates or revisions to any forward-looking statement

to reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is based.

Additional information concerning these, and other risk factors is

contained in Chimera’s most recent filings with the Securities and

Exchange Commission (SEC). All subsequent written and oral

forward-looking statements concerning Chimera or matters

attributable to Chimera or any person acting on its behalf are

expressly qualified in their entirety by the cautionary statements

above.

Readers are advised that the financial information in this press

release is based on company data available at the time of this

presentation and, in certain circumstances, may not have been

audited by the Company’s independent auditors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240613425016/en/

Investor Relations 888-895-6557 www.chimerareit.com

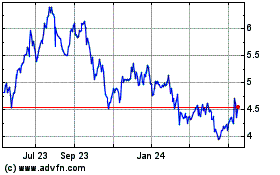

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

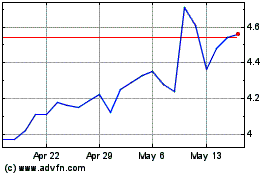

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Jan 2024 to Jan 2025