Chimera Investment Corporation Announces Closing of Public Offering of $74.75 Million Senior Notes

20 August 2024 - 6:13AM

Business Wire

Chimera Investment Corporation (NYSE: CIM) (the “Company”)

announced today that it has closed its previously announced

underwritten public offering of $74.75 million aggregate principal

amount (including $9.75 million issued pursuant to the

over-allotment option) of its 9.250% senior notes due 2029 (the

“Notes”). The Company has been authorized to list the Notes on the

New York Stock Exchange under the symbol “CIMO” and expects trading

in the Notes on the New York Stock Exchange to begin on August 22,

2024. The Notes have received an investment grade rating of BBB

from Egan-Jones Ratings Company, an independent, unaffiliated

rating agency.

“Today’s bond offering, our second for 2024, brings our total

unsecured debt raise for the year to $140 million,” said Phillip J.

Kardis II, President and CEO. “We believe the ability to grow our

business through successful capital raising activities will benefit

our shareholders over the long-term.”

Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, UBS

Securities LLC, Wells Fargo Securities, LLC, Keefe, Bruyette &

Woods, Inc., and Piper Sandler & Co. served as joint

book-running managers for the offering. Hunton Andrews Kurth LLP

acted as legal advisor to the Company. Venable LLP acted as

Maryland counsel to the Company. Ropes & Gray LLP acted as

legal advisor to the joint book-running managers.

The Notes were offered under the Company’s existing shelf

registration statement filed with the Securities and Exchange

Commission (the “SEC”).

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the Notes or any other securities,

nor shall there be any sale of such Notes or any other securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or other

jurisdiction.

About Chimera Investment Corporation

Chimera is a publicly traded real estate investment trust, or

REIT, that is primarily engaged in the business of investing

directly or indirectly through its subsidiaries, on a leveraged

basis, in a diversified portfolio of mortgage assets, including

residential mortgage loans, Agency RMBS, Non-Agency RMBS, Agency

CMBS, and other real estate related securities.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the safe harbor provisions of the United States

Private Securities Litigation Reform Act of 1995, including, but

not limited to, statements regarding the offering and the intended

use of proceeds. Actual results may differ from expectations,

estimates and projections and, consequently, readers should not

rely on these forward-looking statements as predictions of future

events. Words such as “expect,” “target,” “assume,” “estimate,”

“project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believe,” “predicts,”

“potential,” “continue,” and similar expressions are intended to

identify such forward-looking statements. These forward-looking

statements involve significant risks and uncertainties that could

cause actual results to differ materially from expected results,

including, among other things, those described in our most recent

Annual Report on Form 10-K, and any subsequent Quarterly Reports on

Form 10-Q and Current Reports on Form 8-K, under the caption “Risk

Factors.” Factors that could cause actual results to differ

include, but are not limited to: our business and investment

strategy; our ability to accurately forecast the payment of future

dividends on our common and preferred stock, and the amount of such

dividends; our ability to determine accurately the fair market

value of our assets; availability of investment opportunities in

real estate-related and other securities, including our valuation

of potential opportunities that may arise as a result of current

and future market dislocations; our expected investments; changes

in the value of our investments, including negative changes

resulting in margin calls related to the financing of our assets;

changes in inflation, interest rates and mortgage prepayment rates;

prepayments of the mortgage and other loans underlying our

mortgage-backed securities, or MBS, or other asset-backed

securities, or ABS; rates of default, forbearance, deferred

payments, delinquencies or decreased recovery rates on our

investments; general volatility of the securities markets in which

we invest; our ability to maintain existing financing arrangements

and our ability to obtain future financing arrangements; our

ability to effect our strategy to securitize residential mortgage

loans; interest rate mismatches between our investments and our

borrowings used to finance such purchases; effects of interest rate

caps on our adjustable-rate investments; the degree to which our

hedging strategies may or may not protect us from interest rate

volatility; the impact of and changes to various government

programs; impact of and changes in governmental regulations, tax

law and rates, accounting guidance, and similar matters; market

trends in our industry, interest rates, the debt securities markets

or the general economy; estimates relating to our ability to make

distributions to our stockholders in the future; our understanding

of our competition; our ability to find and retain qualified

personnel; our ability to maintain our classification as a real

estate investment trust, or, REIT, for U.S. federal income tax

purposes; our ability to maintain our exemption from registration

under the Investment Company Act of 1940, as amended, or 1940 Act;

our expectations regarding materiality or significance; and the

effectiveness of our disclosure controls and procedures.

Readers are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

We do not undertake or accept any obligation to release publicly

any updates or revisions to any forward-looking statement to

reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is based.

Additional information concerning these, and other risk factors is

contained in our most recent filings with the SEC. All subsequent

written and oral forward-looking statements concerning the Company

or matters attributable to the Company or any person acting on its

behalf are expressly qualified in their entirety by the cautionary

statements above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819616623/en/

Chimera Investment Corporation Investor Relations Tel:

888-895-6557

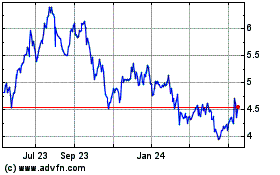

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Dec 2024 to Jan 2025

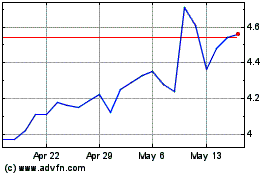

Chimera Investment (NYSE:CIM)

Historical Stock Chart

From Jan 2024 to Jan 2025