UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16 OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-41625

| | |

| Cool Company Ltd. |

| (Translation of registrant's name into English) |

|

Canon's Court, 22 Victoria St., Hamilton, Pembroke HM 12, Bermuda |

| (Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

On May 22, 2024, the Registrant issued a press release, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | Cool Company Ltd.

(registrant) |

| |

| |

| Date | May 22, 2024 | By: | /s/ Richard Tyrrell |

| | | |

| | | Name: Richard Tyrrell |

| | | Title: Chief Executive Officer |

May 22, 2024

Q1 2024 BUSINESS UPDATE

This release includes business updates and unaudited financial results for the three months ended March 31, 2024 ("Q1", "Q1 2024" or the "Quarter") of Cool Company Ltd. ("CoolCo" or the "Company").

Q1 Highlights and Subsequent Events

•Generated total operating revenues of $88.1 million in Q1, compared to $97.1 million for the fourth quarter of 2023 ("Q4" or "Q4 2023") primarily related to brief off-hire on the Kool Husky as it transitioned to a new charter and a lower floating rate on another vessel;

•Net income of $36.81 million in Q1, compared to $22.41 million for Q4 with the increase primarily related to unrealized mark-to-market gains on our interest rate swaps;

•Achieved average Time Charter Equivalent Earnings ("TCE")2 of $77,200 per day for Q1, compared to $87,300 per day for Q4;

•Adjusted EBITDA2 of $58.5 million for Q1, compared to $69.4 million for Q4;

•Upsized the $520 million term loan facility by $200 million, pushing out the first debt maturity to February 2027;

•Secured a 14-year charter with GAIL (India) Limited during Q2 2024 for one of the two state-of-the-art MEGA LNG carriers currently under order at Hyundai-Samho (the "Newbuilds"), expected to be delivered towards the end of 2024;

•Commenced drydock cycle with one vessel during Q2 2024, with a further three vessels scheduled to follow in Q3 2024;

•Declared a quarterly dividend of $0.41 per share, payable to shareholders of record on May 31, 2024.

Richard Tyrrell, CEO, commented:

“The first quarter was a transitional quarter for both the market and CoolCo after the winter season in northern hemisphere ended early and two of CoolCo’s vessels delivered into new charters. While one of the vessels delivered into a higher rate charter, the other was off-hire for a handful of days before delivery and this, combined with lower rates on our single variable rate contract reduced our overall fleet TCE to $77,200 per day.

Energy security concerns continue to support the price of LNG at above $9/MMBTU, which is supportive of shipping as average cargo values now exceed $30 million. Our next available vessels are well spaced and do not come open before the second half of 2024, when the market is anticipated to be in a seasonal upswing. Additionally, following two atypically warm winters in the northern hemisphere, during which China and India relied heavily upon significant coal inventories, we expect to see longer voyage distances in the second half of 2024 as greater volumes of LNG head east.

Subsequent to the first quarter, CoolCo was pleased to announce a long-term charter for one of its two state-of-the-art Newbuilds and looks forward to securing employment for its second Newbuild. The 14-year long-term charter takes CoolCo’s firm revenue backlog to more than $1.2 billion and total revenue backlog including extensions to almost $1.9 billion as of March 31, 2024, and underscores the significant gap between the prevailing spot market and the long-term employment prospects for the high-quality, fuel-efficient LNG carriers."

1 Net income for Q1 2024 includes a mark-to market gain on interest rate swaps amounting to $11.3 million, of which $8.1 million was unrealized gain.

2 Refer to 'Appendix A' - Non-GAAP financial measures and definitions, for definitions of these measures and a reconciliation to the nearest GAAP measure.

Financial Highlights

The table below sets forth certain key financial information for Q1 2024, Q4 2023 and Q1 2023.

| | | | | | | | | | | | | | |

(in thousands of $, except average daily TCE) | Q1 2024 | Q4 2023 | Q1 2023 | |

| | | | | | |

| Time and voyage charter revenues | 78,710 | 89,319 | 91,168 | | | |

| Total operating revenues | 88,125 | 97,144 | 98,649 | | | |

| Operating income | 44,097 | 55,051 | 52,022 | | | |

Net income 1 | 36,812 | 22,415 | 70,132 | | | |

Adjusted EBITDA2 | 58,541 | 69,432 | 67,814 | | | |

| | | | | | |

Average daily TCE2 (to the closest $100) | 77,200 | 87,300 | 83,700 | | | |

LNG Market Review

The average Japan/Korea Marker gas price ("JKM") for the Quarter was $9.43/MMBtu compared to $15.82/MMBtu for Q4 2023; with average JKM for Q2 2024 at $9.96/MMBtu as of May 14, 2024. The Quarter commenced with Dutch Title Transfer Facility gas price ("TTF") at $10.31/MMBtu and quoted TFDE headline spot rates of $78,750 per day. The Quarter concluded with TTF at $8.76/MMBtu and quoted TFDE headline spot rates of $39,500 per day. The TFDE headline spot rate has subsequently stabilized at around this level and is quoted at $39,000 per day as of May 14, 2024.

Most LNG has continued to trade within its basin of origin, reducing the number of long-distance inter-basin voyages and limiting the effect of the Panama and Suez Canal closures. While demand for gas in Europe has dropped, the price of LNG is supported by concerns over energy security and the potential for a further decrease in gas from Russia whether in gas or liquid form. The high value of the cargos delivered into Europe is supportive of LNG shipping even though the distances involved are shorter.

The volatility of LNG markets is expected to increase as the winter heating season approaches. Onshore storage in Europe could fill up, resulting in more cargoes heading east and a return to using LNG carriers for storage – both of which would be positive for CoolCo’s vessels.

Operational Review

CoolCo's fleet continued to perform well with a Q1 fleet utilization of 95% compared to 97% for Q4 2023, with the difference primarily reflecting 51 off-hire days due to time lost between charterhire as Kool Husky transitioned to its new charter in early March. While there were no drydocks during Q1 2024, one drydock has commenced in the second quarter, with a further three vessels scheduled to start their drydocks during the third quarter of 2024. The average cost of these drydocks is estimated to be at approximately $6.5 million per vessel, plus up to 30 days off-hire. One of the drydocks scheduled for the third quarter will also include the upgrade of a vessel to LNGe specification through the retrofit of a sub-cooler with high liquefaction capacity and other performance enhancements at an estimated cost of an additional $15.0 million and an additional 20 days off-hire.

Business Development

The chartering of one of CoolCo’s two Newbuilds sets a strong precedent for the second Newbuild and CoolCo continues to be in discussions with potential charterers regarding its employment. CoolCo is also developing leads

1 Net income for Q1 2024 includes a mark-to market gain on interest rate swaps amounting to $11.3 million, of which $8.1 million was unrealized gain.

2 Refer to 'Appendix A' - Non-GAAP financial measures and definitions, for definitions of these measures and a reconciliation to the nearest GAAP measure.

for its other two vessels redelivering in the second half of 2024, both of which are earmarked for an upgrade to LNGe specification during their scheduled drydocks during the first half of 2025.

Financing and Liquidity

During the Quarter, the Company closed on the upsize of the existing $520 million term loan facility maturing in May 2029 in anticipation of the maturity of the two existing sale & leaseback facilities (Kool Ice and Kool Kelvin) during the first quarter of 2025. As previously disclosed, the $200 million upsize will be available on a delayed drawdown basis, at our option.

As of March 31, 2024, CoolCo had cash and cash equivalents of $105.8 million and total short and long-term debt, net of deferred finance charges, amounting to $1,042.6 million. In addition, CoolCo has approximately $49 million remaining undrawn capacity under its Newbuild Vessel pre-delivery facility. Total Contractual Debt2 stood at $1,145.9 million, which is comprised of $475.8 million in respect of the $570 million bank facility maturing in March 2027, $461.9 million in respect of the $520 million term loan facility maturing in May 2029, $168.2 million of sale and leaseback financing in respect of the two vessels maturing in the first quarter of 2025 (Kool Ice and Kool Kelvin) and $40.0 million in respect of the Newbuilds' financing (Kool Tiger and Kool Panther).

In February 2024, lender approval was obtained for an amendment of financial covenants under the $570 million bank facility including a relaxation of the minimum cash covenant and a reduction in the minimum value clause. The new financial ratios include minimum net worth, maximum net debt to total assets and a minimum free cash restriction.

In March 2024, the Company and a group of lenders under the $520 million term loan facility maturing in May 2029, signed an amendment for a $200 million upsize of this facility (on a delayed drawdown basis) in anticipation of the maturity of the two existing sale and leaseback facilities during the first quarter of 2025. The amendment also includes a reduction in minimum free cash restriction.

Overall, the Company’s interest rate on its debt is currently fixed or hedged for approximately 80% of the notional amount of net debt, adjusting for existing cash on hand.

Corporate and Other Matters

As of March 31, 2024, CoolCo had 53,702,846 shares issued and outstanding. Of these, 31,254,390 shares (58.2%) were owned by EPS Ventures Ltd ("EPS") and 22,448,456 (41.8%) were owned by other public investors.

In line with the Company’s variable dividend policy, the Board has declared a Q1 dividend of $0.41 per common share. The record date is May 31, 2024 and the dividend will be distributed to DTC-registered shareholders on or around June 10, 2024, while due to the implementation of the Central Securities Depositories Regulation in Norway, the dividend will be distributed to Euronext VPS-registered shareholders on or around June 13, 2024.

Outlook

In the near term, the spot LNG carrier market is likely to remain substantially detached from prospects for either multi-year secondhand employment or very long-term charters for newbuilds. Charterer comfort levels have been buoyed by two consecutive mild winters in the northern hemisphere and delays to commissioning and startup of very late-stage liquefaction facilities, resulting in both an enlarged pool of vessels available for short-term employment and an increased willingness of charterers to rely upon the availability of such temporary tonnage. As evidenced by the dislocation between the spot market and longer-term charter markets, current prevailing spot rates are more indicative of a market in a holding pattern than a longer-term call on overall market direction.

As anticipated, the imposition of a carbon pricing scheme and increasingly stringent environmental regulations are increasingly disadvantaging older steam turbine vessels in mainstream LNG trades. As such, that portion of the

1 Net income for Q1 2024 includes a mark-to market gain on interest rate swaps amounting to $11.3 million, of which $8.1 million was unrealized gain.

2 Refer to 'Appendix A' - Non-GAAP financial measures and definitions, for definitions of these measures and a reconciliation to the nearest GAAP measure.

fleet, representing approximately 30% of the global LNG carriers, is experiencing both increased idleness and reduced charter rates relative to more modern, fuel-efficient vessels. Additionally, as has been seen in other shipping sectors in recent years, an increasing number of older steam turbine vessels have begun transitioning out of mainstream trades via sales to owners based primarily in Asia. This phenomenon has served as a dampener on anticipated scrapping levels for those older, less efficient ships, but nevertheless removes them from direct competition for primary business in a way that is likely to be sticky.

Moving beyond the short-term, liquefaction projects that have already reached FID (“Final Investment Decision”) remain set to increase the total volume of LNG on the water by more than 50% in the years ahead, with a particularly heavy concentration for commissioning in 2025, for which charterers will need to secure tonnage. Even against the backdrop of a sizable orderbook and relatively limited scrapping of older steam turbine vessels, the charter market is positioned to tighten considerably as these new volumes come online. Furthermore, even a typical winter season has the potential to absorb significant incremental tonnage. In that scenario, the prospect of being short transportation capacity is likely to reorient charterers away from their recent complacency in the spot market and back towards the risk-averse, energy security focus they have historically been willing to pay a premium for in the multi-year charter market.

1 Net income for Q1 2024 includes a mark-to market gain on interest rate swaps amounting to $11.3 million, of which $8.1 million was unrealized gain.

2 Refer to 'Appendix A' - Non-GAAP financial measures and definitions, for definitions of these measures and a reconciliation to the nearest GAAP measure.

Forward Looking Statements

This press release and any other written or oral statements made by us in connection with this press release include forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts, that address activities and events that will, should, could, are expected to or may occur in the future are forward-looking statements. These forward-looking statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by words or phrases such as “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “will,” “may,” “should,” “expect,” “could,” “would,” “predict,” “propose,” “continue,” or the negative of these terms and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include statements relating to our outlook, industry trends and expected impact, expected results and performance, expectations on chartering and charter rates, expected drydockings including the timing and duration, and impact of performance enhancements on our vessels, timeline for delivery of newbuilds, dividends, expected growth in LNG supply and the attractiveness of LNG, expected industry and business trends including expected trends in LNG demand and market trends and potential future drivers of demand and market volatility, expected trends in LNG shipping capacity including timing for newbuilds, LNG vessel supply and demand (including expected seasonal upswings), factors impacting supply and demand of vessels, regulatory updates such as IMO CII rules, rates and expected trends in charter and spot rates, backlog, contracting, utilization, LNG vessel newbuild order-book and underlying market fundamentals and expectation that fundamentals may support vessel orders and the continuity of a healthy charter rate environment, seasonality and volatility statements, under “LNG Market Review” and “Outlook” and other non-historical matters.

The forward-looking statements in this document are based upon management’s current expectations, estimates and projections. These statements involve significant risks, uncertainties, contingencies and factors that are difficult or impossible to predict and are beyond our control, and that may cause our actual results, performance or achievements to be materially different from those expressed or implied by the forward-looking statements. Numerous factors could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by these forward-looking statements including:

•general economic, political and business conditions, including sanctions and other measures;

•general LNG market conditions, including fluctuations in charter hire rates and vessel values;

•changes in demand in the LNG shipping industry, including the market for our vessels;

•changes in the supply of LNG vessels;

•our ability to successfully employ our vessels;

•changes in our operating expenses, including fuel or cooling down prices and lay-up costs when vessels are not on charter, drydocking and insurance costs;

•compliance with, and our liabilities under, governmental, tax, environmental and safety laws and regulations;

•changes in governmental regulation, tax and trade matters and actions taken by regulatory authorities;

•potential disruption of shipping routes and demand due to accidents, piracy or political events and/or instability, including the ongoing conflicts in the Middle East;

•vessel breakdowns and instances of loss of hire;

•vessel underperformance and related warranty claims;

•our expectations regarding the availability of vessel acquisitions;

•our ability to procure or have access to financing and refinancing;

•continued borrowing availability under our credit facilities and compliance with the financial covenants therein;

•fluctuations in foreign currency exchange and interest rates;

•potential conflicts of interest involving our significant shareholders;

•our ability to pay dividends;

•information system failures, cyber incidents or breaches in security;

•adjustments in our ship management business and related costs; and

•other risks indicated in the risk factors included in CoolCo’s Annual Report on Form 20-F for the year ended December 31, 2023 and other filings with the U.S. Securities and Exchange Commission.

The foregoing factors that could cause our actual results to differ materially from those contemplated in any forward-looking statement included in this report should not be construed as exhaustive. Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

As a result, you are cautioned not to place undue reliance on any forward-looking statements which speak only as of the date of this press release. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise unless required by law.

Responsibility Statement

We confirm that, to the best of our knowledge, the interim unaudited condensed consolidated financial statements for the three months ended March 31, 2024, which have been prepared in accordance with accounting principles generally accepted in the United States (US GAAP) give a true and fair view of the Company’s consolidated assets, liabilities, financial position and results of operations. To the best of our knowledge, the financial report for the three months ended March 31, 2024 includes a fair review of important events that have occurred during the period and their impact on the interim unaudited condensed consolidated financial statements, the principal risks and uncertainties, and major related party transactions.

May 22, 2024

Cool Company Ltd.

London, UK

Questions should be directed to:

c/o Cool Company Ltd - +1(441) 295 2244

| | | | | |

| Richard Tyrrell (Chief Executive Officer & Director) | Cyril Ducau (Chairman of the Board)

|

John Boots (Chief Financial Officer) | Antoine Bonnier (Director)

|

| Joanna Huipei Zhou (Director) |

| Sami Iskander (Director) |

| Neil Glass (Director)

|

| Peter Anker (Director) |

| | | | | |

Cool Company Ltd | |

Unaudited Condensed Consolidated Statement of Operations |

| | | | | | | | | | | | | | | | | | | | | |

| (in thousands of $) | Jan-March 2024 | | | | | Oct-Dec

2023 | | Jan-March

2023 |

| | | | | | | | | |

| | | | | | | | | |

| Time and voyage charter revenues | 78,710 | | | | | | 89,319 | | | 91,168 | | |

| Vessel and other management fee revenues | 4,923 | | | | | | 3,308 | | | 3,376 | | |

| Amortization of intangible assets and liabilities - charter agreements, net | 4,492 | | | | | | 4,517 | | | 4,105 | | |

| Total operating revenues | 88,125 | | | | | | 97,144 | | | 98,649 | | |

| | | | | | | | | |

| Vessel operating expenses | (17,594) | | | | | | (16,804) | | | (18,588) | | |

| Voyage, charter hire and commission expenses, net | (1,439) | | | | | | (1,019) | | | (1,499) | | |

| Administrative expenses | (6,059) | | | | | | (5,372) | | | (6,643) | | |

| Depreciation and amortization | (18,936) | | | | | | (18,898) | | | (19,897) | | |

| | | | | | | | | |

| Total operating expenses | (44,028) | | | | | | (42,093) | | | (46,627) | | |

| | | | | | | | | |

| | | | | | | | | |

| Operating income | 44,097 | | | | | | 55,051 | | | 52,022 | | |

| | | | | | | | | |

| Other non-operating income | — | | | | | | — | | | 42,528 | | |

| | | | | | | | | |

| Financial income/(expense): | | | | | | | | | |

| Interest income | 1,705 | | | | | | 1,743 | | | 1,517 | | |

| Interest expense | (19,678) | | | | | | (20,463) | | | (19,485) | | |

Gains /(losses) on derivative instruments | 11,301 | | | | | | (13,115) | | | (6,001) | | |

| Other financial items, net | (480) | | | | | | (426) | | | (393) | | |

| Financial expenses, net | (7,152) | | | | | | (32,261) | | | (24,362) | | |

| | | | | | | | | |

| Income before income taxes and non-controlling interests | 36,945 | | | | | | 22,790 | | | 70,188 | | |

| Income taxes, net | (133) | | | | | | (375) | | | (56) | | |

| | | | | | | | | |

| Net income | 36,812 | | | | | | 22,415 | | | 70,132 | | |

| Net income attributable to non-controlling interests | (238) | | | | | | (351) | | | (1,287) | | |

Net income attributable to the Owners of Cool Company Ltd | 36,574 | | | | | | 22,064 | | | 68,845 | | |

| | | | | | | | | |

| Net income attributable to: | | | | | | | | | |

| Owners of Cool Company Ltd | 36,574 | | | | | | 22,064 | | | 68,845 | | |

| Non-controlling interests | 238 | | | | | | 351 | | | 1,287 | | |

| Net income | 36,812 | | | | | | 22,415 | | | 70,132 | | |

| | | | | | | | | |

| | | | | |

Cool Company Ltd | |

Unaudited Condensed Consolidated Balance Sheet |

| | | | | | | | | |

| | | |

| | At March 31, | At December 31, | |

(in thousands of $, except number of shares) | 2024 | 2023 | |

| | | (Audited) | |

| ASSETS | | | |

| | | |

| Current assets | | | |

| Cash and cash equivalents | 105,818 | | 133,496 | | |

| Restricted cash and short-term deposits | 3,242 | | 3,350 | | |

| Intangible assets, net | 413 | | 825 | | |

| Trade receivable and other current assets | 15,323 | | 12,923 | | |

| | | |

| Inventories | 309 | 3,659 | |

| | | |

| Total current assets | 125,105 | | 154,253 | | |

| | | |

| Non-current assets | | | |

| Restricted cash | 463 | | 492 | | |

| Intangible assets, net | 9,066 | | 9,438 | | |

| Newbuildings | 205,223 | | 181,904 | | |

| Vessels and equipment, net | 1,687,656 | | 1,700,063 | | |

| Other non-current assets | 18,438 | | 10,793 | | |

| Total assets | 2,045,951 | | 2,056,943 | | |

| | | |

| LIABILITIES AND EQUITY | | | |

| | | |

| Current liabilities | | | |

| Current portion of long-term debt and short-term debt | 185,013 | | 194,413 | | |

| Trade payable and other current liabilities | 95,272 | | 98,917 | | |

| | | |

| | | |

| | | |

| Total current liabilities | 280,285 | | 293,330 | | |

| | | |

| Non-current liabilities | | | |

| Long-term debt | 857,597 | | 866,671 | | |

| Other non-current liabilities | 86,055 | | 90,362 | | |

| Total liabilities | 1,223,937 | | 1,250,363 | | |

| | | |

| Equity | | | |

Owners' equity includes 53,702,846 (2023: 53,702,846) common shares of $1.00 each, issued and outstanding | 751,186 | | 735,990 | | |

| Non-controlling interests | 70,828 | | 70,590 | | |

| Total equity | 822,014 | | 806,580 | | |

| | | |

| Total liabilities and equity | 2,045,951 | | 2,056,943 | | |

| | | |

| | | |

| | | | | |

Cool Company Ltd | |

Unaudited Condensed Consolidated Statement of Cash Flows |

| | | | | | | | | | | | |

| (in thousands of $) | | Jan-March

2024 | | Jan-March

2023 |

| Operating activities | | | | |

| Net income | | 36,812 | | | 70,132 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization expenses | | 18,936 | | | 19,897 | |

| Amortization of intangible assets and liabilities arising from charter agreements, net | | (4,492) | | | (4,105) | |

| Amortization of deferred charges and fair value adjustments | | 881 | | | 1,539 | |

Gain on sale of vessel | | — | | | (42,528) | |

| Drydocking expenditure | | (1,494) | | | (884) | |

| Compensation cost related to share-based payment | | 640 | | | 589 | |

| Change in fair value of derivative instruments | | (8,145) | | | (7,557) | |

| Changes in assets and liabilities: | | | | |

| Trade accounts receivable | | 699 | | | (378) | |

| Inventories | | 3,350 | | | 172 | |

| Other current and other non-current assets | | (3,533) | | | 2,692 | |

Amounts (due to)/ from related parties | | (216) | | | (1,626) | |

| Trade accounts payable | | 3,057 | | | 12,334 | |

| Accrued expenses | | (3,154) | | | 1,766 | |

| Other current and non-current liabilities | | (4,780) | | | 4,908 | |

| Net cash provided by operating activities | | 38,561 | | | 56,951 | |

| | | | |

| Investing activities | | | | |

| Additions to vessels and equipment | | (2,571) | | | (798) | |

| Additions to newbuildings | | (22,300) | | | — | |

Additions to intangible assets | | (132) | | | — | |

Proceeds from sale of vessel | | — | | | 184,300 | |

| | | | |

| Net cash provided by investing activities | | (25,003) | | | 183,502 | |

| | | | |

| Financing activities | | | | |

| | | | |

| | | | |

| Repayments of short-term and long-term debt | | (19,355) | | | (107,490) | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Cash dividends paid | | (22,018) | | | (21,475) | |

| Net cash used in financing activities | | (41,373) | | | (128,965) | |

| | | | |

Net (decrease)/ increase in cash, cash equivalents and restricted cash | | (27,815) | | | 111,488 | |

| Cash, cash equivalents and restricted cash at beginning of period | | 137,338 | | | 133,077 | |

| Cash, cash equivalents and restricted cash at end of period | | 109,523 | | | 244,565 | |

| | | | | |

Cool Company Ltd | |

Unaudited Condensed Consolidated Statement of Changes in Equity |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the three months ended March 31, 2024 |

| (in thousands of $, except number of shares) | | | Number of

common shares | | Owners’ Share Capital | Additional Paid-in Capital(1) | Retained Earnings | Owners' Equity | Non-

controlling

Interests | Total

Equity |

Consolidated balance at December 31, 2023 | | | 53,702,846 | | | 53,703 | | 509,327 | | 172,960 | | 735,990 | | 70,590 | | 806,580 | |

Net income for the period | | | — | | | — | | — | | 36,574 | | 36,574 | | 238 | | 36,812 | |

Share based payments contribution | | | — | | | — | | 640 | | — | | 640 | | — | | 640 | |

| Dividends | | | — | | | — | | — | | (22,018) | | (22,018) | | — | | (22,018) | |

Consolidated balance at

March 31, 2024 | | | 53,702,846 | | | 53,703 | | 509,967 | | 187,516 | | 751,186 | | 70,828 | | 822,014 | |

(1) Additional paid-in capital refers to the amount of capital contributed or paid-in over and above the par value of the Company's issued share capital.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | For the three months ended March 31, 2023 |

| (in thousands of $, except number of shares) | | | Number of

common shares | | Owners’ Share Capital | Additional Paid-in Capital(1) | Retained Earnings | Owners' Equity | Non-

controlling

Interests | Total

Equity |

Consolidated balance at December 31, 2022 | | | 53,688,462 | | | 53,688 | | 507,127 | | 85,742 | | 646,557 | | 68,956 | | 715,513 | |

Net income for the period | | | — | | | — | | — | | 68,845 | | 68,845 | | 1,287 | | 70,132 | |

| Share based payments contribution | | | — | | | — | | 589 | | — | | 589 | | — | | 589 | |

| Dividends | | | — | | | — | | — | | (21,475) | | (21,475) | | — | | (21,475) | |

Consolidated balance at

March 31, 2023 | | | 53,688,462 | | | 53,688 | | 507,716 | | 133,112 | | 694,516 | | 70,243 | | 764,759 | |

(1) Additional paid-in capital refers to the amount of capital contributed or paid-in over and above the par value of the Company's issued share capital.

Appendix A - Non-GAAP Financial Measures and Definitions

Non-GAAP Financial Metrics Arising from How Management Monitors the Business

In addition to disclosing financial results in accordance with U.S. generally accepted accounting principles (US GAAP), this earnings release and the associated investor presentation and discussion contain references to the non-GAAP financial measures which are included in the table below. We believe these non-GAAP financial measures provide investors with useful supplemental information about the financial performance of our business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating our business and measuring our performance. These non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures calculated in accordance with US GAAP, and the financial results calculated in accordance with US GAAP. Non-GAAP measures are not uniformly defined by all companies, and may not be comparable with similar titles, measures and disclosures used by other companies. The reconciliations from these results should be carefully evaluated.

| | | | | | | | | | | |

| Non-GAAP measure | Closest equivalent US GAAP measure | Adjustments to reconcile to primary financial statements prepared under US GAAP | Rationale for adjustments |

| Performance Measures |

| | | |

| | | |

| | | |

| Adjusted EBITDA | Net income | '+/- Other non-operating income +/- Net financial expense, representing: Interest income, Interest expense, Gains/(Losses) on derivative instruments and Other financial items, net +/- Income taxes, net + Depreciation and amortization - Amortization of intangible assets and liabilities - charter agreements, net | Increases the comparability of total business performance from period to period and against the performance of other companies by removing the impact of other non-operating income, depreciation, amortization of intangible assets and liabilities -charter agreements, net, financing and tax items. |

| Average daily TCE | Time and voyage charter revenues | - Voyage, charter hire and commission expenses, net

The above total is then divided by calendar days less scheduled off-hire days. | Measure of the average daily net revenue performance of a vessel.

Standard shipping industry performance measure used primarily to compare period-to-period changes in the vessel’s net revenue performance despite changes in the mix of charter types (i.e. spot charters, time charters and bareboat charters) under which the vessel may be employed between the periods.

Assists management in making decisions regarding the deployment and utilization of its fleet and in evaluating financial performance. |

| | | | | | | | | | | |

| Liquidity measures |

| Total Contractual Debt | Total debt (current and non-current), net of deferred finance charges | + VIE Consolidation and fair value adjustments upon acquisition

+ Deferred Finance Charges | We consolidate two lessor VIEs for our sale and leaseback facilities (for the vessels Ice and Kelvin). This means that on consolidation, our contractual debt is eliminated and replaced with the Lessor VIEs’ debt.

Contractual debt represents our actual debt obligations under our various financing arrangements before consolidating the Lessor VIEs.

The measure enables investors and users of our financial statements to assess our liquidity and the split of our debt (current and non-current) based on our underlying contractual obligations. |

| Total Company Cash | CoolCo cash based on GAAP measures:

+ Cash and cash equivalents

+ Restricted cash and short-term deposits (current and non-current) | - VIE restricted cash and short-term deposits (current and non-current) | We consolidate two lessor VIEs for our sale and leaseback facilities. This means that on consolidation, we include restricted cash held by the lessor VIEs.

Total Company Cash represents our cash and cash equivalents and restricted cash and short-term deposits (current and non-current) before consolidating the lessor VIEs.

Management believes that this measure enables investors and users of our financial statements to assess our liquidity and aids comparability with our competitors.

|

Reconciliations - Performance Measures

Adjusted EBITDA | | | | | | | | | | | | | | | | | | | | | |

| (in thousands of $) | Jan-March 2024 | | Oct-Dec

2023 | | Jan-March

2023 | | | |

| | | | | | | | | |

| Net income | 36,812 | | | 22,415 | | | 70,132 | | | | | |

| Other non-operating income | — | | | — | | | (42,528) | | | | | |

| Interest income | (1,705) | | | (1,743) | | | (1,517) | | | | | |

| Interest expense | 19,678 | | | 20,463 | | | 19,485 | | | | | |

| (Gains)/Losses on derivative instruments | (11,301) | | | 13,115 | | | 6,001 | | | | | |

| Other financial items, net | 480 | | | 426 | | | 393 | | | | | |

| Income taxes, net | 133 | | | 375 | | | 56 | | | | | |

| Depreciation and amortization | 18,936 | | | 18,898 | | | 19,897 | | | | | |

| Amortization of intangible assets and liabilities - charter agreements, net | (4,492) | | | (4,517) | | | (4,105) | | | | | |

| Adjusted EBITDA | 58,541 | | | 69,432 | | | 67,814 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Average daily TCE | | | | | | | | | | | | | | | | | | |

| (in thousands of $, except number of days and average daily TCE) | Jan-March 2024 | | Oct-Dec

2023 | | Jan-March

2023 |

| | | | | | |

| Time and voyage charter revenues | 78,710 | | | 89,319 | | | 91,168 | | |

| Voyage, charter hire and commission expenses, net | (1,439) | | | (1,019) | | | (1,499) | | |

| 77,271 | | | 88,300 | | | 89,669 | | |

| Calendar days less scheduled off-hire days | 1,001 | | | 1,012 | | | 1,071 | | |

| Average daily TCE (to the closest $100) | $ | 77,200 | | | $ | 87,300 | | | $ | 83,700 | | |

Reconciliations - Liquidity measures

Total Contractual Debt | | | | | | | | | | | | | | | | |

| (in thousands of $) | | | | At March 31, 2024 | At December 31,

2023 | | | | | |

| Total debt (current and non-current) net of deferred finance charges | | | | 1,042,610 | 1,061,084 | | | | | |

| Add: VIE consolidation and fair value adjustments | | | | 98,184 | 97,245 | | | | | |

| Add: Deferred finance charges | | | | 5,083 | 5,563 | | | | | |

| | | | | | | | | | |

| Total Contractual Debt | | | | 1,145,877 | | 1,163,892 | | | | | | |

Total Company Cash | | | | | | | | | | | | | | | | |

| (in thousands of $) | | | | At March 31, 2024 | At December 31,

2023 | | | | | |

| Cash and cash equivalents | | | | 105,818 | 133,496 | | | | | |

| Restricted cash and short-term deposits | | | | 3,705 | 3,842 | | | | | |

| Less: VIE restricted cash | | | | (3,242) | (3,350) | | | | | |

| Total Company Cash | | | | 106,281 | | 133,988 | | | | | | |

Other definitions

Contracted Revenue Backlog

Contracted revenue backlog is defined as the contracted daily charter rate for each vessel multiplied by the number of scheduled hire days for the remaining contract term. Contracted revenue backlog is not intended to represent adjusted EBITDA or future cashflows that will be generated from these contracts. This measure should be seen as a supplement to and not a substitute for our US GAAP measures of performance.

This information is subject to the disclosure requirements in Regulation EU 596/2014 (MAR) article 19 number 3 and section 5-12 of the Norwegian Securities Trading Act.

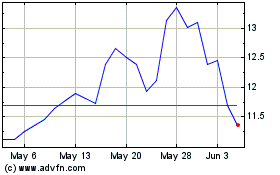

Cool (NYSE:CLCO)

Historical Stock Chart

From May 2024 to Jun 2024

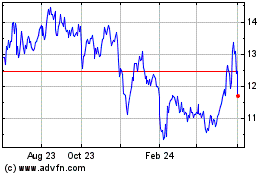

Cool (NYSE:CLCO)

Historical Stock Chart

From Jun 2023 to Jun 2024