Tesoro Returns to Profit in 4Q - Analyst Blog

07 February 2013 - 8:20PM

Zacks

Independent refiner Tesoro

Corporation (TSO) swung back to profit in the fourth

quarter of 2012 compared to a net loss a year earlier on the back

of higher margins and a significant crude oil differentials

advantage.

Earnings per share (excluding special items) came in at $1.34,

missing the Zacks Consensus Estimate of $1.38 but improving

significantly from the year-ago adjusted loss of 87 cents.

The San Antonio, Texas-based firm reported revenue of $8,273.0

million for the three-month period ending Dec 31. This was 15.4%

above our projection and was also up 7.3% year over year on the

back of higher throughput and solid refining margins.

Segmental Analysis

Refining: Tesoro’s Refining segment

posted an operating income of $106 million against loss of $123

million in the year-earlier quarter. The improvement can be

attributed to higher refinery throughput rates.

Retail: The Retail unit earned $44

million during the December quarter, up from $27 million in the

fourth quarter of 2011. The growth was aided by higher fuel

margins.

Throughput

Total refining throughput averaged 604 thousand barrels per day

(MBbl/d) compared with 567 MBbl/d in the year-ago quarter.

Overall throughput volumes in California (consisting of the Golden

Eagle and Los Angeles refineries), Pacific Northwest (Alaska and

Washington) and the Mid-Continent (North Dakota & Utah)

increased 3.3%, 15.1% and 7.0% year over year to 249 MBbl/d, 160

MBbl/d and 123 MBbl/d, respectively.

However, throughput in the company’s Mid-Pacific (Hawaii)

operations remained unchanged from the fourth quarter of 2011 at 72

MBbl/d.

Refining Margins

Gross refining margin saw a robust increase of 136.7% year over

year to $14.25 per barrel.

In terms of different regions, refining margin increased in

California (by 547.7% year over year to $11.14 per barrel), in

Mid-Pacific (by 182.4% to $3.57 per barrel), in Pacific Northwest

(by 125.2% to $13.42 per barrel) and Mid-Continent (by 30.4% to

$27.88 per barrel).

Realized Costs & Prices

Manufacturing costs before depreciation and amortization fell 6.6%

from the year-earlier level to $4.70 per barrel, in keeping with

Tesoro’s stated objectives of reducing operating costs and

increasing throughput rates.

Total refined product sales during the quarter averaged 694 MBbl/d,

up 2.2% year over year. Average price realized on product sales

decreased 2.8% year over year to $115.72 per barrel and average

cost per barrel also decreased 6.8% to $105.18 per barrel.

Capital Expenditure & Balance Sheet

Tesoro’s total capital spending during the quarter under review was

$176 million (82% directed toward refining segment). The company

informed that it expects capital spending for 2013 at around $530

million, together with turnaround spending of around $310

million.

As of Dec 31, 2012, Tesoro had $1,639.0 million cash on hand and

total debt of $1,590.0 million, representing a

debt-to-capitalization ratio of 25%.

Dividend Hike

Tesoro announced a 33.0% increase in its quarterly dividend to 20

cents per share, or 80 cents per share annualized. The dividend is

payable on Mar 15, 2013 to shareholders of record on Feb 28.

Zacks Rating

The company currently retains a Zacks Rank #3 (Hold), implying that

it is expected to perform in line with the broader U.S. equity

market over the next one to three months.

Management at Tesoro is paying greater attention to improving

business processes, reducing operating costs, enhancing the

integration of the refining portfolio and investing in organic

growth. Tesoro is involved with a number of high-return projects

that are expected to be cost effective. These projects will not

only boost the company’s competitive position among its peer group,

but will also provide significant earnings and cash flow growth

visibility.

However, the inherent volatility of the refining business reduces

the accuracy and reliability of long-term earnings and revenue

estimates. Additionally, results are exposed to unplanned

shut-downs that may have a lingering impact.

But there are certain other companies in the oil refining and

marketing industry that are expected to perform well in the coming

one to three months. These include CVR Energy Inc.

(CVI) with a Zacks Rank #1 (Strong Buy), and Alon USA

Energy, Inc. (ALJ) and HollyFrontier

Corporation (HFC) with Zacks Rank #2 (Buy).

ALON USA ENERGY (ALJ): Free Stock Analysis Report

CVR ENERGY INC (CVI): Free Stock Analysis Report

HOLLYFRONTIER (HFC): Free Stock Analysis Report

TESORO CORP (TSO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

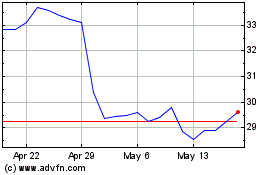

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jun 2024 to Jul 2024

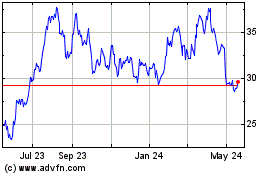

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Jul 2023 to Jul 2024