CVR Energy Announces Pricing of Private Placement of $600 Million of 8.500% Senior Notes due 2029

09 December 2023 - 8:20AM

CVR Energy, Inc. (the “Company” or “CVR Energy”) (NYSE: CVI)

announced today the pricing of its private placement (the

“Offering”) pursuant to Rule 144A and Regulation S under the

Securities Act of 1933, as amended (the “Securities Act”), of $600

million in aggregate principal amount of 8.500% senior

unsecured notes due 2029 (the “Notes”). The Notes mature on January

15, 2029, and will be issued at par. The Notes will be jointly and

severally guaranteed on a senior unsecured basis by certain of the

Company’s domestic subsidiaries, including each of the Company’s

subsidiaries that is a borrower or guarantor under the Company’s

$275 million senior secured asset based revolving credit facility.

The Offering is expected to close on December 21, 2023, subject to

customary closing conditions.

The Company intends to use the net proceeds from

the Offering, together with cash on hand, to redeem all of its

outstanding 5.250% Senior Notes due 2025 (the “2025 Notes”). The

Company expects to redeem the 2025 Notes on or after February 15,

2024, at an expected redemption price equal to 100% of the

principal amount thereof, plus accrued and unpaid interest, if any,

on the 2025 Notes to be redeemed to the redemption date.

The offer and sale of the Notes and the related

guarantees have not been registered under the Securities Act, or

any state securities laws, and unless so registered, these

securities may not be offered or sold in the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws. The Company plans to offer and sell these

securities only to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities Act

and to non-U.S. persons outside the United States pursuant to

Regulation S under the Securities Act.

This news release shall not constitute an offer

to sell, or the solicitation of an offer to buy, any of these

securities or any other securities, nor shall there be any sale of

these securities or any other securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful. This news release shall not constitute a notice of

redemption under the indenture governing the 5.250% Senior Notes

due 2025.

Forward-Looking Statements

This news release may contain forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Securities Exchange Act of 1934, as amended.

Statements concerning current estimates, expectations and

projections about future results, performance, prospects,

opportunities, plans, actions and events and other statements,

concerns, or matters that are not historical facts are

“forward-looking statements,” as that term is defined under the

federal securities laws. These forward-looking statements include,

but are not limited to, statements regarding the expected timing of

the closing of the Offering, the intended use of proceeds therefrom

and other aspects of the Offering and the Notes. You can generally

identify forward-looking statements by our use of forward-looking

terminology such as “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “explore,” “evaluate,” “intend,” “may,”

“might,” “outlook,” “plan,” “potential,” “predict,” “seek,”

“should,” or “will,” or the negative thereof or other variations

thereon or comparable terminology. These forward-looking statements

are only predictions and involve known and unknown risks and

uncertainties, many of which are beyond our control. For a

discussion of risk factors which may affect our results, please see

the risk factors and other disclosures included in our most recent

Annual Report on Form 10-K, any subsequently filed Quarterly

Reports on Form 10-Q and our other filings with the Securities

and Exchange Commission. These and other risks may cause our actual

results, performance or achievements to differ materially from any

future results, performance or achievements expressed or implied by

these forward-looking statements. Given these risks and

uncertainties, you are cautioned not to place undue reliance on

such forward-looking statements. The forward-looking statements

included in this news release are made only as of the date

hereof. CVR Energy disclaims any intention or obligation

to update publicly or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except to the extent required by law.

About CVR Energy, Inc.

Headquartered in Sugar Land, Texas, CVR Energy

is a diversified holding company primarily engaged in the

renewables, petroleum refining and marketing business as well as in

the nitrogen fertilizer manufacturing business through its interest

in CVR Partners, LP. CVR Energy subsidiaries serve as the general

partner and own 37 percent of the common units of CVR Partners,

LP.

For further information, please contact:

Investor RelationsRichard

RobertsCVR Energy, Inc.(281)

207-3205InvestorRelations@CVREnergy.com

Media RelationsBrandee StephensCVR

Energy, Inc.(281) 207-3516MediaRelations@CVREnergy.com

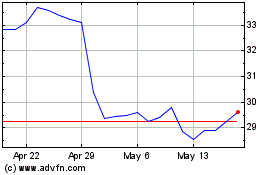

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Oct 2024 to Nov 2024

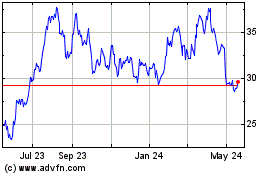

CVR Energy (NYSE:CVI)

Historical Stock Chart

From Nov 2023 to Nov 2024