Ducommun Incorporated (NYSE: DCO) (“Ducommun” or the “Company”)

today reported results for its second quarter ended June 29,

2024.

Second Quarter 2024

Recap

- Net revenue was

$197.0 million, an increase of 5.2% over Q2 2023

- Net income of $7.7

million (increase of 225% year-over-year), or $0.52 per diluted

share, or 3.9% of revenue, up 260 bps year-over-year

- Non-GAAP adjusted

net income of $12.5 million (increase of 72% year-over-year), or

$0.83 per diluted share

- Gross margin of

26.0%, year-over-year growth of 460 bps

- Adjusted EBITDA of

$30.0 million (increase of 15% year-over-year), or 15.2% of

revenue, up 130 bps year-over-year

“Q2 was another outstanding quarter for DCO as

we grew our topline both year-over-year and sequentially, led by

strength in both of our Commercial Aerospace and Military segments

along with strong quarterly gross margins and Adjusted EBITDA

margins,” said Stephen G. Oswald, chairman, president and chief

executive officer. “Net revenue was a quarterly record $197.0

million, up over 5% compared to Q2 2023, with strong demand for

business jets, select Airbus platforms, required buffer stock build

for the Monrovia facility closure along with maintaining level load

production rates on other commercial aerospace platforms despite

the temporary slowdown in demand from aircraft OEMs.

"The other big news is Ducommun delivered a new

quarterly record for gross margin, expanding 460 bps year-over-year

from 21.4% to 26.0%. In addition, Adjusted EBITDA margins also were

very strong as we now gain increased momentum on our Vision 2027

strategy and financial goals. Continued growth in our higher margin

engineered products businesses, some benefits of favorable product

mix, savings from our on-going restructuring program, value pricing

along with productivity, all contributed to the excellent margin

story in Q2.

“In December 2022, we laid out our Vision 2027

Plan to investors and now halfway through year two of the Plan, we

have made solid progress in achieving our revenue and especially

EBITDA margin growth targets. The team is driving the business and

on track to deliver our longer-term goals as we remain relentless

on meeting the commitments.

“Ducommun was also a participant at the

Farnborough Air Show last month where there was significant focus

on the quality challenges and supply chain constraints in the

industry. I am proud of the Ducommun team for being laser focused

on delivering high quality products to our customers, on-time while

maintaining a strong position to meet the anticipated higher demand

for Commercial Aerospace products later this year and in 2025. It

also shows in our numerous A&D OEM customer awards over the

last 18 months recognizing our performance.”

Second Quarter

Results

Net revenue for the second quarter of 2024 was

$197.0 million compared to $187.3 million for the second quarter of

2023. The year-over-year increase of 5.2% was primarily due to the

following in the Company's key end-use markets:

- $9.9 million higher

revenue in the Company’s commercial aerospace end-use markets due

to higher production on selected single-aisle and twin-aisle

aircraft, buffer stock build for the Monrovia performance center

closure, and growth in regional and business aircraft platforms,

partially offset by lower revenues from in-flight entertainment;

and

- $3.2 million higher

revenue in the Company’s military and space end-use markets due to

higher rates on rotary-wing aircraft and naval platforms, partially

offset by lower rates on fixed-wing aircraft platforms.

In addition, revenue for the Company’s

industrial end-use markets for the second quarter of 2024 decreased

$3.4 million compared to the second quarter of 2023 mainly due to

the Company selectively pruning non-core business.

Net income for the second quarter of 2024 was

$7.7 million, or 3.9% of revenue, or $0.52 per diluted share,

compared to $2.4 million, or 1.3% revenue, or $0.17 per diluted

share, for the second quarter of 2023. This reflects higher gross

profit of $11.1 million and lower restructuring charges of $2.7

million ($0.9 million was recorded as cost of sales), partially

offset by higher selling, general and administrative (“SG&A”)

expenses of $5.7 million and lower other income of $4.1 million. A

portion of the higher SG&A expenses were due to the $1.4

million of professional fees related to the unsolicited non-binding

offer to acquire all the shares of Ducommun Incorporated and BLR

Aerospace (“BLR”) SG&A expenses of $1.3 million which did not

exist in the prior year period as the acquisition of BLR was not

completed until the end of April 2023 as well as higher other legal

and professional fees of $1.5 million, including for the evaluation

of acquisition opportunities.

Gross profit for the second quarter of 2024 was

$51.2 million, or 26.0% of revenue, compared to gross profit of

$40.1 million, or 21.4% of revenue, for the second quarter of 2023.

The increase in gross profit as a percentage of net revenue

year-over-year was primarily due to higher manufacturing volume and

favorable product mix, pricing actions, along with some improving

benefits from the restructuring initiative, partially offset by

higher other manufacturing costs.

Operating income for the second quarter of 2024

was $13.9 million, or 7.1% of revenue, compared to $5.0 million, or

2.7% of revenue, in the comparable period last year. The

year-over-year increase of $8.9 million was primarily due to higher

gross profit and lower restructuring charges, partially offset by

higher SG&A expenses, which was noted above. Non-GAAP adjusted

operating income for the second quarter of 2024 was $19.9 million,

or 10.1% of revenue, compared to $15.2 million, or 8.1% of revenue,

in the comparable period last year. The year-over-year increase was

primarily due to higher GAAP operating income, partially offset by

lower add backs of restructuring charges and Guaymas fire related

expenses.

Adjusted EBITDA for the second quarter of 2024

was $30.0 million, or 15.2% of revenue, compared to $26.1 million,

or 13.9% of revenue, for the comparable period in 2023.

Interest expense for the second quarter of 2024

was $4.0 million compared to $5.7 million in the comparable period

of 2023. The year-over-year decrease was primarily due to the

benefit from the interest rate swaps which became effective on

January 1, 2024, along with a lower debt balance in the second

quarter of 2024.

During the second quarter of 2024, the net cash

provided by operations was $3.5 million compared to $9.2 million

during the second quarter of 2023. The lower net cash provided by

operations during the second quarter of 2024 was primarily due to

higher contract assets and lower accounts payable, partially offset

by higher net income and lower inventories.

Business Segment

Information

Electronic Systems

Electronic Systems segment net revenue for the

quarter ended June 29, 2024 was $101.4 million, compared to

$107.1 million for the second quarter of 2023. The year-over-year

decrease was primarily due to the following in the Company's key

end-use markets:

- $1.8 million lower

revenue within the Company’s military and space end-use markets due

to lower rates on fixed-wing aircraft platforms, partially offset

by higher rates on naval and submarine platforms and rotary-wing

aircraft platforms; and

- $0.5 million lower

revenue in the Company’s commercial aerospace end-use markets due

to lower in-flight entertainment revenues, partially offset by

higher rates on regional and business aircraft and large aircraft

platforms.

In addition, revenue for the Company’s

industrial end-use markets for the second quarter of 2024 decreased

$3.4 million compared to the second quarter of 2023 mainly due to

the Company selectively pruning non-core business.

Electronic Systems segment operating income for

the quarter ended June 29, 2024 was $16.8 million, or 16.6% of

revenue, compared to $9.5 million, or 8.9% of revenue, for the

comparable quarter in 2023. The year-over-year increase of $7.3

million was primarily due to higher manufacturing volume, favorable

product mix, pricing actions, and lower restructuring charges.

Non-GAAP adjusted operating income for the second quarter of 2024

was $17.2 million, or 16.9% of revenue, compared to $12.2 million,

or 11.4% of revenue, in the comparable period last year.

Structural Systems

Structural Systems segment net revenue for the

quarter ended June 29, 2024 was $95.6 million, compared to

$80.2 million for the second quarter of 2023. The year-over-year

increase was primarily due to the following:

- $10.4 million

higher revenue within the Company’s commercial aerospace end-use

markets due to higher production on selected single-aisle and

twin-aisle aircraft, buffer stock build for the Monrovia

performance center closure, and growth in various business jet

platforms; and

- $5.0 million higher

revenue within the Company’s military and space end-use markets due

to higher rates on fixed-wing and rotary-wing aircraft

platforms.

Structural Systems segment operating income for

the quarter ended June 29, 2024 was $10.6 million, or 11.0% of

revenue, compared to $5.4 million, or 6.7% of revenue, for the

comparable quarter in 2023. The year-over-year increase of $5.2

million was primarily due to higher volume, favorable product mix,

pricing actions, and lower Guaymas fire related expenses. Non-GAAP

adjusted operating income for the second quarter of 2024 was $14.7

million, or 15.4% of revenue, compared to $12.8 million, or 16.0%

of revenue, in the comparable period last year.

Corporate General and Administrative

(“CG&A”) Expenses

CG&A expenses for the second quarter of 2024

were $13.4 million, or 6.8% of total Company revenue, compared to

$9.9 million, or 5.3% of total Company revenue, for the comparable

quarter in the prior year. The year-over-year increase in CG&A

expenses was primarily due to higher professional services fees of

$2.9 million, of which $1.4 million was related to the unsolicited

non-binding offer to acquire all the shares of Ducommun

Incorporated, $1.5 million in other legal and professional

services, including for the evaluation of acquisition

opportunities.

Conference Call

A teleconference hosted by Stephen G. Oswald,

the Company’s chairman, president and chief executive officer, and

Suman B. Mookerji, the Company’s senior vice president, chief

financial officer will be held today, August 8, 2024 at 10:00

a.m. PT (1:00 p.m. ET) to review these financial results. To access

the conference call, please pre-register using the following

registration link:

https://register.vevent.com/register/BI56958946b480425da35343eca4b411bf

Registrants will receive a confirmation with

dial-in details. Mr. Oswald and Mr. Mookerji will be speaking on

behalf of the Company and anticipate the call (including Q&A)

to last approximately 45 minutes. A live webcast of the event can

be accessed using the link above. A replay of the webcast will be

available on the Ducommun website at Ducommun.com.

Additional information regarding Ducommun's

results can be found in the Q2 2024 Earnings Presentation available

at Ducommun.com.

About Ducommun Incorporated

Ducommun Incorporated delivers value-added

innovative manufacturing solutions to customers in the aerospace,

defense and industrial markets. Founded in 1849, the Company

specializes in two core areas - Electronic Systems and Structural

Systems - to produce complex products and components for commercial

aircraft platforms, mission-critical military and space programs,

and sophisticated industrial applications. For more information,

visit Ducommun.com.

Forward Looking Statements

This press release and any attachments include

“forward-looking statements,” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, including, in

particular, any statements about the Company's 2027 Vision

Strategy, long-term goals and the anticipated demand for commercial

aerospace products through 2025. The Company generally uses the

words “may,” “will,” “could,” “expect,” “anticipate,” “believe,”

“estimate,” “plan,” “intend,” “continue” and similar expressions in

this press release and any attachments to identify forward-looking

statements. The Company bases these forward-looking statements on

its current views with respect to future events and financial

performance. Actual results could differ materially from those

projected in the forward-looking statements. These forward-looking

statements are subject to risks, uncertainties and assumptions,

including, among other things: whether the anticipated pre-tax

restructuring charges will be sufficient to address all anticipated

restructuring costs, including related to employee separation,

facilities consolidation, inventory write-down and other asset

impairments; whether the expected cost savings from the

restructuring will ultimately be obtained in the amount and during

the period anticipated; whether the restructuring in the affected

areas will be sufficient to build a more cost efficient, focused,

higher margin enterprise with higher returns for the Company's

shareholders; the strength of the real estate market, the duration

of any lease entered into as part of any sale-leaseback

transaction, the amount of commissions owed to brokers, and

applicable tax rates; the impact of the Company’s debt service

obligations and restrictive debt covenants; the Company’s end-use

markets are cyclical; the Company depends upon a selected base of

industries and customers; a significant portion of the Company’s

business depends upon U.S. Government defense spending; the Company

is subject to extensive regulation and audit by the Defense

Contract Audit Agency; contracts with some of the Company’s

customers contain provisions which give the its customers a variety

of rights that are unfavorable to the Company; further

consolidation in the aerospace industry could adversely affect the

Company’s business and financial results; the Company’s ability to

successfully make acquisitions, including its ability to

successfully integrate, operate or realize the projected benefits

of such businesses; the Company relies on its suppliers to meet the

quality and delivery expectations of its customers; the Company

uses estimates when bidding on fixed-price contracts which

estimates could change and result in adverse effects on its

financial results; the impact of existing and future laws and

regulations; the impact of existing and future accounting standards

and tax rules and regulations; environmental liabilities could

adversely affect the Company’s financial results; cyber security

attacks, internal system or service failures may adversely impact

the Company’s business and operations; the ultimate geographic

spread, duration and severity of the coronavirus (COVID-19)

outbreak, and the effectiveness of actions taken, or actions that

may be taken, by governmental authorities to contain the outbreak

or treat its impact, and other risks and uncertainties, including

those detailed from time to time in the Company’s periodic reports

filed with the Securities and Exchange Commission. You should not

put undue reliance on any forward-looking statements. You should

understand that many important factors, including those discussed

herein, could cause the Company’s results to differ materially from

those expressed or suggested in any forward-looking statement.

Except as required by law, the Company does not undertake any

obligation to update or revise these forward-looking statements to

reflect new information or events or circumstances that occur after

the date of this news release, August 8, 2024, or to reflect

the occurrence of unanticipated events or otherwise. Readers are

advised to review the Company’s filings with the Securities and

Exchange Commission (which are available from the SEC’s EDGAR

database at www.sec.gov).

Note Regarding Non-GAAP Financial

Information

This release contains non-GAAP financial

measures, including Adjusted EBITDA (which excludes interest

expense, income tax expense, depreciation, amortization,

stock-based compensation expense, restructuring charges,

professional fees related to unsolicited non-binding acquisition

offer, Guaymas fire related expenses, other fire related expenses,

insurance recoveries related to loss on operating assets, insurance

recoveries related to business interruption, and inventory purchase

accounting adjustments), including as a percentage of revenue,

non-GAAP operating income, including as a percentage of net

revenues, non-GAAP earnings, non-GAAP earnings per share, and

backlog. In addition, certain other prior period amounts have been

reclassified to conform to current year’s presentation.

The Company believes the presentation of these

non-GAAP measures provide important supplemental information to

management and investors regarding financial and business trends

relating to its financial condition and results of operations. The

Company’s management uses these non-GAAP financial measures along

with the most directly comparable GAAP financial measures in

evaluating the Company’s actual and forecasted operating

performance, capital resources and cash flow. The non-GAAP

financial information presented herein should be considered

supplemental to, and not as a substitute for, or superior to,

financial measures calculated in accordance with GAAP. The Company

discloses different non-GAAP financial measures in order to provide

greater transparency and to help the Company’s investors to more

meaningfully evaluate and compare Ducommun’s results to its

previously reported results. The non-GAAP financial measures that

the Company uses may not be comparable to similarly titled

financial measures used by other companies.

The Company defines backlog as potential revenue

and is based on customer placed purchase orders and long-term

agreements (“LTAs”) with firm fixed price and expected delivery

dates of 24 months or less. The majority of the LTAs do not meet

the definition of a contract under ASC 606 and thus, the backlog

amount disclosed herein is greater than the remaining performance

obligations disclosed under ASC 606. Backlog is subject to delivery

delays or program cancellations, which are beyond the Company’s

control. Backlog is affected by timing differences in the placement

of customer orders and tends to be concentrated in several programs

to a greater extent than the Company’s net revenues. As a result of

these factors, trends in the Company’s overall level of backlog may

not be indicative of trends in the Company’s future net

revenues.

CONTACT:

Suman Mookerji, Senior Vice President, Chief Financial Officer,

657.335.3665

|

|

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESCONDENSED CONSOLIDATED

BALANCE SHEETS(Unaudited)(Dollars in thousands) |

| |

| |

|

June 29,2024 |

|

December 31,2023 |

| Assets |

|

|

|

|

| Current Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

29,405 |

|

$ |

42,863 |

|

Accounts receivable, net |

|

|

106,585 |

|

|

104,692 |

|

Contract assets |

|

|

210,314 |

|

|

177,686 |

|

Inventories |

|

|

201,831 |

|

|

199,201 |

|

Production cost of contracts |

|

|

6,181 |

|

|

7,778 |

|

Other current assets |

|

|

14,398 |

|

|

17,349 |

|

Total Current Assets |

|

|

568,714 |

|

|

549,569 |

| Property and Equipment, Net |

|

|

111,299 |

|

|

111,379 |

| Operating Lease Right-of-Use

Assets |

|

|

27,128 |

|

|

29,513 |

| Goodwill |

|

|

244,600 |

|

|

244,600 |

| Intangibles, Net |

|

|

157,967 |

|

|

166,343 |

| Deferred income taxes |

|

|

641 |

|

|

641 |

| Other Assets |

|

|

21,151 |

|

|

18,874 |

| Total

Assets |

|

$ |

1,131,500 |

|

$ |

1,120,919 |

| Liabilities and

Shareholders’ Equity |

|

|

|

|

| Current Liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

76,810 |

|

$ |

72,265 |

|

Contract liabilities |

|

|

50,034 |

|

|

53,492 |

|

Accrued and other liabilities |

|

|

40,293 |

|

|

42,260 |

|

Operating lease liabilities |

|

|

7,943 |

|

|

7,873 |

|

Current portion of long-term debt |

|

|

10,938 |

|

|

7,813 |

|

Total Current Liabilities |

|

|

186,018 |

|

|

183,703 |

| Long-Term Debt, Less Current

Portion |

|

|

250,896 |

|

|

256,961 |

| Non-Current Operating Lease

Liabilities |

|

|

20,414 |

|

|

22,947 |

| Deferred Income Taxes |

|

|

2,945 |

|

|

4,766 |

| Other Long-Term Liabilities |

|

|

15,328 |

|

|

16,448 |

|

Total Liabilities |

|

|

475,601 |

|

|

484,825 |

| Commitments and

Contingencies |

|

|

|

|

| Shareholders’ Equity |

|

|

|

|

| Common Stock |

|

|

147 |

|

|

146 |

| Additional Paid-In Capital |

|

|

208,930 |

|

|

206,197 |

| Retained Earnings |

|

|

436,553 |

|

|

421,980 |

| Accumulated Other Comprehensive

Income |

|

|

10,269 |

|

|

7,771 |

|

Total Shareholders’ Equity |

|

|

655,899 |

|

|

636,094 |

| Total Liabilities and

Shareholders’ Equity |

|

$ |

1,131,500 |

|

$ |

1,120,919 |

|

|

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESCONDENSED CONSOLIDATED

STATEMENTS OF INCOME(Unaudited)(Dollars in thousands, except per

share amounts) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 29,2024 |

|

July 1,2023 |

|

June 29,2024 |

|

July 1,2023 |

|

Net Revenues |

|

$ |

197,000 |

|

|

$ |

187,320 |

|

|

$ |

387,847 |

|

|

$ |

368,511 |

|

| Cost of

Sales |

|

|

145,761 |

|

|

|

147,198 |

|

|

|

289,665 |

|

|

|

291,622 |

|

| Gross

Profit |

|

|

51,239 |

|

|

|

40,122 |

|

|

|

98,182 |

|

|

|

76,889 |

|

| Selling,

General and Administrative Expenses |

|

|

36,061 |

|

|

|

30,348 |

|

|

|

69,012 |

|

|

|

56,573 |

|

|

Restructuring Charges |

|

|

1,254 |

|

|

|

4,769 |

|

|

|

2,624 |

|

|

|

8,939 |

|

|

Operating Income |

|

|

13,924 |

|

|

|

5,005 |

|

|

|

26,546 |

|

|

|

11,377 |

|

| Interest

Expense |

|

|

(3,975 |

) |

|

|

(5,735 |

) |

|

|

(7,858 |

) |

|

|

(9,954 |

) |

| Other

Income |

|

|

— |

|

|

|

4,059 |

|

|

|

— |

|

|

|

7,945 |

|

| Income

Before Taxes |

|

|

9,949 |

|

|

|

3,329 |

|

|

|

18,688 |

|

|

|

9,368 |

|

| Income

Tax Expense |

|

|

2,225 |

|

|

|

955 |

|

|

|

4,115 |

|

|

|

1,763 |

|

| Net

Income |

|

$ |

7,724 |

|

|

$ |

2,374 |

|

|

$ |

14,573 |

|

|

$ |

7,605 |

|

| Earnings

Per Share |

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

$ |

0.52 |

|

|

$ |

0.18 |

|

|

$ |

0.99 |

|

|

$ |

0.59 |

|

|

Diluted earnings per share |

|

$ |

0.52 |

|

|

$ |

0.17 |

|

|

$ |

0.97 |

|

|

$ |

0.58 |

|

|

Weighted-Average Number of Common Shares Outstanding |

|

|

|

|

|

|

|

|

|

Basic |

|

|

14,775 |

|

|

|

13,403 |

|

|

|

14,735 |

|

|

|

12,799 |

|

|

Diluted |

|

|

14,961 |

|

|

|

13,599 |

|

|

|

14,954 |

|

|

|

13,075 |

|

| |

|

|

|

|

|

|

|

|

| Gross

Profit % |

|

|

26.0 |

% |

|

|

21.4 |

% |

|

|

25.3 |

% |

|

|

20.9 |

% |

| SG&A

% |

|

|

18.3 |

% |

|

|

16.2 |

% |

|

|

17.8 |

% |

|

|

15.4 |

% |

|

Operating Income % |

|

|

7.1 |

% |

|

|

2.7 |

% |

|

|

6.8 |

% |

|

|

3.1 |

% |

| Net

Income % |

|

|

3.9 |

% |

|

|

1.3 |

% |

|

|

3.8 |

% |

|

|

2.1 |

% |

|

Effective Tax Rate |

|

|

22.4 |

% |

|

|

28.7 |

% |

|

|

22.0 |

% |

|

|

18.8 |

% |

| |

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESGAAP TO NON-GAAP NET INCOME

TO ADJUSTED EBITDA RECONCILIATION(Unaudited)(Dollars in

thousands) |

| |

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 29,2024 |

|

July 1,2023 |

|

June 29,2024 |

|

July 1,2023 |

|

GAAP net income |

|

$ |

7,724 |

|

|

$ |

2,374 |

|

|

$ |

14,573 |

|

|

$ |

7,605 |

|

| Non-GAAP

Adjustments: |

|

|

|

|

|

|

|

|

| Interest

expense |

|

|

3,975 |

|

|

|

5,735 |

|

|

|

7,858 |

|

|

|

9,954 |

|

| Income

tax expense |

|

|

2,225 |

|

|

|

955 |

|

|

|

4,115 |

|

|

|

1,763 |

|

|

Depreciation |

|

|

4,038 |

|

|

|

3,932 |

|

|

|

8,054 |

|

|

|

7,672 |

|

|

Amortization |

|

|

4,207 |

|

|

|

4,022 |

|

|

|

8,544 |

|

|

|

8,271 |

|

|

Stock-based compensation expense (1) |

|

|

4,028 |

|

|

|

5,036 |

|

|

|

8,286 |

|

|

|

8,117 |

|

|

Restructuring charges |

|

|

2,111 |

|

|

|

4,769 |

|

|

|

3,481 |

|

|

|

8,939 |

|

|

Professional fees related to unsolicited non-binding acquisition

offer |

|

|

1,374 |

|

|

|

— |

|

|

|

1,374 |

|

|

|

— |

|

| Guaymas

fire related expenses |

|

|

— |

|

|

|

1,880 |

|

|

|

— |

|

|

|

3,348 |

|

| Other

fire related expenses |

|

|

— |

|

|

|

477 |

|

|

|

— |

|

|

|

477 |

|

|

Insurance recoveries related to loss on operating assets |

|

|

— |

|

|

|

(1,677 |

) |

|

|

— |

|

|

|

(5,563 |

) |

|

Insurance recoveries related to business interruption |

|

|

— |

|

|

|

(2,160 |

) |

|

|

— |

|

|

|

(2,160 |

) |

|

Inventory purchase accounting adjustments |

|

|

291 |

|

|

|

766 |

|

|

|

1,082 |

|

|

|

766 |

|

| Adjusted

EBITDA |

|

$ |

29,973 |

|

|

$ |

26,109 |

|

|

$ |

57,367 |

|

|

$ |

49,189 |

|

|

Net income as a % of net revenues |

|

|

3.9 |

% |

|

|

1.3 |

% |

|

|

3.8 |

% |

|

|

2.1 |

% |

|

Adjusted EBITDA as a % of net revenues |

|

|

15.2 |

% |

|

|

13.9 |

% |

|

|

14.8 |

% |

|

|

13.3 |

% |

(1) The three and six months ended June 29, 2024 included

$0.5 million and $1.9 million, respectively, of stock-based

compensation expense for awards with both performance and market

conditions that will be settled in cash. The three and six months

ended July 1, 2023 included $0.8 million and $1.2 million,

respectively, of stock-based compensation expense for awards with

both performance and market conditions that will be settled in

cash. The three and six months ended June 29, 2024 each

included $0.1 million of stock-based compensation expense recorded

as cost of sales. The three and six months ended July 1, 2023

each included $0.2 million of stock-based compensation expense

recorded as cost of sales.

|

|

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESBUSINESS SEGMENT

PERFORMANCE(Unaudited)(Dollars in thousands) |

|

|

|

|

Three Months Ended |

|

Six Months Ended |

| |

%Change |

|

June 29,2024 |

|

July 1,2023 |

|

%of Net Revenues2024 |

|

%of Net Revenues2023 |

|

%Change |

|

June 29,2024 |

|

July 1,2023 |

|

%of Net Revenues2024 |

|

%of Net Revenues2023 |

|

Net Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Systems |

(5.3) |

% |

|

$ |

101,440 |

|

|

$ |

107,124 |

|

|

51.5 |

% |

|

57.2 |

% |

|

(1.8) |

% |

|

$ |

208,979 |

|

|

$ |

212,750 |

|

|

53.9 |

% |

|

57.7 |

% |

|

Structural Systems |

19.2 |

% |

|

|

95,560 |

|

|

|

80,196 |

|

|

48.5 |

% |

|

42.8 |

% |

|

14.8 |

% |

|

|

178,868 |

|

|

|

155,761 |

|

|

46.1 |

% |

|

42.3 |

% |

|

Total Net Revenues |

5.2 |

% |

|

$ |

197,000 |

|

|

$ |

187,320 |

|

|

100.0 |

% |

|

100.0 |

% |

|

5.2 |

% |

|

$ |

387,847 |

|

|

$ |

368,511 |

|

|

100.0 |

% |

|

100.0 |

% |

|

Segment Operating Income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Systems |

|

|

$ |

16,806 |

|

|

$ |

9,528 |

|

|

16.6 |

% |

|

8.9 |

% |

|

|

|

$ |

35,775 |

|

|

$ |

19,539 |

|

|

17.1 |

% |

|

9.2 |

% |

|

Structural Systems |

|

|

|

10,559 |

|

|

|

5,385 |

|

|

11.0 |

% |

|

6.7 |

% |

|

|

|

|

13,427 |

|

|

|

10,130 |

|

|

7.5 |

% |

|

6.5 |

% |

|

|

|

|

|

27,365 |

|

|

|

14,913 |

|

|

|

|

|

|

|

|

|

49,202 |

|

|

|

29,669 |

|

|

|

|

|

|

Corporate General and Administrative Expenses (1) |

|

|

|

(13,441 |

) |

|

|

(9,908 |

) |

|

(6.8) |

% |

|

(5.3) |

% |

|

|

|

|

(22,656 |

) |

|

|

(18,292 |

) |

|

(5.8) |

% |

|

(5.0) |

% |

|

Total Operating Income |

|

|

$ |

13,924 |

|

|

$ |

5,005 |

|

|

7.1 |

% |

|

2.7 |

% |

|

|

|

$ |

26,546 |

|

|

$ |

11,377 |

|

|

6.8 |

% |

|

3.1 |

% |

| Adjusted

EBITDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

|

$ |

16,806 |

|

|

$ |

9,528 |

|

|

|

|

|

|

|

|

$ |

35,775 |

|

|

$ |

19,539 |

|

|

|

|

|

|

Other Income |

|

|

|

— |

|

|

|

222 |

|

|

|

|

|

|

|

|

|

— |

|

|

|

222 |

|

|

|

|

|

|

Depreciation and Amortization |

|

|

|

3,662 |

|

|

|

3,561 |

|

|

|

|

|

|

|

|

|

7,294 |

|

|

|

7,059 |

|

|

|

|

|

|

Stock-Based Compensation Expense (2) |

|

|

|

91 |

|

|

|

119 |

|

|

|

|

|

|

|

|

|

171 |

|

|

|

251 |

|

|

|

|

|

|

Restructuring Charges |

|

|

|

— |

|

|

|

2,071 |

|

|

|

|

|

|

|

|

|

459 |

|

|

|

3,945 |

|

|

|

|

|

|

|

|

|

|

20,559 |

|

|

|

15,501 |

|

|

20.3 |

% |

|

14.5 |

% |

|

|

|

|

43,699 |

|

|

|

31,016 |

|

|

20.9 |

% |

|

14.6 |

% |

|

Structural Systems |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

|

|

10,559 |

|

|

|

5,385 |

|

|

|

|

|

|

|

|

|

13,427 |

|

|

|

10,130 |

|

|

|

|

|

|

Depreciation and Amortization |

|

|

|

4,547 |

|

|

|

4,335 |

|

|

|

|

|

|

|

|

|

9,209 |

|

|

|

8,767 |

|

|

|

|

|

|

Stock-Based Compensation Expense (3) |

|

|

|

70 |

|

|

|

101 |

|

|

|

|

|

|

|

|

|

156 |

|

|

|

203 |

|

|

|

|

|

|

Restructuring Charges |

|

|

|

2,111 |

|

|

|

2,612 |

|

|

|

|

|

|

|

|

|

3,022 |

|

|

|

4,908 |

|

|

|

|

|

|

Guaymas fire related expenses |

|

|

|

— |

|

|

|

1,880 |

|

|

|

|

|

|

|

|

|

— |

|

|

|

3,348 |

|

|

|

|

|

|

Other fire related expenses |

|

|

|

— |

|

|

|

477 |

|

|

|

|

|

|

|

|

|

— |

|

|

|

477 |

|

|

|

|

|

|

Inventory Purchase Accounting Adjustments |

|

|

|

291 |

|

|

|

766 |

|

|

|

|

|

|

|

|

|

1,082 |

|

|

|

766 |

|

|

|

|

|

|

|

|

|

|

17,578 |

|

|

|

15,556 |

|

|

18.4 |

% |

|

19.4 |

% |

|

|

|

|

26,896 |

|

|

|

28,599 |

|

|

15.0 |

% |

|

18.4 |

% |

|

Corporate General and Administrative Expenses (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

|

|

(13,441 |

) |

|

|

(9,908 |

) |

|

|

|

|

|

|

|

|

(22,656 |

) |

|

|

(18,292 |

) |

|

|

|

|

|

Depreciation and Amortization |

|

|

|

36 |

|

|

|

58 |

|

|

|

|

|

|

|

|

|

95 |

|

|

|

117 |

|

|

|

|

|

|

Stock-Based Compensation Expense (4) |

|

|

|

3,867 |

|

|

|

4,816 |

|

|

|

|

|

|

|

|

|

7,959 |

|

|

|

7,663 |

|

|

|

|

|

|

Restructuring Charges |

|

|

|

— |

|

|

|

86 |

|

|

|

|

|

|

|

|

|

— |

|

|

|

86 |

|

|

|

|

|

|

Professional Fees Related to Unsolicited Non-Binding Acquisition

Offer |

|

|

|

1,374 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

1,374 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

(8,164 |

) |

|

|

(4,948 |

) |

|

|

|

|

|

|

|

|

(13,228 |

) |

|

|

(10,426 |

) |

|

|

|

|

|

Adjusted EBITDA |

|

|

$ |

29,973 |

|

|

$ |

26,109 |

|

|

15.2 |

% |

|

13.9 |

% |

|

|

|

$ |

57,367 |

|

|

$ |

49,189 |

|

|

14.8 |

% |

|

13.3 |

% |

|

Capital Expenditures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Electronic Systems |

|

|

$ |

1,143 |

|

|

$ |

1,923 |

|

|

|

|

|

|

|

|

$ |

1,939 |

|

|

$ |

3,774 |

|

|

|

|

|

|

Structural Systems |

|

|

|

1,353 |

|

|

|

4,111 |

|

|

|

|

|

|

|

|

|

2,877 |

|

|

|

7,241 |

|

|

|

|

|

|

Corporate Administration |

|

|

|

723 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

3,148 |

|

|

|

— |

|

|

|

|

|

|

Total Capital Expenditures |

|

|

$ |

3,219 |

|

|

$ |

6,034 |

|

|

|

|

|

|

|

|

$ |

7,964 |

|

|

$ |

11,015 |

|

|

|

|

|

(1) Includes costs not allocated to either the

Electronic Systems or Structural Systems operating segments.

(2) The three and six months ended

June 29, 2024 each included less than $0.1 million of

stock-based compensation expense recorded as cost of sales. The

three and six months ended July 1, 2023 included less than

$0.1 million and $0.1 million, respectively, of stock-based

compensation expense recorded as cost of sales.

(3) The three and six months ended

June 29, 2024 included less than $0.1 million and $0.1

million, respectively, of stock-based compensation expense recorded

as cost of sales. The three and six months ended July 1, 2023

each included less than $0.1 million of stock-based compensation

expense recorded as cost of sales.

(4) The three and six months ended

June 29, 2024 included $0.5 million and $1.9 million,

respectively, of stock-based compensation expense for awards with

both performance and market conditions that will be settled in

cash. The three and six months ended July 1, 2023 included

$0.8 million and $1.2 million, respectively, of stock-based

compensation expense for awards with both performance and market

conditions that will be settled in cash.

| |

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESGAAP TO NON-GAAP OPERATING

INCOME RECONCILIATION(Unaudited)(Dollars in thousands) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| GAAP To Non-GAAP

Operating Income |

June 29, 2024 |

|

July 1, 2023 |

|

%of Net Revenues2024 |

|

%of Net Revenues2023 |

|

June 29, 2024 |

|

July 1, 2023 |

|

%of Net Revenues2024 |

|

%of Net Revenues2023 |

| GAAP operating income |

$ |

13,924 |

|

|

$ |

5,005 |

|

|

|

|

|

|

$ |

26,546 |

|

|

$ |

11,377 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating income -

Electronic Systems |

$ |

16,806 |

|

|

$ |

9,528 |

|

|

|

|

|

|

$ |

35,775 |

|

|

$ |

19,539 |

|

|

|

|

|

| Adjustments to GAAP operating

income - Electronic Systems: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income |

|

— |

|

|

|

222 |

|

|

|

|

|

|

|

— |

|

|

|

222 |

|

|

|

|

|

| Restructuring charges |

|

— |

|

|

|

2,071 |

|

|

|

|

|

|

|

459 |

|

|

|

3,945 |

|

|

|

|

|

| Amortization of

acquisition-related intangible assets |

|

374 |

|

|

|

374 |

|

|

|

|

|

|

|

747 |

|

|

|

747 |

|

|

|

|

|

|

Total adjustments to GAAP operating income - Electronic

Systems |

|

374 |

|

|

|

2,667 |

|

|

|

|

|

|

|

1,206 |

|

|

|

4,914 |

|

|

|

|

|

|

Non-GAAP adjusted operating income - Electronic Systems |

|

17,180 |

|

|

|

12,195 |

|

|

16.9 |

% |

|

11.4 |

% |

|

|

36,981 |

|

|

|

24,453 |

|

|

17.7 |

% |

|

11.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating income -

Structural Systems |

|

10,559 |

|

|

|

5,385 |

|

|

|

|

|

|

|

13,427 |

|

|

|

10,130 |

|

|

|

|

|

| Adjustments to GAAP operating

income - Structural Systems: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restructuring charges |

|

2,111 |

|

|

|

2,612 |

|

|

|

|

|

|

|

3,022 |

|

|

|

4,908 |

|

|

|

|

|

| Guaymas fire related

expenses |

|

— |

|

|

|

1,880 |

|

|

|

|

|

|

|

— |

|

|

|

3,348 |

|

|

|

|

|

| Other fire related

expenses |

|

— |

|

|

|

477 |

|

|

|

|

|

|

|

— |

|

|

|

477 |

|

|

|

|

|

| Inventory purchase accounting

adjustments |

|

291 |

|

|

|

766 |

|

|

|

|

|

|

|

1,082 |

|

|

|

766 |

|

|

|

|

|

| Amortization of

acquisition-related intangible assets |

|

1,785 |

|

|

|

1,701 |

|

|

|

|

|

|

|

3,719 |

|

|

|

2,938 |

|

|

|

|

|

|

Total adjustments to GAAP operating income - Structural

Systems |

|

4,187 |

|

|

|

7,436 |

|

|

|

|

|

|

|

7,823 |

|

|

|

12,437 |

|

|

|

|

|

| Non-GAAP adjusted operating

income - Structural Systems |

|

14,746 |

|

|

|

12,821 |

|

|

15.4 |

% |

|

16.0 |

% |

|

|

21,250 |

|

|

|

22,567 |

|

|

11.9 |

% |

|

14.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating loss -

Corporate |

|

(13,441 |

) |

|

|

(9,908 |

) |

|

|

|

|

|

|

(22,656 |

) |

|

|

(18,292 |

) |

|

|

|

|

| Adjustments to GAAP Operating

Income - Corporate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restructuring charges |

|

— |

|

|

|

86 |

|

|

|

|

|

|

|

— |

|

|

|

86 |

|

|

|

|

|

| Professional fees related to

unsolicited non-binding acquisition offer |

|

1,374 |

|

|

|

— |

|

|

|

|

|

|

|

1,374 |

|

|

|

— |

|

|

|

|

|

|

Total adjustments to GAAP Operating Income - Corporate |

|

1,374 |

|

|

|

86 |

|

|

|

|

|

|

|

1,374 |

|

|

|

86 |

|

|

|

|

|

| Non-GAAP adjusted operating

loss - Corporate |

|

(12,067 |

) |

|

|

(9,822 |

) |

|

|

|

|

|

|

(21,282 |

) |

|

|

(18,206 |

) |

|

|

|

|

| Total non-GAAP adjustments to

GAAP operating income |

|

5,935 |

|

|

|

10,189 |

|

|

|

|

|

|

|

10,403 |

|

|

|

17,437 |

|

|

|

|

|

| Non-GAAP adjusted operating

income |

$ |

19,859 |

|

|

$ |

15,194 |

|

|

10.1 |

% |

|

8.1 |

% |

|

$ |

36,949 |

|

|

$ |

28,814 |

|

|

9.5 |

% |

|

7.8 |

% |

|

|

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESGAAP TO NON-GAAP NET INCOME

AND EARNINGS PER SHARE RECONCILIATION(Unaudited)(Dollars in

thousands, except per share amounts) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| GAAP To Non-GAAP Net

Income |

June 29,2024 |

|

July 1,2023 |

|

June 29,2024 |

|

July 1,2023 |

|

GAAP net income |

$ |

7,724 |

|

|

$ |

2,374 |

|

|

$ |

14,573 |

|

|

$ |

7,605 |

|

| Adjustments to GAAP net

income: |

|

|

|

|

|

|

|

| Restructuring charges |

|

2,111 |

|

|

|

4,769 |

|

|

|

3,481 |

|

|

|

8,939 |

|

| Professional fees related to

unsolicited non-binding acquisition offer |

|

1,374 |

|

|

|

— |

|

|

|

1,374 |

|

|

|

— |

|

| Guaymas fire related

expenses |

|

— |

|

|

|

1,880 |

|

|

|

— |

|

|

|

3,348 |

|

| Other fire related

expenses |

|

— |

|

|

|

477 |

|

|

|

— |

|

|

|

477 |

|

| Insurance recoveries related

to loss on operating assets |

|

— |

|

|

|

(1,677 |

) |

|

|

— |

|

|

|

(5,563 |

) |

| Insurance recoveries related

to business interruption |

|

— |

|

|

|

(2,160 |

) |

|

|

— |

|

|

|

(2,160 |

) |

| Inventory purchase accounting

adjustments |

|

291 |

|

|

|

766 |

|

|

|

1,082 |

|

|

|

766 |

|

| Amortization of

acquisition-related intangible assets |

|

2,159 |

|

|

|

2,075 |

|

|

|

4,466 |

|

|

|

3,685 |

|

| Total adjustments to GAAP net

income before provision for income taxes |

|

5,935 |

|

|

|

6,130 |

|

|

|

10,403 |

|

|

|

9,492 |

|

| Income tax effect on non-GAAP

adjustments (1) |

|

(1,187 |

) |

|

|

(1,226 |

) |

|

|

(2,081 |

) |

|

|

(1,898 |

) |

| Non-GAAP adjusted net

income |

$ |

12,472 |

|

|

$ |

7,278 |

|

|

$ |

22,895 |

|

|

$ |

15,199 |

|

| |

Three Months Ended |

|

Six Months Ended |

| GAAP Earnings Per

Share To Non-GAAP Earnings Per Share |

June 29,2024 |

|

July 1,2023 |

|

June 29,2024 |

|

July 1,2023 |

|

GAAP diluted earnings per share (“EPS”) |

$ |

0.52 |

|

|

$ |

0.17 |

|

|

$ |

0.97 |

|

|

$ |

0.58 |

|

| Adjustments to GAAP diluted

EPS: |

|

|

|

|

|

|

|

| Restructuring charges |

|

0.14 |

|

|

|

0.35 |

|

|

|

0.24 |

|

|

|

0.68 |

|

| Professional fees related to

unsolicited non-binding acquisition offer |

|

0.09 |

|

|

|

— |

|

|

|

0.09 |

|

|

|

— |

|

| Guaymas fire related

expenses |

|

— |

|

|

|

0.14 |

|

|

|

— |

|

|

|

0.26 |

|

| Other fire related

expenses |

|

— |

|

|

|

0.04 |

|

|

|

— |

|

|

|

0.04 |

|

| Insurance recoveries related

to loss on operating assets |

|

— |

|

|

|

(0.12 |

) |

|

|

— |

|

|

|

(0.43 |

) |

| Insurance recoveries related

to business interruption |

|

— |

|

|

|

(0.16 |

) |

|

|

— |

|

|

|

(0.16 |

) |

| Inventory purchase accounting

adjustments |

|

0.02 |

|

|

|

0.06 |

|

|

|

0.07 |

|

|

|

0.06 |

|

| Amortization of

acquisition-related intangible assets |

|

0.14 |

|

|

|

0.15 |

|

|

|

0.30 |

|

|

|

0.28 |

|

| Total adjustments to GAAP

diluted EPS before provision for income taxes |

|

0.39 |

|

|

|

0.46 |

|

|

|

0.70 |

|

|

|

0.73 |

|

| Income tax effect on non-GAAP

adjustments (1) |

|

(0.08 |

) |

|

|

(0.09 |

) |

|

|

(0.14 |

) |

|

|

(0.15 |

) |

| Non-GAAP adjusted diluted

EPS |

$ |

0.83 |

|

|

$ |

0.54 |

|

|

$ |

1.53 |

|

|

$ |

1.16 |

|

| |

|

|

|

|

|

|

|

| Shares used for non-GAAP

adjusted diluted EPS |

|

14,961 |

|

|

|

13,599 |

|

|

|

14,954 |

|

|

|

13,075 |

|

(1) Effective tax rate of 20.0% used for both 2024 and 2023

adjustments.

|

|

|

DUCOMMUN INCORPORATED AND SUBSIDIARIESNON-GAAP BACKLOG* BY

REPORTING SEGMENT(Unaudited)(Dollars in thousands) |

| |

| |

June 29,2024 |

|

December 31,2023 |

|

Consolidated Ducommun |

|

|

|

|

Military and space |

$ |

592,476 |

|

$ |

527,143 |

|

Commercial aerospace |

|

451,070 |

|

|

429,494 |

|

Industrial |

|

24,469 |

|

|

36,931 |

|

Total |

$ |

1,068,015 |

|

$ |

993,568 |

|

Electronic Systems |

|

|

|

| Military

and space |

$ |

447,441 |

|

$ |

397,681 |

|

Commercial aerospace |

|

85,601 |

|

|

87,994 |

|

Industrial |

|

24,469 |

|

|

36,931 |

|

Total |

$ |

557,511 |

|

$ |

522,606 |

|

Structural Systems |

|

|

|

| Military

and space |

$ |

145,035 |

|

$ |

129,462 |

|

Commercial aerospace |

|

365,469 |

|

|

341,500 |

|

Total |

$ |

510,504 |

|

$ |

470,962 |

* Under ASC 606, the Company defines performance

obligations as customer placed purchase orders with firm fixed

price and firm delivery dates. The remaining performance

obligations disclosed under ASC 606 as of June 29, 2024 were

$840.0 million. The Company defines backlog as potential revenue

and is based on customer placed purchase orders and long-term

agreements (“LTAs”) with firm fixed price and expected delivery

dates of 24 months or less. Backlog as of June 29, 2024 was

$1,068.0 million compared to $993.6 million as of December 31,

2023.

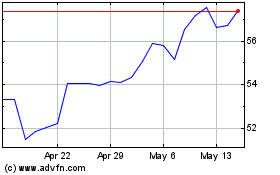

Ducommun (NYSE:DCO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ducommun (NYSE:DCO)

Historical Stock Chart

From Nov 2023 to Nov 2024