Dillard’s, Inc. (NYSE: DDS) (the “Company” or “Dillard’s”)

announced operating results for the 13 weeks ended April 29, 2023.

This release contains certain forward-looking statements. Please

refer to the Company’s cautionary statements included below under

“Forward-Looking Information.”

Dillard’s Chief Executive Officer William T. Dillard, II

stated, “We had a good quarter against a tough comparison. We

achieved retail gross margin of 45.6% on a sales decrease of 4% as

customer activity declined in the back half of the quarter. We

repurchased $113.8 million of stock and still had $955 million in

cash and short-term investments remaining.”

Highlights of the First Quarter (compared to the prior year

first quarter):

- Total retail sales decreased 4%

- Comparable store sales decreased 4%

- Net income of $201.5 million compared to $251.1

million

- Earnings per share of $11.85 compared to $13.68

- Retail gross margin of 45.6% of sales compared to 47.3% of

sales

- Operating expenses were $406.4 million (25.7% of sales)

compared to $400.8 million (24.9% of sales)

- Share repurchase of $113.8 million (approximately 357,000

shares)

- Ending inventory increase of 3%

First Quarter Results

Dillard’s reported net income for the 13 weeks ended April 29,

2023 of $201.5 million, or $11.85 per share, marking the Company’s

second highest first quarter net income performance. This compares

to $251.1 million, or $13.68 per share, for the prior year 13-week

period. Included in net income for the 13 weeks ended April 29,

2023 is a pretax gain of $1.8 million ($1.4 million after tax or

$0.08 per share) primarily related to the sale of a store

property.

Included in net income for the prior year 13-week period ended

April 30, 2022 is a pretax gain of $7.2 million ($5.6 million after

tax or $0.31 per share) primarily related to the sale of a store

property.

Sales

Net sales for the 13 weeks ended April 29, 2023 and April 30,

2022 were $1.584 billion and $1.612 billion, respectively. Net

sales includes the operations of the Company’s construction

business, CDI Contractors, LLC (“CDI”).

Total retail sales (which excludes CDI) for the 13 weeks ended

April 29, 2023 and April 30, 2022 were $1.515 billion and $1.581

billion, respectively. Total retail sales decreased 4% for the

13-week period ended April 29, 2023 compared to the prior year

first quarter. Sales in comparable stores decreased 4%. The Company

noted a decline in customer activity in the back half of the

quarter. Cosmetics was the strongest performing category followed

by shoes and ladies’ apparel. Ladies’ accessories and lingerie and

juniors’ and children’s apparel were the weakest categories.

Gross Margin

Consolidated gross margin for the 13 weeks ended April 29, 2023

was 43.7% of sales compared to 46.5% of sales for the prior year

first quarter.

Retail gross margin (which excludes CDI) for the 13 weeks ended

April 29, 2023 was 45.6% of sales compared to a record 47.3% of

sales for the prior year first quarter.

Selling, General & Administrative Expenses

Consolidated selling, general and administrative expenses

(“operating expenses”) for the 13 weeks ended April 29, 2023 were

$406.4 million (25.7% of sales) compared to $400.8 million (24.9%

of sales) for the prior year first quarter.

Share Repurchase

During the 13 weeks ended April 29, 2023, the Company purchased

$113.8 million (approximately 357,000 shares) of Class A Common

Stock at an average price of $318.66 per share.

As of April 29, 2023, authorization of $61.6 million remained

under the February 2022 program.

Total shares outstanding (Class A and Class B Common Stock) at

April 29, 2023 and April 30, 2022 were 16.8 million and 18.1

million, respectively.

Store Information

The Company operates 247 Dillard’s locations and 27 clearance

centers spanning 29 states (47.0 million square feet) and an

Internet store at dillards.com.

Dillard’s, Inc. and

Subsidiaries

Condensed Consolidated Statements

of Income (Unaudited)

(In Millions, Except Per Share

Data)

13 Weeks Ended

April 29, 2023

April 30, 2022

% of

% of

Net

Net

Amount

Sales

Amount

Sales

Net sales

$

1,583.9

100.0

%

$

1,611.7

100.0

%

Service charges and other income

30.0

1.9

31.1

1.9

1,613.9

101.9

1,642.8

101.9

Cost of sales

891.3

56.3

861.4

53.5

Selling, general and administrative

expenses

406.4

25.7

400.8

24.9

Depreciation and amortization

45.7

2.9

46.2

2.9

Rentals

4.4

0.3

5.1

0.3

Interest and debt expense, net

0.1

—

10.6

0.7

Other expense

4.7

0.3

1.9

0.1

Gain on disposal of assets

1.8

0.1

7.2

0.4

Income before income taxes

263.1

16.6

324.0

20.1

Income taxes

61.6

72.9

Net income

$

201.5

12.7

%

$

251.1

15.6

%

Basic and diluted earnings per share

$

11.85

$

13.68

Basic and diluted weighted average shares

outstanding

17.0

18.4

Dillard’s, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets (Unaudited)

(In Millions)

April 29,

April 30,

2023

2022

Assets

Current Assets:

Cash and cash equivalents

$

848.3

$

862.2

Restricted cash

8.4

—

Accounts receivable

59.1

30.9

Short-term investments

98.4

—

Merchandise inventories

1,410.0

1,365.0

Other current assets

79.0

96.2

Total current assets

2,503.2

2,354.3

Property and equipment, net

1,108.7

1,170.3

Operating lease assets

32.9

39.7

Deferred income taxes

41.8

29.1

Other assets

62.4

65.4

Total Assets

$

3,749.0

$

3,658.8

Liabilities and Stockholders’ Equity

Current Liabilities:

Trade accounts payable and accrued

expenses

$

1,099.7

$

1,163.3

Current portion of long-term debt

—

44.8

Current portion of operating lease

liabilities

9.1

11.3

Federal and state income taxes

82.0

99.3

Total current liabilities

1,190.8

1,318.7

Long-term debt

321.4

321.3

Operating lease liabilities

23.7

28.5

Other liabilities

330.0

278.0

Subordinated debentures

200.0

200.0

Stockholders’ equity

1,683.1

1,512.3

Total Liabilities and Stockholders’

Equity

$

3,749.0

$

3,658.8

Dillard’s, Inc. and

Subsidiaries

Condensed Consolidated Statements

of Cash Flows (Unaudited)

(In Millions)

13 Weeks Ended

April 29,

April 30,

2023

2022

Operating activities:

Net income

$

201.5

$

251.1

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization of property

and other deferred cost

46.1

46.6

Gain on disposal of assets

(1.8

)

(7.2

)

Accrued interest on short-term

investments

(1.9

)

—

Changes in operating assets and

liabilities:

(Increase) decrease in accounts

receivable

(2.1

)

8.9

Increase in merchandise inventories

(289.8

)

(284.8

)

Decrease (increase) in other current

assets

7.2

(18.5

)

Increase in other assets

(0.4

)

(0.4

)

Increase in trade accounts payable and

accrued expenses and other liabilities

261.6

293.5

Increase in income taxes

60.5

76.0

Net cash provided by operating

activities

280.9

365.2

Investing activities:

Purchase of property and equipment and

capitalized software

(32.4

)

(27.3

)

Proceeds from disposal of assets

1.9

8.1

Proceeds from insurance

—

4.4

Purchase of short-term investments

(97.5

)

—

Proceeds from maturities of short-term

investments

150.0

—

Net cash provided by (used in) investing

activities

22.0

(14.8

)

Financing activities:

Cash dividends paid

(3.4

)

(3.9

)

Purchase of treasury stock

(103.1

)

(201.1

)

Net cash used in financing activities

(106.5

)

(205.0

)

Increase in cash and cash equivalents and

restricted cash

196.4

145.4

Cash and cash equivalents and restricted

cash, beginning of period

660.3

716.8

Cash and cash equivalents and restricted

cash, end of period

$

856.7

$

862.2

Non-cash transactions:

Accrued capital expenditures

$

8.6

$

6.7

Accrued purchase of treasury stock

11.9

1.6

Lease assets obtained in exchange for new

operating lease liabilities

1.8

—

Estimates for 2023

The Company is providing the following estimates for certain

financial statement items for the 53-week period ending February 3,

2024 based upon current conditions. Actual results may differ

significantly from these estimates as conditions and factors change

- See “Forward-Looking Information.”

In Millions

2023

2022

Estimated

Actual

Depreciation and amortization

$

180

$

188

Rentals

22

23

Interest and debt (income) expense,

net

(3

)

31

Capital expenditures

150

120

Forward-Looking Information

This report contains certain forward-looking statements. The

following are or may constitute forward- looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995: (a) statements including words such as “may,” “will,”

“could,” “should,” “believe,” “expect,” “future,” “potential,”

“anticipate,” “intend,” “plan,” “estimate,” “continue,” or the

negative or other variations thereof; (b) statements regarding

matters that are not historical facts; and (c) statements about the

Company’s future occurrences, plans and objectives, including

statements regarding management’s expectations and forecasts for

the 53-week period ended February 3, 2024 and beyond, statements

concerning the opening of new stores or the closing of existing

stores, statements concerning capital expenditures and sources of

liquidity and statements concerning estimated taxes. The Company

cautions that forward-looking statements contained in this report

are based on estimates, projections, beliefs and assumptions of

management and information available to management at the time of

such statements and are not guarantees of future performance. The

Company disclaims any obligation to update or revise any

forward-looking statements based on the occurrence of future

events, the receipt of new information or otherwise.

Forward-looking statements of the Company involve risks and

uncertainties and are subject to change based on various important

factors. Actual future performance, outcomes and results may differ

materially from those expressed in forward-looking statements made

by the Company and its management as a result of a number of risks,

uncertainties and assumptions. Representative examples of those

factors include (without limitation) the COVID-19 pandemic and its

effects on public health, our supply chain, the health and

well-being of our employees and customers and the retail industry

in general; other general retail industry conditions and

macro-economic conditions including inflation and changes in

traffic at malls and shopping centers; economic and weather

conditions for regions in which the Company’s stores are located

and the effect of these factors on the buying patterns of the

Company’s customers, including the effect of changes in prices and

availability of oil and natural gas; the availability of and

interest rates on consumer credit; the impact of competitive

pressures in the department store industry and other retail

channels including specialty, off-price, discount and Internet

retailers; changes in the Company’s ability to meet labor needs

amid nationwide labor shortages and an intense competition for

talent, changes in consumer spending patterns, debt levels and

their ability to meet credit obligations; high levels of

unemployment; changes in tax legislation; changes in legislation,

affecting such matters as the cost of employee benefits or credit

card income; adequate and stable availability and pricing of

materials, production facilities and labor from which the Company

sources its merchandise; changes in operating expenses, including

employee wages, commission structures and related benefits; system

failures or data security breaches; possible future acquisitions of

store properties from other department store operators; the

continued availability of financing in amounts and at the terms

necessary to support the Company’s future business; fluctuations in

LIBOR and other base borrowing rates; the elimination of LIBOR;

potential disruption from terrorist activity and the effect on

ongoing consumer confidence; other epidemic, pandemic or public

health issues; potential disruption of international trade and

supply chain efficiencies; any government-ordered restrictions on

the movement of the general public or the mandated or voluntary

closing of retail stores in response to the COVID-19 pandemic;

global conflicts (including the recent conflict in Ukraine) and the

possible impact on consumer spending patterns and other economic

and demographic changes of similar or dissimilar nature. The

Company's filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

January 28, 2023, contain other information on factors that may

affect financial results or cause actual results to differ

materially from forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230511005300/en/

Dillard’s, Inc. Julie J. Guymon 501-376-5965

julie.guymon@dillards.com

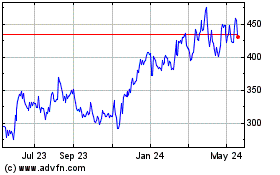

Dillards (NYSE:DDS)

Historical Stock Chart

From Jan 2025 to Feb 2025

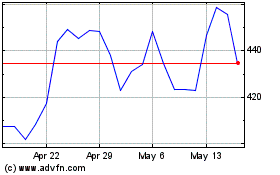

Dillards (NYSE:DDS)

Historical Stock Chart

From Feb 2024 to Feb 2025