Glass Lewis Says Nilesh Undavia Makes Persuasive Case for GrafTech Board Change

02 May 2024 - 5:33AM

Nilesh Undavia, one of the largest shareholders of GrafTech

International Ltd. (NYSE: EAF) (“GrafTech” or the “Company”), today

announced that Glass, Lewis & Co., LLC (“Glass Lewis”), a

leading independent proxy advisory firm, recommends the Company’s

shareholders vote

FOR the election of Nilesh

Undavia to the Company’s board of directors (the “Board”) on the

BLUE universal proxy card at the Company’s 2024

Annual Meeting of Shareholders (“Annual Meeting”) to be held on May

9, 2024.

Having carefully evaluated all relevant

information regarding the situation at GrafTech, Glass Lewis

concluded, in its report published on April 29, 2024, that

“the [B]oard's questionable stewardship of shareholder

value and disconcerting effort to take accountability for several

key operational missteps” make a “persuasive case for change” and

“serve as adequate cause to advance the election of a shareholder

advocate to the [B]oard.”1

Regarding our nominee, Nilesh Undavia, Glass Lewis says:

“Mr. Undavia, most

notably, is a significant shareholder, owning approximately 5.9% of

the Company's issued and outstanding share capital. In contrast,

the incumbent [B]oard as a whole currently owns less than 1% of the

Company's issued and outstanding share capital, thus

echoing a lack of shareholder representation in the [B]oard's

current membership. Given what we consider to be the

[B]oard's questionable stewardship of shareholder value and

disconcerting effort to take accountability for several key

operational missteps, we believe Mr. Undavia's advocacy on

behalf of other GrafTech investors could be valuable

relative to maintenance of the status quo.”

While GrafTech has sought to blame its financial

performance on external headwinds and a cyclical industry, Glass

Lewis “questions whether GrafTech’s observed operational

impediments — at least one of which (Monterrey) appears to be

self-inflicted — adequately off-set perceived

underperformance.”

Additionally, Glass Lewis notes:

Value

Destruction: “[W]e consider the [B]oard has not adequately

addressed significant declines in shareholder value following

GrafTech's IPO, nor do we find sufficient recognition of the

Company's lackluster financial performance relative to its direct

competitors…”

Customers: “[W]hile demand for

UHP graphite electrodes has been stable, the Company has

not been able to retain customers over time, contributing to

progressive declines in market share. In this regard,

while we acknowledge the presence of increased competitive

pressure, we find the [B]oard affords investors an

incomplete rationale in relation to the scale of decline suffered

by GrafTech relative to peers…. In this regard, we believe

the Dissident persuasively argues that GrafTech failed to

effectively offset losses in LTA-based revenue through spot sales,

contributing to significant erosion in the Company's market

share.… While we appreciate the need to remediate those

relationships, we are concerned the [B]oard is seemingly

disinclined to accept responsibility for consequences associated

with the LTAs. In this regard, we note that while the

[B]board has undergone significant turnover since the LTAs were

negotiated between the last quarter of 2017 and early 2019…

director and nominee Anthony R. Taccone, and director and chair of

the audit committee Michael Dumas were also serving as directors at

the time some of those LTAs were negotiated…”

Monterrey

Facility: “[W]e believe it is worth

noting the [B]oard has taken what we consider to be a

comparably taciturn approach to discussing the temporary closure of

the Monterrey facility in 2022. In particular, while we

appreciate the Company's prompt response in ensuring the Monterrey

facility re-opened in less than 60 days, the [B]oard has not, in

our view, adequately addressed the Dissident's assertion that

the [B]oard and the Company's management were ultimately to

blame for poor management of environmental risk and associated lack

of regulatory compliance. Further, this lack of oversight

has even more relevance when considering that, when the suspension

occurred, the Monterrey facility — which at the time was the only

facility owned by the Company producing connecting pins, a

necessary component of the Company's graphite electrodes — had a

vital role in the Company's chain of production. As a result, and

as disclosed by the Company in its definitive proxy statement for

the upcoming general meeting, the Monterrey facility

suspension, coupled with significantly higher costs, caused the

Company's net sales to decrease by $660.8 million, corresponding to

a 52% decrease for 2022.”

Financial

Underperformance: “While we acknowledge it is not possible

to independently quantify the impact of each operational

impediment, the Dissident argues, we believe persuasively, that

increasingly weak financial performance reported by

GrafTech is directly attributable to the Company's failure to

efficiently and effectively manage the foregoing issues,

including those that appear to fall within the responsibility of

management and the [B]oard (e.g. closure of the Monterrey

facility). As a result, GrafTech appears to have underperformed its

closest peers over a range of standard time frames.”

We are gratified by the endorsement of Glass

Lewis and the support we have received from other independent

analysts and fellow shareholders. The Board seems content with

blaming cyclical and macroeconomic challenges instead of correcting

past mistakes and devising a comprehensive strategy to regain

market share and generate growth. Shareholders have an opportunity

in this election to either push for change or revert to the status

quo and hope for the best. We urge shareholders to follow

Glass Lewis’s recommendation by voting

TODAY on the

BLUE universal proxy card

FOR Nilesh Undavia.

Additional Information and Where to Find

It

Mr. Undavia and certain family trusts

(collectively, the “Undavia Group”) are participants in the

solicitation of proxies from shareholders of the Company in favor

of Mr. Undavia’s nomination for the Board at the Annual Meeting. On

April 2, 2024, the Undavia Group filed with the U.S. Securities and

Exchange Commission (the “SEC”) its definitive proxy statement and

accompanying BLUE universal proxy card in

connection with its solicitation of proxies from the shareholders

of the Company for the Annual Meeting. ALL SHAREHOLDERS OF

THE COMPANY ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT

(INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO), THE ACCOMPANYING

BLUE UNIVERSAL PROXY CARD AND OTHER DOCUMENTS RELATED TO THE

SOLICITATION OF PROXIES BY THE UNDAVIA GROUP, AS THEY CONTAIN

IMPORTANT INFORMATION, INCLUDING ADDITIONAL INFORMATION RELATED TO

THE UNDAVIA GROUP AND ITS DIRECT OR INDIRECT INTERESTS IN THE

COMPANY, BY SECURITY HOLDINGS OR OTHERWISE. Investors and

security holders may obtain copies of the definitive proxy

statement, BLUE universal proxy card and other

documents filed with the SEC by the Undavia Group free of charge

through the website maintained by the SEC at http://www.sec.gov/.

Copies of the definitive proxy statement and accompanying

BLUE universal proxy card filed with the SEC by

the Undavia Group are also available free of charge by accessing

the website at https://www.icomproxy.com/EAF.

Contact:

Nilesh Undavia(617) 763-8191

InvestorCom LLC19 Old Kings Highway S. – Suite

130Darien, CT 06820Toll Free (877) 972-0090Banks and Brokers call

collect (203) 972-9300info@investor-com.com

_______________1 Permission to use quotations from the Glass

Lewis report was neither sought nor obtained. Emphases added.

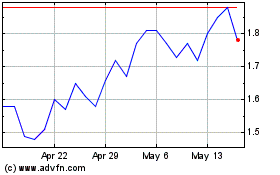

GrafTech (NYSE:EAF)

Historical Stock Chart

From Oct 2024 to Nov 2024

GrafTech (NYSE:EAF)

Historical Stock Chart

From Nov 2023 to Nov 2024