SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2023

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its

charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA

PARANAENSE DE ENERGIA – COPEL

Corporate Taxpayer ID (CNPJ/ME) 76.483.817/0001-20 –

Company

Registry (NIRE) 41300036535 - CVM Registration

B3

(CPLE3, CPLE5, CPLE6, CPLE11)

NYSE

(ELP)

LATIBEX

(XCOP, XCOPO, XCOPU)

Approval and

schedule for cancellation of the Unit Program

COPEL (“Company”),

a company that generates, transmits, distributes and trade energy, with shares listed on B3 (CPLE3, CPLE5, CPLE6), the NYSE (ELPVY, ELP)

and the LATIBEX (XCOP), in continuation of Relevant Fact 18/23, of 11/14/2023, that, on this date, the 209th Extraordinary General Meeting

of the Company (“EGM”) approved the undo of the “1st Share Conversion and Formation of Share Deposit Certificates Program

(“Unit Program”).

The approval will result in the

cancellation of the share deposit certificates (“Units”) (CPLE11) and the consequent delivery of the 5 (five) shares issued

by the Company each Unit, being 1 (one) common share (CPLE3) and 4 (four) class “B” preferred shares (CPLE6), preserving the

Unit holders the same rights, advantages and restrictions of these shares, according to the following calendar:

12/22/2023 (Friday): Last day of

trading of Units

12/26/2023 (Tuesday): Undoing of

Units and trading only of shares issued by the Company, including those underlying the Units

12/28/2023 (Thursday): Credit of

common shares (CPLE3) and class “B” preferred shares (CPLE6) in the portfolio of shareholders holding Units

In the US market (NYSE), the depositary

bank The Bank of New York Mellon (“BNY Mellon”) will adopt procedures in relation to depositary receipts as described below.

In the European market (LATIBEX), a financial institution will be hired to carry out the operation between B3 and LATIBEX.

Each American Depositary Share (“ADS”)

of COPEL currently represents one (1) Unit. Effective December 28, 2023, the COPEL Unit American Depositary Receipt Deposit Agreement

will be amended such that one (1) COPEL ADS (CUSIP#20441B605) will represent four (4) Preferred shares. No exchange of American Depositary

Receipt (“ADR”) certificates is required. Any outstanding ADR certificates will automatically be deemed to conform to the

new parameters of the ADR facility. The CUSIP will remain the same. ADR holders need not take any action in regards to this change in

the deposited securities.

In addition, the COPEL Unit ADS

holders will receive a distribution of new COPEL ADSs representing Common shares. Each new COPEL ADS (Ticker:ELPC) (CUSIP #20441B704)

will represent 4 Common Shares.

The following are the pertinent

details:

| · | ADR Record Date: December 27, 2023 |

| · | ADR Payable Date: December 28, 2023 |

| · | Distribution Rate: one (1) new Common ADS for every four (4) old Unit ADSs held |

| · | Issuance Fee: $0.05 for each new COPEL Common ADS issued |

The new COPEL ADSs representing

common shares (Ticker ELPC) and the COPEL ADSs representing preferred shares (ELP) are anticipated to begin trading on The NYSE on or

about December 29, 2023. Only whole ADSs will be distributed. BNY Mellon will attempt to sell any fractional ADSs and distribute the

cash proceeds to ADR holders. BNY Mellon’s books will be closed for all issuance and cancellation transactions of the old COPEL

ADSs as of the close of business December 22, 2023 and will be opened on January 3, 2024.

More details are available in the

Minutes and in the Management Proposal for the EGM, published on Copel's IR website and on the Securities and Exchange Commission portal.

Curitiba, December

18, 2023.

Adriano Rudek de Moura

Chief Financial and Investor Relations Officer

For further information, please contact the Investor

Relations team:

ri@copel.com or (41) 3331-4011

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date December 18, 2023

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| |

|

|

| By: |

/S/

Daniel Pimentel Slaviero

|

|

| |

Daniel Pimentel Slaviero

Chief Executive Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates of future

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

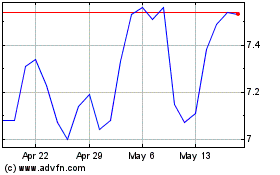

Companhia Parana De Energ (NYSE:ELP)

Historical Stock Chart

From Jan 2025 to Feb 2025

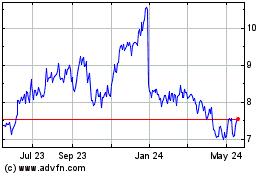

Companhia Parana De Energ (NYSE:ELP)

Historical Stock Chart

From Feb 2024 to Feb 2025