Form 6-K/A - Report of foreign issuer [Rules 13a-16 and 15d-16]: [Amend]

11 July 2024 - 9:00PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K/A

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of July, 2024

Commission File Number 1-14668

COMPANHIA PARANAENSE DE ENERGIA

(Exact name of registrant as specified in its

charter)

Energy Company of Paraná

(Translation of Registrant's name into English)

José Izidoro Biazetto, 158

81200-240 Curitiba, Paraná

Federative Republic of Brazil

+55 (41) 3331-4011

(Address of principal executive offices)

Indicate by check

mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

COMPANHIA PARANAENSE DE ENERGIA

– COPEL

Corporate Taxpayer ID (CNPJ/ME)

76.483.817/0001-20 - Company Registry (NIRE) 41300036535 - CVM Registration

B3 (CPLE3, CPLE5, CPLE6)

NYSE (ELP, ELPC)

LATIBEX (XCOP, XCOPO)

Divestment in Compagas – Signing

of Control

Block Purchase and Sale Agreement

COPEL (“Company”),

in continuity with what was published in Material Fact No. 16/23, informs its shareholders and the market in general that it entered into,

on this date, a Control Block Purchase and Sale Agreement (CCVBC) with Compass Dois Ltda. (“Buyer”), a subsidiary of

Compass Gás e Energia S.A. (“Buyer”), relating to the sale of all shares representing 51% of Companhia Paranaense de

Gás – Compagas (“Transaction”).

The Transaction is part of the Company’s

strategy of focusing on its core business and decarbonizing its portfolio. The sale value (equity value) of its stake was R$906.0 million,

to be adjusted in accordance with the contract.

The equity value will be paid according

to the following schedule:

| i. | | 40% until the closing of the Operation; |

| ii. | | 30% until December 31, 2025; |

| iii. | | 30% until December 31, 2026. |

The base date of the Transaction

is December 31, 2023. On that date, Compagas' total net debt was R$182.8 million.

The completion of the Transaction

is conditional on the non-exercise of the pre-emptive rights by current shareholders and the verification of usual conditions for operations

of this nature, including approval by the competent bodies.

The Company count on XP Investimentos

as its exclusive financial advisor and Stocche Forbes Advogados as its legal advisor.

Curitiba, July 10, 2024.

Felipe Gutterres

Director of Finance and Investor Relations

For further information, please contact the Investor

Relations team:

ri@copel.com or (41) 3331-4011

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date July 10, 2024

| COMPANHIA PARANAENSE DE ENERGIA – COPEL |

| |

|

|

| By: |

/S/

Daniel Pimentel Slaviero

|

|

| |

Daniel Pimentel Slaviero

Chief Executive Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates of future

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

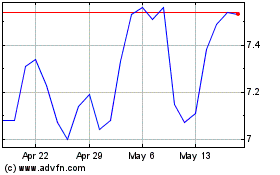

Companhia Parana De Energ (NYSE:ELP)

Historical Stock Chart

From Mar 2025 to Apr 2025

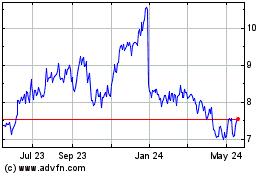

Companhia Parana De Energ (NYSE:ELP)

Historical Stock Chart

From Apr 2024 to Apr 2025