Templeton Emerging Markets Fund Announces Commitment to Share Repurchases in Response to Fund Discount

15 November 2023 - 8:00AM

Business Wire

TEMPLETON EMERGING MARKETS FUND (NYSE: EMF) (the “Fund”),

a closed-end investment company managed by Templeton Asset

Management Ltd. (“TAML”), announced today that its Board is

committed to supporting the Fund and intends to repurchase shares

in the open market when the Fund’s discount to net asset value

exceeds -10%, subject to TAML’s discretion and market

conditions.

Other information

You may request a copy of the Fund’s current Report to

Shareholders by contacting Franklin Templeton’s Fund Information

Department at 1-800/DIAL BEN® (1-800-342-5236) or by visiting

franklintempleton.com. All investments involve risks, including

possible loss of principal. International investments are subject

to special risks, including currency fluctuations and social,

economic and political uncertainties, which could increase

volatility. These risks are magnified in emerging markets. There

are special risks associated with investments in China, including

expropriation, confiscatory taxation, nationalization and exchange

control regulations (including currency blockage). Heightened

geopolitical risks and adverse Government policies can have an

impact on Chinese companies. In addition, investments in Taiwan and

Hong Kong could be adversely affected by its political and economic

relationship with China. The Fund is actively managed but there is

no guarantee that the manager's investment decisions will produce

the desired results. For portfolio management discussions,

including information regarding the Fund’s investment strategies,

please view the most recent Annual or Semi-Annual Report to

Shareholders which can be found at franklintempleton.com or

sec.gov.

Unlike open-end funds (mutual funds), closed-end funds are not

continuously offered. Closed-end funds trade on the secondary

market through a national stock exchange at a price which may be

above (a premium), but is often below (a discount to) the net asset

value (NAV) of the fund's portfolio. Unlike a mutual fund, the

market price for a closed-end fund is based on supply and demand,

not the fund's NAV.

Franklin Resources, Inc. is a global investment management

organization with subsidiaries operating as Franklin Templeton and

serving clients in over 150 countries. Franklin Templeton’s mission

is to help clients achieve better outcomes through investment

management expertise, wealth management and technology solutions.

Through its specialist investment managers, the company offers

specialization on a global scale, bringing extensive capabilities

in fixed income, equity, alternatives and multi-asset solutions.

With more than 1,300 investment professionals, and offices in major

financial markets around the world, the California-based company

has over 75 years of investment experience and over $1.3 trillion

in assets under management as of October 31, 2023. For more

information, please visit franklintempleton.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231114969987/en/

For more information, please contact Franklin Templeton at

1-800-342-5236

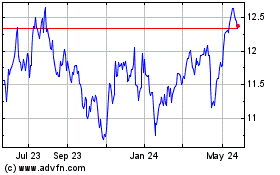

Templeton Emerging Markets (NYSE:EMF)

Historical Stock Chart

From Dec 2024 to Jan 2025

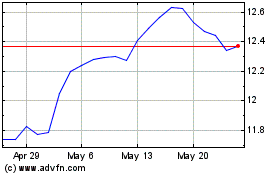

Templeton Emerging Markets (NYSE:EMF)

Historical Stock Chart

From Jan 2024 to Jan 2025