Equity Commonwealth Declares Initial Cash Liquidating Distribution of $19.00 Per Common Share and Announces Ex-Dividend Date

15 November 2024 - 10:45PM

Business Wire

Increases Estimated Aggregate Shareholder

Liquidating Distribution Range to $20.00–$21.00 Per Common

Share

Equity Commonwealth (NYSE: EQC) (the “Company”) announced today

that its Board of Trustees has authorized an initial cash

liquidating distribution of $19.00 per common share (the “Initial

Liquidating Distribution”) which will be paid on December 6, 2024

to shareholders of record on November 25, 2024. The Company is also

updating the estimated aggregate shareholder liquidating

distribution range of $19.50 to $21.00 per common share disclosed

in its definitive proxy statement filed on October 2, 2024 (the

“Definitive Proxy”) to an estimated aggregate shareholder

liquidating distribution range of $20.00 to $21.00 per common

share.

In addition, the Company announced today that, in connection

with the Initial Liquidating Distribution, the New York Stock

Exchange (“NYSE”) has determined that the ex-dividend date for the

Initial Liquidating Distribution will be December 9, 2024 (the

“Ex-Dividend Date”), the first business day after the payment

date.

Because the payment of the Initial Liquidating Distribution

represents more than 25% of the price of the Company’s common

shares, NYSE has determined that the Company’s common shares will

trade with “due bills” representing an assignment of the right to

receive the Initial Liquidating Distribution from the record date

of November 25, 2024 through the closing of trading on NYSE on the

payment date of December 6, 2024 (this period of time representing

the “Dividend Right Period”). Thus, the Company’s common shares

will trade with this “due bill” and the assignment of the right to

receive the Initial Liquidating Distribution during the Dividend

Right Period, which is through and includes the payment date.

Shareholders who sell their common shares during the Dividend

Right Period will be selling their right to the Initial Liquidating

Distribution, and such shareholders will not be entitled to receive

the Initial Liquidating Distribution. Due bills obligate a seller

of common shares to deliver the Initial Liquidating Distribution

payable on such common shares to the buyer and holder of the common

shares as of the payment date (the “Dividend Right”). The record

date of November 25, 2024 will be used as the date for establishing

the due bill tracking of the Dividend Right to the holder of common

shares.

Due bill obligations are settled customarily between the brokers

representing the buyers and the sellers of shares. The Company has

no obligation for either the amount of the due bill or the

processing of the due bill. Buyers and sellers of the Company’s

common shares should consult their brokers before trading to be

sure they understand the effect of NYSE’s due bill procedures.

The U.S. federal income tax consequences of the liquidating

distributions, as well as the Plan of Sale and Dissolution of the

Company, are summarized in the Definitive Proxy.

About Equity Commonwealth

Equity Commonwealth (NYSE: EQC) is a Chicago based, internally

managed and self-advised real estate investment trust (REIT).

Regulation FD Disclosures

We use any of the following to comply with our disclosure

obligations under Regulation FD: press releases, U.S. Securities

and Exchange Commission (“SEC”) filings, public conference calls,

or our website. We routinely post important information on our

website at www.eqcre.com, including information that may be deemed

to be material. We encourage investors and others interested in the

Company to monitor these distribution channels for material

disclosures.

Forward-Looking Statements

This press release may contain forward-looking statements and

information within the meaning of the federal securities laws.

These statements, including statements relating to the expected tax

treatment of distributions, are based on current expectations,

estimates, projections and assumptions made by management. While

Equity Commonwealth management believes the assumptions underlying

its forward-looking statements are reasonable, such information is

inherently subject to uncertainties and may involve certain risks.

Other risks and uncertainties are described under the heading “Risk

Factors” in our Annual Report on Form 10-K and subsequent periodic

reports filed with the SEC and available on our website,

www.eqcre.com. Many of these uncertainties and risks are difficult

to predict and beyond management’s control. Forward-looking

statements are not guarantees of future performance, results or

events. Equity Commonwealth assumes no obligation to update or

supplement forward-looking statements that become untrue because of

subsequent events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115088622/en/

Investor Contact Bill Griffiths, (312) 646-2801

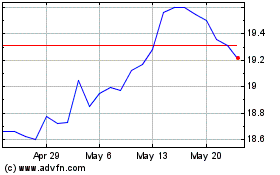

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Nov 2024 to Dec 2024

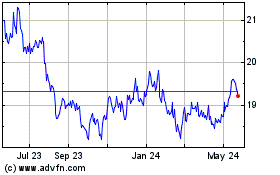

Equity Commonwealth (NYSE:EQC)

Historical Stock Chart

From Dec 2023 to Dec 2024