Fathom Digital Manufacturing Corp. (“Fathom” or the

“Company”) (NYSE: FATH), an industry leader in on-demand

digital manufacturing services, today announced its Board of

Directors approved a 1-for-20 reverse stock split of the Company’s

common stock that will become effective after the close of market

trading on September 28, 2023. The reverse stock split was approved

by the Company’s stockholders on July 11, 2023 at the Company’s

annual meeting of stockholders, with authorization to determine the

final ratio having been granted to the Company’s Board of

Directors.

At the effective time of the reverse stock split, every 20

shares of issued and outstanding common stock will be combined and

reclassified into one issued and outstanding share of common stock.

Once effective, the reverse stock split will reduce the current

number of issued and outstanding shares of the Company’s Class A

common stock from approximately 70.1 million to approximately 3.5

million. Additionally, at the effective time, every 20 issued and

outstanding shares of the Company’s Class B common stock, which is

not listed on the New York Stock Exchange (“NYSE”), will be

combined and reclassified into one share of the Company’s Class B

common stock.

No fractional shares of the Company’s Class A common stock will

be issued in connection with the reverse stock split. In lieu

thereof, the Company’s transfer agent, Continental Stock Transfer

& Trust Company, as agent for the affected holders of record of

Class A common stock, will aggregate all fractional shares of Class

A common stock otherwise issuable in the reverse stock split and

arrange for their sale as soon as practicable after the effective

time on the basis of the prevailing market prices of the Class A

common stock at the time of the sale. After such sale, the transfer

agent will pay to such holders of record their pro rata share of

the total net proceeds derived from the sale of the fractional

shares of Class A common stock. The reverse stock split will affect

all stockholders uniformly and will not alter any stockholder’s

percentage interest in the Company’s equity, except for adjustments

that may result from the treatment of fractional shares of Class A

common stock.

All outstanding public warrants to purchase the Company’s Class

A common stock will be proportionately adjusted as a result of the

reverse stock split in accordance with the terms of the warrants,

such that warrants representing the right to purchase 20 shares of

the Company’s Class A common stock immediately prior to the reverse

stock split will represent the right to purchase one share of the

Company’s Class A common stock immediately following the reverse

stock split. Correspondingly, the exercise price per share of the

Company’s Class A common stock attributable to such warrants

immediately prior to the reverse stock split will be

proportionately increased, such that the exercise price per share

of the Company’s Class A common stock attributable to such warrants

immediately following the reverse stock split is $230.00, which

equals the product of 20 multiplied by $11.50, the exercise price

per share immediately prior to the reverse stock split. The number

of shares of the Company’s Class A common stock subject to the

public warrants will decrease by 20 times, to an aggregate of

431,250 shares. Proportionate adjustments will be made to the

exercise prices, grant prices or purchase prices and the number of

shares underlying the Company’s outstanding equity awards, as

applicable, and private warrants exercisable for shares of the

Company’s Class A common stock, as well as to the number of shares

issuable under the Company’s equity incentive plans, as determined

by the Compensation Committee of the Company’s Board of Directors

and/or in accordance with the terms of certain existing agreements,

as applicable.

Continental Stock Transfer & Trust Company is acting as

transfer and exchange agent for the reverse stock split and is also

the Company’s warrant agent. Registered stockholders who hold

shares of the Company’s common stock are not required to take any

action to receive post-reverse split shares. Stockholders owning

shares of Class A common stock via a broker, bank, trust or other

nominee will have their positions automatically adjusted to reflect

the reverse stock split, subject to such broker's particular

processes, and will not be required to take any action in

connection with the reverse stock split.

The primary goal of the reverse stock split is to increase the

per share market price of the Company’s Class A common stock to

meet the minimum $1.00 average closing price requirement for

continued listing on the NYSE. The Company’s Class A common stock

is expected to begin trading on a split-adjusted basis on the NYSE

at market open on September 29, 2023. The trading symbol for the

Class A common stock will remain “FATH” and the new CUSIP number

for the Class A common stock following the Reverse Stock Split will

be 31189Y202. The trading symbol and CUSIP number for the Company’s

public warrants will remain unchanged.

Additional information regarding the reverse stock split can be

found in the Company’s definitive proxy statement filed with the

Securities and Exchange Commission on May 25, 2023, and is

available on the SEC’s website at www.sec.gov and the Company’s

website at https://investors.fathommfg.com.

About Fathom Digital Manufacturing

Fathom is one of the largest on-demand digital manufacturing

platforms in North America, serving the comprehensive product

development and low- to mid-volume manufacturing needs of some of

the largest and most innovative companies in the world. With more

than 25 quick turn manufacturing processes combined with an

extensive national footprint, Fathom seamlessly blends in-house

capabilities across plastic and metal additive technologies, CNC

machining, injection molding and tooling, sheet metal fabrication,

design and engineering, and more. Fathom has more than 35 years of

industry experience and is at the forefront of the Industry 4.0

digital manufacturing revolution, serving clients in the

technology, defense, aerospace, medical, automotive, IOT sectors,

and others. Fathom's certifications include: ITAR Registered, ISO

9001:2015 Design Certified, ISO 9001:2015, ISO 13485:2016,

AS9100:2016, and NIST 800-171. To learn more, visit

https://fathommfg.com/.

Forward-Looking Statements

Certain statements made in this press release are

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. Words such as “estimates,”

“projects,” “expects,” “anticipates,” “forecasts,” “plans,”

“intends,” “believes,” “seeks,” “may,” “will,” “would,” “should,”

“future,” “propose,” “target,” “goal,” “objective,” “outlook” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements are

not guarantees of future performance, conditions or results, and

involve a number of known and unknown risks, uncertainties,

assumptions and other important factors, many of which are outside

the control of Fathom Digital Manufacturing Corporation (“Fathom”)

that could cause actual results or outcomes to differ materially

from those discussed in the forward-looking statements. Important

factors, among others, that may affect actual results or outcomes

include: the inability to recognize the anticipated benefits of our

business combination with Altimar Acquisition Corp. II; changes in

general economic conditions, including as a result of the COVID-19

pandemic or any future outbreaks of other highly infectious or

contagious disease; the implementation of our optimization plan

could result in greater costs and fewer benefits than we

anticipate; the outcome of litigation related to or arising out of

the business combination, or any adverse developments therein or

delays or costs resulting therefrom; the ability to meet the New

York Stock Exchange’s listing standards following the consummation

of the business combination; costs related to the business

combination and additional factors discussed in Fathom’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022,

filed with the Securities and Exchange Commission (the “SEC”) on

April 7, 2023, as amended on May 1, 2023, as well as Fathom’s other

filings with the SEC. If any of the risks described above

materialize or our assumptions prove incorrect, actual results

could differ materially from the results implied by our

forward-looking statements. There may be additional risks that

Fathom does not presently know or that Fathom currently believes

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect Fathom’s expectations, plans or

forecasts of future events and views as of the date of this press

release. These forward-looking statements should not be relied upon

as representing Fathom’s assessments as of any date subsequent to

the date of this press release. Accordingly, undue reliance should

not be placed upon the forward-looking statements. Fathom

undertakes no obligation to update or revise any forward-looking

statements made by management or on its behalf whether as a result

of future developments, subsequent events or circumstances or

otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230915095485/en/

Michael Cimini Director, Investor Relations Fathom Digital

Manufacturing (262) 563-5575 michael.cimini@fathommfg.com

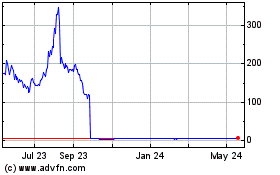

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Jan 2025 to Feb 2025

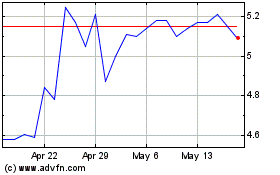

Fathom Digital Manufactu... (NYSE:FATH)

Historical Stock Chart

From Feb 2024 to Feb 2025