UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38264

Four Seasons Education (Cayman) Inc.

Room1301, Zi’an Building, 309 Yuyuan Road, Jing’an District, Shanghai

PRC 200040

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

1

EXHIBIT INDEX

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

Four Seasons Education (Cayman) Inc. |

|

|

|

By: |

|

/s/ Yi Zuo |

Name: |

|

Yi Zuo |

Title: |

|

Director and Chief Executive Officer |

Date: November 22, 2023

3

Exhibit 99.1

Four Seasons Education Reports First Half of Fiscal Year 2024 Unaudited Financial Results

SHANGHAI, November 22, 2023 (PRNewswire) – Four Seasons Education (Cayman) Inc. (“Four Seasons Education” or the “Company”) (NYSE: FEDU), a tourism and education-related service provider in China, today announced its unaudited financial results for the first half of fiscal year 2024, ended August 31, 2023.

Financial and Operational Highlights for the First Half of Fiscal Year 2024

•Revenue increased by 347.5% to RMB61.8 million (US$8.5 million), compared to RMB13.8 million in the same period of last year.

•Gross profit increased by 650.1% to RMB26.7 million (US$3.7 million) from RMB3.6 million in the same period of last year.

•Operating income was RMB0.9 million (US$0.1 million), compared to an operating loss of RMB25.3 million in the same period of last year.

•Adjusted operating income(1) (non-GAAP) was RMB2.7 million (US$0.4 million), as compared to an adjusted operating loss of RMB23.3 million in the same period of last year.

•Net income was RMB5.7 million (US$0.8 million), compared to a net loss of RMB23.9 million in the same period of last year.

•Adjusted net income(2) (non-GAAP) was RMB6.2 million (US$0.9 million), as compared to an adjusted net loss of RMB18.4 million in the same period of last year.

•Basic and diluted net income per American Depositary Share (“ADS”) attributable to ordinary shareholders were both RMB2.70 (US$0.37), as compared to a net loss of RMB11.23 in the same period of last year. Each ADS represents ten ordinary shares.

•Adjusted basic and diluted net income per ADS attributable to ordinary shareholders(3) (non-GAAP) were both RMB2.93 (US$0.41), compared to a net loss of RMB8.65 in the same period of last year.

(1) Adjusted operating income/loss is defined as operating income/loss excluding share-based compensation expenses.

(2) Adjusted net income/loss is defined as net income/loss excluding share-based compensation expenses and fair value change of investments.

(3) Adjusted basic/diluted net income/loss per ADS attributable to ordinary shareholders is defined as basic/diluted net income/loss per ADS attributable to ordinary shareholders excluding share-based compensation expenses per ADS attributable to ordinary shareholders and fair value change of investments per ADS attributable to ordinary shareholders.

For more information on these adjusted financial measures, please see the section captioned under "About Non-GAAP Financial Measures" and the tables captioned "Reconciliation of GAAP and non-GAAP Results" set forth at the end of this release.

Ms. Yi (Joanne) Zuo, Chief Executive Officer and Director of Four Seasons Education said, “We experienced a strong recovery in the six months ended August 31, 2023, evidenced by a triple-digit percentage growth in total revenues which drove our gross

margin to approximately 43%. The substantial revenue increase was primarily attributable to the robust growth of our tourism business, as well as the increase of the non-academic tutoring business. Additionally, our bottom line turned positive in the period as a result of the improved operating leverage and prudent cost management.

“Excitingly, we experienced rapid growth in both our domestic and outbound tourism business for all ages. Furthermore, beyond the regular travel agency business, we capitalized on our abundant study resources and keen industry sense to roll out a broad array of themed enrichment learning trip programs for students. We are also actively developing and providing tourism programs tailored for senior adults. Meanwhile, operations and construction at our proprietary study camps are progressing well. We have been steadily expanding the service offerings of our study camps in operation and construction at our new camp in Jiangxi province is on course with partial facilities set to open next year.

“Furthermore, we witnessed encouraging progress in advancing our non-academic tutoring programs as we maintained our strategic focus on enriching and diversifying our non-academic offerings to meet learning needs across broader age groups. Moreover, we further expanded our footprint in school-based tutoring product solutions and training programs for teachers. Leveraging our in-depth expertise and experience in the education sector, we have recently embarked on our overseas learning preparation and consulting businesses, with the goal of providing our customer groups and communities with more comprehensive services.

“Moving forward, we plan to further explore new business opportunities that align with relevant rules and regulations in the tourism and education-related services sectors. As we navigate market dynamics and cycles, we remain committed to advancing our strategy to develop our business and increase shareholder value by further enriching our service offerings, diversifying our customer base and investing in our core capabilities,” Ms. Zuo concluded.

First Half Fiscal Year 2024 Financial Results

Revenue increased by 347.5% to RMB61.8 million (US$8.5 million) in the first half of fiscal year 2024, from RMB13.8 million in the same period of last year, mainly driven by the rapid growth in the Company’s tourism and non-academic tutoring businesses.

Cost of revenue increased by 242.6% to RMB35.1 million (US$4.8 million) in the first half of fiscal year 2024 from RMB10.3 million in the same period of last year, mainly due to the increase in cost related to the Company’s tourism business and the staff cost of the Company’s non-academic tutoring business, which is in line with the revenue growth.

Gross profit increased by 650.1% to RMB26.7 million (US$3.7 million) in the first half of fiscal year 2024 from RMB3.6 million in the same period of last year.

General and administrative expenses decreased by 10.6% to RMB23.5 million (US$3.2 million) in the first half of fiscal year 2024 from RMB26.3 million in the same period of last year, mainly attributable to the one-time expenses associated with the stock reserve split-up incurred last year.

Sales and marketing expenses decreased by 11.2% to RMB2.2 million (US$0.3 million) in the first half of fiscal year 2024 from RMB2.5 million in the same period of last year, mainly resulting from the Company’s cost control initiatives.

Operating income was RMB0.9 million (US$0.1 million) in the first half of fiscal year 2024, compared with an operating loss of RMB25.3 million in the same period of last year. Adjusted operating income(1) (non-GAAP), which is calculated as operating income (loss) excluding share-based compensation expenses, was RMB2.7 million (US$0.4 million) in the first half of fiscal year 2024, compared with an adjusted operating loss of RMB23.3 million in the same period of last year.

Other income, net was RMB2.7 million (US$0.4 million) in the first half of fiscal year 2024, compared with other expenses of RMB0.8 million in the same period of last year.

Income tax expense was RMB0.2 million (US$0.02 million) in the first half of fiscal year 2024, compared with income tax benefit of RMB0.6 million in the same period of last year.

Net income was RMB5.7 million (US$0.8 million) during the first half of fiscal year 2024, compared with a net loss of RMB23.9 million in the same period of last year. Adjusted net income(2) (non-GAAP), which is calculated as net income (loss) excluding share-based compensation expenses and fair value change of the Company’s investments, was RMB6.2 million (US$0.9 million), compared with an adjusted net loss of RMB18.4 million in the same period of last year.

Basic and diluted net income per ADS attributable to ordinary shareholders in the first half of fiscal year 2024 were both RMB2.70 (US$0.37), compared with a net loss of RMB11.23 in the same period of last year. Adjusted basic and diluted net income per ADS attributable to ordinary shareholders(3) (non-GAAP) in the first half of fiscal year 2024 were both RMB2.93 (US$0.41), compared with an adjusted net loss of RMB8.65, for the same period of last year.

Cash and cash equivalents. As of August 31, 2023, the Company had cash and cash equivalents of RMB221.2 million (US$30.5 million), compared with RMB175.7 million as of February 28, 2023.

About Four Seasons Education (Cayman) Inc.

Four Seasons Education (Cayman) Inc. is a service provider of both tourism and education-related services in China. The Company's program, service and product offerings mainly consist of non-academic tutoring programs, school-based tutoring product solutions and training programs for teachers, study camps and learning trips for students, and travel agency services for all age groups. For more information, please visit https://ir.sijiedu.com.

About Non-GAAP Financial Measures

In evaluating the Company’s business, the Company considers and uses certain non-GAAP measures, including primarily adjusted operating income/loss, adjusted net income/loss and adjusted basic and diluted net income/loss per ADS attributable to ordinary shareholders, as supplemental measures to review and assess the Company’s operating performance. Adjusted operating income/loss is defined as operating income/loss excluding share-based compensation expenses. Adjusted net income/loss is defined as net income/loss excluding share-based compensation expenses and fair value change of investments (net of tax effect). Adjusted basic/ diluted net income/loss per ADS attributable to ordinary shareholders is defined as basic/diluted net income/loss per ADS attributable to ordinary shareholders excluding share-based compensation expenses per ADS attributable to ordinary shareholders and fair value change of investments measured at fair value per ADS attributable to ordinary shareholders. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP.

The Company believes that these non-GAAP financial measures provide meaningful supplemental information regarding its performance and liquidity by excluding share-based expenses, fair value change of investments measured at fair value and impairment loss on intangible assets and goodwill (where applicable) that may not be indicative of the Company’s operating performance from a cash perspective. The Company believes that both management and investors benefit from these non-GAAP financial measures in assessing its performance and when planning and forecasting future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to the Company’s historical performance and liquidity. The Company also believes these non-GAAP financial measures are useful to investors in allowing for greater transparency with respect to supplemental information used by management in the Company’s financial and operational decision making. A limitation of using non-GAAP measures is that these non-GAAP measures exclude share-based compensation charges and fair value change of investments measured at fair value (where applicable) that have been and will continue to be for the foreseeable future a significant recurring expense in the Company’s business. The Company compensates for these limitations by providing specific information regarding the GAAP amounts excluded from each non-GAAP measure. The accompanying tables have more details on the reconciliations between GAAP financial measures that are most directly comparable to non-GAAP financial measures.

Exchange Rate Information

This announcement contains translations of certain RMB amounts into U.S. dollars at a specified rate solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to U.S. dollars are made at a rate of RMB7.2582 to US$1.00, the rate set forth in the H.10 statistical release of the U.S. Federal Reserve Board on August 31, 2023.

Safe Harbor Statement

This press release contains statements of a forward-looking nature. These statements, including the statements relating to the Company’s future financial and operating results, are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “will,” “expects,” “believes,” “anticipates,” “intends,” “estimates” and similar statements. Among other things, management’s quotations and the Business Outlook section contain forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry. Potential risks and uncertainties include, but are not limited to, those relating to its ability to attract new students and retain existing students, its ability to deliver a satisfactory learning experience and improving their academic performance, PRC regulations and policies relating to the education industry in China, general economic conditions in China, and the Company’s ability to meet the standards necessary to maintain listing of its ADSs on the NYSE or other stock exchange, including its ability to cure any non-compliance with the NYSE’s continued listing criteria. All information provided in this press release is as of the date hereof, and the Company undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. Further information regarding risks and uncertainties faced by the Company is included in the Company’s filings with the U.S. Securities and Exchange Commission, including its annual reports on Form 20-F.

For investor and media inquiries, please contact:

In China:

Four Seasons Education (Cayman) Inc.

Olivia Li

Tel: +86 (21) 6317-6177

E-mail: IR@fsesa.com

The Piacente Group, Inc.

Jenny Cai

Tel: +86-10-6508-0677

E-mail: fourseasons@tpg-ir.com

In the United States:

The Piacente Group, Inc.

Brandi Piacente

Tel: +1-212-481-2050

E-mail: fourseasons@tpg-ir.com

FOUR SEASONS EDUCATION (CAYMAN) INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

February 28, |

|

|

August 31, |

|

|

August 31, |

|

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

|

|

|

|

Unaudited |

|

|

Unaudited |

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Current assets |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

175,696 |

|

|

|

221,191 |

|

|

|

30,475 |

|

Accounts receivable and contract assets |

|

|

887 |

|

|

|

6,217 |

|

|

|

857 |

|

Other receivables, deposits and other assets |

|

|

7,306 |

|

|

|

8,571 |

|

|

|

1,181 |

|

Amounts due from related parties, net |

|

|

11,127 |

|

|

|

10,412 |

|

|

|

1,435 |

|

Short-term investments |

|

|

24,332 |

|

|

|

- |

|

|

|

- |

|

Short-term investments under fair value |

|

|

156,639 |

|

|

|

136,645 |

|

|

|

18,826 |

|

Long-term investments under fair value – current |

|

|

135,201 |

|

|

|

139,773 |

|

|

|

19,257 |

|

Total current assets |

|

|

511,188 |

|

|

|

522,809 |

|

|

|

72,031 |

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Restricted cash |

|

|

1,362 |

|

|

|

1,652 |

|

|

|

228 |

|

Property and equipment, net |

|

|

13,979 |

|

|

|

25,357 |

|

|

|

3,494 |

|

Operating lease right-of-use assets |

|

|

29,379 |

|

|

|

28,468 |

|

|

|

3,922 |

|

Intangible assets, net |

|

|

2,476 |

|

|

|

2,087 |

|

|

|

288 |

|

Goodwill |

|

|

- |

|

|

|

1,125 |

|

|

|

155 |

|

Deferred tax assets |

|

|

601 |

|

|

|

881 |

|

|

|

121 |

|

Long-term investment |

|

|

27,500 |

|

|

|

36,500 |

|

|

|

5,029 |

|

Long-term investment under fair value – non-current |

|

|

13,583 |

|

|

|

14,124 |

|

|

|

1,946 |

|

Other non-current assets |

|

|

972 |

|

|

|

956 |

|

|

|

132 |

|

Total non-current assets |

|

|

89,852 |

|

|

|

111,150 |

|

|

|

15,315 |

|

TOTAL ASSETS |

|

|

601,040 |

|

|

|

633,959 |

|

|

|

87,346 |

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Amounts due to related parties |

|

|

867 |

|

|

|

2,124 |

|

|

|

293 |

|

Accrued expenses and other current liabilities |

|

|

59,542 |

|

|

|

65,587 |

|

|

|

9,036 |

|

Operating lease liabilities – current |

|

|

2,531 |

|

|

|

1,768 |

|

|

|

244 |

|

Income tax payable |

|

|

17,171 |

|

|

|

17,549 |

|

|

|

2,418 |

|

Deferred revenue |

|

|

7,269 |

|

|

|

12,893 |

|

|

|

1,776 |

|

Total current liabilities |

|

|

87,380 |

|

|

|

99,921 |

|

|

|

13,767 |

|

FOUR SEASONS EDUCATION (CAYMAN) INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

|

|

February 28, |

|

|

August 31, |

|

|

August 31, |

|

|

|

2023 |

|

|

2023 |

|

|

2023 |

|

|

|

|

|

|

Unaudited |

|

|

Unaudited |

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Deferred tax liabilities |

|

|

575 |

|

|

|

575 |

|

|

|

79 |

|

Operating lease liabilities – non-current |

|

|

1,195 |

|

|

|

1,502 |

|

|

|

207 |

|

Total non-current liabilities |

|

|

1,770 |

|

|

|

2,077 |

|

|

|

286 |

|

TOTAL LIABILITIES |

|

|

89,150 |

|

|

|

101,998 |

|

|

|

14,053 |

|

|

|

|

|

|

|

|

|

|

|

EQUITY |

|

|

|

|

|

|

|

|

|

Total equity |

|

|

511,890 |

|

|

|

531,961 |

|

|

|

73,293 |

|

TOTAL LIABILITIES AND EQUITY |

|

|

601,040 |

|

|

|

633,959 |

|

|

|

87,346 |

|

FOUR SEASONS EDUCATION (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended August 31, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Revenue |

|

|

|

|

|

|

|

|

|

-- Revenue from third parties |

|

|

9,899 |

|

|

|

60,718 |

|

|

|

8,365 |

|

-- Revenue from related parties |

|

|

3,917 |

|

|

|

1,113 |

|

|

|

153 |

|

Total revenue |

|

|

13,816 |

|

|

|

61,831 |

|

|

|

8,518 |

|

Cost of revenue |

|

|

(10,258 |

) |

|

|

(35,143 |

) |

|

|

(4,842 |

) |

Gross profit |

|

|

3,558 |

|

|

|

26,688 |

|

|

|

3,676 |

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

(26,343 |

) |

|

|

(23,549 |

) |

|

|

(3,244 |

) |

Sales and marketing expenses |

|

|

(2,526 |

) |

|

|

(2,244 |

) |

|

|

(309 |

) |

Operating income (loss) |

|

|

(25,311 |

) |

|

|

895 |

|

|

|

123 |

|

|

|

|

|

|

|

|

|

|

|

Subsidy income |

|

|

1,238 |

|

|

|

49 |

|

|

|

7 |

|

Interest income, net |

|

|

377 |

|

|

|

2,224 |

|

|

|

306 |

|

Other income/ (expenses), net |

|

|

(799 |

) |

|

|

2,698 |

|

|

|

372 |

|

Income (loss) before income taxes |

|

|

(24,495 |

) |

|

|

5,866 |

|

|

|

808 |

|

|

|

|

|

|

|

|

|

|

|

Income tax benefit/ (expense) |

|

|

642 |

|

|

|

(154 |

) |

|

|

(21 |

) |

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

|

(23,853 |

) |

|

|

5,712 |

|

|

|

787 |

|

Net income (loss) attributable to non-controlling interest |

|

|

(1,940 |

) |

|

|

664 |

|

|

|

91 |

|

Net income (loss) attributable to Four Seasons Education (Cayman) Inc. |

|

|

(21,913 |

) |

|

|

5,048 |

|

|

|

696 |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per ordinary share: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

(1.03 |

) |

|

|

0.24 |

|

|

|

0.03 |

|

Diluted |

|

|

(1.03 |

) |

|

|

0.24 |

|

|

|

0.03 |

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in calculating net income (loss) per ordinary share: |

|

|

|

|

|

|

|

|

|

Basic |

|

|

21,238,806 |

|

|

|

21,189,215 |

|

|

|

21,189,215 |

|

Diluted |

|

|

21,238,806 |

|

|

|

21,189,215 |

|

|

|

21,189,215 |

|

FOUR SEASONS EDUCATION (CAYMAN) INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended August 31, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Net income (loss) |

|

|

(23,853 |

) |

|

|

5,712 |

|

|

|

787 |

|

Other comprehensive income, net of tax of nil |

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

34,317 |

|

|

|

1,641 |

|

|

|

226 |

|

Comprehensive income |

|

|

10,464 |

|

|

|

7,353 |

|

|

|

1,013 |

|

Less: Comprehensive income (loss) attributable to non-controlling interest |

|

|

(1,940 |

) |

|

|

664 |

|

|

|

91 |

|

Comprehensive income attributable to Four Seasons Education (Cayman) Inc. |

|

|

12,404 |

|

|

|

6,689 |

|

|

|

922 |

|

FOUR SEASONS EDUCATION (CAYMAN) INC.

RECONCILIATION OF GAAP AND NON-GAAP RESULTS

(in thousands, except share data and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended August 31, |

|

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

|

RMB |

|

|

RMB |

|

|

USD |

|

Operating income (loss) |

|

|

(25,311 |

) |

|

|

895 |

|

|

|

123 |

|

Add: share-based compensation expenses |

|

|

2,012 |

|

|

|

1,800 |

|

|

|

248 |

|

Adjusted operating income (loss) (non-GAAP) |

|

|

(23,299 |

) |

|

|

2,695 |

|

|

|

371 |

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

|

(23,853 |

) |

|

|

5,712 |

|

|

|

787 |

|

Add: share-based compensation expenses (net of tax effect of nil) |

|

|

2,012 |

|

|

|

1,800 |

|

|

|

248 |

|

Add: fair value change of investments, excluding foreign currency

translation adjustment (net of tax effect of nil) |

|

|

3,471 |

|

|

|

(1,304 |

) |

|

|

(180 |

) |

Adjusted net income (loss) (non-GAAP) |

|

|

(18,370 |

) |

|

|

6,208 |

|

|

|

855 |

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) per ADS attributable to ordinary shareholders |

|

|

(11.23 |

) |

|

|

2.70 |

|

|

|

0.37 |

|

Add: share-based compensation expenses per ADS attributable to

ordinary shareholders |

|

|

0.95 |

|

|

|

0.85 |

|

|

|

0.12 |

|

Add: fair value change of investments per ADS attributable to

ordinary shareholders |

|

|

1.63 |

|

|

|

(0.62 |

) |

|

|

(0.08 |

) |

Adjusted basic net income (loss) per ADS attributable to

ordinary shareholders (non-GAAP) |

|

|

(8.65 |

) |

|

|

2.93 |

|

|

|

0.41 |

|

Diluted net income (loss) per ADS attributable to

ordinary shareholders |

|

|

(11.23 |

) |

|

|

2.70 |

|

|

|

0.37 |

|

Add: share-based compensation expenses per ADS attributable to

ordinary shareholders |

|

|

0.95 |

|

|

|

0.85 |

|

|

|

0.12 |

|

Add: fair value change of investments per ADS attributable to

ordinary shareholders |

|

|

1.63 |

|

|

|

(0.62 |

) |

|

|

(0.08 |

) |

Adjusted diluted net income (loss) per ADS attributable to

ordinary shareholders (non-GAAP) |

|

|

(8.65 |

) |

|

|

2.93 |

|

|

|

0.41 |

|

Weighted average ADSs used in calculating earnings per ADS |

|

|

|

|

|

|

|

|

|

Basic |

|

|

2,123,881 |

|

|

|

2,118,922 |

|

|

|

2,118,922 |

|

Diluted |

|

|

2,123,881 |

|

|

|

2,118,922 |

|

|

|

2,118,922 |

|

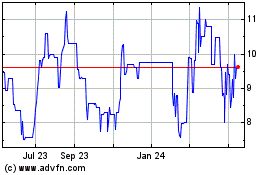

Four Seasons Education C... (NYSE:FEDU)

Historical Stock Chart

From Nov 2024 to Dec 2024

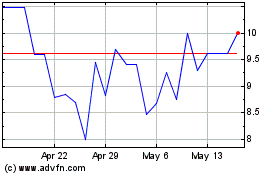

Four Seasons Education C... (NYSE:FEDU)

Historical Stock Chart

From Dec 2023 to Dec 2024