UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13A-16 OR 15D-16 UNDER THE SECURITIES

EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-32749

FRESENIUS MEDICAL

CARE AG

(Translation of registrant's name into English)

Else-Kröner-Strasse 1

61346 Bad Homburg

Germany

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F ¨

INFORMATION CONTAINED IN THIS FORM 6-K

REPORT

On February 21, 2023, the supervisory board

of Fresenius Medical Care Management AG ("Management AG") in its capacity as General Partner of Fresenius Medical Care AG &

Co., KGaA a partnership limited by shares (Kommanditgesellschaft auf Aktien – KGaA), approved the resolution of the management

board of Management AG ("Management Board") to initiate a change of the legal form of Fresenius Medical Care AG & Co.

KGaA ("FME KGaA") from a KGaA into a German stock corporation (Aktiengesellschaft – AG) with the name Fresenius

Medical Care AG ("FME AG") (the "Conversion"). References in this Form 6-K to the "Company" refer to

FME KGaA prior to the effective date of the Conversion and to FME AG from the effective date of the Conversion.

Management AG, in its capacity as General Partner

of the Company, convened an extraordinary general meeting (EGM) of the shareholders of the Company that was held on July 14, 2023

to resolve on the Conversion. At the EGM, shareholders approved the proposed resolutions, including the Conversion.

In

connection with the EGM, the Company filed a registration statement on Form F-4 (registration number 333-271081) (the "Registration

Statement") with the U.S. Securities and Exchange Commission (SEC) that was declared effective on June 6, 2023. The final Information

Statement / Prospectus dated June 6, 2023 ("Final Information Statement / Prospectus"), which was distributed or otherwise

made available to the shareholders of the Company (including holders of American Depositary Shares (ADSs) representing such shares),

contains additional information regarding the Conversion. The Final Information Statement / Prospectus is available on the SEC’s

website, www.sec.gov.

The Conversion became effective on Thursday,

November 30, 2023 with the registration of the Conversion with the commercial register (Handelsregister) of the local

court (Amtsgericht) of Hof (Saale), Germany ("Commercial Register"). Upon the registration of the Conversion,

Management AG, a subsidiary of Fresenius SE & Co. KGaA ("Fresenius SE")), exited the Company and Fresenius SE

ceased to control (as defined by International Financial Reporting Standards 10, Consolidated Financial Statements) the Company.

Upon the effectiveness of the Conversion, FME KGaA’s and its subsidiaries’ business, assets and liabilities prior to the

Conversion continue as those of FME AG and its subsidiaries by operation of German law. An English convenience translation of an

extract from the Commercial Register confirming the registration of the Conversion is attached hereto as Exhibit 99.1. A press

release announcing the registration of the Conversion is attached hereto as Exhibit 99.2.

With the effectiveness of the Conversion, FME

AG’s outstanding ordinary shares continue to be outstanding and have become by operation of German law ordinary shares of FME AG

each with the same nominal value. Consequently, upon effectiveness of the Conversion, each holder of FME KGaA’s ordinary shares

instead holds ordinary shares of FME AG of the same nominal value, representing the same proportional equity interest in FME AG as that

shareholder held in FME KGaA. The number of ordinary shares of FME AG outstanding immediately after the Conversion continues to be

the same as the number of ordinary shares of FME KGaA outstanding immediately prior to the Conversion. Each outstanding ADSs which represented

an interest in one-half of an underlying share in FME KGaA before the Conversion represents an interest in one-half of an underlying share

in FME AG after the Conversion, and the number of outstanding ADSs remained unchanged by the Conversion. The ordinary shares of FME AG

have replaced the ordinary shares of FME KGaA as the "deposited securities" under the deposit agreement for the ADSs.

With effectiveness of the Conversion, the rights

of shareholders of FME AG continue to be governed by German law and the FME AG Articles of Association, each of which is described in

the Registration Statement. As disclosed by FME AG in the Final Information Statement / Prospectus, the Conversion does not change either

the number of shares available as conditional capital (e.g., capital available for grants of stock options) or the Company's authority

to use treasury shares excluded from shareholder subscription rights, in lieu of issuing new shares. Information relating to the ordinary

shares is described under the caption “Description of the Shares of FME AG” in the Registration Statement and Final Information

Statement / Prospectus and the text of the FME AG Articles of Association is included therein as Part II to Appendix A, and is incorporated

herein by reference.

The rights of the holders of ADSs continue to

be governed by the deposit agreement between the Company and The Bank of New York Mellon as Depositary, as modified by an Amended and

Restated Deposit Agreement dated the date hereof, (the "Deposit Agreement") between the Company and the Depositary, which made

non-substantive amendments (e.g., change of name from "KGaA" to "AG", removal of references to the General Partner)

to the document to give effect to the Conversion. A copy of the Deposit Agreement is attached to the Form F-6 filed with the SEC

by the Depositary and the Company on the date hereof and will be available on the SEC's website. Further information relating to the ADSs

is described under the caption “Description of American Depositary Shares" in the Registration Statement and Final Information

Statement / Prospectus and is incorporated herein by reference.

At the EGM the Company’s shareholders also

elected four of the six shareholder representatives on the Supervisory Board of the Company whose terms of office commenced upon the effectiveness

of the Conversion. The shareholder representatives elected at the EGM are Shervin J. Korangy, Dr Marcus Kuhnert, Gregory Sorensen, M.D.

and Pascale Witz. In addition to these four members, under the terms of FME AG's Articles of Association Fresenius SE, which holds approximately

32.2% of the ordinary share capital of the Company, appointed two members to the new Supervisory Board: Michael Sen, Chief Executive Officer

of Fresenius SE who has been elected as Chair of the new Supervisory Board, as well as Sara Hennicken, Chief Financial Officer of Fresenius

SE. Under applicable German law requiring co-determination of Supervisory Boards, the six shareholder representatives will be joined by

an equal number of employee representative who will be elected by a vote of the employees of the Company in due course. However, in order

to create parity on the Supervisory Board of the Company before this employee election process has been completed, the Company intends

to initiate a formal filing to the local court in Hof (Saale), Germany, for an interim court appointment of employee representatives in

the Supervisory Board of the Company. Additional information regarding the election of the shareholder representatives at the EGM and

their business backgrounds may be found in the final Information Statement / Prospectus under the caption "The Extraordinary General

Meeting - The Election Proposal" and in “Appendix A - The Conversion Proposal - Section III. Information of the Candidates

for the Supervisory Board of Fresenius Medical Care AG (Shareholder Representatives)."

The new Supervisory Board has appointed a new

management board for the Company which consists of the members of the previous management board of Management AG. It is expected that

upon election of the employee representatives to the Supervisory Board, the Supervisory Board will appoint a Director of Labor Relations

who will become a member of the Company’s management board.

FME KGaA’s ordinary shares and ADSs are

registered pursuant to Section 12(b) of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and the ADSs are listed and traded on the New York Stock Exchange (“NYSE”) under the symbol FMS. FME KGaA’s ordinary

shares are listed and trade on the Frankfurt Stock Exchange under the symbol “FME”. following

the Conversion, the ADSs will continue to be listed for trading on the NYSE under the existing ticker symbol FMS and the ordinary shares

will continue to trade on the Frankfurt Stock exchange under the existing symbol FME. The Company's ADSs will continue to bear the existing

CUSIP number: 358029106.

The Company is a “foreign private issuer”

as such term is defined in Rule 3b-4 under the Exchange Act. This Report on Form 6-K is being filed pursuant to Rule 12g-3(a) under

the Exchange Act using the EDGAR format type 8-K12B for the purpose of establishing FME AG as the successor issuer to FME KGaA under the

Exchange Act, and to disclose certain events with respect to FME in connection with the consummation of the Conversion. Pursuant to 12g-3(a) under

the Exchange Act, FME AG's ordinary shares and ADSs evidencing FME AG’s ordinary shares are deemed registered under Section 12(b) of

the Exchange Act as the ordinary shares of the successor issuer under the Exchange Act and as ADSs evidencing such ordinary shares, respectively.

FME AG is subject to the informational requirements of the Exchange Act and the rules and regulations promulgated thereunder. FME

AG hereby reports this succession in accordance with Rule 12g-3(f) under the Exchange Act.

EXHIBITS

The following exhibits are being furnished with

this Report:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

FRESENIUS

MEDICAL CARE AG |

| |

|

| Dated: November 30,

2023 |

By: |

/s/

Helen Giza |

| |

|

Name: Helen Giza |

| |

|

Title: Chief Executive

Officer and Chair of the Management Board |

| |

By: |

/s/

Martin Fischer |

| |

|

Name: Martin Fischer |

| |

|

Title: Chief Financial Officer and Member of the

Management Board |

Exhibit 99.1

| Commercial Register B of the Local Court of Hof | Company

Number HRB 6841 |

| | Page 1 of 1 |

Retrieved on 30 Nov. 2023 at 0920 hours

| Entry No. |

a) Name of the company

b) Registered office, place of

business, business address in

Germany,

authorized

recipient,

branch offices

c) Purpose of the enterprise |

Share or

nominal capital |

a) General provision for representation

b) Board of management,

managing bodies, managing

directors, personally

liable

(general) partners, authorized

representatives, and special

power of representation |

Prokura =

Full power to represent the

company

[Authorized signatory =

Prokurist

DOB: Date of Birth

dd/mm/yyyy] |

a) Legal form, formation date, articles of association or

articles of incorporation

b) Other legal relationships |

a) Date of entry

b) Remarks

[dd/mm/yyyy] |

| 1 |

2 |

3 |

4 |

5 |

6 |

7 |

| 1 |

a)

Fresenius Medical Care AG

b)

Hof

Business address:

Else-Kröner-Strasse 1, 61352 Bad Homburg

c)

The development, manufacturing, and distribution of and trade in healthcare

products, systems and processes in the areas of medical care and health care, including dialysis and related forms of therapy, as well

as the provision of any and all services in these areas; projection, planning, establishment, acquisition and operation of healthcare

businesses, including dialysis centers, even as separate enterprises or through third parties, and participation in such dialysis centers;

development, manufacture and distribution of other pharmaceutical products and the provision of services in this field; the provision

of consulting services in the fields of medicine and pharmaceuticals, as well as scientific information and documentation; the provision

of services in laboratories for dialysis and non-dialysis patients and homecare medical services. |

EUR

293,413,449.00 |

a)

The Company shall be represented by two members of the Management Board

or by one member of the Management Board acting jointly with an authorized signatory (“Prokurist”).

b)

Appointed:

Chair of the Management Board:

Giza, Helen, of Riverwoods, Illinois, United States, DOB: /24/01/1968

Appointed:

Management Board member:

Maddux, Franklin W., of Lincoln, Massachusetts, United States, DOB:

25/11/1957

Appointed:

Management Board member:

Dr. Mazur-Hofsäß, Katarzyna, of Hofheim am Taunus, DOB:

01/09/1963

Appointed:

Management Board member:

Valle, William, of Estero, Florida, United States, DOB: 06/10/1960

Appointed:

Fischer, Martin, of White Plains, New York, United States, DOB: 08/10/1976 |

Collective full power of attorney jointly with a Management Board member

or another authorized signatory:

Dr. Beringer, Kathrin, of Schweinfurt, DOB: 16/12/1980

Dambeck, Alexandra, of Wiesbaden, DOB: 29/09/1970

Domnica, Alina, of Bad Vilbel,

DOB: 02/11/1981

Dr. Dreyhsig, Jörg, of Berlin,

DOB: 17/03/1964

Dr. Heger, Dominik, of Munich, DOB: 15/09/1975

Dr. Hennke, Peter, of Friedrichsdorf, DOB: 27/05/1972

Dr. Himstedt, Thomas, of Harsum, DOB: 07/09/1971

Dr. Hofmann, Wolfgang, of Frankfurt am Main, DOB: 13/04/1968

Kesper, Jürgen, of Diemelsee, DOB: 13/01/1966

Klotz, Gunther, of Bad Homburg, DOB: 01/01/1965

Köster, Christof, of Bad Homburg,

DOB: 11/06/1971

Mannigel, Martina, of Wiesbaden, DOB: 08/07/1982

Patzak, Steffen, of Friedrichsdorf, DOB: 07/06/1976

Pieper, Arnold, of Ockenheim, DOB: 24/03/1963

Dr. Schermeier, Olaf, of Frankfurt am Main, DOB: 11/07/1972

Stock, Wolfgang, of Schweinfurt, DOB: 10/04/1970

Weitkowitz-Salazar, Beate, of Usingen, DOB: 07/08/1962

Dr. Wild, Thomas, Bad Homburg v.d. Höhe, DOB:06/10/1959

Zange, Julia, of Frankfurt am Main,

DOB: 21/07/1974 |

a)

Joint stock corporation (Aktiengesellschaft)

Articles of Association dated 07/14/2023.

b)

Established because of the change in legal form of Fresenius Medical

Care AG & Co. KGaA with its registered office in Hof (Local Court of Hof HRB 4019).

By resolution of the General Meeting of 27/08/2020, the Management

Board is authorized to increase the share capital with the consent of the Supervisory Board once or multiple times by a total of up to

EUR 35,000,000.00 against cash contributions by no later than 26/08/2025, whereby shareholder subscription rights may be excluded (Authorized

Capital 2020/I).

The Management Board is authorized by resolution of the General Meeting

of 27/08/2020 to increase the share capital with the consent of the Supervisory Board by a total of up to EUR 25,000,000.00 against cash

or contributions in kind by no later than 26/08/2025, whereby shareholder subscription rights may be excluded (Authorized Capital 2020/II).

The Company’s share capital is conditionally increased by resolution

of the General Meeting of 12/05/2011 by up to EUR 8,956,675.00 to serve the 2011 Stock Option Program

(Conditional Capital 2011/1)

|

a)

30/11/2023

Übelmesser |

Translation prepared November 30, 2023.

Exhibit 99.2

Press Release | Media contact

Sabine Blessing

T +1 800 723 2384

sabine.blessing@fmc-ag.com

Contact for analysts and investors

Dr. Dominik Heger

T +49 6172 609 2601

dominik.heger@fmc-ag.com

www.freseniusmedicalcare.com

|

Fresenius Medical Care completes change of legal form into a German

stock corporation

| ● | Change of legal form simplifies the corporate governance structure as a German

stock corporation (Aktiengesellschaft) |

| ● | The composition of the Management Board remains as before; the new Supervisory

Board assumes office with immediate effect |

| ● | Business model and strategic plan remain strong and continue to translate

into improved operating performance |

Bad Homburg (November 30, 2023)

Fresenius Medical Care, the world’s leading provider of products and services for individuals with renal diseases, announces the

successful completion of its change of legal form from a partnership limited by shares (Kommanditgesellschaft auf Aktien, KGaA) into a

German stock corporation (Aktiengesellschaft, AG) as of November 30, 2023. With this important milestone, Fresenius Medical Care

is opening a new chapter in the history of the Company with a simplified corporate governance structure that gives the Company more flexibility

and autonomy. The role of the free float shareholders is also strengthened.

With the successful completion, the new Supervisory Board takes office,

and comprises Shervin J. Korangy, Dr Marcus Kuhnert, Gregory Sorensen, M.D., Pascale Witz, who were formally elected by the Extraordinary

General Meeting on July 14, 2023. As the largest shareholder with approx. 32.2 percent of the ordinary share capital, Fresenius SE &

Co. KGaA (Fresenius) has appointed its CEO Michael Sen and its CFO Sara Hennicken as members of the new Supervisory Board – with

Michael Sen serving as Chair. In addition to the six shareholder representatives, the new Supervisory Board will also comprise six employee

representatives. Their first appointment is expected to be completed in the first quarter of 2024. The committees of the Supervisory Board

have been established, while certain representatives will need to be appointed by the end of the first quarter of 2024.

Michael

Sen, Chair of the Supervisory Board of Fresenius Medical Care AG, said: “The deconsolidation is a historic landmark. Fresenius

Medical Care gains significantly more freedom and flexibility to ultimately create value for its shareholders and patients. I look forward

to supporting the company actively together with my colleagues on the new Supervisory Board.”

Helen

Giza, CEO of Fresenius Medical Care AG, affirmed: “Fresenius Medical Care will benefit from its new legal form as it simplifies

the governance structure and allows for faster and more agile decision making. I want to extend my thanks and heartfelt gratitude to

all involved in supporting the deconsolidation process this year. Our business model remains strong as we continue implementing our strategic

plan and turnaround measures. Our patient centricity is at the heart of our mission and core of our brand, and our unwavering focus on

execution continues translating into improved operating performance.”

We expect that the trading of Fresenius Medical Care’s shares

and ADS will continue under the new company name of Fresenius Medical Care AG as of Friday December 1, 2023.

About Fresenius Medical Care:

Fresenius Medical Care is the world's leading

provider of products and services for individuals with renal diseases of which around 3.9 million patients worldwide regularly undergo

dialysis treatment. Through its network of 4,014 dialysis clinics, Fresenius Medical Care provides dialysis treatments for approximately

342,000 patients around the globe and is the leading provider of dialysis products such as dialysis machines and dialyzers. Fresenius

Medical Care is listed on the Frankfurt Stock Exchange (FME) and on the New York Stock Exchange (FMS).

For more information visit the Company’s

website at www.freseniusmedicalcare.com.

Disclaimer:

This release contains forward-looking statements

that are subject to various risks and uncertainties. Actual results could differ materially from those described in these forward-looking

statements due to various factors, including, but not limited to, changes in business, economic and competitive conditions, legal changes,

regulatory approvals, impacts related to the COVID-19 pandemic results of clinical studies, foreign exchange rate fluctuations, uncertainties

in litigation or investigative proceedings, and the availability of financing. These and other risks and uncertainties are detailed in

Fresenius Medical Care’s reports filed with the U.S. Securities and Exchange Commission. Fresenius Medical Care does not undertake

any responsibility to update the forward-looking statements in this release.

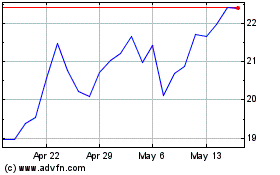

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Mar 2024 to Mar 2025