Second Quarter 2024 Highlights

- Great Park Venture sold 105 homesites on 12.3 acres of land for

an aggregate purchase price of $96.1 million.

- Great Park Venture distributions and incentive compensation

payments to the Company totaled $29.7 million.

- Great Park builder sales of 63 homes during the quarter.

- Valencia builder sales of 84 homes during the quarter.

- Consolidated revenues of $51.2 million; consolidated net income

of $38.2 million.

- Cash and cash equivalents of $217.4 million as of June 30,

2024.

- Debt to total capitalization ratio of 20.6% and liquidity of

$342.4 million as of June 30, 2024.

Five Point Holdings, LLC (“Five Point” or the “Company”)

(NYSE:FPH), an owner and developer of large mixed-use planned

communities in California, today reported its second quarter 2024

results.

Dan Hedigan, Chief Executive Officer, said, “We had another

strong quarter, with consolidated net income of $38.2 million on

revenues of $51.2 million, ending with total cash and cash

equivalents of $217.4 million. Although the inflation and interest

rate environment remained challenging during the quarter, we

continued to see meaningful appreciation in our residential land

sale pricing, especially in our Great Park Neighborhoods community

where we closed a sale during the quarter at a price of $7.8

million per acre and are seeing current pricing for new land sales

move even higher. As we plan for the future of Five Point, our team

is focused on perfecting our entitlements at our Valencia and San

Francisco communities and continuing to execute on our key

priorities: generating revenue, controlling our SG&A, and

managing our capital spend. For the second half of 2024, we expect

demand in our chronically undersupplied housing markets to remain

strong and to drive a strong finish to the year. While we expect a

relatively soft third quarter, we expect to close land sales in the

fourth quarter in both of our active communities and to end the

year with consolidated annual net income of over $100 million and

cash and cash equivalents in excess of $300 million.”

Consolidated Results

Liquidity and Capital Resources

As of June 30, 2024, total liquidity of $342.4 million was

comprised of cash and cash equivalents totaling $217.4 million and

borrowing availability of $125.0 million under our unsecured

revolving credit facility. Total capital was $2.0 billion,

reflecting $2.9 billion in assets and $0.9 billion in liabilities

and redeemable noncontrolling interests.

Results of Operations for the Three Months Ended June 30,

2024

Revenues. Revenues of $51.2 million for the three months

ended June 30, 2024 were primarily generated from management

services.

Equity in earnings from unconsolidated entities. Equity

in earnings from unconsolidated entities was $15.5 million for the

three months ended June 30, 2024. The Great Park Venture generated

net income of $44.9 million during the three months ended June 30,

2024, and our share of the net income from our 37.5% percentage

interest, adjusted for basis differences, was $15.5 million.

Additionally, we recognized $0.2 million in earnings from our 10%

interest in the Valencia Landbank Venture, offset by $0.2 million

in loss from our 75% interest in the Gateway Commercial

Venture.

During the three months ended June 30, 2024, the Great Park

Venture sold 105 homesites on 12.3 acres of land at the Great Park

Neighborhoods for an aggregate purchase price of $96.1 million.

After completing the land sale, the Great Park Venture made

aggregate distributions of $7.3 million to holders of Legacy

Interests and $62.5 million to holders of Percentage Interests. We

received $23.4 million for our 37.5% Percentage Interest.

Selling, general, and administrative. Selling, general,

and administrative expenses were $12.2 million for the three months

ended June 30, 2024.

Net income. Consolidated net income for the quarter was

$38.2 million. Net income attributable to noncontrolling interests

totaled $23.5 million, resulting in net income attributable to the

Company of $14.7 million. Net income attributable to noncontrolling

interests represents the portion of income allocated to related

party partners and members that hold units of the operating company

and the San Francisco Venture. Holders of units of the operating

company and the San Francisco Venture can redeem their interests

for either, at our election, our Class A common shares on a

one-for-one basis or cash. In connection with any redemption or

exchange, our ownership of our operating subsidiaries will increase

thereby reducing the amount of income allocated to noncontrolling

interests in subsequent periods.

Conference Call

Information

In conjunction with this release, Five Point will host a

conference call on Thursday, July 18, 2024 at 5:00 p.m. Eastern

Time. Dan Hedigan, Chief Executive Officer, and Kim Tobler, Chief

Financial Officer, will host the call. Interested investors and

other parties can listen to a live Internet audio webcast of the

conference call that will be available on the Five Point website at

ir.fivepoint.com. The conference call can also be accessed by

dialing (877) 451-6152 (domestic) or (201) 389-0879

(international). A telephonic replay will be available starting

approximately three hours after the end of the call by dialing

(844) 512-2921, or for international callers, (412) 317-6671. The

passcode for the live call and the replay is 13747738. The

telephonic replay will be available until 11:59 p.m. Eastern Time

on July 27, 2024.

About Five Point

Five Point, headquartered in Irvine, California, designs and

develops large mixed-use planned communities in Orange County, Los

Angeles County, and San Francisco County that combine residential,

commercial, retail, educational, and recreational elements with

public amenities, including civic areas for parks and open space.

Five Point’s communities include the Great Park Neighborhoods® in

Irvine, Valencia® in Los Angeles County, and Candlestick® and The

San Francisco Shipyard® in the City of San Francisco. These

communities are designed to include up to approximately 40,000

residential homes and up to approximately 23 million square feet of

commercial space.

Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to risks and uncertainties. These statements concern

expectations, beliefs, projections, plans and strategies,

anticipated events or trends and similar expressions concerning

matters that are not historical facts. When used, the words

“anticipate,” “believe,” “expect,” “intend,” “may,” “might,”

“plan,” “estimate,” “project,” “should,” “will,” “would,” “result”

and similar expressions that do not relate solely to historical

matters are intended to identify forward-looking statements.

Forward-looking statements include, among others, statements that

refer to: our expectations of our future home sales and/or builder

sales; the impact of inflation and interest rates; our future

revenues, costs and financial performance, including with respect

to cash generation and profitability; and future demographics and

market conditions, including housing supply levels, in the areas

where our communities are located. We caution you that any

forward-looking statements included in this press release are based

on our current views and information currently available to us.

Forward-looking statements are subject to risks, trends,

uncertainties and factors that are beyond our control. Some of

these risks and uncertainties are described in more detail in our

filings with the SEC, including our Annual Report on Form 10-K,

under the heading “Risk Factors.” Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

anticipated, estimated or projected. We caution you therefore

against relying on any of these forward-looking statements. While

forward-looking statements reflect our good faith beliefs, they are

not guarantees of future performance. They are based on estimates

and assumptions only as of the date hereof. We undertake no

obligation to update or revise any forward-looking statement to

reflect changes in underlying assumptions or factors, new

information, data or methods, future events or other changes,

except as required by applicable law.

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except share

and per share amounts)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

REVENUES:

Land sales

$

307

$

16

$

842

$

(9

)

Land sales—related party

3

(29

)

—

595

Management services—related party

50,279

20,774

59,005

25,010

Operating properties

603

588

1,280

1,454

Total revenues

51,192

21,349

61,127

27,050

COSTS AND EXPENSES:

Land sales

—

—

—

—

Management services

11,315

9,682

15,211

12,048

Operating properties

1,878

1,798

2,868

2,970

Selling, general, and administrative

12,186

12,710

25,102

26,462

Total costs and expenses

25,379

24,190

43,181

41,480

OTHER INCOME (EXPENSE):

Interest income

2,755

1,293

5,980

2,129

Miscellaneous

26

(20

)

(5,881

)

(41

)

Total other income

2,781

1,273

99

2,088

EQUITY IN EARNINGS FROM UNCONSOLIDATED

ENTITIES

15,498

52,128

33,084

53,176

INCOME BEFORE INCOME TAX PROVISION

44,092

50,560

51,129

40,834

INCOME TAX PROVISION

(5,865

)

(5

)

(6,819

)

(13

)

NET INCOME

38,227

50,555

44,310

40,821

LESS NET INCOME ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

23,505

26,984

27,262

21,786

NET INCOME ATTRIBUTABLE TO THE COMPANY

$

14,722

$

23,571

$

17,048

$

19,035

NET INCOME ATTRIBUTABLE TO THE COMPANY PER

CLASS A SHARE

Basic

$

0.21

$

0.34

$

0.25

$

0.28

Diluted

$

0.21

$

0.34

$

0.24

$

0.27

WEIGHTED AVERAGE CLASS A SHARES

OUTSTANDING

Basic

69,239,296

68,811,975

69,148,940

68,758,894

Diluted

145,936,206

145,040,689

145,906,521

144,939,450

NET INCOME ATTRIBUTABLE TO THE COMPANY PER

CLASS B SHARE

Basic and diluted

$

0.00

$

0.00

$

0.00

$

0.00

WEIGHTED AVERAGE CLASS B SHARES

OUTSTANDING

Basic and diluted

79,233,544

79,233,544

79,233,544

79,233,544

FIVE POINT HOLDINGS,

LLC

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except

shares)

(Unaudited)

June 30, 2024

December 31, 2023

ASSETS

INVENTORIES

$

2,292,264

$

2,213,479

INVESTMENT IN UNCONSOLIDATED ENTITIES

237,777

252,816

PROPERTIES AND EQUIPMENT, NET

29,359

29,145

INTANGIBLE ASSET, NET—RELATED PARTY

13,728

25,270

CASH AND CASH EQUIVALENTS

217,387

353,801

RESTRICTED CASH AND CERTIFICATES OF

DEPOSIT

992

992

RELATED PARTY ASSETS

120,551

83,970

OTHER ASSETS

8,081

9,815

TOTAL

$

2,920,139

$

2,969,288

LIABILITIES AND CAPITAL

LIABILITIES:

Notes payable, net

$

524,104

$

622,186

Accounts payable and other liabilities

83,267

81,649

Related party liabilities

74,173

78,074

Deferred income tax liability, net

12,917

7,067

Payable pursuant to tax receivable

agreement

173,351

173,208

Total liabilities

867,812

962,184

REDEEMABLE NONCONTROLLING INTEREST

25,000

25,000

CAPITAL:

Class A common shares; No par value;

Issued and outstanding: June 30, 2024—69,358,504 shares; December

31, 2023—69,199,938 shares

Class B common shares; No par value;

Issued and outstanding: June 30, 2024—79,233,544 shares; December

31, 2023—79,233,544 shares

Contributed capital

593,211

591,606

Retained earnings

105,828

88,780

Accumulated other comprehensive loss

(2,321

)

(2,332

)

Total members’ capital

696,718

678,054

Noncontrolling interests

1,330,609

1,304,050

Total capital

2,027,327

1,982,104

TOTAL

$

2,920,139

$

2,969,288

FIVE POINT HOLDINGS,

LLC

SUPPLEMENTAL DATA

(In thousands)

(Unaudited)

Liquidity

June 30, 2024

Cash and cash equivalents

$

217,387

Borrowing capacity(1)

125,000

Total liquidity

$

342,387

(1)

As of June 30, 2024, no borrowings or

letters of credit were outstanding on the Company’s $125.0 million

revolving credit facility.

Debt to Total

Capitalization and Net Debt to Total Capitalization

June 30, 2024

Debt(1)

$

524,994

Total capital

2,027,327

Total capitalization

$

2,552,321

Debt to total capitalization

20.6

%

Debt(1)

$

524,994

Less: Cash and cash equivalents

217,387

Net debt

307,607

Total capital

2,027,327

Total net capitalization

$

2,334,934

Net debt to total

capitalization(2)

13.2

%

(1)

For purposes of this calculation, debt is

the amount due on the Company’s notes payable before offsetting for

capitalized deferred financing costs.

(2)

Net debt to total capitalization is a

non-GAAP financial measure defined as net debt (debt less cash and

cash equivalents) divided by total net capitalization (net debt

plus total capital). The Company believes the ratio of net debt to

total capitalization is a relevant and a useful financial measure

to investors in understanding the leverage employed in the

Company’s operations. However, because net debt to total

capitalization is not calculated in accordance with GAAP, this

financial measure should not be considered in isolation or as an

alternative to financial measures prescribed by GAAP. Rather, this

non-GAAP financial measure should be used to supplement the

Company’s GAAP results.

Segment Results

The following tables reconcile the results of operations of our

segments to our consolidated results for the three and six months

ended June 30, 2024 (in thousands):

Three Months Ended June 30,

2024

Valencia

San Francisco

Great Park

Commercial

Total reportable

segments

Corporate and

unallocated

Total under management

Removal of unconsolidated

entities(1)

Total consolidated

REVENUES:

Land sales

$

307

$

—

$

134,638

$

—

$

134,945

$

—

$

134,945

$

(134,638

)

$

307

Land sales—related party

3

—

4,734

—

4,737

—

4,737

(4,734

)

3

Management services—related party(2)

—

—

50,151

128

50,279

—

50,279

—

50,279

Operating properties

435

168

—

2,224

2,827

—

2,827

(2,224

)

603

Total revenues

745

168

189,523

2,352

192,788

—

192,788

(141,596

)

51,192

COSTS AND EXPENSES:

Land sales

—

—

29,016

—

29,016

—

29,016

(29,016

)

—

Management services(2)

—

—

11,315

—

11,315

—

11,315

—

11,315

Operating properties

1,878

—

—

864

2,742

—

2,742

(864

)

1,878

Selling, general, and administrative

2,515

1,294

2,625

1,019

7,453

8,377

15,830

(3,644

)

12,186

Management fees—related party

—

—

64,470

—

64,470

—

64,470

(64,470

)

—

Total costs and expenses

4,393

1,294

107,426

1,883

114,996

8,377

123,373

(97,994

)

25,379

OTHER INCOME (EXPENSE):

Interest income

—

17

1,671

59

1,747

2,738

4,485

(1,730

)

2,755

Interest expense

—

—

—

(690

)

(690

)

—

(690

)

690

—

Miscellaneous

23

—

—

—

23

3

26

—

26

Total other income (expense)

23

17

1,671

(631

)

1,080

2,741

3,821

(1,040

)

2,781

EQUITY IN EARNINGS FROM UNCONSOLIDATED

ENTITIES

243

—

—

—

243

—

243

15,255

15,498

SEGMENT (LOSS) PROFIT/INCOME BEFORE INCOME

TAX PROVISION

(3,382

)

(1,109

)

83,768

(162

)

79,115

(5,636

)

73,479

(29,387

)

44,092

INCOME TAX PROVISION

—

—

—

—

—

(5,865

)

(5,865

)

—

(5,865

)

SEGMENT (LOSS) PROFIT/NET INCOME

$

(3,382

)

$

(1,109

)

$

83,768

$

(162

)

$

79,115

$

(11,501

)

$

67,614

$

(29,387

)

$

38,227

(1)

Represents the removal of the Great Park

Venture and Gateway Commercial Venture operating results, which are

included in the Great Park segment and Commercial segment operating

results at 100% of each venture’s historical basis, respectively,

but are not included in our consolidated results as we account for

our investment in each venture using the equity method of

accounting.

(2)

For the Great Park and Commercial

segments, represents the revenues and expenses attributable to the

management company for providing services to the Great Park Venture

and the Gateway Commercial Venture, as applicable.

Six Months Ended June 30,

2024

Valencia

San Francisco

Great Park

Commercial

Total reportable

segments

Corporate and

unallocated

Total under management

Removal of unconsolidated

entities(1)

Total consolidated

REVENUES:

Land sales

$

842

$

—

$

215,456

$

—

$

216,298

$

—

$

216,298

$

(215,456

)

$

842

Land sales—related party

—

—

16,625

—

16,625

—

16,625

(16,625

)

—

Management services—related party(2)

—

—

58,764

241

59,005

—

59,005

—

59,005

Operating properties

944

336

—

4,773

6,053

—

6,053

(4,773

)

1,280

Total revenues

1,786

336

290,845

5,014

297,981

—

297,981

(236,854

)

61,127

COSTS AND EXPENSES:

Land sales

—

—

58,974

—

58,974

—

58,974

(58,974

)

—

Management services(2)

—

—

15,211

—

15,211

—

15,211

—

15,211

Operating properties

2,868

—

—

1,840

4,708

—

4,708

(1,840

)

2,868

Selling, general, and administrative

5,709

2,429

5,564

2,048

15,750

16,964

32,714

(7,612

)

25,102

Management fees—related party

—

—

72,632

—

72,632

—

72,632

(72,632

)

—

Total costs and expenses

8,577

2,429

152,381

3,888

167,275

16,964

184,239

(141,058

)

43,181

OTHER INCOME (EXPENSE):

Interest income

—

32

3,150

93

3,275

5,948

9,223

(3,243

)

5,980

Interest expense

—

—

—

(1,384

)

(1,384

)

—

(1,384

)

1,384

—

Miscellaneous

47

—

—

—

47

(5,928

)

(5,881

)

—

(5,881

)

Total other income (expense)

47

32

3,150

(1,291

)

1,938

20

1,958

(1,859

)

99

EQUITY IN EARNINGS FROM UNCONSOLIDATED

ENTITIES

259

—

—

—

259

—

259

32,825

33,084

SEGMENT (LOSS) PROFIT/INCOME BEFORE INCOME

TAX PROVISION

(6,485

)

(2,061

)

141,614

(165

)

132,903

(16,944

)

115,959

(64,830

)

51,129

INCOME TAX PROVISION

—

—

—

—

—

(6,819

)

(6,819

)

—

(6,819

)

SEGMENT (LOSS) PROFIT/NET INCOME

$

(6,485

)

$

(2,061

)

$

141,614

$

(165

)

$

132,903

$

(23,763

)

$

109,140

$

(64,830

)

$

44,310

(1)

Represents the removal of the Great Park

Venture and Gateway Commercial Venture operating results, which are

included in the Great Park segment and Commercial segment operating

results at 100% of each venture’s historical basis, respectively,

but are not included in our consolidated results as we account for

our investments in each venture using the equity method of

accounting.

(2)

For the Great Park and Commercial

segments, represents the revenues and expenses attributable to the

management company for providing services to the Great Park Venture

and the Gateway Commercial Venture, as applicable.

The table below reconciles the Great Park segment results to the

equity in earnings from our investment in the Great Park Venture

that is reflected in the condensed consolidated statements of

operations for the three and six months ended June 30, 2024 (in

thousands):

Three Months Ended

June 30, 2024

Six Months Ended

June 30, 2024

Segment profit from operations

$

83,768

$

141,614

Less net income of management company

attributed to the Great Park segment

38,836

43,553

Net income of the Great Park Venture

44,932

98,061

The Company’s share of net income of the

Great Park Venture

16,850

36,773

Basis difference amortization, net

(1,377

)

(3,643

)

Equity in earnings from the Great Park

Venture

$

15,473

$

33,130

The table below reconciles the Commercial segment results to the

equity in loss from our investment in the Gateway Commercial

Venture that is reflected in the condensed consolidated statements

of operations for the three and six months ended June 30, 2024 (in

thousands):

Three Months Ended

June 30, 2024

Six Months Ended

June 30, 2024

Segment loss from operations

$

(162

)

$

(165

)

Less net income of management company

attributed to the Commercial segment

128

241

Net loss of the Gateway Commercial

Venture

(290

)

(406

)

Equity in loss from the Gateway Commercial

Venture

$

(218

)

$

(305

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240718932678/en/

Investor Relations: Kim Tobler, 949-425-5211

Kim.Tobler@fivepoint.com

or

Media: Eric Morgan, 949-349-1088 Eric.Morgan@fivepoint.com

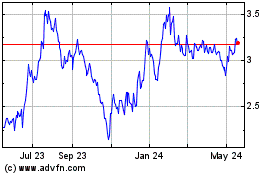

Five Point (NYSE:FPH)

Historical Stock Chart

From Nov 2024 to Dec 2024

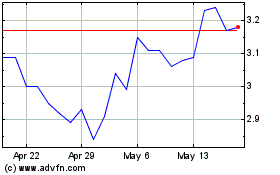

Five Point (NYSE:FPH)

Historical Stock Chart

From Dec 2023 to Dec 2024