Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

22 February 2024 - 12:59AM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on February 21, 2024

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

First Trust High Income

Long/Short Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act

Rules 14a-6(i)(1) and 0-11. |

| PRESS RELEASE | | SOURCE: First Trust Advisors L.P. |

First

Trust Announces Adjournment of Special Meeting of Shareholders Relating to the Reorganizations of First Trust High Income Long/Short Fund

and First Trust/abrdn Global Opportunity Income Fund with and into abrdn Income Credit Strategies Fund

WHEATON, IL – (BUSINESS WIRE) –

February 20, 2024 – First Trust Advisors L.P. (“FTA”) announced today that the joint special meeting of shareholders

of each of First Trust High Income Long/Short Fund (NYSE: FSD) and

First Trust/abrdn Global Opportunity Income Fund (NYSE: FAM) (each, a “Fund” and collectively, the “Funds”)

held on February 20, 2024 has been adjourned in order to permit additional solicitation of shareholders of each Fund and to allow shareholders

additional time to vote on the respective reorganizations of the Funds with and into abrdn Income Credit Strategies Fund (“ACP”).

The joint special meeting of shareholders of the Funds will reconvene on March 7, 2024 at 12:30 Central time in the offices of FTA at

120 East Liberty Drive, Suite 400, Wheaton, Illinois (the “Meeting”).

Shareholders of record

of each Fund as of the close of business on October 23, 2023, are entitled to vote at the Meeting. Whether or not shareholders plan to

attend the Meeting, it is important that their shares be represented and voted at the Meeting. Shareholders may vote their shares by

one of the methods described in the proxy materials previously mailed to them, which includes a combined proxy statement and prospectus

(the “proxy statement”). The proxy statement contains important information regarding the proposed reorganizations and shareholders

of the Fund are urged to read the proxy statement and accompanying materials carefully. The proxy statement is also available at https://www.ftportfolios.com/Common/ContentFileLoader.aspx?ContentGUID=e7273425-e2a9-48b7-bb6d-73153c910a7a

and the Securities and Exchange Commission’s website at www.sec.gov. If shareholders

have any questions regarding the proposals, or need assistance voting, they may call EQ Fund Solutions, LLC at (866) 620-8437. The Boards

of Trustees of the Funds believe the reorganizations are in the best interests of the Fund and recommend that shareholders each Fund

vote “FOR” the reorganization.

FTA is

a federally registered investment advisor and serves as the investment advisor of the Fund.

FTA and its affiliate First Trust Portfolios L.P. (“FTP”), a FINRA registered broker-dealer, are privately-held companies

that provide a variety of investment services. FTA has collective assets under management or supervision of approximately $211 billion

as of January 31, 2024 through unit investment trusts, exchange-traded funds, closed-end funds, mutual funds and separate managed

accounts. FTA is the supervisor of the First Trust unit investment trusts, while FTP is the sponsor. FTP is also a distributor of mutual

fund shares and exchange-traded fund creation units. FTA and FTP are based in Wheaton, Illinois.

In the United States, abrdn

is the marketing name for the following affiliated, registered investment advisers: abrdn Inc., abrdn Investments Limited, abrdn Asia

Limited, abrdn Private Equity (Europe) Limited and abrdn ETFs Advisors LLC.

Additional Information

/ Forward-Looking Statements

This press

release is not intended to, and shall

not, constitute an offer to purchase or sell

shares of the Funds or ACP; nor is this press release intended to solicit a proxy from any shareholder of the Funds.

The Funds and their trustees and officers, FTA, abrdn and certain of their respective officers and employees, and other persons may be

deemed under the rules of the Securities and Exchange Commission to be participants in the solicitation of proxies from shareholders in

connection with the matters described above. Information about each Fund’s trustees and officers, FTA and its officers and employees,

and other persons may be found in the proxy statement.

Certain

statements made in this news release that are

not historical facts are referred to as “forward-looking

statements” under the U.S. federal securities

laws. Actual future results or occurrences may

differ significantly from those anticipated

in any forward-looking statements due to numerous factors.

Generally, the words “believe,” “expect,” “intend,” “estimate,”

“anticipate,” “project,” “will” and similar expressions identify forward-looking statements,

which generally are not historical in nature.

Forward-looking statements are subject to certain risks and

uncertainties that could cause actual results to differ

from the historical experience of FTA and

the funds managed by FTA and

its present expectations or projections. You

should not place undue reliance on forward-looking

statements, which speak only as of the date

they are made. FTA, the Funds and ACP undertake

no responsibility to update publicly or revise any forward-looking

statements.

_______________________________________

CONTACT: Jeff Margolin – (630)

517-7643

_______________________________________

CONTACT: Daniel Lindquist – (630)

765-8692

_______________________________________

CONTACT: Chris Fallow – (630)

517-7628

___________________________________

SOURCE: First Trust Advisors L.P.

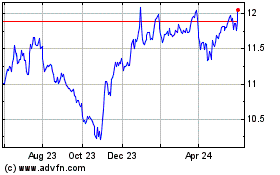

First Trust High Income ... (NYSE:FSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

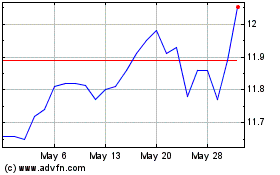

First Trust High Income ... (NYSE:FSD)

Historical Stock Chart

From Mar 2024 to Mar 2025