American Express Global Business Travel, which is operated by

Global Business Travel Group, Inc. (NYSE: GBTG) (“Amex GBT” or the

“Company”), a leading B2B software and services company for travel

and expense, today announced financial results for the first

quarter ended March 31, 2024.

First Quarter 2024 Highlights

Delivered Strong Financial Results

- TTV grew 9% year-over-year (10% workday adjusted1).

- Revenue grew 6% year-over-year to $610 million (7% workday

adjusted1).

- Record first-quarter Adjusted EBITDA of $123 million,

representing growth of 24%.

- Reiterated full-year 2024 revenue and Adjusted EBITDA guidance

ranges.

Continued Share Gains

- LTM Total New Wins Value totaled $3.3 billion, including $2.0

billion from SME.

- 96% LTM customer retention rate.

Operating Leverage

- 6% revenue growth versus 2% Adjusted Operating Expense

growth.

- Operating leverage drove Adjusted EBITDA margin expansion of

300bps year-over-year.

Positive Cash Flow & Deleveraging

- Important milestone reaching positive first quarter Free Cash

Flow of $24 million, representing growth of $133 million

year-over-year.

- Lowered leverage ratio to 2.2x2; further interest rate

reduction under our credit agreement.

Agreement to Acquire CWT

- Announced definitive agreement to acquire CWT, a global

business travel and meetings solutions provider.

- Transaction value of $570M represents multiple of 2.5x Adjusted

EBITDA including $155 million of identified synergies.

- Expected to be break-even to earnings per share in the first

year after transaction close and accretive thereafter.

Paul Abbott, Amex GBT’s Chief Executive Officer, stated: “In the

first quarter, we delivered strong financial results with share

gains, significant margin expansion and meaningful Adjusted EBITDA

growth to reach the highest first quarter Adjusted EBITDA in our

company's history. This puts us well on track to deliver against

our full-year guidance. Our recently announced agreement to acquire

CWT accelerates our ability to deliver long-term growth and value

creation for shareholders."

First Quarter 2024 Financial Summary

(in millions, except percentages;

unaudited)

Three Months Ended

YOY

March 31,

2024

2023

Total Transaction Value (TTV)

$

8,105

$

7,422

9

%

Transaction Growth

6

%

60

%

Revenue

$

610

$

578

6

%

Travel Revenue

$

492

$

467

5

%

Product and Professional Services

Revenue

$

118

$

111

7

%

Total operating expenses

$

594

$

587

1

%

Adjusted Operating Expenses

$

487

$

479

2

%

Net loss

$

(19

)

$

(27

)

$

8

Net loss margin

(3

)%

(5

)%

200bps

EBITDA

$

88

$

45

98

%

Adjusted EBITDA

$

123

$

99

24

%

Adjusted EBITDA Margin

20

%

17

%

300bps

Net cash provided by (used in) operating

activities

$

49

$

(77

)

$

126

Free Cash Flow

$

24

$

(109

)

$

133

Net Debt

$

888

$

1,035

Net Debt / LTM Adjusted EBITDA

2.2x

4.5x

Workday adjusted TTV, transaction and revenue year-over-year

growth was 10%, 7% and 7%, respectively1.

First Quarter 2024 Financial Highlights (Changes compared

to prior year period unless otherwise noted)

Revenue of $610 million increased $32 million, or 6%, in line

with the Company's expectations for the quarter. Within this,

Travel Revenue increased $25 million, or 5%, primarily due to

Transaction Growth partially offset by a small decline in yield.

Product and Professional Services Revenue increased $7 million, or

7%, primarily due to increased management fees and increased

product and consulting revenue. Total revenue yield (revenue / TTV)

declined modestly due to mix of non-TTV-driven revenue and higher

digital transactions.

Total operating expenses of $594 million increased $7 million,

or 1%. Increased cost of revenue to support transaction growth,

investments in technology and content and higher general and

administrative costs largely related to mergers & acquisitions

costs were significantly offset by cost savings initiatives and

productivity improvements, in addition to decreased restructuring

and integration charges.

Adjusted Operating Expenses of $487 million increased $8

million, or 2%.

Net loss was $19 million, an improvement of $8 million versus

net loss of $27 million in the same period in 2023, primarily due

to improvement in operating leverage from higher revenue and

favorable fair value movements on earnout derivative liabilities,

partially offset by higher provision for income taxes.

Adjusted EBITDA of $123 million increased $24 million, or 24%.

Revenue growth and operating leverage resulted in Adjusted EBITDA

margin expansion of 300bps to 20%.

Net cash provided by operating activities totaled $49 million,

an improvement of $126 million versus $77 million in cash used by

operating activities in the same period in 2023, due to favorable

net change in working capital primarily driven by the Egencia

working capital optimization program and timing of certain receipts

and payments.

Free Cash Flow totaled $24 million, an improvement of $133

million versus Free Cash Flow use of $109 million in the same

period in 2023, due to the increase in net cash provided by

operating activities and decreased use of cash for the purchase of

property and equipment.

Net Debt: As of March 31, 2024, total debt, net of unamortized

debt discount and debt issuance cost was $1,363 million, compared

to $1,362 million as of December 31, 2023. Net Debt was $888

million as of March 31, 2024, compared to $886 million as of

December 31, 2023. Leverage ratio was 2.2x as of March 31, 2024,

down from 2.3x as of December 31, 2023. The cash balance was $475

million as of March 31, 2024, compared to $476 million as of

December 31, 2023.

Reiterating Full-Year 2024 Guidance

Karen Williams, Amex GBT's Chief Financial Officer, stated:

"First quarter performance was in line with our expectations, and

we remain confident in delivering the strong profitability growth

we have guided to for the full year. We expect our continued focus

on productivity, margin expansion and cash flow acceleration will

drive full-year Adjusted EBITDA growth between 18% and 32% and Free

Cash Flow generation in excess of $100 million in 2024."

The guidance below does not incorporate the impact of the CWT

acquisition, which is expected to close in the second half of

2024.

Full-Year 2024

Guidance

Year-over-Year Growth

Revenue

$2.43B – $2.50B

+ 6% – 9%

Adjusted EBITDA

$450M – $500M

+ 18% – 32%

Adjusted EBITDA Margin

18% – 20%

+ ~150bps – 350bps

Free Cash Flow

> $100M

Please refer to the section below titled "Reconciliation of

Full-Year 2024 Adjusted EBITDA and Free Cash Flow Guidance" for a

description of certain assumptions and risks associated with this

guidance and reconciliation to GAAP.

Webcast Information

Amex GBT will host its first quarter 2024 investor conference

call today at 9:00 a.m. E.T. The live webcast and accompanying

slide presentation can be accessed on the Amex GBT Investor

Relations website at investors.amexglobalbusinesstravel.com. A

replay of the event will be available on the website for at least

90 days following the event.

Glossary of Terms

See the “Glossary of Terms” for the definitions of certain terms

used within this press release.

Non-GAAP Financial Measures

The Company refers to certain financial measures that are not

recognized under GAAP in this press release, including EBITDA,

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating

Expenses, Free Cash Flow and Net Debt. See “Non-GAAP Financial

Measures” below for an explanation of these non-GAAP financial

measures and “Tabular Reconciliations for Non-GAAP Financial

Measures” below for reconciliations of the non-GAAP financial

measures to the comparable GAAP measures.

About American Express Global Business Travel

American Express Global Business Travel is the world’s leading

B2B travel platform, providing software and services to manage

travel, expenses, and meetings & events for companies of all

sizes. We have built the most valuable marketplace in B2B travel to

deliver unrivalled choice, value and experiences. With travel

professionals in more than 140 countries, our customers and

travelers enjoy the powerful backing of American Express Global

Business Travel.

Visit amexglobalbusinesstravel.com for more information about

Amex GBT. Follow @amexgbt on X (formerly known as Twitter),

LinkedIn and Instagram.

GLOBAL BUSINESS TRAVEL GROUP,

INC. CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

Three months ended

March 31,

(in $ millions, except share and per

share data)

2024

2023

Revenue

$

610

$

578

Costs and expenses:

Cost of revenue (excluding depreciation

and amortization shown separately below)

245

242

Sales and marketing

99

103

Technology and content

108

101

General and administrative

86

72

Restructuring and other exit charges

9

23

Depreciation and amortization

47

46

Total operating expenses

594

587

Operating income (loss)

16

(9

)

Interest expense

(33

)

(34

)

Fair value movement on earnout derivative

liabilities

18

3

Other income, net

7

5

Income (loss) before income taxes

8

(35

)

(Provision for) benefit from income

taxes

(27

)

8

Net loss

(19

)

(27

)

Less: net loss attributable to

non-controlling interests in subsidiaries

—

(25

)

Net loss attributable to the Company’s

Class A common stockholders

$

(19

)

$

(2

)

Basic loss per share attributable to the

Company’s Class A common stockholders

$

(0.04

)

$

(0.03

)

Weighted average number of shares

outstanding - Basic

461,386,280

60,376,708

Diluted loss per share attributable to the

Company’s Class A common stockholders

$

(0.04

)

$

(0.06

)

Weighted average number of shares

outstanding - Diluted

461,386,280

454,825,189

GLOBAL BUSINESS TRAVEL GROUP,

INC. CONSOLIDATED BALANCE SHEETS

(in $ millions, except share and per

share data)

March 31, 2024

December 31,

2023

(Unaudited)

Assets

Current assets:

Cash and cash equivalents

$

475

$

476

Accounts receivable (net of allowance for

credit losses of $13 and $12 as of March 31, 2024 and December 31,

2023, respectively)

812

726

Due from affiliates

37

42

Prepaid expenses and other current

assets

152

116

Total current assets

1,476

1,360

Property and equipment, net

232

232

Equity method investments

13

14

Goodwill

1,206

1,212

Other intangible assets, net

528

552

Operating lease right-of-use assets

52

50

Deferred tax assets

264

281

Other non-current assets

64

50

Total assets

$

3,835

$

3,751

Liabilities and shareholders’

equity

Current liabilities:

Accounts payable

$

386

$

302

Due to affiliates

44

39

Accrued expenses and other current

liabilities

526

466

Current portion of operating lease

liabilities

18

17

Current portion of long-term debt

8

7

Total current liabilities

982

831

Long-term debt, net of unamortized debt

discount and debt issuance costs

1,355

1,355

Deferred tax liabilities

5

5

Pension liabilities

176

183

Long-term operating lease liabilities

56

55

Earnout derivative liabilities

59

77

Other non-current liabilities

28

33

Total liabilities

2,661

2,539

Commitments and Contingencies

Shareholders’ equity:

Class A common stock (par value $0.0001;

3,000,000,000 shares authorized; 472,617,208 shares and 467,092,817

shares issued and outstanding as of March 31, 2024 and December 31,

2023, respectively)

—

—

Additional paid-in capital

2,751

2,748

Accumulated deficit

(1,456

)

(1,437

)

Accumulated other comprehensive loss

(124

)

(103

)

Total equity of the Company’s

shareholders

1,171

1,208

Equity attributable to non-controlling

interest in subsidiaries

3

4

Total shareholders’ equity

1,174

1,212

Total liabilities and shareholders’

equity

$

3,835

$

3,751

GLOBAL BUSINESS TRAVEL GROUP,

INC. CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

Three months ended

March 31,

(in $ millions)

2024

2023

Operating activities:

Net loss

$

(19

)

$

(27

)

Adjustments to reconcile net loss to net

cash from (used in) operating activities:

Depreciation and amortization

47

46

Deferred tax charge (benefit)

17

(9

)

Equity-based compensation

18

19

Allowance for credit losses

4

6

Fair value movement on earnout derivative

liabilities

(18

)

(3

)

Other

(9

)

—

Changes in working capital:

Accounts receivable

(95

)

(163

)

Prepaid expenses and other current

assets

(43

)

(47

)

Due from affiliates

5

8

Due to affiliates

5

37

Accounts payable, accrued expenses and

other current liabilities

144

63

Defined benefit pension funding

(7

)

(7

)

Net cash from (used in) operating

activities

49

(77

)

Investing activities:

Purchase of property and equipment

(25

)

(32

)

Net cash used in investing activities

(25

)

(32

)

Financing activities:

Proceeds from senior secured term

loans

—

131

Repayment of senior secured term loans

(1

)

(1

)

Contributions for ESPP and proceeds from

exercise of stock options

4

1

Payment of taxes withheld on vesting of

equity awards

(12

)

(8

)

Repayment of finance lease obligations

—

(2

)

Payment of debt financing costs

—

(2

)

Other

(1

)

3

Net cash (used in) from financing

activities

(10

)

122

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(5

)

4

Net increase in cash, cash equivalents and

restricted cash

9

17

Cash, cash equivalents and restricted

cash, beginning of period

489

316

Cash, cash equivalents and restricted

cash, end of period

$

498

$

333

Supplemental cash flow information:

Cash (refund)/paid for income taxes,

net

$

(11

)

$

2

Cash paid for interest (net of interest

received)

$

34

$

33

Non-cash additions for operating lease

right-of-use assets

$

6

$

5

Glossary of Terms

B2B refers to business-to-business.

Customer retention rate is calculated based on Total

Transaction Value (TTV).

CWT refers to CWT Holdings, LLC.

LTM refers to the last twelve months ended March 31,

2024.

SME refers to clients Amex GBT considers

small-to-medium-sized enterprises (“SME”), which Amex GBT generally

defines as having an expected annual spend on air travel of less

than $20 million. This criterion can vary by country and client

needs.

SME New Wins Value is calculated using expected annual

average Total Transaction Value (TTV) over the contract term from

new SME client wins over the last twelve months.

Total New Wins Value is calculated using expected annual

average Total Transaction Value (TTV) over the contract term from

all new client wins over the last twelve months.

Total Transaction Value or TTV refers to the sum of the

total price paid by travelers for air, hotel, rail, car rental and

cruise bookings, including taxes and other charges applied by

suppliers at point of sale, less cancellations and refunds.

Transaction Growth (Decline) represents year-over-year

increase or decrease as a percentage of the total transactions,

including air, hotel, car rental, rail or other travel-related

transactions, recorded at the time of booking, and is calculated on

a net basis to exclude cancellations, refunds and exchanges. To

calculate year-over-year growth or decline, we compare the total

number of transactions in the comparative previous period/ year to

the total number of transactions in the current period/year in

percentage terms. For the three months ended March 31, 2024, we

have presented Transaction Growth (Decline) on a net basis to

exclude cancellations, refunds and exchanges as management believes

this better aligns Transaction Growth (Decline) with the way we

measure TTV and earn revenue. Prior period Transaction Growth

percentages have been recalculated and represented to conform to

current period presentation.

Yield is calculated as total revenue divided by Total

Transaction Value (TTV) for the same period.

Non-GAAP Financial Measures

We report our financial results in accordance with GAAP. Our

non-GAAP financial measures are provided in addition, and should

not be considered as an alternative, to other performance or

liquidity measures derived in accordance with GAAP. Non-GAAP

financial measures have limitations as analytical tools, and you

should not consider them either in isolation or as a substitute for

analyzing our results as reported under GAAP. In addition, because

not all companies use identical calculations, the presentations of

our non-GAAP financial measures may not be comparable to other

similarly titled measures of other companies and can differ

significantly from company to company.

Management believes that these non-GAAP financial measures

provide users of our financial information with useful supplemental

information that enables a better comparison of our performance or

liquidity across periods. In addition, we use certain of these

non-GAAP financial measures as performance measures as they are

important metrics used by management to evaluate and understand the

underlying operations and business trends, forecast future results

and determine future capital investment allocations. We also use

certain of our non-GAAP financial measures as indicators of our

ability to generate cash to meet our liquidity needs and to assist

our management in evaluating our financial flexibility, capital

structure and leverage. These non-GAAP financial measures

supplement comparable GAAP measures in the evaluation of the

effectiveness of our business strategies, to make budgeting

decisions, and/or to compare our performance and liquidity against

that of other peer companies using similar measures.

We define EBITDA as net income (loss) before interest income,

interest expense, gain (loss) on early extinguishment of debt,

benefit from (provision for) income taxes and depreciation and

amortization.

We define Adjusted EBITDA as net income (loss) before interest

income, interest expense, gain (loss) on early extinguishment of

debt, benefit from (provision for) income taxes and depreciation

and amortization and as further adjusted to exclude costs that

management believes are non-core to the underlying business of the

Company, consisting of restructuring, exit and related charges,

integration costs, costs related to mergers and acquisitions,

non-cash equity-based compensation and related employer taxes,

long-term incentive plan costs, certain corporate costs, fair value

movements on earnout derivative liabilities, foreign currency gains

(losses), non-service components of net periodic pension benefit

(costs) and gains (losses) on disposal of businesses.

We define Adjusted EBITDA Margin as Adjusted EBITDA divided by

revenue.

We define Adjusted Operating Expenses as total operating

expenses excluding depreciation and amortization and costs that

management believes are non-core to the underlying business of the

Company, consisting of restructuring, exit and related charges,

integration costs, costs related to mergers and acquisitions,

non-cash equity-based compensation and related employer taxes,

long-term incentive plan costs and certain corporate costs.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted

Operating Expenses are supplemental non-GAAP financial measures of

operating performance that do not represent and should not be

considered as alternatives to net income (loss) or total operating

expenses, as determined under GAAP. In addition, these measures may

not be comparable to similarly titled measures used by other

companies.

These non-GAAP measures have limitations as analytical tools,

and these measures should not be considered in isolation or as a

substitute for analysis of the Company’s results or expenses as

reported under GAAP. Some of these limitations are that these

measures do not reflect:

- changes in, or cash requirements for, our working capital needs

or contractual commitments;

- our interest expense, or the cash requirements to service

interest or principal payments on our indebtedness;

- our tax expense, or the cash requirements to pay our

taxes;

- recurring, non-cash expenses of depreciation and amortization

of property and equipment and definite-lived intangible assets and,

although these are non-cash expenses, the assets being depreciated

and amortized may have to be replaced in the future;

- the non-cash expense of stock-based compensation, which has

been, and will continue to be for the foreseeable future, an

important part of how we attract and retain our employees and a

significant recurring expense in our business;

- restructuring, mergers and acquisition and integration costs,

all of which are intrinsic of our acquisitive business model;

and

- impact on earnings or changes resulting from matters that are

non-core to our underlying business, as we believe they are not

indicative of our underlying operations.

EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted

Operating Expenses should not be considered as a measure of

liquidity or as a measure determining discretionary cash available

to us to reinvest in the growth of our business or as measures of

cash that will be available to us to meet our obligations.

We believe that the adjustments applied in presenting EBITDA,

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Operating

Expenses are appropriate to provide additional information to

investors about certain material non-cash and other items that

management believes are non-core to our underlying business.

We use these measures as performance measures as they are

important metrics used by management to evaluate and understand the

underlying operations and business trends, forecast future results

and determine future capital investment allocations. These non-GAAP

measures supplement comparable GAAP measures in the evaluation of

the effectiveness of our business strategies, to make budgeting

decisions, and to compare our performance against that of other

peer companies using similar measures. We also believe that EBITDA,

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Operating

Expenses are helpful supplemental measures to assist potential

investors and analysts in evaluating our operating results across

reporting periods on a consistent basis.

We define Free Cash Flow as net cash from (used in) operating

activities, less cash used for additions to property and

equipment.

We believe Free Cash Flow is an important measure of our

liquidity. This measure is a useful indicator of our ability to

generate cash to meet our liquidity demands. We use this measure to

conduct and evaluate our operating liquidity. We believe it

typically presents an alternate measure of cash flow since

purchases of property and equipment are a necessary component of

our ongoing operations and it provides useful information regarding

how cash provided by operating activities compares to the property

and equipment investments required to maintain and grow our

platform. We believe Free Cash Flow provides investors with an

understanding of how assets are performing and measures

management’s effectiveness in managing cash.

Free Cash Flow is a non-GAAP measure and may not be comparable

to similarly named measures used by other companies. This measure

has limitations in that it does not represent the total increase or

decrease in the cash balance for the period, nor does it represent

cash flow for discretionary expenditures. This measure should not

be considered as a measure of liquidity or cash flow from

operations as determined under GAAP. This measure is not a

measurement of our financial performance under GAAP and should not

be considered in isolation or as an alternative to net income

(loss) or any other performance measures derived in accordance with

GAAP or as an alternative to cash flow from operating activities as

a measure of liquidity.

We define Net Debt as total debt outstanding consisting of the

current and non-current portion of long-term debt, net of

unamortized debt discount and unamortized debt issuance costs,

minus cash and cash equivalents. Net Debt is a non-GAAP measure and

may not be comparable to similarly named measures used by other

companies. This measure is not a measurement of our indebtedness as

determined under GAAP and should not be considered in isolation or

as an alternative to assess our total debt or any other measures

derived in accordance with GAAP or as an alternative to total debt.

Management uses Net Debt to review our overall liquidity, financial

flexibility, capital structure and leverage. Further, we believe

that certain debt rating agencies, creditors and credit analysts

monitor our Net Debt as part of their assessment of our

business.

Tabular Reconciliations for Non-GAAP Measures

Reconciliation of net loss to EBITDA and Adjusted EBITDA:

Three months ended March

31,

(in $ millions)

2024

2023

Net loss

$

(19

)

$

(27

)

Interest expense

33

34

Provision for (benefit from) income

taxes

27

(8

)

Depreciation and amortization

47

46

EBITDA

88

45

Restructuring, exit and related charges

(a)

9

23

Integration costs (b)

6

8

Mergers and acquisitions (c)

19

—

Equity-based compensation and related

employer taxes (d)

22

19

Fair value movement on earnout derivative

liabilities (e)

(18

)

(3

)

Other adjustments, net (f)

(3

)

7

Adjusted EBITDA

$

123

$

99

Net loss margin

(3

)%

(5

)%

Adjusted EBITDA Margin

20

%

17

%

Reconciliation of total operating expenses to Adjusted Operating

Expenses:

Three months ended March

31,

(in $ millions)

2024

2023

Total operating expenses

$

594

$

587

Adjustments:

Depreciation and amortization

(47

)

(46

)

Restructuring, exit and related charges

(a)

(9

)

(23

)

Integration costs (b)

(6

)

(8

)

Mergers and acquisitions (c)

(19

)

—

Equity-based compensation and related

employer taxes (d)

(22

)

(19

)

Other adjustments, net (f)

(4

)

(12

)

Adjusted Operating Expenses

$

487

$

479

a)

Represents employee severance

costs.

b)

Represents expenses related to

the integration of businesses acquired.

c)

Represents expenses related to

business acquisitions, including potential business acquisitions,

and includes pre-acquisition due diligence and related activities

costs.

d)

Represents non-cash equity-based

compensation expense and employer taxes paid related to equity

incentive awards to certain employees.

e)

Represents fair value movements

on earnout derivative liabilities during the periods.

f)

Adjusted Operating Expenses

excludes (i) long-term incentive plan expense of $3 million and $7

million for the three months ended March 31, 2024 and 2023,

respectively, and (ii) legal and professional services costs of $1

million and $5 million for the three months ended March 31, 2024

and 2023, respectively. Adjusted EBITDA additionally excludes (i)

unrealized foreign exchange gains of $8 million and $6 million for

the three months ended March 31, 2024 and 2023, respectively, and

(ii) non-service component of our net periodic pension cost related

to our defined benefit pension plans of $1 million and $1 million

for the three months ended March 31, 2024 and 2023,

respectively.

Reconciliation of net cash from (used in) operating activities

to Free Cash Flow:

Three months ended March

31,

($ in millions)

2024

2023

Net cash from (used in) operating

activities

$

49

$

(77

)

Less: Purchase of property and

equipment

(25

)

(32

)

Free Cash Flow

$

24

$

(109

)

Reconciliation of Net Debt:

As of

(in $ millions)

March 31, 2024

December 31, 2023

March 31, 2023

Current portion of long-term debt

$

8

$

7

$

4

Long-term debt, net of unamortized debt

discount and debt issuance costs

1,355

1,355

1,351

Total debt, net of unamortized debt

discount and debt issuance costs

1,363

1,362

1,355

Less: Cash and cash equivalents

(475

)

(476

)

(320

)

Net Debt

$

888

$

886

$

1,035

LTM Adjusted EBITDA

$

404

$

380

$

230

Net Debt / LTM Adjusted EBITDA

2.2x

2.3x

4.5x

Reconciliation of Full-Year 2024 Adjusted EBITDA and Free

Cash Flow Guidance

The Company’s full-year 2024 guidance considers various material

assumptions. Because the guidance is forward-looking and reflects

numerous estimates and assumptions with respect to future industry

performance under various scenarios as well as assumptions for

competition, general business, economic, market and financial

conditions and matters specific to the business of Amex GBT, all of

which are difficult to predict and many of which are beyond the

control of Amex GBT, actual results may differ materially from the

guidance due to a number of factors, including the ultimate

inaccuracy of any of the assumptions described above and the risks

and other factors discussed in the section entitled

“Forward-Looking Statements” below and the risk factors in the

Company’s SEC filings.

The guidance below does not incorporate the impact of the CWT

acquisition, which is expected to close in the second half of

2024.

Adjusted EBITDA guidance for the year ending December 31, 2024

consists of expected net loss for the year ending December 31,

2024, adjusted for: (i) interest expense of approximately $120-125

million; (ii) income taxes of approximately $60 million - $70

million; (iii) depreciation and amortization of property and

equipment of approximately $180-185 million; (iv) restructuring

costs of approximately $30-35 million; (v) integration expenses and

costs related to mergers and acquisitions of approximately $30-35

million; (vi) non-cash equity-based compensation of approximately

$80-85 million, and; (vii) other adjustments, including long-term

incentive plan costs, legal and professional services costs,

non-service component of our net periodic pension benefit (cost)

related to our defined benefit pension plans and foreign exchange

gains and losses of approximately $20 million. We are unable to

reconcile Adjusted EBITDA to net income (loss) determined under

U.S. GAAP due to the unavailability of information required to

reasonably predict certain reconciling items such as impairment of

long-lived assets and right-of-use assets, fair value movement on

earnout derivative liabilities and/or loss on early extinguishment

of debt and the related tax impact of these adjustments. The exact

amount of these adjustments is not currently determinable but may

be significant.

Free Cash Flow guidance for the year ending December 31, 2024

consists of expected net cash from operating activities of greater

than $230-250 million less capitalized expenditures of

approximately $130-150 million.

Forward-Looking Statements

This release contains statements that are forward-looking and as

such are not historical facts. This includes, without limitation,

statements regarding our financial position, business strategy, the

plans and objectives of management for future operations and fourth

quarter and full-year guidance. These statements constitute

projections, forecasts and forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “will,” “would” and

similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not

forward-looking.

The forward-looking statements contained in this release are

based on our current expectations and beliefs concerning future

developments and their potential effects on us. There can be no

assurance that future developments affecting us will be those that

we have anticipated. These forward-looking statements involve a

number of risks, uncertainties (some of which are beyond our

control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements. These risks and

uncertainties include, but are not limited to, the following risks,

uncertainties and other factors: (1) changes to projected financial

information or our ability to achieve our anticipated growth rate

and execute on industry opportunities; (2) our ability to maintain

our existing relationships with customers and suppliers and to

compete with existing and new competitors; (3) various conflicts of

interest that could arise among us, affiliates and investors; (4)

our success in retaining or recruiting, or changes required in, our

officers, key employees or directors; (5) factors relating to our

business, operations and financial performance, including market

conditions and global and economic factors beyond our control; (6)

the impact of geopolitical conflicts, including the war in Ukraine

and the conflicts in the Middle East, as well as related changes in

base interest rates, inflation and significant market volatility on

our business, the travel industry, travel trends and the global

economy generally; (7) the sufficiency of our cash, cash

equivalents and investments to meet our liquidity needs; (8) the

effect of a prolonged or substantial decrease in global travel on

the global travel industry; (9) political, social and macroeconomic

conditions (including the widespread adoption of teleconference and

virtual meeting technologies which could reduce the number of

in-person business meetings and demand for travel and our

services); (10) the effect of legal, tax and regulatory changes;

(11) the impact of any future acquisitions including the

integration of any acquisition and (12) other risks and

uncertainties described in the Company’s Form 10-K, filed with the

SEC on March 13, 2024, and in the Company’s other SEC filings.

Should one or more of these risks or uncertainties materialize, or

should any of our assumptions prove incorrect, actual results may

vary in material respects from those projected in these

forward-looking statements. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

Disclaimer

An investment in Global Business Travel Group, Inc. is not an

investment in American Express. American Express shall not be

responsible in any manner whatsoever for, and in respect of, the

statements herein, all of which are made solely by Global Business

Travel Group, Inc.

______________________ A reconciliation of non-GAAP financial

measures to the most comparable GAAP measures is provided at the

end of this release. 1There were 62.5 average workdays in Q1 2024

compared to 63.2 average workdays in Q1 2023; percentages are

adjusted to reflect growth metrics assuming 62.5 workdays in each

period. 2Leverage ratio is calculated as Net Debt / LTM Adjusted

EBITDA and is different than leverage ratio defined in our senior

secured credit agreement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507465669/en/

Media: Martin Ferguson Vice President Global Communications and

Public Affairs martin.ferguson@amexgbt.com

Investors: Jennifer Thorington Vice President Investor Relations

investor@amexgbt.com

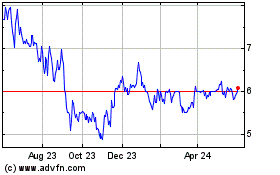

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

From Nov 2024 to Dec 2024

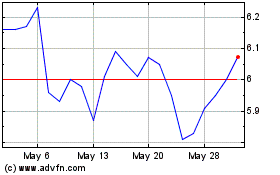

Global Business Travel (NYSE:GBTG)

Historical Stock Chart

From Dec 2023 to Dec 2024