Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 May 2024 - 8:05PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of May, 2024

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: May 2, 2024 |

|

|

|

By: |

|

/s/ Santosh Haldankar |

|

|

|

|

Name: Santosh Haldankar |

|

|

|

|

Title: Company Secretary |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Disclosure

Exhibit 99

May 2, 2024

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir/ Madam,

Sub: Disclosure

It is hereby informed that the penalties as given below has been imposed on the Bank. The details as required to be provided as per sub-para 20 of Para A of Part A of Schedule III of SEBI LODR Regulations are included in the Annexures:

| |

1. |

Penalty of Rs. 0.02 crore has been imposed on the Bank by Additional Commissioner – Customs &

Central Tax, Telangana (Details provided in Annexure 1) |

| |

2. |

Penalty of Rs. 0.98 crore has been imposed on the Bank by Deputy Commissioner of State Tax, Maharashtra

(Details provided in Annexure 2) |

| |

3. |

Penalty of Rs. 0.003 crore has been imposed on the Bank by Deputy Commissioner of State Tax, Assam (Details

provided in Annexure 3) |

The Bank is evaluating appropriate legal remedy, including appeal, as per law.

Yours faithfully,

For HDFC Bank Limited

Sd/-

Santosh Haldankar

Company Secretary

Annexure 1

Details as required to be provided as per sub-para 20 of Para A of Part A of Schedule III of SEBI LODR Regulations

w.r.t. Penalty of Rs. 0.02 crore has been imposed on the Bank by Additional Commissioner – Customs & Central Tax, Telangana

|

|

|

|

|

Sr.

no |

|

Particulars |

|

Details |

| 1. |

|

Name of the authority |

|

Additional Commissioner - Customs & Central Tax, Telangana |

| 2. |

|

Period Involved |

|

F.Y. 2018-19 |

| 3. |

|

Nature and details of the action(s) taken, initiated or order(s) passed |

|

Alleged excess availment of input tax credit - Order passed under section 73 (9) of CGST Act |

| 4. |

|

Date of receipt of direction or order, including any ad-interim or interim orders, or any other communication from the authority. |

|

29-04-2024 |

| 5. |

|

Details of the violation(s)/contravention(s) committed or alleged to be committed |

|

Alleged excess availment of input tax credit |

| 6. |

|

Impact on financial, operation or other activities of the listed entity, quantifiable in monetary terms to the extent possible |

|

Rs. 0.25 crore (includes tax and penalty) |

Annexure 2

Details as required to be provided as per sub-para 20 of Para A of Part A of Schedule III of SEBI LODR Regulations

w.r.t. Penalty of Rs. 0.98 crore has been imposed on the Bank by Deputy Commissioner of State Tax, Maharashtra

|

|

|

|

|

Sr.

no |

|

Particulars |

|

Details |

| 1. |

|

Name of the authority |

|

Deputy Commissioner of State Tax, Maharashtra |

| 2. |

|

Period Involved |

|

F.Y. 2018-19 |

| 3. |

|

Nature and details of the action(s) taken, initiated or order(s) passed |

|

Alleged short payment of Tax and disallowance of input tax credit - Order passed under section 73 (9) of

CGST Act |

| 4. |

|

Date of receipt of direction or order, including any ad-interim or interim orders, or any other communication from the authority. |

|

29-04-2024 |

| 5. |

|

Details of the violation(s)/contravention(s) committed or alleged to be committed |

|

Alleged short payment of tax and excess availment of input tax credit |

| 6. |

|

Impact on financial, operation or other activities of the listed entity, quantifiable in monetary terms to the extent possible |

|

Rs. 16.75 crore (includes tax, interest and penalty) |

Annexure 3

Details as required to be provided as per sub-para 20 of Para A of Part A of Schedule III of SEBI LODR Regulations

w.r.t. Penalty of Rs. 0.003 crore has been imposed on the Bank by Deputy Commissioner of State Tax, Assam

|

|

|

|

|

Sr.

no |

|

Particulars |

|

Details |

| 1. |

|

Name of the authority |

|

Deputy Commissioner of State Tax, Assam |

| 2. |

|

Period Involved |

|

F.Y. 2018-19 |

| 3. |

|

Nature and details of the action(s) taken, initiated or order(s) passed |

|

Alleged excess availment of input tax credit - Order passed under section 73(9) of CGST Act |

| 4. |

|

Date of receipt of direction or order, including any ad-interim or interim orders, or any other communication from the authority. |

|

30-04-2024 |

| 5. |

|

Details of the violation(s)/contravention(s) committed or alleged to be committed |

|

Alleged excess availment of input tax credit |

| 6. |

|

Impact on financial, operation or other activities of the listed entity, quantifiable in monetary terms to the extent possible |

|

Rs. 0.03 crore (includes tax, interest and penalty) |

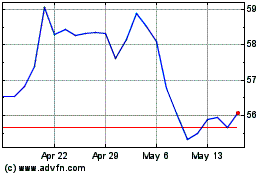

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Apr 2024 to May 2024

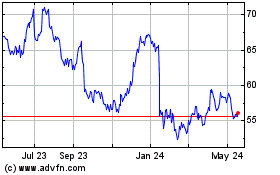

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From May 2023 to May 2024