Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

01 June 2024 - 1:59AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under the

Securities Exchange Act of 1934

For the month of May, 2024

Commission File Number 001-15216

HDFC BANK LIMITED

(Translation of registrant’s name into English)

HDFC Bank House, Senapati Bapat Marg,

Lower Parel, Mumbai. 400 013, India

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HDFC BANK LIMITED |

|

|

|

|

(Registrant) |

|

|

|

|

| Date: May 31, 2024 |

|

|

|

By: |

|

/s/ Santosh Haldankar |

|

|

|

|

Name: |

|

Santosh Haldankar |

|

|

|

|

Title: |

|

Company Secretary |

EXHIBIT INDEX

The following documents (bearing the exhibit number listed below) are furnished herewith and are made a part of this report pursuant to the General

Instructions for Form 6-K.

Exhibit No. 99

Description

Disclosure – Investment in Truboard

Technologies Private Limited

Exhibit 99

May 31, 2024

New York Stock Exchange

11, Wall Street,

New York,

NY 10005

USA

Dear Sir/ Madam,

Sub: Disclosure – Investment in

Truboard Technologies Private Limited

With reference to the captioned subject, we would like to inform you that HDFC Capital Advisors Limited

(“HCAL”), a subsidiary of the HDFC Bank Limited, has entered into a Share Subscription Agreement for acquisition of 1,043 Equity Shares of TruBoard which post allotment, would entitle HCAL to 8.5% of the equity share capital of TruBoard on

a fully diluted basis.

|

|

|

|

|

| a. |

|

Name of the

target entity, details in brief as size, turnover etc. |

|

Truboard Technologies Private Limited

Turnover of TruBoard:

FY 21-22 – NIL* FY

22-23 – NIL* FY 23-24 – NIL*

* did not commence its operations |

| b. |

|

Whether the acquisition would fall within related party transaction(s) and

whether the promoter/ promoter group/ group companies have any interest in the entity being acquired? If yes, nature of interest and details thereof and whether the same is done at “arm’s length” |

|

This is not a related party transaction for HCAL or HDFC Bank

Limited. HDFC Bank Limited is a promoter of HCAL and does not

have any interest in TruBoard. |

| c. |

|

Industry to

which the entity being acquired belongs |

|

Technology solutions for the real estate sector |

| d. |

|

Objects and effects of acquisition (including but not limited to, disclosure of

reasons for acquisition of target entity, if its business is outside the main line of business of the listed entity) |

|

Investment in TruBoard is proposed to be made by HCAL under

its H@ART initiative programme to invest in technology companies for the benefit of the real estate ecosystem. A binding share subscription agreement in relation to such proposed investment has been entered into by HCAL on May 30,

2024. |

| e. |

|

Brief details of any governmental or regulatory

approvals required for the acquisition |

|

Not applicable |

| f. |

|

Indicative time

period for completion of the acquisition |

|

Till 7th June 2024 |

| g. |

|

Nature of consideration – whether cash

consideration or share swap and details of the same |

|

Cash |

| h. |

|

Cost of acquisition or the price at which the

shares are acquired |

|

~INR 698.77 per Equity

Shares Total Consideration: INR 7,28,817/- |

| i. |

|

Percentage of shareholding / control acquired

and / or number of shares acquired |

|

Upon completion, shareholding

of HCAL in TruBoard shall be as follows on a fully diluted basis (assuming no other investments/ changes to share capital of TruBoard or other corporate action in the interim):

• No. of Equity Shares – 1,043

• Percentage (%) –

8.5% |

|

|

|

|

|

| j. |

|

Brief background

about the entity acquired in terms of products/line of business acquired, date of incorporation, history of last 3 years turnover, country in which the acquired entity has presence and any other significant information (in brief) |

|

• Incorporated in 2021 in Mumbai, India

• Engaged in the business of providing technology led service solutions,

including Software-as-a-Service (SaaS) through project management, consultancy & advisory, due diligence, compliance management, project performance (financial and non-financial) monitoring, project management, and other services to developers

and investors in the real estate sector.

• TruBoard has presence only in India

• Turnover details of TruBoard are set out below:

FY 21-22 – NIL

FY 22-23 – NIL

FY 23-24 – NIL |

The aforesaid disclosure is made on a voluntary basis. You are requested to take note of the above

Yours faithfully,

For HDFC Bank Limited

Sd/-

Santosh Haldankar

Company Secretary

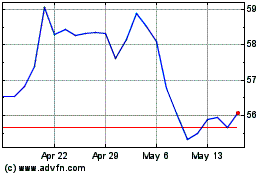

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From May 2024 to Jun 2024

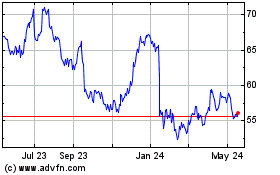

HDFC Bank (NYSE:HDB)

Historical Stock Chart

From Jun 2023 to Jun 2024