Horace Mann Reports Results for Fourth Quarter and Year

SPRINGFIELD, Ill., Feb. 17 /PRNewswire-FirstCall/ -- Horace Mann

Educators Corporation today reported net income of $23.1 million

(54 cents per share) and $19.0 million (44 cents per share) for the

three and twelve months ended December 31, 2003, respectively,

including adverse development and strengthening of prior years'

property and casualty reserves as well as a significant level of

catastrophe losses. These results compare to net income of $13.5

million (33 cents per share) and $11.3 million (28 cents per share)

for the same periods in 2002. Included in current year net income

were net realized gains on securities of $20.8 million ($13.5

million after tax, or 32 cents per share) and$25.5 million ($16.6

million after tax, or 38 cents per share) for the fourth quarter

and twelve months of 2003, compared to net realized gains of $2.5

million ($1.6 million after tax, or 4 cents per share) and net

realized losses of $49.4 million ($32.2 million after tax, or 77

cents per share) for the comparable periods a year earlier. In

2002, net income also included charges for restructuring, debt

retirement and class action litigation which totaled $0.8 million

($0.5 million after tax, or 1 cent per share) and $8.1 million

($5.2 million after tax, or 13 cents per share) for the three and

twelve months, respectively. All per-share amounts are stated on a

diluted basis. The company's earnings for the quarter ended

December 31, 2003 were negatively affected by $12.1 million pretax,

approximately 18 cents per share, of adverse development and

strengthening of prior years' property and casualty claims

reserves, which primarily related to voluntary automobile liability

claims. Total property and casualty reserves were $320.9 million as

of December 31, 2003. The independent property and casualty

actuarial and claims consultants from Deloitte & Touche

recently completed the previously announced review of the company's

claims operations and reserving processes. This included a review

of claims files and claim handling processes and procedures

(including case reserving) and the process for establishing

supplemental and IBNR reserves. In addition, Deloitte was engaged

to perform the independent property and casualty claims reserve

study for December 31, 2003. "The in-depth review conducted by

Deloitte and the additional insights it has provided regarding

recent adverse property and casualty reserve development have been

incorporated intothe establishment of year-end reserves," stated

Louis G. Lower II, President and Chief Executive Officer. "Reserve

levels at December 31, 2003 are consistent with Deloitte's point

estimates with the exception of voluntary automobile liability

reserves which were recorded toward the high end of their range to

improve our confidence in the property and casualty reserve levels

going into 2004." As previously announced, the company's earnings

for the quarter ended December 31, 2003 were also negatively

affected by catastrophe losses. Total catastrophe losses were 21

cents per share for the quarter, due primarily to the California

wildfires, compared to losses of 9 cents per share in the fourth

quarter of 2002. These negative prior year comparisons were

partially offset by the impact of property and casualty rate

increases on earned premiums and favorable property loss results

excluding the impact of catastrophes. "Our underlying 2003 results

support a preliminary full year 2004 estimate of net income before

realized investment gains and losses of between $1.20 and $1.30 per

share," said Lower. "This projection anticipates improvement in the

property and casualty statutory combined ratio and stabilization of

operating results in the annuity and life segments." Results of

Operations The company's core lines premiums written and contract

deposits increased 9 and 8 percent compared to the fourth quarter

and twelve months of 2002, respectively, resulting from rate

increases in the property and automobile lines and notable growth

in new annuity deposits in both the third and fourth quarters.

Horace Mann's career agency force totaled 888 agents at December

31, 2003. "While the number of agents declined compared to a year

ago, average agent productivity increased for both the fourth

quarter and the year. We have implemented additional programs to

continue development of a high quality agency force and improve

retention of productive agents," Lower said. "Total sales increased

25 percent and 15 percent for the quarter and full year,

respectively, compared to the prior year. While also benefitting

from strong life and homeowner insurance sales, this increase was

primarily driven by growth in new annuity deposits. The combination

of our independent and career agent channels produced growth of 34

percent in annuity sales for the quarter and 22 percent for the

year." Property and Casualty Written premiums for voluntary

property and casualty insurance increased 6 percent and 7 percent

in the current quarter and twelve months, respectively. On an

annual basis, the growth was a result of increases in average

written premium per policy of approximately 5 percent for

automobile and 12 percent for homeowners. The number of automobile

policies in force decreased slightly compared to a year earlier,

and homeowners policies in force decreased by 2 percent. In the

current periods, involuntary automobile and involuntary property

premiums were negatively impacted by adjustments to anticipated

premiums from state reinsurance facilities. For the fourth quarter

of 2003, property and casualty segment net income was $2.2 million,

compared to $3.8 million for the same period in 2002. Horace Mann's

property and casualty statutory combined ratio was 111.5 percent

for the fourth quarter of 2003, compared to 104.8 percent a year

earlier. For the year, the property and casualty segment recorded a

net loss of $17.8 million and the combined ratio was 111.5 percent,

compared to net income of $19.9 million and a combined ratio of

103.6 percent a year earlier. In 2002, the combined ratio reflected

the impact of restructuring charges, which represented 0.8

percentage points for the year, as well as class action litigation

charges, which represented 0.3 percentage points for the twelve

months. The property and casualty statutory expense ratio of 23.2

percent for the full year 2003 was 1 percentage point lower than a

year earlier, primarily as a result of the non-recurring charge

related to the restructure of the property and casualty claims

operation recorded in 2002. The 2003 property and casualty results

included adverse prior years' loss reserve development representing

8.8 percentage points of the combined ratio, or $12.1 million

pretax, in the fourth quarter and 10.5 percentage points, or $56.4

million pretax, for the full year. In 2002, development of prior

years' reserves decreased property and casualty pretax earnings

$15.2 million and $24.0 million for the fourth quarter and full

year, respectively. Compared to the prior year, the higher level of

2003 wildfire and weather-related catastrophe losses represented an

increase in the combined ratio of approximately 6 and 4 percentage

points for the quarter and year, respectively. Fourth quarter 2003

catastrophe losses of $14.0 million pretax were $8.1 million

greater than the same period a year earlier. Homeowner claims from

the California wildfires, net of anticipated reinsurance

recoveries, represented $12.0 million of the currentquarter's

losses. For the full year, catastrophe losses in 2003 were $21.3

million greater than in 2002. The voluntary automobile statutory

loss ratio for the fourth quarter of 2003 was 93.0 percent, an

increase of 15.4 percentage points compared to 77.6 percent for the

same period in 2002. The current period included 13.7 percentage

points due to adverse development of prior years' reserves,

compared to a 10.7 percentage point impact in the prior year. For

full year 2003, the voluntary automobile statutory loss ratio was

89.7 percent and included 14.5 percentage points of adverse prior

years' development, compared to a 2002 loss ratio of 77.0 percent

including 4.1 percentage points of adverse prior years'

development. The property statutory loss ratio of 82.6 percent for

the full year increased 1.6 percentage points compared to 2002 in

spite of a 13.1 percentage point increase attributable to higher

catastrophe losses in the current year. For full year 2003, the

property statutory combined ratio excluding catastrophes of 84.5

percent improved 11.9 percentage points compared to the prior year,

due primarily to the favorable results in the current quarter.

Annuity New annuity deposits in the fourth quarter increased 18

percent over the prior year. The full year growth of 13 percent

primarily reflected a 46 percent increase in new single premium and

rollover deposits. New scheduled annuity deposits decreased 4

percent compared to the full year 2002. During 2003, the retention

ratio forfixed and variable accumulated annuity deposits remained

strong -- in the mid-90s -- and the number of annuity contracts

outstanding increased 4 percent compared to December 31, 2002. New

annuity sales by Horace Mann agents increased 1 percent and 4

percent in the quarter and year, respectively, compared to the same

periods in 2002. Primarily driven by Horace Mann's independent

agent distribution initiative, total annuity sales increased 34

percent for the quarter and 22 percent for the full year. Annuity

production from independent agents has shown steady sequential

growth for each quarter in 2003, particularly in the last six

months. "In 2004, we will continue to leverage the independent

agent channel as a key source for growth in our annuity business,

but with greater emphasis on variable deposits to improve overall

returns in this low interest rate environment," Lower commented.

Annuity segment net income was $5.7 million for the fourth quarter

of 2003, an increase of 21 percent compared to the same period in

2002, while full year net income was $14.4 million in 2003 versus

$17.0 million a year earlier. On a pretax basis, fourth quarter

2003 income increased $0.3 million compared to 2002 while full year

pretax income decreased $3.4 million versus prior year. Current

period earnings were adversely impacted by a reduction in the

pretax net interest margin of $0.7 million for the quarter and $6.2

million for the year, reflecting spread compression due to lower

investment income. Valuation of annuity segment deferred

acquisition costs and value of acquired insurance in force at

December 31, 2003 increased pretax income by $1.3 million and $2.6

million for the current quarter and year, respectively, compared to

similar valuations a year earlier. Changes in reserves for

guaranteed minimum death benefits (GMDB) in 2003 increased pretax

income by $0.2 million and $1.2 million in the fourth quarter and

full year, respectively, compared to the changes recorded for the

same periods in 2002. For the current quarter and year, fee income

related to variable annuity deposits increased $0.7 million and

$0.4 million, respectively, compared to 2002, due primarily to

favorable equity market performance. Life Life segment insurance

premiums and contract deposits for the quarter and year decreased

slightly compared to the same periods in 2002. Life policies in

force declined while the amount of insurance in force increased

during 2003. Life segment net income of $3.8 million for the

quarter and $13.4 million for the year declined $1.6 million and

$5.5 million compared to the respective periods in 2002, primarily

reflecting a decline in investment income and an increase in

mortality costs. Valuation of life segment deferred acquisition

costs at December 31, 2003 increased pretax income by $1.9 million

and $1.0 million in the current quarter and year, respectively,

compared to a similar valuation in 2002. Realized Investment Gains

and Losses In 2003, pretax realized investment gains were $20.8

million and $25.5 million for the quarter and year, respectively.

In the current quarter, impairment of one security in the amount of

$3.2 million pretax was more than offset by gains from portfolio

transactions. Gains realized in the quarter included $12.9 million

pretax from sales of securities impaired in 2002. For the year

ended December 31, 2003, impairment charges totaled $12.5 million

pretax. In 2002, the company recorded impairment charges, largely

related to fixed income securities of companies in the

communications sector, which represented the primary component of

the $49.4 million pretax realized investment losses for the year.

Horace Mann -- the largest national multiline insurance company

focusing on educators' financialneeds -- provides retirement

annuities, life insurance, property/casualty insurance, and other

financial solutions. Founded by educators for educators in 1945,

the company is headquartered in Springfield, Ill. Horace Mann is

publicly traded on the NewYork Stock Exchange as HMN. For more

information, visit http://www.horacemann.com/ . Statements included

in this news release that are not historical in nature are

forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995 and are subject to certain risks and

uncertainties. Horace Mann undertakes no obligation to publicly

update or revise any forward-looking statements, whether as the

result of new information, future events or otherwise. Information

concerning factors that could cause actual results to differ

materially from those in forward-looking statements is contained

from time to time in the company's public filings with the

Securities and Exchange Commission. HORACE MANN EDUCATORS

CORPORATION Digest of Earnings and Highlights (Dollars in Millions,

Except Per Share Data) Quarter Ended Year Ended December 31,

December 31, 2003 2002 % Change 2003 2002 % Change DIGEST OF

EARNINGS Net income $23.1 $13.5 71.1% $19.0 $11.3 68.1% Net income

per share: Basic $0.54 $0.33 63.6% $0.44 $0.28 57.1% Diluted $0.54

$0.33 63.6% $0.44 $0.28 57.1% Weighted average number of shares and

equivalent shares: Basic 42.7 41.3 42.7 40.9 Diluted 42.9 41.5 42.9

41.2 HIGHLIGHTS Operations Insurance premiums written and contract

deposits Core lines $254.2 $233.8 8.7% $958.2 $887.6 8.0% Total

249.8 236.3 5.7% 955.5 899.3 6.2% Return on equity (A) 3.5% 2.4%

Property & Casualty statutory combined ratio (B) 111.5% 104.8%

111.5% 103.6% Property & Casualty statutory combined ratio

before catastrophes (B) 101.3% 100.3% 105.3% 101.3% Experienced

agents 510 527 -3.2% Financed agents 378 395 -4.3% Total agents 888

922 -3.7% Additional Per Share Information Dividends paid $0.105

$0.105 - $0.42 $0.42 - Book value (C) $12.42 $12.390.2% Financial

Position Total assets $4,983.6 $4,512.3 10.4% Short-term debt $25.0

- Long-term debt 144.7 144.7 Total shareholders' equity 530.5 528.8

0.3% (A) Based on 12-month net income and average quarter-end

shareholders' equity. (B) Consistent with management's evaluation

of the property and casualty operations, the combined ratio, which

is the sum of the loss ratio and the expense ratio is computed

based on financial information prepared in accordance with

statutory accounting principles and as reported to state insurance

departments. Expenses are divided by net written premiums.

Statutory expenses differ from GAAP expenses primarily with regard

to policy acquisition costs, which are not deferred and amortized

for statutory purposes, but ratherrecognized as incurred. The sum

of losses and loss adjustment expenses incurred is divided by net

earned premiums. Property and casualty statutory net written

premiums and net earned premiums differ from the comparable GAAP

amounts primarily with regard to the classification of certain

service fees and escrowed amounts. (C) Before the market value

adjustment for investments, book value per share was $10.51 at

December 31, 2003 and $10.50 at December 31, 2002. Ending shares

outstanding were 42,721,940 at December 31, 2003 and 42,691,244 at

December 31, 2002. -1- HORACE MANN EDUCATORS CORPORATION Statements

of Operations (Dollars in Millions, Except Per Share Data) Quarter

Ended Year Ended December 31, December 31, 2003 2002 % Change 2003

2002 % Change STATEMENTS OF OPERATIONS Insurance premiums written

and contract deposits (A) $249.8 $236.3 5.7% $955.5 $899.3 6.2%

Insurance premiums and contract charges earned (A) $165.5 $159.7

3.6% $643.5 $625.2 2.9% Net investment income 46.2 48.4 -4.5% 184.7

196.0 -5.8% Realized investment gains (losses) 20.8 2.5 25.5 (49.4)

Total revenues 232.5 210.6 10.4% 853.7 771.8 10.6% Benefits, claims

and settlement expenses 130.4 112.7 519.0 450.9 Interest credited

26.2 25.3 103.0 98.4 Policy acquisition expenses amortized 14.0

15.5 64.3 61.3 Operating expenses 38.1 34.9 9.2% 137.3 131.2 4.6%

Amortization of intangible assets 0.2 1.1 5.0 5.7 Interest expense

1.6 1.8 6.3 8.5 Restructuring charges (adjustments) - - (0.4) 4.2

Debt retirement costs - 0.8 - 2.3 Litigation charges - - - 1.6

Total benefits, losses and expenses 210.5 192.1 9.6% 834.5 764.1

9.2% Income before income taxes 22.0 18.5 18.9% 19.2 7.7 149.4%

Income tax expense (benefit) (1.1) 5.0 0.2 (3.6) Net income $23.1

$13.5 71.1% $19.0 $11.3 68.1% (A) Effective December 31, 2001,

Horace Mann ceased writing automobile insurance policies in

Massachusetts. See footnote (A) on page 3 for quantification. -2-

HORACE MANN EDUCATORS CORPORATION Supplemental GAAP Consolidated

Data (Dollars in Millions) Quarter Ended Year Ended December 31,

December 31, 2003 2002 % Change 2003 2002 % Change Analysis of

Premiums Written and Contract Deposits Automobile and property

(voluntary) (A) $139.0 $131.1 6.0% $549.2 $513.2 7.0% Annuity

deposits 84.3 71.3 18.2% 296.6 261.5 13.4% Life 30.9 31.4 -1.6%

112.4 112.9 -0.4% Subtotal -core lines 254.2 233.8 8.7% 958.2 887.6

8.0% Involuntary and other property & casualty (A) (4.4) 2.5

(2.7) 11.7 Total (A) 249.8 236.3 5.7% 955.5 899.3 6.2% Total,

excluding Massachusetts automobile (A) 249.8 236.5 5.6% 955.5 898.1

6.4% Analysis of Net Income Property & Casualty Before

catastrophes $11.4 $7.7 48.1% $3.8 $27.7 -86.3% Catastrophe losses,

after tax (9.2) (3.9) (21.6) (7.8) Total Property & Casualty

2.2 3.8 -42.1% (17.8) 19.9 Annuity 5.7 4.7 21.3% 14.4 17.0 -15.3%

Life 3.8 5.4 -29.6% 13.4 18.9 -29.1% Corporate and other (B) 11.4

(0.4) 9.0 (44.5) Net income 23.1 13.5 71.1% 19.0 11.3 68.1% (A)

Effective December 31, 2001,Horace Mann ceased writing automobile

insurance policies in Massachusetts. This business represented the

following amounts for the periods indicated: Premiums written

Voluntary automobile and core lines - - - - Total - ($0.2) - $1.2

Premiums earned Voluntary automobile and core lines - 0.6 - 9.9

Total - 1.3 $0.2 15.6 Policies in force (in thousands) Voluntary

automobile - - (B) The Corporate and Other segment includes

interest expense on debt and the impact of realized investment

gains and losses and other reconciling items to net income. The

Company does not allocate the impact of corporate level

transactions to the insurance segments consistent with management's

evaluation of the results of those segments. See detail for this

segment on page 5. -3- HORACE MANN EDUCATORS CORPORATION

Supplemental Business Segment Overview (Dollars in Millions)

Quarter Ended Year Ended December 31, December 31, 2003 2002 %

Change 2003 2002 % Change Property & Casualty Premiums written

(A) $134.6 $133.6 0.7% $546.5 $524.9 4.1% Premiums earned (A) 138.1

132.8 4.0% 533.8 519.6 2.7% Net investment income 8.0 8.8 -9.1%

31.9 35.2 -9.4% Losses and loss adjustment expenses 119.9 104.5

472.9 410.2 Operating expenses (includes policy acquisition

expenses amortized) 34.7 32.9 128.0 120.8 Income (loss) before tax

(8.5) 4.2 (35.2) 23.8 Net income (loss) 2.2 3.8 -42.1% (17.8) 19.9

Net investment income, after tax 6.6 6.9 -4.3% 26.2 27.1 -3.3%

Catastrophe losses, after tax 9.2 3.9 21.6 7.8 Statutory operating

statistics (B): Loss and loss adjustment expense ratio 87.0% 78.3%

88.3% 79.2% Expense ratio 24.5% 26.5% 23.2% 24.4% Combined ratio

111.5% 104.8% 111.5% 103.6% Expense ratio impact of restructuring

charges (C) - - - 0.8% Impact of litigation charges (D) - - - 0.3%

Combined ratio before catastrophes 101.3% 100.3% 105.3% 101.3%

Automobile and property detail: Premiums written (voluntary) (A)

$139.0 $131.1 6.0% $549.2 $513.2 7.0% Automobile (A) 101.2 95.5

6.0% 399.4 376.8 6.0% Property 37.8 35.6 6.2% 149.8 136.4 9.8%

Premiums earned, including Massachusetts (voluntary) (A) 138.8

127.6 8.8% 534.8 504.3 6.0% Premiums earned, excluding

Massachusetts (voluntary) (A) 138.8 127.0 9.3% 534.8 494.4 8.2%

Automobile, excluding Massachusetts (A) 100.7 93.4 7.8% 391.3 365.3

7.1% Automobile, including Massachusetts (A) 100.7 94.0 7.1% 391.3

375.2 4.3% Property 38.1 33.6 13.4% 143.5 129.1 11.2% Policies in

force (voluntary) (in thousands) (A) 850 857 -0.8% Automobile,

excluding Massachusetts (A) 571 573 -0.3% Automobile, including

Massachusetts (A) 571 573 -0.3% Property 279 284 -1.8% Voluntary

automobile statutory operating statistics (B): Loss and loss

adjustment expense ratio 93.0% 77.6% 89.7% 77.0% Expense ratio

23.5% 26.1% 23.1% 24.8% Combined ratio 116.5% 103.7% 112.8% 101.8%

Expense ratio impact of restructuring charges (C) - - - 0.9% Impact

of litigation charges (D) - - - 0.4% Combined ratio before

catastrophes 116.1% 103.2% 111.7% 101.2% Total property statutory

operating statistics (B): Loss and loss adjustment expense ratio

68.0% 73.5% 82.6% 81.0% Expense ratio 24.9% 25.3% 22.5% 22.9%

Combined ratio 92.9% 98.8% 105.1% 103.9% Expense ratio impact of

restructuring charges (C) - - - 0.7% Combined ratio before

catastrophes 55.5% 83.6% 84.5% 96.4% Prior years' reserves

favorable (adverse) development, pretax Voluntary automobile (D)

($13.8) ($10.1) ($57.0) ($15.5) Total property (0.1) (3.1) (0.6)

(4.2) Other property and casualty 1.8 (2.0) 1.2 (4.3) Total (D)

(12.1) (15.2) (56.4) (24.0) (A) Effective December 31, 2001, Horace

Mann ceased writing automobile insurance policies in Massachusetts.

See footnote (A) on page 3 for quantification. (B) Also see

footnote (B) on page 1. (C) Represents a $4.2 million pretax

statutory accounting charge for claims restructuring costs for the

year ended December 31, 2002 which was recorded in the third

quarter of 2002. $3.3 million was charged to voluntary automobile,

and $0.9 million was charged to property. (D) Includes a $1.6

million pretax statutory accounting charge for class action

litigation for the year ended December 31, 2002 which was recorded

in the second quarter of 2002. -4- HORACE MANN EDUCATORS

CORPORATION Supplemental Business Segment Overview (Dollars in

Millions) Quarter Ended Year Ended December 31, December 31, 2003

2002 % Change 2003 2002 % Change Annuity Contract deposits $84.3

$71.3 18.2% $296.6 $261.5 13.4% Variable 36.3 32.5 11.7% 115.3

120.3 -4.2% Fixed 48.0 38.8 23.7% 181.3 141.2 28.4% Contract

charges earned 4.0 3.3 21.2% 14.6 14.2 2.8% Net investment income

26.3 26.5 -0.8% 104.4 107.7 -3.1% Net interest margin (without

realized gains) 8.2 8.9 33.1 39.3 Net margin (includes fees and

contract charges earned) 10.8 12.7 -15.0% 49.6 55.5 -10.6%

Mortality gain (loss) and other reserve changes (0.1) 1.1 (0.8)

(0.8) Operating expenses (includes policy acquisition expenses

amortized) 3.9 6.4 25.6 27.5 Income before tax and amortization of

intangible assets 6.8 7.4 -8.1% 23.2 27.2 -14.7% Amortization of

intangible assets (0.2) 0.7 3.4 4.0 Income before tax 7.0 6.7 19.8

23.2 Net income 5.7 4.7 21.3% 14.4 17.0 -15.3% Pretax income

increase (decrease) due to valuation of: Deferred policy

acquisition costs $1.4 $0.9 $2.4 $0.1 Value of acquired insurance

in force 1.1 0.3 0.2 (0.1) Guaranteed minimum death benefit reserve

0.4 0.2 0.7 (0.5) Annuity contracts in force (in thousands) 153 147

4.1% Accumulated value on deposit $2,769.8 $2,360.5 17.3% Variable

1,119.2 854.5 31.0% Fixed 1,650.6 1,506.0 9.6% Annuity accumulated

value retention - 12 months Variable accumulations 92.8% 92.1%

Fixed accumulations 95.1% 94.0% Life Premiums and contract deposits

$30.9 $31.4 -1.6% $112.4 $112.9 -0.4% Premiums andcontract charges

earned 23.4 23.6 -0.8% 95.1 91.4 4.0% Net investment income 12.2

13.3 -8.3% 49.6 53.9 -8.0% Income before tax 6.0 8.3 20.8 29.2 Net

income 3.8 5.4 -29.6% 13.4 18.9 -29.1% Pretax income increase

(decrease) due to valuation of: Deferred policy acquisition costs

$1.4 ($0.5) $1.4 $0.4 Life policies in force (in thousands) 259 264

-1.9% Life insurance in force (in millions) $13,267 $13,197 0.5%

Lapse ratio - 12 months (Ordinary life insurance) 7.7% 9.1%

Corporate and Other (A) Components of gain (loss) before tax:

Realized investment gains (losses) $20.8 $2.5 $25.5 ($49.4)

Restructuring (charges) adjustments - - 0.4 (4.2) Debt retirement

costs - (0.8) - (2.3) Litigation charges - - - (1.6) Interest

expense (1.6) (1.8) (6.3) (8.5) Other operating expenses (1.7)

(0.6) (5.8) (2.5) Gain (loss) before tax 17.5 (0.7) 13.8 (68.5) Net

gain (loss) 11.4 (0.4) 9.0 (44.5) (A) The Corporate and Other

segment includes interest expense on debt and the impact of

realized investment gains and losses and other reconciling items to

net income. The Company does not allocate the impact of corporate

level transactions to the insurance segments consistent with

management's evaluation of the results of those segments. -5-

HORACE MANN EDUCATORS CORPORATION Supplemental Business Segment

Overview (Dollars in Millions) Quarter Ended Year Ended December

31, December 31, 2003 2002 % Change 2003 2002 % Change Investments

Annuity and Life Fixed maturities, at market (amortized cost 2003,

$2,501.2; 2002, $2,291.4) $2,613.0 $2,397.3 Mortgage loans and real

estate 4.6 4.9 Short-term investments 9.0 52.6 Short-term

investments, securities lending collateral 22.1 1.3 Policy loans

and other 74.0 69.1 Total Annuity and Life investments 2,722.7

2,525.2 7.8% Property & Casualty Fixed maturities, at market

(amortized cost 2003, $623.7; 2002, $567.6) 645.7 593.9 Short-term

investments 9.8 5.0 Short-term investments, securities lending

collateral - 2.6 Other 0.7 0.3 Total Property & Casualty

investments 656.2 601.8 9.0% Corporate investments 6.8 3.6 Total

investments 3,385.7 3,130.6 8.1% Net investment income Before tax

$46.2 $48.4 -4.5% $184.7 $196.0 -5.8% After tax 31.4 32.7 -4.0%

125.5 131.7 -4.7% Realized investment gains (losses) by investment

portfolio included in Corporate & Other segment income Property

& Casualty $11.0 - $10.2 ($16.1) Annuity 11.2 ($3.1) 16.8

(24.9) Life (1.5) 5.6 (1.6) (8.0) Corporate and Other 0.1 - 0.1

(0.4) Total, before tax 20.8 2.5 25.5 (49.4) Total, after tax 13.5

1.6 16.6 (32.2) Per share, diluted $0.32 $0.04 $0.38 ($0.77) Other

Information End of period goodwill asset $47.4 $47.4 End of period

property and casualty net reserves as of: December 31, 2003 $320.9

September 30, 2003 308.0 June 30, 2003 285.4 March 31, 2003 275.7

December 31, 2002 272.6 December 31, 2001 272.0 December 31, 2000

249.8 December 31, 1999 235.4 -6- DATASOURCE: Horace Mann Educators

Corporation CONTACT: Dwayne D. Hallman, Senior Vice President -

Finance, of Horace Mann Educators Corporation, +1-217-788-5708 Web

site: http://www.horacemann.com/

Copyright

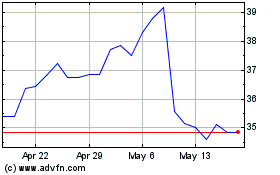

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Horace Mann Educators (NYSE:HMN)

Historical Stock Chart

From Jul 2023 to Jul 2024