– Signed 1.6 Million Sq Ft of Office Leases

Year to Date with 539,000 Sq Ft in 3Q –

– Provides 4Q FFO Outlook and Updated

Full-Year Assumptions –

Hudson Pacific Properties, Inc. (NYSE: HPP) (the

"Company," "Hudson Pacific," or "HPP"), a unique provider of

end-to-end real estate solutions for dynamic tech and media

tenants, today announced financial results for the third quarter

2024.

"Year to date, we have leased 1.6 million square feet of office

space, 25% ahead of this time last year, and following nearly

540,000 square feet signed in the third quarter, our leasing

pipeline and touring activity remain strong,” commented Victor

Coleman, Hudson Pacific’s Chairman and CEO. “Growth in west coast

tenant requirements has begun to outpace the broader US office

market, a trend we anticipate will continue, given more 4-5 day

in-office mandates from major employers, slowing tech layoffs,

solid venture and AI investments, and increased venture fundraising

activity. On the studios side, while Los Angeles show counts have

yet to normalize post-strike, we presently have contracts for or

interest in nearly 80% of our film and television stages, with

demand coalescing around 2025 production starts and recently

bolstered by the Governor's proposal to increase California's film

and television tax credit program to three quarters of a billion

dollars.

"While all of these positive developments point to meaningfully

improved operating performance in the year ahead, we are laser

focused on maintaining financial flexibility, and with no debt

maturities until the end of 2025, we have good momentum on multiple

asset-level transactions to further enhance balance sheet

strength."

Financial Results Compared to Third Quarter 2023

- Total revenue of $200.4 million compared to $231.4 million,

almost entirely due to the sale of One Westside and expiration of

the Block lease at 1455 Market last year, all partially offset by

growth in studio revenue

- Net loss attributable to common stockholders of $97.9 million,

or $0.69 per diluted share, compared to net loss of $37.6 million,

or $0.27 per diluted share, largely attributable to non-cash

impairments associated with potential asset sales, along with the

items affecting revenue, all partially offset by reduced

depreciation and interest expense

- FFO, excluding specified items, of $14.3 million, or $0.10 per

diluted share, compared to $26.1 million, or $0.18 per diluted

share, mostly attributable to the items affecting revenue and lower

FFO attributable to non-controlling interests. Specified items

consisted of a one-time straight-line rent reserve related to

transitioning a tenant to cash basis reporting of $3.9 million, or

$0.03 per diluted share; a non-cash revaluation associated with a

loan swap unqualified for hedge accounting of $2.2 million, or

$0.02 per diluted share; a non-cash deferred tax asset write-off of

$1.2 million, or $0.01 per diluted share; and transaction-related

expense of $0.3 million, or $0.00 per diluted share. There were no

specified items for the third quarter 2023

- FFO of $6.8 million, or $0.05 per diluted share, compared to

$26.1 million, or $0.18 per diluted share

- AFFO of $15.8 million, or $0.11 per diluted share, compared to

$28.1 million, or $0.20 per diluted share, primarily attributable

to the items affecting FFO

- Same-store cash NOI of $96.9 million, compared to $113.2

million, mostly due to tenant move outs, including Block at 1455

Market

Leasing

- Executed 85 new and renewal leases totaling 539,272 square

feet, with significant leases including:

- 42,000-square-foot new lease at Page Mill Hill with an 11-year

term

- 41,000-square-foot renewal lease at 901 Market with an

approximately 10-year term

- 31,000-square-foot new lease at Bentall Centre with an

approximately 11-year term

- 27,000-square-foot new lease at Palo Alto Square with an

approximately 11-year term

- 24,000-square-foot new lease at Page Mill Center with a 4-year

term

- 18,000-square-foot renewal at Concourse with a 15-year

term

- GAAP and cash rents decreased 11.5% and 13.3% from prior

levels, respectively, but excluding a 29,000-square-foot short-term

lease extension in Los Angeles, and two mid-size Bay Area leases

totaling 68,000 square feet, GAAP and cash rent spreads would have

been essentially flat

- In-service office portfolio ended the quarter at 79.1% occupied

and 80.0% leased, compared to 78.7% occupied and 80.0% leased,

respectively, in second quarter of this year, with the change in

occupancy primarily due to leases signed in the San Francisco

Peninsula and Silicon Valley. But for the designation of Foothill

Research Center as held-for-sale, the Company's in-service office

portfolio would have ended the quarter at 79.3% occupied and 80.2%

leased

- On average over the trailing 12 months, the in-service studio

portfolio was 73.8% leased, and the stages were 75.9% leased,

compared to 76.1% and 78.1%, respectively, in the second quarter of

this year, with the change due to a single tenant move out at

Sunset Las Palmas Studios last year

Transactions

- Entered into a contract to sell Foothill Research Center, a

195,121-square-foot office asset in Palo Alto and reclassified the

property as held-for-sale

Balance Sheet as of September 30, 2024

- $695.7 million of total liquidity comprised of $90.7 million of

unrestricted cash and cash equivalents and $605.0 million of

undrawn capacity under the unsecured revolving credit facility

- $12.0 million and $183.1 million, or $6.0 million and $46.8

million at HPP's share, of undrawn capacity under construction

loans secured by Sunset Glenoaks Studios and Sunset Pier 94

Studios, respectively

- HPP's share of net debt to HPP's share of undepreciated book

value was 37.4% with 91.5% of debt fixed or capped with no

maturities until November 2025

Dividend

- The Company's Board of Directors suspended payment of a

quarterly dividend on its common stock and declared and paid a

dividend on its 4.750% Series C cumulative preferred stock of

$0.296875 per share

Personnel Update

- Stefanie Bourne has been promoted to EVP, Studios effective

October 15, 2024, and will oversee studio and production services

sales, production services operations, and strategic initiatives

for the Company's studio business. Bourne most recently served as

SVP, Studio Operations and Strategic Initiatives. Prior to joining

Hudson Pacific, she worked at the Walt Disney Company in global

development for parks, experiences and products, and in real estate

investments for Colony Capital

- Anne Mehrtens has been promoted to EVP, Studio Real Estate

& Southern California Office Operations effective October 15,

2024, and will continue to oversee studio real estate and office

operations in Los Angeles, having recently served as an SVP with

similar responsibilities. Prior to joining Hudson Pacific, she

worked in asset management for Topa Management Company

2024 Outlook

Hudson Pacific is providing an FFO outlook for the fourth

quarter of $0.09 to $0.13 per diluted share along with updated

full-year assumptions (see table below). There are no specified

items in connection with this outlook.

This outlook reflects management’s view of current and future

market conditions, including assumptions with respect to rental

rates, occupancy levels and the earnings impact of events

referenced in this press release and in earlier announcements. It

otherwise excludes any impact from new acquisitions, dispositions,

debt financings, amendments or repayments, recapitalizations,

capital markets activity or similar matters. There can be no

assurance that actual results will not differ materially from these

estimates.

Below are some of the assumptions the Company used in providing

this outlook:

Unaudited, in thousands, except share data

Full Year 2024

Assumptions

Metric

Low

High

Growth in same-store property cash

NOI(1)(2)

(14.00)%

(13.00)%

GAAP non-cash revenue (straight-line rent

and above/below-market rents)(3)

$(14,500)

$(9,500)

GAAP non-cash expense (straight-line rent

expense and above/below-market ground rent)

$(6,500)

$(8,500)

General and administrative expenses(4)

$(77,000)

$(83,000)

Interest expense(5)

$(173,000)

$(183,000)

Non-real estate depreciation and

amortization

$(32,000)

$(34,000)

FFO from unconsolidated joint

ventures(6)

$(3,000)

$(1,000)

FFO attributable to non-controlling

interests

$(13,000)

$(17,000)

FFO attributable to preferred

units/shares

$(21,000)

$(21,000)

Weighted average common stock/units

outstanding—diluted(7)

145,000,000

146,000,000

(1)

Same-store for the full year 2024 is

defined as the 40 office properties and three studio properties, as

applicable, owned and included in the Company's stabilized

portfolio as of January 1, 2023, and anticipated to still be owned

and included in the stabilized portfolio through December 31, 2024.

Due to reclassification as held-for-sale, Foothill Research Center

has been removed from the same-store population. If Foothill

Research Center remained within the same-store, growth in

same-store property cash NOI would have been (13.50)% to

(12.50)%.

(2)

Please see non-GAAP information below for

definition of cash NOI.

(3)

Includes non-cash straight-line rent

associated with the studio and office properties. Also includes a

one-time straight-line rent reserve of approximately $7,600 related

to transitioning a tenant to cash basis reporting.

(4)

Includes non-cash compensation expense,

which the Company estimates at $26,000 in 2024.

(5)

Includes non-cash interest expense, which

the Company estimates at $5,000 in 2024.

(6)

Includes non-cash revaluation associated

with a loan swap unqualified for hedge accounting of approximately

$2,200.

(7)

Diluted shares represent ownership in the

Company through shares of common stock, OP Units and other

convertible or exchangeable instruments. The weighted average fully

diluted common stock/units outstanding for 2024 includes an

estimate for the dilution impact of stock grants to the Company's

executives under its long-term incentive programs. This estimate is

based on the projected award potential of such programs as of the

end of the most recently completed quarter, as calculated in

accordance with the ASC 260, Earnings Per Share.

The Company does not provide a reconciliation for non-GAAP

estimates on a forward-looking basis, where it is unable to provide

a meaningful or accurate calculation or estimation of reconciling

items and the information is not available without unreasonable

effort. This is due to the inherent difficulty of forecasting the

timing and/or amount of various items that would impact net income

attributable to common stockholders per diluted share, which is the

most directly comparable forward-looking GAAP financial measure.

This includes, for example, acquisition costs and other non-core

items that have not yet occurred, are out of the Company's control

and/or cannot be reasonably predicted. For the same reasons, the

Company is unable to address the probable significance of the

unavailable information. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

Supplemental Information

Supplemental financial information regarding Hudson Pacific's

third quarter 2024 results may be found on the Investors section of

the Company's website at HudsonPacificProperties.com. This

supplemental information provides additional detail on items such

as property occupancy, financial performance by property and debt

maturity schedules.

Conference Call

The Company will hold a conference call to discuss third quarter

2024 financial results at 2:00 p.m. PT / 5:00 p.m. ET on November

12, 2024. The conference call will be available via live audio

webcast on the Investors section of the Company's website at

HudsonPacificProperties.com. A replay of the audio webcast will

also be available following the call.

About Hudson Pacific Properties

Hudson Pacific Properties (NYSE: HPP) is a real estate

investment trust serving dynamic tech and media tenants in global

epicenters for these synergistic, converging and secular growth

industries. Hudson Pacific’s unique and high-barrier tech and media

focus leverages a full-service, end-to-end value creation platform

forged through deep strategic relationships and niche expertise

across identifying, acquiring, transforming and developing

properties into world-class amenitized, collaborative and

sustainable office and studio space. For more information visit

HudsonPacificProperties.com.

Forward-Looking Statements

This press release may contain forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements relate to expectations, beliefs, projections, future

plans and strategies, anticipated events or trends and similar

expressions concerning matters that are not historical facts. In

some cases, you can identify forward-looking statements by the use

of forward-looking terminology such as "may," "will," "should,"

"expects," "intends," "plans," "anticipates," "believes,"

"estimates," "predicts," or "potential" or the negative of these

words and phrases or similar words or phrases that are predictions

of or indicate future events, or trends and that do not relate

solely to historical matters. Forward-looking statements involve

known and unknown risks, uncertainties, assumptions and

contingencies, many of which are beyond the Company's control,

which may cause actual results to differ significantly from those

expressed in any forward-looking statement. All forward-looking

statements reflect the Company's good faith beliefs, assumptions

and expectations, but they are not guarantees of future

performance. Furthermore, the Company disclaims any obligation to

publicly update or revise any forward-looking statement to reflect

changes in underlying assumptions or factors, of new information,

data or methods, future events or other changes. For a further

discussion of these and other factors that could cause the

Company's future results to differ materially from any

forward-looking statements, see the section entitled "Risk Factors"

in the Company's Annual Report on Form 10-K filed with the

Securities and Exchange Commission, or SEC, and other risks

described in documents subsequently filed by the Company from time

to time with the SEC.

Consolidated Balance Sheets

In thousands, except share data

9/30/24

12/31/23

(Unaudited)

ASSETS

Investment in real estate, at cost

$

8,318,085

$

8,212,896

Accumulated depreciation and

amortization

(1,769,128

)

(1,728,437

)

Investment in real estate, net

6,548,957

6,484,459

Non-real estate property, plant and

equipment, net

122,958

118,783

Cash and cash equivalents

90,692

100,391

Restricted cash

23,243

18,765

Accounts receivable, net

14,985

24,609

Straight-line rent receivables, net

205,779

220,787

Deferred leasing costs and intangible

assets, net

324,498

326,950

Operating lease right-of-use assets

359,266

376,306

Prepaid expenses and other assets, net

95,517

94,145

Investment in unconsolidated real estate

entities

227,418

252,711

Goodwill

264,144

264,144

Assets associated with real estate held

for sale

39,935

—

TOTAL ASSETS

$

8,317,392

$

8,282,050

LIABILITIES AND EQUITY

Liabilities

Unsecured and secured debt, net

$

4,139,702

$

3,945,314

Joint venture partner debt

66,136

66,136

Accounts payable, accrued liabilities and

other

264,645

203,736

Operating lease liabilities

366,599

389,210

Intangible liabilities, net

23,550

27,751

Security deposits, prepaid rent and

other

79,397

88,734

Liabilities associated with real estate

held for sale

31,064

—

Total liabilities

4,971,093

4,720,881

Redeemable preferred units of the

operating partnership

9,815

9,815

Redeemable non-controlling interest in

consolidated real estate entities

50,172

57,182

Equity

HPP stockholders' equity:

4.750% Series C cumulative redeemable

preferred stock, $0.01 par value, $25.00 per share liquidation

preference, 18,400,000 authorized; 17,000,000 shares outstanding at

9/30/24 and 12/31/23

425,000

425,000

Common stock, $0.01 par value, 481,600,000

authorized, 141,232,361 and 141,034,806 shares outstanding at

9/30/24 and 12/31/23, respectively

1,403

1,403

Additional paid-in capital

2,603,414

2,651,798

Accumulated other comprehensive loss

(2,344

)

(187

)

Total HPP stockholders' equity

3,027,473

3,078,014

Non-controlling interest—members in

consolidated real estate entities

166,477

335,439

Non-controlling interest—units in the

operating partnership

92,362

80,719

Total equity

3,286,312

3,494,172

TOTAL LIABILITIES AND EQUITY

$

8,317,392

$

8,282,050

Consolidated Statements of

Operations

Unaudited, in thousands, except per share

data

Three Months Ended

Nine Months Ended

9/30/24

9/30/23

9/30/24

9/30/23

REVENUES

Office

Rental revenues

$

162,908

$

199,633

$

506,931

$

605,776

Service and other revenues

4,034

3,954

11,125

11,735

Total office revenues

166,942

203,587

518,056

617,511

Studio

Rental revenues

13,720

13,482

41,761

46,109

Service and other revenues

19,731

14,374

72,599

65,254

Total studio revenues

33,451

27,856

114,360

111,363

Total revenues

200,393

231,443

632,416

728,874

OPERATING EXPENSES

Office operating expenses

79,502

80,521

227,753

231,342

Studio operating expenses

35,339

31,655

110,400

103,578

General and administrative

19,544

17,512

59,959

55,177

Depreciation and amortization

86,672

98,580

265,324

294,654

Total operating expenses

221,057

228,268

663,436

684,751

OTHER INCOME (EXPENSES)

Loss from unconsolidated real estate

entities

(3,219

)

(759

)

(6,443

)

(2,219

)

Fee income

1,437

340

3,933

5,026

Interest expense

(45,005

)

(53,581

)

(133,253

)

(162,036

)

Interest income

542

800

1,975

1,407

Management services reimbursement

income—unconsolidated real estate entities

989

1,015

3,187

3,138

Management services expense—unconsolidated

real estate entities

(989

)

(1,015

)

(3,187

)

(3,138

)

Transaction-related expenses

(269

)

—

(2,306

)

1,344

Unrealized loss on non-real estate

investments

(1,081

)

(2,265

)

(3,024

)

(2,269

)

Gain on extinguishment of debt

—

—

—

10,000

Gain on sale of real estate

—

16,108

—

23,154

Impairment loss

(36,543

)

—

(36,543

)

—

Other (expense) income

(28

)

5

1,449

139

Total other expenses

(84,166

)

(39,352

)

(174,212

)

(125,454

)

Loss before income tax (provision)

benefit

(104,830

)

(36,177

)

(205,232

)

(81,331

)

Income tax (provision) benefit

(2,183

)

425

(2,693

)

(715

)

Net loss

(107,013

)

(35,752

)

(207,925

)

(82,046

)

Net income attributable to Series A

preferred units

(153

)

(153

)

(459

)

(459

)

Net income attributable to Series C

preferred shares

(5,047

)

(5,047

)

(15,141

)

(15,141

)

Net income attributable to participating

securities

—

—

(409

)

(850

)

Net loss attributable to non-controlling

interest in consolidated real estate entities

10,777

1,752

18,697

375

Net loss attributable to redeemable

non-controlling interest in consolidated real estate entities

968

931

3,086

2,333

Net loss attributable to common units in

the operating partnership

2,550

672

5,004

1,600

NET LOSS ATTRIBUTABLE TO COMMON

STOCKHOLDERS

$

(97,918

)

$

(37,597

)

$

(197,147

)

$

(94,188

)

BASIC AND DILUTED PER SHARE

AMOUNTS

Net loss attributable to common

stockholders—basic

$

(0.69

)

$

(0.27

)

$

(1.40

)

$

(0.67

)

Net loss attributable to common

stockholders—diluted

$

(0.69

)

$

(0.27

)

$

(1.40

)

$

(0.67

)

Weighted average shares of common stock

outstanding—basic

141,232

140,938

141,179

140,957

Weighted average shares of common stock

outstanding—diluted

141,232

140,938

141,179

140,957

Funds from Operations(1)

Unaudited, in thousands, except per share

data

Three Months Ended

Nine Months Ended

9/30/24

9/30/23

9/30/24

9/30/23

RECONCILIATION OF NET LOSS TO FUNDS

FROM OPERATIONS (“FFO”)(1):

Net loss

$

(107,013

)

$

(35,752

)

$

(207,925

)

$

(82,046

)

Adjustments:

Depreciation and

amortization—consolidated

86,672

98,580

265,324

294,654

Depreciation and amortization—non-real

estate assets

(8,031

)

(8,300

)

(24,223

)

(25,524

)

Depreciation and amortization—HPP's share

from unconsolidated real estate entities(2)

1,231

1,165

4,388

3,623

Gain on sale of real estate

—

(16,108

)

—

(23,154

)

Impairment loss—real estate assets

36,543

—

36,543

—

Unrealized loss on non-real estate

investments

1,081

2,265

3,024

2,269

FFO attributable to non-controlling

interests

1,508

(10,509

)

(9,601

)

(37,371

)

FFO attributable to preferred shares and

units

(5,200

)

(5,200

)

(15,600

)

(15,600

)

FFO to common stock/unit

holders

6,791

26,141

51,930

116,851

Specified items impacting FFO:

Transaction-related expenses

269

—

2,306

(1,344

)

Non-cash deferred tax asset

write-off—HPP’s share(2)

1,170

—

1,170

3,516

Non-cash revaluation associated with a

loan swap (unqualified for hedge accounting)

2,219

—

3,529

—

One-time straight-line rent reserve—HPP’s

share(2)

3,871

—

3,871

—

Prior period net property tax

adjustment—HPP’s share(2)

—

—

—

(1,469

)

One-time gain on debt extinguishment

—

—

—

(10,000

)

One-time tax impact of gain on debt

extinguishment

—

—

—

2,751

FFO (excluding specified items) to

common stock/unit holders

$

14,320

$

26,141

$

62,806

$

110,305

Weighted average common stock/units

outstanding—diluted

145,640

143,483

145,564

143,519

FFO per common stock/unit—diluted

$

0.05

$

0.18

$

0.36

$

0.81

FFO (excluding specified items) per common

stock/unit—diluted

$

0.10

$

0.18

$

0.43

$

0.77

(1)

We calculate Funds from Operations ("FFO")

in accordance with the White Paper on FFO approved by the Board of

Governors of the National Association of Real Estate Investment

Trusts. The White Paper defines FFO as net income or loss

calculated in accordance with generally accepted accounting

principles in the United States (“GAAP”), excluding gains and

losses from sales of depreciable real estate and impairment

write-downs associated with depreciable real estate, plus the HPP’s

share of real estate-related depreciation and amortization,

excluding amortization of deferred financing costs and depreciation

of non-real estate assets. The calculation of FFO includes the

HPP’s share of amortization of deferred revenue related to

tenant-funded tenant improvements and excludes the depreciation of

the related tenant improvement assets.

FFO is a non-GAAP financial measure we

believe is a useful supplemental measure of our operating

performance. The exclusion from FFO of gains and losses from the

sale of operating real estate assets allows investors and analysts

to readily identify the operating results of the assets that form

the core of our activity and assists in comparing those operating

results between periods. Also, because FFO is generally recognized

as the industry standard for reporting the operations of REITs, it

facilitates comparisons of operating performance to other REITs.

However, other REITs may use different methodologies to calculate

FFO, and accordingly, our FFO may not be comparable to all other

REITs.

Implicit in historical cost accounting for

real estate assets in accordance with GAAP is the assumption that

the value of real estate assets diminishes predictably over time.

Since real estate values have historically risen or fallen with

market conditions, many industry investors and analysts have

considered presentations of operating results for real estate

companies using historical cost accounting alone to be

insufficient. Because FFO excludes depreciation and amortization of

real estate assets, we believe that FFO along with the required

GAAP presentations provides a more complete measurement of our

performance relative to our competitors and a more appropriate

basis on which to make decisions involving operating, financing and

investing activities than the required GAAP presentations alone

would provide. We use FFO per share to calculate annual cash

bonuses for certain employees.

However, FFO should not be viewed as an

alternative measure of our operating performance because it does

not reflect either depreciation and amortization costs or the level

of capital expenditures and leasing costs necessary to maintain the

operating performance of our properties, which are significant

economic costs and could materially impact our results from

operations.

(2)

HPP's share is a Non-GAAP financial

measure calculated as the measure on a consolidated basis, in

accordance with GAAP, plus our Operating Partnership’s share of the

measure from our unconsolidated joint ventures (calculated based

upon the Operating Partnership’s percentage ownership interest),

minus our partners’ share of the measure from our consolidated

joint ventures (calculated based upon the partners’ percentage

ownership interests). We believe that presenting HPP’s share of

these measures provides useful information to investors regarding

the Company’s financial condition and/or results of operations

because we have several significant joint ventures, and in some

cases, we exercise significant influence over, but do not control,

the joint venture. In such instances, GAAP requires us to account

for the joint venture entity using the equity method of accounting,

which we do not consolidate for financial reporting purposes. In

other cases, GAAP requires us to consolidate the venture even

though our partner(s) own(s) a significant percentage interest.

Adjusted Funds from

Operations(1)

Unaudited, in thousands, except per share

data

Three Months Ended

Nine Months Ended

9/30/24

9/30/23

9/30/24

9/30/23

FFO (excluding specified items)

$

14,320

$

26,141

$

62,806

$

110,305

Adjustments:

GAAP non-cash revenue (straight-line rent

and above/below-market rents)

6,147

2,470

8,047

(9,326

)

GAAP non-cash expense (straight-line rent

expense and above/below-market ground rent)

1,695

1,919

4,999

5,556

Non-real estate depreciation and

amortization

8,031

8,300

24,223

25,524

Non-cash interest expense

1,599

3,121

5,209

12,822

Non-cash compensation expense

5,926

5,519

19,347

16,904

Recurring capital expenditures, tenant

improvements and lease commissions

(21,962

)

(19,359

)

(56,350

)

(67,483

)

AFFO

$

15,756

$

28,111

$

68,281

$

94,302

(1)

Adjusted Funds from Operations ("AFFO") is

a non-GAAP financial measure we believe is a useful supplemental

measure of our performance. We compute AFFO by adding to FFO

(excluding specified items) HPP's share of non-cash compensation

expense and amortization of deferred financing costs, and

subtracting recurring capital expenditures related to HPP's share

of tenant improvements and leasing commissions (excluding

pre-existing obligations on contributed or acquired properties

funded with amounts received in settlement of prorations), and

eliminating the net effect of HPP’s share of straight-line rents,

amortization of lease buy-out costs, amortization of above- and

below-market lease intangible assets and liabilities, amortization

of above- and below-market ground lease intangible assets and

liabilities and amortization of loan discounts/premiums. AFFO is

not intended to represent cash flow for the period. We believe that

AFFO provides useful information to the investment community about

our financial position as compared to other REITs since AFFO is a

widely reported measure used by other REITs. However, other REITs

may use different methodologies for calculating AFFO and,

accordingly, our AFFO may not be comparable to other REITs

Net Operating Income(1)

Unaudited, in thousands

Three Months Ended

9/30/24

9/30/23

RECONCILIATION OF NET LOSS TO NET

OPERATING INCOME (“NOI”):

Net loss

$

(107,013

)

$

(35,752

)

Adjustments:

Loss from unconsolidated real estate

entities

3,219

759

Fee income

(1,437

)

(340

)

Interest expense

45,005

53,581

Interest income

(542

)

(800

)

Management services reimbursement

income—unconsolidated real estate entities

(989

)

(1,015

)

Management services expense—unconsolidated

real estate entities

989

1,015

Transaction-related expenses

269

—

Unrealized loss on non-real estate

investments

1,081

2,265

Gain on sale of real estate

—

(16,108

)

Impairment loss

36,543

—

Other expense (income)

28

(5

)

Income tax provision (benefit)

2,183

(425

)

General and administrative

19,544

17,512

Depreciation and amortization

86,672

98,580

NOI

$

85,552

$

119,267

NOI Detail

Same-store office cash revenues

161,711

176,830

Straight-line rent

(10,578

)

(3,632

)

Amortization of above/below-market leases,

net

1,050

1,359

Amortization of lease incentive costs

(417

)

(91

)

Same-store office revenues

151,766

174,466

Same-store studios cash revenues

14,959

14,053

Straight-line rent

(181

)

316

Amortization of lease incentive costs

(9

)

(9

)

Same-store studio revenues

14,769

14,360

Same-store revenues

166,535

188,826

Same-store office cash expenses

70,043

68,766

Straight-line rent

371

376

Non-cash compensation expense

16

35

Amortization of above/below-market ground

leases, net

628

628

Same-store office expenses

71,058

69,805

Same-store studio cash expenses

9,770

8,879

Non-cash compensation expense

43

114

Same-store studio expenses

9,813

8,993

Same-store expenses

80,871

78,798

Same-store NOI

85,664

110,028

Non-same-store NOI

(112

)

9,239

NOI

$

85,552

$

119,267

(1)

We evaluate performance based upon

property Net Operating Income ("NOI") from continuing operations.

NOI is not a measure of operating results or cash flows from

operating activities or cash flows as measured by GAAP and should

not be considered an alternative to income from continuing

operations, as an indication of our performance, or as an

alternative to cash flows as a measure of liquidity, or our ability

to make distributions. All companies may not calculate NOI in the

same manner. We consider NOI to be a useful performance measure to

investors and management because when compared across periods, NOI

reflects the revenues and expenses directly associated with owning

and operating our properties and the impact to operations from

trends in occupancy rates, rental rates and operating costs,

providing a perspective not immediately apparent from income from

continuing operations. We calculate NOI as net income (loss)

excluding corporate general and administrative expenses,

depreciation and amortization, impairments, gains/losses on sales

of real estate, interest expense, transaction-related expenses and

other non-operating items. We define NOI as operating revenues

(rental revenues, other property-related revenue, tenant recoveries

and other operating revenues), less property-level operating

expenses (external management fees, if any, and property-level

general and administrative expenses). NOI on a cash basis is NOI

adjusted to exclude the effect of straight-line rent and other

non-cash adjustments required by GAAP. We believe that NOI on a

cash basis is helpful to investors as an additional measure of

operating performance because it eliminates straight-line rent and

other non-cash adjustments to revenue and expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112621794/en/

Investor Contact Laura Campbell Executive Vice President,

Investor Relations & Marketing (310) 622-1702

lcampbell@hudsonppi.com

Media Contact Laura Murray Vice President, Communications

(310) 622-1781 lmurray@hudsonppi.com

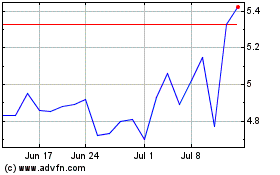

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

From Oct 2024 to Nov 2024

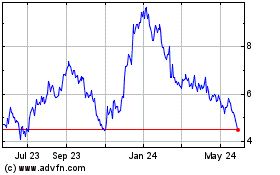

Hudson Pacific Properties (NYSE:HPP)

Historical Stock Chart

From Nov 2023 to Nov 2024