UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange

Act of 1934 (Amendment No. 1)*

Independence Contract Drilling, Inc.

(Name of Issuer)

Common Stock, $0.01 par value per share

(Title of Class of Securities)

453415309

(CUSIP Number)

Haig Maghakian, Glendon Capital Management LP

2425 Olympic Blvd., Suite 500E Santa Monica, California 90404

Phone : 310-907-0450

(Name, Address and Telephone

Number of Person Authorized to Receive Notices and Communications)

April 17, 2023

(Date of Event which Requires

Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

Note: Schedules filed in paper format shall include

a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to

be sent.

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover

page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES

ONLY)

Glendon Capital Management LP

46-1394333 |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(e) or 2(f) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7 |

SOLE VOTING POWER

1,442,669 |

| 8 |

SHARED VOTING POWER |

| 9 |

SOLE DISPOSITIVE POWER

1,442,669 |

| 10 |

SHARED DISPOSITIVE POWER |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

1,442,669 (*) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.9% (**) |

| 14 |

TYPE OF REPORTING PERSON

IA |

| |

|

|

|

|

(*) Glendon Capital Management LP (“GCM”)

beneficially owns 511,481 shares of the Issuer’s Common Stock, $0.01 par value per share (“Common Stock”). In addition,

subject to the Section 16 Conversion Blocker (as defined below), GCM may also be deemed to beneficially own 15,501,479 shares of the Issuer’s

Common Stock underlying the $78,592,500 principal amount of the Issuer’s Floating Rate Convertible Senior Secured PIK Toggle Notes

due 2026 (the “Notes”) held by Glendon Opportunities Fund II, L.P., a private fund for which GCM acts as the investment manager

(“G2”). The Notes held by G2 are convertible into shares of Common Stock at the option of the holder at a conversion price

of $5.07 per share, which conversion price will be lowered to $4.51 per share if approved by the Issuer’s shareholders. Pursuant

to the terms of the Notes, a holder of the Notes is not entitled to receive any shares of Common Stock upon conversion of any Notes held

by such holder, to the extent that such holder, together with such holder’s affiliates and any other person whose beneficial ownership

of Common Stock would be aggregated with such holder’s for the purposes of Section 13 or Section 16 of the Exchange Act and the

rules promulgated thereunder, as determined pursuant to the rules promulgated Section 13(d) of the Exchange Act, would beneficially own

a number of shares of Common Stock in excess of the Restricted Ownership Percentage (the “Section 16 Conversion Blocker”).

The “Restricted Ownership Percentage” is 9.9% of the shares of Common Stock then issued and outstanding, which percentage

may be changed to 19.9% at a holder’s election upon 61 days’ notice to the Issuer.

(**) Percentage based on the sum of (a) 13,641,228

shares of the Issuer’s Common Stock outstanding as of February 24, 2023, as reported by the Issuer in the Form 10-K for the annual

period ended December 31, 2022 as filed with the SEC on March 6, 2023, (b) and 931,188 shares of Common Stock issuable upon conversion

of certain of the Notes, which, due to the Restricted Ownership Percentage, is the maximum number of shares that could be received by

G2 upon conversion of the Notes.

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES

ONLY)

Christopher Sayer |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

OO |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(e) or 2(f) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7 |

SOLE VOTING POWER |

| 8 |

SHARED VOTING POWER

1,442,669 |

| 9 |

SOLE DISPOSITIVE POWER |

| 10 |

SHARED DISPOSITIVE POWER

1,442,669 |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

1,442,669 (i) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

9.9% (ii) |

| 14 |

TYPE OF REPORTING PERSON

IN HC |

| |

|

|

|

|

(i) See Footnote *.

(ii) See Footnotes **.

| 1 |

NAMES OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES

ONLY)

Glendon Opportunities Fund II, L.P.

82-1515613 |

| 2 |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a)

¨

(b)

¨ |

| 3 |

SEC USE ONLY |

| 4 |

SOURCE OF FUNDS

WC |

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(e) or 2(f) |

¨ |

| 6 |

CITIZENSHIP OR PLACE OF ORGANIZATION

Cayman Islands |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH |

7 |

SOLE VOTING POWER

931,188 |

| 8 |

SHARED VOTING POWER |

| 9 |

SOLE DISPOSITIVE POWER

931,188 |

| 10 |

SHARED DISPOSITIVE POWER |

| 11 |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

931,188 (iii) |

| 12 |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

¨ |

| 13 |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.4% (iv) |

| 14 |

TYPE OF REPORTING PERSON

PN |

| |

|

|

|

|

(iii) See Footnote *.

(iv) See Footnotes **.

| Item 1. | Security and Issuer |

Explanatory Note: This Amendment No. 1 amends and restates

the Schedule 13D, originally filed by the Reporting Entities on March 28, 2022 (the "Original Schedule 13D"), in order to report

the appointment of a director of the Issuer (as defined below).

This statement on Schedule 13D (this “Schedule

13D”) relates to the common stock, $0.01 par value per share (“Common Stock”), of Independence Contract Drilling, Inc.,

a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 20475 State Highway 249,

Suite 300, Houston, TX 77070.

| Item 2. | Identity and Background |

| (a) | This Schedule 13D is being filed jointly by Glendon Capital Management, LP (“GCM”),

Christopher Sayer, and Glendon Opportunities Fund II, L.P. (“G2”) (collectively referred to as the “Reporting Persons”).

GCM and Mr. Sayer have the power to direct the voting and disposition of the shares of the Issuer's Shares held directly by G2. |

| (b) | The business address of GCM and Mr. Sayer is 2425 Olympic Blvd., Suite 500E Santa Monica, CA 90404. |

The business address of G2 is Walkers

Corporate Limited, Cayman Corporate Centre, 27 Hospital Rd, George Town, Grand Cayman, KY1-9008, Cayman Islands.

| (c) | The principal business of GCM is a registered investment adviser. |

The principal occupation of Mr. Sayer

is a partner of GCM.

The principal

business of G2 is a pooled investment vehicle.

| (d) | During the last five years, none of the Reporting Entities nor any of their respective

general partners or officers, have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors). |

| (e) | During the last five years, none of the Reporting Entities nor any of their respective

general partners or officers, was a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as

a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such law. |

| (f) | GCM is a Delaware limited partnership. |

Mr. Sayer is a United States citizen.

G2 is a Cayman Islands exempted limited partnership.

| Item 3. | Source and Amount of Funds or Other Consideration |

On March 18, 2022, the Issuer entered

into a comprehensive refinancing of its term loan indebtedness pursuant to the private placement of $157.5 million aggregate principal

amount of Floating Rate Convertible Senior Secured PIK Toggle Notes due 2026 (the “Notes”). In connection with the refinancing,

G2 entered into a subscription agreement, dated March 18, 2022 (the “Subscription Agreement”), with the Issuer and certain

affiliates of MSD Partners, L.P. (the “Other Noteholders”) pursuant to which the G2 purchased an aggregate of $78,592,500

principal amount of Notes.

The source of funds to purchase the

Notes was the working capital of the G2. For the avoidance of doubt, the Reporting Persons and the Other Noteholders are not affiliates

or acting as a “group” of beneficial owners in connection with the voting or disposition of the Common Stock.

In addition, on March 18, 2022, GCM

received 567,000 shares of Common Stock in a private placement as a structuring fee in connection with the structuring of the issuance

of the Note pursuant to a Fee Letter by and among GCM, the Issuer and the Other Noteholders (the “Fee Letter”). In March 2023

and April 2023, GCM sold 55,519 of the Common Stock, which represents approximately 0.41% of the outstanding Common Stock.

| Item 4. | Purpose of Transaction |

The Reporting Persons acquired the Common

Stock covered by this Schedule 13D for investment purposes, in the ordinary course of business. The Reporting Persons will routinely monitor

a wide variety of investment considerations, including, without limitation, current and anticipated future trading prices for the Common

Stock, the Issuer’s operations, assets, prospects, business development, markets and capitalization, the Issuer’s management

and personnel, Issuer-related competitive and strategic matters, general economic, financial market and industry conditions, as well as

other investment considerations. The Reporting Persons expect to discuss their investment in the Issuer and the foregoing investment considerations

with the Issuer’s Board of Directors (“Board”), management, other investors, industry analysts and others. These considerations,

these discussions and other factors may result in the Reporting Persons’ consideration of various alternatives with respect to their

investment, including possible changes in the present Board of Directors and/or management of the Issuer or other alternatives to increase

stockholder value.

The Reporting Persons may also enter

into confidentiality or similar agreements with the Issuer and, subject to such an agreement or otherwise, exchange information with the

Issuer. In addition, the Reporting Persons may acquire additional Issuer securities in the public markets, in privately negotiated transactions

or otherwise or may determine to sell, trade or otherwise dispose of all or some holdings in the Issuer in the public markets, in privately

negotiated transactions or otherwise, or take any other lawful action they deem to be in their best interests.

Indenture

Shareholder Approval

Under the Indenture governing the Notes

(the “Indenture”), the Issuer is required to submit two matters for stockholder approval at its 2022 Annual Meeting of Stockholders:

(a) an amendment to increase the number of shares of the Issuer’s common stock authorized under its certificate of incorporation

to 250,000,000 shares; and (b) the issuances of the Issuer’s Common Stock upon conversion of the Notes based on each of (i)

the conversion rate increase from 197.23866 Shares per $1,000 principal amount of Notes (representing a conversion price of $5.07 per

share) to 221.72949 Shares per $1,000 principal amount of Notes (representing a conversion price of $4.51 per share), (ii) the issuance

by the Issuer of additional Notes, if and when issued by the Issuer, (iii) the conversion of all Notes (including PIK Notes) without any

limitation of the “Pre-Approval Conversion Ratio” (as defined in the Indenture) and (iv) the issuance of Common Stock upon

conversion of Notes in connection with a “Qualified Merger Conversion” (as defined in the Indenture) to the extent the number

of shares issuable upon such conversion would exceed the number of shares of common stock issuable at the otherwise then-current conversion

rate (with the requisite stockholder approval of such proposals referred to as the “Shareholder Approval”). Following Shareholder

Approval, the Issuer will have the right, at its option, to PIK interest under the Notes for the entire term of the Notes, and the PIK

interest rate will reduce from SOFR plus 14.0% to SOFR plus 9.5%.

Preemptive Rights

Subject to the terms and conditions

of the Indenture, as long as the Reporting Persons have at least $25 million in aggregate principal amount of the Notes, they have the

right to purchase their pro rata share of the number of equity interests which the Issuer may sell and issue in a “Major Dilutive

Issuance” (as defined in the Indenture).

Note Holders’ Optional Right

to Convert All or Part of the Notes

Subject to limitations under the Indenture,

the Reporting Persons may convert their Notes at any time following the issue date of the Notes until the close of business on the second

trading day immediately before March 18, 2026. The limitations on such conversions include that if the Issuer calls any Note for redemption

in connection with a permitted redemptions up to $50 million of Notes during an 18-month period following the issue date of the Notes,

then the holder of such Note may not convert such Note after the close of business on the business day on which the applicable redemption

notice is sent in accordance with the Indenture (unless the Issuer fails to pay the redemption price due on the redemption date for such

Note in full in accordance with the Indenture); for the avoidance of doubt, any Note not called for redemption may be converted during

such period.

The initial conversion rate is 197.23866

shares of Common Stock per $1,000 principal amount of Notes (representing a conversion price of $5.07 per share). Following the applicable

shareholder approval described above, the conversion rate will be increased to 221.72949 shares of Common Stock per $1,000 principal amount

of Notes (reflecting a decrease in the conversion price to $4.51 per share).

Limitation on Holders’ Right

to Convert Notes if Conversion Would Result in Beneficial Ownership of More Than 9.9% or 19.9% of the Issuer’s Outstanding Common

Stock Following Conversion

Under the Indenture, a holder is not

entitled to receive shares of the Issuer’s Common Stock upon conversion of any Notes to the extent to which the aggregate number

of shares that may be acquired by such holder upon conversion of Notes, when added to the aggregate number of shares of Common Stock deemed

beneficially owned, directly or indirectly, by any affiliate of the holder and any other person subject to aggregation of the Common Stock

with such holder under Section 13 or Section 16 of the Exchange Act and the rules promulgated thereunder at such time (other than by virtue

of the ownership of securities or rights to acquire securities that have limitations on such beneficial owner’s or such person’s

right to convert, exercise or purchase similar to this limitation), as determined pursuant to the rules promulgated under Section 13(d)

of the Exchange Act, would exceed 9.9% (the “Restricted Ownership Percentage”) of the total issued and outstanding shares

of Common Stock (the “Section 16 Conversion Blocker”); provided that any holder has the right to elect for the Restricted

Ownership Percentage to be 19.9% with respect to such holder, (x) at any time, in which case, such election will become effective sixty-one

(61) days following written notice thereof to the Issuer or (y) in the case of a holder acquiring Notes on the Issue Date, in the Subscription

Agreement.

In lieu of any shares of Common Stock

not delivered to the Reporting Persons by operation of the Section 16 Conversion Blocker, the Issuer will deliver to the Reporting Persons

pre-funded warrants (“Pre-Funded Warrants”) in respect of any equal number of Shares; provided that such Pre-Funded Warrants

will contain restricted ownership limitations substantially similar Section 16 Conversion Blocker.

Pre-Approval Conversion Ratio prior

to Shareholder Approval

Under the Indenture, the conversion

of the Notes prior to the shareholder approval described above is subject to a “Pre-Approval Conversion Ratio” of 75%. Any

Pre-Funded Warrants issued in lieu of Shares in connection with a conversion of Notes prior to shareholder approval would also not be

exercisable in accordance with the terms of the Pre-Funded Warrants prior to shareholder approval.

Registration Rights

Under the Indenture, the Issuer has

agreed that within 30 business days following the Issue Date, the Issuer will submit to or file with the SEC a registration statement

for a shelf registration on Form S-1 or Form S-3 (if the Issuer is then eligible to use a Form S-3 shelf registration), in each case,

registering the resale of the shares of common stock issuable upon conversion of the Notes (including any shares of common stock issuable

upon exercise of any Pre-Funded Warrants delivered upon conversion of any Note) which are eligible for registration. The Issuer has also

agreed to use its commercially reasonable efforts to have the Registration Statement declared effective as soon as practicable after the

filing thereof, but no later than 180 days after March 18, 2022. The registration rights also include customary rights regarding underwritten

offerings and piggyback registration rights. The Issuer will be obligated to pay additional interest if it fails to comply with its obligations

to register the resale of the shares of common stock within the specified time periods.

Under the Fee Letter, the Issuer has

agreed to reciprocal resale registration obligations with respect to the Issuer’s shares of common stock issued pursuant to the

Fee Letter, including liquidated damages if the Issuer fails to comply with its obligations to register the resales of the shares of common

stock within the specified time periods.

Issuer’s Right to Redeem Notes

During the first six months immediately

following issuance of the Notes, the Issuer has the right to redeem up to $25 million principal amount of Notes at 105% plus accrued interest;

and during the period between the first six months and 18 months from the Notes issue date, the Issuer has the right to redeem up to an

additional $25 million of Notes at 104% plus accrued interest.

Redemptions are required to be made

from proceeds from sales of the Issuer’s common stock at a price equal to at least the conversion price under the Notes. The Issuer

also may elect to convert all, but not less than all, of the Notes in connection with a “Qualified Merger,” as detailed in

the Indenture.

Issuer’s Mandatory Obligation

to Offer to Redeem Notes

The Issuer is required to offer to repurchase

the amount of Notes as follows: $5,000,000 on each of June 30, September 30 and December 31, 2023; $3,500,000 on each of March 31,

June 30, September 30 and December 31, 2024, and March 31, June 30, September 30 and December 31, 2025. Such mandatory offer amounts,

in chronological order, will be reduced (but not below $0) by any principal amount of Notes redeemed pursuant to the Issuer’s right

to redeem the Notes (if any such redemptions are made). The mandatory offer price for any Note to be repurchased upon a mandatory offer

is an amount in cash equal to the principal amount of such Note plus accrued and unpaid interest on such Note to, but excluding, the mandatory

offer Date for such mandatory offer, subject to certain record date adjustments

Voting and Support Agreement

In connection with the Subscription

Agreement, GCM entered into a Voting and Support Agreement (the “Voting Agreement”) with the Issuer and the Other Noteholders

and certain of its affiliates. The parties to the Voting Agreement have, among other things, agreed with the Issuer (but not any of the

other stockholders) to vote the shares of the Issuer’s common stock held by each such stockholder (1) in favor of an amendment of

the Issuer’s certificate of incorporation to increase the number of authorized shares of the Issuer’s common stock from 50,000,000

shares to 250,000,000 shares (the “Charter Amendment Proposal”), (2) in favor of the issuance of the shares of the Issuer’s

common stock pursuant to the Indenture, including shares issuable at the amended conversion rate, and upon conversion under PIK Notes

or up to $7.5 million of Additional Notes, or at the Issuer’s option in connection with a Qualified Merger (the “Share Issuance

Proposal”), and (3) in favor of an amendment to increase the authorized shares of the Issuer’s common stock under the Issuer’s

long-term incentive plan by 4,300,000 shares (the “Incentive Plan Proposal”). The Voting Agreement expressly disclaimed that

the Reporting Persons and the Other Noteholders are affiliates or acting as a “group” of beneficial owners.

The Issuer plans to submit each of the

Charter Amendment Proposal, the Share Issuance Proposal and the Incentive Plan Proposal for approval at the Issuer’s 2022 Annual

Meeting of Stockholders.

Investor’s Rights Agreement

In connection with the Subscription

Agreement and the issuance of the Notes on March 18, 2022, GCM entered into an Investor’s Rights Agreement with the Issuer, pursuant

to which the Issuer granted GCM the right to designate one director to the Issuer’s newly expanded Board. As long as GCM and its

affiliates continues to own at least $25 million principal amount of Notes (the “Sunset Date”), GCM will have the right to

nominate one director to the slate of nominees recommended by the Board for election as directors at each applicable annual or special

meeting of the Issuer’s stockholders at which directors are to be elected, subject to applicable law and approval by the Issuer’s

nominating and governance committee. The Issuer also entered into an Investor’s Rights Agreement with the Other Noteholders that

permitted them to designate, and permits them to nominate, one director on the same terms. As long as each of GCM and the Other Noteholders

have the right to appoint such Board representatives, the two holder representatives will have the right to nominate one additional director

to the Board, subject to review by the Issuer’s nominating and governance committee, provided that the third director nominee must

be an independent director unless GCM’s or the Other Noteholders’ representatives is not independent for NYSE purposes. Following

the Sunset Date for the applicable party, GCM will cause its designee to offer to tender his or her resignation, unless otherwise requested

by the Issuer’s Board, and the third representative may be removed by the Issuer’s Board.

Pursuant to the Investor Rights Agreement,

GCM initially designated Vincent J. Cebula to serve as a director of the Issuer’s Board of Directors. Mr. Cebula is not an officer,

director, principal, managing partner or employee of the Reporting Persons and will receive no compensation from the Reporting Persons

or any of their affiliates in connection with his service on the Issuer’s Board.

On April 17, 2023, in connection with

the recent retirement of Chairman of the Issuer’s Board, the Issuer recently requested, and GCM agreed, that Mr. Cebula, an independent

director, be redesignated as an Issuer nominee and not one appointed under the Investor’s Rights Agreement. As a result of Mr. Cebula’s

redesignation, the Investor’s Rights Agreement authorizes GCM to designate a new director to the Issuer’s Board of Directors.

GCM has designated Brian D. Berman, a partner in GCM, to serve as the new director.

The foregoing summary descriptions of

the Subscription Agreement, the Indenture, the Investor’s Rights Agreement, the Voting Agreement and the Fee Letter, and the transactions

contemplated thereby, are subject to and qualified in their entirety by reference to the texts of the actual agreements, copies of which

are attached as Exhibits 10.1, 10.2, 10.5, 10.6, and 10.7, respectively, to the Issuer’s Current Report on Form 8-K filed with the

SEC on March 21, 2022, the terms of which are incorporated herein by reference.

Except as set forth in this Item 4,

no Reporting Person has any present plans or proposals that relate to or would result in: (a) the acquisition by any person of additional

securities of the Issuer, or the disposition of securities of the Issuer; (b) an extraordinary corporate transaction, such as a merger,

reorganization or liquidation, involving the Issuer or any of its subsidiaries; (c) a sale or transfer of a material amount of assets

of the Issuer or of any of its subsidiaries; (d) any change in the present board of directors or management of the Issuer, including

any plans or proposals to change the number or term of such directors or to fill any existing vacancies on such board; (e) any material

change in the present capitalization or dividend policy of the Issuer; (f) any other material change in the Issuer’s business

or corporate structure; (g) changes in the Issuer’s charter, by-laws or instruments corresponding thereto or other actions

that may impede the acquisition of control of the Issuer by any person; (h) causing a class of securities of the Issuer to be delisted

from a national securities exchange or to cease to be authorized to be quoted in an inter-dealer quotation system of a registered national

securities association; (i) a class of equity securities of the Issuer becoming eligible for termination of registration pursuant

to Section 12(g)(4) of the Exchange Act; or (j) any action similar to any of those enumerated in subparagraphs (a)-(i) above. There

is no assurance that the Reporting Persons will develop any plans or proposals with respect to any of these matters. However, the Reporting

Persons reserve the right to formulate plans or proposals which would relate to or result in the transactions described in subparagraphs

(a) through (j) of this Item 4.

| Item 5. | Interest in Securities of the Issuer |

(a) Amount beneficially owned:

GCM – 1,442,669^

Christopher Sayer - 1,442,669^

G2 – 931,188^

Percent of class:

GCM – 9.9%^^

Christopher Sayer - 9.9%^^

G2 – 6.4%^^

(b) Number of shares as to

which GCM has:

(i) Sole power to

vote or to direct the vote:

1,442,669 ^

(ii) Shared power

to vote or to direct the vote:

0

(iii) Sole

power to dispose or to direct the disposition of:

1,442,669^

(iv) Shared power

to dispose or to direct the disposition of:

0

Number of shares as to which Christopher Sayer has:

(i) Sole power

to vote or to direct the vote:

0

(ii) Shared power

to vote or to direct the vote:

1,442,669^

(iii) Sole power

to dispose or to direct the disposition of:

0

(iv) Shared power

to dispose or to direct the disposition of:

1,442,669^

Number of shares as to which G2 has:

(i) Sole power to

vote or to direct the vote:

931,188^

(ii) Shared power

to vote or to direct the vote:

0

(iii) Sole power

to dispose or to direct the disposition of:

931,188^

(iv) Shared power

to dispose or to direct the disposition of:

0

(^) GCM beneficially owns 511,481 shares

of Common Stock. In addition, subject to the Section 16 Conversion Blocker, GCM may also be deemed to beneficially own 15,501,479 shares

underlying the Notes held by G2, which are convertible into shares of Common Stock at the option of the holder at a conversion price of

$5.07 per share, which conversion price will be lowered to $4.51 per share if approved by the Issuer’s shareholders. Pursuant to

the terms of the Notes, a holder of the Notes is not entitled to receive any shares of Common Stock upon conversion of any Notes held

by such holder if the Section 16 Conversion Blocker applies.

(^^) Percentage based on the sum of

(a) 13,641,228 shares of the Issuer’s Common Stock outstanding as of February 24, 2023, as reported by the Issuer in the Form 10-K

for the annual period ended December 31, 2022 as filed with the SEC on March 6, 2023, (b) and 931,188 shares of Common Stock issuable

upon conversion of certain of the Notes held by G2, which, due to the Restricted Ownership Percentage, is the maximum number of shares

that could be received by G2 upon conversion of the Notes.

| (c) | The information in Item 3 relating to the transactions effected by the Reporting Persons in the Issuer’s

Common Stock is incorporated herein by reference. No other transactions have been effected by the Reporting Persons during the past sixty

days. |

| Transaction Date |

|

Shares or Units Purchased (Sold) |

|

Price Per Share or Unit |

| |

|

|

|

|

(d) Not applicable.

(e) Not applicable.

| Item 6. | Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer |

The information in Items 3 and 4 is

incorporated by reference herein.

Except as described above, no contracts,

arrangements, understandings, or relationships (legal or otherwise) exist between any Reporting Person and any person with respect to

any securities of the Issuer, including, but not limited to, transfer or voting of any of the securities, finder’s fees, joint ventures,

loan or option arrangements, puts or calls, guarantees of profits, divisions of profits or loss, or the giving or withholding of proxies.

Except as described above, none of the Reporting Persons is a party to any arrangement whereby securities of the Issuer are pledged or

are otherwise subject to a contingency the occurrence of which would give another person voting power or investment power over such securities.

| Item 7. | Material to Be Filed as Exhibits |

Exhibit 99.1 - Joint Filing Agreement,

by and among the Reporting Entities, dated as of April 19, 2023

Exhibit 99.2 - Subscription Agreement,

dated as of March 18, 2022, by and among Independence Contract Drilling, Inc., MSD PCOF Partners LXXIII, LLC, MSD Private Credit Opportunity

(NON- ECI) Fund, LL, MSD Credit Opportunity Master Fund, L.P. and Glendon Opportunities Fund II, L.P. (incorporated herein by reference

to Exhibit 10.1 to the Issuer’s Current Report on Form 8-K, filed with the SEC on March 21, 2022).

Exhibit 99.3 - Indenture, dated as

of March 18, 2022, by and among Independence Contract Drilling, Inc., U.S. Bank Trust Company, National Association, as trustee and collateral

agent, and Sidewinder Drilling LLC, as guarantor (incorporated herein by reference to Exhibit 10.2 to the Issuer’s Current Report

on Form 8-K, filed with the SEC on March 21, 2022).

Exhibit 99.4 - Investor’s Rights

Agreement, dated as of March 18, 2022, by and among Independence Contract Drilling, Inc. and Glendon Capital Management L.P. (incorporated

herein by reference to Exhibit 10.5 to the Issuer’s Current Report on Form 8-K, filed with the SEC on March 21, 2022).

Exhibit 99.5 - Voting and Support Agreement,

dated as of March 18, 2022, by and among Independence Contract Drilling, Inc., MSD Partners, L.P., MSD PCOF Partners LXXIII, LLC, MSD

Private Credit Opportunity (NON-ECI) Fund, LL, MSD Credit Opportunity Master Fund, L.P., Glendon Capital Management L.P., Glendon Opportunities

Fund II, L.P., William Monroe and the directors and officers of Independence Contract Drilling, Inc. named therein (incorporated herein

by reference to Exhibit 10.6 to the Issuer’s Current Report on Form 8-K, filed with the SEC on March 21, 2022).

Exhibit 99.6 - Fee Letter, dated as

of March 18, 2022, by and among Independence Contract Drilling, Inc., MSD Partners, L.P., and Glendon Capital Management L.P. (incorporated

herein by reference to Exhibit 10.7 to the Issuer’s Current Report on Form 8-K, filed with the SEC on March 21, 2022).

Signature

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Glendon Capital Management, LP |

| |

|

|

| April 19, 2023 |

By: |

/s/ Haig Maghakian |

| |

|

Chief Compliance Officer / General Counsel |

| |

|

|

| April 19, 2023 |

By: |

/s/ Christopher Sayer |

| |

|

Individual |

| |

|

|

| |

Glendon Opportunities Fund II, L.P. |

| |

|

|

| April 19, 2023 |

By: |

/s/ Haig Maghakian |

| |

|

Glendon Capital Associates II, LLC its General Partner |

The original statement shall be signed by each person

on whose behalf the statement is filed or his authorized representative. If the statement is signed on behalf of a person by his authorized

representative (other than an executive officer or general partner of the filing person), evidence of the representative’s authority

to sign on behalf of such person shall be filed with the statement: provided, however, that a power of attorney for this purpose which

is already on file with the Commission may be incorporated by reference. The name and any title of each person who signs the statement

shall be typed or printed beneath his signature.

Footnotes:

Attention: Intentional misstatements or omissions of fact

constitute Federal criminal violations (See 18 U.S.C. 1001)

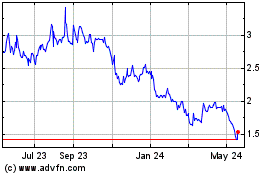

Independence Contract Dr... (NYSE:ICD)

Historical Stock Chart

From Dec 2024 to Jan 2025

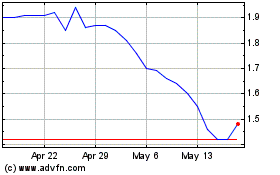

Independence Contract Dr... (NYSE:ICD)

Historical Stock Chart

From Jan 2024 to Jan 2025