RAIT Financial Trust (“RAIT”) (NYSE: RAS) today announced second

quarter 2015 financial results.

Highlights:

Financial Performance

Quarter over Quarter Highlights

- Cash Available for Distribution (“CAD”)

per share grew 95% to $0.37 for the quarter ended June 30, 2015

compared to $0.19 for the quarter ended March 31, 2015.

- Net interest margin increased 1.2% to

$16.5 million for the quarter ended June 30, 2015 compared to $16.3

million for the quarter ended March 31, 2015.

- Fee and other income increased 32.1% to

$7.4 million for the quarter ended June 30, 2015 from $5.6 million

for the quarter ended March 31, 2015.

Year over Year Highlights

- CAD per share grew 54.2% to $0.37 for

the quarter ended June 30, 2015 compared to $0.24 for the quarter

ended June 30, 2014.

- Total revenues grew 8.3% to $79.4

million for the quarter ended June 30, 2015 from $73.3 million for

the quarter ended June 30, 2014.

Commercial Real Estate (“CRE”) Lending Business

- RAIT originated $218.6 million of loans

during the quarter ended June 30, 2015 consisting of $118.3 million

of fixed-rate conduit loans, $95.3 million of floating-rate bridge

loans and a $5 million mezzanine loan. RAIT originated $437.4

million of loans during the six-month period ended June 30, 2015

consisting of $247.0 million of fixed-rate conduit loans, $185.4

million of floating-rate bridge loans and a $5 million mezzanine

loan.

- RAIT sold $130.4 million of conduit

loans during the quarter ended June 30, 2015 which generated fee

income of $3.7 million. RAIT sold $223.3 million of conduit loans

during the six-month period ended June 30, 2015 which generated fee

income of $5.7 million.

- On May 22, 2015, RAIT closed RAIT

2015-FL4 Trust, a $223 million non-recourse, floating-rate CMBS

securitization collateralized by floating-rate bridge loans. RAIT

issued $181.2 million of investment grade notes with a weighted

average cost of LIBOR plus 1.84%. RAIT retained the below

investment grade and un-rated subordinate interests totaling

approximately $41.8 million.

- Investments in mortgages and loans

increased 8.0% to $1.49 billion at June 30, 2015 from $1.38 billion

at December 31, 2014.

- CRE loan repayments were $113.4 million

for the quarter ended June 30, 2015 as compared to $17.1 million

for the quarter ended March 31, 2015.

CRE Property Portfolio

- On June 23, 2015, RAIT sold a 420 unit

apartment property located in Houston, Texas and recognized a net

cash gain of approximately $13.1 million after costs and full

repayment of the underlying debt.

- As of June 30, 2015, RAIT’s investments

in real estate were $1.6 billion which includes $685.4 million of

multi-family properties owned by Independence Realty Trust, Inc.

(“IRT”) (NYSE MKT: IRT). IRT is externally advised by RAIT and is a

consolidated RAIT entity. IRT is a REIT focused on owning

multifamily properties. At June 30, 2015, RAIT owned 23% of IRT’s

outstanding common stock.

- On May 11, 2015, IRT entered into a

definitive merger agreement (the “Merger Agreement”) to acquire the

common stock of Trade Street Residential, Inc. (“TSRE”) (NASDAQ:

TSRE). IRT has disclosed that, upon completion of the merger (the

“Merger”) contemplated by the Merger Agreement, it expects to have

over $1.4 billion of total capitalization with 50 properties with

14,044 units with enhanced scale, improved portfolio quality,

accelerated market penetration and immediate financial benefit for

IRT. RAIT expects the Merger to benefit RAIT through RAIT’s

ownership of IRT common stock and increased fees paid to RAIT by

IRT.

- Rental income increased 41.6% to $55.5

million during the quarter ended June 30, 2015 from $39.2 million

for the quarter ended June 30, 2014 driven largely by the

acquisition of 28 properties during 2014 and improved rental and

occupancy rates.

- Average effective rent per unit per

month in RAIT’s multifamily portfolio increased 7.9% to $834 for

the quarter ended June 30, 2015 from $773 for the quarter ended

June 30, 2014.

Asset & Property Management

- Total assets under management increased

6.7% to $4.8 billion at June 30, 2015 from $4.5 billion at December

31, 2014.

- RAIT’s property management companies

managed 15,721 apartment units and 26.8 million square feet of

office and retail space at June 30, 2015.

Dividends

- On June 22, 2015, RAIT’s Board of

Trustees (the “Board”) declared a second quarter 2015 cash dividend

on RAIT’s common shares of $0.18 per common share. The dividend

will be paid on July 31, 2015 to holders of record on July 10,

2015.

- On July 28, 2015, the Board declared a

third quarter 2015 cash dividend of $0.484375 per share on RAIT’s

7.75% Series A Cumulative Redeemable Preferred Shares, $0.5234375

per share on RAIT’s 8.375% Series B Cumulative Redeemable Preferred

Shares and $0.5546875 per share on RAIT’s 8.875% Series C

Cumulative Redeemable Preferred Shares. The dividends will be paid

on September 30, 2015 to holders of record on September 1,

2015.

Scott Schaeffer, RAIT’s Chairman and CEO, said, “During the

second quarter we originated $218.6 million of loans, closed our

fourth RAIT sponsored floating-rate securitization and delivered

$0.37 of CAD which more than covered the $0.18 quarterly dividend

to common shareholders. We see a strong third quarter loan pipeline

which is in various stages of due diligence. RAIT’s property

portfolio continues to deliver stable operating income led by our

multi-family portfolio and we generated a $13.1 million cash gain

from a property sale during the quarter.”

Financial Results

RAIT reported CAD, a non-GAAP financial measure, for the

three-month period ended June 30, 2015 of $30.3 million, or $0.37

per share based on 82.2 million weighted-average shares

outstanding, as compared to CAD for the three-month period ended

June 30, 2014 of $19.7 million, or $0.24 per share based on 81.8

million weighted-average shares outstanding. RAIT reported a net

income allocable to common shares for the three-month period ended

June 30, 2015 of $19.0 million, or $0.21 total earnings per share -

diluted based on 89.3 million weighted-average shares outstanding –

diluted, as compared to net loss allocable to common shares for the

three-month period ended June 30, 2014 of $25.7 million, or $0.31

total loss per share – diluted based on 81.8 million

weighted-average shares outstanding – diluted.

RAIT reported CAD for the six-month period ended June 30, 2015

of $45.6 million, or $0.56 per share based on 82.1 million

weighted-average shares outstanding, as compared to CAD for the

six-month period ended June 30, 2014 of $37.0 million, or $0.46 per

share – diluted based on 80.6 million weighted-average shares

outstanding – diluted. RAIT reported a net income allocable to

common shares for the six-month period ended June 30, 2015 of $11.9

million, or $0.14 total earnings per share based on 84.1 million

weighted-average shares outstanding – diluted, as compared to net

loss allocable to common shares for the six-month period ended June

30, 2014 of $40.2 million, or $0.50 total loss per share based on

80.6 million weighted-average shares outstanding – diluted.

A reconciliation of RAIT's reported net income (loss) allocable

to common shares to its CAD is included as Schedule I to this

release. A reconciliation of RAIT's total shareholders’ equity to

its adjusted book value, a non-GAAP financial measure, is included

as Schedule II to this release. A reconciliation of RAIT's net

income (loss) allocable to common shares to its funds from

operations, a non-GAAP financial measure, is included as Schedule

III to this release.

These Schedules also include management's respective rationales

for the usefulness of each of these non-GAAP financial

measures.

Key Statistics(Unaudited and dollars in thousands, except

per share information)

As of or For the Three-Month Periods

Ended

June 30, March 31, December 31,

September 30, June 30, 2015

2015 2014 2014

2014 Financial Statistics: Total revenue $79,413

$75,897 $73,857 $75,293 $73,256 Net interest margin $16,525 $16,334

$22,569 $25,637 $27,123 Fee and other income $7,415 $5,594 $5,167

$7,842 $6,919 Earnings (loss) per share – diluted $0.21 $(0.09)

$(3.11) $(0.28) $(0.31) Funds from Operations (“FFO”) per share

$0.15 $0.05 $(2.97) $(0.17) $(0.20) CAD per share $0.37 $0.19 $0.26

$0.00(5) $0.24 Common dividend declared per share $0.18 $0.18 $0.18

$0.18 $0.18 Assets under management $4,764,259 $4,607,413

$4,485,525 $5,417,579 $5,266,296

Commercial Real Estate (“CRE”) Loan

Portfolio:

CRE loans-- unpaid principal $1,524,159 $1,518,969 $1,409,254

$1,369,138 $1,325,748 CRE loans-- weighted average coupon 6.1% 6.6%

6.5% 6.6% 6.8% Non-accrual loans -- unpaid principal $24,851

$24,851 $25,281 $40,741 $30,269 Non-accrual loans as a % of

reported loans 1.6% 1.6% 1.8% 3.0% 2.3% Reserve for losses $12,796

$10,797 $9,218 $15,662 $15,336 Reserves as a % of non-accrual loans

51.5% 43.4% 36.5% 38.4% 50.7% Provision for losses $2,000 $2,000

$2,000 $1,500 $1,000

CRE Property Portfolio:

Reported investments in real estate $1,605,316(1) $1,658,659

$1,671,971 $1,400,715 $1,268,769 Net operating income $29,116(1)

$27,990 $23,148 $20,932 $19,524 Number of properties owned 87(1) 89

89 80 74 Multifamily units owned – RAIT 5,911 7,043 7,043 7,043

7,043 Multifamily units owned – IRT 9,055(1) 8,819 8,819 6,473

5,345 Office square feet owned 2,498,803 2,498,803 2,498,803

2,286,284 2,248,321 Retail square feet owned 1,378,171 1,378,171

1,356,487 1,356,487 986,427 Redevelopment square feet owned 436,719

435,307 434,482 434,482 434,482 Land (acres owned) 21.92 21.92

21.92 21.92 21.92 Average occupancy data: Multifamily – RAIT

93.3% 93.5% 92.0% 92.8% 92.7% Multifamily – IRT 92.5%(1) 94.0%

92.7% 92.6% 93.1% Office 77.7% 75.0% 75.6% 75.0% 74.3% Retail(6)

69.1% 70.4% 70.5% 71.1% 62.1% Average Effective Rent per

Unit/Square Foot (2): Multifamily - RAIT (3) $834 $817 $785 $783

$773 Multifamily - IRT (3) $840(1) $824 $789 $789 $765 Office (4)

$21.44 $21.01 $21.53 $19.64 $20.10 Retail (4) (6) $15.30 $14.53

$15.11 $14.11 $13.82 (1) Includes 31 apartment

properties owned by IRT with 9,055 units and a book value of $685.4

million and a net operating income of $12.2 million at June 30,

2015. (2) Based on properties owned as of June 30, 2015. (3)

Average effective rent is rent per unit per month. (4) Average

effective rent is rent per square foot per year. (5) Includes a

$0.26 per share charge taken due to an agreement in principle

between the SEC and Taberna Capital Management, LLC (“TCM”), a RAIT

subsidiary, to settle an SEC investigation of TCM, as disclosed in

RAIT’s public filings. Excluding this one-time item, CAD per share

in this period would have been $0.26 per common share. (6) Excludes

Murrels Retail, a retail property in re-development with an

occupancy of 52.5% and average effective rent per square foot of

$9.93 for the quarter ended June 30, 2015.

Conference Call

All interested parties can listen to the live conference call

webcast at 9:00 AM ET on Thursday, July 30, 2015 from the home page

of the RAIT Financial Trust website at www.rait.com or by dialing

877.299.4454, access code 76901070. For those who are not available

to listen to the live call, the replay will be available shortly

following the live call on RAIT’s website and telephonically until

Thursday, August 6, 2015, by dialing 888.286.8010, access code

93207351.

About RAIT Financial Trust

RAIT Financial Trust is an internally-managed real estate

investment trust that provides debt financing options to owners of

commercial real estate and invests directly into commercial real

estate properties located throughout the United States. In

addition, RAIT is an asset and property manager of real

estate-related assets. For more information, please visit

www.rait.com or call Investor Relations at 215.243.9000.

Forward-Looking Statements

This press release may contain certain forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Such forward-looking statements can generally

be identified by our use of forward-looking terminology such as

"may," “trend”, "will," "continue," "expect," "intend,"

"anticipate," "estimate," "believe," “look forward” or other

similar words or terms. Because such statements include risks,

uncertainties and contingencies, actual results may differ

materially from the expectations, intentions, beliefs, plans or

predictions of the future expressed or implied by such

forward-looking statements. These risks, uncertainties and

contingencies include, but are not limited to, (i) changes in

financial markets and interest rates, or to the business or

financial condition of RAIT or its business, (ii) whether RAIT will

determine that the loans in its pipeline are advisable to make and

will be able to make such loans, (iii) the availability of

financing and capital, (iv) the occurrence of any event,

change or other circumstances that could give rise to the

termination of the Merger Agreement, (v) the inability to

complete the Merger within the currently contemplated time period

or at all, and (vi) those disclosed in RAIT’s filings with the

Securities and Exchange Commission. RAIT undertakes no obligation

to update these forward-looking statements to reflect events or

circumstances after the date hereof or to reflect the occurrence of

unanticipated events, except as may be required by law.

RAIT Financial Trust Consolidated Statements of Operations

(Dollars in thousands, except share and per share information)

(unaudited)

For the Three-Month For the

Six-Month Periods Ended Periods Ended June

30, June 30, Revenues:

2015

2014(1) 2015 2014(1) Net

interest margin: Investment Interest income $ 24,107

$ 34,646 $ 47,355 $ 69,609 Investment Interest expense

(7,582) (7,523) (14.496)

(14,706) Net interest margin 16,525 27,123 32,859 54,903 Rental

income 55,473 39,214 109,442 74,390 Fee and other income

7,415 6,919 13,009 11,271 Total

revenue 79,413 73,256 155,310 140,564 Expenses: Interest expense

19,673 13,241 39,356 24.846 Real estate operating expense 26,357

19,690 52,336 37,773 Compensation expense 6,568 7,376 12,676 15,931

General and administrative expense 5,065 4,655 10,465 8,483

Acquisition expense 985 219 1,942 592 Provision for losses 2,000

1,000 4,000 2,000 Depreciation and amortization expense

17,005 13,441 36,022 25,483

Total expenses 77,653 59,622 156,797

115,108 Operating income 1,760 13,634 (1,487) 25,456

Other income (expense) (241) 5 (636) 15 Gains (losses) on assets

17,281 (7,599) 17,281 (5,375) Gains (losses) on extinguishment of

debt - - - 2,421 Change in fair value of financial instruments

8,356 (25,071) 12,846

(49,210) Income (loss) before taxes and discontinued operations

27,156 (19,031) 28,004 (26,693) Income tax benefit (provision)

(715) 21 (1,297) 260 Net

income (loss) 26,441 (19,010) 26,707 (26,433) (Income) loss

allocated to preferred shares (8,221) (7,415) (16,080) (13,221)

(Income) loss allocated to noncontrolling interests 736

775 1,232 (583) Net income

(loss) allocable to common shares $ 18,956 $ (25,650) $

11,859 $ (40,237) Earnings (loss) per share—Basic: Total

earnings (loss) per share—Basic $ 0.23 $ (0.31) $ 0.14

$ (0.50) Weighted-average shares outstanding—Basic

82,150,475 81,778,947 82,115,941

80,636,895 Earnings (loss) per share—Diluted: Total earnings (loss)

per share—Diluted $ 0.21 $ (0.31) $ 0.14 $ (0.50)

Weighted-average shares outstanding—Diluted 89,268,462

81,778,947 84,134,040 80,636,895

(1) Net interest margin for the three and six month

periods ended June 30, 2014 includes $5.5 million and $10.5 million

from the Taberna business we exited in December 2014; operating

income for the three and six month periods ended June 30, 2014

includes $1.6. million and $9.3 million from such Taberna business;

net income (loss) available to common shares for the three and six

month periods ended June 30, 2014 includes ($30.0) million and

($50.4) million from such Taberna business; earnings (loss) per

share – diluted for the three and six month periods ended June 30,

2014 includes ($0.36) and ($0.62) per share from such Taberna

business. RAIT Financial Trust Consolidated

Balance Sheets (Dollars in thousands, except share and per share

information) (unaudited)

As of As of June

30, December 31, 2015 2014

Assets Investments in mortgages and loans, at amortized

cost: Commercial mortgages, mezzanine loans, other loans and

preferred equity interests $ 1,506,542 $ 1,392,436 Allowance for

losses (12,796) (9,218) Total investments in

mortgages and loans 1,493,746 1,383,218 Investments in real estate,

net of accumulated depreciation of $178,572 and $168,480,

respectively 1,605,316 1,671,971 Investments in securities and

security-related receivables, at fair value - 31,412 Cash and cash

equivalents 104,772 121,726 Restricted cash 179,878 124,220 Accrued

interest receivable 56,844 51,640 Other assets 77,708 72,023

Deferred financing costs, net of

accumulated amortization of $30,896 and $26,056, respectively

25,117 27,802

Intangible assets, net of accumulated

amortization of $20,935 and $13,911, respectively

32,195 29,463

Total assets $ 3,575,576

$ 3,513,475

Liabilities and Equity

Indebtedness: Recourse indebtedness $ 497,430 $ 509,701

Non-recourse indebtedness 2,164,098 2,105,965

Total indebtedness 2,661,528 2,615,666 Accrued interest payable

11,042 10,269 Accounts payable and accrued expenses 52,728 54,962

Derivative liabilities 12,154 20,695 Deferred taxes, borrowers’

escrows and other liabilities 172,621 144,733

Total liabilities 2,910,073 2,846,325

Series D

Preferred Shares, 4,000,000 shares authorized, 4,000,000 and

2,600,000 shares issued and outstanding

82,513

79,308

Equity:

Preferred shares, $0.01 par value per

share, 25,000,000 shares authorized:

7.75% Series A cumulative redeemable

preferred shares, liquidation preference $25.00 per share,

8,069,288 shares authorized, 5,303,591 shares issued and

outstanding

53

48

8.375% Series B cumulative redeemable preferred shares, liquidation

preference $25.00 per share, 4,300,000 shares authorized, 2,325,626

shares issued and outstanding

23

23

8.875% Series C cumulative redeemable preferred shares, liquidation

preference $25.00 per share, 3,600,000 shares authorized, 1,640,100

shares issued and outstanding

17

17

Series E cumulative redeemable preferred shares, liquidation

preference $25.00 per share, 4,000,000 shares authorized

-

-

Common shares, $0.03 par value per share, 200,000,000 shares

authorized, 82,895,723 and 82,506,606 issued and outstanding,

including 743,014 and 541,575 unvested restricted common share

awards

2,487

2,473

Additional paid in capital 2,039,594 2,025,683 Accumulated other

comprehensive income (loss) (11,605) (20,788) Retained earnings

(deficit) (1,651,613) (1,633,911) Total

shareholders’ equity 378,956 373,545 Noncontrolling interests

204,034 214,297

Total equity

582,990 587,842

Total liabilities and equity $

3,575,576 $ 3,513,475 Schedule I

RAIT Financial Trust Reconciliation of Net income (loss) Allocable

to Common Shares and Cash Available for Distribution (1) (Dollars

in thousands, except share and per share amounts) (unaudited)

For the

Three-Month Period Ended June 30, For the Six-Month

Period Ended June 30, 2015

2014 2015

2014

Amount

Per Share(2)

Amount

Per Share(3)

Amount

Per Share(2)

Amount

Per Share(3)

Cash Available for Distribution: Net income (loss) allocable

to common shares $ 18,956 $ 0.23 $ (25,650) $ (0.31) $ 11,859 $

0.14 $ (40,237) $ (0.50) Adjustments: Depreciation and amortization

expense 17,005 0.21 13,441 0.16 36,022 0.45 25,483 0.32 Change in

fair value of financial instruments (8,356) (0.10) 25,071 0.32

(12,846) (0.16) 49,210 0.61 (Gains) losses on assets (4,196) (0.05)

7,599 0.09 (3,371) (0.04) 5,375 0.07 (Gains) losses on

extinguishment of debt - - - - - - (2,421) (0.03) Taberna VIII and

Taberna IX securitizations, net effect - - (7,028) (0.09) - -

(14,088) (0.18) Straight-line rental adjustments 23 0.00 24 0.00 25

0.00 (91) 0.00 Share-based compensation 1,046 0.01 1,180 0.01 2,394

0.03 2,629 0.03 Origination fees and other deferred items 8,253

0.10 5,181 0.06 16,636 0.20 9,732 0.12 Provision for losses 2,000

0.02 1,000 0.01 4,000 0.05 2,000 0.03 Noncontrolling interest

effect from certain adjustments (4,421) (0.05)

(1,095) (0.01) (9,134)

(0.11) (635) (0.01) Cash

Available for Distribution $ 30,310 $ 0.37 $ 19,723

$ 0.24 $ 45,585 $ 0.56 $ 36,957

$ 0.46 (1) Cash available for distribution, or CAD, is a

non-GAAP financial measure. We believe that CAD provides investors

and management with a meaningful indicator of operating

performance. Management also uses CAD, among other measures, to

evaluate profitability and our board of trustees considers CAD in

determining our quarterly cash dividends. We also believe that CAD

is useful because it adjusts for a variety of noncash items (such

as depreciation and amortization, equity-based compensation,

realized gain (loss) on assets, provision for loan losses and

non-cash interest income and expense items). Furthermore, CAD

removes the effect of our previous consolidation of the legacy

Taberna securitizations which we deconsolidated as part of our exit

of the Taberna business in December 2014. We calculate CAD

by subtracting from or adding to net income (loss) attributable to

common shareholders the following items: depreciation and

amortization items including, depreciation and amortization,

straight-line rental income or expense, amortization of in place

leases, amortization of deferred financing costs, amortization of

discount on financings and equity-based compensation; changes in

the fair value of our financial instruments, including such changes

reflected in our such Taberna securitizations; net interest income

from such Taberna securitizations; realized noncash gain (loss) on

assets and other; provision for loan losses; impairment on

depreciable property; acquisition gains or losses and transaction

costs; certain fee income eliminated in consolidation that is

attributable to third parties and one-time events pursuant to

changes in U.S. GAAP and certain other non-recurring items.

CAD should not be considered as an alternative to net income

(loss), determined in accordance with U.S. GAAP, as an indicator of

operating performance. In addition, our methodology for calculating

CAD may differ from the methodologies used by other comparable

companies, including other REITs, when calculating the same or

similar supplemental financial measures and may not be comparable

with these companies. In these Schedules, references to “we”, “us”,

and “our” refer to RAIT Financial Trust and its subsidiaries.

(2) Based on 82,150,475 and 82,115,941 weighted-average

shares outstanding for the three-month period and six-month period

ended June 30, 2015. The weighted-average shares outstanding

excludes the dilutive effect of securities totaling 7,117,987 and

2,018,099 shares for the three-month period and six-month period

ended June 30, 2015, as these securities are not outstanding for

purposes of our quarterly dividends. These securities will be

included in weighted average shares for purposes of CAD when, and

if, these securities are converted to common shares. (3)

Based on 81,778,947 and 80,636,895 weighted-average shares

outstanding for the three-month period and six-month period ended

June 30, 2014. Schedule II RAIT Financial Trust

Reconciliation of Shareholders’ Equity to Adjusted Book Value (1)

(Dollars in thousands, except share and per share amounts)

(unaudited)

As of June 30, 2015 Amount

Per Share (2) Total shareholders’ equity $ 378,956 $

4.57 Liquidation value of preferred shares characterized as

equity(3) (231,733) (2.80) Book value 147,223 1.77

Adjustments: RAIT I and RAIT II derivative liabilities 12,154 0.15

Fair value for warrants and investor SARs 22,181 0.27 Accumulated

depreciation and amortization 263,464 3.17 Valuation of recurring

collateral, property management fees and other items (4)

75,106 0.91 Total adjustments $ 372,905 $ 4.50 Adjusted book

value $ 520,128 $ 6.27 (1) Management views adjusted

book value as a useful and appropriate supplement to shareholders’

equity and book value per share. The measure serves as an

additional measure of our value because it facilitates evaluation

of us without the effects of various items that we are required to

record in accordance with GAAP but which have limited economic

impact on our business. Those adjustments primarily reflect

accumulated depreciation and amortization, the valuation of

long-term derivative instruments and a valuation of our recurring

collateral and property management fees. Adjusted book value is a

non-GAAP financial measurement, and does not purport to be an

alternative to reported shareholders’ equity, determined in

accordance with GAAP, as a measure of book value. Adjusted book

value should be reviewed in connection with shareholders’ equity as

set forth in our consolidated balance sheets, to help analyze our

value to investors. Adjusted book value may be defined in various

ways throughout the REIT industry. Investors should consider these

differences when comparing our adjusted book value to that of other

REITs. (2) Based on 82,895,723 common shares outstanding as

of June 30, 2015. (3) Based on 5,303,591 Series A preferred

shares, 2,325,626 Series B preferred shares, and 1,640,100 Series C

preferred shares outstanding as of June 30, 2015, all of which have

a liquidation preference of $25.00 per share. (4) Includes

the estimated value of the (1) property management fees to be

received by RAIT as of June 30, 2015 from RAIT Residential and

Urban Retail, the RAIT I and RAIT II securitizations, value

ascribed to fixed-rate CMBS loan sale business and (2) advisory

fees to be received by RAIT from IRT as of June 30, 2015. The other

item included is the incremental market value of RAIT’s ownership

of 7.3 million shares of IRT common stock over RAIT’s book value

for these shares at June 30, 2015. We did not tax effect the

valuation of these items as we have loss carryforwards that could

absorb the potential gain. Schedule III RAIT Financial Trust

Reconciliation of Net income (loss) Allocable to Common Shares and

Funds From Operations (“FFO”) (1) (Dollars in thousands, except

share and per share amounts) (unaudited)

For the

Three-Month Period Ended June 30, For the Six-Month

Period Ended June 30, 2015

2014 2015

2014

Amount

Per Share(2)

Amount

Per Share(3)

Amount

Per Share(2)

Amount

Per Share (3)

Funds From Operations: Net income (loss) allocable to common

shares

$

18,956

$

0.23

$

(25,650)

$ (0.31)

$

11,859

$ 0.14 $ (40,237) $ (0.50) Adjustments: Real estate depreciation

and amortization 10,246 0.12 9,315 0.11 21,444 0.26 18,134 0.23

(Gains) losses on the sale of real estate

(17,281) (0.20) - -

(17,281) (0.20) 321

0.00 Funds From Operations

$

11,921

$

0.15

$

(16,335)

$ (0.20)

$

16,022

$ 0.20 $ (21,782) $ (0.27) (1) We

believe that funds from operations, or FFO, which is a non-GAAP

measure, is an additional appropriate measure of the operating

performance of a REIT. We compute FFO in accordance with the

standards established by the National Association of Real Estate

Investment Trusts, or NAREIT, as net income or loss allocated to

common shares (computed in accordance with GAAP), excluding real

estate-related depreciation and amortization expense, gains or

losses on sales of real estate and the cumulative effect of changes

in accounting principles. Our management utilizes FFO as a measure

of our operating performance. FFO is not an equivalent to net

income or cash generated from operating activities determined in

accordance with U.S. GAAP. Furthermore, FFO does not represent

amounts available for management’s discretionary use because of

needed capital replacement or expansion, debt service obligations

or other commitments or uncertainties. FFO should not be considered

as an alternative to net income as an indicator of our operating

performance or as an alternative to cash flow from operating

activities as a measure of our liquidity. (2) Based on

82,150,475 and 82,115,941 weighted-average shares outstanding for

the three-month period and six-month period ended June 30, 2015.

The weighted-average shares outstanding excludes the dilutive

effect of securities totaling 7,117,987 and 2,018,099 shares for

the three-month period and six-month period ended June 30, 2015, as

the respective securities are not actual shares outstanding.

(3) Based on 81,778,947 and 80,636,895 weighted-average shares

outstanding-diluted for the three-month period and six-month period

ended June 30, 2014.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150730005739/en/

RAIT Financial TrustAndres Viroslav,

215-243-9000aviroslav@rait.com

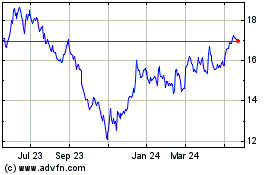

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Nov 2024 to Dec 2024

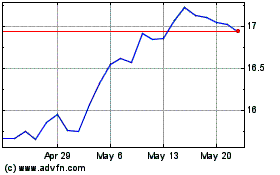

Independence Realty (NYSE:IRT)

Historical Stock Chart

From Dec 2023 to Dec 2024