0001437071false00014370712024-11-052024-11-050001437071us-gaap:CommonStockMember2024-11-052024-11-050001437071ivr:SeriesBCumulativeRedeemablePreferredStockMember2024-11-052024-11-050001437071ivr:SeriesCCumulativeRedeemablePreferredStockMember2024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 5, 2024

Invesco Mortgage Capital Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-34385 | | 26-2749336 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 1331 Spring St., N.W. Suite 2500, | | |

| Atlanta, | Georgia | | 30309 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (404) 892-0896

n/a

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | IVR | | New York Stock Exchange |

| 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock | | IVR PrB | | New York Stock Exchange |

| 7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock | | IVR PrC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

Item 7.01. | Regulation FD Disclosure. |

On November 5, 2024, Invesco Mortgage Capital Inc., a Maryland corporation (the “Company”), issued a press release (the “Press Release”) announcing the intended redemption of preferred shares set forth under Item 8.01 of this Current Report on Form 8-K. A copy of the Press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished under this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

On November 5, 2024, the Company announced that it intends to redeem all 4,247,989 of its outstanding shares of 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock, $0.01 par value per share (the “Series B Preferred Stock”), at a redemption price per share of Series B Preferred Stock of $25.00 plus accrued and unpaid dividends per share to, but not including, the redemption date of December 27, 2024.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| | | | | | | | |

| | |

Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

INVESCO MORTGAGE CAPITAL INC.

By: /s/ Tina Carew

Name: Tina Carew

Title: Vice President, General Counsel and Secretary

Dated: November 5, 2024

Invesco Mortgage Capital Inc. Announces Redemption of 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock

ATLANTA, November 5, 2024 – Invesco Mortgage Capital Inc. (the “Company”) (NYSE: IVR) announced today that it intends to redeem all 4,247,989 of the outstanding shares of the Company’s 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock, par value $0.01 per share (“Series B Preferred Stock”) on December 27, 2024 (the “Redemption Date”). Shares of the Series B Preferred Stock are currently listed on the New York Stock Exchange under the symbol “IVR PrB.”

All outstanding shares of Series B Preferred Stock will be redeemed at a cash redemption price of $25.00 per share, plus any accrued and unpaid dividends (whether or not declared) up to, but not including, the Redemption Date (the “Redemption Price”). Upon redemption, the shares of Series B Preferred Stock will no longer be deemed outstanding and all rights with respect to the shares of Series B Preferred Stock shall cease and terminate, except only the right of the holders thereof to receive the Redemption Price, without interest, from the redemption and payment agent.

All issued and outstanding shares of Series B Preferred Stock are held in book-entry form through The Depository Trust Company (“DTC”). The shares of Series B Preferred Stock will be redeemed in accordance with the procedures of DTC. Payment to DTC for the shares of Series B Preferred Stock will be made by Computershare Trust Company N.A., which is serving as redemption and payment agent (the “Redemption Agent”). The Redemption Agent’s address is as follows:

Computershare Trust Company N.A.

150 Royall Street

Canton, MA 02021

Attn: Corporate Actions

This press release does not constitute a notice of redemption under the Company’s Articles Supplementary governing the shares of Series B Preferred Stock.

About Invesco Mortgage Capital Inc.

Invesco Mortgage Capital Inc. is a real estate investment trust that primarily focuses on investing in, financing and managing mortgage-backed securities and other mortgage-related assets. Invesco Mortgage Capital Inc. is externally managed and advised by Invesco Advisers, Inc., a registered investment adviser and an indirect wholly-owned subsidiary of Invesco Ltd., a leading independent global investment management firm.

Cautionary Notice Regarding Forward-Looking Statements

This press release may include statements and information that constitute “forward-looking statements” within the meaning of the U.S. securities laws as defined in the Private Securities Litigation Reform Act of 1995, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company’s control. These forward-looking statements include information about planned redemption of the Series B Preferred Stock and the Company’s ability to complete such redemption, as well as any other statements other than statements of historical fact. The words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may” or similar expressions and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” and any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

The forward-looking statements are based on management’s beliefs, assumptions and expectations of the Company’s future performance, taking into account all information currently available. You should not place undue reliance on these forward-looking statements. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to the Company. For example, the redemption described above is contingent on the Company’s continuing ability to pay the Redemption Price. If the Company is unable to pay the Redemption Price, the redemption may not occur as described above. Some of the other factors are described in the Company’s annual report on Form 10-K and quarterly reports on Form 10-Q, which are available on the Securities and Exchange Commission’s website at www.sec.gov, under the

headings “Risk Factors,” “Forward-Looking Statements,” “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Invesco Mortgage Capital Inc.

Investor Relations Contact:

Greg Seals, 404-439-3323

v3.24.3

Cover

|

Nov. 05, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 05, 2024

|

| Entity Registrant Name |

Invesco Mortgage Capital Inc.

|

| Entity Central Index Key |

0001437071

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34385

|

| Entity Tax Identification Number |

26-2749336

|

| Entity Address, Address Line One |

1331 Spring St., N.W. Suite 2500,

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30309

|

| City Area Code |

404

|

| Local Phone Number |

892-0896

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

IVR

|

| Security Exchange Name |

NYSE

|

| 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

IVR PrB

|

| Security Exchange Name |

NYSE

|

| 7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

IVR PrC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ivr_SeriesBCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ivr_SeriesCCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

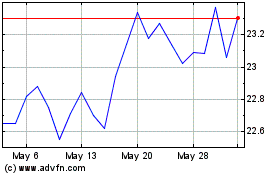

Invesco Mortgage Capital (NYSE:IVR-C)

Historical Stock Chart

From Dec 2024 to Jan 2025

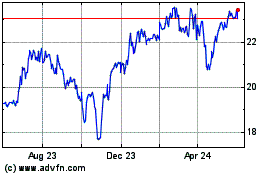

Invesco Mortgage Capital (NYSE:IVR-C)

Historical Stock Chart

From Jan 2024 to Jan 2025