Kimco Realty® (NYSE: KIM), a real estate investment trust (REIT)

and leading owner and operator of high-quality, open-air,

grocery-anchored shopping centers and mixed-used properties in the

United States, today announced the publication of its fourth Green

Bond Report, outlining the use of the net proceeds and the

associated estimated environmental impact of the company’s

inaugural green bond, issued in July of 2020. The $493.7 million in

net proceeds from the green bond issuance were fully allocated to

finance Eligible Green Projects, as defined by Kimco’s Green Bond

Framework.

“We are incredibly proud to have achieved full

allocation of our inaugural green bond – an achievement which

demonstrates our commitment to sustainable growth and prudent

financial management. By investing in projects such as green

buildings, renewable energy, and sustainable water and energy

projects, we are not only enhancing the value of our assets but

also delivering long-term benefits to our investors and

communities,” said Kimco Executive Vice President and CFO Glenn G.

Cohen.

This milestone marks the early achievement of

one of Kimco’s long-term public goals. Per Kimco’s Green Bond

Framework, Eligible Green Projects include Renewable Energy

projects, Green Buildings, Energy Efficiency projects and

Sustainable Water and Wastewater Management projects. Green bond

proceeds allocated in the most recent year include The Milton,

Kimco’s LEED Silver certified residential tower at Pentagon Centre

in Arlington, Virginia.

Additional Eligible Green Projects funded to date that

contributed to the full allocation include:

- Renewable Energy Projects –

Acquisition of a 988.8 kW Solar Renewable Energy Project at Carmans

Plaza in Massapequa, New York, estimated to produce approximately

1.2 Gigawatt hours of renewable energy annually, with an estimated

annual Greenhouse gas (GHG) emissions savings of 678 metric tonnes

of carbon dioxide equivalent (MTCO2e).

- Green Buildings –

Funding/Acquisition of LEED Silver certified projects including The

Milton and The Witmer® residential towers at Pentagon Centre in

Arlington, Virginia and the West Alex mixed-use building in

Alexandria, Virginia. Green bond proceeds were also allocated

towards the acquisition of 19 ENERGY STAR Certified tenant

spaces.

- Energy Efficiency Projects – Energy

Efficiency projects at 129 properties, resulting in an estimated

total GHG savings of 7,500 MTCO2e (based on estimated emissions

associated with usage one year after project completion compared to

one year prior).

- Sustainable Water and Wastewater

Management projects – Projects at 46 properties, including the

installation of a stormwater management system for flood protection

and mitigation. The sustainable water projects resulted in an

estimated average water efficiency gain of more than 35 percent. A

stormwater management system for flood protection and mitigation at

Dania Pointe in Dania Beach, Florida exceeded requirements for the

LEED Rainwater Management Standard and is designed to withstand a

100-year, 72-hour storm event.

Additional information on Kimco’s industry

leading corporate responsibility initiatives and its publicly

stated goals can be found in the company’s 2023 Corporate

Responsibility Report.

About Kimco

Realty®

Kimco Realty® (NYSE: KIM) is a real estate

investment trust (REIT) and leading owner and operator of

high-quality, open-air, grocery-anchored shopping centers and

mixed-use properties in the United States. The company’s portfolio

is strategically concentrated in the first-ring suburbs of the top

major metropolitan markets, including high-barrier-to-entry coastal

markets and rapidly expanding Sun Belt cities. Its tenant mix is

focused on essential, necessity-based goods and services that drive

multiple shopping trips per week. Publicly traded on the NYSE since

1991 and included in the S&P 500 Index, the company has

specialized in shopping center ownership, management, acquisitions,

and value-enhancing redevelopment activities for more than 60

years. With a proven commitment to corporate responsibility, Kimco

Realty is a recognized industry leader in this area. As of June 30,

2024, the company owned interests in 567 U.S. shopping centers and

mixed-use assets comprising 101 million square feet of gross

leasable space.

The company announces material information to

its investors using the company’s investor relations website

(investors.kimcorealty.com), SEC filings, press releases, public

conference calls, and webcasts. The company also uses social media

to communicate with its investors and the public, and the

information the company posts on social media may be deemed

material information. Therefore, the company encourages investors,

the media, and others interested in the company to review the

information that it posts on the social media channels, including

Facebook (www.facebook.com/kimcorealty), Twitter

(www.twitter.com/kimcorealty) and LinkedIn

(www.linkedin.com/company/kimco-realty-corporation). The list of

social media channels that the company uses may be updated on its

investor relations website from time to time.

Safe Harbor Statement

This communication contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The company intends

such forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and includes this

statement for purposes of complying with the safe harbor

provisions. Forward-looking statements, which are based on certain

assumptions and describe the company’s future plans, strategies and

expectations, are generally identifiable by use of the words

“believe,” “expect,” “intend,” “commit,” “anticipate,” “estimate,”

“project,” “will,” “target,” “plan,” “forecast” or similar

expressions. You should not rely on forward-looking statements

since they involve known and unknown risks, uncertainties and other

factors which, in some cases, are beyond the company’s control and

could materially affect actual results, performances or

achievements. Factors which may cause actual results to differ

materially from current expectations include, but are not limited

to, (i) unexpected delays, difficulties, and expenses in executing

against the goals, targets and commitments identified in the Green

Bond Report, (ii) unexpected cost increases or technical

difficulties in constructing, maintaining or modifying properties,

and lack of available or suitable Eligible Green Projects being

initiated (iii) energy prices, (iv) technological innovations, (v)

natural disasters, and weather and climate-related events, (vi)

general adverse economic and local real estate conditions, (vii)

the impact of competition, including the availability of

acquisition or development opportunities and the costs associated

with purchasing and maintaining assets, (viii) the inability of

major tenants to continue paying their rent obligations due to

bankruptcy, insolvency or a general downturn in their business,

(ix) the reduction in the company’s income in the event of multiple

lease terminations by tenants or a failure of multiple tenants to

occupy their premises in a shopping center, (x) the potential

impact of e-commerce and other changes in consumer buying

practices, and changing trends in the retail industry and

perceptions by retailers or shoppers, including safety and

convenience, (xi) the availability of suitable acquisition,

disposition, development and redevelopment opportunities, and the

costs associated with purchasing and maintaining assets and risks

related to acquisitions not performing in accordance with our

expectations, (xii) the company’s ability to raise capital by

selling its assets, (xiii) disruptions and increases in operating

costs due to inflation and supply chain disruptions, (xiv) risks

associated with the development of mixed-use commercial properties,

including risks associated with the development, and ownership of

non-retail real estate, (xv) changes in governmental laws and

regulations, including, but not limited to, changes in data

privacy, environmental (including climate change), safety and

health laws, and management’s ability to estimate the impact of

such changes, (xvi) the company’s failure to realize the expected

benefits of the merger with RPT Realty (“RPT Merger”), (xvii)

significant transaction costs and/or unknown or inestimable

liabilities related to the RPT Merger, (xviii) the risk of

litigation, including shareholder litigation, in connection with

the RPT Merger, including any resulting expense, (xix) the ability

to successfully integrate the operations of the company and RPT and

the risk that such integration may be more difficult,

time-consuming or costly than expected, (xx) risks related to

future opportunities and plans for the combined company, including

the uncertainty of expected future financial performance and

results of the combined company, (xxi) effects relating to the RPT

Merger on relationships with tenants, employees, joint venture

partners and third parties, (xxii) the possibility that, if the

company does not achieve the perceived benefits of the RPT Merger

as rapidly or to the extent anticipated by financial analysts or

investors, the market price of the company’s common stock could

decline, (xxiii) our ability to achieve and maintain favorable

corporate responsibility-related rankings and scores, (xxiv)

valuation and risks related to the company’s joint venture and

preferred equity investments and other investments, (xxv)

collectability of mortgage and other financing receivables, (xxvi)

impairment charges, (xxvii) criminal cybersecurity attacks,

disruption, data loss or other security incidents and breaches,

(xxviii) risks related to artificial intelligence, (xxix) impact of

natural disasters and weather and climate-related events, (xxx)

pandemics or other health crises, such as the coronavirus disease

2019 (“COVID-19”), (xxxi) our ability to attract, retain and

motivate key personnel, (xxxii) financing risks, such as the

inability to obtain equity, debt or other sources of financing or

refinancing on favorable terms to the company, (xxxiii) the level

and volatility of interest rates and management’s ability to

estimate the impact thereof, (xxxiv) changes in the dividend policy

for the company's common and preferred stock and the company’s

ability to pay dividends at current levels, (xxxv) unanticipated

changes in the company’s intention or ability to prepay certain

debt prior to maturity and/or hold certain securities until

maturity, (xxxvi) the company’s ability to continue to maintain its

status as a REIT for U.S. federal income tax purposes and potential

risks and uncertainties in connection with its UPREIT structure,

and (xxxvii) the other risks and uncertainties identified under

Item 1A, “Risk Factors” and elsewhere in our most recent Annual

Report on Form 10-K for the year-ended December 31, 2023 and in the

company’s other filings with the Securities and Exchange Commission

(“SEC”). Accordingly, there is no assurance that the company’s

expectations will be realized. The company disclaims any intention

or obligation to update the forward-looking statements, whether as

a result of new information, future events or otherwise. You are

advised to refer to any further disclosures the company makes or

related subjects in the company’s quarterly reports on Form 10-Q

and current reports on Form 8-K that the company files with the

SEC.

CONTACT:David F. BujnickiSenior Vice President, Investor

Relations and StrategyKimco Realty

Corporation1-866-831-4297dbujnicki@kimcorealty.com

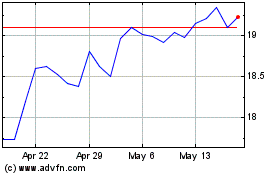

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

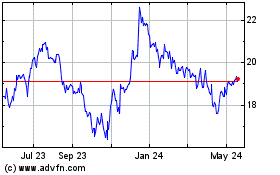

Kimco Realty (NYSE:KIM)

Historical Stock Chart

From Feb 2024 to Feb 2025