Kemper Corporation (NYSE: KMPR) reported net income of $97.4

million, or $1.51 per diluted share, for the fourth quarter of

2024, compared to net income of $51.4 million, or $0.80 per diluted

share, for the fourth quarter of 2023.

Adjusted Consolidated Net Operating Income1 was $115.1 million,

or $1.78 per diluted share, for the fourth quarter of 2024,

compared to Adjusted Consolidated Net Operating Income1 of $50.5

million, or $0.78 per diluted share, for the fourth quarter of

2023.

Key themes of the quarter include:

- Delivered another quarter of strong operating and financial

results

- Generated a 14.0% ROE and a 21.4% Adjusted ROE1 for the

quarter; 11.9% and 18.3%, respectively, for FY’24

- Specialty P&C achieved 5.1% YoY (1.8% QoQ) PIF growth;

91.5% annual underlying combined ratio1 (91.7% quarterly)

- Life business continued to generate strong return on capital

and distributable cash flows

- Parent liquidity remains strong at $1.3 billion; repurchased

~$14 million of stock, increased quarterly dividend, and retiring

$450 million of senior notes due February 2025

“I’m pleased to report that we delivered very strong results for

the year and even stronger results for the quarter,” said Joseph P.

Lacher, Jr., President and CEO. “Our core businesses are performing

very well, led by Specialty Auto’s operating results including

solid policies in force growth and an underlying combined ratio

outperforming long-term expectations. We further strengthened our

balance sheet, providing us with ongoing financial flexibility. Our

competitive advantages position us very well to continue to meet

the needs of our underserved markets, grow our business, and

deliver strong financial results.”

*Unless otherwise specified, discussion of

our fourth quarter 2024 results is focused on net income

attributable to Kemper Corporation common shareholders, which does

not include financial results from Kemper Reciprocal that are

presented within the condensed consolidated financial results in

this release. The results of Kemper Reciprocal are consolidated

under US GAAP.

1Non-GAAP financial measure. All Non-GAAP

financial measures are denoted with footnote 1 throughout this

release. See “Use of Non-GAAP Financial Measures” for additional

information.

Three Months Ended

Year Ended

(Dollars in Millions, Except Per Share

Amounts) (Unaudited)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Net Income (Loss)

$

97.4

$

51.4

$

317.8

$

(272.1

)

Adjusted Consolidated Net Operating Income

(Loss)1

$

115.1

$

50.5

$

381.5

$

(47.2

)

Impact of Catastrophe Losses and Related

Loss Adjustment Expense (LAE) on Net Income (Loss)

$

(4.3

)

$

(8.3

)

$

(51.6

)

$

(76.4

)

Diluted Net Income (Loss) Per Share

From:

Net Income (Loss)

$

1.51

$

0.80

$

4.91

$

(4.25

)

Adjusted Consolidated Net Operating Income

(Loss)1

$

1.78

$

0.78

$

5.89

$

(0.74

)

Impact of Catastrophe Losses and Related

LAE on Net Income (Loss) Per Share

$

(0.07

)

$

(0.16

)

$

(0.80

)

$

(1.51

)

Revenues

Total revenues for the fourth quarter of 2024 decreased $0.4

million to $1,186.8 million compared to the fourth quarter of 2023

that included an $82.4 million reduction in earned premium from our

Non-Core Operations, due primarily to lower volumes resulting from

the exit and run-off of the Preferred Insurance business, offset by

an $89.2 million increase in Specialty Property & Casualty

Insurance earned premiums resulting from higher new business

volumes and higher average earned premium per exposure from rate

increases.

Segment Results

Unless otherwise noted, (i) the segment results discussed below

are presented on an after-tax basis, (ii) prior-year development

includes both catastrophe and non-catastrophe losses and LAE, (iii)

catastrophe losses and LAE exclude the impact of prior-year

development, (iv) loss ratio includes loss and LAE, and (v) all

comparisons are made to the prior year quarter unless otherwise

stated.

Three Months Ended

Year Ended

(Dollars in Millions) (Unaudited)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Segment Adjusted Net Operating Income

(Loss):

Specialty Property & Casualty

Insurance

$

101.2

$

45.3

$

376.3

$

(57.1

)

Life Insurance

23.5

15.0

50.2

51.8

Total Segment Adjusted Net Operating

Income

124.7

60.3

426.5

(5.3

)

Corporate and Other Adjusted Net Operating

Loss

(11.3

)

(9.9

)

(50.3

)

(42.1

)

Less: Net Loss attributable to

Noncontrolling Interest

(1.7

)

(0.1

)

(5.3

)

(0.2

)

Adjusted Consolidated Net Operating Income

(Loss)1

115.1

50.5

381.5

(47.2

)

Net Income (Loss) From:

Change in Fair Value of Equity and

Convertible Securities

(2.0

)

(1.8

)

(2.1

)

3.7

Net Realized Investment Gains (Losses)

3.1

15.6

10.4

(14.7

)

Impairment Losses

(1.6

)

(1.0

)

(4.6

)

(0.9

)

Acquisition and Disposition Related

Transaction, Integration, Restructuring and Other Costs

(7.5

)

(14.4

)

(31.8

)

(95.0

)

Debt Extinguishment, Pension Settlement

and Other Charges

(7.3

)

—

(7.4

)

(55.5

)

Goodwill Impairment Charge

—

—

—

(45.5

)

Non-Core Operations

(2.4

)

2.5

(28.2

)

(17.0

)

Net Income (Loss) attributable to Kemper

Corporation

$

97.4

$

51.4

$

317.8

$

(272.1

)

The Specialty Property and Casualty Insurance segment reported

adjusted net operating income of $101.2 million for the fourth

quarter of 2024, compared to adjusted net operating income of $45.3

million in the fourth quarter of 2023. This increase was due

primarily to an improvement in the Underlying Combined Ratio1. The

segment’s Underlying Combined Ratio1 was 91.7 percent compared to

98.2 percent in the fourth quarter of 2023. The improvement was

primarily driven by higher average earned premiums per exposure

resulting from rate increases and lower underlying claim

frequency.

The Life Insurance segment reported adjusted net operating

income of $23.5 million for the fourth quarter of 2024, compared to

adjusted net operating income of $15.0 million in the fourth

quarter of 2023, primarily driven by favorable mortality experience

from life insurance products.

Capital

Total Kemper Corporation Shareholders’ Equity as of December 31,

2024 was $2,788.4 million, an increase of $283.2 million, or 11

percent, since year-end 2023 primarily driven by net income for the

year. Kemper and its direct non-insurance subsidiaries ended the

quarter with cash and investments of $547.6 million, and $512.0

million of available borrowing capacity under the revolving credit

agreement.

On November 7, 2024, Kemper announced that its Board of

Directors declared a quarterly dividend of $0.31 per share, or

$20.0 million. The dividend was paid on December 4, 2024, to its

shareholders of record as of November 18, 2024.

Kemper ended the year with a book value per share of $43.68, an

increase of 12 percent from $39.08 at the end of 2023. Adjusted

book value per share1 was $29.04 at the end of the year, compared

to $25.39 at the end of 2023.

Unaudited Condensed Consolidated Statements of Income (Loss)

for the three months and year ended December 31, 2024 and 2023 are

presented below.

Three Months Ended

Year Ended

(Dollars in Millions, Except Per Share

Amounts)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Revenues:

Earned Premiums1

$

1,081.8

$

1,063.8

$

4,215.9

$

4,529.4

Net Investment Income

103.0

104.6

407.5

419.7

Change in Value of Alternative Energy

Partnership Investments

0.8

0.6

2.3

2.9

Other Income

1.8

1.9

8.2

7.2

Change in Fair Value of Equity and

Convertible Securities

(2.6

)

(2.2

)

(2.7

)

4.7

Net Realized Investment Gains (Losses)

4.0

19.7

13.2

(18.6

)

Impairment Losses

(2.0

)

(1.2

)

(5.8

)

(1.1

)

Total Revenues

1,186.8

1,187.2

4,638.6

4,944.2

Expenses:

Policyholders’ Benefits and Incurred

Losses and Loss Adjustment Expenses2

743.4

808.1

3,013.1

3,820.0

Insurance and Other Expenses

309.5

301.7

1,180.1

1,365.6

Interest Expense

14.6

13.9

56.9

56.1

Goodwill Impairment

—

—

—

49.6

Total Expenses

1,067.5

1,123.7

4,250.1

5,291.3

Income (Loss) before Income Taxes

119.3

63.5

388.5

(347.1

)

Income Tax Expense (Benefit)

23.6

12.2

76.0

(74.8

)

Net Income (Loss)

95.7

51.3

312.5

(272.3

)

Less: Net Loss attributable to

Noncontrolling Interest

(1.7

)

(0.1

)

(5.3

)

(0.2

)

Net Income (Loss) attributable to Kemper

Corporation

$

97.4

$

51.4

$

317.8

$

(272.1

)

Net Income (Loss) attributable to

Kemper Corporation per Unrestricted Share:

Basic

$

1.52

$

0.80

$

4.95

$

(4.25

)

Diluted

$

1.51

$

0.80

$

4.91

$

(4.25

)

Weighted-average Outstanding (Shares in

Thousands):

Unrestricted Shares - Basic

63,858.6

64,088.3

64,179.5

64,025.6

Unrestricted Shares and Equivalent Shares

- Diluted

64,631.8

64,566.0

64,776.0

64,025.6

Dividends Paid to Shareholders per

Share

$

0.31

$

0.31

$

1.24

$

1.24

1 Includes a remeasurement loss related to

the deferred profit liability within the Life Insurance business of

$6.0 million and $7.2 million for the three months and year ended

December 31, 2024, respectively, and a remeasurement loss of $17.3

million and $19.1 million for the three months and year ended

December 31, 2023, respectively.

2 Includes a remeasurement gain related to

the liability for future policyholder benefits within the Life

Insurance business of $16.5 million and $19.2 million for the three

months and year ended December 31, 2024, respectively, and a

remeasurement gain of $27.2 million and $30.3 million for the three

months and year ended December 31, 2023, respectively.

Unaudited business segment revenues for the three months and

year ended December 31, 2024 and 2023 are presented below.

Three Months Ended

Year Ended

(Dollars in Millions)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

REVENUES:

Specialty Property & Casualty

Insurance:

Earned Premiums:

Personal Automobile

$

753.3

$

699.3

$

2,851.4

$

2,977.8

Commercial Automobile

201.5

166.3

725.0

654.7

Total Earned Premiums

954.8

865.6

3,576.4

3,632.5

Net Investment Income

49.9

42.6

189.6

168.3

Change in Value of Alternative Energy

Partnership Investments

0.6

0.3

1.4

1.6

Other Income

0.9

1.3

4.7

4.5

Total Specialty Property & Casualty

Insurance Revenues

1,006.2

909.8

3,772.1

3,806.9

Life Insurance:

Earned Premiums:

Life1

78.9

67.3

328.1

319.2

Accident & Health

5.5

5.6

22.3

23.1

Property

10.8

11.1

43.5

45.3

Total Earned Premiums

95.2

84.0

393.9

387.6

Net Investment Income

45.5

47.1

170.6

193.4

Change in Value of Alternative Energy

Partnership Investments

0.2

0.1

0.6

0.7

Other Income (Loss)

0.2

0.2

0.5

(0.2

)

Total Life Insurance Revenues

141.1

131.4

565.6

581.5

Total Segment Revenues

1,147.3

1,041.2

4,337.7

4,388.4

Change in Fair Value of Equity and

Convertible Securities

(2.6

)

(2.2

)

(2.7

)

4.7

Net Realized Investment Gains (Losses)

4.0

19.7

13.2

(18.6

)

Net Impairment Losses Recognized in

Earnings

(2.0

)

(1.2

)

(5.8

)

(1.1

)

Non-Core Operations

37.6

126.7

282.4

558.4

Other Income

2.5

3.0

13.8

12.4

Total Revenues

$

1,186.8

$

1,187.2

$

4,638.6

$

4,944.2

1 Earned premiums were impacted by changes

in deferred profit liability related to the annual review and

assumptions update under LDTI that decreased earned premiums by

$4.8 million in the fourth quarter and full year 2024 and decreased

earned premiums by $15.0 million in the fourth quarter and full

year 2023.

KEMPER CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in Millions)

(Unaudited)

Dec 31, 2024

Dec 31, 2023

Assets:

Investments:

Fixed Maturities at Fair Value

$

6,409.6

$

6,881.9

Equity Securities at Fair Value

218.5

225.8

Equity Method Limited Liability

Investments

186.3

221.7

Alternative Energy Partnership

Investments

17.6

17.3

Short-term Investments at Cost which

Approximates Fair Value

1,037.1

520.9

Company-Owned Life Insurance

539.2

513.5

Loans to Policyholders

280.7

281.2

Other Investments

199.5

241.9

Total Investments

8,888.5

8,904.2

Cash

64.4

64.1

Receivables from Policyholders

977.9

959.5

Other Receivables

185.7

200.5

Deferred Policy Acquisition Costs

628.9

591.6

Goodwill

1,250.7

1,250.7

Current Income Tax Assets

63.4

64.5

Deferred Income Tax Assets

93.3

210.4

Other Assets

436.1

492.6

Assets of Consolidated Variable Interest

Entity

Fixed Maturities at Fair Value

1.7

1.7

Short-term Investments at Cost which

Approximates Fair Value

28.0

2.0

Receivables from Policyholders

8.2

0.7

Deferred Policy Acquisition Costs

1.1

0.1

Deferred Income Tax Assets

1.5

—

Other Assets

—

0.1

Total Assets

$

12,630.4

$

12,742.7

KEMPER CORPORATION AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS (Continued)

(Dollars in Millions)

(Unaudited)

Dec 31, 2024

Dec 31, 2023

Liabilities and Shareholders’

Equity:

Insurance Reserves:

Life & Health

$

3,199.7

$

3,422.4

Property & Casualty

2,611.9

2,680.5

Total Insurance Reserves

5,811.6

6,102.9

Unearned Premiums

1,264.1

1,300.8

Policyholder Obligations

637.7

655.7

Deferred Income Tax Liabilities

14.8

50.6

Accrued Expenses and Other Liabilities

705.2

737.7

Long-term Debt, Current, at Amortized

Cost

449.9

—

Long-term Debt, Non-current, at Amortized

Cost

941.7

1,389.2

Liabilities of Consolidated Variable

Interest Entity

Insurance Reserves

9.4

—

Unearned Premiums

11.2

0.5

Accrued Expenses and Other Liabilities

0.5

0.3

Total Liabilities

9,846.1

10,237.7

Kemper Corporation Shareholders’

Equity:

Common Stock

6.4

6.4

Paid-in Capital

1,854.9

1,845.3

Retained Earnings

1,231.6

1,014.3

Accumulated Other Comprehensive Loss

(304.5

)

(360.8

)

Total Kemper Corporation Shareholders’

Equity

2,788.4

2,505.2

Noncontrolling Interest

(4.1

)

(0.2

)

Total Shareholders’ Equity

2,784.3

2,505.0

Total Liabilities and Shareholders’

Equity

$

12,630.4

$

12,742.7

Unaudited selected financial information for the Specialty

Property & Casualty Insurance segment follows.

Three Months Ended

Year Ended

(Dollars in Millions)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Results

of Operations

Net Premiums Written

$

948.9

$

719.7

$

3,685.4

$

3,305.4

Earned Premiums

$

954.8

$

865.6

$

3,576.4

$

3,632.5

Net Investment Income

49.9

42.6

189.6

168.3

Change in Value of Alternative Energy

Partnership Investments

0.6

0.3

1.4

1.6

Other Income

0.9

1.3

4.7

4.5

Total Revenues

1,006.2

909.8

3,772.1

3,806.9

Incurred Losses and LAE related to:

Current Year:

Non-catastrophe Losses and LAE

668.8

673.1

2,514.8

2,974.5

Catastrophe Losses and LAE

1.9

2.5

19.9

34.5

Prior Years:

Non-catastrophe Losses and LAE

1.9

(0.2

)

6.3

135.2

Catastrophe Losses and LAE

(0.1

)

0.1

0.7

(2.3

)

Total Incurred Losses and LAE

672.5

675.5

2,541.7

3,141.9

Insurance Expenses

207.0

177.7

759.5

741.3

Segment Adjusted Operating Income

(Loss)

126.7

56.6

470.9

(76.3

)

Income Tax Expense (Benefit)

25.5

11.3

94.6

(19.2

)

Total Segment Adjusted Net Operating

Income (Loss)

$

101.2

$

45.3

$

376.3

$

(57.1

)

Ratios

Based On Earned Premiums

Current Year Non-catastrophe Losses and

LAE Ratio

70.0

%

77.7

%

70.3

%

82.0

%

Current Year Catastrophe Losses and LAE

Ratio

0.2

0.3

0.6

0.9

Prior Years Non-catastrophe Losses and LAE

Ratio

0.2

—

0.2

3.7

Prior Years Catastrophe Losses and LAE

Ratio

—

—

—

(0.1

)

Total Incurred Loss and LAE Ratio

70.4

78.0

71.1

86.5

Insurance Expense Ratio

21.7

20.5

21.2

20.4

Combined Ratio

92.1

%

98.5

%

92.3

%

106.9

%

Underlying Combined Ratio1

Current Year Non-catastrophe Losses and

LAE Ratio

70.0

%

77.7

%

70.3

%

82.0

%

Insurance Expense Ratio

21.7

20.5

21.2

20.4

Underlying Combined Ratio1

91.7

%

98.2

%

91.5

%

102.4

%

Non-GAAP

Measure Reconciliation

Combined Ratio

92.1

%

98.5

%

92.3

%

106.9

%

Less:

Current Year Catastrophe Losses and LAE

Ratio

0.2

0.3

0.6

0.9

Prior Years Non-catastrophe Losses and LAE

Ratio

0.2

—

0.2

3.7

Prior Years Catastrophe Losses and LAE

Ratio

—

—

—

(0.1

)

Underlying Combined Ratio1

91.7

%

98.2

%

91.5

%

102.4

%

Unaudited selected financial information for the Life

Insurance segment follows.

Three Months Ended

Year Ended

(Dollars in Millions)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Results

of Operations

Earned Premiums

$

95.2

$

84.0

$

393.9

$

387.6

Net Investment Income

45.5

47.1

170.6

193.4

Change in Value of Alternative Energy

Partnership Investments

0.2

0.1

0.6

0.7

Other Income (Loss)

0.2

0.2

0.5

(0.2

)

Total Revenues

141.1

131.4

565.6

581.5

Policyholders’ Benefits and Incurred

Losses and LAE

43.5

40.5

234.5

243.4

Insurance Expenses

69.2

71.0

272.1

275.8

Segment Adjusted Operating Income

28.4

19.9

59.0

62.3

Income Tax Expense

4.9

4.9

8.8

10.5

Total Segment Adjusted Net Operating

Income

$

23.5

$

15.0

$

50.2

$

51.8

Use of Non-GAAP Financial Measures

Adjusted Consolidated Net Operating Income

(Loss)1 is an after-tax, non-GAAP financial measure and is

computed by excluding from Net Income (Loss) attributable to Kemper

Corporation the after-tax impact of:

(i) Change in Fair Value of Equity and

Convertible Securities; (ii) Net Realized Investment Gains

(Losses); (iii) Impairment Losses; (iv) Acquisition and Disposition

Related Transaction, Integration, Restructuring and Other Costs;

(v) Debt Extinguishment, Pension Settlement and Other Charges; (vi)

Goodwill Impairment Charges; (vii) Non-Core Operations; and (viii)

Significant non-recurring or infrequent items that may not be

indicative of ongoing operations

Significant non-recurring items are excluded when (a) the nature

of the charge or gain is such that it is reasonably unlikely to

recur within two years, and (b) there has been no similar charge or

gain within the prior two years. The most directly comparable GAAP

financial measure is Net Income (Loss) attributable to Kemper

Corporation. There were no applicable significant non-recurring

items that Kemper excluded from the calculation of Adjusted

Consolidated Net Operating Income (Loss)1 for the three months and

year ended December 31, 2024 or 2023.

Kemper believes that Adjusted Consolidated Net Operating Income

(Loss)1 provides investors with a valuable measure of its ongoing

performance because it reveals underlying operational performance

trends that otherwise might be less apparent if the items were not

excluded. Change in Fair Value of Equity and Convertible

Securities, Net Realized Investment Gains (Losses) and Impairment

Losses related to investments included in Kemper’s results may vary

significantly between periods and are generally driven by business

decisions and external economic developments such as capital market

conditions that impact the values of Kemper’s investments, the

timing of which is unrelated to the insurance underwriting process.

Acquisition and Disposition Related Transaction, Integration,

Restructuring and Other Costs may vary significantly between

periods and are generally driven by the timing of acquisitions and

business decisions which are unrelated to the insurance

underwriting process. Debt Extinguishment, Pension Settlement and

Other Charges relate to (i) loss from early extinguishment of debt,

which is driven by Kemper’s financing and refinancing decisions and

capital needs, as well as external economic developments such as

debt market conditions, the timing of which is unrelated to the

insurance underwriting process; (ii) settlement of pension plan

obligations which are business decisions made by Kemper, the timing

of which is unrelated to the underwriting process; and (iii) other

charges that are non-standard, not part of the ordinary course of

business, and unrelated to the insurance underwriting process.

Goodwill Impairment Charges are excluded because they are

infrequent and non-recurring charges. Non-Core Operations includes

the results of our Preferred Insurance business which we expect to

fully exit. These results are excluded because they are irrelevant

to our ongoing operations and do not qualify for Discontinued

Operations under Generally Accepted Accounting Principles ("GAAP").

Significant non-recurring items are excluded because, by their

nature, they are not indicative of Kemper’s business or economic

trends. The preceding non-GAAP financial measures should not be

considered a substitute for the comparable GAAP financial measures,

as they do not fully recognize the profitability of Kemper’s

businesses.

A reconciliation of Net Income (Loss) attributable to Kemper

Corporation to Adjusted Consolidated Net Operating Income (Loss)1

for the three months and year ended December 31, 2024 and 2023 is

presented below.

Three Months Ended

Year Ended

(Dollars in Millions) (Unaudited)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Net Income (Loss) attributable to Kemper

Corporation

$

97.4

$

51.4

$

317.8

$

(272.1

)

Less Net (Loss) Income From:

Change in Fair Value of Equity and

Convertible Securities

(2.0

)

(1.8

)

(2.1

)

3.7

Net Realized Investment Gains (Losses)

3.1

15.6

10.4

(14.7

)

Impairment Losses

(1.6

)

(1.0

)

(4.6

)

(0.9

)

Acquisition and Disposition Related

Transaction, Integration, Restructuring and Other Costs

(7.5

)

(14.4

)

(31.8

)

(95.0

)

Debt Extinguishment, Pension Settlement

and Other Charges

(7.3

)

—

(7.4

)

(55.5

)

Goodwill Impairment Charge

—

—

—

(45.5

)

Non-Core Operations

(2.4

)

2.5

(28.2

)

(17.0

)

Adjusted Consolidated Net Operating Income

(Loss)1

$

115.1

$

50.5

$

381.5

$

(47.2

)

Diluted Adjusted Net Operating Income

(Loss) per Unrestricted Share1 is a non-GAAP financial

measure computed by dividing Adjusted Net Operating Income (Loss)1

attributed to unrestricted shares by the weighted-average

unrestricted shares and equivalent shares outstanding. The most

directly comparable GAAP financial measure is Diluted Net Loss per

Unrestricted Share.

A reconciliation of Diluted Net Income (Loss) per Unrestricted

Share to Diluted Adjusted Net Operating Income (Loss) per

Unrestricted Share1 for the three months and year ended December

31, 2024 and 2023 is presented below.

Three Months Ended

Year Ended

(Unaudited)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Diluted Net Income (Loss) attributable to

Kemper Corporation per Unrestricted Share

$

1.51

$

0.80

$

4.91

$

(4.25

)

Less Net (Loss) Income per Unrestricted

Share From:

Change in Fair Value of Equity and

Convertible Securities

(0.03

)

(0.03

)

(0.03

)

0.06

Net Realized Investment Gains (Losses)

0.06

0.24

0.18

(0.23

)

Impairment Losses

(0.03

)

(0.01

)

(0.08

)

(0.01

)

Acquisition and Disposition Related

Transaction, Integration, Restructuring and Other Costs

(0.12

)

(0.22

)

(0.50

)

(1.49

)

Debt Extinguishment, Pension Settlement

and Other Charges

(0.11

)

—

(0.11

)

(0.87

)

Goodwill Impairment Charge

—

—

—

(0.71

)

Non-Core Operations

(0.04

)

0.04

(0.44

)

(0.26

)

Diluted Adjusted Net Operating Income

(Loss) per Unrestricted Share1

$

1.78

$

0.78

$

5.89

$

(0.74

)

Return on Adjusted Shareholders'

Equity1 is a calculation that uses a non-GAAP financial

measure. It is calculated by dividing the period’s net income

attributable to Kemper Corporation by the average shareholders’

equity excluding net unrealized gains and losses on fixed

maturities, the change in discount rate on future life policyholder

benefits and goodwill. Return on Shareholders’ Equity is the most

directly comparable GAAP measure. We use this non-GAAP measure to

identify and analyze the change in performance attributable to

management efforts between periods. Kemper believes this non-GAAP

financial measure is useful to investors because it eliminates the

effect of items that can fluctuate significantly from period to

period and are generally driven by economic developments, primarily

capital market conditions, the magnitude and timing of which are

not influenced by management. Kemper believes it enhances

understanding and comparability of performance by highlighting

underlying business activity and profitability drivers. The “Return

on Adjusted Shareholders’ Equity” metric was referred to as “Return

on Tangible Shareholders’ Equity” in prior periods.

A reconciliation of Return on Shareholders’ Equity to Return on

Adjusted Shareholders’ Equity1 is presented below:

Three Months Ended

Year Ended

(Dollars in Millions) (Unaudited)

Dec 31, 2024

Dec 31, 2023

Dec 31, 2024

Dec 31, 2023

Numerator:

Annualized Net Income (Loss) attributable

to Kemper Corporation

$

389.6

$

205.6

$

317.8

$

(272.1

)

Denominator:

Average Shareholders' Equity2

$

2,780.9

$

2,433.3

$

2,665.6

$

2,539.2

Less: Average Net Unrealized Losses on

Fixed Maturities

576.1

716.9

598.1

673.1

Less: Average Change in Discount Rate on

Future Life Policyholder Benefits

(286.6

)

(286.7

)

(272.8

)

(232.6

)

Less: Average Goodwill

(1,250.7

)

(1,250.7

)

(1,250.7

)

(1,270.5

)

Average Adjusted Shareholders' Equity2

$

1,819.7

$

1,652.8

$

1,740.2

$

1,709.2

Return on

Shareholders' Equity:

Return on Shareholders' Equity

14.0

%

8.4

%

11.9

%

(10.7

)%

Return on Adjusted Shareholders'

Equity1

21.4

%

12.7

%

18.3

%

(15.9

)%

2 Average shareholders' equity and average

adjusted shareholders’ equity for the three months and year ended

is the simple average of the beginning and ending balances for the

period. Average shareholders’ equity and average adjusted

shareholders’ equity on a year-to-date basis is the (a) the sum of

the balance at the beginning of the year and the ending balance for

each quarter within that year divided by (b) the number of quarters

in the period presented plus one.

Underlying Combined Ratio1 is a

non-GAAP financial measure. It is computed by adding the Current

Year Non-catastrophe Losses and LAE Ratio with the Insurance

Expense Ratio. The most directly comparable GAAP financial measure

is the Combined Ratio, which is computed by adding Total Incurred

Losses and LAE Ratio, including the impact of catastrophe losses

and loss and LAE reserve development from prior years, with the

Insurance Expense Ratio.

Kemper believes Underlying Losses and LAE and the Underlying

Combined Ratio are useful to investors and uses these financial

measures to reveal the trends in Kemper’s Property & Casualty

Insurance segment that may be obscured by catastrophe losses and

prior-year reserve development. These catastrophe losses may cause

Kemper’s loss trends to vary significantly between periods as a

result of their incidence of occurrence and magnitude and can have

a significant impact on incurred losses and LAE and the Combined

Ratio. Prior-year reserve developments are caused by unexpected

loss development on historical reserves. Because reserve

development relates to the re-estimation of losses from earlier

periods, it has no bearing on the performance of Kemper’s insurance

products in the current period. Kemper believes it is useful for

investors to evaluate these components separately and in the

aggregate when reviewing Kemper’s underwriting performance.

Adjusted Book Value Per Share1 is a

calculation that uses a non-GAAP financial measure. It is

calculated by dividing shareholders’ equity after excluding the

after-tax impact of net unrealized gains and losses on fixed income

securities, the change in discount rate on future life policyholder

benefits and goodwill by total Common Shares Issued and

Outstanding. Book value per share is the most directly comparable

GAAP financial measure. Kemper uses the trends in book value per

share excluding the after-tax impact of net unrealized gains and

losses on fixed income securities, the change in discount rate on

future life policyholder benefits and goodwill in conjunction with

book value per share to identify and analyze the change in net

worth excluding goodwill attributable to management efforts between

periods. Kemper believes the non-GAAP financial measure is useful

to investors because it eliminates the effect of items that can

fluctuate significantly from period to period and are generally

driven by economic developments, primarily capital market

conditions, the magnitude and timing of which are not influenced by

management. Kemper believes it enhances understanding and

comparability of performance by highlighting underlying business

activity and profitability drivers. The “Adjusted Book Value Per

Share” metric was referred to as “Tangible Book Value Per Share” in

prior periods.

A reconciliation of Book Value Per Share to Adjusted Book Value

Per Share1 is presented below:

As of

(Dollars and Shares in Millions Except Per

Share Amounts) (Unaudited)

Dec 31, 2024

Dec 31, 2023

Numerator:

Kemper Corporation Shareholders’

Equity

$

2,788.4

$

2,505.2

Less: Net Unrealized Losses on Fixed

Maturities

696.5

533.8

Less: Change in Discount Rate on Future

Life Policyholder Benefits

(380.3

)

(160.6

)

Less: Goodwill

(1,250.7

)

(1,250.7

)

Adjusted Shareholders’ Equity

$

1,853.9

$

1,627.7

Denominator:

Common Shares Issued and Outstanding

63.840

64.112

Book Value Per

Share:

Book Value Per Share

$

43.68

$

39.08

Less: Net Unrealized Losses on Fixed

Maturities

10.91

8.33

Less: Change in Discount Rate on Future

Life Policyholder Benefits

(5.96

)

(2.51

)

Less: Goodwill

(19.59

)

(19.51

)

Adjusted Book Value Per Share1

$

29.04

$

25.39

Conference Call

Kemper will host its conference call to discuss fourth quarter

2024 results on Wednesday, February 5, at 5:00 p.m. Eastern (4:00

p.m. Central). The conference call will be accessible via the

internet and by telephone at 888.259.6580, Conference ID

79586. To listen via webcast, register online at the investor

section of kemper.com at least 15 minutes prior to the webcast to

download and install any necessary software. A replay of the call

will be available online at the investor section of kemper.com.

More detailed financial information can be found in Kemper’s

Investor Financial Supplement and Earnings Call Presentation for

the fourth quarter of 2024, which is available at the investor

section of kemper.com.

About Kemper

The Kemper family of companies is one of the nation’s leading

specialized insurers. With approximately $13 billion in assets,

Kemper is improving the world of insurance by providing affordable

and easy-to-use personalized solutions to individuals, families and

businesses through its Kemper Auto and Kemper Life brands. Kemper

serves over 4.7 million policies, is represented by approximately

22,200 agents and brokers, and has approximately 7,400 associates

dedicated to meeting the ever-changing needs of its customers.

Learn more about Kemper at kemper.com.

Caution Regarding Forward-Looking Statements

This press release may contain or incorporate by reference

information that includes or is based on forward-looking statements

within the meaning of the safe-harbor provisions of the Private

Securities Litigation Reform Act of 1995. We caution investors that

these forward-looking statements are not guarantees of future

performance, and actual results may differ materially. Such

statements involve known and unknown risks, uncertainties, and

other factors, including but not limited to:

- changes in the frequency and severity of insurance claims;

- claim development and the process of estimating claim

reserves;

- the impacts of inflation;

- changes in the interest rate environment;

- supply chain disruption;

- product demand and pricing;

- effects of governmental and regulatory actions;

- litigation outcomes and trends;

- investment risks;

- cybersecurity risks or incidents;

- impact of catastrophes; and

- other risks and uncertainties detailed in Kemper’s Annual

Report on Form 10-K and subsequent filings with the Securities and

Exchange Commission (“SEC”).

Kemper assumes no obligation to publicly correct or update any

forward-looking statements as a result of events or developments

subsequent to the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250205566308/en/

Investors: Michael Marinaccio 312.661.4930 or

investors@kemper.com Media: Barbara Ciesemier 312.661.4521 or

bciesemier@kemper.com

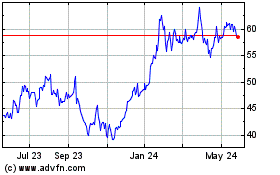

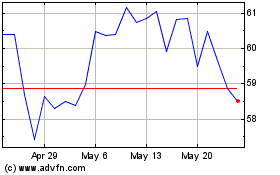

Kemper (NYSE:KMPR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Kemper (NYSE:KMPR)

Historical Stock Chart

From Feb 2024 to Feb 2025