0000060086FALSE00000600862024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| | | | | | | | |

| Date of Report (Date of earliest event reported) | | May 6, 2024 |

LOEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-6541 | | 13-2646102 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | |

9 West 57th Street, New York, NY | 10019-2714 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| Registrant’s telephone number, including area code: | (212) 521-2000 |

| | |

| NOT APPLICABLE |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | L | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2024, Loews Corporation issued a press release and posted on its website (www.loews.com) earnings remarks providing information on its results of operations for the first quarter of 2024. The press release is furnished as Exhibit 99.1 and the earnings remarks are furnished as Exhibit 99.2 to this Form 8-K.

The information under Item 2.02 and in Exhibits 99.1 and 99.2 in this Current Report is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under Item 2.02 and in Exhibits 99.1 and 99.2 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits:

See Exhibit Index.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Loews Corporation press release, issued May 6, 2024, providing information on its results of operations for the first quarter of 2024. |

| | Loews Corporation earnings remarks, posted on its website May 6, 2024, providing information on its results of operations for the first quarter of 2024. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | LOEWS CORPORATION |

| | (Registrant) |

| | |

| | | |

| | | |

Dated: May 6, 2024 | By: | /s/ Marc A. Alpert |

| | | Marc A. Alpert |

| | | Senior Vice President, |

| | General Counsel |

| | and Secretary |

Exhibit 99.1

NEWS RELEASE

LOEWS CORPORATION REPORTS NET INCOME OF $457 MILLION

FOR THE FIRST QUARTER OF 2024

New York, NY, May 6, 2024: Loews Corporation (NYSE: L) today released its first quarter 2024 financial results.

First Quarter 2024 highlights:

Loews Corporation reported net income of $457 million, or $2.05 per share, in the first quarter of 2024, which represents a 22% increase over $375 million, or $1.61 per share, in the first quarter of 2023. The following are the highlights:

•CNA Financial Corporation’s (NYSE: CNA) net income attributable to Loews improved year-over-year due to higher net investment income and favorable net prior year loss reserve development, partially offset by higher net catastrophe losses.

•Boardwalk Pipelines’ results improved year-over-year due to higher revenues from re-contracting at higher rates and recently completed growth projects.

•Parent company investment returns improved year-over-year driven by higher returns on equity securities.

•Book value per share, excluding AOCI, increased to $83.68 as of March 31, 2024, from $81.92 as of December 31, 2023 due to strong operating results in the first quarter 2024.

•As of March 31, 2024, the parent company had $3.2 billion of cash and investments and $1.8 billion of debt.

•Loews Corporation repurchased 0.9 million shares of its common stock for a total cost of $67 million since December 31, 2023.

CEO commentary:

“Loews had an exceptional quarter driven by stellar results at CNA and Boardwalk. CNA continues to experience strong profitable growth, reporting its highest ever first quarter core income.”

–James S. Tisch, President and CEO, Loews Corporation

Consolidated highlights:

| | | | | | | | | | |

| | Three Months Ended March 31, |

| (In millions) | | | 2024 | 2023 |

| Net Income (Loss) Attributable to Loews Corporation: | | | | |

| CNA Financial | | | $ | 310 | | $ | 268 | |

| Boardwalk Pipelines | | | 121 | | 86 | |

| Loews Hotels & Co | | | 16 | | 24 | |

| Corporate | | | 10 | | (3) | |

| Net income attributable to Loews Corporation | | | $ | 457 | | $ | 375 | |

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

|

| |

|

| Book value per share | $ | 72.87 | | | $ | 70.69 | |

| Book value per share excluding AOCI | 83.68 | | | 81.92 | |

Three months ended March 31, 2024 compared to 2023

CNA:

•Net income attributable to Loews Corporation improved 16% to $310 million from $268 million.

•Core income increased 9% to $355 million from $325 million.

•Net investment income increased due to favorable returns from limited partnerships and common stock as well as higher income from fixed income securities as a result of favorable reinvestment rates.

•Net written premiums grew by 6% driven by strong retention and new business. Net earned premiums grew by 9%.

•Property and Casualty underwriting income decreased slightly due to higher net catastrophe losses, partially offset by favorable net prior year loss reserve development.

•Property and Casualty combined ratio was 94.6% compared to 93.9% in the first quarter of 2023 due to a 1.4 point increase in catastrophe losses, partially offset by favorable prior period development. The Property and Casualty underlying combined ratio was 91.0% compared to 90.8% in the first quarter of 2023.

•Net income was positively impacted by lower investment losses driven by the favorable change in fair value of non-redeemable preferred stock.

Boardwalk:

•Net income increased 41% to $121 million compared to $86 million.

•EBITDA increased 20% to $307 million compared to $256 million.

•Net income and EBITDA improved due to higher transportation revenues from re-contracting at higher rates and recently completed growth projects, increased storage and parking and lending revenues, and the impact of the Bayou Ethane acquisition.

Loews Hotels:

•Net income of $16 million compared to $24 million.

•Adjusted EBITDA of $80 million compared to $86 million.

•Lower equity income from joint ventures was driven by decreased occupancy rates in Orlando.

•Net income was also impacted by higher depreciation and pre-opening expenses due to the opening of the Loews Arlington Hotel and Convention Center.

Corporate & Other:

•Net income of $10 million compared to a net loss of $3 million.

•The increase in results is primarily due to higher investment income from parent company equity securities.

Share Purchases:

•On March 31, 2024, there were 222.1 million shares of Loews common stock outstanding.

•Loews Corporation repurchased 0.9 million shares of its common stock for a total cost of $67 million since December 31, 2023.

•Depending on market conditions, Loews may from time to time purchase shares of its and its subsidiaries’ outstanding common stock in the open market, in privately negotiated transactions or otherwise.

Reconciliation of GAAP Measures to Non-GAAP Measures

This news release contains financial measures that are not in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management believes some investors may find these measures useful to evaluate our and our subsidiaries’ financial performance. CNA utilizes core income, Boardwalk utilizes earnings before interest, income tax expense, depreciation and amortization (“EBITDA”), and Loews Hotels utilizes Adjusted EBITDA. These measures are defined and reconciled to the most comparable GAAP measures on pages 6 and 7 of this release.

Earnings Remarks and Conference Calls

For Loews Corporation

–Today, May 6, 2024, earnings remarks will be available on our website.

–Remarks will include commentary from Loews’s president and chief executive officer and chief financial officer.

For CNA

–Today, May 6, 2024, CNA will host an earnings call at 9:00 a.m. ET.

–A live webcast will be available via the Investor Relations section of CNA’s website at www.cna.com.

–To participate by phone, dial 1-844-481-2830 (USA toll-free) or +1-412-317-1850 (International).

About Loews Corporation

Loews Corporation is a diversified company with businesses in the insurance, energy, hospitality and packaging industries. For more information, please visit www.loews.com.

Forward-Looking Statements

Statements contained in this news release which are not historical facts are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters, as well as the Company’s overall business and financial performance, can be found in the Company’s reports filed with the Securities and Exchange Commission and readers of this release are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company’s website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of this news release. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Investor relations and media relations contact:

Chris Nugent

1-212-521-2403

Loews Corporation and Subsidiaries

Selected Financial Information

| | | | | | | | | | |

| | | |

| | Three Months Ended March 31, |

| (In millions) | | | 2024 | 2023 |

| Revenues: | | | | |

| CNA Financial (a) | | | $ | 3,444 | | $ | 3,152 | |

| Boardwalk Pipelines | | | 517 | | 397 | |

| Loews Hotels & Co | | | 216 | | 192 | |

| Corporate investment income, net | | | 54 | | 42 | |

| Total | | | $ | 4,231 | | $ | 3,783 | |

| Income (Loss) Before Income Tax: | | | | |

| CNA Financial (a) | | | $ | 427 | | $ | 371 | |

| Boardwalk Pipelines | | | 162 | | 116 | |

| Loews Hotels & Co | | | 28 | | 34 | |

| Corporate: | | | | |

| Investment income, net | | | 54 | | 42 | |

| Other (b) | | | (42) | | (44) | |

| Total | | | $ | 629 | | $ | 519 | |

| Net Income (Loss) Attributable to Loews Corporation: | | | | |

| CNA Financial (a) | | | $ | 310 | | $ | 268 | |

| Boardwalk Pipelines | | | 121 | | 86 | |

| Loews Hotels & Co | | | 16 | | 24 | |

| Corporate: | | | | |

| Investment income, net | | | 43 | | 33 | |

| Other (b) | | | (33) | | (36) | |

| Net income attributable to Loews Corporation | | | $ | 457 | | $ | 375 | |

(a)The three months ended March 31, 2024 and 2023 include net investment losses of $22 million and $35 million ($16 million and $25 million after tax and noncontrolling interests).

(b)Consists of parent company interest expense, corporate expenses and the equity income (loss) of Altium Packaging.

Loews Corporation and Subsidiaries

Consolidated Financial Review

| | | | | | | | | | |

| | | |

| | Three Months Ended March 31, |

| (In millions, except per share data) | | | 2024 | 2023 |

| Revenues: | | | | |

| Insurance premiums | | | $ | 2,441 | | $ | 2,248 | |

| Net investment income | | | 669 | | 569 | |

| Investment losses | | | (22) | | (35) | |

| Operating revenues and other | | | 1,143 | | 1,001 | |

| Total | | | 4,231 | | 3,783 | |

| | | | |

| Expenses: | | | | |

| Insurance claims and policyholders’ benefits | | | 1,807 | | 1,653 | |

| Operating expenses and other | | | 1,795 | | 1,611 | |

| Total | | | 3,602 | | 3,264 | |

| | | | |

| Income before income tax | | | 629 | | 519 | |

| Income tax expense | | | (144) | | (115) | |

| Net income | | | 485 | | 404 | |

| Amounts attributable to noncontrolling interests | | | (28) | | (29) | |

| Net income attributable to Loews Corporation | | | $ | 457 | | $ | 375 | |

| | | | |

| Net income per share attributable to Loews Corporation | | | $ | 2.05 | | $ | 1.61 | |

| | | | |

| Weighted average number of shares | | | 222.78 | | 233.62 | |

Definitions of Non-GAAP Measures and Reconciliation of GAAP Measures to Non-GAAP Measures:

CNA Financial Corporation

Core income is calculated by excluding from CNA’s net income attributable to Loews Corporation the after-tax effects of investment gains (losses) and the effects of noncontrolling interests. The calculation of core income excludes investment gains (losses) because these are generally driven by economic factors that are not necessarily reflective of CNA’s primary operations. The following table presents a reconciliation of CNA net income attributable to Loews Corporation to core income:

| | | | | | | | | | |

| | | |

| | Three Months Ended March 31, |

| (In millions) | | | 2024 | 2023 |

| CNA net income attributable to Loews Corporation | | | $ | 310 | | $ | 268 | |

| Investment losses | | | 17 | | 28 | |

| Noncontrolling interests | | | 28 | | 29 | |

| Core income | | | $ | 355 | | $ | 325 | |

Boardwalk Pipelines

EBITDA is defined as earnings before interest, income tax expense, depreciation and amortization. The following table presents a reconciliation of Boardwalk net income attributable to Loews Corporation to its EBITDA:

| | | | | | | | | | |

| | | |

| | Three Months Ended March 31, |

| (In millions) | | | 2024 | 2023 |

| Boardwalk net income attributable to Loews Corporation | | | $ | 121 | | $ | 86 | |

| Interest, net | | | 39 | | 39 | |

| Income tax expense | | | 41 | | 30 | |

| Depreciation and amortization | | | 106 | | 101 | |

| EBITDA | | | $ | 307 | | $ | 256 | |

Loews Hotels & Co

Adjusted EBITDA is calculated by excluding from Loews Hotels & Co’s EBITDA, the noncontrolling interest share of EBITDA adjustments, state and local government development grants, gains or losses on asset acquisitions and dispositions, asset impairments, and equity method income, and including Loews Hotels & Co’s pro rata Adjusted EBITDA of equity method investments. Pro rata Adjusted EBITDA of equity method investments is calculated by applying Loews Hotels & Co’s ownership percentage to the underlying equity method investment’s components of EBITDA and excluding distributions in excess of basis.

The following table presents a reconciliation of Loews Hotels & Co net income attributable to Loews Corporation to its Adjusted EBITDA:

| | | | | | | | | | |

| | | |

| | Three Months Ended March 31, |

| (In millions) | | | 2024 | 2023 |

| Loews Hotels & Co net income attributable to Loews Corporation | | | $ | 16 | | $ | 24 | |

| Interest, net | | | 5 | | 6 | |

| Income tax expense | | | 12 | | 10 | |

| Depreciation and amortization | | | 21 | | 16 | |

| EBITDA | | | 54 | | 56 | |

| Noncontrolling interest share of EBITDA adjustments | | | (2) | | |

| | | | |

| | | | |

| Equity investment adjustments: | | | | |

| Loews Hotels & Co’s equity method income | | | (27) | | (31) | |

| Pro rata Adjusted EBITDA of equity method investments | | | 56 | | 62 | |

| Consolidation adjustments | | | (1) | | (1) | |

| Adjusted EBITDA | | | $ | 80 | | $ | 86 | |

The following table presents a reconciliation of Loews Hotels & Co’s equity method income to the Pro rata Adjusted EBITDA of its equity method investments:

| | | | | | | | | | |

| | | |

| | Three Months Ended March 31, |

| (In millions) | | | 2024 | 2023 |

| Loews Hotels & Co’s equity method income | | | $ | 27 | | $ | 31 | |

| Pro rata share of equity method investments: | | | | |

| Interest, net | | | 10 | | 12 | |

| Income tax expense | | | | |

| Depreciation and amortization | | | 12 | | 13 | |

| Distributions in excess of basis | | | 7 | | 6 | |

| | | | |

| Pro rata Adjusted EBITDA of equity method investments | | | $ | 56 | | $ | 62 | |

Exhibit 99.2

Loews Corporation First Quarter 2024 Earnings Remarks

James Tisch, President & CEO:

Good morning and welcome to our first quarter 2024 earnings report. Loews had an exceptional quarter, reporting net income of $457 million or $2.05 per share compared to net income of $375 million or $1.61 per share in the first quarter of 2023. The more-than-20% year-over-year increase in net income is due to strong results at CNA and Boardwalk, as well as higher net investment income at the parent company.

While Jane will provide more details about our results in her remarks, I wanted to highlight CNA’s stellar first quarter. We were pleased to see that the company reported underlying underwriting income in excess of $200 million for the fourth quarter in a row. CNA’s results also included a 16% year-over-year increase in net investment income due to higher reinvestment rates and improved LP and common stock results. While the LP and common stock portfolios are subject to yearly fluctuations, we expect higher yields in the fixed income portfolio to be a tailwind for the foreseeable future.

For the remainder of my remarks, I’d like to review three headlines: executive changes at Boardwalk Pipelines, new developments at Loews Hotels and share repurchases.

A few weeks ago, Boardwalk announced that Stan Horton will retire as CEO in June and will be succeeded by Scott Hallam, who is currently the company’s President and Chief Operating Officer. Stan will retain his position on Boardwalk’s Board of Directors and Scott will also join Boardwalk’s Board.

Stan joined Boardwalk in 2011 and has been instrumental in guiding the company through significant growth and transformation, establishing it as a key player in the midstream industry. We are deeply grateful for Stan’s leadership and expertise, which—in conjunction with the contributions of Boardwalk’s talented management team and employees—have transformed Boardwalk into the operationally and financially strong business that it is today. Stan led a team that invested in significant growth projects and new acquisitions. These projects resulted in substantial growth and significantly improved the quality of the company. In particular, Stan was responsible for identifying the natural gas liquids market as an attractive growth area and successfully building a large NGL transportation and storage business. More recently, Stan also enhanced the quality and stability of Boardwalk’s revenues by converting its customer base from mostly gas marketers and producers to mostly end users—primarily power generators, LNG exporters and industrial companies.

Finally, Stan achieved these remarkable results at Boardwalk while operating with the highest level of integrity. Loews could not have asked for a better or more collaborative partner. Stan has established a solid foundation for future success and is leaving Boardwalk with a deep bench of talent and a strong balance sheet.

Boardwalk’s next leader, Scott Hallam, joined the company in September of 2023, bringing with him over two decades of upstream, midstream, and downstream experience in the natural gas and NGL industries. Prior to joining Boardwalk, Scott was a Senior Vice President at the Williams Companies and had held leadership roles in numerous areas such as Operations, Commercial, Engineering, Construction, Environmental and Safety. Over the past seven months, we have been impressed with Scott’s leadership and knowledge of the pipeline industry. We are excited to work with Scott in his new role and are confident that Boardwalk will continue to excel under his leadership. Of course, it goes without saying that a business’s performance is not solely dependent on the CEO. Boardwalk has a fantastic management team that will continue to operate the business in partnership with Scott.

Loews Hotels opened its much-anticipated 888-room property in Arlington, Texas this quarter. The Loews Arlington Hotel began welcoming customers on February 13th, and has already attracted substantial group business due to its prime location next to three professional sports stadiums and the National Medal of Honor Museum, scheduled to open in April of 2025. The Loews Arlington contains about 250,000 square feet of best-in-class meeting and event space, including the largest ballroom in North Texas. In Orlando, construction continues on three new hotels with a combined total of 2,000 rooms in conjunction with the opening of Universal theme park’s new “Epic Universe” campus. We are excited to announce the opening dates for the first two of those hotels, each of which will have 750 rooms. The Universal Stella Nova Resort is expected to open in January of 2025, and the Universal Terra Luna Resort is expected to open in February of 2025. The third property under development, the Universal Grand Helios, will have 500 rooms and is expected to open later in 2025. We look forward to providing more details in the coming months. By the end of 2025, we anticipate Loews Hotels will manage and have a 50% interest in 11 properties in Orlando, with a combined total of 11,000 rooms.

Next, I want to give you an update on our recent share repurchases. Since the end of 2023 we spent $67 million to repurchase almost 900,000 shares, including just over 200,000 shares in the first quarter and just under 700,000 shares since the end of the first quarter. We slowed down the rate of share repurchases in the first quarter given that Loews’s share price was at or near all-time highs. For context, Loews shares are now trading about 25% higher than the average price of approximately $60 per share that we paid last year to repurchase 14 million shares. Share repurchases remain integral to our capital allocation strategy and we continue to believe that our stock trades at a discount to its intrinsic value.

Before I turn it over to Jane to discuss our first quarter results in greater detail, I am sad to report that Joe Rosenberg, Loews’s long-time Chief Investment Strategist, passed away last Monday. When I arrived at Loews in June of 1977, my father said to Joe, “Take an hour and teach Jim the business.” Forty-seven years later I was still learning from him.

Joe was the consummate investor, proficient in investing in commodities, fixed income, currencies and stocks. He was a global thinker with a nose for value – and, much more often than not, that nose led to great investments. He loved talking about markets to anyone who had thoughts and insights to offer, and his Rolodex included the best in the investment business. Over the course of his 45-year tenure at Loews Corporation, Joe was a beloved mentor to many of us, and respected by all. He will be sorely missed.

Jane Wang, CFO:

For the first quarter of 2024, Loews reported net income of $457 million or $2.05 per share, compared with net income of $375 million or $1.61 per share in last year’s first quarter. This year-over-year increase was driven by higher income at CNA and Boardwalk, as well as higher investment income at the parent company.

Book value per share increased from $70.69 at the end of 2023 to $72.87 at the end of 2024’s first quarter, and book value per share excluding AOCI increased from $81.92 at the end of 2023 to $83.68 at the end of the first quarter. These increases were driven by strong earnings in the first quarter.

CNA had an excellent first quarter, contributing net income of $310 million to Loews, which represents an increase of $42 million compared to $268 million in the first quarter of last year. The year-over-year increase was driven by higher net investment income and higher underlying underwriting income, offset by greater catastrophe losses.

CNA’s net investment income increased 16% compared to the first quarter of 2023 as a result of improved LP and common stock returns as well as favorable reinvestment rates on fixed income securities. LP and common stock income increased by $40 million over last year’s first quarter. Fixed income results benefited from a more than 10-basis point increase in pre-tax yields to 4.7%.

As Jim mentioned, CNA produced another quarter of robust underlying underwriting income, which was driven by continued profitable growth. Net earned and net written Property & Casualty premiums increased by 9% and 6%, respectively, compared with the first quarter of 2023. Written premium growth was driven by four points of rate, two points of exposure growth and strong retention at 85%.

CNA’s combined ratio increased by 0.7 points to 94.6% in the first quarter of 2024 versus 93.9% in the first quarter of last year. That increase was driven by a 1.4-point increase in catastrophe losses, partially offset by favorable prior period development. CNA’s catastrophe losses of 3.8 points were more in line with typical first quarter losses compared to benign losses in last year’s first quarter. The underlying combined ratio increased 0.2 points to 91.0%.

During the first quarter of 2024 CNA also issued $500 million of ten-year notes at 5.125% to prefund the company’s $550 million maturity in May of this year.

Please refer to CNA’s Investor Relations website for more details on their results.

Turning to our natural gas pipeline business, Boardwalk’s EBITDA increased by $51 million to $307 million in the first quarter of 2024 compared to $256 million in the first quarter of 2023. The 20% increase in EBITDA was driven by higher recontracting rates for natural gas transportation and storage as well as greater product sales. The acquisition of Bayou Ethane and recently completed growth projects also contributed to the year-over-year increase.

Boardwalk contributed $121 million of net income to Loews in 2024’s first quarter, which represents an increase of $35 million from $86 million in the first quarter of 2023. The increase in net income was smaller than the change in EBITDA due to higher depreciation expense from the company’s acquisition of Bayou Ethane as well as recently completed growth projects.

During the first quarter of 2024, Boardwalk also issued $600 million of notes at 5.625% in order to prefund an upcoming $600 million maturity in December of this year.

Loews Hotels reported Adjusted EBITDA of $80 million in the first quarter of 2024 compared to $86 million in the first quarter of 2023. The hotel company contributed $16 million of net income to Loews in the first quarter of 2024 versus $24 million in the prior year’s first quarter. The main driver of the year-over-year decline was lower occupancy in Orlando due in part to ongoing renovations, partially offset by higher occupancy at city-center hotels as a result of the continued recovery in group travel. Results were impacted by greater depreciation and pre-opening expenses from the company’s new property in Arlington.

Finally, at the parent company, Loews recorded after-tax investment income of $43 million in the first quarter of 2024, which represents an increase of $10 million compared to $33 million in last year’s first quarter. The improvement was driven by higher returns on our common stock portfolio.

From a cash flow perspective, Loews received $606 million in dividends from CNA and $50 million of distributions from Boardwalk in the first quarter of 2024. Since the end of 2023, we repurchased about 900,000 shares of our common stock at a cost of approximately $67 million. Loews ended 2024’s first quarter with $3.2 billion in cash and short-term investments.

Investor Q&A

Every quarter, we encourage shareholders to send us questions in advance of earnings that they would like us to answer in our remarks. Please see below for the questions we have received, along with some additional questions we found relevant.

Jim, how will data centers impact natural gas demand and Boardwalk?

Growth in artificial intelligence has driven and should continue to drive a proliferation of data centers, creating a substantial uptick in U.S. electricity demand. Incremental demand from data centers also coincides with pressure on the grid from the adoption of electric cars and the onshoring of certain manufacturing facilities. Therefore, after more than a decade of stagnation, electricity demand may grow as much as 20% by the end of this decade. The increase in power demand cannot be met by renewables alone given issues with intermittency, land use and permitting new transmission lines. Therefore, new natural gas-fired power plants will need to be constructed. Boardwalk is already seeing attractive growth projects from new power plants that are being built near its pipeline system.

Jane, how has the higher interest rate environment impacted Loews Hotels?

The higher interest rate environment has not materially impacted Loews Hotels’ ability to refinance its properties, due in large part to its staggered maturities. That being said, the hotel company anticipates that higher rates may impact interest expense as loans mature. However, as the company replaces construction loans with permanent financing, it will likely benefit from lower spreads.

It is important to keep in mind that while higher interest rates are a headwind for Loews Hotels, they are actually a tailwind for Loews Corp overall. As a 92% owner of CNA, Loews benefits from the higher rates that CNA earns on its $47 billion investment portfolio.

Jim, are there any updates on the Boardwalk litigation?

In December of 2022 the Delaware Supreme Court reversed the Delaware Court of Chancery’s ruling in favor of the former Boardwalk minority unitholders. The Delaware Court of Chancery held oral arguments on April 12th regarding unresolved issues that the Delaware Supreme Court remanded back to the lower court. We expect a decision from the Chancery Court later this year. Loews has the ability to appeal any unfavorable decision back to the Delaware Supreme Court.

Reconciliation of GAAP Measures to Non-GAAP Measures

These earnings remarks contain financial measures that are not in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management believes some investors may find these measures useful to evaluate our and our subsidiaries’ financial performance. Boardwalk Pipelines utilizes earnings before interest, income tax expense, depreciation and amortization (“EBITDA”) and Loews Hotels & Co utilizes Adjusted EBITDA. These measures are defined and reconciled to the most comparable GAAP measures on page 6 of these remarks.

About Loews Corporation

Loews Corporation is a diversified company with businesses in the insurance, energy, hospitality and packaging industries. For more information, please visit www.loews.com.

Forward-Looking Statements

Statements contained in these earnings remarks which are not historical facts are "forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters as well as the Company's overall business and financial performance can be found in the Company's reports filed with the Securities and Exchange Commission and readers of these remarks are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company's website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of these remarks. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Definitions of Non-GAAP Measures and Reconciliation of GAAP Measures to Non-GAAP Measures:

Boardwalk Pipelines

EBITDA is defined as earnings before interest, income tax expense, depreciation and amortization. The following table presents a reconciliation of Boardwalk net income attributable to Loews Corporation to its EBITDA:

| | | | | | | | | | |

| | | Three Months Ended March 31, |

| | |

| (In millions) | | | 2024 | 2023 |

| Boardwalk net income attributable to Loews Corporation | | | $ | 121 | | $ | 86 | |

| Interest, net | | | 39 | | 39 | |

| Income tax expense | | | 41 | | 30 | |

| Depreciation and amortization | | | 106 | | 101 | |

| EBITDA | | | $ | 307 | | $ | 256 | |

Loews Hotels & Co

Adjusted EBITDA is calculated by excluding from Loews Hotels & Co’s EBITDA, the noncontrolling interest share of EBITDA adjustments, state and local government development grants, gains or losses on asset acquisitions and dispositions, asset impairments, and equity method income, and including Loews Hotels & Co’s pro rata Adjusted EBITDA of equity method investments. Pro rata Adjusted EBITDA of equity method investments is calculated by applying Loews Hotels & Co’s ownership percentage to the underlying equity method investment’s components of EBITDA and excluding distributions in excess of basis.

The following table presents a reconciliation of Loews Hotels & Co net income attributable to Loews Corporation to its Adjusted EBITDA:

| | | | | | | | | | |

| | | Three Months Ended March 31, |

| | |

| (In millions) | | | 2024 | 2023 |

| Loews Hotels & Co net income attributable to Loews Corporation | | | $ | 16 | | $ | 24 | |

| Interest, net | | | 5 | | 6 | |

| Income tax expense | | | 12 | | 10 | |

| Depreciation and amortization | | | 21 | | 16 | |

| EBITDA | | | 54 | | 56 | |

| Noncontrolling interest share of EBITDA adjustments | | | (2) | | |

| | | | |

| | | | |

| Equity investment adjustments: | | | | |

| Loews Hotels & Co’s equity method income | | | (27) | | (31) | |

| Pro rata Adjusted EBITDA of equity method investments | | | 56 | | 62 | |

| Consolidation adjustments | | | (1) | | (1) | |

| Adjusted EBITDA | | | $ | 80 | | $ | 86 | |

The following table presents a reconciliation of Loews Hotels & Co’s equity method income to the Pro rata Adjusted EBITDA of its equity method investments:

| | | | | | | | | | |

| | | Three Months Ended March 31, |

| | |

| (In millions) | | | 2024 | 2023 |

| Loews Hotels & Co’s equity method income | | | $ | 27 | | $ | 31 | |

| Pro rata share of equity method investments: | | | | |

| Interest, net | | | 10 | | 12 | |

| Income tax expense | | | | |

| Depreciation and amortization | | | 12 | | 13 | |

| Distributions in excess of basis | | | 7 | | 6 | |

| | | | |

| Pro rata Adjusted EBITDA of equity method investments | | | $ | 56 | | $ | 62 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

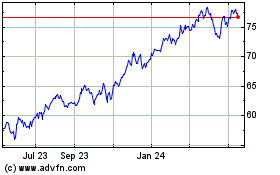

Loews (NYSE:L)

Historical Stock Chart

From Apr 2024 to May 2024

Loews (NYSE:L)

Historical Stock Chart

From May 2023 to May 2024