Dreyfus Strategic Municipals, Inc. (LEO) Releases Fund Statistics

25 April 2009 - 5:02AM

Business Wire

The following information for Dreyfus Strategic Municipals, Inc.

(NYSE: LEO) is as of March 31, 2009 (except as otherwise noted),

and is subject to change at any time. All percentages are based on

total net assets (except as otherwise noted).

Dreyfus Strategic Municipals,

Inc.

Symbol : �LEO�

� � � � � As of March 31, 2009 �

Portfolio Overview

Sector Distribution (Top Five)

Subject to AMT 21% Health Care 15% Number of Issues 171 Housing 12%

Average maturity 19 years Education 5% Effective maturity 13 years

Transportation 8% Duration 6.624 Other Revenue 5% Average rating* A

Average coupon 6.168%

State Distribution (Top Five)

Average dollar price $94.143 Texas 12% Pre-refunded securities 31%

Illinois 7% Leverage 39% California 6% Wisconsin 6%

Market Summary

Michigan 4% Market price range (52 weeks) $6.90-$5.64 NAV range (52

weeks) $7.26-$6.67

Call Schedule (Through 2013)

Market price $6.64 2009 14% NAV $7.25 2010 5% Premium/(discount)

(8.414) 2011 3% Average daily volume (52 weeks) 99,567 2012 6%

Shares outstanding 60.72mm 2013 3% Net assets $725,843,735

Market Yield and Dividend

Rate**

Portfolio Quality*

Current market yield 7.59% AAA 36% Current dividend rate .042 AA 9%

A 17% BBB 23% Below investment grade 15% �

* The percentages of these ratings

are

calculated based on the higher

of

Standard & Poor's or

Moody's�for

individual issues and on a Dreyfus

rating

for non-rated issues.

�

**The market yield is calculated

by

multiplying the current market

distribution

by 12 and dividing by the market

price per

share of $6.64 as of March 31,

2009. Past

Performance is no guarantee of

future

performance and price and yield

will vary.

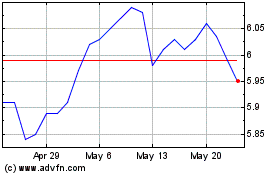

BNY Mellon Strategic Mun... (NYSE:LEO)

Historical Stock Chart

From Jun 2024 to Jul 2024

BNY Mellon Strategic Mun... (NYSE:LEO)

Historical Stock Chart

From Jul 2023 to Jul 2024