FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements and, with respect to common stock, market price data for the fund’s common shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended September 30,

|

|

|

|

|

|

2012

|

|

2011

|

|

2010

|

|

2009

|

|

2008

|

|

|

Per Share Data ($):

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of period

|

8.41

|

|

8.65

|

|

8.47

|

|

7.88

|

|

9.12

|

|

|

Investment Operations:

|

|

|

|

|

|

|

|

|

|

|

|

Investment income—net

a

|

.58

|

|

.60

|

|

.62

|

|

.67

|

|

.68

|

|

|

Net realized and unrealized

|

|

|

|

|

|

|

|

|

|

|

|

gain (loss) on investments

|

.92

|

|

(.24

|

)

|

.15

|

|

.48

|

|

(1.25

|

)

|

|

Dividends to Preferred Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

from investment income—net

|

(.01

|

)

|

(.01

|

)

|

(.02

|

)

|

(.06

|

)

|

(.17

|

)

|

|

Total from Investment Operations

|

1.49

|

|

.35

|

|

.75

|

|

1.09

|

|

(.74

|

)

|

|

Distributions to Common Shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from investment income—net

|

(.59

|

)

|

(.59

|

)

|

(.57

|

)

|

(.50

|

)

|

(.50

|

)

|

|

Net asset value, end of period

|

9.31

|

|

8.41

|

|

8.65

|

|

8.47

|

|

7.88

|

|

|

Market value, end of period

|

10.02

|

|

8.50

|

|

9.02

|

|

7.91

|

|

6.75

|

|

|

Total Return (%)

b

|

25.98

|

|

1.32

|

|

22.13

|

|

26.05

|

|

(18.00

|

)

|

FINANCIAL HIGHLIGHTS

(continued)

|

|

|

|

|

|

|

|

|

|

Year Ended September 30,

|

|

|

|

2012

|

2011

|

2010

|

2009

|

2008

|

|

Ratios/Supplemental Data (%):

|

|

|

|

|

|

|

Ratio of total expenses to average

|

|

|

|

|

|

|

net assets applicable to

|

|

|

|

|

|

|

Common Stock

c

|

1.30

|

1.40

|

1.40

|

1.50

|

1.58

|

|

Ratio of net expenses to average

|

|

|

|

|

|

|

net assets applicable to

|

|

|

|

|

|

|

Common Stock

c

|

1.16

|

1.26

|

1.24

|

1.34

|

1.42

|

|

Ratio of interest and expense related

|

|

|

|

|

|

|

to floating rate notes issued

|

|

|

|

|

|

|

to average net assets applicable

|

|

|

|

|

|

|

to Common Stock

c

|

.10

|

.10

|

.05

|

—

|

.17

|

|

Ratio of net investment income

|

|

|

|

|

|

|

to average net assets applicable

|

|

|

|

|

|

|

to Common Stock

c

|

6.59

|

7.51

|

7.43

|

9.09

|

7.79

|

|

Ratio of total expenses

|

|

|

|

|

|

|

to total average net assets

|

.94

|

.96

|

.92

|

.92

|

1.03

|

|

Ratio of net expenses

|

|

|

|

|

|

|

to total average net assets

|

.84

|

.86

|

.82

|

.82

|

.92

|

|

Ratio of interest and expense related

|

|

|

|

|

|

|

to floating rate notes issued

|

|

|

|

|

|

|

to total average net assets

|

.07

|

.07

|

.03

|

—

|

.11

|

|

Ratio of net investment income

|

|

|

|

|

|

|

to total average net assets

|

4.73

|

5.18

|

4.89

|

5.57

|

5.07

|

|

Portfolio Turnover Rate

|

19.16

|

17.81

|

24.41

|

28.72

|

48.60

|

|

Asset coverage of Preferred Stock,

|

|

|

|

|

|

|

end of period

|

368

|

341

|

324

|

281

|

268

|

|

Net Assets, net of Preferred Stock,

|

|

|

|

|

|

|

end of period ($ x 1,000)

|

573,909

|

515,399

|

528,607

|

514,786

|

478,586

|

|

Preferred Stock outstanding,

|

|

|

|

|

|

|

end of period ($ x 1,000)

|

213,750

|

213,750

|

235,750

|

285,000

|

285,000

|

|

|

|

|

a

|

Based on average common shares outstanding at each month end.

|

|

b

|

Calculated based on market value.

|

|

c

|

Does not reflect the effect of dividends to Preferred Shareholders.

|

See notes to financial statements.

32

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Strategic Municipals, Inc. (the “fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified closed-end management investment company.The fund’s investment objective is to maximize current income exempt from federal income tax to the extent consistent with the preservation of capital.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.The fund’s Common Stock trades on the New York Stock Exchange (the “NYSE”) under the ticker symbol LEO.

The fund has outstanding 1,710 shares of Series M, Series T, Series W, Series TH and Series F for a total of 8,550 shares of Auction Preferred Stock (“APS”), with a liquidation preference of $25,000 per share (plus an amount equal to accumulated but unpaid dividends upon liquida-tion).APS dividend rates are determined pursuant to periodic auctions or by reference to a market rate. Deutsche Bank Trust Company America, as Auction Agent, receives a fee from the fund for its services in connection with such auctions.The fund also compensates broker-dealers generally at an annual rate of .15%-.25% of the purchase price of the shares of APS.

The fund is subject to certain restrictions relating to the APS. Failure to comply with these restrictions could preclude the fund from declaring any distributions to common shareholders or repurchasing common shares and/or could trigger the mandatory redemption of APS at liquidation value.Thus, redemptions of APS may be deemed to be outside of the control of the fund.

NOTES TO FINANCIAL STATEMENTS

(continued)

The holders of the APS, voting as a separate class, have the right to elect at least two directors.The holders of the APS will vote as a separate class on certain other matters, as required by law. The fund has designated Robin A. Melvin and John E. Zuccotti as directors to be elected by the holders of APS.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements

(a) Portfolio valuation:

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

34

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1

—unadjusted quoted prices in active markets for identical investments.

Level 2

—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3

—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the fund’s Board of Directors (the “Board”). Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of the following: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. All of the preceding securities are categorized within Level 2 of the fair value hierarchy. Investments in swap transactions are valued each business day by the Service. Swaps are valued by the Service by using a swap pricing model which incorporates

NOTES TO FINANCIAL STATEMENTS

(continued)

among other factors, default probabilities, recovery rates, credit curves of the underlying issuer and swap spreads on interest rates.These securities are generally categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of September 30, 2012 in valuing the fund’s investments:

|

|

|

|

|

|

|

|

|

|

|

Level 2—Other

|

|

Level 3—

|

|

|

|

|

Level 1—

|

Significant

|

|

Significant

|

|

|

|

|

Unadjusted

|

Observable

|

|

Unobservable

|

|

|

|

|

Quoted Prices

|

Inputs

|

|

Inputs

|

Total

|

|

|

Assets ($)

|

|

|

|

|

|

|

|

Investments in Securities:

|

|

|

|

|

|

|

Municipal Bonds

|

—

|

853,754,673

|

|

—

|

853,754,673

|

|

|

Liabilities ($)

|

|

|

|

|

|

|

|

Floating Rate Notes

†

|

—

|

(74,886,216

|

)

|

—

|

(74,886,216

|

)

|

|

|

|

|

†

|

Certain of the fund’s liabilities are held at carrying amount, which approximates fair value for

|

|

|

financial reporting purposes.

|

36

At September 30, 2012, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Securities transactions and investment income:

Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when issued or delayed delivery basis may be settled a month or more after the trade date.

(c) Dividends to shareholders of Common Stock (“Common Shareholders(s)”):

Dividends are recorded on the ex-dividend date. Dividends from investment income-net are declared and paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

For Common Shareholders who elect to receive their distributions in additional shares of the fund, in lieu of cash, such distributions will be reinvested at the lower of the market price or net asset value per share (but not less than 95% of the market price) in additional shares of the fund at the lower of prevailing market price or net asset value (but not less than 95% of market value at the time of valuation) unless such Common Shareholder elects to receive cash as provided below. If market price is equal to or exceeds net asset value, shares will be issued at net asset value. If net asset value exceeds market price or if a cash dividend only is declared, Computershare Shareowner Services LLC (“Computershare”), the fund’s transfer agent, will buy fund shares in the open market.

NOTES TO FINANCIAL STATEMENTS

(continued)

On September 27, 2012, the Board declared a cash dividend of $.049 per share from investment income-net, payable on October 31, 2012 to Common Shareholders of record as of the close of business on October 12, 2012.

(d) Dividends to shareholders of APS:

Dividends, which are cumulative, are generally reset every 7 days for each Series of APS pursuant to a process specified in related fund charter documents. Dividend rates as of September 30, 2012, for each Series of APS were as follows: Series M-0.274%, Series T-0.274%, Series W-0.274%, Series TH-0.274% and Series F-0.274%.These rates reflect the “maximum rates” under the governing instruments as a result of “failed auctions” in which sufficient clearing bids are not received. The average dividend rates for the period ended September 30, 2012 for each Series of APS were as follows: Series M-0.24%, Series T-0.24%, Series W-0.24%, Series TH-0.24% and Series F-0.24%.

(e) Federal income taxes:

It is the policy of the fund to continue to qualify as a regulated investment company, which can distribute tax-exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended September 30, 2012, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended September 30, 2012 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At September 30, 2012, the components of accumulated earnings on a tax basis were as follows: tax-exempt income $9,128,311, accumulated capital losses $55,684,767 and unrealized appreciation $87,045,120.

38

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute.The 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”).As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to September 30, 2012. If not applied, $264,789 of the carryover expires in fiscal year 2016, $9,875,465 expires in fiscal year 2017, $32,540,019 expires in fiscal year 2018 and $6,369,224 expires in fiscal year 2019.The fund has $2,783,034 of post-enactment short-term capital losses and $3,852,236 of post-enactment long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended September 30, 2012 and September 30, 2011 were as follows: tax-exempt income $36,538,290 and $36,656,908 and ordinary income $125,238 and $83,617, respectively.

During the period ended September 30, 2012, as a result of permanent book to tax differences, primarily due to the tax treatment for amortization adjustments and capital loss carryover expiration, the fund decreased accumulated undistributed investment income-net by $187,008, increased accumulated net realized gain (loss) on investments by $27,300,498 and decreased paid-in capital by $27,113,490. Net assets and net asset value per share were not affected by this reclassification.

(f) New Accounting Pronouncement:

In December 2011, FASB issued Accounting Standards Update No. 2011-11 “Disclosures about

NOTES TO FINANCIAL STATEMENTS

(continued)

Offsetting Assets and Liabilities” (“ASU 2011-11”). These disclosure requirements are intended to help investors and other financial statement users to better assess the effect or potential effect of offsetting arrangements on a company’s financial position.They also improve transparency in the reporting of how companies mitigate credit risk, including disclosure of related collateral pledged or received. In addition,ASU 2011-11 facilitates comparison between those entities that prepare their financial statements on the basis of GAAP and those entities that prepare their financial statements on the basis of International Financial Reporting Standards (“IFRS”). ASU 2011-11 requires entities to: disclose both gross and net information about both instruments and transactions eligible for offset in the financial statements; and disclose instruments and transactions subject to an agreement similar to a master netting agreement. ASU 2011-11 is effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods.At this time, management is evaluating the implications of ASU 2011-11 and its impact on the fund’s financial statement disclosures.

NOTE 2—Management Fee and Other Transactions With Affiliates:

(a)

Pursuant to a management agreement (“Agreement”) with the Manager, the management fee is computed at the annual rate of .75% of the value of the fund’s average weekly net assets, inclusive of the outstanding APS, and is payable monthly.The Agreement provides for an expense reimbursement from the Manager should the fund’s aggregate expenses, exclusive of taxes, interest on borrowings, brokerage and extraordinary expenses, in any full fiscal year exceed the lesser of (1) the expense limitation of any state having jurisdiction over the fund or (2) 2% of the first $10 million, 1

1

/

2

% of the next $20 million and 1% of the excess over $30 million of the average weekly value of the fund’s net assets.The Manager has currently undertaken for the period from October 1, 2011 through May 31, 2013, to waive receipt of a portion of the fund’s management fee, in the amount of .10% of the value of the fund’s average weekly net assets (including

40

net assets representing APS outstanding).The reduction in expenses, pursuant to the undertaking, amounted to $756,847 during the period ended September 30, 2012.

(b)

For the period from October 1, 2011 to December 31, 2011, the fund compensated BNY Mellon Shareowner Services LLC, an affiliate of the Manager, under a transfer agency agreement for performing transfer agency services for the fund. During the period ended December 31, 2011, the fund was charged $32,477 pursuant to the transfer agency agreement with BNY Mellon Shareowner Services LLC, which is included in Shareholder servicing costs in the Statement of Operations. Effective January 1, 2012, Computershare acquired BNY Mellon Shareowner Services LLC and is performing the transfer agency services for the fund. Computershare is not affiliated with the Manager.

The fund compensates The Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, under a custody agreement for providing custodial services to the fund. During the period ended September 30, 2012, the fund was charged $56,194 pursuant to the custody agreement.

The fund has an arrangement with the custodian bank whereby the fund receives earnings credits from the custodian when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits, as an expense offset in the Statement of Operations.

During the period ended September 30, 2012, the fund was charged $8,384 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $471,568, custodian fees $18,400 and chief compliance officer fees $1,991 which are offset against an expense reimbursement currently in effect in the amount of $64,110.

NOTES TO FINANCIAL STATEMENTS

(continued)

(c)

Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 3—Securities Transactions and Swap Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and swap transactions, during the period ended September 30, 2012, amounted to $146,423,834 and $142,620,840, respectively.

Inverse Floater Securities:

The fund participates in secondary inverse floater structures in which fixed-rate, tax-exempt municipal bonds are transferred to a trust.The trust subsequently issues two or more variable rate securities that are collateralized by the cash flows of the fixed-rate, tax-exempt municipal bonds. One or more of these variable rate securities pays interest based on a short-term floating rate set by a remarketing agent at predetermined intervals.A residual interest tax-exempt security is also created by the trust, which is transferred to the fund, and is paid interest based on the remaining cash flow of the trust, after payment of interest on the other securities and various expenses of the trust.

The fund accounts for the transfer of bonds to the trust as secured borrowings, with the securities transferred remaining in the fund’s investments, and the related floating rate certificate securities reflected as fund liabilities in the Statement of Assets and Liabilities.

The average amount of borrowings outstanding under the inverse floater structure during the period ended September 30, 2012 was approximately $74,886,200, with a related weighted average annualized interest rate of .72%.

Derivatives:

A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of derivative instrument that was held by the fund during the period ended September 30, 2012 is discussed below.

42

Swap Transactions:

The fund enters into swap agreements to exchange the interest rate on, or return generated by, one nominal instrument for the return generated by another nominal instrument.The fund enters into these agreements to hedge certain market or interest rate risks, to manage the interest rate sensitivity (sometimes called duration) of fixed income securities, to provide a substitute for purchasing or selling particular securities or to increase potential returns.

The fund accrues for the interim payments on swap contracts on a daily basis, with the net amount recorded within unrealized appreciation (depreciation) on swap contracts in the Statement of Assets and Liabilities. Once the interim payments are settled in cash, the net amount is recorded as a realized gain (loss) on swaps, in addition to realized gain (loss) recorded upon the termination of swap contracts in the Statement of Operations. Upfront payments made and/or received by the fund, are recorded as an asset and/or liability in the Statement of Assets and Liabilities and are recorded as a realized gain or loss ratably over the contract’s term/event with the exception of forward starting interest rate swaps which are recorded as realized gains or losses on the termination date. Fluctuations in the value of swap contracts are recorded for financial statement purposes as unrealized appreciation or depreciation on swap transactions.

Interest Rate Swaps:

Interest rate swaps involve the exchange of commitments to pay and receive interest based on a notional principal amount.The fund may elect to pay a fixed rate and receive a floating rate, or receive a fixed rate and pay a floating rate on a notional principal amount. The net interest received or paid on interest rate swap agreements is included within unrealized appreciation (depreciation) on swap contracts in the Statement of Assets and Liabilities. Interest rate swaps are valued daily and the change, if any, is recorded as an unrealized gain or loss in the Statement of Operations.When a swap

NOTES TO FINANCIAL STATEMENTS

(continued)

contract is terminated early, the fund records a realized gain or loss equal to the difference between the current realized value and the expected cash flows. For financial reporting purposes, forward rate agreements are classified as interest rate swaps.At September 30, 2012, there were no interest rate swap agreements outstanding.

At September 30, 2012, the cost of investments for federal income tax purposes was $691,823,337; accordingly, accumulated net unrealized appreciation on investments was $87,045,120, consisting of $90,289,018 gross unrealized appreciation and $3,243,898 gross unrealized depreciation.

44

|

|

|

REPORT OF INDEPENDENT REGISTERED

|

|

PUBLIC ACCOUNTING FIRM

|

Shareholders and Board of Directors

Dreyfus Strategic Municipals, Inc.

We have audited the accompanying statement of assets and liabilities of Dreyfus Strategic Municipals, Inc., including the statement of investments, as of September 30, 2012, and the related statements of operations and cash flows for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting.Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of September 30, 2012 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Strategic Municipals, Inc. at September 30, 2012, the results of its operations and its cash flows for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

November 27, 2012

ADDITIONAL INFORMATION

(Unaudited)

Dividend Reinvestment and Cash Purchase Plan

Under the fund’s Dividend Reinvestment and Cash Purchase Plan (the “Plan”), a holder of Common Stock who has fund shares registered in his name will have all dividends and distributions reinvested automatically by Computershare Trust Company, N.A., as Plan administrator (the “Administrator”), in additional shares of the fund at the lower of prevailing market price or net asset value (but not less than 95% of market value at the time of valuation) unless such shareholder elects to receive cash as provided below. If market price is equal to or exceeds net asset value, shares will be issued at net asset value. If net asset value exceeds market price or if a cash dividend only is declared, the Administrator, as agent for the Plan participants, will buy fund shares in the open market. A Plan participant is not relieved of any income tax that may be payable on such dividends or distributions.

A Common Shareholder who owns fund shares registered in nominee name through his broker/dealer (i.e., in “street name”) may not participate in the Plan, but may elect to have cash dividends and distributions reinvested by his broker/dealer in additional shares of the fund if such service is provided by the broker/dealer; otherwise such dividends and distributions will be treated like any other cash dividend.

A Common Shareholder who has fund shares registered in his or her name may elect to withdraw from the Plan at any time for a $2.50 fee and thereby elect to receive cash in lieu of shares of the fund. Changes in elections must be in writing, sent to The Bank of New York Mellon, c/o Shareowner Services, P.O. Box 35803, Pittsburgh, PA 15252-8035, should include the shareholder’s name and address as they appear on the Administrator’s records and will be effective only if received more than fifteen days prior to the record date for any distribution.

46

A Plan participant who has fund shares in his name has the option of making additional cash payments to the Administrator, semi-annually, in any amount from $1,000 to $10,000, for investment in the fund’s shares in the open market on or about January 15 and July 15.Any voluntary cash payments received more than 30 days prior to these dates will be returned by the Administrator, and interest will not be paid on any uninvested cash payments.A participant may withdraw a voluntary cash payment by written notice, if the notice is received by the Administrator not less than 48 hours before the payment is to be invested.A Common Shareholder who owns fund shares registered in street name should consult his broker/dealer to determine whether an additional cash purchase option is available through his broker/dealer.

The Administrator maintains all Common Shareholder accounts in the Plan and furnishes written confirmations of all transactions in the account. Shares in the account of each Plan participant will be held by the Administrator in non-certificated form in the name of the participant, and each such participant’s proxy will include those shares purchased pursuant to the Plan.

The fund pays the Administrator’s fee for reinvestment of dividends and distributions. Plan participants pay a pro rata share of brokerage commissions incurred with respect to the Administrator’s open market purchases and purchases from voluntary cash payments, and a $1.25 fee for each purchase made from a voluntary cash payment.

The fund reserves the right to amend or terminate the Plan as applied to any voluntary cash payments made and any dividend or distribution paid subsequent to notice of the change sent to Plan participants at least 90 days before the record date for such dividend or distribution. The Plan also may be amended or terminated by the Administrator on at least 90 days’ written notice to Plan participants.

ADDITIONAL INFORMATION (Unaudited)

(continued)

Level Distribution Policy

The fund’s dividend policy is to distribute substantially all of its net investment income to its shareholders on a monthly basis. In order to provide shareholders with a more consistent yield to the current trading price of shares of Common Stock of the fund, the fund may at times pay out more or less than the entire amount of net investment income earned in any particular month and may at times in any month pay out any accumulated but undistributed income in addition to net investment income earned in that month. As a result, the dividends paid by the fund for any particular month may be more or less than the amount of net investment income earned by the fund during such month.

Benefits and Risks of Leveraging

The fund utilizes leverage to seek to enhance the yield and net asset value of its Common Stock.These objectives cannot be achieved in all interest rate environments. To leverage, the fund has issued Preferred Stock and employs the use of tax-exempt tender option bonds, which pay dividends or interest, respectively, at prevailing short-term interest rates, and invests the proceeds in long-term municipal bonds. The interest earned on these investments is paid to Common Shareholders in the form of dividends, and the value of these portfolio holdings is reflected in the per share net asset value of the fund’s Common Stock. In order for either of these forms of leverage to benefit Common Shareholders, the yield curve must be positively sloped: that is, short-term interest rates must be lower than long-term interest rates. At the same time, a period of generally declining interest rates will benefit Common Shareholders. If either of these conditions change along with other factors that may have an effect on preferred dividends or tender option bonds, then the risk of leveraging will begin to outweigh the benefits.

48

Supplemental Information

For the period ended September 30, 2012, there were: (i) no material changes in the fund’s investment objectives or policies, (ii) no changes in the fund’s charter or by-laws that would delay or prevent a change of control of the fund, (iii) no material changes in the principal risk factors associated with investment in the fund, and (iv) no change in the persons primarily responsible for the day-to-day management of the fund’s portfolio.

IMPORTANT TAX INFORMATION

(Unaudited)

In accordance with federal tax law, the fund hereby reports all the dividends paid from investment income-net during its fiscal year ended September 30, 2012 as “exempt-interest dividends” (not generally subject to regular federal income tax), except $125,238 that is being reported as an ordinary income distribution for reporting purposes. Where required by federal tax law rules, shareholders will receive notification of their portion of the fund’s taxable ordinary dividends (if any), capital gains distributions (if any) and tax-exempt dividends paid for the 2012 calendar year on Form 1099-DIV, which will be mailed in early 2013.

PROXY RESULTS

(Unaudited)

Common Shareholders and holders of Auction Preferred Stock (“APS”) voted together as a single class (except as noted below) on the following proposal presented at the annual shareholders’ meeting held on June 8, 2012.

|

|

|

|

|

|

|

|

Shares

|

|

|

|

For

|

|

Authority Withheld

|

|

To elect three Class III Directors:

†

|

|

|

|

|

Hans C. Mautner

|

53,681,194

|

|

1,568,303

|

|

Burton N. Wallack

|

53,681,168

|

|

1,568,329

|

|

John E. Zuccotti

††

|

5,828

|

|

360

|

|

|

|

|

†

|

The terms of these Class III Directors expire in 2015.

|

|

††

|

Elected solely by APS holders, Common Shareholders not entitled to vote.

|

50

BOARD MEMBERS INFORMATION

(Unaudited)

|

|

|

Joseph S. DiMartino (68)

|

|

Chairman of the Board (1995)

|

|

Current term expires in 2013

|

|

Principal Occupation During Past 5Years:

|

|

• Corporate Director and Trustee

|

|

Other Public Company Board Memberships During Past 5Years:

|

|

• CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small

|

|

and medium size companies, Director (1997-present)

|

|

• Sunair Services Corporation, a provider of certain outdoor-related services to homes and

|

|

businesses, Director (2005-2009)

|

|

• The Newark Group, a provider of a national market of paper recovery facilities, paperboard

|

|

mills and paperboard converting plants, Director (2000-2010)

|

|

No. of Portfolios for which Board Member Serves:

157

|

|

|

|

———————

|

|

William Hodding Carter III (77)

|

|

Board Member (1988)

|

|

Current term expires in 2013

|

|

Principal Occupation During Past 5Years:

|

|

• Professor of Leadership & Public Policy, University of North Carolina, Chapel Hill (2006-present)

|

|

• President and Chief Executive Officer of the John S. and James L. Knight Foundation (1998-2006)

|

|

No. of Portfolios for which Board Member Serves:

27

|

|

|

|

———————

|

|

Gordon J. Davis (71)

|

|

Board Member (2007)

|

|

Current term expires in 2014

|

|

Principal Occupation During Past 5Years:

|

|

• Partner in the law firm of Venable, LLP

|

|

• Partner in the law firm of Dewey & LeBoeuf, LLP (1994-2012)

|

|

Other Public Company Board Memberships During Past 5Years:

|

|

• Consolidated Edison, Inc., a utility company, Director (1997-present)

|

|

• The Phoenix Companies, Inc., a life insurance company, Director (2000-present)

|

|

No. of Portfolios for which Board Member Serves:

50

|

BOARD MEMBERS INFORMATION (Unaudited)

(continued)

|

|

|

Joni Evans (70)

|

|

Board Member (2007)

|

|

Current term expires in 2013

|

|

Principal Occupation During Past 5Years:

|

|

• Chief Executive Officer, www.wowOwow.com an online community dedicated to women’s

|

|

conversations and publications (2007-present)

|

|

• Principal, Joni Evans Ltd. (publishing) (2006-present)

|

|

• Senior Vice President of the William Morris Agency (1994-2006)

|

|

No. of Portfolios for which Board Member Serves:

27

|

|

———————

|

|

Ehud Houminer (72)

|

|

Board Member (1994)

|

|

Current term expires in 2014

|

|

Principal Occupation During Past 5Years:

|

|

• Executive-in-Residence at the Columbia Business School, Columbia University (1992-present)

|

|

No. of Portfolios for which Board Member Serves:

73

|

|

———————

|

|

Richard C. Leone (72)

|

|

Board Member (1989)

|

|

Current term expires in 2013

|

|

Principal Occupation During Past 5Years:

|

|

• Senior Fellow and former President of The Century Foundation (formerly,The Twentieth

|

|

Century Fund, Inc.), a tax exempt research foundation engaged in the study of economic,

|

|

foreign policy and domestic issues

|

|

Other Public Company Board Memberships During Past 5Years:

|

|

• Partnership for a Secure America, Director

|

|

No. of Portfolios for which Board Member Serves:

27

|

|

———————

|

|

Hans C. Mautner (74)

|

|

Board Member (1989)

|

|

Current term expires in 2015

|

|

Principal Occupation During Past 5Years:

|

|

• President—International Division and an Advisory Director of Simon Property Group, a real

|

|

estate investment company (1998-2010)

|

|

• Chairman and Chief Executive Officer of Simon Global Limited (1999-2010)

|

|

No. of Portfolios for which Board Member Serves:

27

|

52

|

|

|

Robin A. Melvin (49)

|

|

Board Member (1995)

|

|

Current term expires in 2014

|

|

Principal Occupation During Past 5Years:

|

|

• Director, Boisi Family Foundation, a private family foundation that supports youth-serving

|

|

organizations that promote the self sufficiency of youth from disadvantaged circumstances

|

|

(1995-2012)

|

|

No. of Portfolios for which Board Member Serves:

83

|

|

——————

|

|

Burton N.Wallack (61)

|

|

Board Member (2007)

|

|

Current term expires in 2015

|

|

Principal Occupation During Past 5Years:

|

|

• President and Co-owner of Wallack Management Company, a real estate management company

|

|

No. of Portfolios for which Board Member Serves:

27

|

|

——————

|

|

John E. Zuccotti (75)

|

|

Board Member (1989)

|

|

Current term expires in 2015

|

|

Principal Occupation During Past 5Years:

|

|

• Chairman of Brookfield Properties, Inc.

|

|

• Senior Counsel of Weil, Gotshal & Manges, LLP

|

|

• Emeritus Chairman of the Real Estate Board of New York

|

|

Other Public Company Board Memberships During Past 5Years:

|

|

• Emigrant Savings Bank, Director (2004-present)

|

|

• Doris Duke Charitable Foundation,Trustee (2006-present)

|

|

• New York Private Bank & Trust, Director

|

|

No. of Portfolios for which Board Member Serves:

27

|

|

——————

|

|

The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York,

|

|

NewYork 10166.

|

|

David W. Burke, Emeritus Board Member

|

|

Arnold S. Hiatt, Emeritus Board Member

|

OFFICERS OF THE FUND

(Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009; from April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 72 investment companies (comprised of 156 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since February 1988.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Assistant General Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. She is 49 years old and has been an employee of the Manager since February 1984.

KIESHA ASTWOOD, Vice President and Assistant Secretary since January 2010.

Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. She is 39 years old and has been an employee of the Manager since July 1995.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. She is 56 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since June 2000.

JOHN B. HAMMALIAN, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since February 1991.

ROBERT R. MULLERY, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 60 years old and has been an employee of the Manager since May 1986.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 54 years old and has been an employee of the Manager since April 1985.

54

RICHARD CASSARO, Assistant Treasurer since January 2007.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 53 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since May 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since August 2005.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 73 investment companies (comprised of 183 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (73 investment companies, comprised of 183 portfolios). He is 55 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

|

|

|

OFFICERS AND DIRECTORS

|

|

Dreyfus Strategic Municipals, Inc.

|

|

|

|

200 Park Avenue

|

|

New York, NY 10166

|

The fund’s net asset value per share appears in the following publications: Barron’s, Closed-End Bond Funds section under the heading “Municipal Bond Funds” every Monday;Wall Street Journal, Mutual Funds section under the heading “Closed-End Bond Funds” every Monday.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940, as amended, that the fund may purchase shares of its common stock in the open market when it can do so at prices below the then current net asset value per share.

For More Information

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund's Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Information regarding how the fund voted proxies relating to portfolio securities for the most recent 12-month period ended June 30 is available on the SEC’s website at http://www.sec.gov and without charge, upon request, by calling 1-800-DREYFUS.

Item

2. Code of Ethics.

The

Registrant has adopted a code of ethics that applies to the Registrant's

principal executive officer, principal financial officer, principal accounting

officer or controller, or persons performing similar functions. There have

been no amendments to, or waivers in connection with, the Code of Ethics during

the period covered by this Report.

Item 3. Audit

Committee Financial Expert.

The

Registrant's Board has determined that Ehud Houminer, a member of the Audit

Committee of the Board, is an audit committee financial expert as defined by

the Securities and Exchange Commission (the "SEC"). Ehud Houminer is

"independent" as defined by the SEC for purposes of audit committee

financial expert determinations.

Item 4. Principal

Accountant Fees and Services.

(a)

Audit Fees

. The aggregate fees billed for each of the last two fiscal

years (the "Reporting Periods") for professional services rendered by

the Registrant's principal accountant (the "Auditor") for the audit

of the Registrant's annual financial statements or services that are normally

provided by the Auditor in connection with the statutory and regulatory filings

or engagements for the Reporting Periods, were $30,312 in 2011 and $32,015 in

2012.

(b)

Audit-Related Fees

.

The aggregate fees billed in the Reporting Periods for assurance and related

services by the Auditor that are reasonably related to the performance of the

audit of the Registrant's financial statements and are not reported under

paragraph (a) of this Item 4 were $46,082 in 2011 and $32,442 in 2012. These

services consisted of one or more of the following: (i) agreed upon procedures

related to compliance with Internal Revenue Code section 817(h), (ii) security

counts required by Rule 17f-2 under the Investment Company Act of 1940, as

amended, (iii) advisory services as to the accounting or disclosure treatment

of Registrant transactions or events, (iv) advisory services to the accounting

or disclosure treatment of the actual or potential impact to the Registrant of

final or proposed rules, standards or interpretations by the Securities and

Exchange Commission, the Financial Accounting Standards Boards or other

regulatory or standard-setting bodies and (v) agreed upon procedures in

evaluating compliance by the Fund with provisions of the Fund’s articles

supplementary, creating the series of auction rate preferred stock.

The

aggregate fees billed in the Reporting Periods for non-audit assurance and

related services by the Auditor to the Registrant's investment adviser (not

including any sub-investment adviser whose role is primarily portfolio

management and is subcontracted with or overseen by another investment

adviser), and any entity controlling, controlled by or under common control

with the investment adviser that provides ongoing services to the Registrant

("Service Affiliates"), that were reasonably related to the

performance of the annual audit of the Service Affiliate, which required

pre-approval by the Audit Committee were $0 in 2011 and $0 in 2012.

(c)

Tax Fees

. The aggregate fees billed in the Reporting Periods for

professional services rendered by the Auditor for tax compliance, tax advice,

and tax planning ("Tax Services") were $2,731 in 2011 and $3,267 in

2012. These services consisted of: (i) review or preparation of U.S. federal,

state, local and excise tax returns; (ii) U.S. federal, state and local tax

planning, advice and assistance regarding statutory, regulatory or

administrative developments; (iii) tax advice regarding tax qualification

matters and/or treatment of various financial instruments held or proposed to

be acquired or held. The aggregate fees billed in the Reporting Periods for Tax

Services by the Auditor to Service Affiliates, which required pre-approval by

the Audit Committee were $0 in 2011 and $0 in 2012.

(d)

All Other Fees

. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the services reported in paragraphs (a) through (c) of this Item, were $217 in 2011 and $0 in 2012. [These services consisted of a review of the Registrant's anti-money laundering program].

The aggregate fees billed in the Reporting Periods for Non-Audit Services by the Auditor to Service Affiliates, other than the services reported in paragraphs (b) through (c) of this Item, which required pre-approval by the Audit Committee, were $0 in 2011 and $200,000 in 2012.

(e)(1) Audit Committee Pre-Approval Policies and Procedures

. The Registrant's Audit Committee has established policies and procedures (the "Policy") for pre-approval (within specified fee limits) of the Auditor's engagements for non-audit services to the Registrant and Service Affiliates without specific case-by-case consideration. The pre-approved services in the Policy can include pre-approved audit services, pre-approved audit-related services, pre-approved tax services and pre-approved all other services. Pre-approval considerations include whether the proposed services are compatible with maintaining the Auditor's independence. Pre-approvals pursuant to the Policy are considered annually.

(e)(2) Note: None of the services described in paragraphs (b) through (d) of this Item 4 were approved by the Audit Committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) None of the hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year were attributed to work performed by persons other than the principal account's full-time, permanent employees.

Non-Audit Fees

. The aggregate non-audit fees billed by the Auditor for services rendered to the Registrant, and rendered to Service Affiliates, for the Reporting Periods were $16,565,389 in 2011 and $43,887,310 in 2012.

Auditor Independence

. The Registrant's Audit Committee has considered whether the provision of non-audit services that were rendered to Service Affiliates, which were not pre-approved (not requiring pre-approval), is compatible with maintaining the Auditor's independence.

Item 5. Audit Committee of Listed Registrants.

The Registrant has a separately-designated standing Audit Committee established in accordance with Section 3(a) (58)(A) of the Securities Exchange Act of 1934, consisting of the following members: Joseph S. DiMartino, David W. Burke, Hodding Carter III, Joni Evans, Ehud Houminer, Richard C. Leone, Hans C. Mautner, Robin A. Melvin, Burton N. Wallack and John E. Zuccotti of applicable.

Item 6. Investments.

(a)

Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable. [CLOSED-END FUNDS ONLY]

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a) (1)

The following information is as of November 29, 2012, the date of the filing of this report:

Steven Harvey and

Daniel A. Barton

manage the Registrant.

(a)

(2)

The following information is as of the Registrant’s most recently completed

fiscal year, except where otherwise noted:

Portfolio Managers.

The

Manager manages the Fund's portfolio of investments in accordance with the

stated policies of the Fund, subject to the approval of the Fund's Board

members. The Manager is responsible for investment decisions and provides the

Fund with portfolio managers who are authorized by the Fund's Board to execute

purchases and sales of securities. The Fund's portfolio managers are Steven

Harvey and

Dan Barton

. The Manager also

maintains a research department with a professional staff of portfolio managers

and securities analysts who provide research services for the Fund and for

other funds advised by the Manager.

Portfolio Manager

Compensation

. The portfolio managers' compensation is comprised primarily

of a market-based salary and an incentive compensation plan (annual and long-term).

Funding for the Standish Incentive Plan is through a pre-determined fixed

percentage of overall company profitability. Therefore, all bonus awards are

based initially on Standish's overall performance as opposed to the performance

of a single product or group. All investment professionals are eligible to

receive incentive awards. Cash awards are payable in the February month end

pay of the following year. Most of the awards granted have some portion

deferred for three years in the form of deferred cash, BNY Mellon equity,

interests in investment vehicles (consisting of investments in a range of

Standish products), or a combination of the above. Individual awards for

portfolio managers are discretionary, based on both individual and multi-sector

product risk adjusted performance relative to both benchmarks and peer

comparisons over one year, three year and five year periods. Also considered

in determining individual awards are team participation and general

contributions to Standish. Individual objectives and goals are also

established at the beginning of each calendar year and are taken into account.

Portfolio managers whose compensation exceeds certain levels may elect to defer

portions of their base salaries and/or incentive compensation pursuant to BNY

Mellon's Elective Deferred Compensation Plan.

Additional

Information About Portfolio Managers

. The following table lists the

number and types of other accounts advised by the Fund’s primary portfolio

manager and assets under management in those accounts as of the end of the

Fund's fiscal year:

|

Portfolio Manager

|

Registered Investment Company

Accounts

|

Assets Managed

|

Pooled

Accounts

|

Assets Managed

|

Other

Accounts

|

Assets Managed

|

|

Steven

Harvey

|

7

|

$3,252.1

million

|

5

|

$1,247.5

million

|

425

|

$5,991.6

million

|

|

Daniel A. Barton

|

6

|

$2,877.6

million

|

0

|

$0

|

0

|

$0

|

None of the funds or accounts are subject

to a performance-based advisory fee.

The dollar range of Fund shares beneficially owned by the primary portfolio

manager is as follows as of the end of the Fund’s fiscal year:

|

Portfolio Manager

|

Registrant Name

|

Dollar Range

of Registrant

Shares Beneficially

Owned

|

|

Steven

Harvey

|

Dreyfus Strategic

Municipals, Inc.

|

None

|

|

Daniel

A. Barton

|

Dreyfus Strategic Municipals, Inc.

|

None

|

Portfolio

managers may manage multiple accounts for a diverse client base, including

mutual funds, separate accounts (assets managed on behalf of institutions such

as pension funds, insurance companies and foundations), bank common trust

accounts and wrap fee programs (“Other Accounts”).

Potential

conflicts of interest may arise because of Dreyfus’ management of the Fund and

Other Accounts. For example, conflicts of interest may arise with both

the aggregation and allocation of securities transactions and allocation of

limited investment opportunities, as Dreyfus may be perceived as causing

accounts it manages to participate in an offering to increase Dreyfus’ overall

allocation of securities in that offering, or to increase Dreyfus’ ability to

participate in future offerings by the same underwriter or issuer.

Allocations of bunched trades, particularly trade orders that were only

partially filled due to limited availability and allocation of investment

opportunities generally, could raise a potential conflict of interest, as

Dreyfus may have an incentive to allocate securities that are expected to

increase in value to preferred accounts. Initial public offerings, in

particular, are frequently of very limited availability. Additionally,

portfolio managers may be perceived to have a conflict of interest if there are

a large number of Other Accounts, in addition to the Fund, that they are

managing on behalf of Dreyfus. Dreyfus periodically reviews each

portfolio manager’s overall responsibilities to ensure that he or she is able

to allocate the necessary time and resources to effectively manage the

Fund. In addition, Dreyfus could be viewed as having a conflict of

interest to the extent that Dreyfus or its affiliates and/or portfolio managers

have a materially larger investment in Other Accounts than their investment in

the Fund.

Other

Accounts may have investment objectives, strategies and risks that differ from

those of the Fund. For these or other reasons, the portfolio manager may

purchase different securities for the Fund and the Other Accounts, and the

performance of securities purchased for the Fund may vary from the performance

of securities purchased for Other Accounts. The portfolio manager may

place transactions on behalf of Other Accounts that are directly or indirectly

contrary to investment decisions made for the Fund, which could have the

potential to adversely impact the Fund, depending on market conditions.

A

potential conflict of interest may be perceived to arise if transactions in one

account closely follow related transactions in another account, such as when a

purchase increases the value of securities previously purchased by the other

account, or when a sale in one account lowers the sale price received in a sale

by a second account.

Dreyfus’ goal

is to provide high quality investment services to all of its clients, while

meeting Dreyfus’ fiduciary obligation to treat all clients fairly.

Dreyfus has adopted and implemented policies and procedures, including

brokerage and trade allocation policies and procedures that it believes address

the conflicts associated with managing multiple accounts for multiple

clients. In addition, Dreyfus monitors a variety of areas, including

compliance with Fund guidelines, the allocation of IPOs, and compliance with

the firm’s Code of Ethics. Furthermore, senior investment and business

personnel at Dreyfus periodically review the performance of the portfolio

managers for Dreyfus-managed funds.

Item 9. Purchases

of Equity Securities by Closed-End Management Investment Companies and Affiliated

Purchasers.

Not applicable. [CLOSED-END FUNDS ONLY]

Item 10. Submission

of Matters to a Vote of Security Holders.

There have been no material changes to the procedures

applicable to Item 10.

Item 11. Controls

and Procedures.

(a) The Registrant's principal executive and

principal financial officers have concluded, based on their evaluation of the

Registrant's disclosure controls and procedures as of a date within 90 days of

the filing date of this report, that the Registrant's disclosure controls and

procedures are reasonably designed to ensure that information required to be

disclosed by the Registrant on Form N-CSR is recorded, processed, summarized

and reported within the required time periods and that information required to

be disclosed by the Registrant in the reports that it files or submits on Form

N-CSR is accumulated and communicated to the Registrant's management, including

its principal executive and principal financial officers, as appropriate to

allow timely decisions regarding required disclosure.

(b) There

were no changes to the Registrant's internal control over financial reporting

that occurred during the second fiscal quarter of the period covered by this

report that have materially affected, or are reasonably likely to materially

affect, the Registrant's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and

principal financial officers as required by Rule 30a-2(a) under the Investment

Company Act of 1940.

(a)(3) Not applicable.

(b) Certification of principal executive and

principal financial officers as required by Rule 30a-2(b) under the Investment

Company Act of 1940.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, the Registrant has duly caused this Report to be signed on

its behalf by the undersigned, thereunto duly authorized.

DREYFUS STRATEGIC

MUNICIPALS, INC.

|

By:

/s/ Bradley J. Skapyak

|

|

Bradley J.

Skapyak,

President

|

|

Date:

|

November 20, 2012

|

|

|

|

Pursuant

to the requirements of the Securities Exchange Act of 1934 and the Investment

Company Act of 1940, this Report has been signed below by the following

persons on behalf of the Registrant and in the capacities and on the dates

indicated.

|

|

|

|

By:

/s/ Bradley J. Skapyak

|

|

Bradley J.

Skapyak,

President

|

|

Date:

|

November 20, 2012

|

|

|

|

By:

/s/ James Windels

|

|

James Windels,

Treasurer

|

|

Date:

|

November 20, 2012

|

|

|

EXHIBIT INDEX

(a)(1) Code of ethics referred to in Item 2.

(a)(2) Certifications of principal executive and

principal financial officers as required by Rule 30a-2(a) under the Investment

Company Act of 1940. (EX-99.CERT)

(b) Certification of principal executive and

principal financial officers as required by Rule 30a-2(b) under the Investment

Company Act of 1940. (EX-99.906CERT)

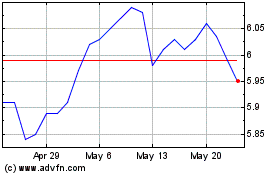

BNY Mellon Strategic Mun... (NYSE:LEO)

Historical Stock Chart

From Jun 2024 to Jul 2024

BNY Mellon Strategic Mun... (NYSE:LEO)

Historical Stock Chart

From Jul 2023 to Jul 2024