FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated November

7, 2024

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro

– Brazilian Agricultural Real Estate Company

(Translation

of Registrant’s Name)

1309

Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

(Address

of principal executive offices)

Gustavo

Javier Lopez,

Administrative

Officer and Investor Relations Officer,

Tel.

+55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309

Av. Brigadeiro Faria Lima, 5th floor

São

Paulo, São Paulo 01452-002, Brazil

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Earnings

Release 1Q25

São

Paulo, November 06, 2024 – BrasilAgro (B3: AGRO3) (NYSE: LND) announces its consolidated results for the quarter ended September

30, 2024 (“1Q25”). The consolidated information is prepared in accordance with the International Financial Reporting Standards

(IFRS).

Highlights

of the Period

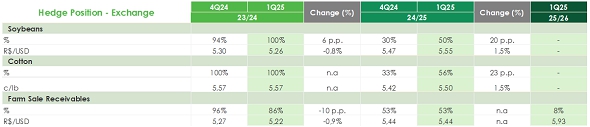

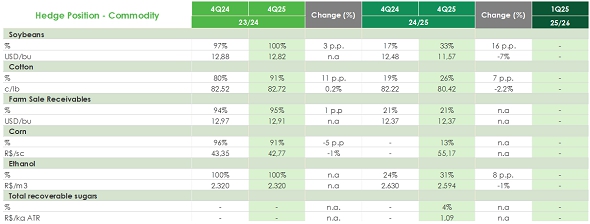

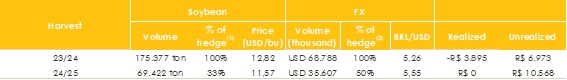

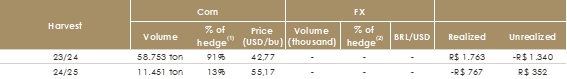

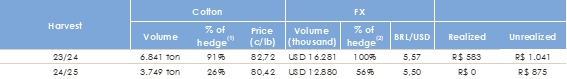

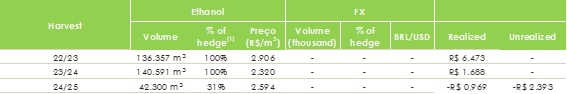

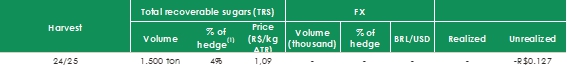

Hedge

Position

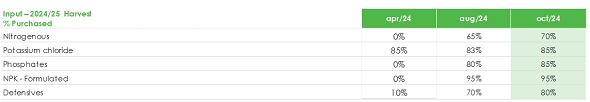

Status

of Input Acquisitions

Estimates

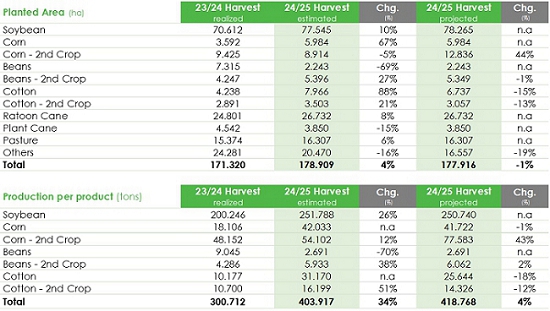

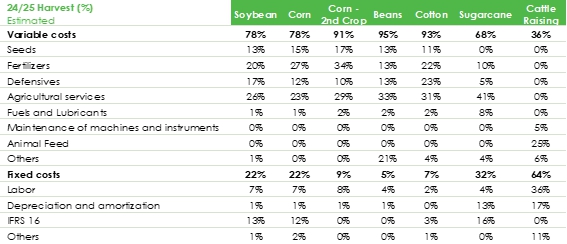

- 24/25 Crop Year

Note

that the estimates are hypothetical and do not constitute a guarantee of performance. To learn more about the operational estimates of

the Company, refer to the section on projections in our Reference Form.

MESSAGE

FROM THE MANAGEMENT

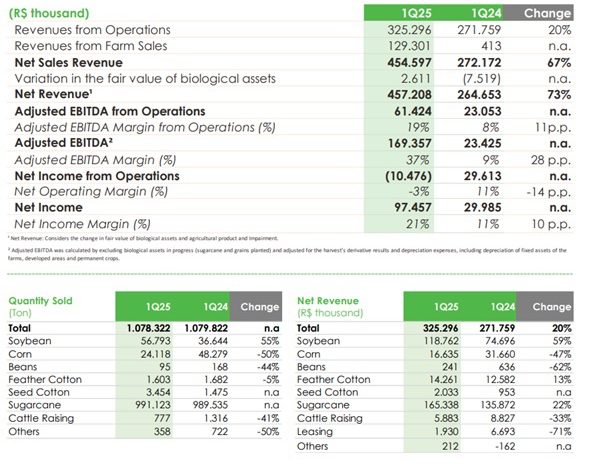

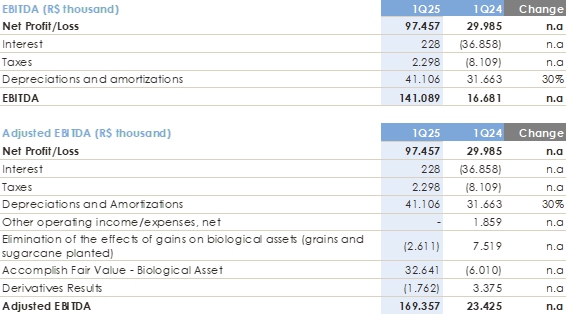

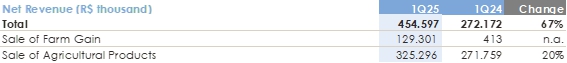

We began the 2024/2025 crop year with a Net

Income of R$97.4 million, a net margin of 21%, and Adjusted EBITDA of R$169.4 million, with a margin of 37%. These results reflect a

Net Revenue of R$454.6 million, composed of R$129.3 million from farm sales and R$325.3 million from agricultural product sales.

The

period was marked by volatility in the prices of key commodities and exchange rate fluctuations, which brought challenges for the beginning

of the crop year. However, our commercialization and hedge strategy, along with efficient management of production costs, helped mitigate

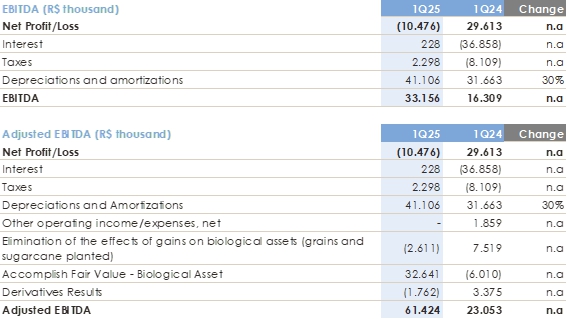

these impacts, resulting in better margins per crop. We closed the quarter with an operational Adjusted EBITDA of R$61.4 million, representing

a 166% growth compared to the previous year.

We

started planting the 2024/2025 crop, and to date, 34% of the soybean area has been planted. It is worth highlighting that 76% of the

soybeans in the state of Mato Grosso have been planted within the optimal planting window. Weather forecasts continue to indicate a weak

La Niña year, which is characterized by better distribution of rainfall in the regions where we operate.

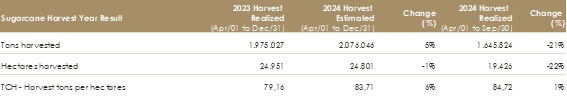

Still

from an operational perspective, we delivered 1.6 million tons of sugarcane from the 2024 crop, with a TCH (tons per hectare) of 84.72,

surpassing the challenges of the previous cycle. By the end of the harvest in December, we expect to deliver a total of 2.0 million tons,

in line with our estimates.

The

1Q25 was also marked by the recognition of revenue from the sale of the second part of the Alto Taquari farm, in the nominal amount of

R$189.4 million. This sale was realized in two stages, the first stage in October 2021, for R$336.0 million. The combined IRR (Internal

Rate of Return) for both stages was 18.6%.

On

October 22, the General Shareholder Meeting approved the distribution of R$155.0 million in dividends, equivalent to R$1.56 per share,

generating a dividend yield of 6%, reaffirming our commitment to returning value to our shareholders.

Finally,

it is with great enthusiasm that we celebrate once again the achievement of the GPTW seal! This certification reaffirms our commitment

to building an increasingly positive and welcoming work environment. In addition to being recognized as one of the best places to work,

we were honored to receive the Great People Mental Health seal, an important milestone in our journey to promote the well-being of our

employees. This achievement is the result of hard work and dedication by the entire team, and motivates us to continue seeking excellence

in all areas.

André Guillaumon, CEO of BrasilAgro

REAL

ESTATE PERFORMANCE

Sale

of Farm

ALTO

TAQUARI FARM: In September, we completed the second stage of the sale of the Alto Taquari farm, a rural property located in the municipality

of Alto Taquari (MT). The transaction was entered into in October 2021, with two stages, totaling 3,723 hectares (2,694 arable hectares).

The

area was sold for 1,100 soybean bags per usable hectare. The transfer of possession of the areas and, consequently, the recognition of

the sales revenue, were carried out in two stages: 2,566 hectares (1,537 arable hectares) in October 2021, valued at approximately R$336.0

million (nominal value at the date of sale) and 1,157 arable hectares in September 2024, valued at approximately R$189.4 million (nominal

value at the date of sale). With the completion of this stage, we transferred possession and ceased to operate in this area.

From

the accounting standpoint, the value of this area on the Company’s books is R$31.3 million (acquisition + investments net of depreciation),

with an expected Internal Rate of Return (IRR) in Brazilian reais of 18.6% (updated value).

Considering

this sale, all the plateau areas of the Alto Taquari farm have been sold, leaving an area of 1,380 hectares (809 arable hectares) in

the Company’s portfolio, which is adjacent to the areas sold and has distinct characteristics in terms of soil and altitude. Even though

it is not a plateau area, it is occupied with sugarcane crops.

Property

Portfolio

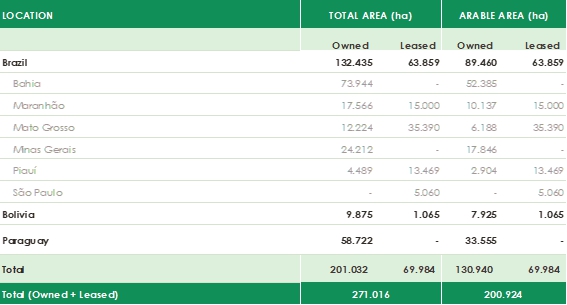

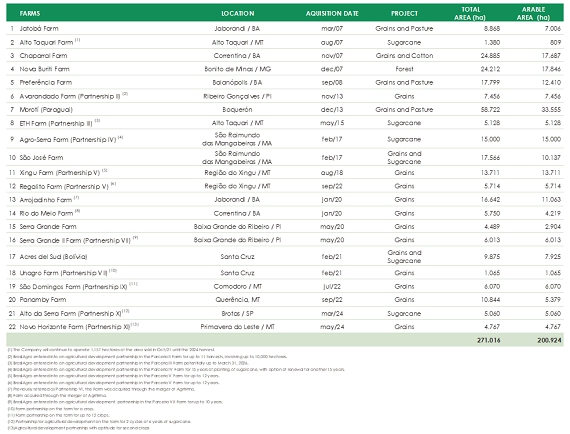

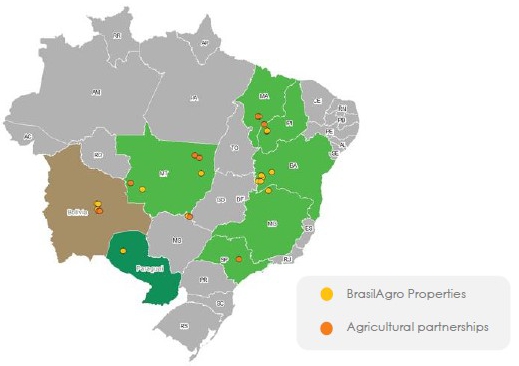

The

Company’s property portfolio comprises 271,016 hectares across six Brazilian states, as well as Paraguay and Bolivia.

The current mix of the production area, which includes owned and leased land, enables greater flexibility in portfolio

management and reduces volatility in operating cash flow.

OPERATIONAL

PERFORMANCE 24/25

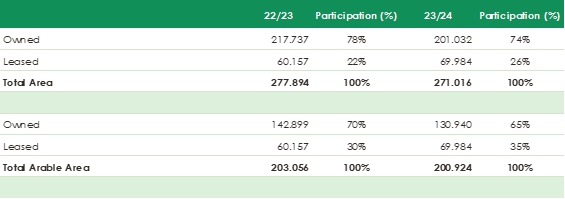

The

table below shows the planted area in the 2024/2025 crop year by region.

Faced

with a favorable scenario for corn, with the expectation of better prices, the Company chose to expand its area intended for second-crop

corn.

Due

to the weather conditions in Mato Grosso, with the delay of rainfall within the ideal planting window, the Company reduced by 1,600 hectares

its cotton area, switching it to soybean crops. Despite this adjustment, total planted area increased 3% compared to the previous crop

year, with a 1% deviation from the initial estimate.

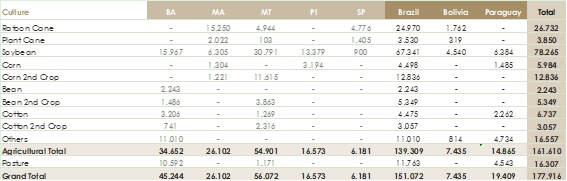

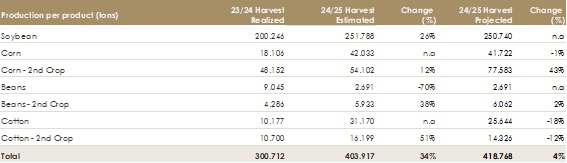

Grains and Cotton

The

revision of the crop mix will result in an increase of 4% in total grain and cotton production, driven by the growth of 43% in the estimated

production of second-crop corn in relation to the initial projection. This change reflects the optimization of the planted area, aiming

to maximize the profitability of agricultural production.

So

far, we have planted 40% of the soybean crop. As to soybean, we have planted 76% of the area in Mato Grosso, within the optimal planting

window.

Sugarcane

Unlike

other crops, the sugarcane crop spans from April to December. By September 30, 2024, we harvested 1,600,000 tons of sugarcane, corresponding

to 84.72 tons of cane per hectare (TCH).

The

sugarcane crop year in Mato Grosso and São Paulo was concluded with satisfactory results, in line with expectations. The harvest

in Maranhão is nearing completion and is expected to yield good results. The harvested crops exhibited strong vegetative growth,

successfully overcoming the water stress effects from the previous cycle, thanks to favorable weather conditions and effective management

practices.

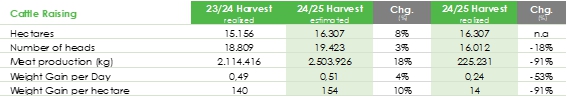

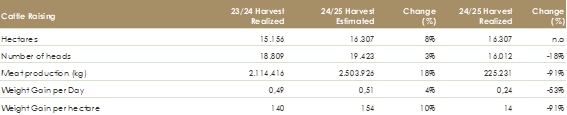

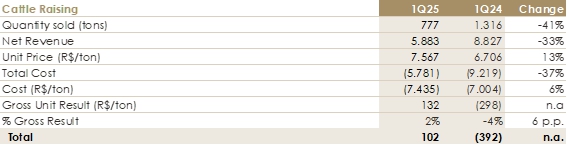

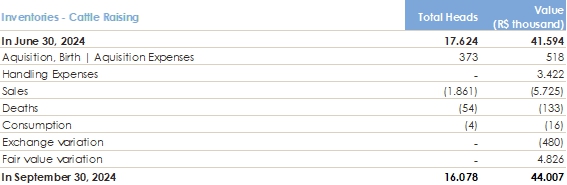

Cattle Raising

Cattle

raising is a transitory activity for the Company, aimed at land transformation. We have an inventory of 16,000 head of cattle distributed

over 16,307 hectares of active pasture in Brazil and Paraguay.

Note

that the first four months of each crop year historically register lower weight gain, due to the distribution of rainfall and availability

of pasture.

FINANCIAL

PERFORMANCE

The

consolidated financial statements were prepared and are presented in accordance with the International Financial Reporting Standards

(IFRS), issued by the International Accounting Standards Board.

Seasonality

The

agribusiness sector witnesses seasonality throughout the crop year, especially due to the cycles of each crop and the development of

crops that depend on specific weather conditions. Consequently, the Company’s operating revenues are also seasonal as they are directly

related to crop cycles. In addition, the commercial strategy adopted for each crop year also has seasonal effects and directly impacts

the Company’s results. In the first and second quarters (July through December), net revenue from grains and cotton is lower. On

the other hand, sugarcane generates net revenue more evenly during the crop year.

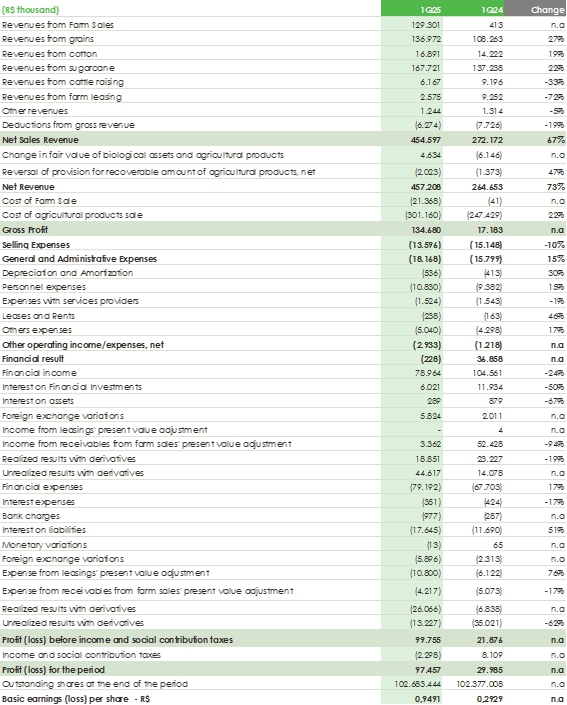

EBITDA

and Adjusted EBITDA

EBITDA

is presented under the accounting standards, based on Net Income adjusted for interest, taxes, depreciation and amortization.

Adjusted

EBITDA was calculated excluding gains from biological assets in formation (sugarcane and grains), adjusted by the realized gains/losses

on derivatives and depreciation expenses, including depreciation of the farms’ fixed assets, depreciation of the developed areas

and depreciation of the permanent crop.

EBITDA

and Adjusted EBITDA from Operations

In

1Q25, Adjusted EBITDA from operations reached R$61.4 million, increasing 166% from 1Q24, mainly explained by the increase in the margin

of soybean and sugarcane crops.

Statement

of Income

NET

SALES REVENUE

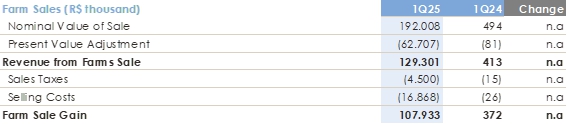

SALE OF FARM

In

1Q25, the gain from the sale of the farm reached R$107.9 million due to: (i) the conclusion of the second stage of the sale of the

Alto Taquari farm (R$103.3 million); and (ii) the conclusion of the sale of the Rio do Meio farm (R$4.6 million), which was

sold in November 2022, with its transfer of possession occurring in four stages. We completed the third stage, which involved the

transfer of 190 hectares to the buyers.

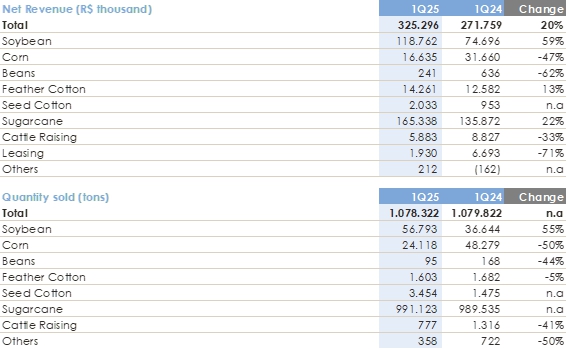

SALE OF AGRICULTURAL PRODUCTS

In

1Q25, net revenue from operations amounted to R$325.3 million, up 20% from 1Q24, mainly reflecting the higher sales of soybean, combined

with the rise in sugarcane prices, with TRS increasing from R$0.97 in 1Q24 to R$1.16 in 1Q25.

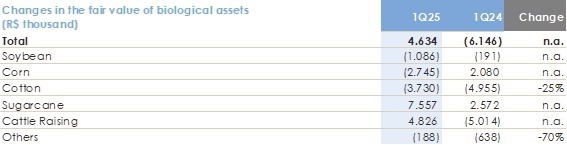

VARIATION IN FAIR VALUE OF BIOLOGICAL

ASSETS

The

variation in the fair value of biological assets is calculated by the difference between the harvested volume at market value (net of

selling expenses and taxes) and production costs incurred (direct and indirect costs, leasing and depreciation).

Harvested

agricultural products are measured at fair value at the time of harvest taking into account the market price in the corresponding distribution

channel of each farm.

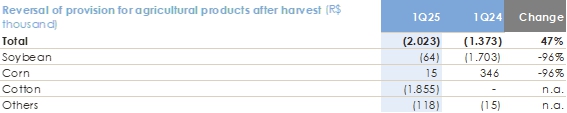

IMPAIRMENT

(REVERSAL OF PROVISION FOR RECOVERABLE VALUE OF AGRICULTURAL PRODUCTS, NET)

A

provision for adjustment of inventories to the net realizable value of the agricultural products is created when the value recorded in

inventory is higher than the realization value. The realization value is the estimated sales price during the normal course of business

less the estimated selling expenses.

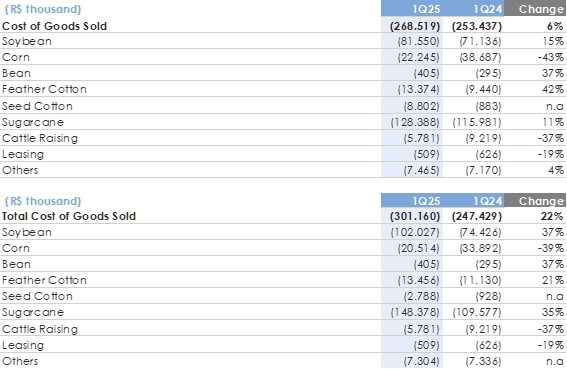

COST OF GOODS SOLD

Cost

of goods sold increased 22% in 1Q25 vs. 1Q24, mainly due to the increase in soybean and cottonseed sales by 55% and 134%,

respectively, combined with the increase in sugarcane production costs, mainly impacted by the higher production cost at the

Brotas-SP unit compared to that of the Goiás region, where we had a relevant sugarcane operation. This difference reflects

various factors, such as leasing cost, higher harvesting cost and the need for amortization of investments in new planting areas.

However, the selling price of the production from this region is higher due to the composition of its product mix.

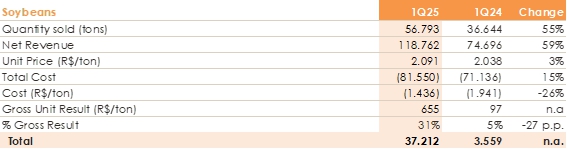

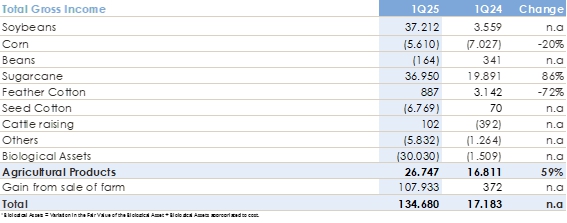

GROSS INCOME BY CROP

In

1Q25, our gross margin came to 31%, up 27 p.p. from the previous crop year, due to the combination of several factors: (i) a 55% increase

in sales volume, (ii) a 3% increase in unit prices and, mainly, (iii) a 26% reduction in unit costs, driven by the drop in input prices

during the period.

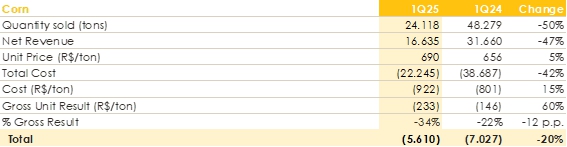

In

1Q25, the gross margin from corn was a negative 34%, down 12 p.p. from the previous quarter. This performance was strongly impacted by

the 50% reduction in the billed volume, due to a pig attack on the crops, which led to an increase in corn production costs, putting

additional pressure on the gross margin.

In

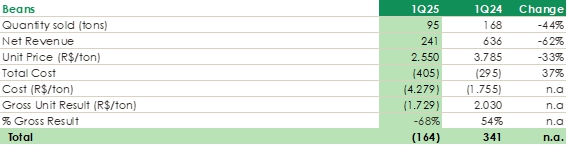

1Q25, the gross margin from beans was a negative 68%, compared to a positive margin of 54% in the previous quarter, chiefly driven by

a 33% decrease in unit price due to quality discounts. The loss of quality of beans resulted in lower prices and increased production

costs, further pressuring gross margin. These combined factors led to a sharp decline in revenue and, consequently, to a negative gross

margin.

The

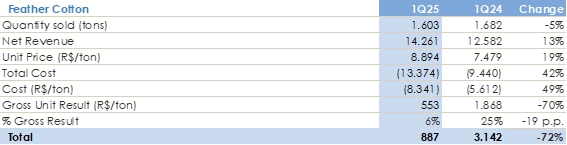

higher costs of cotton lint and cottonseed are explained by the low productivity in Paraguay and Mato Grosso.

In

1Q25, the margin from cotton lint was 6%, down 19 p.p. from 1Q24, reflecting a 49% increase in unit production cost, outpacing the 19%

growth in selling price.

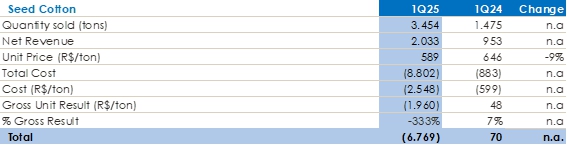

In

the same period, cottonseed experienced a negative gross margin, due to an increase in unit production cost, combined with a 9% reduction

in the selling price.

In

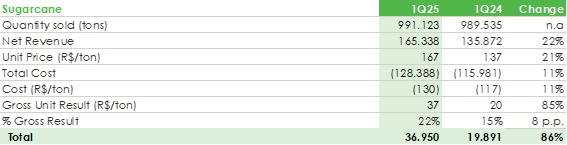

1Q25, gross margin from sugarcane was 22%, up 8 p.p. from 1Q24, chiefly reflecting the increase in TRS price from R$0.97 in 1Q24 to R$1.16

in 1Q25.

In

1Q25, the gross margin from cattle raising was 2%, up 6 p.p. from the previous quarter, mainly due to a 13% decrease in unit price.

Gross

income from the Company’s operations came to R$134.7 million in 1Q25, an increase of R$117.2 million compared to 1Q24, reflecting

mainly the higher margins from soybean and sugarcane.

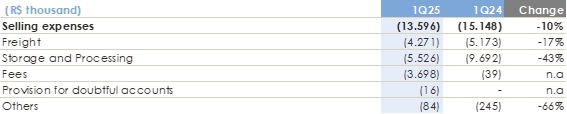

SELLING

EXPENSES

In

1Q25, selling expenses decreased by 10% compared to the previous year, reaching R$13.6 million. This variation is a result of a R$5.1

million reduction in freight, storage, and processing expenses, reflecting the lower volume of grains sold during the period. This reduction

was partially offset by commission payments for the sale of the Alto Taquari farm, amounting R$3.7 million.

GENERAL

AND ADMINISTRATIVE EXPENSES

General

and administrative expenses increased 15% from the previous year, reflecting:

| (i) | the

increase in personnel expenses, explained mainly by the payment of a 4.65% wage increase; |

| (ii) | the

increase in expenses with the Long-Term Incentive Plan (ILPA), due to the launch of the 3rd

ILPA Plan, as a continuation of the share-based compensation program; and |

| (iii) | the

increase in software expenses, due to the implementation of new management systems and the

enhancement of server and equipment infrastructure. |

OTHER

OPERATING INCOME / EXPENSES

Other

operating income / expenses were affected mainly by:

| (i) | donations

to Instituto BrasilAgro, annual donation approved by the Board of Directors in September,

2024; |

| (ii) | expenses

with intermediation incurred in the process of acquisition of the Novo Horizonte farm; and |

| (iii) | accounting

for stock warrants (which did not occur in 1Q25) issued in connection with the merger of

Agrifirma. |

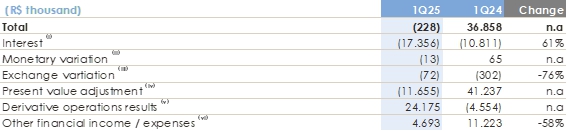

FINANCIAL

INCOME (LOSS)

The

consolidated financial result is composed of the following elements: (i) interest on loans; (ii) inflation adjustment on the amount payable

for the acquisition of farm; (iii) foreign exchange variation on offshore account, loans and inputs; (iv) present value of receivables

from the sale of farm (fixed in soybean bags) and from leases; (v) gain/loss from hedge transactions; and (vi) bank expenses and charges

as well as income from financial investments of cash and cash equivalents.

The

increase in interest expenses between 1Q24 and 1Q25 was attributed to the higher interest rates and increase in debt balance, which went

from R$546.6 million to R$736.7 million. In addition, debt payments made at the beginning of 1Q24, combined with new credit released

only at the end of the quarter, resulted in a lower interest amount recognized in that period.

Fair

value adjustment amounted to -R$11.6 million in 1Q25, explained by the negative variation in the amount receivable from the sale of farm

due to the decline in the price of soybean bag (in BRL) when compared to 1Q24, as well as new lease agreements added to the Company’s

portfolio.

In

1Q25, the result of derivative operations totaled R$24.2 million, composed of R$17.0 million from currency operations, R$9.0 million

related to commodities and a negative impact of R$2.0 million in interest rate swaps. The main factor that positively influenced this

result was the appreciation of the Brazilian real during the period, which benefited hedge positions in U.S. dollar for the 2024/2025

crop year. In addition, the drop in commodity prices, especially for soybean, also contributed significantly to the positive performance

of derivative operations.

The

gain/loss from derivative transactions reflects mainly the result of commodity and U.S. dollar FX hedge operations contracted to reduce

the volatility in the Company’s exposure, since our revenues, inventories, biological assets and farm receivables are positively

or negatively correlated to commodity prices and the U.S. dollar rate.

DERIVATIVE

OPERATIONS

HEDGE

POSITION ON SEPTEMBER 30, 2024

Note: For ethanol hedge, we consider the 2022/23 crop year as the sugarcane

calendar (April through March).

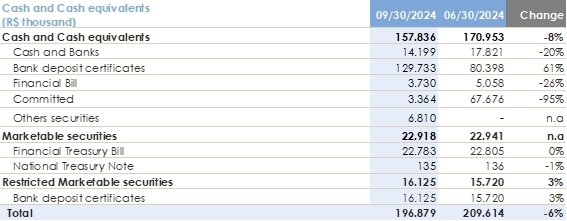

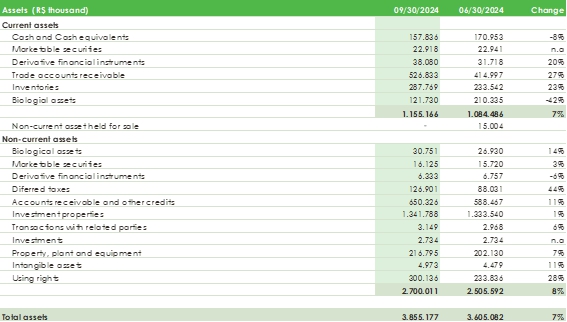

Balance

Sheet

CASH

AND CASH EQUIVALENTS

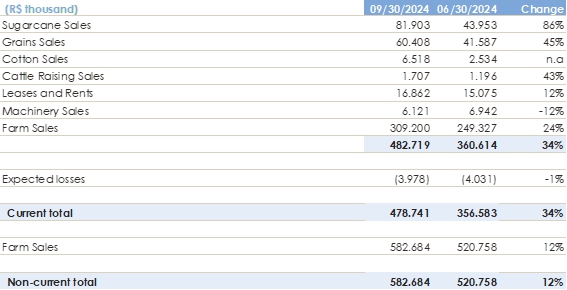

DEBT

The

average cost of debt is 98.2% of the CDI rate.

TRADE ACCOUNTS RECEIVABLE

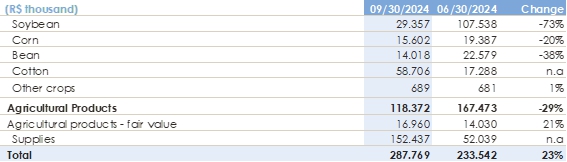

INVENTORIES

The

biological assets for cattle are measured at fair value and controlled in accordance with two methodologies: calves and steers (heifers)

from 12 to 15 months are controlled and valued per head, while older cattle are controlled based on weight.

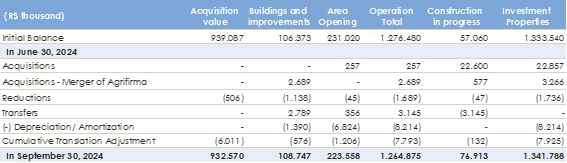

INVESTMENT

PROPERTIES

The

Company’s business strategy is based on the acquisition, development, commercial exploration and sale of rural properties suitable

for agricultural and cattle raising activities. The Company acquires rural properties with significant potential to create value through

transformation of the asset and the development of profitable agricultural and cattle raising activities.

Once

a rural property is acquired, the Company strives to implement higher value-added crops and transform such properties by investing in

infrastructure and technology. According to our strategy, when we understand that a rural property has reached its expected return, we

sell it to realize capital gains.

The

rural properties acquired by the Company are recognized at their acquisition cost, which does not exceed their net realizable value,

and recorded under “Non-Current Assets.”

Investment

properties are assessed at their historical cost plus investments in buildings, improvements and clearing of areas, less accumulated

depreciation, following the same criteria described for property, plant and equipment.

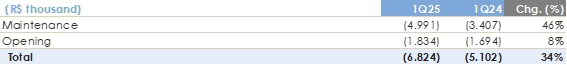

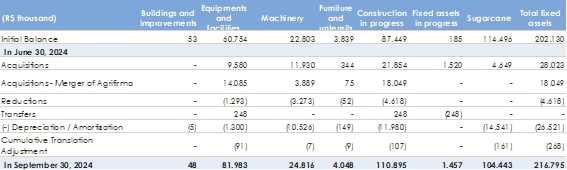

DEPRECIATION – AREA CLEARING

CAPEX - PROPERTY, PLANT AND EQUIPMENT

CAPITAL

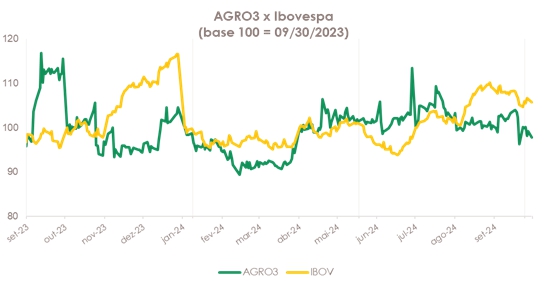

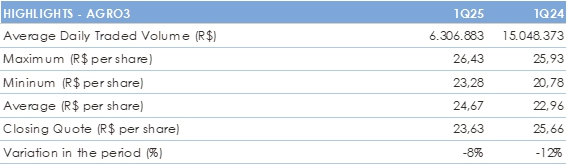

MARKETS

Stock

Performance

The

Company was the first agricultural production company to list its shares on the Novo Mercado segment of B3 (São Paulo Stock Exchange)

and the first Brazilian agribusiness company to list its ADRs on the NYSE (New York Stock Exchange).

Stock

Performance

On

November 6, 2024, BrasilAgro’s shares (AGRO3) were quoted at R$24.39, representing market capitalization of R$2.5 billion, while

its ADRs (LND) were quoted at US$4.32.

CONTACTS

+

55 (11) 3035 5374

ri@brasil-agro.com

Investor Relations Team

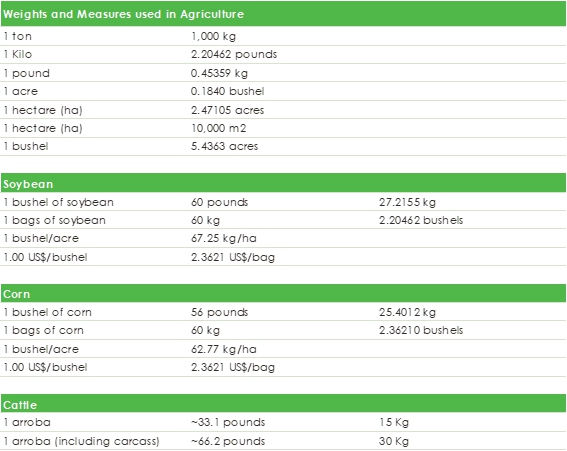

WEIGHTS

AND MEASURES USED IN AGRIBUSINESS

PORTFOLIO

MARKET

VALUE OF PORTFOLIO

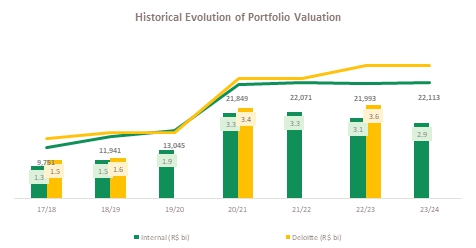

We

update the internal market value of our farms annually and, on June 30, 2024, the market value of our portfolio was R$2.9 billion.

To

estimate the market capitalization, we take into account for each of the properties: (i) its level of development; (ii) the quality of

the soil and its maturity; and (iii) the agricultural aptitude and potential.

The

current value of the average arable hectare of the Company’s own areas is R$22,113.1 (CAGR of 13.1% in the last five years).

Note

that the value of properties in the internal appraisal is given in soybean bags and the average price used in the appraisal was R$104.75

per bag.

Even

with the decrease in the average value of the soybean bag used in the appraisal (from R$111.52/bag to R$104.75/bag) and the sale of part

of the Chaparral farm, the appraisal value remained the same as last year, mainly reflecting the process of transformation and maturation

of the areas.

The

chart below shows the market appraisals of the internal portfolio, carried out by independent consulting firm Deloitte Touche Tohmatsu

in recent years:

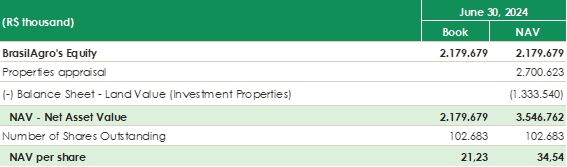

NAV

– NET ASSET VALUE

The

market value of the properties considered in the calculation of the net asset value is as of June 30, 2024, net of taxes.

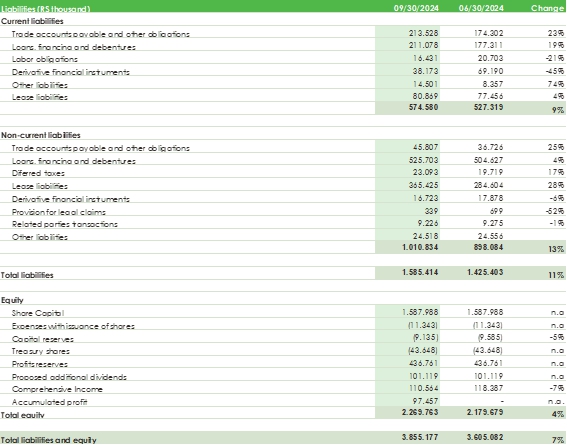

INCOME

STATEMENT

BALANCE

SHEET – ASSETS

BALANCE

SHEET – LIABILITIES

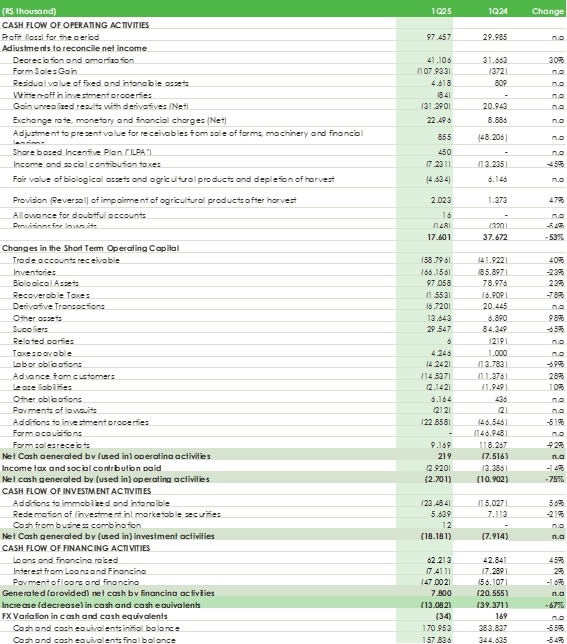

CASH

FLOW

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| Date:

November 7, 2024 |

By: |

/s/

Gustavo Javier Lopez |

| |

|

Name: |

Gustavo

Javier Lopez |

| |

|

Title: |

CFO and IRO |

35

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Nov 2024 to Dec 2024

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

From Dec 2023 to Dec 2024