UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

| M.D.C. HOLDINGS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

FROM THE DESK OF

David Mandarich |

Subject: A message from Toru Tsuji and Dave Mandarich

Dear Team:

We

are writing to share some updates on our progress toward completing the transaction between Sekisui House and MDC Holdings.

On

March 4, MDC filed what is known as a “definitive proxy statement” with the U.S. Securities and Exchange Commission in connection

with the Merger. This filing contains information MDC shareholders need to make an informed decision when voting on the transaction.

It also sets the date for the MDC Special Meeting to vote on the transaction, which will be held on April 2, 2024, and keeps us on our

path to closing in the first half of this year.

Over

recent weeks our leadership has come to know each other even better and we are beginning to develop plans for MDC to become a part of

the Sekisui House family of companies. We thought we would share a Q&A focused on the opportunities we see and what excites us most.

A

Q&A with Toru Tsuji, CEO of SH Residential Holdings, LLC and Executive Officer of Sekisui House, and

David Mandarich, President CEO

and Director of MDC Holdings

What

is the biggest topic you have heard from your team since announcing the transaction?

David

Mandarich: One word: technology. Before we announced the transaction, several MDC leaders and I traveled to Japan to meet Sekisui

House leadership in person and visit the Company’s headquarters and R&D center. We saw firsthand their advanced technology

and cutting-edge building practices.

On

our division tour, the entire MDC team echoed this excitement. The technology is truly awesome, especially the strides they've made in

energy-efficient construction.

Toru

Tsuji: For me, the biggest question has been: how does Sekisui House view the Richmond American brand relative to Chesmar, Hubble,

Holt and Woodside?

I

want to emphasize that this transaction is firmly about growth. Growth of our combined portfolio, growth of our teams and growth of our

technology and capabilities. We recognize the value and brand power of Richmond American relative to our current portfolio, and we are

continuing to appreciate the value of each brand and will be thoughtful about how we bring Richmond American into the Sekisui House family.

Each of these brands brings unique strengths and opportunities that will be critical to our long-term success together.

It

is our expectation that this growth and leveraging of each brand will translate to value for customers across the country and ultimately,

we believe, new opportunities for team members after closing the transaction.

The

U.S. is an important global region and demand for single-family homes in the U.S. is expected to remain high. All of this equals opportunity.

Should

employees expect any changes in the near term?

Toru

Tsuji: We remain separate companies until closing and it is business as usual. After closing, we expect all our brands will continue

to operate much as they do today with little change in the near term. This means that MDC’s Richmond American Homes brand will

operate as a subsidiary within the Sekisui House family of U.S. brands – just like Woodside, Holt, Hubble and Chesmar.

David

Mandarich: To echo that statement, we expect much will stay the same upon the closing. As a portfolio

company of Sekisui House, we will be a private company and that will create some changes to our business over time. But overall,

there is a significant amount of financial and operational flexibility that we gain from a private structure that we expect will

create new opportunities.

We

are excited that our senior leaders, Larry A. Mizel, Bob Martin, David Viger and I, will stay at the helm, eager to gain industry knowledge

that will fuel our growth long-term.

How

do you think the two cultures of the companies align?

Toru

Tsuji: Our cultures are very complementary. MDC shares our commitment to quality and value in each home it builds and is aligned

with our vision to “make home the happiest place in the world.”

David

Mandarich: Strong cultural fit was an important consideration for us, and we believe that Sekisui House shares our values of providing

superior quality, comfort and security.

What’s

the path forward from here?

David

Mandarich: The transaction is subject, among other things, to government antitrust approval, which we’ve already received,

and MDC shareholder approval, which will be decided at our Special Meeting on April 2, 2024.

Toru

Tsuji: Shortly following receipt of all required approvals, we expect that the transaction will close and MDC will officially become

part of the Sekisui House family of brands. Until then, the best thing we can all do is focus on executing our separate business plans

for the year.

What

are you most excited about as it relates to this transaction?

David

Mandarich: I’m most excited about integrating Sekisui House technology in our offerings. Together, we are creating the future

of homebuilding.

Toru

Tsuji: I’m most excited about advancing our global vision to “make homes the happiest place in the world,” creating

homes and communities that last for generations. We are well on our way to achieving our vision.

|

MDC • RAH • HMC • AHI • AHT

|

Forward

Looking Statements

This

communication includes certain disclosures which contain “forward-looking statements” within the meaning of the federal securities

laws, including but not limited to those statements related to the proposed transaction, including financial estimates and statements

as to the expected timing, completion and effects of the proposed transaction, as well as the operations of MDC’s business following

the completion of the proposed transaction. These forward-looking statements may be identified by terminology such as “likely,”

“predicts,” “continue,” “anticipates,” “believes,” “confident,” “could,”

“estimates,” “expects,” “intends,” “target,” “potential,” “may,”

“will,” “might,” “plans,” “path,” “should,” “approximately,”

“our planning assumptions,” “forecast,” “outlook” or the negative of such terms and other comparable

terminology. These forward-looking statements, including statements regarding the proposed transaction, are based largely on information

currently available and management's current expectations and assumptions, and involve known and unknown risks, uncertainties and other

factors that may cause the actual results, performance or achievements to be materially different from those expressed or implied by

the forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements contained in this

communication are reasonable, we cannot guarantee future results. There is no assurance that our expectations will occur or that our

estimates or assumptions will be correct, and we caution investors and all others not to place undue reliance on such forward-looking

statements.

Important

factors, risks and uncertainties and other factors that may cause actual results to differ materially from such plans, estimates or expectations

include but are not limited to: (i) the completion of the proposed transaction on the anticipated terms and timing, including obtaining

required stockholder and regulatory approvals, and the satisfaction of other conditions to the completion of the proposed transaction;

(ii) potential litigation relating to the proposed transaction that could be instituted against MDC or its directors, managers or officers,

including the effects of any outcomes related thereto; (iii) the risk that disruptions from the proposed transaction will harm MDC’s

business, including current plans and operations, including during the pendency of the proposed transaction; (iv) the ability of MDC

to retain and hire key personnel; (v) the diversion of management’s time and attention from ordinary course business operations

to completion of the proposed transaction and integration matters; (vi) potential adverse reactions or changes to business relationships

resulting from the announcement or completion of the proposed transaction; (vii) legislative, regulatory and economic developments; (viii)

potential business uncertainty, including changes to existing business relationships, during the pendency of the proposed transaction

that could affect MDC’s financial performance; (ix) certain restrictions during the pendency of the proposed transaction that may

impact MDC’s ability to pursue certain business opportunities or strategic transactions; (x) unpredictability and severity of catastrophic

events, including but not limited to acts of terrorism, outbreaks of war or hostilities or the COVID-19 pandemic, as well as management’s

response to any of the aforementioned factors; (xi) the possibility that the proposed transaction may be more expensive to complete than

anticipated, including as a result of unexpected factors or events; (xii) the occurrence of any event, change or other circumstance that

could give rise to the termination of the proposed transaction, including in circumstances requiring MDC to pay

a termination fee; (xiii) those risks and uncertainties set forth under the headings “Forward Looking Statements” and “Risk

Factors” in MDC’s most recent Annual Report on Form 10-K, as such risk factors may be amended, supplemented or superseded

from time to time by other reports filed by MDC with the SEC from time to time, which are available via the SEC’s website at www.sec.gov;

and (xiv) those risks that are described in the proxy statement that was filed with the SEC and is available from the sources indicated

below.

These

risks, as well as other risks associated with the proposed transaction, are more fully discussed in the proxy statement filed with the

SEC in connection with the proposed transaction. There can be no assurance that the proposed transaction will be completed, or if it

is completed, that it will close within the anticipated time period. These factors should not be construed as exhaustive and should be

read in conjunction with the other forward-looking statements. The forward-looking statements relate only to events as of the date on

which the statements are made. MDC undertakes no duty to update publicly any forward-looking statements except as required by law, whether

as a result of new information, future events or otherwise. If one or more of these or other risks or uncertainties materialize, or if

our underlying assumptions prove to be incorrect, our actual results may vary materially from what we may have expressed or implied by

these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. You should

specifically consider the factors identified in this communication that could cause actual results to differ. Furthermore, new risks

and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect MDC.

Risks

related to Sekisui House’s forward-looking statements include, but are not limited to, the possibility of incurring significant

expenses for remediation or administrative sanctions in the event of violation of laws and regulations; the possibility of occurring

serious quality problems due to unexpected human errors or other factors; computer viruses and advanced cyberattacks which could allow

personal information and confidential information to leak or be tampered with, or cause system shutdowns; the possibility of failing

to take sufficient steps to address human rights-related issues; risks arising from climate change; the possibility of employees’

health problems and extended leaves of absence resulting from long working hours; the risk of occurrence of occupational accidents; declines

in Sekisui House’s hiring competitiveness or serious outflows of human resources via resignation; changes in the housing market

environment; the possibility of changes in asset value due to declining market conditions or fluctuations in foreign exchange rates;

the possibility of increases in fundraising costs due to events as major fluctuations in market interest rates, turmoil in financial

markets or a significant downgrading of Sekisui House’s credit ratings by rating agencies; disruptions to material supply chains

due to major natural disasters or social unrest, or surges in raw materials and energy prices around the world; changes in base rates

for the calculation of retirement benefit liabilities, or a large deviation of estimates calculated based on expected return rates from

the result; and the possibility of delay in addressing largescale natural disasters or pandemic due to lack of clear business continuity

plan. All information in this communication is as of the date above. Neither MDC nor Sekisui House undertakes any duty to update any

forward-looking statement to conform the statement to actual results or changes in MDC’s or Sekisui House’s expectations

whether as a result of new information, future events or otherwise, except as required by law.

Important Information for Investors and Stockholders

This communication is being made in connection with the proposed transaction

involving MDC, Sekisui House and the other parties to the Merger Agreement. MDC has filed a proxy statement and certain other documents,

and may file additional relevant materials, regarding the proposed transaction with the SEC. The Company filed the definitive proxy statement

with the SEC on March 4, 2024, and mailed it to stockholders of the Company beginning on March 4, 2024. This communication is not a substitute

for the proxy statement or any other document that MDC may file with the SEC or send to its stockholders in connection with the proposed

transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION, STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT FILED WITH THE SEC (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. The proxy statement and any other relevant materials in connection with the proposed transaction

and any other documents filed by MDC with the SEC, may be obtained free of charge at the SEC’s website (http://www.sec.gov),

at MDC’s website (https://ir.richmondamerican.com/sec-filings) or upon written request

to MDC at 4350 South Monaco Street, Suite 500, Denver, CO 80237.

Participants

in the Solicitation

MDC

and its directors, executive officers and certain other employees may be deemed to be participants in the solicitation of proxies from

stockholders of MDC in connection with the proposed transaction. Information about MDC’s directors and executive officers is set

forth in the sections entitled “Proposal One Election of Directors,” “Executive Officers,” “2022 Director

Compensation” and “Transactions with Related Persons” of MDC’s proxy statement for its 2023 Annual Meeting of

Stockholders, which was filed with the SEC on March 1, 2023. Additional information regarding the identity of the participants, and their

respective direct and indirect interests in the proposed transaction, by security holdings or otherwise, is set forth in the sections

entitled “The Merger—Interests of the Directors and Executive Officers of MDC in the Merger” and “Security Ownership

of Certain Beneficial Owners and Management” of MDC’s proxy statement on Schedule 14A filed with the SEC on March 4, 2024.

You may obtain free copies of these documents using the sources indicated above.

M D C (NYSE:MDC)

Historical Stock Chart

From Nov 2024 to Dec 2024

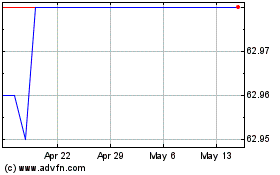

M D C (NYSE:MDC)

Historical Stock Chart

From Dec 2023 to Dec 2024