Second Quarter 2024 Highlights (comparisons to second

quarter 2023)

- Highest-ever total revenue of $173.3 million, an increase of

$14.2 million, or 8.9%

- Margin expansion in all three segments

- Net loss of $10.2 million, or $0.39 net loss per diluted share

attributable to common stockholders (LPS), and Adjusted Net Income1

of $10.8 million, or $0.20 Diluted Adjusted Net Income per share1

(Adj EPS)

- Record Consolidated Adjusted EBITDA1 of $23.3 million, an

increase of $2.1 million, or 10.0%

- Reaffirms full-year 2024 guidance for total revenue of $690

million to $740 million, and Consolidated Adjusted EBITDA1 of $95

million to $100 million

First Half 2024 Highlights (comparisons to first half

2023)

- Record total revenue of $328.7 million, an increase of $38.1

million, or 13.1%

- Net loss of $23.5 million, or $0.91 LPS, and Adjusted Net

Income1 of $19.3 million, or $0.37 Adj EPS1

- Record Consolidated Adjusted EBITDA1 of $40.2 million, an

increase of $2.4 million, or 6.5%

Strategic Capital Allocation Highlights

- Raised net proceeds of $121.8 million in a common stock

offering in April

- Invested $27.0 million, since stock offering, on two strategic

and accretive acquisitions, while maintaining a robust merger and

acquisition pipeline

- Repurchased $60.0 million of Series A-2 stock in January,

reducing associated future cash dividends by $5.4 million

annually

- Received two patents during the second quarter 2024, bringing

total patent portfolio to 19

- Reported significant liquidity2 of $188.3 million, with 2.4x

leverage as of June 30, 2024

Montrose Environmental Group, Inc. (the “Company,” “Montrose” or

“MEG”) (NYSE: MEG) today announced results for the second quarter

and first half periods ended June 30, 2024.

Montrose Chief Executive Officer and Director, Vijay

Manthripragada, commented, “We’re thrilled to build on our strong

first quarter performance with another period of exceptional

results. Broad-based strength across our business lines drove

year-over-year growth in our key operating metrics. This resulted

in record quarterly revenues and record Consolidated Adjusted

EBITDA1, and year-over-year margin improvement across all three

segments. We're especially pleased with our continued organic

growth this quarter, fueled by the growing traction of our

cross-selling initiatives. This strong organic growth, five highly

accretive acquisitions completed so far this year, and ongoing

secular tailwinds reinforce our confidence in our outlook.”

Mr. Manthripragada continued, “We do not anticipate the recent

United States (US) Supreme Court decision in Loper Bright

Enterprises v. Raimondo or the outcome of the upcoming US

presidential election to alter our growth or outlook. As we

demonstrated with our strong performance during the prior Obama and

Trump administrations, and our strong performance during the

current Biden administration, our perspective remains upbeat

regardless of the US election outcome. The impact of US federal

policy swings has historically been muted for Montrose given the

significant influence of state and local environmental regulations,

stakeholder pressure, and our limited exposure to any one end

market. Our business mix may shift, but our aggregate outlook and

growth algorithms remain unchanged. We expect further regulatory

complexity for our US clients and anticipate a shift of influence

to state regulatory agencies, which are expected to drive

incremental demand across our portfolio of services. It is also

important to note that approximately 20% of our revenue is

generated in Canada, Australia, and Europe, which continue to see

independent, attractive, and secular tailwinds. Demand for our

business is strong, and we are seeing increased customer activity

across our service lines that we expect to continue. With our

flexibility in capital allocation and our ability to adjust

investments in innovation based on client relationships, Montrose

is well positioned for continued success in delivering value to

both our customers and shareholders in this dynamic environmental

landscape."

______________________

(1)

Consolidated Adjusted EBITDA, Adjusted Net Income (Loss) and

Adjusted Net Income (Loss) per Share are non-GAAP measures. See the

appendix to this release for a discussion of these measures,

including how they are calculated and the reasons why we believe

they provide useful information to investors, and a reconciliation

for historical periods to the most directly comparable GAAP

measures.

(2)

Liquidity of $188.3 million included $16.9 million of cash and

$171.4 million of availability on the Company’s revolving credit

facility.

Second Quarter 2024 Results

Total revenue in the second quarter of 2024 was $173.3 million

compared to $159.1 million in the prior year quarter, an increase

of 8.9%. The increase in revenues was primarily due to strong

organic revenue growth in our Assessment, Permitting and Response

and Measurement and Analysis segments, and the contributions of

acquisitions, partially offset by lower environmental emergency

response and water treatment revenues, and the shift away from

lower margin revenue in our renewable services business.

Net loss was $10.2 million, or $0.39 of LPS, in the second

quarter of 2024, compared to a net loss of $7.2 million, or $0.38

LPS, in the prior year quarter. The year-over-year change in net

loss was primarily attributable to higher interest and income tax

expenses in the current year quarter, partially offset by improved

loss from operations. The year-over-year decline in LPS was due to

a net loss increase, partially offset by lower dividends on our

Series A-2 preferred stock and a higher weighted average

outstanding share count.

Adjusted Net Income1 was $10.8 million, and Adj EPS1 was $0.20,

in the second quarter of 2024 compared to Adjusted Net Income1 of

$14.8 million, and Adj EPS1 of $0.29 in the prior year quarter.

Both Adjusted Net Income1 and Adj EPS1 were lower than the prior

year primarily the result of higher interest and income tax

expenses, partially offset by improved loss from operations. Adj

EPS1 was also impacted by a higher weighted average outstanding

share count in the current period and lower dividends on our Series

A-2 preferred stock.

Second quarter 2024 Consolidated Adjusted EBITDA1 was $23.3

million, or 13.5% of revenues, compared to $21.2 million, or 13.3%

of revenues, in the prior year quarter. The increase in

Consolidated Adjusted EBITDA1 was due to higher revenues driven by

organic growth and acquisitions. Adjusted EBITDA margins increased

in all three operating segments.

First Six Months 2024 Results

Total revenue in the first six months of 2024 increased 13.1% to

$328.7 million compared to $290.5 million in the prior year period.

The increase in revenues was primarily due to organic growth in our

Assessment, Permitting and Response, and Measurement and Analysis

segments, and the contributions of acquisitions, partially offset

by lower environmental emergency response and water treatment

revenues, and the shift away from lower margin revenue in our

renewable services business.

Net loss was $23.5 million, or $0.91 LPS, in the first six

months of 2024 compared to a net loss of $21.9 million, or $1.00

LPS, in the prior year period. The year-over-year increase in net

loss was primarily attributable to higher interest and income tax

expenses in the current year period, partially offset by an

improved loss from operations. Improved LPS was a result of lower

dividends on the Series A-2 preferred stock and a higher weighted

average outstanding share count, partially offset by a higher net

loss.

Adjusted Net Income1 was $19.3 million, and Adj EPS1 was $0.37,

in the first six months of 2024 compared to Adjusted Net Income1 of

$25.2 million, and Adj EPS1 of $0.47, in the prior year period.

Both Adjusted Net Income1 and Adj EPS1 were lower than the prior

year primarily as a result of higher interest and income tax

expenses, partially offset by improved loss from operations. Adj

EPS1 was also impacted by a higher weighted average outstanding

share count in the year-to-date period and lower dividends on our

Series A-2 preferred stock.

Consolidated Adjusted EBITDA1 for the first six months of 2024

was $40.2 million, or 12.2% of revenues, compared to $37.8 million,

or 13.0% of revenues, in the prior year period. The increase in

Consolidated Adjusted EBITDA1 was primarily due to higher revenues

driven by organic growth and acquisitions. Consolidated Adjusted

EBITDA1 as a percentage of revenues decreased primarily due to the

first quarter 2024 impact of the Matrix acquisition.

Operating Cash Flow, Liquidity and Capital Resources

Cash used in operating activities for the first six months ended

June 30, 2024, was $21.1 million compared to cash provided by

operating activities of $24.5 million in the prior year period.

Lower cash flow from operations was driven primarily by an increase

in receivables, related to the integration of Matrix earlier this

year and several large new projects. Cash flow from operating

activities is expected to improve over the balance of the year, and

operating cash flow in the back half of the current year is

expected to be up significantly versus the second half of 2023.

In April 2024, Montrose completed a public offering of 3,450,000

shares of its common stock, raising approximately $121.8 million in

proceeds, net of underwriting discounts and commissions. The

proceeds from the offering have been and will be used for general

corporate purposes and continued acceleration of strategic growth

initiatives, including, but not limited to, acquisitions or

business expansion, commercialization of intellectual property

given expanded environmental regulations, research and development,

software development, capital expenditures, working capital and the

repayment of debt.

As of June 30, 2024, Montrose had $188.3 million of liquidity,

including $16.9 million of cash and $171.4 million of availability

on its revolving credit facility.

As of June 30, 2024, Montrose’s leverage ratio under its credit

facility, which includes recently completed acquisitions and

acquisition-related contingent earnout payments that may become

payable in cash, was 2.4 times.

Recent Acquisitions

In April 2024, Montrose acquired Engineering & Technical

Associates. (ETA), a leader in Process Safety Management. ETA is

part of the Company’s Assessment, Permitting & Response

segment.

In May 2024, Montrose acquired Paragon Soil & Environmental

Consulting, Inc. (Paragon), a leading environmental consulting firm

in Canada. Paragon is part of the Company’s Remediation & Reuse

segment.

In July 2024, Montrose acquired Spirit Environmental, LLC.

(Spirit), a leading provider of air permitting and compliance

services. Spirit is part of the Company’s Assessment, Permitting

& Response segment.

Full Year 2024 Outlook

The Company reaffirms its full year 2024 Revenue and

Consolidated Adjusted EBITDA1 outlook. The Company expects Revenue

to be in the range of $690 million to $740 million. Consolidated

Adjusted EBITDA1 is expected to be in the range of $95 million to

$100 million for the full year 2024. The midpoints of the ranges

incorporate an expectation of low double digit organic revenue

growth and continued year-on-year Consolidated Adjusted EBITDA1

margin expansion.

Our Revenue and Consolidated Adjusted EBITDA1 outlook does not

include any benefit from future acquisitions.

Webcast and Conference Call

The Company will host a webcast and conference call on

Wednesday, August 7, 2024, at 8:30 a.m. Eastern time to discuss

second quarter financial results. The prepared remarks will be

followed by a question-and-answer session. A live webcast of the

conference call will be available in the Investors section of the

Montrose website at www.montrose-env.com. The conference call will

also be accessible by dialing 1-844-826-3035 (Domestic) and

1-412-317-5195 (International). For those who are unable to listen

to the live broadcast, an audio replay of the conference call will

be available on the Montrose website for 30 days.

About Montrose

Montrose is a leading environmental solutions company focused on

supporting commercial and government organizations as they deal

with the challenges of today and prepare for what's coming

tomorrow. With ~3,400 employees across 100+ locations worldwide,

Montrose combines deep local knowledge with an integrated approach

to design, engineering, and operations, enabling Montrose to

respond effectively and efficiently to the unique requirements of

each project. From comprehensive air measurement and laboratory

services to regulatory compliance, emergency response, permitting,

engineering, and remediation, Montrose delivers innovative and

practical solutions that keep its clients on top of their immediate

needs – and well ahead of the strategic curve. For more

information, visit www.montrose-env.com.

Forward‐Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements may be identified by the use of

words such as “intend,” “expect”, and “may”, and other similar

expressions that predict or indicate future events or that are not

statements of historical matters. Forward-looking statements are

based on current information available at the time the statements

are made and on management’s reasonable belief or expectations with

respect to future events, and are subject to risks and

uncertainties, many of which are beyond the Company’s control, that

could cause actual performance or results to differ materially from

the belief or expectations expressed in or suggested by the

forward-looking statements. Additional factors or events that could

cause actual results to differ may also emerge from time to time,

and it is not possible for the Company to predict all of them.

Forward-looking statements speak only as of the date on which they

are made, and the Company undertakes no obligation to update any

forward-looking statement to reflect future events, developments or

otherwise, except as may be required by applicable law. Investors

are referred to the Company’s filings with the Securities and

Exchange Commission, including its Annual Report on Form 10-K for

the year ended December 31, 2023, for additional information

regarding the risks and uncertainties that may cause actual results

to differ materially from those expressed in any forward-looking

statement.

MONTROSE ENVIRONMENTAL GROUP,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS

(In thousands, except per share

data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

$

173,325

$

159,101

$

328,650

$

290,529

Cost of revenues (exclusive of

depreciation and amortization shown below)

104,086

98,196

200,643

179,829

Selling, general and administrative

expense

59,239

55,247

116,313

104,860

Fair value changes in business acquisition

contingencies

136

353

242

(45

)

Depreciation and amortization

12,515

11,398

24,168

21,953

Loss from operations

(2,651

)

(6,093

)

(12,716

)

(16,068

)

Other income (expense), net

(924

)

947

(417

)

(889

)

Interest expense, net

(3,976

)

(1,877

)

(7,282

)

(3,418

)

Total other income (expense), net

(4,900

)

(930

)

(7,699

)

(4,307

)

Loss before expense from income taxes

(7,551

)

(7,023

)

(20,415

)

(20,375

)

Income tax expense

2,619

151

3,112

1,518

Net loss

$

(10,170

)

$

(7,174

)

$

(23,527

)

$

(21,893

)

Equity adjustment from foreign currency

translation

35

(118

)

—

(106

)

Comprehensive loss

(10,135

)

(7,292

)

(23,527

)

(21,999

)

Convertible and redeemable series A-2

preferred stock dividend

(2,750

)

(4,100

)

(5,564

)

(8,200

)

Net loss attributable to common

stockholders

(12,920

)

(11,274

)

(29,091

)

(30,093

)

Weighted average common shares

outstanding— basic and diluted

33,318

30,047

31,850

29,952

Net loss per share attributable to common

stockholders— basic and diluted

$

(0.39

)

$

(0.38

)

$

(0.91

)

$

(1.00

)

MONTROSE ENVIRONMENTAL GROUP,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(In thousands, except share

data)

June 30,

December 31,

2024

2023

Assets

Current assets

Cash, cash equivalents and restricted

cash

$

16,905

$

23,240

Accounts receivable, net

135,669

112,360

Contract assets

73,224

51,629

Prepaid and other current assets

14,222

13,695

Total current assets

240,020

200,924

Non-current assets

Property and equipment, net

63,627

56,825

Operating lease right-of-use asset,

net

38,898

32,260

Finance lease right-of-use asset, net

14,827

13,248

Goodwill

435,483

364,449

Other intangible assets, net

142,870

140,813

Other assets

8,191

8,267

Total assets

$

943,916

$

816,786

Liabilities, Convertible and Redeemable

Series A-2 Preferred Stock and Stockholders’ Equity

Current liabilities

Accounts payable and other accrued

liabilities

$

58,223

$

59,920

Accrued payroll and benefits

28,339

34,660

Business acquisitions contingent

consideration, current

6,351

3,592

Current portion of operating lease

liabilities

11,134

9,963

Current portion of finance lease

liabilities

4,005

3,956

Current portion of long-term debt

23,667

14,196

Total current liabilities

131,719

126,287

Non-current liabilities

Business acquisitions contingent

consideration, long-term

9,595

2,448

Other non-current liabilities

6,118

6,569

Deferred tax liabilities, net

8,238

6,064

Conversion option

19,570

19,017

Operating lease liability, net of current

portion

30,003

25,048

Finance lease liability, net of current

portion

8,223

8,185

Long-term debt, net of deferred financing

fees

188,749

148,988

Total liabilities

$

402,215

$

342,606

Commitments and contingencies

Convertible and redeemable series A-2

preferred stock $0.0001 par value

Authorized, issued and outstanding shares:

11,667 and 17,500 at June 30, 2024 and December 31, 2023,

respectively; aggregate liquidation preference of $122.2 million

and $182.2 million at June 30, 2024 and December 31, 2023,

respectively

92,928

152,928

Stockholders’ equity:

Common stock, $0.000004 par value;

authorized shares: 190,000,000 at June 30, 2024 and December 31,

2023; issued and outstanding shares: 34,168,713 and 30,190,231 at

June 30, 2024 and December 31, 2023, respectively

—

—

Additional paid-in-capital

682,879

531,831

Accumulated deficit

(233,883

)

(210,356

)

Accumulated other comprehensive (loss)

income

(223

)

(223

)

Total stockholders’ equity

448,773

321,252

Total liabilities, convertible and

redeemable series A-2 preferred stock and stockholders’ equity

$

943,916

$

816,786

MONTROSE ENVIRONMENTAL GROUP,

INC.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

For the Six Months Ended June

30,

2024

2023

Operating activities:

Net loss

$

(23,527

)

$

(21,893

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

24,168

21,953

Amortization of right-of-use asset

5,429

5,041

Stock-based compensation expense

23,103

24,125

Other operating activities, net

4,121

5,439

Changes in operating assets and

liabilities, net of acquisitions:

—

Accounts receivable and contract

assets

(38,021

)

2,078

Accounts payable and other accrued

liabilities

(938

)

(5,553

)

Accrued payroll and benefits

(7,940

)

411

Payment of contingent consideration

—

(611

)

Change in operating leases

(6,306

)

(4,805

)

Other assets

(1,216

)

(1,673

)

Net cash (used in) provided by operating

activities

(21,127

)

24,512

Investing activities:

Proceeds from corporate owned and property

insurance

120

86

Purchases of property and equipment

(17,928

)

(20,951

)

Proceeds from the sale of property and

equipment

2,070

—

Proprietary software development and other

software costs

(1,736

)

(2,041

)

Purchase price true ups

—

(1,027

)

Minority investments

(210

)

—

Cash paid for acquisitions, net of cash

acquired

(70,252

)

(63,050

)

Net cash used in investing activities

(87,937

)

(86,983

)

Financing activities:

Proceeds from line of credit

202,771

—

Repayment of the line of credit

(199,119

)

—

Proceeds from the aircraft loan

—

10,935

Repayment of aircraft loan

(526

)

—

Proceeds from term loan

50,000

—

Repayment of term loan

(3,906

)

(6,597

)

Payment of contingent consideration and

other purchase price true ups

(525

)

(1,194

)

Repayment of finance leases

(3,103

)

(2,198

)

Payments of deferred financing costs

(348

)

—

Proceeds from issuance of common stock for

exercised stock options

1,375

3,295

Proceeds from issuance of common stock in

follow-on offering

121,776

—

Dividend payment to the series A-2

stockholders

(5,564

)

(8,200

)

Repayment to the series A-2

stockholders

(60,000

)

—

Net cash provided by (used in) financing

activities

102,829

(3,959

)

Change in cash, cash equivalents and

restricted cash

(6,234

)

(66,430

)

Foreign exchange impact on cash

balance

(100

)

(91

)

Cash, cash equivalents and restricted

cash:

Beginning of year

23,240

89,828

End of period

$

16,905

$

23,307

Supplemental disclosures of cash flows

information:

Cash paid for interest

$

6,858

$

2,937

Cash paid for income tax

$

699

$

1,261

Supplemental disclosures of non-cash

investing and financing activities:

Accrued purchases of property and

equipment

$

1,217

$

2,304

Property and equipment purchased under

finance leases

$

2,666

$

3,326

Common stock issued to acquire new

businesses

$

9,271

$

2,598

Acquisitions unpaid contingent

consideration

$

15,946

$

6,430

Acquisitions contingent consideration paid

in common stock

$

1,087

$

—

MONTROSE ENVIRONMENTAL GROUP,

INC.

SEGMENT REVENUES AND ADJUSTED

EBITDA

(In thousands)

(Unaudited)

Three Months Ended June

30,

2024

2023

Segment Revenues

Segment Adjusted

EBITDA(1)

Segment Revenues

Segment Adjusted

EBITDA(1)

Assessment, Permitting and Response

$

53,444

$

12,621

$

61,411

$

13,833

Measurement and Analysis

54,812

12,359

50,055

(2)

10,789

Remediation and Reuse

65,069

8,929

47,635

6,043

Total Operating Segments

$

173,325

$

33,909

$

159,101

$

30,665

Corporate and Other

—

(10,593

)

—

(9,474

)

Total

$

173,325

$

23,316

$

159,101

$

21,191

Six Months Ended June

30,

2024

2023

Segment Revenues

Segment Adjusted

EBITDA(1)

Segment Revenues

Segment Adjusted

EBITDA(1)

Assessment, Permitting and Response

$

112,024

$

28,901

$

113,625

$

28,099

Measurement and Analysis

100,306

18,863

92,582

(2)

17,176

Remediation and Reuse

116,319

13,940

84,322

11,321

Total Operating Segments

$

328,650

$

61,705

$

290,529

$

56,596

Corporate and Other

—

(21,466

)

—

(18,802

)

Total

$

328,650

$

40,239

$

290,529

$

37,794

______________________

(1)

For purposes of evaluating segment profit,

the Company’s chief operating decision maker reviews Segment

Adjusted EBITDA as a basis for making the decisions to allocate

resources and assess performance.

(2)

Includes revenue of $2.4 million and $3.9 million from the

Discontinued Specialty Lab for the three and six months ended June

30, 2023, respectively.

Non-GAAP Financial Information

In addition to our results under GAAP, in this release we also

present certain other supplemental financial measures of financial

performance that are not required by, or presented in accordance

with, GAAP, including, Consolidated Adjusted EBITDA, Adjusted Net

Income and Basic and Diluted Adjusted Net Income per Share. We

calculate Consolidated Adjusted EBITDA as net income (loss) before

interest expense, income tax expense (benefit) and depreciation and

amortization, adjusted for the impact of certain other items,

including stock-based compensation expense and acquisition-related

costs, as set forth in greater detail in the table below. We

calculate Adjusted Net Income as net income (loss) before

amortization of intangible assets, stock-based compensation

expense, fair value changes to financial instruments and contingent

earnouts, discontinued specialty lab, and other gain or losses, as

set forth in greater detail in the table below. Basic and Diluted

Adjusted Net Income per Share represents Adjusted Net Income

attributable to stockholders divided by the fully diluted number of

shares of common stock outstanding during the applicable

period.

Consolidated Adjusted EBITDA is one of the primary metrics used

by management to evaluate our financial performance and compare it

to that of our peers, evaluate the effectiveness of our business

strategies, make budgeting and capital allocation decisions and in

connection with our executive incentive compensation. Adjusted Net

Income and Basic and Diluted Adjusted Net Income per Share are

useful metrics to evaluate ongoing business performance after

interest and tax. These measures are also frequently used by

analysts, investors and other interested parties to evaluate

companies in our industry. Further, we believe they are helpful in

highlighting trends in our operating results because they allow for

more consistent comparisons of financial performance between

periods by excluding gains and losses that are non-operational in

nature or outside the control of management, and, in the case of

Consolidated Adjusted EBITDA, by excluding items that may differ

significantly depending on long-term strategic decisions regarding

capital structure, the tax jurisdictions in which we operate and

capital investments.

These non-GAAP measures do, however, have certain limitations

and should not be considered as an alternative to net income

(loss), earnings (loss) per share or any other performance measure

derived in accordance with GAAP. Our presentation of Consolidated

Adjusted EBITDA, Adjusted Net Income and Basic and Diluted Adjusted

Net Income per Share should not be construed as an inference that

our future results will be unaffected by unusual or non-recurring

items for which we may make adjustments. In addition, Consolidated

Adjusted EBITDA, Adjusted Net Income and Basic and Diluted Adjusted

Net Income per Share may not be comparable to similarly titled

measures used by other companies in our industry or across

different industries, and other companies may not present these or

similar measures. Management compensates for these limitations by

using these measures as supplemental financial metrics and in

conjunction with our results prepared in accordance with GAAP. We

encourage investors and others to review our financial information

in its entirety, not to rely on any single measure and to view

Consolidated Adjusted EBITDA, Adjusted Net Income and Basic and

Diluted Adjusted Net Income per Share in conjunction with the

related GAAP measures.

Additionally, we have provided estimates regarding Consolidated

Adjusted EBITDA for 2024. These projections account for estimates

of revenue, operating margins and corporate and other costs.

However, we cannot reconcile our projection of Consolidated

Adjusted EBITDA to net income (loss), the most directly comparable

GAAP measure, without unreasonable efforts because of the

unpredictable or unknown nature of certain significant items

excluded from Consolidated Adjusted EBITDA and the resulting

difficulty in quantifying the amounts thereof that are necessary to

estimate net income (loss). Specifically, we are unable to estimate

for the future impact of certain items, including income tax

(expense) benefit, stock-based compensation expense, fair value

changes and the accounting for the issuance of the Series A-2

preferred stock. We expect the variability of these items could

have a significant impact on our reported GAAP financial

results.

In this release we also reference our organic growth. We define

organic growth as the change in revenues excluding revenues from i)

our environmental emergency response business, ii) acquisitions for

the first twelve months following the date of acquisition, and iii)

businesses held for sale, disposed of or discontinued. Management

uses organic growth as one of the means by which it assesses our

results of operations. Organic growth is not, however, a measure of

revenue growth calculated in accordance with U.S. generally

accepted accounting principles, or GAAP, and should be considered

in conjunction with revenue growth calculated in accordance with

GAAP. We have grown organically over the long term and expect to

continue to do so.

Montrose Environmental Group,

Inc.

Reconciliation of Net Loss to

Adjusted Net Income

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(10,170

)

$

(7,174

)

$

(23,527

)

$

(21,893

)

Amortization of intangible assets (1)

7,137

7,350

14,566

14,590

Stock-based compensation (2)

11,831

11,090

23,103

24,125

Acquisition costs (3)

1,082

2,696

3,607

3,471

Fair value changes in financial

instruments (4)

1,202

(865

)

905

1,008

Expenses related to financing transactions

(5)

95

353

239

(45

)

Fair value changes in business acquisition

contingencies (6)

136

—

242

4

Discontinued Specialty Lab (7)

—

1,583

596

4,019

Other (gains) losses and expenses (8)

30

82

512

216

Tax effect of adjustments (9)

(543

)

(301

)

(922

)

(301

)

Adjusted Net Income

$

10,800

$

14,814

$

19,321

$

25,194

Preferred dividends Series A-2

(2,750

)

(4,100

)

(5,564

)

(8,200

)

Adjusted Net Income attributable to

stockholders

$

8,050

$

10,714

$

13,757

$

16,994

Net Loss per share attributable to

stockholders

$

(0.39

)

$

(0.38

)

$

(0.91

)

$

(1.00

)

Basic Adjusted Net Income per share

(10)

$

0.24

$

0.36

$

0.43

$

0.57

Diluted Adjusted Net Income per share

(11)

$

0.20

$

0.29

$

0.37

$

0.47

Weighted average common shares

outstanding

33,318

30,047

31,850

29,952

Fully diluted shares

39,576

37,079

37,631

36,485

_____________

(1)

Represents amortization of intangible

assets.

(2)

Represents non-cash stock-based

compensation expenses related to (i) option awards issued to

employees, (ii) restricted stock grants issued to directors and

selected employees, (iii) and stock appreciation rights grants

issued to selected employees.

(3)

Includes financial and tax diligence,

consulting, legal, valuation, accounting and travel costs and

acquisition-related incentives related to our acquisition

activity.

(4)

Amounts relate to the change in fair value

of the interest rate swap instruments and the embedded derivative

attached to the Series A-2 preferred stock.

(5)

Amounts represent non-capitalizable

expenses associated with refinancing and amending our debt

facilities.

(6)

Amounts reflect the difference between the

expected settlement value of acquisition related earn-out payments

at the time of the closing of acquisitions and the expected (or

actual) value of earn-outs at the end of the relevant period.

(7)

Amounts consist of operating losses before

depreciation related to the Discontinued Specialty Lab.

(8)

Amount in 2024 consists of costs

associated with a lease abandonment. Amount in 2023 consists of

costs associated with an aviation loss.

(9)

The Company applied the estimated

effective tax rate on portions of the adjustments related to our

significant foreign entities, and determined the US portion of the

adjustments do not have any tax impact since we are in a full

deferred tax asset valuation allowance as of June 30, 2024.

(10)

Represents Adjusted Net Income

attributable to stockholders divided by the weighted average number

of shares of common stock outstanding.

(11)

Represents Adjusted Net Income

attributable to stockholders divided by fully diluted number of

shares of common stock.

Montrose Environmental Group, Inc.

Reconciliation of Net Loss to

Consolidated Adjusted EBITDA

(In thousands)

(Unaudited)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net loss

$

(10,170

)

$

(7,174

)

$

(23,527

)

$

(21,893

)

Interest expense

3,976

1,877

7,282

3,418

Income tax expense (benefit)

2,619

151

3,112

1,518

Depreciation and amortization

12,515

11,398

24,168

21,953

EBITDA

$

8,940

$

6,252

$

11,035

$

4,996

Stock-based compensation (1)

11,831

11,090

23,103

24,125

Acquisition costs (2)

1,082

2,696

3,607

3,471

Fair value changes in financial

instruments (3)

1,202

(865

)

905

1,008

Expenses related to financing transactions

(4)

95

—

239

4

Fair value changes in business acquisition

contingencies (5)

136

353

242

(45

)

Discontinued Specialty Lab (6)

—

1,583

596

4,019

Other (gains) losses and expenses (7)

30

82

512

216

Consolidated Adjusted EBITDA

$

23,316

$

21,191

$

40,239

$

37,794

_____________ (1)

Represents non-cash stock-based

compensation expenses related to (i) option awards issued to

employees, (ii) restricted stock grants issued to directors and

selected employees, (iii) and stock appreciation rights grants

issued to selected employees.

(2)

Includes financial and tax diligence,

consulting, legal, valuation, accounting and travel costs and

acquisition-related incentives related to our acquisition

activity.

(3)

Amounts relate to the change in fair value

of the interest rate swap instruments and the embedded derivative

attached to the Series A-2 preferred stock.

(4)

Amounts represent non-capitalizable

expenses associated with refinancing and amending our debt

facilities.

(5)

Reflects the difference between the

expected settlement value of acquisition related earn-out payments

at the time of the closing of acquisitions and the expected (or

actual) value of earn-outs at the end of the relevant period.

(6)

Amounts consist of operating losses before

depreciation related to the Discontinued Specialty Lab.

(7)

Amount in 2024 consists of costs

associated with a lease abandonment. Amount in 2023 consist of

costs associated with an aviation loss.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806019065/en/

Investor Relations: Rodny Nacier (949) 988-3383

ir@montrose-env.com

Media Relations: Sarah Kaiser (225) 955-1702

pr@montrose-env.com

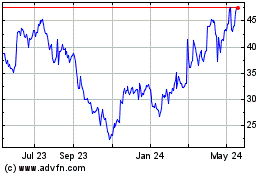

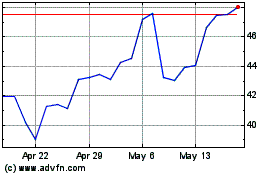

Montrose Environmental (NYSE:MEG)

Historical Stock Chart

From Dec 2024 to Dec 2024

Montrose Environmental (NYSE:MEG)

Historical Stock Chart

From Dec 2023 to Dec 2024