Amundi Pioneer Announces Planned Redemptions of Auction Preferred Shares by Two Pioneer Closed-End Funds

14 July 2017 - 6:09AM

Business Wire

Amundi Pioneer Asset Management (Amundi Pioneer) announced today

that each of Pioneer Municipal High Income Advantage Trust (NYSE:

MAV) and Pioneer Municipal High Income Trust (NYSE: MHI) intend to

redeem all of their outstanding auction preferred shares (APS) at

the liquidation preference per share (sometimes referred to as “at

par”) of each series of APS, together with accrued and unpaid

dividends, if any, as of the redemption date.

Each fund’s Board of Trustees has approved a refinancing plan

expected to result in the redemption of all of each fund’s

outstanding APS. The redemption of each fund’s APS is subject to

the successful negotiation of the new financing, the satisfaction

of certain notice and regulatory requirements, and the closing

conditions of the new financing. Specific information related to

the redemption process and timeframes will be released by the funds

separately. Amundi Pioneer expects the redemptions to be completed

by the end of 2017.

After the refinancing is completed, each fund will continue to

employ financial leverage for investment purposes. Amundi Pioneer

does not expect the refinancing to reduce either fund’s leverage

outstanding.

MAV and MHI are closed-end investment companies that trade on

the New York Stock Exchange (NYSE).

Amundi Pioneer Asset Management, Inc. is each fund’s investment

adviser. On July 3, 2017, the name of the adviser was changed from

Pioneer Investment Management, Inc., coinciding with its

acquisition by Amundi. As a result of the transaction, Amundi

Pioneer Asset Management, Inc. became an indirect wholly owned

subsidiary of Amundi. Amundi, one of the world’s largest asset

managers, is headquartered in Paris, France.

Closed-end funds, unlike open-end funds, are not continuously

offered. Once issued, common shares of closed-end funds are bought

and sold in the open market through a stock exchange and frequently

trade at prices lower than their net asset value. Net Asset Value

(NAV) is total assets less total liabilities (and the liquidation

preference of preferred shares, if any) divided by the number of

common shares outstanding. For performance data on Amundi Pioneer's

closed-end funds, please call 800-225-6292 or visit our closed-end

pricing page.

Various statements contained in this press release are “forward

looking statements”. All forward looking statements involve risks

and uncertainties. In particular, any statement contained in this

press release regarding expectations or assumptions is subject to

risks, uncertainties and contingencies, including market risks,

which are beyond our control and which may cause actual results or

achievements to differ materially and perhaps substantially from

anticipated results or achievements. None of Amundi Pioneer, MAV or

MHI makes any representations or warranties (express or implied)

about the accuracy of forward looking statements.

About Amundi Pioneer Asset Management

Amundi Pioneer Asset Management (Amundi Pioneer) references the

U.S. business of the Amundi group of companies, Europe’s largest

asset manager by assets under management and among the top ten

global asset managers1. Amundi Pioneer was formed in 2017 as part

of the acquisition of Pioneer Investments by Amundi, and includes

the operations of Amundi Pioneer Asset Management USA, Inc., based

in Boston, and Amundi Smith Breeden, based in Durham, N.C.

Incorporating the expertise of the regional hub in Durham, Boston

is one of Amundi’s six main investment hubs. In addition to

investment management activities, Amundi Pioneer offers and

services a wide array of investment solutions for institutional and

private investors globally. Amundi Pioneer Asset Management, Inc.

(formerly, Pioneer Investment Management, Inc.) is an investment

adviser subsidiary of Amundi Pioneer Asset Management USA, Inc.

Pioneer Investments was founded in 1928 by Philip L. Carret and

has been a leading innovator in global asset management since its

inception. Amundi Smith Breeden, founded as Smith Breeden

Associates in 1982, is a highly regarded relative value credit

investor managing an extensive range of fixed-income strategies

tailored to the needs of institutional investors. In aggregate,

Amundi Pioneer Asset Management offers a broad range of

fixed-income, equity and multi-asset investment solutions. A focus

on proprietary research, robust risk management, disciplined

investment processes, and close partnerships with clients has made

the firms that comprise Amundi Pioneer investment managers of

choice among leading institutional and individual investors

worldwide. Amundi Pioneer had approximately $78.8 billion in assets

under management as of December 31, 2016.

Visit amundipioneer.com or amundismithbreeden.com for more

information.

Follow us on LinkedIn or Twitter.

Shareholder Inquiries: Please contact your financial advisor or

visit amundipioneer.com.Broker/Advisor Inquiries Please Contact:

800-622-9876Media Inquiries Please Contact: Geoff Smith,

617-422-4727

Amundi Pioneer Distributor, Inc., Member SIPC© 2017 Amundi

Pioneer Asset Management

1 Source IPE “Top 400 asset managers” published in June 2017 and

based on AUM as of end December 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170713006163/en/

Amundi Pioneer Asset ManagementGeoff Smith,

617-422-4758geoff.smith@amundipioneer.com

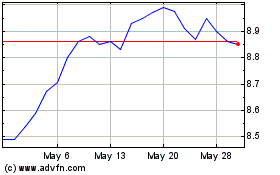

Pioneer Municipal High I... (NYSE:MHI)

Historical Stock Chart

From Jun 2024 to Jul 2024

Pioneer Municipal High I... (NYSE:MHI)

Historical Stock Chart

From Jul 2023 to Jul 2024