CALHOUN, Ga., July 27 /PRNewswire-FirstCall/ -- Mohawk Industries,

Inc. (NYSE:MHK) today announced 2006 second quarter net earnings of

$119,513,000 (22% above last year) and diluted earnings per share

(EPS) of $1.76 (21% above last year), in accordance with U.S.

Generally Accepted Accounting Principles (GAAP). Adjusted net

earnings for the second quarter of 2006 were $117,714,000 and

adjusted EPS were $1.73 per share. The adjusted net earnings

exclude a stock option charge that was not required in 2005

increasing net earnings $2,104,000 and exclude income for a portion

of a one-time refund received from U.S. Customs decreasing net

earnings by $3,903,000. Net sales for the quarter were

$2,058,123,000, an increase of 27% from 2005. The growth resulted

from the Unilin acquisition, total hard surface sales growth,

internal growth, price increases and new patent licenses. Mohawk

changed its method of accounting for soft surface inventories from

LIFO to FIFO during the second quarter of 2006. If Mohawk had

continued on LIFO, then net earnings for the second quarter would

have been slightly higher. All prior period amounts have been

revised to reflect this change. For the first half of 2006, net

earnings were $198,634,000 (16% above last year) and EPS was $2.92

(15% above last year), in accordance with U.S. GAAP. Adjusted net

earnings for the first half of 2006 were $198,577,000 and adjusted

EPS was $2.92 per share. The adjusted net earnings exclude a stock

option charge that was not required in 2005 increasing net earnings

by $3,846,000 and exclude income for a portion of a one-time refund

received from U.S. Customs decreasing net earnings by $3,903,000.

The change of accounting from LIFO to FIFO improved first quarter

2006 net earnings by $8,001,000. Net sales for the first half of

2006 were $3,983,229,000, representing a 28% increase over 2005.

This increase is attributable to the Unilin acquisition, strong

hard surface sales growth, internal growth, price increases and new

patent licenses. In commenting on the quarter results, Jeffrey S.

Lorberbaum, Chairman and CEO, stated, "I am pleased with our second

quarter performance, especially in light of the economic and

industry factors we are facing. Hard surface growth and higher

selling prices positively affected our sales while replacement

demand for carpet remains slow. The change from LIFO to FIFO

inventory accounting removes some uncertainty in predicting future

results. Our Unilin integration is progressing as planned. We

expect to benefit from the many capital projects recently completed

and the introduction of Mohawk-branded laminate in the future. The

Mohawk segment grew sales by 5% with margins improving from the

first quarter. In the second quarter, carpet raw material costs

remained relatively flat, and our suppliers announced increases in

July. In August, Mohawk is implementing selling price increases to

recover these cost changes. Industry sales improved from the first

quarter but were still behind last year in units. Sales trends

continued with the commercial channel and residential construction

channel performing better than the residential replacement channel.

While the economy continues to grow with employment at relatively

high levels, the higher gasoline and energy costs appear to be

impacting consumer behavior. We incurred greater marketing expenses

as a result of a higher level of product introductions due to

carpet raw material changes and the new laminate introductions. Our

expansion of the South Carolina fiber and yarn manufacturing is

complete and running as planned. Overall, quality has improved in

carpet manufacturing and our Six Sigma program continues to expand

with many cost reduction projects across our business. Our Dal-Tile

segment second quarter sales were strong as revenues grew 15% over

2005 from both volume and price increases. We had higher than

normal product introductions, absorbed start-up costs in the

Oklahoma ceramic facility, and had higher energy and transportation

costs. The Mexican ceramic expansion was completed in the first

quarter of the year and is running as planned. The Oklahoma

expansion started production at the end of the second quarter.

These capacity expansions will support our expected future growth

and allow us to produce a greater portion of our sales

requirements. The Unilin segment greatly improved margins from the

previous quarter. This improvement was attributable to seasonally

higher sales in Europe, better product mix and new patent licenses.

Laminate sales in Europe were up and sales to our U.S. distributors

were down as we had anticipated. Our U.S. distributors were able to

substantially reduce their inventories because we now supply them

from our U.S. factory instead of Europe. Our U.S. distributors

reported that sales of our product to their customers were up

versus the prior year. Our U.S. laminate sales should return to a

more normalized level in the third quarter. The initial launch of

Unilin products through the Mohawk channel has received favorable

retailer reception. There will be additional laminate product

introductions through the year. We are managing our balance sheet

with the debt to capitalization ratio improving to 48% after paying

down $161 million of debt during the second quarter. The

organization has many initiatives focused on improving inventory

turns and working capital management. We received a favorable

ruling from the U.S. Supreme Court which vacated the lower court's

prior ruling on the pending class action suit that alleged the

Company suppressed wages by hiring illegal aliens. The Supreme

Court ruled on another case, which may have a positive bearing on

ours. We expect it to take six to twelve months for the lower court

to reconsider the case. We remain confident in our position and

believe the allegations are unfounded." We expect the Mohawk

segment to realize benefit from earlier price increases and capital

investments offset by continued weakness in the residential carpet

business and rising material costs. Dal-Tile investments in sales

and marketing should support future growth in market share. Unilin

results will be more normalized in the third quarter as they move

into the European vacation period when plant maintenance is

performed. After considering these factors, the third quarter

earnings forecast is from $1.76 to $1.85 EPS. This guidance does

not include any future refunds from U.S. Customs. There continues

to be uncertainty in consumer demand, oil prices, interest rates

and the flooring industry. Most economists are predicting slower

GDP growth. We will manage our business through this environment as

we have done in the past. Due to this uncertainty, we are

approaching the end of the year cautiously. Certain of the

statements in the immediately preceding paragraphs, particularly

anticipating future performance, business prospects, growth and

operating strategies, proposed acquisitions, and similar matters,

and those that include the words "believes," "anticipates,"

"forecasts," "estimates," or similar expressions constitute

"forward-looking statements." For those statements, Mohawk claims

the protection of the safe harbor for forward- looking statements

contained in the Private Securities Litigation Reform Act of 1995.

There can be no assurance that the forward-looking statements will

be accurate because they are based on many assumptions, which

involve risks and uncertainties. The following important factors

could cause future results to differ: changes in economic or

industry conditions; competition; raw material and energy prices;

timing and level of capital expenditures; integration of

acquisitions; introduction of new products; rationalization of

operations; litigation and other risks identified in Mohawk's SEC

reports and public announcements. Mohawk is a leading supplier of

flooring for both residential and commercial applications. Mohawk

offers a complete selection of carpet, ceramic tile, laminate,

wood, stone, vinyl, rugs and other home products. These products

are marketed under the premier brands in the industry, which

include Mohawk, Karastan, Ralph Lauren, Lees, Bigelow, Dal-Tile,

American Olean, Unilin and Quick Step. Mohawk's unique

merchandising and marketing assist our customers in creating the

consumers' dream. Mohawk provides a premium level of service with

its own trucking fleet and over 250 local distribution locations.

There will be a conference call Friday, July 28, 2006 at 11:00 AM

Eastern Time. The telephone number to call is 1-800-603-9255 for

US/Canada and 1-706-634-2294 for International/Local. A conference

call replay will also be available until Tuesday, August 1, 2006 by

dialing 1-800-642-1687 for US/local calls and (706) 645-9291 for

international calls and entering Conference ID # 2073625. MOHAWK

INDUSTRIES, INC. AND SUBSIDIARIES Consolidated Statement of

Earnings Data Three Months Ended Six Months Ended (Amounts in

thousands, except July 1, July 2, July 1, July 2, per share data)

2006 2005 2006 2005 Net sales $2,058,123 1,624,692 3,983,229

3,117,914 Cost of sales 1,465,745 1,186,527 2,874,507 2,289,380

Gross profit 592,378 438,165 1,108,722 828,534 Selling, general and

administrative expenses 369,333 271,020 721,776 532,092 Operating

income 223,045 167,145 386,946 296,442 Interest expense 46,123

12,515 86,458 24,391 Other (income) expense, net 3,598 922 6,325

2,926 U.S. Customs refund, net (6,232) - (6,232) - Earnings before

income taxes 179,556 153,708 300,395 269,125 Income taxes 60,043

55,628 101,761 97,383 Net earnings $119,513 98,080 198,634 171,742

Basic earnings per share $1.77 1.47 2.94 2.57 Weighted-average

shares outstanding 67,693 66,811 67,629 66,807 Diluted earnings per

share $1.76 1.45 2.92 2.54 Weighted-average common and dilutive

potential common shares outstanding 68,067 67,504 68,073 67,598

Other Financial Information (Amounts in thousands) Net cash

provided by operating activities $238,181 104,079 342,707 154,780

Depreciation & amortization $69,781 31,497 134,634 63,762

Capital expenditures $37,027 64,832 82,659 99,353 Consolidated

Balance Sheet Data (Amounts in thousands) July 1, July 2, 2006 2005

ASSETS Current assets: Cash $73,398 - Receivables 987,626 775,992

Inventories 1,283,931 1,140,870 Prepaid expenses 134,087 49,125

Deferred income taxes 41,427 55,311 Total current assets 2,520,469

2,021,298 Property, plant and equipment, net 1,904,803 973,627

Goodwill 2,691,910 1,377,349 Intangibles 1,196,310 320,645 Other

assets 34,319 13,055 $8,347,811 4,705,974 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Current portion of

long-term debt $530,626 183,835 Accounts payable and accrued

expenses 1,146,904 757,813 Total current liabilities 1,677,530

941,648 Long-term debt, less current portion 2,596,412 700,000

Deferred income taxes and other long- term liabilities 654,332

226,883 Total liabilities 4,928,274 1,868,531 Total stockholders'

equity 3,419,537 2,837,443 $8,347,811 4,705,974 As of or for the As

of or for the Segment Information Three Months Ended Six Months

Ended (Amounts in thousands) July 1, July 2, July 1, July 2, 2006

2005 2006 2005 Net sales: Mohawk $1,241,992 1,184,914 2,392,538

2,276,260 Dal-Tile 506,914 439,778 980,824 841,654 Unilin 313,765 -

616,395 - Intersegment eliminations (4,548) - (6,528) -

Consolidated net sales $2,058,123 1,624,692 3,983,229 3,117,914

Operating income: Mohawk $98,993 102,399 164,606 173,691 Dal-Tile

74,042 69,291 143,644 127,761 Unilin 59,657 - 99,676 - Corporate

and intersegment eliminations (9,647) (4,545) (20,980) (5,010)

Consolidated operating income $223,045 167,145 386,946 296,442

Assets: Mohawk $2,622,196 2,508,066 Dal-Tile 2,270,910 2,147,812

Unilin 3,353,389 - Corporate and eliminations 101,316 50,096

Consolidated assets $8,347,811 4,705,974 Reconciliation of reported

net earnings to adjusted net earnings Three Months Six Months

(Amounts in thousands, except Ended Ended per share data) July 1,

2006 July 1, 2006 Net earnings reported $119,513 198,634

Adjustments: Stock option expense, net of taxes of $1,255 and

$2,263, respectively 2,104 3,846 U.S. Customs refund, net of taxes

of $2,329 (3,903) (3,903) $117,714 198,577 Adjusted net earnings

per common share (basic) $1.74 2.94 Adjusted net earnings per

common share (diluted) $1.73 2.92 The Company believes it is useful

for itself and investors to review, as applicable, both GAAP

information that includes the stock compensation impact of SFAS

123R and the U.S. Customs refund, and the non-GAAP measure that

excludes such information in order to assess the performance of the

Company's business for planning and forecasting in subsequent

periods. DATASOURCE: Mohawk Industries, Inc. CONTACT: Frank H.

Boykin, Chief Financial Officer of Mohawk Industries, Inc.,

+1-706-624-2695 Web site: http://www.mohawkind.com/

Copyright

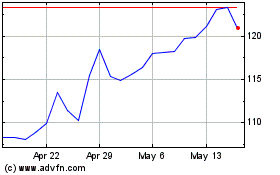

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

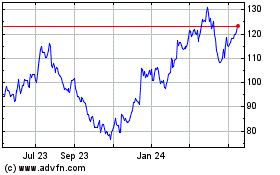

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024