CALHOUN, Ga., May 3, 2012 /CNW/ - Mohawk Industries, Inc. today

announced 2012 first quarter net earnings of $40 million and

diluted earnings per share (EPS) of $0.58, a 38% increase over last

year's first quarter adjusted EPS. Net sales for the first quarter

of 2012 were $1.4 billion, increasing 5% as reported and 6% with a

constant exchange rate. For the first quarter of 2011, net earnings

were $23 million and EPS was $0.34. Excluding restructuring charges

for the first quarter of 2011, adjusted net earnings were $29

million and EPS was $0.42. Commenting on Mohawk Industries'

performance, Jeffrey S. Lorberbaum, Chairman and CEO, stated,

"Volume increases, price increases, cost reductions and lower

interest expense contributed to our earnings growth in the quarter.

In March, Standard & Poor's upgraded our credit rating and

Moody's elevated our outlook to positive, reducing the interest

rate on our notes. In April, we paid our 2012 maturing notes using

our bank revolver which has lower interest rates. Our balance sheet

remains strong with net debt to adjusted EBITDA at 2.2 times and

approximately $500 million available for strategic opportunities,

after the payment of the 2012 notes." Mohawk segment sales grew 1%

as we executed price increases that should cover our material cost

in the second period. Higher carpet sales in the segment were

offset by lower rug sales from deferred customer promotions,

inventory reductions in the channel and lower product mix. In

residential, we launched our revolutionary SmartStrand Silk

collection, the next generation of soft carpet, with the inherent

performance, ease of care and unique environmental features that

have made SmartStrand successful. In the commercial business, our

hospitality and core business improved, but we experienced weakness

in our premium products. To provide greater value in commercial, we

have introduced new high-end products, extended our SmartStrand

brand into commercial applications and utilized new technology for

improved pattern definition in hospitality. Productivity increases,

improved yields, product re-engineering, process simplification and

reduced complexity improved our cost position and service levels.

Dal-Tile segment net sales grew 14% during the quarter through

increased residential remodeling and commercial renovation,

successful product launches and growth in the Mexican market. Price

increases along with energy surcharges are being implemented to

recover material and freight costs. Sales grew in all channels,

driven by new products featuring Reveal Imaging, larger sizes,

realistic wood designs and a premium commercial collection. In

Mexico, we opened our Salamanca plant ahead of schedule. Sales in

Mexico are growing dramatically due to our expanded offering of

product designs, sizes and price points. We lowered manufacturing

costs through higher productivity, reduced waste, and improved

formulations that increase production speeds and recycled content.

Unilin segment net sales grew 4% as reported and 7% on a local

basis supported by growth of laminate flooring and panels. The

impact of the European debt situation on our business has been

limited by our lower exposure to Southern European markets. We

continue to gain share through new products, channels and regions,

offsetting the impact of slowing national economies. We have

implemented price increases in European laminate, roofing and most

panels to recover higher material costs. We are increasing product

placements in the home center and DIY channels with both laminate

and wood. Our insulation panels business grew significantly and we

are preparing to expand in France. Our strategies to expand

internationally are progressing with our new Russian plant

increasing production and our Australian distribution being

integrated with Unilin. Low mortgage rates, increasing home sales,

and higher employment should sustain industry growth. Our emphasis

on product and process innovation, cost management and flexibility

has resulted in a stronger company. In the second quarter, we

anticipate continued sales growth and improving margins as selling

prices align with material inflation. We believe that our new

product launches will improve profitability and sales growth.

Improvements in productivity, inventory management, and interest

expenses will favorably impact our results. With these factors, our

guidance for second quarter earnings is $1.07 to $1.16 per share,

excluding any restructuring costs. Our recent investments in new

markets, technology, production capacity and R&D will improve

our results. We have a strong financial position to pursue new

strategic opportunities. Mohawk is a leading supplier of flooring

for both residential and commercial applications. Mohawk provides a

complete selection for all markets of carpet, ceramic tile,

laminate, wood, stone, vinyl, and rugs. These products are marketed

under the premier brands in the industry including Mohawk,

Karastan, Lees, Bigelow, Durkan, Daltile, American Olean, Unilin

and Quick-Step. Mohawk's unique merchandising and marketing assists

the consumer in creating exquisite floors to fulfill their dreams.

Mohawk provides a premium level of service with its own trucking

fleet and local distribution in the U.S. Mohawk's international

presence includes operations in Australia, Brazil, China, Europe,

Malaysia, Mexico and Russia. Certain of the statements in the

immediately preceding paragraphs, particularly anticipating future

performance, business prospects, growth and operating strategies

and similar matters and those that include the words "could,"

"should," "believes," "anticipates," "expects," and "estimates," or

similar expressions constitute "forward-looking statements." For

those statements, Mohawk claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. There can be no assurance that the

forward-looking statements will be accurate because they are based

on many assumptions, which involve risks and uncertainties. The

following important factors could cause future results to differ:

changes in economic or industry conditions; competition; inflation

in raw material prices and other input costs; energy costs and

supply; timing and level of capital expenditures; timing and

implementation of price increases for the Company's products;

impairment charges; integration of acquisitions; international

operations; introduction of new products; rationalization of

operations; tax, product and other claims; litigation; and other

risks identified in Mohawk's SEC reports and public announcements.

Conference call Friday, May 4, 2012 at 11:00 AM Eastern Time. The

telephone number is 1-800-603-9255 for US/Canada and 1-706-634-2294

for International/Local. Conference ID # 69432176. A replay will

also be available until May 18, 2012 by dialing 855-859-2056 for

US/local calls and 404-537-3406 for International/Local calls and

entering Conference ID # 69432176. MOHAWK INDUSTRIES, INC. AND

SUBSIDIARIES Consolidated Statement of Three Months Ended

Operations (Amounts in thousands, except March 31, 2012 April 2,

2011 per share data) Net sales $ 1,409,035 1,343,595 Cost of sales

1,049,609 1,002,003 Gross profit 359,426 341,592 Selling, general

and 287,450 285,508 administrative expenses Operating income 71,976

56,084 Interest expense 22,498 26,595 Other (income) expense, net

(1,825) (15) Earnings before income taxes 51,303 29,504 Income tax

expense 10,291 4,966 Net earnings 41,012 24,538 Net earnings

attributable to (635) (1,096) noncontrolling interest Net earnings

attributable to $ 40,377 23,442 Mohawk Industries, Inc. Basic

earnings per share attributable to Mohawk $ 0.59 0.34 Industries,

Inc. Weighted-average common 68,862 68,674 shares outstanding -

basic Diluted earnings per share attributable to Mohawk $ 0.58 0.34

Industries, Inc. Weighted-average common 69,141 68,904 shares

outstanding - diluted Other Financial Information (Amounts in

thousands) Net cash used in operating $ 44,470 67,413 activities

Depreciation and amortization $ 73,286 74,253 Capital expenditures

$ 43,251 52,811 Consolidated Balance Sheet Data (Amounts in

thousands) March 31, 2012 April 2, 2011 ASSETS Current assets: Cash

and cash equivalents $ 304,775 256,231 Receivables, net 782,000

754,826 Inventories 1,164,991 1,075,613 Prepaid expenses and other

136,752 97,846 current assets Deferred income taxes 156,110 155,159

Total current assets 2,544,628 2,339,675 Property, plant and

1,718,396 1,715,895 equipment, net Goodwill 1,390,712 1,406,731

Intangible assets, net 599,625 689,703 Deferred income taxes and

145,833 114,229 other non-current assets $ 6,399,194 6,266,233

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Current

portion of long-term $ 57,309 52,706 debt Accounts payable and

accrued 721,383 739,768 expenses Total current liabilities 778,692

792,474 Long-term debt, less current 1,642,419 1,577,188 portion

Deferred income taxes and 458,786 449,984 other long-term

liabilities Total liabilities 2,879,897 2,819,646 Noncontrolling

interest - 33,255 Total stockholders' equity 3,519,297 3,413,332 $

6,399,194 6,266,233 Segment Information As of or for the Three

Months Ended (Amounts in thousands) March 31, 2012 April 2, 2011

Net sales: Mohawk $ 699,880 691,165 Dal-Tile 392,925 344,415 Unilin

337,424 325,832 Intersegment sales (21,194) (17,817) Consolidated

net sales $ 1,409,035 1,343,595 Operating income (loss): Mohawk $

25,282 17,040 Dal-Tile 26,028 17,700 Unilin 27,146 26,250 Corporate

and eliminations (6,480) (4,906) Consolidated operating income $

71,976 56,084 Assets: Mohawk $ 1,820,785 1,749,625 Dal-Tile

1,759,934 1,674,408 Unilin 2,620,013 2,654,268 Corporate and

eliminations 198,462 187,932 Consolidated assets $ 6,399,194

6,266,233 Reconciliation of Net Earnings Attributable to Mohawk

Industries, Inc. to Adjusted Net Earnings Attributable to Mohawk

Industries, Inc. and Adjusted Diluted Earnings Per Share

Attributable to Mohawk Industries, Inc. (Amounts in thousands,

except per share data) Three Months Ended March April 2, 31, 2012

2011 Net earnings attributable to $ 40,377 23,442 Mohawk

Industries, Inc. Unusual items: Business - 6,813 restructurings

Income taxes - (1,018) Adjusted net earnings attributable to $

40,377 29,237 Mohawk Industries, Inc. Adjusted diluted earnings per

share $ 0.58 0.42 attributable to Mohawk Industries, Inc.

Weighted-average common shares 69,141 68,904 outstanding - diluted

Reconciliation of Total Debt to Net Debt (Amounts in thousands)

March 31, 2012 Current portion of long-term $ 57,309 debt Long-term

debt, less current 1,642,419 portion Less: Cash and 304,775 cash

equivalents Net Debt $ 1,394,953 Reconciliation of Operating Income

to Adjusted EBITDA (Amounts in Trailing thousands) Twelve Three

Months Ended Months Ended July 2, October December March March 31,

2011 1, 2011 31, 2011 31, 2012 2012 Operating income $ 101,700

91,464 66,294 71,976 331,434 Other (expense) (396) (13,413) (257)

1,825 (12,241) income Net earnings attributable to (1,191) (1,050)

(966) (635) (3,842) noncontrolling interest Depreciation and 74,344

74,207 74,930 73,286 296,767 amortization EBITDA 174,457 151,208

140,001 146,452 612,118 Unrealized foreign currency - 9,085 - -

9,085 losses (1) Operating lease - - 6,035 - 6,035 correction (2)

Business 6,514 2,186 7,696 - 16,396 restructurings Adjusted EBITDA

$ 180,971 162,479 153,732 146,452 643,634 Net Debt to 2.2 Adjusted

EBITDA Reconciliation of Net Sales to Adjusted Net Sales (Amounts

in thousands) Three Months Ended March 31, 2012 April 2, 2011 Net

sales $ 1,409,035 1,343,595 Adjustments to net sales: Exchange rate

13,636 - Adjusted net sales $ 1,422,671 1,343,595 Reconciliation of

Segment Net Sales to Adjusted Segment Net Sales (Amounts in

thousands) Three Months Ended Unilin March 31, 2012 April 2, 2011

Net sales $ 337,424 325,832 Adjustment to net sales: Exchange rate

11,851 - Adjusted net sales $ 349,275 325,832 Reconciliation of

Operating Income to Adjusted Operating Income (Amounts in

thousands) Three Months Ended March 31, 2012 April 2, 2011

Operating income $ 71,976 56,084 Adjustments to operating income:

Business restructurings - 6,813 Adjusted operating income $ 71,976

62,897 Adjusted operating margin as a 5.1% 4.7% percent of net

sales Reconciliation of Segment Operating Income to Adjusted

Segment Operating Income (Amounts in thousands) Three Months Ended

Mohawk March 31, 2012 April 2, 2011 Operating income $ 25,282

17,040 Adjustments to operating income: Business restructurings -

6,813 Adjusted operating income $ 25,282 23,853 Adjusted operating

margin as a 3.6% 3.5% percent of net sales Reconciliation of

Earnings Before Income Taxes to Adjusted Earnings Before Income

Taxes (Amounts in thousands) Three Months Ended March 31, 2012

April 2, 2011 Earnings before income taxes $ 51,303 29,504 Unusual

items: Business restructurings - 6,813 Adjusted earnings before

income $ 51,303 36,317 taxes Reconciliation of Income Tax Expense

to Adjusted Income Tax Expense (Amounts in thousands) Three Months

Ended March 31, 2012 April 2, 2011 Income tax expense $ 10,291

4,966 Unusual items: Income taxes - 1,018 Adjusted income tax

expense $ 10,291 5,984 Adjusted income tax rate 20% 16%

Reconciliation of Selling, General and Administrative Expenses to

Adjusted Selling, General and Administrative Expenses (Amounts in

thousands) Three Months Ended March 31, 2012 April 2, 2011 Selling,

general and $ 287,450 285,508 administrative expenses Adjustments

to selling, general and administrative expenses: Business

restructurings - 466 Exchange rate 2,378 - Adjusted selling,

general and $ 289,828 285,974 administrative expenses Adjusted

selling, general and administrative expenses as a 20.6% 21.3%

percent of net sales (1) Unrealized foreign currency losses in Q3

2011 for certain of the Company's consolidated foreign subsidiaries

that measure financial position and results using the U.S. dollar

rather than the local currency. (2) Correction of an immaterial

error related to accounting for operating leases The Company

believes it is useful for itself and investors to review, as

applicable, both GAAP and the above non-GAAP measures in order to

assess the performance of the Company's business for planning and

forecasting in subsequent periods. SOURCE Mohawk Industries, Inc.

Mohawk Industries, Inc. CONTACT: Frank H. Boykin, Chief Financial

Officer, +1-706-624-2695http://www.mohawkind.com

Copyright

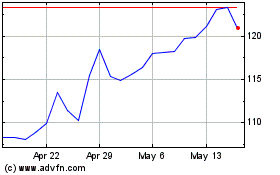

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

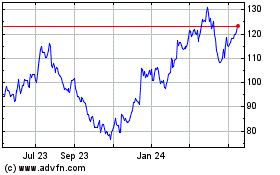

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024