NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY (IN WHOLE OR IN PART) IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF

SUCH JURISDICTION.

TENDER OFFER EXPIRATION AND ACCEPTANCES UPDATE

MariaDB plc (NYSE: MRDB) (“MariaDB” or the

“Company”) announces that Meridian BidCo LLC

(“Bidco”), an affiliate of K1 Investment Management, LLC,

put out a press release on the date hereof (the “Bidco press

release”) relating to the unsolicited offer (the

“Offer”) by Bidco to purchase all of the issued and to be

issued ordinary shares of $0.01 each (nominal value) of the Company

(“MariaDB Shares”). According to the Bidco press release, as

of 5:00 p.m. (New York City time) on July 23, 2024 (the

“Expiration Time”), all remaining conditions to the Offer

were satisfied, fulfilled or, to the extent permitted, waived.

Accordingly, Bidco announced that the Offer has now become

unconditional in all respects and is now closed to further

acceptances with effect from the Expiration Time.

For acceptances that have been received which are valid and

complete in all respects and not properly withdrawn prior to the

Expiration Time, the cash consideration payable will be settled in

accordance with the terms of the Cash Offer on a date promptly

following the Expiration Time, which Bidco currently expects to be

July 25, 2024.

According to the Bidco press release, as of the Expiration Time,

Bidco received valid acceptances in respect of a total of

61,263,283 MariaDB Shares, representing 88.70% of the issued share

capital of MariaDB as of July 22, 2024.

According to the Bidco press release and as previously

announced, Bidco now intends to apply the provisions of Sections

456 to 460 of the Companies Act 2014 to acquire compulsorily, on

the same terms as the Offer, any outstanding MariaDB Shares not

acquired or agreed to be acquired pursuant to the Offer.

According to the Bidco press release, Bidco proposes to shortly

send compulsory acquisition notices (the “Notices”) to those

MariaDB shareholders who have not yet accepted the Offer (the

“Non-Assenting Shareholders”). Following the expiration of

30 calendar days from the date of the Notices, unless a

Non-Assenting Shareholder has applied to the Irish High Court and

the Irish High Court orders otherwise, the MariaDB Shares held by

Non-Assenting Shareholders will be acquired compulsorily by Bidco

on the same terms as the Offer.

Capitalised terms used but not defined in this announcement have

the same meaning given to them in the Solicitation/Recommendation

Statement on Schedule 14D-9 initially filed with the United States

Securities and Exchange Commission on May 24, 2024 (as amended and

restated and supplemented).

IMPORTANT NOTICES

ABOUT MARIADB

MariaDB is a new generation database company whose products are

used by companies big and small, reaching more than a billion users

through Linux distributions and have been downloaded over one

billion times. Deployed in minutes and maintained with ease,

leveraging cloud automation, MariaDB database products are

engineered to support any workload, any cloud and any scale – all

while saving up to 90% of proprietary database costs. Trusted by

organizations such as Bandwidth, DigiCert, InfoArmor, Oppenheimer

and Samsung, MariaDB’s software is the backbone of critical

services that people rely on every day. For more information,

please visit mariadb.com.

RESPONSIBILITY STATEMENT

The directors of the Company accept responsibility for the

information contained in this announcement. To the best of the

knowledge and belief of the directors (who have taken all

reasonable care to ensure that such is the case), the information

contained in this announcement is in accordance with the facts and

does not omit anything likely to affect the import of such

information.

FORWARD-LOOKING STATEMENTS

Certain statements in this announcement are “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Words indicating future events and actions,

such as “will” and “may,” and variations of such words, and similar

expressions and future-looking language identify forward-looking

statements, but their absence does not mean that the statement is

not forward-looking. The forward-looking statements in this

announcement include statements regarding the Offer and related

actions and events. Forward-looking statements are not guarantees

of future events and actions, which may vary materially from those

expressed or implied in such statements. Differences may result

from, among other things, actions taken by the Company or its

management or board or third parties, including those beyond the

Company’s control. Such differences and uncertainties and related

risks include, but are not limited to, any negative effects of this

announcement or failure to consummate a transaction on the market

price of the ordinary shares and other Company securities

(including warrants), and potentially significant transaction and

related costs. The foregoing list of differences and risks and

uncertainties is illustrative, but by no means exhaustive. For more

information on factors that may affect the Offer and related

actions and events, please review “Risk Factors” described in the

Company’s filings and records filed with the United States

Securities and Exchange Commission. These forward-looking

statements reflect the Company’s expectations as of the date

hereof. The Company undertakes no obligation to update the

information provided herein.

FURTHER INFORMATION

The release, publication or distribution of this announcement

in, into, or from, certain jurisdictions other than Ireland may be

restricted or affected by the laws of those jurisdictions.

Accordingly, copies of this announcement are not being, and must

not be, mailed or otherwise forwarded, distributed or sent in,

into, or from any such jurisdiction. Therefore, persons who receive

this announcement (including without limitation nominees, trustees

and custodians) and are subject to the laws of any jurisdiction

other than Ireland who are not resident in Ireland will need to

inform themselves about, and observe any applicable restrictions or

requirements. Any failure to do so may constitute a violation of

the securities laws of any such jurisdiction.

No statement in this announcement is intended to constitute a

profit forecast for any period, nor should any statements be

interpreted as an indication of what the Company’s future financial

or operating results may be, nor should any statements be

interpreted to mean that earnings or earnings per share will

necessarily be greater or lesser than those for the relevant

preceding financial periods for the Company. No statement in this

announcement constitutes an asset valuation. No statement in this

announcement constitutes an estimate of the anticipated financial

effects of an acquisition of the Company, whether for the Company

or any other person.

REQUESTING HARD COPY INFORMATION

Any MariaDB shareholder may request a copy of this announcement

in hard copy form by writing to Investor Relations via e-mail at

ir@mariadb.com. Any written requests must include the identity of

the MariaDB shareholder and any hard copy documents will be posted

to the address of the MariaDB shareholder provided in the written

request.

A hard copy of this announcement will not be sent to MariaDB

shareholders unless requested.

Source: MariaDB

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723498698/en/

Investors: ir@mariadb.com

Media: pr@mariadb.com

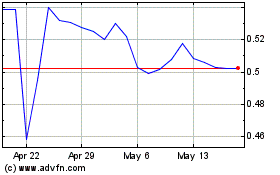

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jan 2025 to Feb 2025

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Feb 2024 to Feb 2025