Mesabi Trust (NYSE: MSB):

Receipt of Quarterly Royalty Report and

Royalty Payment

On April 29, 2022, the Trustees of Mesabi Trust (NYSE: MSB)

received the quarterly royalty report of iron ore shipments from

Silver Bay, Minnesota during the quarter ended March 31, 2022 (the

“Royalty Report”) from Cleveland-Cliffs Inc. (“Cliffs”), the parent

company of Northshore Mining Company (“Northshore”).

As reported to Mesabi Trust by Cliffs in the Royalty Report,

based on shipments of iron ore products by Northshore during the

three months ended March 31, 2022, Mesabi Trust was credited with a

base royalty of $6,032,086. For the three months ended March 31,

2022, Mesabi Trust was also credited with a bonus royalty in the

amount of $7,055,223. The royalty payment received today also

included an increase of $176,283 as a result of positive pricing

adjustments to base and bonus royalty calculations related to

changes in price estimates made in prior quarters. In addition, a

royalty payment of $278,850 was paid to the Mesabi Land Trust.

Accordingly, the total royalty payments received by Mesabi Trust on

April 29, 2022 from Cliffs were $13,542,442.

The royalties paid to Mesabi Trust are based on the volume of

iron ore pellets and other products produced or shipped during the

quarter and the year to date, the pricing of iron ore product

sales, and the percentage of iron ore pellet production and

shipments from Mesabi Trust lands rather than from non-Mesabi Trust

lands. In the first calendar quarter of 2022, Cliffs credited

Mesabi Trust with 1,069,456 tons of iron ore shipped, as compared

to 919,457 tons shipped during the first calendar quarter of

2021.

The volume of shipments of iron ore pellets (and other iron ore

products) by Northshore varies from quarter to quarter and year to

year based on a number of factors, including the requested delivery

schedules of customers, general economic conditions in the iron ore

industry, and weather conditions on the Great Lakes. Further, the

prices under the term contracts among Northshore, Cliffs, and

certain of their customers (the “Cliffs Pellet Agreements”), to

which Mesabi Trust is not a party, are subject to interim and final

pricing adjustments, dependent in part on multiple price and

inflation index factors, some of which are not known until after

the end of a contract year. The factors that could result in price

adjustments under Cliffs’ customer contracts include changes in the

Platts Prices, hot-rolled coil steel price, the Atlantic Basin

pellet premium, published Platts international indexed freight

rates and changes in specified producer price indices, including

those for industrial commodities, fuel and steel. These multiple

factors can result in significant variations in royalties received

by Mesabi Trust (and in turn, the resulting funds available for

distribution to Unitholders by Mesabi Trust) from quarter to

quarter and from year to year. These variations, which can be

positive or negative, cannot be predicted by the Trustees of Mesabi

Trust. Royalty payments anticipated to be received during the

current year will continue to reflect pricing estimates for

shipments of iron ore products that will be subject to positive or

negative pricing adjustments pursuant to the Cliffs Pellet

Agreements. Based on the above factors, and as indicated by Mesabi

Trust’s historical distribution payments, the royalties received by

Mesabi Trust, and the distributions paid to Unitholders, if any, in

any particular quarter are not necessarily indicative of royalties

that will be received, or distributions that will be paid, if any,

in any subsequent quarter or full year.

With respect to calendar year 2022, Northshore has not advised

Mesabi Trust of its expected shipments of iron ore products, or

what percentage of 2022 shipments will be from Mesabi Trust iron

ore. In the Cliffs’ Royalty Report, Cliffs stated that the royalty

payments being reported today were based on estimated iron ore

pellet prices under the Cliffs Pellet Agreements, which are subject

to change. It is possible that future negative price adjustments

could offset, or even eliminate, royalties or royalty income that

would otherwise be payable to Mesabi Trust in any particular

quarter, or at year end, thereby potentially reducing cash

available for distribution to Mesabi Trust’s Unitholders in future

quarters.

Commencement of Idling at Northshore

Mining Company

As previously projected by Cliffs, on May 1, 2022 Cliffs

commenced the idling of Northshore Mining Company at its operations

in Babbitt and Silver Bay, Minnesota. Cliffs’ previous disclosures

announced the idling would be for approximately four months, until

at least fall 2022, and maybe beyond.

References in this Press

Release

All references in this discussion and in this Press Release to

iron ore products “shipped” shall include iron ore products that

are actually shipped from Silver Bay, Minnesota and/or “deemed

shipped” as referenced by the parties to, and in accordance with,

the Amended Assignment of Peters Lease. Similarly, all references

in this Press Release to “shipments” shall include actual shipments

and/or deemed shipments of iron ore products, as referenced by the

parties to, and in accordance with, the Amended Assignment of

Peters Lease. After the outcome of the AAA arbitration (announced

in October 8, 2021) and consistent with Cliffs’ practices, the

Trust is entitled to payment upon production of pellets to be sold

for internal use by facilities owned by Cliffs or its subsidiaries.

As a result, the Trust recognizes revenue for Cliffs’ internal use

pellets upon production of those pellets, which are deemed to be

shipped under the Amended Assignment of Peters Lease, regardless of

pellet grade. Pellets that are not designated for internal use by

Cliffs, or its subsidiaries, continue to be recognized as revenue

upon shipment from Silver Bay, Minnesota.

Other Available Information

Mesabi Trust’s Annual Report on Form 10‑K for the fiscal year

ended January 31, 2022, which includes the audited financial

statements of Mesabi Trust, was filed with the Securities and

Exchange Commission on April 27, 2022. Mesabi Trust Unitholders may

obtain a hard copy of the complete audited financial statements,

which is included as Exhibit 13 to Mesabi Trust’s Annual Report,

free of charge upon request to Mesabi Trust’s Corporate Trustee,

at:

Mesabi Trust c/o Deutsche Bank Trust Company

Americas, Corporate Trustee Trust and Agency Services — GDS 1

Columbus Circle, 17th Floor New York, NY 10019 (904) 271-2520

Unitholders can also directly access the audited financial

statements of Mesabi Trust by navigating to Mesabi Trust’s website

at www.Mesabi-Trust.com and clicking on the Edgar Filings (SEC)

link under the Menu to the right of the SEC Filings page by

scrolling down to the desired Annual Report on Form 10‑K under

Exhibit 13 thereof, beginning on page F‑1 of each such Report.

Forward-Looking

Statements

This report contains certain forward-looking statements with

respect to iron ore pellet production, iron ore pricing and

adjustments to pricing, shipments by Northshore in 2021 and 2022,

royalty (including bonus royalty) amounts, and other matters, which

statements are intended to be made under the safe harbor

protections of the Private Securities Litigation Reform Act of

1995, as amended. Actual production, prices, price adjustments, and

shipments of iron ore pellets, as well as actual royalty payments

(including bonus royalties), and the timing and duration of Cliffs’

idling of Northshore Mining Company at its operations in Babbitt

and Silver Bay, Minnesota, could differ materially from current

expectations due to inherent risks and uncertainties such as

general adverse business and industry economic trends,

uncertainties arising from war, terrorist events, the impact of the

recent coronavirus (COVID-19) pandemic and other global events,

higher or lower customer demand for steel and iron ore, decisions

by mine operators regarding curtailments or idling production lines

or entire plants, environmental compliance uncertainties,

difficulties in obtaining and renewing necessary operating permits,

higher imports of steel and iron ore substitutes, processing

difficulties, consolidation and restructuring in the domestic steel

market, market inputs tied to indexed price adjustment factors

found in Cliffs Pellet Agreements resulting in future adjustments

to royalties payable to Mesabi Trust and other factors. Further,

substantial portions of royalties earned by Mesabi Trust are based

on estimated prices that are subject to interim and final

adjustments, which can be positive or negative, and are dependent

in part on multiple price and inflation index factors under

agreements to which Mesabi Trust is not a party and that are not

known until after the end of a contract year. In addition, the

Trust is unable to predict the duration of the current idling of

Northshore, or the frequency and duration of future Northshore

idling actions that Cliffs may implement. Future production

curtailments or idling of Northshore operations, about which the

Trust may have little or no prior notice, could materially

adversely affect the royalty income of the Trust, as well as the

resulting cash available for distribution by the Trust to

Unitholders. Further, such developments could have a material

adverse impact on the market price of the Trust’s Units. Although

the Mesabi Trustees believe that any such forward-looking

statements are based on reasonable assumptions, such statements are

subject to risks and uncertainties, which could cause actual

results to differ materially. Additional information concerning

these and other risks and uncertainties is contained in Mesabi

Trust’s filings with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the fiscal year ended

January 31, 2022 (filed April 27, 2022). Mesabi Trust undertakes no

obligation to publicly update or revise any of the forward-looking

statements made herein to reflect events or circumstances after the

date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220503006211/en/

Mesabi Trust SHR Unit Deutsche Bank Trust Company Americas

904-271-2520

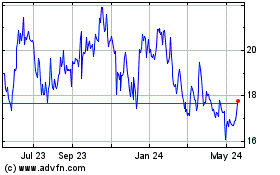

Mesabi (NYSE:MSB)

Historical Stock Chart

From Dec 2024 to Jan 2025

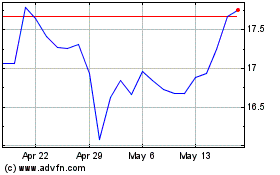

Mesabi (NYSE:MSB)

Historical Stock Chart

From Jan 2024 to Jan 2025