Mesabi Trust Press Release

18 October 2024 - 7:05AM

Business Wire

Announcement of Mesabi Trust Distribution

The Trustees of Mesabi Trust (NYSE:MSB) declared a distribution

of thirty-nine cents ($0.39) per Unit of Beneficial Interest

payable on November 20, 2024 to Mesabi Trust Unitholders of record

at the close of business on October 30, 2024. This compares to a

thirty-five cents ($0.35) per Unit distribution declared for the

same period last year.

The Trustees’ announcement today of a thirty-nine cents ($0.39)

per Unit distribution, as compared to the thirty-five cents ($0.35)

per Unit distribution announced by the Trust at the same time last

year, reflects several points. The Trust’s receipt of total royalty

payments of $5,325,522 on July 30, 2024 from Cleveland-Cliffs Inc.

(“Cliffs”), the parent company of Northshore Mining Company

(“Northshore”), was slightly higher than the total royalty payments

of $5,321,510 received by the Trust from Cliffs in July 2023. The

Trustees also determined that a portion of the unallocated reserve

could be used for this distribution.

As previously reported, the arbitration initiated by the Trust

in October 2022 concluded in June 2024. Pursuant to the AAA

tribunal’s final award dated September 6, 2024, Northshore and

Cliffs paid Mesabi Trust $71,185,029 on October 4, 2024. This

payment satisfied the AAA panel’s unanimous award of damages

(including pre-award interest) for underpayment of royalties due to

the Trust in 2020, 2021 and the first four months of 2022. The

distribution announced today also reflects the Trustees’

determination to hold these funds in reserve pending the expiration

of procedural deadlines related to the arbitration, and an

assessment of all other facts and contingencies. In the interim,

the Trustees have invested the funds in appropriate

interest-bearing accounts.

The Trustees have received no specific updates on Cliffs’ plans

for the current year concerning Northshore iron ore operations. The

Trustees’ distribution announcement today also takes into account

numerous other factors, including uncertainties resulting from

Cliffs’ prior announcements to increase the use of scrap iron in

its vertical supply chain planning, the potential volatility in the

iron ore and steel industries generally, national and global

economic uncertainties, and further potential disturbances from

global unrest.

Quarterly royalty payments from Cliffs and Northshore for iron

ore production and shipments during the third calendar quarter,

which are payable to Mesabi Trust under the royalty agreement, are

due October 30, 2024, together with the quarterly royalty report.

After receiving the quarterly royalty report, Mesabi Trust plans to

file a summary of the quarterly royalty report with the Securities

and Exchange Commission in a Current Report on Form 8-K.

Forward-Looking Statements

This press release contains certain forward-looking statements

with respect to Northshore operations in 2024 and other matters,

which statements are intended to be made under the safe harbor

protections of the Private Securities Litigation Reform Act of

1995, as amended. Cliffs’ actual utilization of the Northshore

operations could differ materially from current expectations due to

inherent risks and uncertainties such as general adverse business

and industry economic trends, uncertainties arising from war,

terrorist events, recession, potential future impacts of the

coronavirus (COVID-19) pandemic and other global events, higher or

lower customer demand for steel and iron ore, decisions by mine

operators regarding curtailments or idling of production lines or

entire plants, announcements and implementation of trade tariffs,

environmental compliance uncertainties, difficulties in obtaining

and renewing necessary operating permits, higher imports of steel

and iron ore substitutes, processing difficulties, consolidation

and restructuring in the domestic steel market, and other factors.

Although the Mesabi Trustees believe that any such forward-looking

statements are based on reasonable assumptions, such statements are

subject to risks and uncertainties, which could cause actual

results to differ materially. Additional information concerning

these and other risks and uncertainties is contained in the Trust’s

filings with the Securities and Exchange Commission, including its

Annual Report on Form 10-K for the fiscal year ended January 31,

2024, and its Quarterly Report on Form 10-Q for the quarter ended

July 31, 2024. Mesabi Trust undertakes no obligation to publicly

update or revise any of the forward-looking statements made herein

to reflect events or circumstances after the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241017799427/en/

Mesabi Trust SHR Unit Deutsche Bank Trust Company Americas

904-271-2520

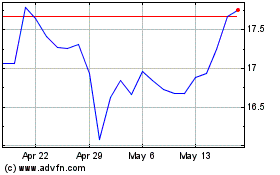

Mesabi (NYSE:MSB)

Historical Stock Chart

From Jan 2025 to Feb 2025

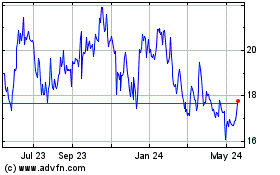

Mesabi (NYSE:MSB)

Historical Stock Chart

From Feb 2024 to Feb 2025