Filed pursuant

to Rule 424(b)(3)

Registration Statement No. 333-276216

Prospectus Supplement No. 5

(To Prospectus Dated April 17, 2024)

Metals Acquisition

Limited

64,478,325

ORDINARY SHARES

6,535,304 PRIVATE WARRANTS

This prospectus

supplement is being filed to update and supplement the information contained in the prospectus dated April 17, 2024 (as supplemented

to date, the “Prospectus”), related to (i) the issuance by us of 8,838,260 ordinary shares, par value $0.0001 per share (the

“Ordinary Shares”) issuable upon the exercise of 8,838,260 outstanding Public Warrants; and (ii) the offer and resale, from

time to time, by the selling securityholders named herein (the “Selling Securityholders”), or their pledgees, donees, transferees,

or other successors in interest, of up to an aggregate of 55,640,065 Ordinary Shares and 6,535,304 Private Warrants issued to certain

Selling Securityholders in connection with the Business Combination, with the information contained herein. Capitalized terms used in

this prospectus supplement and not otherwise defined herein have the meanings specified in the Prospectus.

This prospectus

supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized

except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read

in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement,

you should rely on the information in this prospectus supplement.

Our Ordinary Shares

are listed on NYSE under the trading symbol “MTAL.” On July 17, 2024, the closing price for our Ordinary Shares on NYSE was

$13.73 per share. Our Public Warrants were traded on NYSE under the symbol “MTAL.WS.” However, the Public Warrants ceased

trading on NYSE and were delisted following their redemption on June 5, 2024.

We may amend or

supplement this prospectus from time to time by filing amendments or supplements as required. You should read this entire prospectus

and any amendments or supplements carefully before you make your investment decision.

We are an “emerging

growth company” and a “foreign private issuer” as those terms are defined under the U.S. federal securities laws and,

as such, are subject to certain reduced public company disclosure and reporting requirements. See “Prospectus Summary—Emerging

Growth Company” and “Prospectus Summary—Foreign Private Issuer.”

Investing in

our securities involves a high degree of risk. See “Risk Factors” beginning on page 8 of the Prospectus

for a discussion of information that should be considered in connection with an investment in our securities.

Neither the U.S.

Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this

prospectus supplement or the Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this

prospectus supplement is July 18, 2024.

Change in Registrant’s

Certifying Accountant

| (a) | Resignation

of Independent Registered Public Accounting Firm |

Metals Acquisition

Limited (the “Company”) has replaced Ernst & Young LLP (Canada) (“EY Canada”) with Ernst & Young LLP

(Australia) (“EY Australia”) as its independent registered public accounting firm. As described below, the change in independent

registered public accounting firms is not the result of any disagreement with EY Canada.

On July 16, 2024,

the Audit and Risk Committee of the Board of Directors of the Company (the “Audit and Risk Committee”) approved the dismissal

of EY Canada as the Company’s independent registered public accounting firm and appointed EY Australia.

The reports of EY

Canada on the Company’s consolidated financial statements as of December 31, 2023, December 31, 2022 and January 1, 2022 and for

the fiscal years ended December 31, 2022 and 2023 did not contain any adverse opinion or disclaimer of opinion, nor were they qualified

or modified as to uncertainty, audit scope or accounting principles.

During the fiscal

years ended December 31, 2022 and 2023 and the subsequent interim period through July 16, 2024, there have been no (i) disagreements

with EY Canada on any matter of accounting principles or practices, financial statement disclosure, or audit scope or procedure, which

disagreements, if not resolved to the satisfaction of EY Canada, would have caused them to make reference thereto in their reports on

the consolidated financial statements for such years, or (ii) reportable events as defined in Item 16F(a)(1)(v) of Form 20-F, except

that, in connection with the preparation of the Company’s financial statements included in its Annual Report on Form 20-F for the

fiscal year ended December 31, 2023 (the “2023 Annual Report), EY and management identified material weaknesses in the Company’s

internal control over financial reporting, as described in the 2023 Annual Report.

The Company provided

EY Canada with a copy of the disclosures hereunder and required under Item 16F of Form 20-F and requested from EY Canada a letter addressed

to the Securities and Exchange Commission indicating whether it agrees with such disclosures. A copy of EY Canada’s letter dated

July 18, 2024 is below.

| (b) | New

Independent Registered Public Accounting Firm |

On July 16, 2024,

the Audit and Risk Committee engaged EY Australia as the Company’s independent registered public accounting firm and auditor to

act as the principal accountant to audit the Company’s financial statements for the 2024 fiscal year. During the Company’s

fiscal years ended December 31, 2022 and 2023, and through July 16, 2024, neither the Company, nor anyone acting on its behalf, consulted

with EY Australia regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or

the type of audit opinion that might be rendered on the Company’s financial statements, and no written report or oral advice was

provided that EY Australia concluded was an important factor considered by the Company in reaching a decision as to any such accounting,

auditing or financial reporting issue, or (ii) any matter that was the subject of a disagreement (as defined in Item 16F(a)(1)(iv) of

Form 20-F and the related instructions) or a reportable event (as described in Item 16F(a)(1)(v) of Form 20-F).

***

Copy of Letter

from Ernst & Young LLP (Canada), dated July 18, 2024

18 July 2024

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Commissioners:

We have read the

statements under the caption “Change in Registrant’s Certifying Accountant” of the current report on Form 6-K dated

18 July 2024, of Metals Acquisition Limited and are in agreement with the statements contained therein. We have no basis to agree or disagree

with other statements of the registrant contained therein.

Chartered Accountants

Licensed Public Accountants

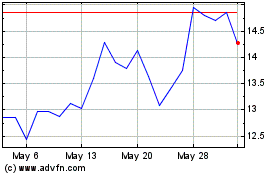

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Dec 2024 to Jan 2025

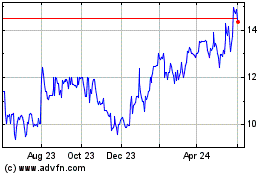

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Jan 2024 to Jan 2025