Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 January 2025 - 2:32AM

Edgar (US Regulatory)

Portfolio

of

Investments

November

30,

2024

NAZ

(Unaudited)

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

LONG-TERM

INVESTMENTS

-

158.2% (100.0%

of

Total

Investments)

X

230,631,525

MUNICIPAL

BONDS

-

158.2% (100.0%

of

Total

Investments)

X

–

EDUCATION

AND

CIVIC

ORGANIZATIONS

-

33.4%

(21.1%

of

Total

Investments)

$

2,175,000

Arizona

Board

of

Regents,

Arizona

State

University

System

Revenue

Bonds,

Green

Series

2016B

5

.000

%

07/01/47

$

2,215,960

2,000,000

Arizona

Board

of

Regents,

Arizona

State

University

System

Revenue

Bonds,

Green

Series

2024A

5

.000

07/01/54

2,191,183

1,500,000

Arizona

Board

of

Regents,

Arizona

State

University

System

Revenue

Bonds,

Refunding

Green

Series

2015A

5

.000

07/01/41

1,510,896

1,500,000

Arizona

Board

of

Regents,

Arizona

State

University

System

Revenue

Bonds,

Series

2015D

5

.000

07/01/41

1,510,896

2,030,000

Arizona

Board

of

Regents,

Arizona

State

University

System

Revenue

Bonds,

Series

2020B

4

.000

07/01/47

2,043,484

2,515,000

Arizona

Board

of

Regents,

Univeristy

of

Arizona,

Speed

Revenue

Bonds,

Stimulus

Plan

for

Economic

and

Educational

Development,

Series

2014

5

.000

08/01/44

2,521,235

1,000,000

Arizona

Board

of

Regents,

University

of

Arizona,

System

Revenue

Bonds,

Refunding

Series

2021A

5

.000

06/01/42

1,093,408

515,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2017A

5

.125

07/01/37

521,312

525,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2017C

5

.000

07/01/47

533,312

250,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2017D

5

.000

07/01/47

251,047

1,700,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2017F

5

.000

07/01/37

1,746,015

1,000,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2017F

5

.000

07/01/52

1,013,041

380,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2017G

5

.000

07/01/47

381,591

240,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Montessori

Academy

Projects,

Refunding

Series

2017A

6

.250

11/01/50

227,630

420,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Somerset

Academy

of

Las

Vegas

Aliante

and

Skye

Canyon

Campus

Projects,

Series

2021A

4

.000

12/15/41

385,789

375,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds, Arizona

Agribusiness

and

Equine

Center,

Inc.

Project,

Series

2017B

5

.000

03/01/48

369,396

145,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2017B

4

.250

07/01/27

145,623

615,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2018A

5

.000

07/01/38

630,164

1,000,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Academies

of

Math

&

Science

Projects,

Series

2018A

5

.000

07/01/48

1,010,570

125,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

GreatHearts

Arizona

Projects,

Series

2021A

5

.000

07/01/28

131,526

125,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

GreatHearts

Arizona

Projects,

Series

2021A

5

.000

07/01/29

132,950

130,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

GreatHearts

Arizona

Projects,

Series

2021A

5

.000

07/01/30

139,531

125,000

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

GreatHearts

Arizona

Projects,

Series

2021A

5

.000

07/01/31

135,088

455,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Pinecrest

Academy

of

Nevada

Horizon,

Inspirada

and

St.

Rose

Campus

Projects,

Series

2018A

5

.750

07/15/38

465,190

1,000,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Pinecrest

Academy

of

Nevada

Sloan

Canyon

Campus

Project,

Series

2020A-2

6

.000

09/15/38

1,040,694

Portfolio

of

Investments

November

30,

2024

(continued)

NAZ

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

EDUCATION

AND

CIVIC

ORGANIZATIONS

(continued)

$

120,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Social

Bonds

Pensar

Academy

Project,

Series

2020

4

.000

%

07/01/30

$

116,373

1,645,000

Arizona

Industrial

Development

Authority,

Arizona,

Lease

Revenue

Bonds,

University

of

Indianapolis

-

Health

Pavilion

Project,

Series

2019A

4

.000

10/01/39

1,503,192

1,080,000

Arizona

Industrial

Development

Authority,

Arizona,

Lease

Revenue

Bonds,

University

of

Indianapolis

-

Health

Pavilion

Project,

Series

2019A

4

.000

10/01/49

905,037

1,500,000

(a)

Arizona

Industrial

Development

Authority,

Education

Facility

Revenue

Bonds,

Caurus

Academy

Project,

Series

2018A

6

.375

06/01/39

1,569,340

360,000

Industrial

Development

Authority,

Pima

County,

Arizona,

Education

Revenue

Bonds,

Center

for

Academic

Success

Project,

Refunding

Series

2019

4

.000

07/01/31

357,919

340,000

Industrial

Development

Authority,

Pima

County,

Arizona,

Education

Revenue

Bonds,

Center

for

Academic

Success

Project,

Refunding

Series

2019

4

.000

07/01/33

335,249

780,000

(a)

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Arizona

Autism

Charter

Schools

Project,

Series

2020A

5

.000

07/01/50

780,916

195,000

(a)

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Arizona

Autism

Charter

Schools

Project,

Social

Series

2021A

4

.000

07/01/51

163,713

355,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Great

Hearts

Academies

Projects,

Series

2017A

5

.000

07/01/37

363,820

490,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Great

Hearts

Academies

Projects,

Series

2017C

5

.000

07/01/48

496,644

1,715,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Highland

Prep

Project,

Series

2019

5

.000

01/01/50

1,751,718

700,000

(a)

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Legacy

Traditional

Schools

Projects,

Series

2021A

4

.000

07/01/41

663,728

335,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Legacy

Traditional

Schools

Projects,

Series

2024

4

.250

07/01/44

320,338

870,000

(a)

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Paradise

Schools

Projects,

Series

2016

5

.000

07/01/47

873,105

520,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Reid

Traditional

School

Projects,

Series

2016

5

.000

07/01/36

525,454

300,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Reid

Traditional

School

Projects,

Series

2016

5

.000

07/01/47

301,012

2,000,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Educational

Facilities

Revenue

Bonds,

Creighton

University

Projects,

Series

2020

4

.000

07/01/50

1,953,095

775,000

McAllister

Academic

Village

LLC,

Arizona,

Revenue

Bonds,

Arizona

State

University

Hassayampa

Academic

Village

Project,

Refunding

Series

2016

5

.000

07/01/37

791,310

1,000,000

McAllister

Academic

Village

LLC,

Arizona,

Revenue

Bonds,

Arizona

State

University

Hassayampa

Academic

Village

Project,

Refunding

Series

2016

5

.000

07/01/38

1,019,472

1,000,000

Northern

Arizona

University,

System

Revenue

Bonds,

Refunding

Series

2020B

-

BAM

Insured

5

.000

06/01/39

1,078,867

70,000

(a)

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Basis

Schools,

Inc.

Projects,

Series

2016A

5

.000

07/01/46

70,074

800,000

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Great

Hearts

Academies

Project,

Series

2016A

5

.000

07/01/41

802,306

315,000

(a)

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Legacy

Traditional

Schools

Projects,

Series

2015

5

.000

07/01/35

316,610

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

EDUCATION

AND

CIVIC

ORGANIZATIONS

(continued)

$

300,000

(a)

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Legacy

Traditional

Schools

Projects,

Series

2015

5

.000

%

07/01/45

$

300,616

650,000

(a)

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Legacy

Traditional

Schools

Projects,

Series

2016A

5

.000

07/01/41

655,426

1,110,000

(a)

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Northwest

Christian

School

Project,

Series

2020A

5

.000

09/01/45

1,031,360

55,000

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Villa

Montessori,

Inc.

Projects,

Series

2015

3

.250

07/01/25

54,547

400,000

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Villa

Montessori,

Inc.

Projects,

Series

2015

5

.000

07/01/35

401,656

900,000

Phoenix

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Vista

College

Preparatory

Project,

Series

2018A

4

.125

07/01/38

884,080

1,995,000

Phoenix

Industrial

Development

Authority,

Arizona,

Lease

Revenue

Bonds,

Eastern

Kentucky

University

Project,

Series

2016

5

.000

10/01/36

2,043,691

500,000

Pima

County

Community

College

District,

Arizona,

Revenue

Bonds,

Series

2019

5

.000

07/01/36

532,228

120,000

(a)

Pima

County

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Champion

Schools

Project,

Series

2017

6

.000

06/15/37

121,516

680,000

(a)

Pima

County

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Champion

Schools

Project,

Series

2017

6

.125

06/15/47

681,945

200,000

Pima

County

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Edkey

Charter

Schools

Project,

Series

2016

5

.250

07/01/36

201,581

115,000

(a)

Pima

County

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

San

Tan

Montessori

School

Project,

Series

2017

6

.750

02/01/50

118,976

500,000

(a)

Pima

County

Industrial

Development

Authority,

Arizona,

Education

Revenue

Bonds,

Noah

Webster

Schools

Mesa

Project,

Series

2015A

5

.000

12/15/34

500,094

730,000

Pinal

County

Community

College

District,

Arizona,

Revenue

Bonds,

Central

Arizona

College,

Series

2017

-

BAM

Insured

5

.000

07/01/35

750,537

1,000,000

(a)

Sierra

Vista

Industrial

Development

Authority,

Arizona,

Education

Facility

Revenue

Bonds,

Desert

Heights

Charter

School

Project,

Refunding

Series

2024

6

.125

06/01/57

1,010,533

TOTAL

EDUCATION

AND

CIVIC

ORGANIZATIONS

48,695,609

HEALTH

CARE

-

17.5%

(11.0%

of

Total

Investments)

890,000

Arizona

Industrial

Development

Authority,

Arizona,

Lease

Revenue

Bonds,

Children's

National

Prince

County

Regional

Medical

Center,

Series

2020A

4

.000

09/01/38

901,653

4,975,000

Arizona

Industrial

Development

Authority,

Hospital

Revenue

Bonds,

Phoenix

Children's

Hospital,

Series

2020A

4

.000

02/01/50

4,915,504

500,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Honor

Health,

Series

2024D

5

.000

12/01/44

550,346

500,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Honor

Health,

Series

2024D

5

.000

12/01/45

548,680

1,250,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

HonorHealth,

Series

2019A

5

.000

09/01/42

1,305,666

3,275,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

HonorHealth,

Series

2021A

4

.000

09/01/51

3,175,951

1,250,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Banner

Health,

Refunding

Series

2016A

5

.000

01/01/32

1,295,534

1,000,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Banner

Health,

Refunding

Series

2016A

5

.000

01/01/35

1,034,759

2,000,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Banner

Health,

Refunding

Series

2016A

5

.000

01/01/38

2,059,905

2,000,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Banner

Health,

Series

2017A

5

.000

01/01/41

2,077,955

Portfolio

of

Investments

November

30,

2024

(continued)

NAZ

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

HEALTH

CARE

(continued)

$

2,000,000

Maricopa

County

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Banner

Health,

Series

2019A

4

.000

%

01/01/44

$

2,003,872

2,250,000

Pima

County

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Tucson

Medical

Center,

Series

2021A

3

.000

04/01/51

1,679,620

1,025,000

Yavapai

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Yavapai

Regional

Medical

Center,

Refunding

Series

2016

5

.000

08/01/36

1,045,908

815,000

Yavapai

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Yavapai

Regional

Medical

Center,

Series

2019

5

.000

08/01/39

852,042

650,000

Yavapai

County

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Yavapai

Regional

Medical

Center,

Series

2019

4

.000

08/01/43

640,507

775,000

Yuma

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Yuma

Regional

Medical

Center,

Series

2024A

5

.250

08/01/49

853,572

500,000

Yuma

Industrial

Development

Authority,

Arizona,

Hospital

Revenue

Bonds,

Yuma

Regional

Medical

Center,

Series

2024A

4

.000

08/01/54

499,457

TOTAL

HEALTH

CARE

25,440,931

HOUSING/MULTIFAMILY

-

1.8%

(1.1%

of

Total

Investments)

1,830,000

Arizona

Industrial

Development

Authority,

Student

Housing

Revenue

Bonds,

Provident

Group

-

NCCU

Properties

LLC-

North

Carolina

Central

University,

Series

2019A

-

BAM

Insured

5

.000

06/01/49

1,914,154

250,000

(b)

Sierra

Vista

Industrial

Development

Authority,

Arizona,

Economic

Development

Revenue

Bonds,

Convertible

Capital

Appreciation

Revenue

Bonds,

Series

2021A

0

.000

10/01/56

209,532

500,000

Sierra

Vista

Industrial

Development

Authority,

Arizona,

Economic

Development

Revenue

Bonds,

Convertible

Capital

Appreciation

Revenue

Bonds,

Series

2022A

7

.000

10/01/56

495,352

TOTAL

HOUSING/MULTIFAMILY

2,619,038

HOUSING/SINGLE

FAMILY

-

3.9%

(2.5%

of

Total

Investments)

1,855,000

Maricopa

County

and

Phoenix

City

Industrial

Development

Authority,

Arizona,

Single

Family

Mortgage

Revenue

Bonds,

Series

2024C

4

.850

09/01/54

1,901,784

1,000,000

Phoenix

and

Maricopa

County

Industrial

Development

Authority,

Arizona,

Single

Family

Mortgage

Revenue

Bonds,

Series

2023A

5

.450

09/01/48

1,056,903

825,000

Phoenix

and

Maricopa

County

Industrial

Development

Authority,

Arizona,

Single

Family

Mortgage

Revenue

Bonds,

Series

2024A

4

.650

09/01/54

843,842

735,000

Tucson

and

Pima

County

Industrial

Development

Authority,

Arizona,

Joint

Single

Family

Mortgage

Revenue

Bonds,

Series

2023A

4

.850

07/01/48

761,234

1,130,000

Tucson

and

Pima

County

Industrial

Development

Authority,

Arizona,

Joint

Single

Family

Mortgage

Revenue

Bonds,

Series

2024A

4

.800

07/01/54

1,155,495

TOTAL

HOUSING/SINGLE

FAMILY

5,719,258

INFORMATION

TECHNOLOGY

-

0.3%

(0.2%

of

Total

Investments)

410,000

Chandler

Industrial

Development

Authority,

Arizona,

Industrial

Development

Revenue

Bonds,

Intel

Corporation

Project,

Series

2007,

(AMT),

(Mandatory

Put

6/15/28)

4

.100

12/01/37

412,816

TOTAL

INFORMATION

TECHNOLOGY

412,816

LONG-TERM

CARE

-

3.5%

(2.2%

of

Total

Investments)

585,000

Arizona

Industrial

Development

Authority,

Multifamily

Housing

Revenue

Bonds,

Bridgewater

Avondale

Project,

Series

2017

5

.375

01/01/38

485,469

1,000,000

Glendale

Industrial

Development

Authority,

Arizona,

Senior

Living

Revenue

Bonds,

Royal

Oaks

Royal

Oaks

-

Inspirata

Pointe

Project,

Series

2020A

5

.000

05/15/41

1,008,306

1,760,000

Phoenix

Industrial

Development

Authority,

Arizona,

Multi-Family

Housing

Revenue

Bonds,

3rd

and

Indian

Road

Assisted

Living

Project,

Series

2016

5

.400

10/01/36

1,472,028

1,435,000

Tempe

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Friendship

Village

of

Tempe

Project,

Refunding

Series

2021A

4

.000

12/01/38

1,369,699

1,080,000

(a)

Tempe

Industrial

Development

Authority,

Arizona,

Revenue

Bonds,

Mirabella

at

ASU

Project,

Series

2017A

6

.125

10/01/47

717,208

TOTAL

LONG-TERM

CARE

5,052,710

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TAX

OBLIGATION/GENERAL

-

20.9%

(13.2%

of

Total

Investments)

$

575,000

Buckeye

Union

High

School

District

201,

Maricopa

County,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project,

Refunding

Series

2017

-

BAM

Insured

5

.000

%

07/01/35

$

602,510

1,000,000

Glendale,

Arizona,

General

Obligation

Bonds,

Series

2024

5

.000

07/01/43

1,119,449

2,105,000

Golder

Ranch

Fire

District,

Pima

and

Pinal

Counties,

Arizona,

General

Obligation

Bonds,

Series

2021

4

.000

07/01/45

2,114,091

1,045,000

Maricopa

County

School

District

14

Creighton

Elementary,

Arizona,

General

Obligation

Bonds,

School

Improvement

Series

2021C

4

.000

07/01/34

1,099,543

2,315,000

Maricopa

County

School

District

214

Tolleson

Union

High,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project

1990,

Series

1990A

5

.000

07/01/38

2,462,276

630,000

Maricopa

County

School

District

214

Tolleson

Union

High,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project

2017,

Series

2018A

5

.000

07/01/37

657,497

1,250,000

Maricopa

County

School

District

66

Roosevelt

Elementary,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project

of

2020,

Series

2024C

-

AGM

Insured

5

.000

07/01/43

1,366,578

1,500,000

Maricopa

County

Special

Health

Care

District,

Arizona,

General

Obligation

Bonds,

Series

2018C

5

.000

07/01/36

1,582,609

1,350,000

Maricopa

County

Unified

School

District

95

Queen

Creek,

Arizona,

General

Obligation

Bonds,

School

Improvement

Series

2018

5

.000

07/01/36

1,389,559

1,275,000

Maricopa

County

Union

High

School

District

210

Phoenix,

Arizona,

General

Obligation

Bonds,

School

Improvement

&

Project

of

2011

Series

2017E

5

.000

07/01/33

1,338,914

1,295,000

Maricopa

County

Union

High

School

District

216

Agua

Fria,

Arizona,

General

Obligation

Bonds,

School

Improvement,

Project

of

2023,

Series

2024A

5

.000

07/01/43

1,440,916

1,000,000

Mohave

County

Union

High

School

District

2

Colorado

River,

Arizona,

General

Obligation

Bonds,

School

Improvement

Series

2017

5

.000

07/01/34

1,049,829

1,000,000

Mohave

County

Union

High

School

District

2

Colorado

River,

Arizona,

General

Obligation

Bonds,

School

Improvement

Series

2017

5

.000

07/01/36

1,048,305

690,000

Northwest

Fire

District

of

Pima

County,

Arizona,

General

Obligation

Bonds,

Series

2017

5

.000

07/01/36

722,487

2,000,000

Paradise

Valley

Unified

School

District

No.

69,

Maricopa

County,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project

of

2019,

Series

2022D

4

.000

07/01/41

2,033,231

1,150,000

Phoenix,

Arizona,

General

Obligation

Bonds,

Various

Purpose

Series

2024A

5

.000

07/01/46

1,275,947

200,000

Pima

County

Unified

School

District

1,

Tucson,

Arizona,

General

Obligation

Bonds,

Project

of

2023

School

Improvement

Series

2024A

-

AGM

Insured

5

.000

07/01/43

220,972

2,895,000

Pima

County

Unified

School

District

12

Sunnyside,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project

2011,

Series

2014D

-

AGM

Insured

5

.000

07/01/34

2,897,917

620,000

Pinal

County

School

District

4

Casa

Grande

Elementary,

Arizona,

General

Obligation

Bonds,

School

improvement

Project

2016,

Series

2017A

-

BAM

Insured

5

.000

07/01/34

648,877

1,000,000

Pinal

County

School

District

4

Casa

Grande

Elementary,

Arizona,

General

Obligation

Bonds,

School

improvement

Project

2016,

Series

2017A

-

BAM

Insured

5

.000

07/01/35

1,045,563

2,000,000

Puerto

Rico,

General

Obligation

Bonds,

Restructured

Series

2022A-1

4

.000

07/01/46

1,907,654

1,025,000

Tempe,

Arizona,

General

Obligation

Bonds,

Refunding

Series

2024

5

.000

07/01/44

1,148,233

950,000

Tempe,

Arizona,

General

Obligation

Bonds,

Series

2021

5

.000

07/01/39

1,051,401

295,000

Western

Maricopa

Education

Center

District

402,

Maricopa

County,

Arizona,

General

Obligation

Bonds,

School

Improvement

Project

2012,

Series2014B

4

.500

07/01/33

295,119

TOTAL

TAX

OBLIGATION/GENERAL

30,519,477

Portfolio

of

Investments

November

30,

2024

(continued)

NAZ

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TAX

OBLIGATION/LIMITED

-

37.8%

(23.9%

of

Total

Investments)

$

100,000

(a)

Arizona

Industrial

Development

Authority,

Arizona,

Economic

Development

Revenue

Bonds,

Linder

Village

Project

in

Meridian,

Ada

County,

Idaho,

Series

2020

5

.000

%

06/01/31

$

101,962

1,250,000

Arizona

State

Transportation

Board,

Highway

Revenue

Bonds,

Refunding

Series

2016

5

.000

07/01/35

1,284,192

275,000

Buckeye,

Arizona,

Excise

Tax

Revenue

Obligations,

Refunding

Series

2016

4

.000

07/01/36

278,486

1,000,000

Buckeye,

Arizona,

Excise

Tax

Revenue

Obligations,

Series

2015

5

.000

07/01/37

1,008,068

1,215,000

Cadence

Community

Facilities

District,

Mesa,

Arizona,

Special

Assessment

Revenue

Bonds,

Assessment

District

3,

Series

2020

4

.000

07/01/45

1,104,408

122,853

(a),(c)

Cahava

Springs

Revitalization

District,

Cave

Creek,

Arizona,

Special

Assessment

Bonds,

Series

2017A

7

.000

07/01/41

94,597

1,210,000

(a)

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

General

Obligation

Bonds,

Series

2015

5

.000

07/15/39

1,210,665

1,810,000

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

General

Obligation

Bonds,

Series

2017

-

AGM

Insured

5

.000

07/15/42

1,884,049

2,445,000

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

General

Obligation

Bonds,

Series

2018

-

BAM

Insured

4

.375

07/15/43

2,461,641

650,000

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

General

Obligation

Bonds,

Series

2021

-

BAM

Insured

4

.000

07/15/41

650,027

484,000

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

Special

Assessment

Revenue

Bonds,

Assessment

District

1,

Series

2013

5

.250

07/01/38

472,330

697,000

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

Special

Assessment

Revenue

Bonds,

Assessment

District

1,

Series

2019

5

.200

07/01/43

670,605

2,280,000

Eastmark

Community

Facilities

District

1,

Mesa,

Arizona,

Special

Assessment

Revenue

Bonds,

Assessment

District

12,

Series

2021

3

.750

07/01/45

1,828,500

1,035,000

Eastmark

Community

Facilities

District

2,

Mesa,

Arizona,

General

Obligation

Bonds,

Series

2020

3

.500

07/15/44

787,662

105,000

Estrella

Mountain

Ranch

Community

Facilities

District,

Goodyear,

Arizona,

General

Obligation

Bonds,

Refunding

Series

2017

-

AGM

Insured

5

.000

07/15/32

110,181

1,145,000

Estrella

Mountain

Ranch

Community

Facilities

District,

Goodyear,

Arizona,

Special

Assessment

Revenue

Bonds,

Lucero

Assessment

District

2,

Series

2023

5

.750

07/01/46

1,169,513

345,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2012

-

BAM

Insured

5

.000

07/15/27

345,459

500,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2016

-

BAM

Insured

4

.000

07/15/36

501,756

1,000,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2017

-

BAM

Insured

5

.000

07/15/37

1,031,069

590,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2018

-

BAM

Insured

5

.000

07/15/38

609,106

1,000,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2020

-

BAM

Insured

4

.000

07/15/40

1,001,184

2,000,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2022

-

AGM

Insured

5

.000

07/15/42

2,114,808

313,000

Festival

Ranch

Community

Facilities

District,

Buckeye,

Arizona,

Special

Assessment

Revenue

Bonds, Assessment

District

11,

Series

2017

5

.200

07/01/37

303,104

545,000

Goodyear

Community

Facilities

Utilities

District

1,

Arizona,

General

Obligation

Bonds,

Refunding

Series

2016

4

.000

07/15/32

552,983

1,500,000

Government

of

Guam,

Business

Privilege

Tax

Bonds,

Refunding

Series

2015D

5

.000

11/15/39

1,506,054

1,250,000

Guam

Government,

Limited

Obligation

Section

30

Revenue

Bonds,

Series

2016A

5

.000

12/01/46

1,256,699

615,000

Matching

Fund

Special

Purpose

Securitization

Corporation,

Virgin

Islands,

Revenue

Bonds,

Series

2022A

5

.000

10/01/39

640,435

200,000

Merrill

Ranch

Community

Facilities

District

2,

Florence,

Arizona,

General

Obligation

Bonds,

Series

2016

5

.000

07/15/31

204,596

385,000

Merrill

Ranch

Community

Facilities

District

2,

Florence,

Arizona,

General

Obligation

Bonds,

Series

2017

-

BAM

Insured

5

.000

07/15/42

396,943

400,000

Parkway

Community

Facilities

District

1,

Prescott

Valley,

Arizona,

General

Obligation

Bonds,

Series

2006

5

.350

07/15/31

333,838

1,625,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Excise

Tax

Revenue

Bonds,

Subordinate

Lien

Series

2020A

4

.000

07/01/45

1,635,595

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

TAX

OBLIGATION/LIMITED

(continued)

$

580,000

Phoenix

Mesa

Gateway

Airport

Authority,

Arizona,

Special

Facility

Revenue

Bonds,

Mesa

Project,

Series

2012,

(AMT)

5

.000

%

07/01/38

$

582,048

1,000,000

Pinal

County,

Arizona,

Pledged

Revenue

Obligations,

Series

2014

5

.000

08/01/33

1,001,211

1,500,000

Pinal

County,

Arizona,

Pledged

Revenue

Obligations,

Series

2019

4

.000

08/01/38

1,521,793

9,520,000

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Restructured

2018A-1

0

.000

07/01/46

3,225,233

2,440,000

Puerto

Rico

Sales

Tax

Financing

Corporation,

Sales

Tax

Revenue

Bonds,

Taxable

Restructured

Cofina

Project

Series

2019A-2

4

.784

07/01/58

2,445,007

390,000

Queen

Creek,

Arizona,

Excise

Tax

&

State

Shared

Revenue

Obligation

Bonds,

Refunding

Series

2016

4

.000

08/01/34

394,866

395,000

Queen

Creek,

Arizona,

Excise

Tax

&

State

Shared

Revenue

Obligation

Bonds,

Refunding

Series

2016

4

.000

08/01/36

398,950

1,740,000

Queen

Creek,

Arizona,

Excise

Tax

&

State

Shared

Revenue

Obligation

Bonds,

Series

2018A

5

.000

08/01/42

1,834,043

2,500,000

Queen

Creek,

Arizona,

Excise

Tax

&

State

Shared

Revenue

Obligation

Bonds,

Series

2020

4

.000

08/01/45

2,506,910

280,000

Sedona,

Arizona,

Excise

Tax

Revenue

Bonds,

Series

2024

-

AGM

Insured

5

.000

07/01/54

297,443

1,650,000

Sundance

Community

Facilities

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Refunding

Series

2018

-

BAM

Insured

5

.000

07/15/39

1,745,440

347,000

Superstition

Vistas

Community

Facilities

District

1,

Apache

Junction,

Arizona,

Special

Assessment

Bonds, Assessment

Area

3,

Series

2024

5

.800

07/01/48

362,461

694,000

Superstition

Vistas

Community

Facilities

District

1,

Apache

Junction,

Arizona,

Special

Assessment

Revenue

Bonds,

Series

2023

6

.000

07/01/47

734,080

750,000

Tartesso

West

Community

Facility

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2024

4

.000

07/15/47

744,812

3,000,000

Town

of

Queen

Creek,

Arizona,

Excise

Tax

and

State

Shared

Revenue

Obligation

Bonds,

Series

2022

5

.000

08/01/47

3,273,170

500,000

Verrado

District

1

Community

Faciliites

District,

Buckeye,

Arizona,

General

Obligation

Bonds,

Series

2023

-

BAM

Insured

4

.125

07/15/41

510,549

405,000

Vistancia

North

Community

Facilities

District,

Peoria,

Arizona,

General

Obligation

Bonds,

Series

2024

-

AGM

Insured

4

.375

07/15/49

408,054

175,000

(a)

Vistancia

West

Community

Facilities

District,

Peoria,

Arizona,

General

Obligation

Bonds,

Series

2016

3

.250

07/15/25

175,003

4,240,000

Yavapai

County

Jail

District,

Arizona,

Pleged

Revenue

Obligation

Bonds,

Series

2020

-

BAM

Insured

4

.000

07/01/40

4,259,049

1,160,000

Yuma

County,

Arizona,

Pledge

Revenue

Obligations,

Series

2022

-

BAM

Insured

4

.250

07/15/42

1,187,443

TOTAL

TAX

OBLIGATION/LIMITED

55,158,080

TRANSPORTATION

-

7.5%

(4.8%

of

Total

Investments)

910,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Junior

Lien

Series

2015A

5

.000

07/01/40

915,900

2,185,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Junior

Lien

Series

2015A

5

.000

07/01/45

2,196,585

2,000,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Junior

Lien

Series

2019B,

(AMT)

5

.000

07/01/49

2,068,098

1,000,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Senior

Lien

Series

2017A,

(AMT)

5

.000

07/01/37

1,027,563

1,000,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Senior

Lien

Series

2017A,

(AMT)

5

.000

07/01/42

1,020,144

1,500,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Airport

Revenue

Bonds,

Senior

Lien

Series

2018,

(AMT)

5

.000

07/01/43

1,542,470

1,045,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Rental

Car

Facility

Charge

Revenue

Bonds,

Series

2019A

5

.000

07/01/35

1,117,895

1,000,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Rental

Car

Facility

Charge

Revenue

Bonds,

Series

2019A

5

.000

07/01/38

1,063,291

TOTAL

TRANSPORTATION

10,951,946

Portfolio

of

Investments

November

30,

2024

(continued)

NAZ

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

U.S.

GUARANTEED

-

1.6%

(1.0%

of

Total

Investments)

(d)

$

550,000

Estrella

Mountain

Ranch

Community

Facilities

District,

Goodyear,

Arizona,

General

Obligation

Bonds,

Refunding

Series

2017,

(Pre-

refunded

7/15/27)

-

AGM

Insured

5

.000

%

07/15/32

$

582,185

55,000

Goodyear

Community

Facilities

Utilities

District

1,

Arizona,

General

Obligation

Bonds,

Refunding

Series

2016,

(Pre-refunded

7/15/26)

4

.000

07/15/32

56,011

150,000

Queen

Creek,

Arizona,

Excise

Tax

&

State

Shared

Revenue

Obligation

Bonds,

Refunding

Series

2016,

(Pre-refunded

8/01/26)

4

.000

08/01/34

152,745

150,000

Queen

Creek,

Arizona,

Excise

Tax

&

State

Shared

Revenue

Obligation

Bonds,

Refunding

Series

2016,

(Pre-refunded

8/01/26)

4

.000

08/01/36

152,744

1,320,000

Scottsdale

Municipal

Property

Corporation,

Arizona,

Excise

Tax

Revenue

Bonds,

Refunding

Series

2017,

(Pre-refunded

7/01/27)

5

.000

07/01/36

1,397,839

TOTAL

U.S.

GUARANTEED

2,341,524

UTILITIES

-

30.0%

(19.0%

of

Total

Investments)

30,000

Carefree

Utilities

Community

Facilities

District,

Arizona,

Water

System

Revenue

Bonds,

Series

2021

4

.000

07/01/41

30,503

650,000

Carefree

Utilities

Community

Facilities

District,

Arizona,

Water

System

Revenue

Bonds,

Series

2021

4

.000

07/01/46

653,965

655,000

Central

Arizona

Water

Conservation

District,

Arizona,

Water

Delivery

O&M

Revenue

Bonds,

Series

2016

5

.000

01/01/36

666,415

2,615,000

City

of

Mesa,

Arizona,

Utility

System

Revenue

Bonds,

Series

2022C

5

.000

07/01/36

3,088,561

1,250,000

Gilbert

Water

Resource

Municipal

Property

Corporation,

Arizona,

Utility

System

Revenue

Bonds,

Senior

Lien

Green

Series

2022

4

.000

07/15/47

1,264,768

785,000

Goodyear,

Arizona,

Water

and

Sewer

Revenue

Obligations,

Refunding

Subordinate

Lien

Series

2016

-

AGM

Insured

5

.000

07/01/45

802,086

875,000

Goodyear,

Arizona,

Water

and

Sewer

Revenue

Obligations,

Subordinate

Lien

Series

2020

-

AGM

Insured

4

.000

07/01/49

869,921

200,000

Guam

Power

Authority,

Revenue

Bonds,

Refunding

Series

2024A

5

.000

10/01/42

215,825

1,125,000

Lake

Havasu

City,

Arizona,

Wastewater

System

Revenue

Bonds,

Refunding

Senior

Lien

Series

2015A

-

AGM

Insured

5

.000

07/01/36

1,135,889

1,205,000

Mesa,

Arizona,

Utility

System

Revenue

Bonds,

Series

2022A

-

BAM

Insured

5

.000

07/01/46

1,312,084

1,840,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Wastewater

System

Revenue

Bonds,

Junior

Lien

Series

2023

5

.250

07/01/47

2,058,997

1,135,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Wastewater

System

Revenue

Bonds,

Refunding

Junior

Lien

Series

2014

5

.000

07/01/29

1,136,387

1,000,000

Phoenix

Civic

Improvement

Corporation,

Arizona,

Water

System

Revenue

Bonds,

Junior

Lien

Series

2021A

4

.000

07/01/42

1,017,029

1,000,000

(a)

Puerto

Rico

Aqueduct

and

Sewerage

Authority,

Revenue

Bonds,

Refunding

Senior

Lien

Series

2021B

5

.000

07/01/37

1,048,358

1,500,000

Salt

River

Project

Agricultural

Improvement

and

Power

District,

Arizona,

Electric

System

Revenue

Bonds,

Refunding

Series

2015A

5

.000

12/01/36

1,511,819

2,500,000

Salt

River

Project

Agricultural

Improvement

and

Power

District,

Arizona,

Electric

System

Revenue

Bonds,

Series

2023A

5

.000

01/01/47

2,754,520

3,000,000

Salt

River

Project

Agricultural

Improvement

and

Power

District,

Arizona,

Electric

System

Revenue

Bonds,

Series

2023A

5

.000

01/01/50

3,275,337

1,155,000

Salt

River

Project

Agricultural

Improvement

and

Power

District,

Arizona,

Electric

System

Revenue

Bonds,

Series

2023B

5

.000

01/01/48

1,273,948

4,000,000

Salt

River

Project

Agricultural

Improvement

and

Power

District,

Arizona,

Electric

System

Revenue

Bonds,

Series

2024A

5

.250

01/01/54

4,517,648

4,500,000

Salt

Verde

Financial

Corporation,

Arizona,

Senior

Gas

Revenue

Bonds,

Citigroup

Energy

Inc

Prepay

Contract

Obligations,

Series

2007

5

.500

12/01/29

4,891,455

5,665,000

Salt

Verde

Financial

Corporation,

Arizona,

Senior

Gas

Revenue

Bonds,

Citigroup

Energy

Inc

Prepay

Contract

Obligations,

Series

2007

5

.000

12/01/37

6,271,651

805,000

Surprise,

Arizona,

Utility System

Revenue

Bonds,

Refunding

Senior

Lien

Series

2018

5

.000

07/01/36

860,270

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

PRINCIPAL

DESCRIPTION

RATE

MATURITY

VALUE

UTILITIES

(continued)

$

3,000,000

Yuma,

Arizona,

Utilities

System

Revenue

Bonds,

Series

2021

-

BAM

Insured

4

.000

%

07/01/40

$

3,062,700

TOTAL

UTILITIES

43,720,136

TOTAL

MUNICIPAL

BONDS

(Cost

$229,579,485)

230,631,525

TOTAL

LONG-TERM

INVESTMENTS

(Cost

$229,579,485)

230,631,525

AMTP

SHARES,

NET

-

(60.5)%

(e)

(

88,265,228

)

OTHER

ASSETS

&

LIABILITIES,

NET

-

2.3%

3,409,629

NET

ASSETS

APPLICABLE

TO

COMMON

SHARES

-

100%

$

145,775,926

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Municipal

Bonds

$

–

$

230,631,525

$

–

$

230,631,525

Total

$

–

$

230,631,525

$

–

$

230,631,525

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(a)

Security

is

exempt

from

registration

under

Rule

144A

of

the

Securities

Act

of

1933,

as

amended.

These

securities

are

deemed

liquid

and

may

be

resold

in

transactions

exempt

from

registration,

which

are

normally

those

transactions

with

qualified

institutional

buyers.

As

of

the

end

of

the

reporting

period,

the

aggregate

value

of

these

securities

is

$16,110,390

or

7.0%

of

Total

Investments.

(b)

Step-up

coupon

bond,

a

bond

with

a

coupon

that

increases

("steps

up"),

usually

at

regular

intervals,

while

the

bond

is

outstanding.

The

rate

shown

is

the

coupon

as

of

the

end

of

the

reporting

period.

(c)

Defaulted

security.

A

security

whose

issuer

has

failed

to

fully

pay

principal

and/or

interest

when

due,

or

is

under

the

protection

of

bankruptcy.

(d)

Backed

by

an

escrow

or

trust

containing

sufficient

U.S.

Government

or

U.S.

Government

agency

securities,

which

ensure

the

timely

payment

of

principal

and

interest.

(e)

AMTP

Shares,

Net

as

a

percentage

of

Total

Investments

is

38.3%.

AMT

Alternative

Minimum

Tax

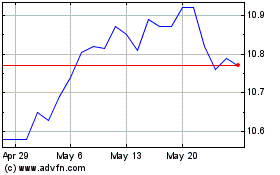

Nuveen Arizona Quality M... (NYSE:NAZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nuveen Arizona Quality M... (NYSE:NAZ)

Historical Stock Chart

From Feb 2024 to Feb 2025