UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date: 23 May 2024

Commission File Number: 001-14958

NATIONAL GRID plc

(Translation

of registrant’s name into English)

England and Wales

(Jurisdiction

of Incorporation)

1-3 Strand, London, WC2N 5EH, United Kingdom

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T

Rule

101(b)(1): ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T

Rule

101(b)(7): ☐

Indicate

by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3- 2(b) under the

Securities

Exchange

Act of 1934. ☐ Yes ☒ No

If

“Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b):

n/a

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

|

99.1

|

Exhibit

99.1 Announcement sent to the London Stock Exchange on 23 May

2024 —

Rule 135c notification - £7bn Rights Issue

|

Exhibit

99.1

FOR IMMEDIATE RELEASE

23 May 2024

National Grid plc

7 for 24 fully underwritten Rights Issue to raise c.£7

billion

New 5-year investment framework for FY25-29

Deliver £60bn investment in energy infrastructure

To fund a significant step up in capital investment to around

£60 billion in energy network infrastructure, the Board of

National Grid plc ("National

Grid" or

the "Company") today announces a capital raise of approximately

£7 billion by way of a fully underwritten Rights Issue of

1,085,448,980 New Shares at 645 pence per New Share on the basis of

7 New Shares for every 24 Existing Shares

(the "Rights

Issue").

National Grid's results for the year ended 31 March 2024 have been

released today in an accompanying announcement.

SUMMARY OF BACKGROUND TO AND REASONS FOR THE RIGHTS

ISSUE

National Grid plays a critical role in delivering the energy

transition across our jurisdictions, by building and maintaining

the transmission and distribution infrastructure to enable the

connection of cleaner, more affordable renewable energy. Not only

will this enable the decarbonisation of the economies we serve, it

will also ensure we can meet the demand growth we anticipate from a

more technology-enabled economy, as well as greater electrification

of homes, heating and vehicles.

The opportunities presented by the growth of electricity demand,

and the consensus among our regulators and jurisdictions of the

urgent need for decarbonisation are unprecedented. It's against

this backdrop that we expect to significantly increase our capital

investment over the next five years.

Our geographic position and our work with governments and

regulators provides us with an unprecedented growth opportunity

that we expect will create substantial value for our shareholders.

This investment in new infrastructure will enhance resiliency and

enable the jurisdictions in which we operate to make meaningful

progress in their journeys towards a decarbonised energy system.

The step-up in investment as set out in our new 5-year financial

framework underscores National Grid's position as one of the FTSE's

biggest investors in the delivery of the energy transition. Over

the last three years we have reshaped our portfolio and now have a

mix of businesses that is increasingly weighted towards electricity

transmission and distribution, making us well-placed to capture the

significant network growth opportunities that lie ahead. With our

operational and regulatory capabilities, combined with a strong

track record of delivery, we are confident that we can deliver this

step-up in new infrastructure that will provide greater levels of

energy security and enable diversification of energy sources to

help decarbonise the economies we serve.

The Board unanimously believes that raising net proceeds of

approximately £6.8 billion through the Rights Issue will give

the Group appropriate financial flexibility to deliver the Group's

strategy over the 5-year financial framework, and funding clarity

until at least the end of the RIIO-T3 period.

The Rights Issue net proceeds of approximately £6.8 billion

will principally be utilised to fund a higher-growth investment

phase for the Group, with around £60 billion of capital

investment expected during the 5-year period from FY25 to FY29. In

the near term, to support efficient management of funding costs,

approximately £750 million of the net proceeds will be used to

refinance a portion of the Group's outstanding hybrid bonds that

have first call dates in the next 15 months.

INDICATIVE SUMMARY TIMETABLE OF PRINCIPAL EVENTS

|

Announcement of Rights Issue

...................................................................................................................................................................................................................................................................

|

23 May 2024

|

|

Admission and commencement of dealings in New Shares, nil paid, on

the London Stock Exchange ...........................................................................................................................................

|

8.00 a.m. on 24 May 2024

|

It is expected that the dealings in the New Shares on the London

Stock exchange will commence at 8.00 a.m. (London time) on 12 June

2024.

FOR FURTHER INFORMATION, PLEASE CONTACT:

National Grid:

Investors

|

Nick Ashworth

|

+44 (0) 7814 355 590

|

|

Angela Broad

|

+44 (0) 7825 351 918

|

|

James Flanagan

|

+44 (0) 7970 778 952

|

Media

|

Molly Neal

|

+44 (0) 7583 102 727

|

|

Danielle Dominey-Kent

|

+44 (0) 7977 054 575

|

|

Lyndsey Evans

|

+44 (0) 7714 672 052

|

|

Brunswick

|

+44 (0) 20 7404

5959

|

|

Susan

Gilchrist

|

|

Dan

Roberts

|

|

|

Peter

Hesse

|

|

IMPORTANT NOTICES

This announcement has been issued by and is the sole responsibility

of the Company. The information contained in this announcement is

for background purposes only and does not purport to be full or

complete. No reliance may or should be placed by any person for any

purpose whatsoever on the information contained in this

announcement or on its accuracy or completeness. The information in

this announcement is subject to change without notice.

This announcement is not a prospectus but an advertisement. Neither

this announcement nor anything contained in it shall form the basis

of, or be relied upon in conjunction with, any offer or commitment

whatsoever in any jurisdiction.

This announcement does not contain or constitute an offer for sale

or the solicitation of an offer to purchase securities in the

United States. The Nil Paid Rights, the Fully Paid Rights and the

New Shares have not been and will not be registered under the US

Securities Act of 1933, as amended (the "Securities

Act") or under any securities

laws of any state or other jurisdiction of the United States and

may not be offered, sold, pledged, taken up, exercised, resold,

renounced, transferred or delivered, directly or indirectly, in or

into the United States except pursuant to an applicable exemption

from, or in a transaction not subject to, the registration

requirements of the Securities Act and in compliance with any

applicable securities laws of any state or other jurisdiction of

the United States or other jurisdiction. There will be no public

offer of the Nil Paid Rights, the Fully Paid Rights, the

Provisional Allotment Letters or the New Shares in the United

States. Subject to certain limited exceptions, Provisional

Allotment Letters have not been, and will not be, sent to, and Nil

Paid Rights have not been, and will not be, credited to the CREST

account of, any Qualifying Shareholder with a registered address in

or that is known to be located in the United States. None of the

New Shares, the Nil Paid Rights, the Fully Paid Rights or the

Provisional Allotment Letters, this announcement or any other

document connected with the Rights Issue has been or will be

approved or disapproved by the United States Securities and

Exchange Commission or by the securities commissions of any state

or other jurisdiction of the United States or any other regulatory

authority, nor have any of the foregoing authorities passed upon or

endorsed the merits of the offering of the New Shares, the Nil Paid

Rights, the Fully Paid Rights or the accuracy or adequacy of the

Provisional Allotment Letters, this announcement or any other

document connected with the Rights Issue. Any representation to the

contrary is a criminal offence in the United

States.

The distribution of this announcement, the Prospectus, the

Provisional Allotment Letter and the offering or transfer of Nil

Paid Rights, Fully Paid Rights or New Shares into jurisdictions

other than the United Kingdom may be restricted by law, and

therefore persons into whose possession this announcement comes

should inform themselves about and observe any such

restrictions.

This announcement does not constitute a recommendation concerning

any investor's options with respect to the Rights Issue. The price

and value of securities can go down as well as up. Past performance

is not a guide to future performance. The contents of this

announcement are not to be construed as legal, business, financial

or tax advice. Each shareholder or prospective investor should

consult his, her or its own legal adviser, business adviser,

financial adviser or tax adviser for legal, financial, business or

tax advice. Acquiring investments to which this announcement

relates may expose an investor to a significant risk of losing all

of the amount invested.

FORWARD-LOOKING STATEMENTS

This announcement contains certain statements that are neither

reported financial results nor other historical information. These

statements are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. These

statements include information with respect to National Grid's (the

Company) financial condition, its results of operations and

businesses, strategy, plans and objectives. Words such as 'aims',

'anticipates', 'expects', 'should', 'intends', 'plans', 'believes',

'outlook', 'seeks', 'estimates', 'targets', 'may', 'will',

'continue', 'project' and similar expressions, as well as

statements in the future tense, identify forward-looking

statements. This document also references climate-related targets

and climate-related risks which differ from conventional financial

risks in that they are complex, novel and tend to involve

projection over long term scenarios which are subject to

significant uncertainty and change. These forward-looking

statements are not guarantees of National Grid's future performance

and are subject to assumptions, risks and uncertainties that could

cause actual future results to differ materially from those

expressed in or implied by such forward-looking statements or

targets. Many of these assumptions, risks and uncertainties relate

to factors that are beyond National Grid's ability to control,

predict or estimate precisely, such as changes in laws or

regulations and decisions by governmental bodies or regulators,

including those relating to current and upcoming price controls in

the UK and rate cases in the US, as well as the future of system

operation in the UK; the timing of construction and delivery by

third parties of new generation projects requiring connection;

breaches of, or changes in, environmental, climate change and

health and safety laws or regulations, including breaches or other

incidents arising from the potentially harmful nature of its

activities; network failure or interruption, the inability to carry

out critical non-network operations and damage to infrastructure,

due to adverse weather conditions including the impact of major

storms as well as the results of climate change, due to

counterparties being unable to deliver physical commodities;

reliability of and access to IT systems, including or due to the

failure of or unauthorised access to or deliberate breaches of

National Grid's systems and supporting technology; failure to

adequately forecast and respond to disruptions in energy supply;

performance against regulatory targets and standards and against

National Grid's peers with the aim of delivering stakeholder

expectations regarding costs and efficiency savings, as well as

against targets and standards designed to support its role in the

energy transition; and customers and counterparties (including

financial institutions) failing to perform their obligations to the

Company. Other factors that could cause actual results to differ

materially from those described in this announcement include

fluctuations in exchange rates, interest rates and commodity price

indices; restrictions and conditions (including filing

requirements) in National Grid's borrowing and debt arrangements,

funding costs and access to financing; regulatory requirements for

the Company to maintain financial resources in certain parts of its

business and restrictions on some subsidiaries' transactions such

as paying dividends, lending or levying charges; the delayed timing

of recoveries and payments in National Grid's regulated businesses,

and whether aspects of its activities are contestable; the funding

requirements and performance of National Grid's pension schemes and

other post-retirement benefit schemes; the failure to attract,

develop and retain employees with the necessary competencies,

including leadership and business capabilities, and any significant

disputes arising with National Grid's employees or breaches of laws

or regulations by its employees; the failure to respond to market

developments, including competition for onshore transmission; the

threats and opportunities presented by emerging technology; the

failure by the Company to respond to, or meet its own commitments

as a leader in relation to, climate change development activities

relating to energy transition, including the integration of

distributed energy resources; and the need to grow the Company's

business to deliver its strategy, as well as incorrect or

unforeseen assumptions or conclusions (including unanticipated

costs and liabilities) relating to business development activity,

including the sale of a stake in its UK Gas Transmission and

Metering business, its strategic infrastructure projects and joint

ventures and the separation and transfer of the ESO to the public

sector. For further details regarding these and other assumptions,

risks and uncertainties that may impact National Grid, please read

the Strategic Report section and the 'Risk factors' on pages 226 to

231 of National Grid's Annual Report and Accounts for the year

ended 31 March 2024, which is published today. In addition, new

factors emerge from time to time and National Grid cannot assess

the potential impact of any such factor on its activities or the

extent to which any factor, or combination of factors, may cause

actual future results to differ materially from those contained in

any forward-looking statement. Except as may be required by law or

regulation, the Company undertakes no obligation to update any of

its forward-looking statements, which speak only as of the date of

this announcement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on

its behalf by the undersigned, thereunto duly

authorized.

|

|

NATIONAL GRID

plc

|

|

|

|

|

|

|

By:

|

Beth Melges

|

|

|

|

Beth Melges

Head of Plc Governance

|

Date:

23 May

2024

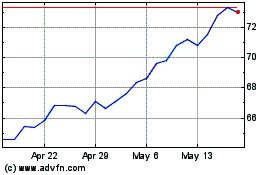

National Grid (NYSE:NGG)

Historical Stock Chart

From Dec 2024 to Jan 2025

National Grid (NYSE:NGG)

Historical Stock Chart

From Jan 2024 to Jan 2025