0000877860FALSE00008778602025-01-082025-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Reported): January 8, 2025

NATIONAL HEALTH INVESTORS INC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-10822 | | 62-1470956 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

222 Robert Rose Drive, Murfreesboro, TN 37129

(Address of principal executive offices)

(615) 890-9100

(Registrant's telephone number, including area code)

Not Applicable

(Former name, former address and former fiscal year,

if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Title of each Class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | NHI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On January 8, 2025, the Company issued a press release, which is also contained on its website (www.nhireit.com), announcing corporate governance updates. See Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section, nor shall such information or exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| Exhibit Index |

| Number | Exhibit |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). |

..

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

NATIONAL HEALTH INVESTORS, INC.

By: /s/ John L. Spaid

Name: John L. Spaid

Title: Principal Financial Officer

Date: January 8, 2025

Contact: Dana Hambly, Vice President, Finance and Investor Relations

Phone: (615) 890-9100

NHI Announces Updates to Corporate Governance

MURFREESBORO, TN --(January 8, 2025) – National Health Investors, Inc. (NYSE:NHI) announced a series of changes to the Board of Directors which enhances the Board’s ability to provide strategic and independent guidance. The changes include the following:

•Robert A. McCabe, Jr. was appointed to serve as Chair of the Board, effective immediately, following the recent retirement of W. Andrew Adams on December 31, 2024;

•Candice W. Todd was appointed to the Board to fill the vacancy of Mr. Adams’ retirement;

•D. Eric Mendelsohn, President, CEO and Board member, was appointed to serve in the newly created role as Vice-Chair of the Board effective immediately; and

•Ms. Todd was appointed to serve as the Chair of the Audit Committee and as a member of the Nominating and Corporate Governance Committee. Ms. Todd was also appointed as a member of the Special Committee described below.

In addition to these recent actions and following discussion with several stockholders over multiple years, the Company’s Board has taken additional measures to increase accountability and transparency which include:

•Appointment of Tracy M.J. Colden as Chair of the Nominating and Corporate Governance Committee in May 2024;

•Commitment to submitting a proposal to the Company’s stockholders at the 2025 annual meeting to amend the Company’s Articles of Incorporation to remove the classified board structure;

•Creation of a Special Committee of Non-Interested Directors which has responsibility for advising the Company on its ongoing master lease negotiations with National HealthCare Corporation;

•Establishment of a management ESG Committee which meets at least quarterly with the Chair of the Nominating and Corporate Governance Committee. The Company expects to publish its first annual sustainability report in the first quarter of 2025; and

•Revisions to the Company’s Corporate Governance Guidelines to include, among other things:

oAdditional requirements regarding selection of director candidates;

olimitations on number of public boards directors may sit;

oaddition of stock ownership requirements; and

oaddition of requirement that director offer to resign upon material changes in circumstances.

Since first expanding in 2020, the Board has grown from four directors to eight directors. As a result, female representation has increased from 0.0% to 37.5%, the average Board tenure has decreased from approximately 21 years to approximately 11 years, and the average age of Board members has remained approximately 70 years.

About NHI

Incorporated in 1991, National Health Investors, Inc. (NYSE: NHI) is a real estate investment trust specializing in sale-leasebacks, joint-ventures, senior housing operating partnerships, and mortgage and mezzanine financing of need-driven and discretionary senior housing and medical investments. NHI’s portfolio consists of independent living, assisted living and memory care communities, entrance-fee retirement communities, skilled nursing facilities, and specialty hospitals. For more information, visit www.nhireit.com.

This press release includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements regarding the Company’s, tenants’, operators’, borrowers’ or managers’ expected future financial position, results of operations, cash flows, funds from operations, dividend and dividend plans, financing opportunities and plans, capital market transactions, business strategy, budgets, projected costs, operating metrics, capital expenditures, competitive positions, acquisitions, investment opportunities, dispositions, acquisition integration, growth opportunities, expected lease income, continued qualification as a real estate investment trust (“REIT”), plans and objectives of management for future operations, continued performance improvements, ability to service and refinance our debt obligations, ability to finance growth opportunities, and similar statements including, without limitation, those containing words such as “may”, “will”, “should”, “believes”, “anticipates”, “expects”, “intends”, “estimates”, “plans”, “projects”, “likely” and other similar expressions are forward-looking statements. Forward-looking statements involve known and unknown risks and uncertainties that may cause our actual results in future periods to differ materially from those projected or contemplated in the forward-looking statements. Such risks and uncertainties include, among other things; the operating success of our tenants, managers and borrowers for collection of our lease and interest income; the risk that our tenants, managers and borrowers may become subject to bankruptcy or insolvency proceedings; risks related to the concentration of a significant percentage of our portfolio to a small number of tenants; risks associated with pandemics, epidemics or outbreaks, such as the COVID-19 pandemic, on our operators’ business and results of operations; risks related to governmental regulations and payors, principally Medicare and Medicaid, and the effect that changes to laws, regulations and reimbursement rates would have on our tenants’ and borrowers’ business; the risk that the cash flows of our tenants, managers and borrowers may be adversely affected by increased liability claims and liability insurance costs; the risk that we may not be fully indemnified by our tenants, managers and borrowers against future litigation; the success of property development and construction activities, which may fail to achieve the operating results we expect; the risk that the illiquidity of real estate investments could impede our ability to respond to adverse changes in the performance of our properties; risks associated with our investments in unconsolidated entities, including our lack of sole decision-making authority and our reliance on the financial condition of other interests; risks related to our joint venture investment with Life Care Services for Timber Ridge; inflation and increased interest rates; adverse developments affecting the financial services industry, including events or concerns involving liquidity, defaults, or non-performance by financial institutions; operational risks with respect to our SHOP structured communities; risks related to our ability to maintain the privacy and security of Company information; risks related to environmental laws and the costs associated with liabilities related to hazardous substances; the risk of damage from catastrophic weather and other natural or man-made disasters and the physical effects of climate change; the success of our future acquisitions and investments; our ability to reinvest cash in real estate investments in a timely manner and on acceptable terms; competition for acquisitions may result in increased prices for properties; our ability to retain our management team and other personnel and attract suitable replacements should any such personnel leave; the risk that our assets may be subject to impairment charges; our ability to raise capital through equity sales is dependent, in part, on the market price of our common stock, and our failure to meet market expectations with respect to our business, or other factors we do not control, could negatively impact such market price and availability of equity capital; the potential need to refinance existing debt or incur

additional debt in the future, which may not be available on terms acceptable to us; our ability to meet covenants related to our indebtedness which impose certain operational limitations and a breach of those covenants could materially adversely affect our financial condition and results of operations; downgrades in our credit ratings could have a material adverse effect on our cost and availability of capital; we rely on external sources of capital to fund future capital needs, and if we encounter difficulty in obtaining such capital, we may not be able to make future investments necessary to grow our business or meet maturing commitments; our dependence on revenues derived mainly from fixed rate investments in real estate assets, while a portion of our debt bears interest at variable rates; our ability to pay dividends in the future; legislative, regulatory, or administrative changes; and our dependence on the ability to continue to qualify for taxation as a real estate investment trust and other risks which are described under the heading “Risk Factors” in Item 1A in our Form 10-K for the year ended December 31, 2024 and under the heading “Risk Factors” in Item 1A in our Form 10-Q for the quarter ended June 30, 2024. Many of these factors are beyond the control of the Company and its management. The Company assumes no obligation to update any of the foregoing or any other forward looking statements, except as required by law, and these statements speak only as of the date on which they are made. Investors are urged to carefully review and consider the various disclosures made by NHI in its periodic reports filed with the Securities and Exchange Commission, including the risk factors and other information in the above referenced Form 10-K and Form 10-Q. Copies of these filings are available at no cost on the SEC’s web site at https://www.sec.gov or on NHI’s web site at https://www.nhireit.com.

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

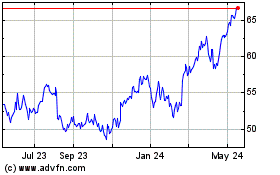

National Health Investors (NYSE:NHI)

Historical Stock Chart

From Dec 2024 to Jan 2025

National Health Investors (NYSE:NHI)

Historical Stock Chart

From Jan 2024 to Jan 2025