Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

12 December 2023 - 8:05AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-269966

Pricing Term Sheet

ONE

GAS, INC.

Pricing Term Sheet

|

|

|

| Issuer: |

|

ONE Gas, Inc. |

|

|

| Ratings*: |

|

A3 (stable) / A- (stable) (Moody’s / S&P) |

|

|

| Legal Format: |

|

SEC Registered |

|

|

| Pricing Date: |

|

December 11, 2023 |

|

|

| Settlement Date: |

|

December 13, 2023 (T+2) |

|

|

| Security Type: |

|

5.10% Senior Notes due 2029 (the “Notes”) |

|

|

| Size: |

|

$300,000,000 |

|

|

| Maturity Date: |

|

April 1, 2029 |

|

|

| Benchmark Treasury: |

|

4.375% due November 30, 2028 |

|

|

| Benchmark Treasury Yield: |

|

4.262% |

|

|

| Spread to Benchmark Treasury: |

|

+87 basis points |

|

|

| Yield to Maturity: |

|

5.132% |

|

|

| Price to the Public: |

|

99.861% of principal amount |

|

|

| Coupon Rate: |

|

5.10% |

|

|

| Interest Payment Dates: |

|

Semi-annually in arrears on April 1 and October 1, commencing April 1, 2024 |

|

|

| Optional Redemption: |

|

Prior to March 1, 2029 (which is the date that is one month prior to the maturity date of the Notes (the “Par Call Date”)),

redeemable, in whole or in part, at any time and from time to time, at a redemption price (expressed as a percentage of principal amount and rounded to three decimal places) equal to the greater of: (1)(a) the sum of the present values of the

remaining scheduled payments of principal and interest thereon discounted to the redemption date (assuming the Notes matured on the Par Call Date) on a semi-annual basis (assuming a 360-day year consisting of

twelve 30-day months) at the Treasury Rate applicable to the Notes +15 bps less (b) interest accrued and unpaid thereon to the redemption date; and (2) 100% of the principal amount of the Notes to be

redeemed, plus, in either case, accrued and unpaid interest thereon to, but excluding, the redemption date.

On or after the Par Call Date, redeemable, in whole or in part, at any time and from time to time, at a redemption price equal to 100% of the principal amount

of the Notes being redeemed plus accrued and unpaid interest thereon to, but excluding, the redemption date. |

|

|

| CUSIP / ISIN: |

|

68235P AN8 / US68235PAN87 |

|

|

|

| Minimum Denomination: |

|

$2,000 and integral multiples of $1,000 in excess thereof |

|

|

| Joint Book-Running Managers: |

|

J.P. Morgan Securities LLC Mizuho Securities

USA LLC U.S. Bancorp Investments, Inc. |

|

|

| Co-Managers: |

|

BofA Securities, Inc. RBC Capital Markets,

LLC Truist Securities, Inc. Wells Fargo Securities, LLC

BOK Financial Securities, Inc. |

| * |

Note: A securities rating is not a recommendation to buy, sell or hold securities and may be revised or

withdrawn at any time. |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get

these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it from J.P. Morgan

Securities LLC by calling collect at 1-212-834-4533, Mizuho Securities USA LLC by calling toll-free at 1-866-271-7403 or U.S. Bancorp Investments, Inc. by calling toll-free at 1-877-558-2607.

Pricing Term Sheet dated December 11, 2023 to

the Preliminary Prospectus Supplement dated December 11, 2023, and the accompanying Prospectus dated February 23, 2023 (together, the “Preliminary Prospectus”) of ONE Gas, Inc. The information in this Pricing Term Sheet

supplements the Preliminary Prospectus and supersedes the information in the Preliminary Prospectus to the extent it is inconsistent with the information in the Preliminary Prospectus. This Pricing Term Sheet is qualified in its entirety by

reference to the Preliminary Prospectus. Financial information presented in the Preliminary Prospectus is deemed to have changed to the extent affected by the changes described herein. This Pricing Term Sheet should be read together with the

Preliminary Prospectus, including the documents incorporated by reference therein, before making a decision in connection with an investment in the securities. Capitalized terms used in this Pricing Term Sheet but not defined have the meanings given

them in the Preliminary Prospectus.

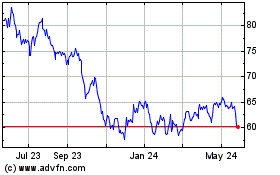

ONE Gas (NYSE:OGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

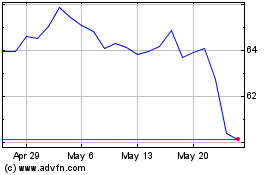

ONE Gas (NYSE:OGS)

Historical Stock Chart

From Jan 2024 to Jan 2025