0001110611FALSE00011106112024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________

FORM 8-K

___________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 7, 2024

___________________

ON24, INC.

(Exact name of registrant as specified in its charter)

___________________

| | | | | | | | | | | | | | | | | |

| Delaware | | 001-39965 | | 94-3292599 | |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

| | | | | | | | | | | | | | |

| 50 Beale Street, | 8th Floor | | |

| San Francisco, | CA | | 94105 |

| (Address of principal executive offices) | | (Zip Code) |

(415) 369-8000

(Registrant’s telephone number, including area code)

_______________________

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | ONTF | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, ON24, Inc. (the “Company”), issued a press release announcing its financial results for the first quarter ended March 31, 2024. A copy of the press release is furnished herewith as Exhibit 99.1 and incorporated herein by reference.

The information contained in this report, including Exhibit 99.1 attached hereto, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: May 7, 2024 | ON24, Inc. |

| | |

| By: | /s/ Steven Vattuone |

| | Steven Vattuone |

| | Chief Financial Officer |

ON24 Announces First Quarter 2024 Financial Results

•Achieved Total Revenue of $37.7 million and exceeded profitability targets for 4th consecutive quarter

•Continued signs of stabilization in customer base driven by positive trends in gross retention

•Strong enterprise business performance metrics; including record percentage of ARR in multiyear agreements and highest ARR per customer

•Growth ARR uplift from momentum of early adopters of the ON24 next gen platform and AI-powered offerings

SAN FRANCISCO--(BUSINESS WIRE)--ON24 (NYSE: ONTF), an intelligent engagement platform for B2B sales and marketing, today announced financial results for the first quarter ended March 31, 2024.

“In Q1, we continued to execute against our strategic and financial targets, delivering solid topline results and achieving our profitability targets for the fourth quarter in a row,” said Sharat Sharan, co-founder and CEO of ON24. “Furthermore, we were pleased with continued signs of stability in our customer base with positive trends in gross retention rates, greater business diversification across customer verticals with mission-critical digital transformation use cases, and expansion through our newly launched AI-powered next generation platform. Looking forward, we are being prudent in our outlook for FY 2024 given continued pressure on marketing budgets, but we remain confident that the company is well-positioned to achieve its long-term goal of generating double-digit top-line growth with double-digit EBITDA margins.”

First Quarter 2024 Financial Highlights

•Revenue:

◦Revenue from our Core Platform, including services, was $36.8 million.

◦Total revenue was $37.7 million.

•ARR:

◦Core Platform ARR of $133.3 million as of March 31, 2024.

◦Total ARR of $136.5 million as of March 31, 2024.

•GAAP Operating Loss was $12.5 million, compared to GAAP operating loss of $19.9 million in the first quarter of 2023.

•Non-GAAP Operating Loss was $0.8 million, compared to non-GAAP operating loss of $4.2 million in the first quarter of 2023.

•GAAP Net Loss was $10.7 million, or $(0.26) per diluted share, compared to GAAP net loss of $17.6 million, or $(0.37) per diluted share in the first quarter of 2023.

•Non-GAAP Net Income was $1.0 million, or $0.02 per diluted share, compared to a non-GAAP net loss of $1.8 million, or $(0.04) per diluted share in the first quarter of 2023.

•Adjusted EBITDA was $0.3 million.

•Cash Flow: Net cash provided by operating activities was $2.1 million, compared to $4.2 million used in operating activities in the first quarter of 2023. Free cash flow was $1.1 million for the quarter, compared to $(4.3) million in the first quarter of 2023.

•Cash, Cash Equivalents and Marketable Securities totaled $196.1 million as of March 31, 2024.

For more information regarding non-GAAP operating income (loss), non-GAAP net income (loss) and free cash flows, see the section titled “Non-GAAP Financial Measures” below. For reconciliations of these non-GAAP financial measures to the most directly comparable GAAP financial measure, see the tables at the end of this press release.

Recent Business Highlights:

•Strong momentum from early adopters of the ON24 Intelligent Engagement Platform and AI-powered ACE with AI-powered ACE ARR reaching the double-digit mark as a percentage of growth ARR in Q1.

•ON24 named winner of the TrustRadius “Most Loved” award in the marketing technology category based on thousands of customer reviews.

•With steadfast focus on enterprises, ON24 ranked top enterprise digital engagement platform for past 5 years on G2.

•As focus on life sciences vertical continues, ON24 achieved Silver Certification in the Veeva Technology Partner Program.

Financial Outlook

For the second quarter of 2024, ON24 expects:

•Core Platform Revenue, including services, to be in the range of $35.0 million to $36.0 million.

•Total revenue of $35.8 million to $36.8 million.

•Non-GAAP operating loss of $1.7 million to $0.7 million.

•Non-GAAP net income per share of $0.00 to $0.02 using approximately 46.9 million diluted shares outstanding.

◦Restructuring charge of $0.6 million to $0.9 million, excluded from the Non-GAAP amounts above.

For the full year 2024, ON24 expects:

•Core Platform Revenue, including services, to be in the range of $139.8 million to $143.8 million.

•Total revenue of $143.0 million to $147.0 million.

•Non-GAAP operating loss of $5.5 million to $3.5 million.

•Non-GAAP net income per share of $0.03 to $0.07 per share using approximately 47.2 million diluted shares outstanding.

Conference Call Information

ON24 will host a conference call and live webcast for analysts and investors today at 2:00 p.m. Pacific Time. Parties in the United States can access the call by dialing (866) 682-6100 or (862) 298-0702.

A webcast and management’s prepared remarks for today’s call will be accessible on ON24’s investor relations website at investors.on24.com. Approximately one hour after completion of the live call, an archived version of the webcast will be available on the Company’s investor relations website.

Definitions of Certain Key Business Metrics

Core Platform: The ON24 Core Platform products include those listed below:

ON24 Elite: live, interactive webinar experience that engages prospective customers in real-time and can be made available in an on-demand format.

ON24 Breakouts: live breakout room experience that facilitates networking, collaboration and interactivity between users.

ON24 Forums: live, interactive experience that facilitates video-to-video interaction between presenters and audiences.

ON24 Go Live: live, interactive video event experience that enables presenters and attendees to engage face-to-face in real-time and can also be made available in an on-demand format.

ON24 Engagement Hub: always-on, rich multimedia content experience that prospective customers can engage anytime, anywhere.

ON24 Target: personalize and curate, rich landing page experience that engages specific segments of prospective customers to drive desired action.

ON24 AI-powered ACE: the next generation AI-powered analytics and content engine.

Annual Recurring Revenue (“ARR”): ARR is calculated as the sum of the annualized value of our subscription contracts as of the measurement date, including existing customers with expired contracts that we expect to be renewed. Our ARR amounts exclude professional services, overages from subscription customers and Legacy revenue.

Non-GAAP Financial Measures

In addition to our results determined in accordance with generally accepted accounting principles in the United States, or “GAAP”, we consider our non-GAAP operating income (loss), non-GAAP net income (loss), Adjusted EBITDA, and free cash flow in evaluating our operating performance. We define non-GAAP operating income (loss) as net income (loss) excluding, interest expense, other (income) expense, net, income tax, stock-based compensation, amortization of acquired intangible assets, shareholder activism related costs, restructuring costs, charges for underutilized real estate, and certain other costs. We define non-GAAP net income (loss) as net income (loss) excluding stock-based compensation, amortization of acquired intangible assets, shareholder activism related costs, restructuring costs, charges for underutilized real estate, and certain other costs. We define Adjusted EBITDA as net income (loss) excluding interest expense, other (income) expense, net, provision for income taxes, depreciation and amortization, amortization of acquired intangible assets, amortization of cloud implementation costs, stock-based compensation, restructuring costs, impairment charges, and shareholder activism related costs. We define free cash flow as net cash provided by (used in) operating activities, less purchases of property and equipment.

We use non-GAAP operating income (loss), non-GAAP net income (loss), and Adjusted EBITDA to evaluate our ongoing operations and for internal planning and forecasting purposes, and we use free cash flow to measure and evaluate cash generated through normal business operations. We believe non-GAAP operating income (loss), non-GAAP net income (loss), and Adjusted EBITDA may be helpful to investors because they provide consistency and comparability with past financial performance. We believe free cash flow may be helpful to investors because it reflects that some purchases of property and equipment are necessary to support ongoing operations, while providing a measure of cash available to acquire customers, expand within existing customers and otherwise pursue our business strategies.

However, these non-GAAP financial measures are each presented for supplemental informational purposes only, have limitations as analytical tools and should not be considered in isolation or as a substitute for financial information presented in accordance with GAAP. Non-GAAP financial measures have no standardized meanings prescribed by GAAP and are not prepared under a comprehensive set of accounting rules or principles. In addition, other companies, including companies in our industry, may calculate similarly-titled non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measure as a tool for comparison.

We do not provide a quantitative reconciliation of the forward-looking non-GAAP financial measures included in this press release to the most directly comparable GAAP measures due to the high variability and difficulty to predict certain items excluded from these non-GAAP financial measures; in particular, the effects of stock-based

compensation expense, and restructuring and transaction expenses. We expect the variability of these excluded items may have a significant, and potentially unpredictable, impact on our future GAAP financial results.

Reconciliations of these non-GAAP financial measures to their most directly comparable GAAP financial measure are included in the tables at the end of this press release.

Forward-Looking Statements

This document contains “forward-looking statements” under applicable securities laws. Such statements can be identified by words such as: “outlook,” “expect,” “target,” “believe,” “plan,” “future,” “may,” “should,” “will,” and similar references to future periods. Forward-looking statements include express or implied statements regarding our expected financial and operating results, the execution of our capital return program, the size of our market opportunity, the success of our new products and capabilities, including our new AI-powered Analytics and Content Engine, and other statements regarding our ability to achieve our business strategies, growth, or other future events or conditions. Such statements are based on our current beliefs, expectations, and assumptions about future events or conditions, which are subject to inherent risks and uncertainties, including our ability to attract new customers and expand sales to existing customers, decline in our growth rate; fluctuation in our performance, our history of net losses and expected increases in our expenses; competition and technological development in our markets and any decline in demand for our solutions; our ability to expand our sales and marketing capabilities and otherwise achieve our growth; the impact of the resumption of in-person marketing activities on our customer growth rate; disruptions or other issues with our technology or third-party services; compliance with data privacy, import and export controls, customs, sanctions and other laws and regulations; intellectual property matters; and matters relating to our common stock, along with the other risks and uncertainties discussed in the filings we make from time to time with the Securities and Exchange Commission. Actual results may differ materially from those indicated in forward-looking statements, and you should not place undue reliance on them. All statements herein are based only on information currently available to us and speak only as of the date hereof. Except as required by law, we undertake no obligation to update any such statement.

About ON24

ON24 is on a mission to help businesses bring their go-to-market strategy into the AI era and drive cost-effective revenue growth. Through its leading intelligent engagement platform, ON24 enables customers to combine best-in-class experiences with personalization and content, to capture and act on connected insights at scale.

ON24 provides industry-leading companies, including 3 of the 5 largest global technology companies, 3 of the 5 top global asset management firms, 3 of the 5 largest global healthcare companies and 3 of the 5 largest global industrial companies, with a valuable source of first-party data to drive sales and marketing innovation, improve efficiency and increase business results. Headquartered in San Francisco, ON24 has offices globally in North America, EMEA and APAC. For more information, visit www.ON24.com.

© 2024 ON24, Inc. All rights reserved. ON24 and the ON24 logo are trademarks owned by ON24, Inc., and are registered in the United States Patent and Trademark Office and in other countries.

ON24, INC.

Condensed Consolidated Balance Sheets

(in thousands)

(Unaudited)

| | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 |

Assets | | | |

Current assets | | | |

Cash and cash equivalents | $ | 18,292 | | | $ | 53,209 | |

Marketable securities | 177,766 | | | 145,497 | |

Accounts receivable, net | 28,523 | | | 37,939 | |

Deferred contract acquisition costs, current | 12,349 | | | 12,428 | |

Prepaid expenses and other current assets | 6,922 | | | 4,714 | |

Total current assets | 243,852 | | | 253,787 | |

Property and equipment, net | 6,130 | | | 5,371 | |

| Operating right-of-use assets | 2,650 | | | 2,981 | |

| Intangible asset, net | 1,102 | | | 1,305 | |

Deferred contract acquisition costs, non-current | 14,421 | | | 15,756 | |

Other long-term assets | 1,009 | | | 1,102 | |

Total assets | $ | 269,164 | | | $ | 280,302 | |

Liabilities and Stockholders’ Equity | | | |

Current liabilities | | | |

Accounts payable | $ | 1,713 | | | $ | 1,914 | |

Accrued and other current liabilities | 13,559 | | | 16,907 | |

Deferred revenue | 73,117 | | | 74,358 | |

| Finance lease liabilities, current | 44 | | | 127 | |

| Operating lease liabilities, current | 2,867 | | | 2,779 | |

Total current liabilities | 91,300 | | | 96,085 | |

| | | |

| Operating lease liabilities, non-current | 1,775 | | | 2,483 | |

| Other long-term liabilities | 1,666 | | | 1,517 | |

Total liabilities | 94,741 | | | 100,085 | |

Stockholders’ equity | | | |

Common stock | 4 | | | 4 | |

Additional paid-in capital | 490,896 | | | 485,291 | |

Accumulated deficit | (316,216) | | | (305,513) | |

| Accumulated other comprehensive income (loss) | (261) | | | 435 | |

Total stockholders’ equity | 174,423 | | | 180,217 | |

Total liabilities and stockholders’ equity | $ | 269,164 | | | $ | 280,302 | |

| | | |

ON24, INC.

Condensed Consolidated Statements of Operations

(in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

Revenue: | | | | | | | |

Subscription and other platform | | | | | $ | 34,829 | | | $ | 39,364 | |

Professional services | | | | | 2,898 | | | 3,699 | |

Total revenue | | | | | 37,727 | | | 43,063 | |

Cost of revenue: | | | | | | | |

Subscription and other platform(1)(4) | | | | | 7,346 | | | 9,889 | |

Professional services(1)(4) | | | | | 2,436 | | | 3,317 | |

Total cost of revenue | | | | | 9,782 | | | 13,206 | |

Gross profit | | | | | 27,945 | | | 29,857 | |

Operating expenses: | | | | | | | |

Sales and marketing(1)(4) | | | | | 20,074 | | | 24,417 | |

Research and development(1)(2)(4) | | | | | 9,109 | | | 11,099 | |

General and administrative(1)(3)(4) | | | | | 11,236 | | | 14,278 | |

Total operating expenses | | | | | 40,419 | | | 49,794 | |

Loss from operations | | | | | (12,474) | | | (19,937) | |

Interest expense | | | | | 11 | | | 29 | |

Other income, net | | | | | (2,277) | | | (2,572) | |

Loss before provision for income taxes | | | | | (10,208) | | | (17,394) | |

Provision for income taxes | | | | | 495 | | | 196 | |

Net loss | | | | | (10,703) | | | (17,590) | |

| | | | | | | |

| | | | | | | |

Net loss per share: | | | | | | | |

Basic and diluted | | | | | $ | (0.26) | | | $ | (0.37) | |

| | | | | | | |

Weighted-average shares used in computing net loss per share: | | | | | | | |

Basic and diluted | | | | | 41,313,674 | | | 47,304,983 | |

| | | | | | | |

(1)Includes stock-based compensation as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

Cost of revenue | | | | | | | |

Subscription and other platform | | | | | $ | 668 | | | $ | 785 | |

Professional services | | | | | 121 | | | 152 | |

Total cost of revenue | | | | | 789 | | | 937 | |

Sales and marketing | | | | | 3,058 | | | 3,057 | |

Research and development | | | | | 2,128 | | | 2,021 | |

General and administrative | | | | | 4,362 | | | 4,106 | |

Total stock-based compensation expense | | | | | $ | 10,337 | | | $ | 10,121 | |

| | | | | | | |

(2)Research and development expense for the three months ended March 31, 2024 and 2023 includes amortization of acquired intangible asset of $138 thousand and $142 thousand, respectively, in connection with the Vibbio acquisition in April 2022.

(3)General and administrative expense for the three months ended March 31, 2024 and 2023 includes fees related to shareholder activism of nil and $2,446 thousand, respectively.

(4)The results of operations for the three months ended March 31, 2024 and 2023 includes restructuring costs, which primarily represent severance and related expense due to restructuring activities, as follows:

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | |

| | | | | | | | | | | |

| 2024 | | | | | | 2023 | | | | |

| Cost of revenue | | | | | | | | | | | |

| Subscription and other platform | $ | 192 | | | | | | | $ | 785 | | | | |

| Professional services | 12 | | | | | | | 54 | | | | |

| Total cost of revenue | 204 | | | | | | | 839 | | | | | |

| Sales and marketing | 675 | | | | | | | 1,211 | | | | |

| Research and development | 112 | | | | | | | 773 | | | | |

| General and administrative | 190 | | | | | | | 230 | | | | |

| Total restructuring costs | $ | 1,181 | | | | | | | $ | 3,053 | | | | | |

| | | | | | | | | | | |

ON24, INC.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

Cash flows from operating activities: | | | | | | | |

Net loss | | | | | $ | (10,703) | | | $ | (17,590) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | |

Depreciation and amortization | | | | | 1,233 | | | 1,417 | |

Stock-based compensation expense | | | | | 10,337 | | | 10,121 | |

Amortization of deferred contract acquisition cost | | | | | 3,843 | | | 3,893 | |

Provision for allowance for doubtful accounts and billing reserves | | | | | 625 | | | 901 | |

Non-cash lease expense | | | | | 391 | | | 497 | |

| Accretion of marketable securities | | | | | (1,507) | | | (1,826) | |

| | | | | | | |

Other | | | | | 35 | | | 128 | |

Change in operating assets and liabilities: | | | | | | | |

Accounts receivable | | | | | 8,791 | | | 9,405 | |

Deferred contract acquisition cost | | | | | (2,429) | | | (3,546) | |

Prepaid expenses and other assets | | | | | (2,378) | | | (2,069) | |

Accounts payable | | | | | (134) | | | (1,353) | |

Accrued liabilities | | | | | (3,902) | | | (1,089) | |

Deferred revenue | | | | | (1,241) | | | (2,287) | |

Other liabilities | | | | | (823) | | | (769) | |

Net cash provided by (used in) operating activities | | | | | 2,138 | | | (4,167) | |

Cash flows from investing activities: | | | | | | | |

Purchase of property and equipment | | | | | (1,038) | | | (178) | |

| | | | | | | |

Purchase of marketable securities | | | | | (74,093) | | | (119,591) | |

Proceeds from maturities of marketable securities | | | | | 38,521 | | | 199,210 | |

| Proceeds from sale of marketable securities | | | | | 4,360 | | | 9,321 | |

Net cash (used in) provided by investing activities | | | | | (32,250) | | | 88,762 | |

Cash flows from financing activities: | | | | | | | |

| | | | | | | |

Proceeds from exercise of stock options | | | | | 753 | | | 255 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment for repurchase of common stock | | | | | (5,270) | | | (10,720) | |

| | | | | | | |

| Repayment of equipment loans | | | | | (36) | | | (71) | |

Repayment of finance lease obligations | | | | | (83) | | | (411) | |

| | | | | | | |

| | | | | | | |

Net cash used in financing activities | | | | | (4,636) | | | (10,947) | |

Effect of exchange rate changes on cash, cash equivalents and restricted cash | | | | | (173) | | | 130 | |

Net (decrease) increase in cash, cash equivalents and restricted cash | | | | | (34,921) | | | 73,778 | |

Cash, cash equivalents and restricted cash, beginning of period | | | | | 53,298 | | | 27,169 | |

Cash, cash equivalents and restricted cash, end of period | | | | | $ | 18,377 | | | $ | 100,947 | |

Reconciliation of cash, cash equivalents, and restricted cash to the condensed consolidated balance sheets: | | | | | | | |

Cash and cash equivalents | | | | | $ | 18,292 | | | $ | 100,777 | |

Restricted cash included in other assets, non-current | | | | | 85 | | | 170 | |

Total cash, cash equivalent, and restricted cash | | | | | $ | 18,377 | | | $ | 100,947 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

ON24, INC.

Reconciliation of GAAP to Non-GAAP Results

(in thousands, except share and per share data)

(Unaudited)

Reconciliation of gross profit and gross margin

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

GAAP gross profit | | | | | $ | 27,945 | | $ | 29,857 |

Add: | | | | | | | |

Stock-based compensation | | | | | 789 | | 937 |

| Restructuring costs | | | | | 204 | | 839 |

| | | | | | | |

Non-GAAP gross profit | | | | | $ | 28,938 | | $ | 31,633 |

| | | | | | | |

GAAP gross margin | | | | | 74 | % | | 69 | % |

Non-GAAP gross margin | | | | | 77 | % | | 73 | % |

| | | | | | | |

Reconciliation of operating expenses

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

GAAP sales and marketing | | | | | $ | 20,074 | | | $ | 24,417 | |

Less: | | | | | | | |

Stock-based compensation | | | | | (3,058) | | | (3,057) | |

| Restructuring costs | | | | | (675) | | | (1,211) | |

| | | | | | | |

Non-GAAP sales and marketing | | | | | $ | 16,341 | | | $ | 20,149 | |

| | | | | | | |

GAAP research and development | | | | | $ | 9,109 | | | $ | 11,099 | |

Less: | | | | | | | |

Stock-based compensation | | | | | (2,128) | | | (2,021) | |

| Restructuring costs | | | | | (112) | | | (773) | |

| | | | | | | |

| Amortization of acquired intangible asset | | | | | (138) | | | (142) | |

Non-GAAP research and development | | | | | $ | 6,731 | | | $ | 8,163 | |

| | | | | | | |

GAAP general and administrative | | | | | $ | 11,236 | | | $ | 14,278 | |

Less: | | | | | | | |

Stock-based compensation | | | | | (4,362) | | | (4,106) | |

| Restructuring costs | | | | | (190) | | | (230) | |

| | | | | | | |

| Fees related to shareholder activism | | | | | — | | | (2,446) | |

Non-GAAP general and administrative | | | | | $ | 6,684 | | | $ | 7,496 | |

| | | | | | | |

ON24, INC.

Reconciliation of GAAP to Non-GAAP Results

(in thousands, except share and per share data)

(Unaudited)

Reconciliation of net loss to non-GAAP operating loss

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

Net loss | | | | | $ | (10,703) | | | $ | (17,590) | |

Add: | | | | | | | |

Interest expense | | | | | 11 | | | 29 | |

| Other income, net | | | | | (2,277) | | | (2,572) | |

| Provision for income taxes | | | | | 495 | | | 196 | |

Stock-based compensation | | | | | 10,337 | | | 10,121 | |

| Amortization of acquired intangible asset | | | | | 138 | | | 142 | |

| Restructuring costs | | | | | 1,181 | | | 3,053 | |

| | | | | | | |

| Fees related to shareholder activism | | | | | — | | | 2,446 | |

Non-GAAP operating loss | | | | | $ | (818) | | | $ | (4,175) | |

| | | | | | | |

Reconciliation of net loss to Adjusted EBITDA

| | | | | | | | | | | | | | | |

| | | | Three Months Ended March 31, |

| | | | | | 2024 | | 2023 |

Net loss | | | | | $ | (10,703) | | | $ | (17,590) | |

Add: | | | | | | | |

Interest expense | | | | | 11 | | | 29 | |

| Other income, net | | | | | (2,277) | | | (2,572) | |

| Provision for income taxes | | | | | 495 | | | 196 | |

| Depreciation and amortization | | | | | 1,095 | | | 1,275 | |

| Amortization of acquired intangible asset | | | | | 138 | | | 142 | |

Amortization of cloud implementation costs | | | | | 36 | | | 37 | |

Stock-based compensation | | | | | 10,337 | | | 10,121 | |

| Restructuring costs | | | | | 1,181 | | | 3,053 | |

| | | | | | | |

| Fees related to shareholder activism | | | | | — | | | 2,446 | |

Adjusted EBITDA | | | | | $ | 313 | | | $ | (2,863) | |

| | | | | | | |

Reconciliation of net loss to non-GAAP net income (loss)

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

Net loss | | | | | $ | (10,703) | | | $ | (17,590) | |

Add: | | | | | | | |

Stock-based compensation | | | | | 10,337 | | | 10,121 | |

| Amortization of acquired intangible asset | | | | | 138 | | | 142 | |

| Restructuring costs | | | | | 1,181 | | | 3,053 | |

| | | | | | | |

| Fees related to shareholder activism | | | | | — | | | 2,446 | |

Non-GAAP net income (loss) | | | | | $ | 953 | | | $ | (1,828) | |

| | | | | | | |

ON24, INC.

Reconciliation of GAAP to Non-GAAP Results

(in thousands, except share and per share data)

(Unaudited)

Reconciliation of GAAP to Non-GAAP basic and diluted net income (loss) per share

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

GAAP basic and diluted net loss per share: | | | | | | | |

Net loss | | | | | $ | (10,703) | | | $ | (17,590) | |

| | | | | | | |

| | | | | | | |

Weighted average common stock outstanding, basic and diluted | | | | | 41,313,674 | | | 47,304,983 | |

Net loss per share, basic and diluted | | | | | $ | (0.26) | | | $ | (0.37) | |

| | | | | | | |

| | | | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

Non-GAAP basic and diluted net income (loss) per share: | | | | | | | |

Net loss | | | | | $ | (10,703) | | | $ | (17,590) | |

Add: | | | | | | | |

| | | | | | | |

Stock-based compensation | | | | | 10,337 | | | 10,121 | |

| Amortization of acquired intangible asset | | | | | 138 | | | 142 | |

| Restructuring costs | | | | | 1,181 | | | 3,053 | |

| | | | | | | |

| Fees related to shareholder activism | | | | | — | | | 2,446 | |

Non-GAAP net income (loss) | | | | | $ | 953 | | | $ | (1,828) | |

Non-GAAP weighted-average common stock outstanding | | | | | | | |

Basic | | | | | 41,313,674 | | | 47,304,983 | |

Diluted | | | | | 45,624,532 | | | 47,304,983 | |

Non-GAAP net income (loss) per share of common stock: | | | | | | | |

Basic | | | | | $ | 0.02 | | | $ | (0.04) | |

Diluted | | | | | $ | 0.02 | | | $ | (0.04) | |

| | | | | | | |

ON24, INC.

Reconciliation of GAAP to Non-GAAP Results

(in thousands)

(Unaudited)

Reconciliation of GAAP Cash Flow from Operating Activities to Free Cash Flow

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

Net cash provided by (used in) operating activities: | | | | | $ | 2,138 | | | $ | (4,167) | |

Less: Purchases of property and equipment | | | | | (1,038) | | | (178) | |

Free cash flow | | | | | $ | 1,100 | | | $ | (4,345) | |

| | | | | | | |

ON24, INC.

Revenue

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| | | | | 2024 | | 2023 |

| Core Platform | | | | | | | |

| Subscription and other platform | | | | | $ | 34,060 | | | $ | 37,811 | |

| Professional services | | | | | 2,755 | | | 3,395 | |

| Total core platform revenue | | | | | $ | 36,815 | | | $ | 41,206 | |

| | | | | | | |

| Virtual Conference | | | | | | | |

| Subscription and other platform | | | | | $ | 769 | | | $ | 1,553 | |

| Professional services | | | | | 143 | | | 304 | |

| Total virtual conference revenue | | | | | $ | 912 | | | $ | 1,857 | |

| | | | | | | |

| Revenue | | | | | | | |

| Subscription and other platform | | | | | $ | 34,829 | | | $ | 39,364 | |

| Professional services | | | | | 2,898 | | | 3,699 | |

| Total revenue | | | | | $ | 37,727 | | | $ | 43,063 | |

| | | | | | | |

Contacts

Media Contact:

Tessa Barron

press@on24.com

Investor Contact:

Lauren Sloane, The Blueshirt Group for ON24

investorrelations@on24.com

v3.24.1.u1

Cover

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

ON24, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39965

|

| Entity Tax Identification Number |

94-3292599

|

| Entity Address, Address Line One |

50 Beale Street,

|

| Entity Address, Address Line Two |

8th Floor

|

| Entity Address, City or Town |

San Francisco,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

415

|

| Local Phone Number |

369-8000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

ONTF

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001110611

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

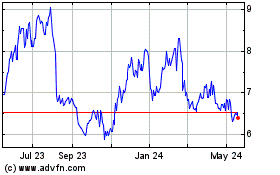

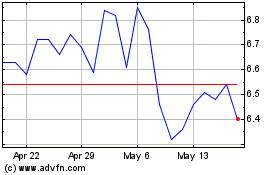

ON24 (NYSE:ONTF)

Historical Stock Chart

From Apr 2024 to May 2024

ON24 (NYSE:ONTF)

Historical Stock Chart

From May 2023 to May 2024