Revenue of $27 million, GAAP gross margin of

34%, and non-GAAP gross margin of 40%

Repaid all outstanding balance under revolving

credit line, strengthening balance sheet

On-track to deliver on long-term financial

framework and reach profitability

Ouster, Inc. (NYSE: OUST) (“Ouster” or the “Company”), a leading

global provider of high-performance lidar sensors and software

solutions for the automotive, industrial, robotics, and smart

infrastructure industries, announced today financial results for

the second quarter ended June 30, 2024.

Second Quarter 2024 Highlights

- $27 million in revenue, up 39% year over year and 4%

sequentially.

- Shipped over 4,000 sensors for revenue.

- GAAP gross margin of 34%, compared to 1% in the second quarter

of 2023 and 29% in the first quarter of 2024.

- Non-GAAP gross margin1 of 40%, compared to 26% in the second

quarter of 2023 and 36% in the first quarter of 2024.

- Net loss of $24 million, compared to $123 million in the second

quarter of 2023 and $24 million in the first quarter of 2024.

- Adjusted EBITDA1 loss of $11 million, compared to $24 million

in the second quarter of 2023 and $12 million in the first quarter

of 2024.

- Cash, cash equivalents, restricted cash, and short-term

investments balance of $186 million as of June 30, 2024.

"Our second quarter results showcase solid execution with GAAP

gross margin increasing to 34%. Consistent with Ouster’s strategy

of expanding into software solutions, we had one of our best

quarters for software-attached sales powered by Ouster Gemini and

Blue City. Alongside the continued improvement in our operating

results, we have built one of the industry’s most resilient balance

sheets and diversified business models,” said Ouster CEO Angus

Pacala. “I am excited to see the use cases for lidar expand as the

world turns to automation to solve an ever increasing number of

modern challenges. With lidar adoption still in its infancy, we are

just beginning to tap into our growth and I see a tremendous

opportunity still in front of us. At the same time, we remain

committed to our long-term financial framework and executing on our

path to profitability.”

Revenue growth in the second quarter was primarily driven by

large orders from customers in the smart infrastructure and

robotics verticals, specifically for perimeter security, tolling,

and mapping applications. GAAP gross margin improved by 500bps

sequentially and benefited from higher revenues along with greater

than expected tailwinds from favorable product mix and lower

manufacturing costs. Non-GAAP gross margin increased to 40%

compared to 26% in the second quarter of 2023. Non-GAAP gross

margin excludes the impact of stock-based compensation expenses and

certain other expenses outside of ordinary operations. Subsequent

to the end of the second quarter, Ouster repaid all outstanding

balance on its revolving credit line utilizing cash on hand.

________________________________________ (1)

Adjusted EBITDA loss and non-GAAP gross

margin are non-GAAP financial measures. See Non-GAAP Financial

Measures for additional information and reconciliations of these

measures to their respective most directly comparable financial

measures calculated in accordance with U.S. GAAP.

2024 Business Objective Updates

- Expand software solutions and grow the installed base

- Advance the development of digital lidar hardware

- Progress on the long-term financial framework

Expand software solutions and grow the

installed base: In the second quarter, Ouster secured

multiple deals to supply Ouster Gemini’s smart infrastructure

software solution, including to one of the world’s largest consumer

technology companies as well as a global telecommunications

company. During the quarter, Ouster also improved movement

detection for security customers, optimized software processing

requirements, and enhanced its deep-learning perception model to

support new use cases such as identifying unauthorized individuals

tailgating into restricted areas.

Advance the development of digital lidar

hardware: During the second quarter, Ouster taped out its

automotive-grade, custom silicon “Chronos” chip. The Company

expects to integrate Chronos into its solid-state, digital flash

“DF” sensors in the next year. Development on the Company’s next

generation custom silicon “L4” chip is advancing with validation

testing underway. Both Chronos and L4 are expected to open up new

verticals and bring significant improvements in performance,

reliability, and manufacturability to the Ouster product

family.

Progress on the long-term financial

framework: Ouster is executing on its path to profitability

and remains committed to deliver on its long-term framework of

30-50% annual revenue growth, expanding gross margins to 35-40%,

and maintaining operating expenses at or below third quarter 2023

levels.

Third Quarter 2024 Outlook

For the third quarter of 2024, Ouster expects to achieve $27

million to $29 million in revenue.

Conference Call

Information

Ouster will host a conference call and live webcast for analysts

and investors at 5:00 p.m. ET today, August 13, 2024 to discuss its

financial results and business outlook. To access the call, please

register at https://registrations.events/direct/Q4I9342824.

Upon registering, each participant will be provided with call

details and a registrant ID. The webcast and related presentation

materials will be accessible for at least 30 days on Ouster’s

investor relations website at https://investors.ouster.com. A

telephone replay of the call will be available 2 hours after the

call ends, and can be accessed via phone through August 27, 2024 by

dialing (800) 770-2030 from the U.S. or +1 (609) 800-9909 from

outside the U.S. The conference I.D. number is 93428.

About Ouster

Ouster (NYSE: OUST) is a leading global provider of lidar

sensors and software solutions for the automotive, industrial,

robotics, and smart infrastructure industries. Ouster is on a

mission to build a safer and more sustainable future by offering

affordable, high-performance sensors that drive mass adoption

across a wide variety of applications. Ouster is headquartered in

San Francisco, CA with offices in the Americas, Europe, and Asia

Pacific. For more information, visit www.ouster.com, or connect

with us on X or LinkedIn.

Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. The Company intends such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933,

as amended and Section 21E of the Securities Exchange Act of 1934,

as amended. Such statements are based upon current plans, estimates

and expectations of management that are subject to various risks

and uncertainties that could cause actual results to differ

materially from such statements. The inclusion of forward-looking

statements should not be regarded as a representation that such

plans, estimates and expectations will be achieved. Words such as

“anticipate,” “expect,” “project,” “intend,” “believe,” “may,”

“will,” “should,” “plan,” “could,” “continue,” “target,”

“contemplate,” “estimate,” “forecast,” “guidance,” “predict,”

“possible,” “potential,” “pursue,” “likely,” and the negative of

these terms and similar expressions are intended to identify

forward-looking statements, though not all forward-looking

statements use these words or expressions. All statements, other

than statements of historical fact, including statements regarding

Ouster’s revenue guidance for the third quarter of 2024;

anticipated new product launches and developments; Ouster’s future

results of operations, cash reserve and financial position; the

anticipated timing and development of Ouster’s next generation

hardware and software solutions; the execution against the

Company’s product roadmap and demand for products; the Company’s

path to profitability and long-term financial framework; industry

and business trends; Ouster’s business objectives, plans, strategic

partnerships, and market growth; and Ouster’s competitive market

position, all constitute forward-looking statements. All

forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from those that

we expected, including, but not limited to, risks related to

Ouster’s limited operating history and history of losses;

fluctuations in its operating results; the substantial research and

development costs needed to develop and commercialize new products;

its ability to maintain competitive average selling prices, high

sales volumes and reduce product costs; competition in Ouster's

industry; the negotiating power and product standards of its

customers; the adoption of its products and the growth of the lidar

market generally; product quality and liability risks; Ouster’s

future capital needs and ability to secure additional capital on

favorable terms or at all; its ability to manage growth, including

growing the sales and marketing organization; risks related to

international operations, including international manufacturing;

cancellation or postponement of contracts or unsuccessful

implementations; the Company's ability to manage its inventory;

credit risk of customers; Ouster's ability to use tax attributes;

Ouster’s dependence on key third party suppliers, in particular

Benchmark Electronics, Inc., Fabrinet, and other suppliers; supply

chain constraints and challenges; conditions in the industries the

Company targets or the global economy; the ability of its lidar

technology roadmap and new software solutions to catalyze growth;

Ouster’s ability to recruit and retain key personnel; its ability

to successfully integrate its business with Velodyne and achieve

the anticipated benefits of the Velodyne merger; Ouster’s ability

to adequately protect and enforce its intellectual property rights,

including as it relates to Hesai Group; legal and regulatory risks;

risks related to operating as a public company; and other important

factors discussed in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023, as may be further updated from

time to time in the Company’s other filings with the SEC. Readers

are urged to consider these factors carefully and in the totality

of the circumstances when evaluating these forward-looking

statements, and not to place undue reliance on any of them. Any

such forward-looking statements represent management’s reasonable

estimates and beliefs as of the date of this press release. While

Ouster may elect to update such forward-looking statements at some

point in the future, it disclaims any obligation to do so, other

than as may be required by law, even if subsequent events cause its

views to change.

In addition, see information below concerning non-GAAP financial

measures.

Non-GAAP Financial

Measures

In addition to its results determined in accordance with

generally accepted accounting principles in the United States

(“GAAP”), Ouster believes the non‑GAAP measures of Non-GAAP Gross

Margin and Adjusted EBITDA are useful in evaluating its operating

performance. Ouster calculates Non-GAAP Gross Profit as gross

profit (loss) excluding amortization of acquired intangibles,

certain excess and obsolete expenses and losses on firm purchase

commitments, and stock-based compensation expense. Non-GAAP Gross

Margin is calculated as Non-GAAP Gross Profit divided by revenues.

Ouster calculates Adjusted EBITDA as net loss excluding interest

expense (income), net, other expense (income), net, stock-based

compensation expense, provision for income tax expense, goodwill

impairment charges, restructuring costs excluding stock-based

compensation expense, certain excess and obsolete expenses and loss

on firm purchase commitments, amortization of acquired intangibles,

depreciation expense, certain litigation and litigation related

expenses, merger and acquisition related expenses. Ouster believes

that Non-GAAP Gross Profit, Non-GAAP Gross Margin, and Adjusted

EBITDA may be helpful to investors because it provides consistency

and comparability with past financial performance and may be

helpful in comparison with other companies, some of which use

similar non‑GAAP information to supplement their GAAP results.

Adjusted EBITDA is also used by the Board and management as a

performance metric for compensation purposes. The non-GAAP

financial information is presented for supplemental informational

purposes only, and should not be considered a substitute for

financial information presented in accordance with GAAP, and may be

different from similarly titled non‑GAAP measures used by other

companies. Reconciliation tables of the most comparable GAAP

financial measures to the non-GAAP financial measures are included

at the end of this press release.

OUSTER, INC. CONDENSED CONSOLIDATED BALANCE SHEETS

(unaudited) (in thousands) June 30,2024

December 31,2023 Assets Current assets: Cash and cash

equivalents

$

52,687

$

50,991

Restricted cash, current

426

552

Short-term investments

131,557

139,158

Accounts receivable, net

14,343

14,577

Inventory

19,453

23,232

Prepaid expenses and other current assets

33,530

34,647

Total current assets

251,996

263,157

Property and equipment, net

9,445

10,228

Operating lease, right-of-use assets

16,822

18,561

Unbilled receivable, non-current portion

7,127

10,567

Intangible assets, net

20,930

24,436

Restricted cash, non-current

1,092

1,091

Other non-current assets

2,463

2,703

Total assets

$

309,875

$

330,743

Liabilities and stockholders’ equity Current liabilities:

Accounts payable

$

4,490

$

3,545

Accrued and other current liabilities

48,506

58,166

Contract liabilities, current

13,812

12,885

Operating lease liability, current portion

7,263

7,096

Total current liabilities

74,071

81,692

Operating lease liability, non-current portion

16,239

18,827

Debt

43,973

43,975

Contract liabilities, non-current portion

3,487

4,967

Other non-current liabilities

1,495

1,610

Total liabilities

139,265

151,071

Commitments and contingencies Stockholders’ equity: Common stock

44

42

Additional paid-in capital

1,035,087

995,464

Accumulated deficit

(863,744

)

(816,026

)

Accumulated other comprehensive (loss) income

(777

)

192

Total stockholders’ equity

170,610

179,672

Total liabilities and stockholders’ equity

$

309,875

$

330,743

OUSTER, INC. CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS AND COMPREHENSIVE LOSS (unaudited) (in

thousands, except share and per share data) Three

Months Ended June 30, Three MonthsEnded March 31, Six

Months Ended June 30,

2024

2023

2024

2024

2023

Revenue

$

26,990

$

19,396

$

25,944

$

52,934

$

36,626

Cost of revenue

17,892

19,210

18,519

36,411

36,816

Gross profit (loss)

9,098

186

7,425

16,523

(190

)

Operating expenses: Research and development

14,432

26,447

13,806

28,238

58,906

Sales and marketing

6,750

11,666

6,860

13,610

25,199

General and administrative

13,166

17,842

12,580

25,746

49,167

Goodwill impairment charges

—

67,266

—

—

166,675

Total operating expenses

34,348

123,221

33,246

67,594

299,947

Loss from operations

(25,250

)

(123,035

)

(25,821

)

(51,071

)

(300,137

)

Other income (expense): Interest income

2,251

2,245

2,651

4,902

3,964

Interest expense

(740

)

(1,728

)

(741

)

(1,481

)

(3,397

)

Other income (expense), net

(7

)

(165

)

193

186

(111

)

Total other income, net

1,504

352

2,103

3,607

456

Loss before income taxes

(23,746

)

(122,683

)

(23,718

)

(47,464

)

(299,681

)

Provision for income tax expense

123

50

131

254

332

Net loss

$

(23,869

)

$

(122,733

)

$

(23,849

)

$

(47,718

)

$

(300,013

)

Other comprehensive loss Changes in unrealized (loss) gain on

available for sale securities

$

(45

)

$

(74

)

$

(459

)

$

(504

)

$

(24

)

Foreign currency translation adjustments

(293

)

23

(172

)

(465

)

(57

)

Total comprehensive loss

$

(24,207

)

$

(122,784

)

$

(24,480

)

$

(48,687

)

$

(300,094

)

Net loss per common share, basic and diluted

$

(0.53

)

$

(3.19

)

$

(0.55

)

$

(1.08

)

$

(8.84

)

Weighted-average shares used to compute basic and diluted net loss

per share

44,737,769

38,448,241

43,454,127

44,077,383

33,937,505

OUSTER, INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (unaudited) (in thousands) Six

Months Ended June 30,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES Net loss

$

(47,718

)

$

(300,013

)

Adjustments to reconcile net loss to net cash used in operating

activities: Goodwill impairment charges

—

166,675

Depreciation and amortization

5,397

10,605

Loss on write-off of construction in progress and right-of-use

asset impairment

214

1,423

Stock-based compensation

20,099

38,246

Reduction of revenue related to stock warrant issued to customer

488

61

Amortization of right-of-use asset

2,391

2,012

Interest expense

—

889

Amortization of debt issuance costs and debt discount

—

125

Accretion or amortization on short-term investments

(2,933

)

(2,097

)

Change in fair value of warrant liabilities

27

(126

)

Inventory write down

742

5,065

Provision (recovery of) for doubtful accounts

(241

)

541

Gain from disposal of property and equipment

(114

)

(248

)

Realized gain on available for sale securities

(275

)

—

Changes in operating assets and liabilities: Accounts receivable

3,915

3,420

Inventory

3,037

(3,644

)

Prepaid expenses and other assets

101

(1,126

)

Accounts payable

958

(1,741

)

Accrued and other liabilities

(9,830

)

(4,779

)

Contract liabilities

(553

)

759

Operating lease liability

(3,071

)

(2,525

)

Net cash used in operating activities

(27,366

)

(86,478

)

CASH FLOWS FROM INVESTING ACTIVITIES Proceeds from sale of

property and equipment

502

560

Purchases of property and equipment

(1,741

)

(1,973

)

Purchase of short-term investments

(49,720

)

(48,554

)

Proceeds from sales of short-term investments

60,028

72,481

Cash and cash equivalents acquired in the Velodyne Merger

—

32,137

Net cash provided by investing activities

9,069

54,651

CASH FLOWS FROM FINANCING ACTIVITIES Proceeds from ESPP

purchase

781

310

Proceeds from exercise of stock options

151

150

Proceeds from the issuance of common stock under at-the-market

offering, net of commissions and fees

19,498

—

At-the-market offering costs for the issuance of common stock

(95

)

—

Net cash provided by financing activities

20,335

460

Effect of exchange rates on cash and cash equivalents

(467

)

(56

)

Net decrease in cash, cash equivalents and restricted cash

1,571

(31,423

)

Cash, cash equivalents and restricted cash at beginning of period

52,634

124,278

Cash, cash equivalents and restricted cash at end of period

$

54,205

$

92,855

OUSTER, INC. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES (unaudited) (in thousands)

Three Months Ended June 30, Three Months Ended March

31, Six Months Ended June 30,

2024

2023

2024

2023

2024

2023

GAAP net loss

$

(23,869

)

$

(122,733

)

$

(23,849

)

$

(177,280

)

$

(47,718

)

$

(300,013

)

Interest expense (income), net

(1,511

)

(517

)

(1,910

)

(50

)

(3,421

)

(567

)

Other expense (income), net

7

165

(193

)

(54

)

(186

)

111

Stock-based compensation(1)

10,695

16,466

9,404

21,780

20,099

38,246

Provision for income tax expense

123

50

131

282

254

332

Goodwill impairment charge

—

67,266

—

99,409

—

166,675

Restructuring costs, excluding stock-based compensation expense

—

3,342

—

12,635

—

15,977

Excess and obsolete expenses and loss on firm purchase commitments

—

3,750

572

3,630

572

7,380

Amortization of acquired intangibles(2)

1,661

1,702

1,754

1,511

3,415

3,213

Depreciation expense(2)

839

2,744

1,053

4,648

1,892

7,392

Litigation expenses(3)

1,636

3,364

1,296

537

2,932

3,901

Merger and acquisition related expenses(4)

—

—

—

6,058

—

6,058

Other items

(114

)

—

—

—

(114

)

—

Adjusted EBITDA

$

(10,533

)

$

(24,401

)

$

(11,743

)

$

(26,893

)

$

(22,276

)

$

(51,294

)

(1)Includes stock-based compensation expense as follows:

Three Months Ended June 30, Three Months Ended March

31, Six Months Ended June 30,

2024

2023

2024

2023

2024

2023

Cost of revenue

$

1,210

$

654

$

913

$

774

$

2,123

$

1,428

Research and development

4,650

8,204

4,188

7,505

8,838

15,709

Sales and marketing

1,492

3,500

1,400

2,881

2,892

6,381

General and administrative

3,343

4,108

2,903

10,620

6,246

14,728

Total stock-based compensation

$

10,695

$

16,466

$

9,404

$

21,780

$

20,099

$

38,246

(2)Includes depreciation and amortization expense as

follows:

Three Months Ended June 30, Three Months Ended

March 31, Six Months Ended June 30,

2024

2023

2024

2023

2024

2023

Cost of revenue

$

999

$

1,772

$

1,100

$

1,750

$

2,099

$

3,522

Research and development

670

892

712

2,964

1,382

3,856

Sales and marketing

249

258

248

181

497

440

General and administrative

582

1,524

747

1,264

1,329

2,787

Total depreciation and amortization expense

$

2,500

$

4,446

$

2,807

$

6,159

$

5,307

$

10,605

(3)Litigation expenses and litigation-related expenses

outside of the Company’s ordinary business operations (4)Merger and

acquisition related expenses represent transaction costs for the

Velodyne Merger which include legal and accounting professional

service fees

Three Months Ended June 30, Three

Months Ended March 31, Six Months Ended June 30,

2024

2023

2024

2023

2024

2023

Gross profit (loss) on GAAP basis

$

9,098

$

186

$

7,425

$

(376

)

$

16,523

$

(190

)

Stock-based compensation

1,210

654

913

774

2,123

1,428

Amortization of acquired intangible assets

371

412

464

249

835

661

Excess and obsolete expenses and loss on firm purchase commitments

—

3,750

572

3,630

572

7,380

Gross profit on non-GAAP basis

$

10,679

$

5,002

$

9,374

$

4,277

$

20,053

$

9,279

Gross margin on GAAP basis

34

%

1

%

29

%

(2

)%

31

%

(1

)%

Gross margin on non-GAAP basis

40

%

26

%

36

%

25

%

38

%

25

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240813944318/en/

For Investors investors@ouster.io

For Media press@ouster.io

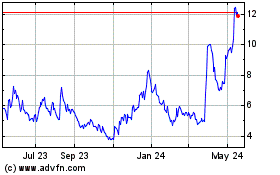

Ouster (NYSE:OUST)

Historical Stock Chart

From Jan 2025 to Feb 2025

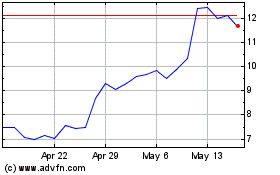

Ouster (NYSE:OUST)

Historical Stock Chart

From Feb 2024 to Feb 2025